TAO | #1D — One More Leg Up Before Major CorrectionStep-by-Step Scenario:

Current Context:

Price is consolidating above the 373–382 support (blue box) after a strong impulse from June lows. This zone aligns with a major HTF demand and retest of the recent breakout.

Expected Move:

Base Case: Holding the 373–382 zone triggers a new leg higher toward the $500 supply area.

Upside Target: $500+ (main target), with interim resistance at $440–460.

Trigger: Look for strong 1D closes above 401 for confirmation, or a quick dip and reclaim of 382 for entries.

Timing:

Expect the final move up to play out into late August. Watch for momentum and trend exhaustion as we enter September.

Major Correction Risk:

If price stalls or forms an SFP at $500 or in upper supply, look to reduce exposure and prepare for a multi-week/month correction.

Breakdown below 373 (especially daily close) invalidates the bullish scenario and may accelerate a correction back to 320–260.

Why:

The market structure remains bullish above support.

Still running on strong narrative/momentum, but approaching key supply zones and cycle timing.

Macro risk: Many alts (including TAO) could top as Q3 ends, mirroring historical cycles.

Breaker

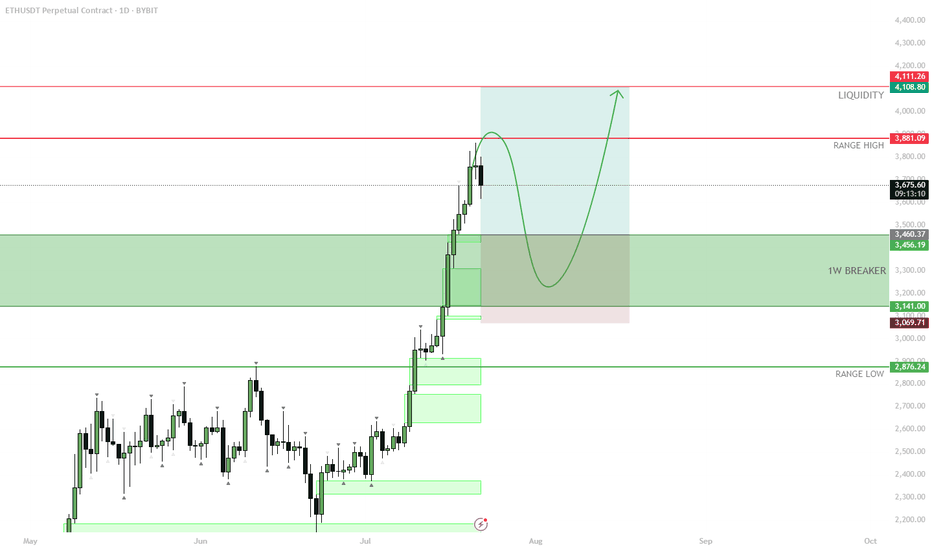

ETH — Perfect Long Play: Pullback & 1W Breaker Reclaim

After the strong move, price is likely to retrace as longs get trapped and late buyers take profit.

Best scenario: ETH pulls back to the 1W breaker zone ($3,141–$3,456), which previously acted as resistance and could now flip into support.

Watch for bullish reaction and confirmation in the 1W breaker zone.

If support holds, enter long — targeting a return to the range high and then the liquidity zone ($4,108+).

Invalidation if ETH closes below the 1W breaker or loses range low ($2,876) support.

ETH has rallied hard. After such a move, it’s normal for price to pull back and test old resistance as new support. The ideal long is on confirmation of a bounce from the 1W breaker zone, which keeps risk controlled and sets up for a continuation move higher. This approach avoids FOMO and protects against reversal if the breakout fails.

TWLO, rebalance to FVG, then make a bullish liquidity run So, my current analysis is built around a bullish bias on this chart. I’ve identified a few key elements that are lining up to potentially signal a strong move upward:

Bullish Block Breaker: First, I've identified a bullish block breaker. This occurred when the price broke above a significant resistance level, indicating a shift in market sentiment from bearish to bullish. This breakout suggests that buyers have taken control, and it's often a sign of a potential trend reversal or continuation to the upside.

Fair Value Gap (FVG): After the bullish block breaker, the price left behind a Fair Value Gap. This gap is an area of price imbalance, where the market moved too quickly and didn't allow for a balanced trading range. I'm looking for the price to potentially retrace into this FVG, as the market often seeks to 'rebalance' itself by filling this gap. This rebalancing process can provide a strategic entry point.

Bullish Order Block with 50% Retracement: Within the area where the FVG resides, I've also identified a bullish order block. This is an area of previous consolidation before the strong upward move. What adds confluence here is the 50% retracement level within this order block. This 50% level is crucial because it often represents a fair value area within the order block itself. Institutions and smart money traders often look to add to their positions around this level. So, if the price can hold above this 50% mark within the order block, it significantly increases the chances of a bounce.

Confluence Zone: The combination of the FVG, the bullish order block, and the 50% retracement level creates a strong confluence zone. This area serves as a potential support level where I expect buyers to step in if the bullish bias is to continue.

Looking for a Liquidity Run: After potentially rebalancing in the FVG and finding support within the order block at the 50% retracement level, I’ll be looking for the price to make a move towards a liquidity run. The target here would be key liquidity zones, such as previous swing highs or resistance levels. These are areas where stop-loss orders from short sellers or breakout orders from buyers are likely concentrated, acting as a magnet for the price.

What is Your Comment on this Gold Set up1H Time frame Break liquidity

And then also Broke Internal Liquidity

Which Create a Fair Value Gap and also a Breaker

Now price have retrace back to FVG

I think a nice place to short position

With a Risk/Reward Ratio 3.84

Cons: AGAINST TREND

Tell me what do you think about this set up

Did i miss anything

Long Nasdaq Turtle soup from potential Low of weekSeasonally bullish July. HTF still bullish imo. Turtle soup long after deep sweep of Weds 3rd July low and after touching +bkr 4hr CE, and after reaching ABCD down projection. Ideally now i want hourly bodies to respect one of these levels, and us to get a lower timeframe break up in structure. If it keeps spooling down all day, then i'll take the loss.

-NQ has been very much weak sister for many days now, feels to me like it's time for it to start showing relative strength now and and become the stronger sister to ES.

-Seeing if we put in Low of week here in the opening hour, or later today.

-Buying around the ABCD downleg projection, and the +OB wick CE W

-Stop below +OBMT W and just below an old daily low (Tues 2nd July): Basically full exit/loss if we properly lose the +OBMT W below.

-Ultimate target is the nice 20600 ABCD confluence (ABCD projections align here from both the 2023-2024 swing and the June'24 swing). Gut says we have NOT properly topped in indices.

-Will take paritals at FVG H nearby overhead, and move stop for remaining position to breakeven.

-Will take further partials and trail stop if we breach ATH Nasdaq.

-Will take last of position off at the beautiful ABCD projection confluence 21600, if we get up there before early August.

-If this runs up, i'm willing to hold til the end of the month (Indices are seasonally bullish in July)

-For confirmation of shift back to bull in earnest, i want to see the FVG H above us 'flipped' bullish (resist, small retrace, then power on up through it)

*Note to self: i should really wait to enter after getting low timeframe confirmation of a bottom, but i'll be totally honest: i want the satisfaction of potentially catching the low of week; I accept the risk of price just spooling on down and stopping me out today.

**Just an idea for paper trading, not financial advice

ICT Breaker & Mitigation Blocks EXPLAINEDToday, we’re diving into two powerful concepts from ICT’s toolkit that can give you an edge in your trading: Breaker Blocks and Mitigation Blocks. There are one of my favourite PD Arrays to trade, especially the Breaker Block. I’m going to explain how I interpret them and how I incorporate them into my trading. Stay tuned all the way to the end because I’m going to drop some gold nuggets along the way"

Ok, so first of all let’s go through what both these PD Arrays look like and what differentiates them, because they are relatively similar and how they are used is practically the same.

On the left we have a Breaker Block and on the right a Mitigation Block. They both are reversal profiles on the timeframe you are seeing them on, and they both break market structure as you can see here. The actual zone to take trade from, or even an entry from, in the instance of this bearish example is the nearest down candle or series of down candles after price makes a lower low. When price pulls back to this area, one could plan or take a trade.

The defining difference is that a Breaker raids liquidity on its respective timeframes by making a higher high or lower low before reversing, whilst a Mitigation Block does not do that. For this reason, a Breaker is always a higher probability PD Array to trade off from. As you should know by now if you are already learning about PD Arrays such as these is that the market moves from one area to liquidity to another. If you don’t even know what liquidity is, stop this video and educate yourself about that first or you will just be doing yourself a disservice.

Alright, so let’s go see some real examples on the chart. Later on I’ll give you a simple mechanical way to trade them, as well as a the discretionary approach which I use. And of course, some tips on how to increase the probability of your setups.

BTC local levels to watch out for You can see here the FVG below that was taken during the Asian Range, and there's an order block above. These are key levels to watch out for when we get the NY-AM open for the CPI release today.

I suspect we'll see a trade setup form around that time. Right now, I'm just eyeballing these levels, with the REH (relatively equal highs) just above the Asian range. This could act as a reversal point if we get a displacement from this level or the order block above.

It's a bit too early to tell what will happen, so let's wait for the setups to develop.

#BTC #Crypto #Trading #CryptoTrading #SmartMoneyConcepts #TradingView

ES | Oct. 23, 2023 - Weekly FVG, NWOG, and BreakerUsing the 15m bellwether chart for ES, we observe price opening higher creating a nice new week opening gap (NWOG).

At the 9:30am open, a Judas swing takes out London sell-side liquidity before rallying to take out the 8:00am swing high, closing above the high forming a bullish breaker.

Price continues to climb into the NWOG and retraces back down into the breaker and into the fair value gap (FVG) providing a clean entry for the ICT 10 - 11am Silver Bullet.

Price continues to run higher, trading above the NWOG and showing support as it ultimately trades into the consequent encroachment (CE) of the weekly FVG.

Throughout the NY PM session, price fell back through the NWOG, touching the breaker one last time before closing and consolidating at the NWOG's CE.

10/2/23: Sell Setup on SPX10/2/23: Sell Setup: I was looking for a continuation set up on SPX. TK/SY session set a small range that held London but was taken out in the premarket session. This left a 1H/15m-FVG set up with a -OB on the 1H. Price trades into the 15m-FVG (L) and pushed down and failed to make a new low followed by EQLs being set in NY open session. Once the EQLs were made we traded back into the 15m-FVG(MT) and tapped into the mid point. I didn’t see the clean enter in the 15m but the 5m chart gave a great entry that I missed. My targets were the PDL, EQLs/Thurs PDL, and PWL.

No entry on the setup, had two attended two meetings back to back and I had to present on the calls.

This was the 1st set up I was looking for but I was on a work call and miss this one. This gave confirmations on the 5m/15m charts and this would have been a trade that would have hit the first target of 4274.08 then BE on the remaining.

This was the second entry I was looking for, higher into the 15m-FVG. NAS was also reaching into its own FVG which gave me a more validation this was a good setup. But as soon as we passed the mid point at 4297.80 it tanked without confirmations on any of the LTFs, even as far as the 1m chart.

This was the final entry, later than I would normally be looking for anything but also no confirmation and this was a good thing because the price could not take out the low and pushed back up off to the DL.

Sell

Entry: 4293.05,4297.80, 4284.39

SL: 4300,4303.65,4293.05

Targets: 4274.08, 4263.03,4238.23

We’re pushing up for now, we have NY session high, Weekly opening price, and Friday PDH

15m chart:

Weekly Bias for Nas100 - 10/1/2023Weekly Chart: Price took out the PWL and the August low into a W+OB and we did close positively for the week. We did create the low of a W-FVG (not drawn but, it's there) and price closed near the middle of the weekly range, Weekly High 14906.5, Weekly Low 14429.3, Weekly Mid point 14667.9, Weekly close 14741.8.

Weekly idea: Price took out lows into the W+OB but for now there is a W+FVG below that may be the target. If we take out the PDL, this will be my target into the the W+FVG(H) near 14232.7. In order to turn bullish I will need to see a high taken out and I'll want to see what price does inside the W-FVG.

Daily Chart: Price traded into a D-FVG and set the high near the D-FVG (MT) and left a huge wick with a Friday close near the Mid point of the Weekly range. We took out the bearish engulfing made on Tuesday but by Friday we traded back into it.

Daily Idea: Price leaving that large wick will cause for me to look at how price response to the close, middle and high of the candle. Do we fail inside this wick or take out the high? This is the question I'll be looking to answer. If we fail, I'll be looking to take out the PDL and THURS PDL. If we take out the high, price should close the D-FVG and trade into another D-FVG just above (not drawn) with the low near 14974.1.

4H Chart: Price left a 4H-OB inside the daily wick and the low was made inside a 4H+FVG(H) 14661.5. There is a +CHOCH above THURS PDH and the this is my hesitation to go full on bearish on the short term. There is also a 4H+Breaker that Friday could not take out as well.

4H Idea: I want to see if price will take out the 4H-OB or the PDL

ES short-term analysisToday I want to see fill of the 1h Breakaway Gap - 4139.

My key level 4125. This is buystops level. Pretty sure it will want to test it to complete ATM/ICT Mentorship Model.

My Pre-market Plan for May 24, 2023:

Bullish Scenario - Break above 4165 (short-term BSL, 4163 NY Midnight Open Price as well) can bring some bulls —> 4175 - this is "NWOG" - 04/16-04/21.

Market looks more bearish anyway. Once it tested 4175 level and failed to hold it, I am going to play long w/ target at 4186-90.

1h OB - 4190 + 1h FVG.

Bearish Scenario - Break below 4132 ("NWOG" - 05/07-05/12) will give short trade opportunity with target at 4126.

Next my trade can be below 4120 - SSL on 1h chart.

Once it breaks this SSL level, it will open the room to the 4111.

Key Levels for long today: 4158, 4168, 4185

Key Levels for short today: 4131, 4122, 4104

$GBPUSD - Fed Rate To Rally Dollar Until 2Q *SMC**SMC = Smart Money Concept - See related Ideas for Tutorials on these concepts.

I pulled two smart Money Fibs on the latest waves. The largest of the two has a Liquidity point that could be broken by the end of the quarter as "Smart Money" or the intuitional powers that be, may push it that way. After it breaks the Liquidity Level (Below 1.20120) or near the top of the Order Block, which is also my first safe entry, then I believe The Pound will catch up and turn Bullish. So My SL is 1.18693 and Take profit is 1.25092 making it a 2:1 R:R I'm taking the Smart Money principles and risking the Most that you should at 3% of your account. Typically, you don't want to risk more than 2%. Just an FYI for any new trader that maybe reading this idea.

Happy Trading

- BXW