NZD/USD Long Setup – Breakout Confirmation & Smart Money SupportTechnical: NZD/USD has broken above 0.5572 resistance, confirming a bottom. This level should now act as support on any pullbacks. Look to enter between 0.5762 – 0.5572, with an upside target of 0.5870. Place a stop loss at 0.5730 to manage risk.

Fundamental: The U.S. dollar is seeing continued selling pressure from commercial participants, while NZD is being accumulated—suggesting smart money positioning for further upside.

Seasonal: Historically, NZD/USD has risen 66.67% of the time between March 17 – April 12, with an average return of 1.31% over the past 21 years.

Trade Idea:

Entry: 0.5762 – 0.5572

Stop Loss: 0.5730

Target: 0.5870

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Breakout!

BNB/USDT: BREAKOUT SETUP!!🚀 Hey Traders! Ready to Ride the BNB Breakout? 👋

If you’re hyped for this setup, smash that 👍 and hit Follow for elite trade ideas that actually deliver! 💹🔥

🔥 BNB Breakout Alert – Big Move Incoming! 🔥

BNB is looking strong and bullish, breaking out from a bull flag formation on the 4H timeframe. If it holds above the flag, we could see a massive 40% surge! 📈

💰 Trade Setup:

📍 Entry Range: $588 - $600

🎯 Targets: $628 / $688 / $746 / $794 / $844

🛑 Stop-Loss: $566

⚡ Leverage: Low (Max 5x)

🔎 Strategy: Enter with low leverage now, add more on dips, and ride the momentum to higher levels!

💬 What’s Your Take?

Are you bullish on BNB’s breakout potential? Share your analysis, predictions, or strategies in the comments! Let’s secure those gains and ride this wave together! 💰🚀🔥

PIPPIN/USDT: LONG TRADE SETUP!!🚀 Hey Traders! PIPPIN Breakout Alert – Big Move Incoming? 👀🔥

If you’re excited for this setup, smash that 👍 and hit Follow for high-quality trade ideas that actually deliver! 💹🔥

🔥 PIPPIN Breakout & Retest – Time to Pump?

PIPPIN has broken out of a falling wedge on the 2H timeframe and is now retesting the breakout level. If this retest holds, we could see a strong rally ahead! 🚀

💰 Trade Setup:

📍 Entry: CMP, add more up to $0.019

🎯 Targets: $0.0225 / $0.0252 / $0.0294 / $0.0334

🛑 Stop-Loss: $0.018

⚡ Leverage: Low (Max 5x)

🔎 Strategy: Enter with low leverage now, scale in on dips, and ride the momentum to key targets!

💬 What’s Your Take?

Are you bullish on PIPPIN’s breakout? Drop your thoughts, analysis, and predictions in the comments! Let’s secure those gains and ride this wave together! 💰🚀🔥

AUD-CHF Move Up Expected! Buy!

Hello,Traders!

AUD-CHF made a bullish

Breakout of the key horizontal

Level of 0.5576 and the

Breakout is confirmed

Because the daily candle

Closed above the key level

So on the market open

We will be expecting a

Local pullback and then

A strong move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_CAD WILL FALL|SHORT|

✅GBP_CAD broke the rising

Support line after trading in an

Uptrend for a long time so

We will be awaiting a long

Overdue correction and a

Move down on Monday

Towards the target of 1.8500

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

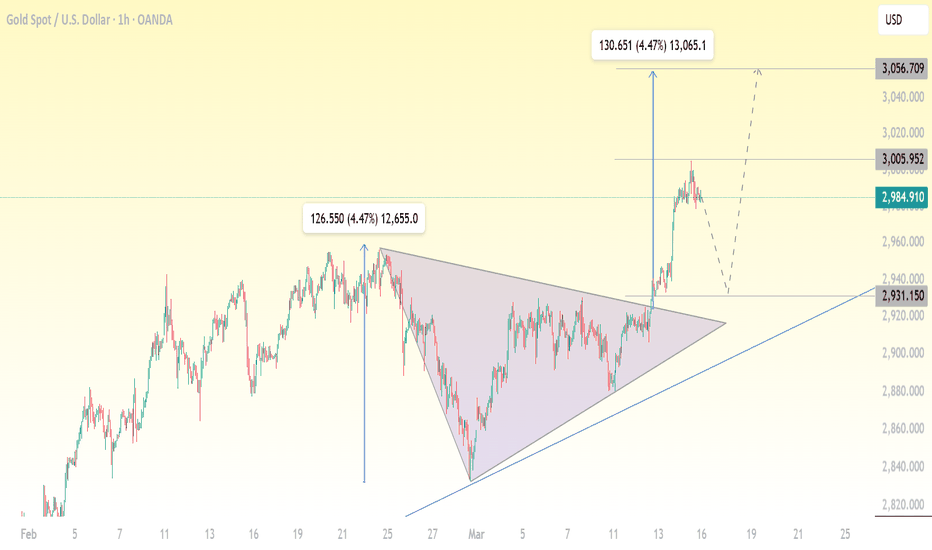

XAU/USD Breakout – Trend Continuation or Pullback?Gold (XAU/USD) has recently broken out of a symmetrical triangle pattern, signaling strong bullish momentum. This breakout was accompanied by a price surge of approximately 4.47%, pushing the price towards the $3,005 resistance level.

The question now is: Will gold continue its bullish trend, or will we see a pullback before the next move?

📊 Technical Analysis:

1️⃣ Symmetrical Triangle Breakout

The symmetrical triangle pattern formed over several weeks, with price consolidating within the narrowing structure.

A clear breakout above the triangle confirms the bullish momentum, suggesting further upside potential.

2️⃣ Measured Move Target

The breakout's measured move (equal to the height of the triangle) projects a potential target near $3,056.

This level aligns with a historical resistance zone, making it a key level to watch.

3️⃣ Key Support & Resistance Levels

✅ Resistance:

$3,005 – Recent high where price is currently facing resistance.

$3,056 – Next major upside target, based on the breakout projection.

✅ Support:

$2,931 – Previous breakout zone; a retest could confirm support before another rally.

Ascending Trendline – Acting as dynamic support for the ongoing uptrend.

📉 Potential Scenarios to Watch:

✅ Bullish Case: Trend Continuation

If the price consolidates above $2,984-$2,931, buyers may push gold towards $3,056 and beyond.

A strong breakout above $3,005 with volume confirmation will likely signal further bullish strength.

❌ Bearish Case: Pullback Before Rally

Gold may retrace towards $2,931 (previous resistance turned support) before resuming its uptrend.

A break below $2,931 could lead to deeper retracement, possibly testing the ascending trendline.

🔍 Trading Strategy & Considerations:

📌 Bullish Traders: Watch for support at $2,931 and a break above $3,005 for confirmation of the next bullish leg.

📌 Bearish Traders: Look for a failed breakout above $3,005 or a rejection at $3,056 for short-term pullback opportunities.

💡 Final Thoughts:

Gold remains in a strong uptrend, with bullish momentum intact. However, a pullback before the next leg up remains a possibility. Traders should monitor key levels and price action confirmations for the next move.

🚀 What’s your outlook on gold? Drop your thoughts in the comments!

Momentum Trading Strategies Across AssetsMomentum trading is a strategy that seeks to capitalize on the continuation of existing trends in asset prices. By identifying and following assets exhibiting strong recent performance—either upward or downward—traders aim to profit from the persistence of these price movements.

**Key Components of Momentum Trading:**

1. **Trend Identification:** The foundation of momentum trading lies in recognizing assets with significant recent price movements. This involves analyzing historical price data to detect upward or downward trends.

2. **Diversification:** Implementing momentum strategies across various asset classes—such as equities, commodities, currencies, and bonds—can enhance risk-adjusted returns. Diversification helps mitigate the impact of adverse movements in any single market segment.

3. **Risk Management:** Effective risk management is crucial in momentum trading. Techniques such as setting stop-loss orders, position sizing, and continuous monitoring of market conditions are employed to protect against significant losses.

4. **Backtesting:** Before deploying a momentum strategy, backtesting it against historical data is essential. This process helps assess the strategy's potential performance and identify possible weaknesses.

5. **Continuous Refinement:** Financial markets are dynamic, necessitating ongoing evaluation and adjustment of trading strategies. Regularly refining a momentum strategy ensures its continued effectiveness amid changing market conditions.

**Tools and Indicators:**

- **Relative Strength Index (RSI):** This momentum oscillator measures the speed and change of price movements, aiding traders in identifying overbought or oversold conditions.

- **Moving Averages:** Utilizing short-term and long-term moving averages helps in smoothing out price data, making it easier to spot trends and potential reversal points.

**Common Pitfalls to Avoid:**

- **Overtrading:** Excessive trading can lead to increased transaction costs and potential losses. It's vital to adhere to a well-defined strategy and avoid impulsive decisions.

- **Ignoring Market Conditions:** Momentum strategies may underperform during sideways or choppy markets. Recognizing the broader market environment is essential to adjust strategies accordingly.

By understanding and implementing these components, traders can develop robust momentum trading strategies tailored to various asset classes, thereby enhancing their potential for consistent returns.

Source: digitalninjasystems.wordpress.com

$4 to $16 with power hour making +60% run $10 to $16It was consolidating for 4 hours after morning news that investor or group purchased at least 5% stake in the company and filled with SEC. This made the stock pop to +150% on the day as traders speculated it could be a big reputable firm or individual so they want to be in as well. After strong support it moved further to +300% area total on the day and I warned everyone on time to get ready for $10 and $11 buys for the vertical new highs.

Last hour brought easy money NASDAQ:RGC

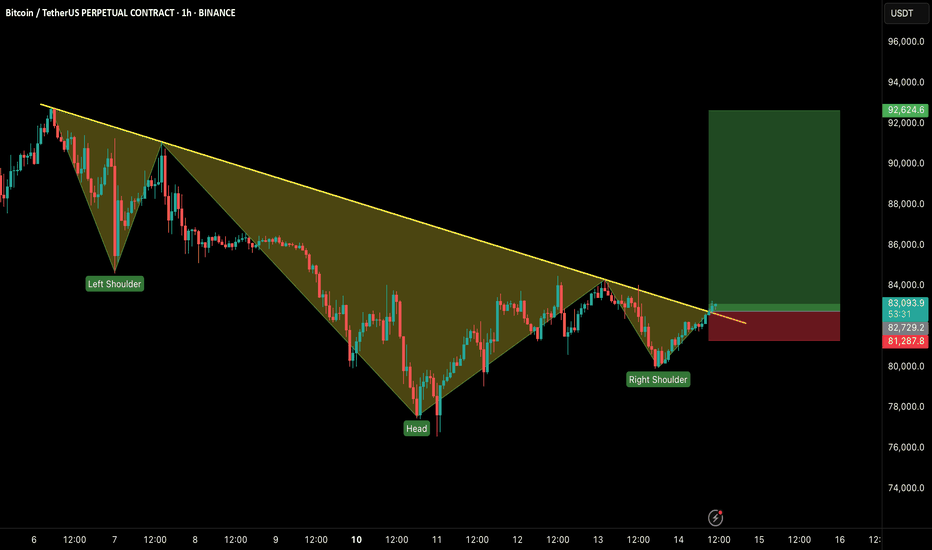

#BTCUSDT: BULLISH BREAKOUT IN LTF!!🚀 Hey Traders!

If you're finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver! 💹🔥

BTC is breaking out from an inverse head & shoulders pattern on the 1H timeframe, signaling strength! 📈 If it holds above the neckline, we could see a strong rally toward $90K– GETTEX:92K in the coming days! 🚀

🔹 Key Levels to Watch:

✅ Target: $90K– GETTEX:92K

❌ Invalidation: Close below $81,200

Momentum is building—can bulls take control? Let us know in the comment section.

Ethereum - Watch This Massive Support!Ethereum ( CRYPTO:ETHUSD ) is weak but testing strong support:

Click chart above to see the detailed analysis👆🏻

The entire crypto market is currently not able to stop the bleeding and also Ethereum just dropped another -20% over the past three days. It might seem like a horrible scenario but overall Ethereum is still in a bullish market. Just watch the final confluence of support now.

Levels to watch: $2.000, $4.000

Keep your long term vision,

Philip (BasicTrading)

Tellor (TRB) a hidden gem, will previous price action repeat?Hello again dear reader for a another analysis.

From August to December 2023 TRB has seen a MASSIVE move of 7000% gains over the course of just 126 days. Since then it has corrected a whopping 96%!

There is now a reason to be bullish on this coin. Looking at the drawn structure we can see multiple important touch zones described with the letters ''A till F'' (NOT ELLIOT). It is quite possible price action might correct further till 19$ where a big support zone lies, but there is no guarantee that ''will'' happen.

Target: 1200$ (M-cap of 3B which is very achievable)

Stoploss: 15$

I aim to keep analysis simple and easy to understand. Any questions of requests for analysis feel free to ask!

Rustle

GBPUSD - LONGStrong cumulative flat. Buying opportunity after the formation of the Cypher pattern.

GBPUSD - LONG

ENTRY PRICE - 1.2912

SL - 1.28500

TP - 1.30780

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

Bitcoin - The Uptrend Remains 100% Valid!Bitcoin ( CRYPTO:BTCUSD ) can create a textbook break and retest:

Click chart above to see the detailed analysis👆🏻

Over the past couple of weeks we have only been seeing a consolidation on all cryptocurrencies, governed by the slow movement on Bitcoin. With today's drop Bitcoin is now approaching the previous all time highs, which are now acting as a major support, pushing price much higher.

Levels to watch: $70.000, $300.000

Keep your long term vision,

Philip (BasicTrading)

TAO ANALYSIS🔮 #TAO Analysis - Breakout 🚀🚀

💲💲 In daily time-frame,Falling Wedge Pattern is forming and a good breakout is done. And a small retest is done, now we would see a good reversal move in #TAO ✅ 💯🚀

💸Current Price -- $249

📈Target Price -- $305

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#TAO #Cryptocurrency #Breakout #DYOR

Bitcoin CME Gap at $77,930 Filled! Now, can $BTC push to $150K?Bitcoin CME Gap at $77,930 Filled! Now, can CRYPTOCAP:BTC push to $150K? 🚀

🔹 Support Level: $75,000 – If it holds, #BTC may target $100K+

🔻 If support breaks, my spot bids: $72K | $69K | $66K (Already filled at $77K ✅)

This drop was a liquidity flush to shake out high leverage traders. Stay prepared!

📢 Where’s your next buy order? Share below! 👇

#Bitcoin

Dogecoin - The Final Break And Retest!Dogecoin ( CRYPTO:DOGEUSD ) is confirming the final retest:

Click chart above to see the detailed analysis👆🏻

After we saw the textbook retest of the previous all time high about three months ago on Dogecoin, so far we also saw the expected correction of about -50%. However Dogecoin is about to confirm the bullish break and retest, which eventually leads to a parabolic rally and new highs.

Levels to watch: $0.2, $0.5, $5.0

Keep your long term vision,

Philip (BasicTrading)