313% vertical this morning $0.30 to $1.24300% vertical BOOM 💥 squeezing out shortsellers who were just moments before trying to manipulate downside 👉🏻 Priceless! 🤑

+33% gain realized with 3 Buy Alerts into vertical NASDAQ:ICCT

What red market is everyone talking about? We don't know anything about that 🤷🏻♂️

Breakout

Gold - They All Call Me Crazy!Gold ( TVC:GOLD ) is just starting the next rally:

Click chart above to see the detailed analysis👆🏻

Just a couple of months ago, Gold perfectly broke out of the long term rising channel formation. After we then witnessed the bullish break and retest confirmation, it was quite clear that Gold will head much higher. This just seems to be the beginning of the next crazy major bullrun.

Levels to watch: $4.000

Keep your long term vision!

Philip (BasicTrading)

EOS ANALYSIS📊 #EOS Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retesting the major resistance zone🧐

Pattern signals potential bullish movement incoming after a breakout of major resistance zone

👀Current Price: $0.6235

🚀 Target Price: $0.9200

⚡️What to do ?

👀Keep an eye on #EOS price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#EOS #Cryptocurrency #TechnicalAnalysis #DYOR

CRUDE OIL Bullish Breakout! Buy!

Hello,Traders!

CRUDE OIL is trading in an

Uptrend and the pair made

A bullish breakout of the key

Level of 70.30$ and the

Breakout is confirmed so we

Are bullish biased and we

Will be expecting a further

Move up after a potential

Local pullback

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ZEC ANALYSIS📊 #ZEC Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retesting the major resistance zone🧐

Pattern signals potential bullish movement incoming after a breakout of major resistance zone

👀Current Price: $37.80

🚀 Target Price: $50.00

⚡️What to do ?

👀Keep an eye on #ZEC price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#ZEC #Cryptocurrency #TechnicalAnalysis #DYOR

GBP_NZD GROWTH AHEAD|LONG|

✅GBP_NZD made a retest

Of the key horizontal level of 2.2600

Which is now a support after a powerful

Breakout so we are bullish biased

And we will be expecting a further

Bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

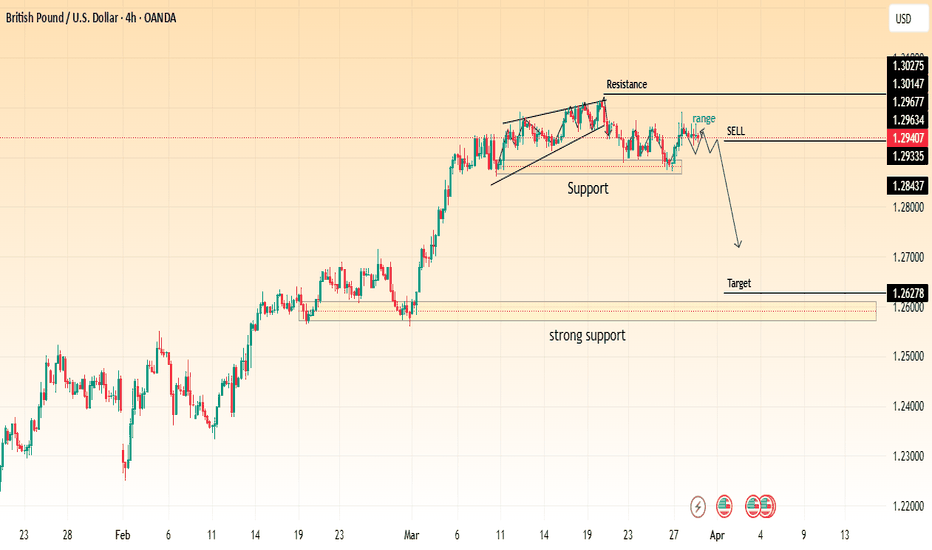

GBP/USD Breakdown: Bearish Setup with Sell Opportunity!"Key Observations:

Rising Wedge Breakdown:

The price initially formed a rising wedge near resistance.

The wedge broke down, indicating bearish momentum.

Support and Resistance Levels:

Resistance Zone: Around 1.3014 – 1.3027, marking a strong rejection area.

Support Zone: Around 1.2933 – 1.2843, where price previously bounced.

Strong Support: Around 1.2627, marked as the target area for a bearish move.

Bearish Setup:

A range-bound consolidation occurred after the breakdown.

The chart marks a sell signal, suggesting a move toward the 1.2627 target zone.

Trading Idea:

Entry: Sell after confirmation below 1.2933.

Target: 1.2627 (major support level).

Stop-Loss: Above 1.3014 (resistance level).

This setup suggests a potential bearish continuation, with price expected to decline further if support breaks. Always confirm with volume and market conditions before entering a trade.

EUR/GBP Bullish Breakout from Falling Wedge – Buy Setup!Introduction

This EUR/GBP 4-hour chart analysis presents a high-probability bullish trading setup based on a falling wedge breakout. A falling wedge is a reliable bullish reversal pattern, signaling that selling pressure is fading, and buyers are regaining control. The price has now broken out of the wedge, confirming potential upside momentum.

This setup provides a well-defined entry, stop-loss, and target level, allowing traders to capitalize on the bullish breakout while maintaining a proper risk management strategy.

1. Chart Pattern: Falling Wedge (Bullish Reversal)

The primary pattern on the chart is a falling wedge, which is a bullish reversal pattern that forms after a downtrend. It is characterized by converging downward-sloping trendlines, indicating that sellers are gradually losing momentum.

🔹 Key Characteristics of the Falling Wedge Pattern:

Lower highs & lower lows within a narrowing price range.

Decreasing selling pressure, indicating a potential shift in trend.

A bullish breakout above the upper trendline confirms a reversal.

Typically followed by a strong price surge, aiming for previous resistance levels.

The price action confirms this pattern as it broke above the wedge's upper boundary, signaling the start of a bullish trend.

2. Key Technical Levels & Market Structure

🔹 Resistance Level (Target) – 0.84183

This level marks a previous strong resistance zone, where the price faced rejection multiple times.

It serves as the primary profit-taking area for this setup.

A successful breakout and close above this level could lead to further upside movement.

🔹 Support Level – 0.83154

This is the major demand zone where price previously bounced.

Strong buying pressure emerged at this level, leading to the recent breakout.

It serves as an important level to define risk and set stop-loss orders.

🔹 Stop-Loss Placement – Below 0.83154

A stop-loss is placed slightly below the support zone, ensuring a logical exit if the market reverses.

This prevents unnecessary losses while allowing room for normal price fluctuations.

🔹 Entry Point Consideration

Ideal entry: Around 0.83700, just after the breakout confirmation.

Confirmation: A strong bullish candle closing above the wedge.

3. Trade Execution Plan: Long Setup

📌 Trade Idea – Bullish Setup

📈 Buy Entry: 0.83600 – 0.83700 (After wedge breakout)

🎯 Target: 0.84183 (Major resistance level)

❌ Stop-Loss: 0.83154 (Below support level)

🔄 Risk-to-Reward Ratio (RRR): ~1:1

📊 Risk Management Strategy

Trade with discipline: Never risk more than 1-2% of your capital per trade.

Adjust position size: Based on risk tolerance and account balance.

Use trailing stops: To secure profits if price continues upward.

4. Market Sentiment & Price Action Analysis

Prior Uptrend: The price previously had a strong bullish rally, indicating overall bullish strength.

Corrective Move: The market entered a falling wedge correction, allowing for a healthy pullback before resuming the trend.

Breakout Confirmation: The breakout above the wedge's upper trendline confirms bullish momentum.

📊 Factors Supporting a Bullish Move:

✅ Breakout confirmation above the wedge pattern.

✅ Higher buying volume supporting the move.

✅ Support level holds strong, preventing further downside.

5. Trading Psychology & Risk Considerations

⚠️ Key Considerations Before Entering the Trade:

✔ Wait for confirmation – Ensure a strong breakout candle before entering.

✔ Avoid chasing the price – Enter at a reasonable pullback level post-breakout.

✔ Monitor economic events – Watch for news that could impact EUR/GBP volatility.

✔ Follow a strict risk-reward ratio – Stick to your predefined stop-loss and target.

6. Conclusion – Bullish Outlook

This falling wedge breakout on EUR/GBP suggests a bullish reversal, offering a high-probability long trade setup. The price is expected to move towards the 0.84183 resistance level, with 0.83154 as the key stop-loss level.

✅ Bias: Bullish

🎯 Target: 0.84183

❌ Stop Loss: 0.83154

📊 Risk-to-Reward: ~1:1

📌 TradingView Idea Title & Description

Title:

🚀 EUR/GBP Falling Wedge Breakout – Bullish Move Incoming!

Description:

📈 Bullish breakout confirmed! EUR/GBP has broken out of a falling wedge, signaling a trend reversal. A long position above 0.83600 targets the 0.84183 resistance level with a stop-loss at 0.83154. Watch for strong bullish momentum! 📊💹

💡 Risk Management: Stick to your stop-loss, and don’t chase price action. Manage your trade wisely! 🔥

GBP-NZD Free Signal! Buy!

Hello,Traders!

GBP-NZD is trading in an

Uptrend and the pair made

A bullish breakout of the

Key horizontal level of 2.2600

Which is now a support then

Made a retest and we are now

Seeing a bullish rebound

Already which reinforces our

Bullish bias on the pair and

Suggests that we enter

A long trade with the

Take Profit of 2.2715

And the Stop Loss of 2.2568

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHF/USD Weekly Forecast: Falling Wedge Breakout Towards TargetMarket Overview: Bullish Reversal in CHF/USD

The Swiss Franc (CHF) / U.S. Dollar (USD) currency pair has recently broken out of a Falling Wedge pattern, signaling a bullish trend reversal. This breakout is significant as it suggests the end of a prolonged downtrend and the beginning of a new upward momentum. Traders who capitalize on this pattern could benefit from potential long opportunities.

This analysis will cover the chart pattern, key levels, trading setup, risk management, and market sentiment, providing a comprehensive professional breakdown of the CHF/USD price action.

1. Chart Pattern: Falling Wedge – Bullish Breakout

A Falling Wedge is a well-known bullish reversal pattern that forms when price action creates lower highs and lower lows, but the slope of the highs is steeper than the lows. This leads to a narrowing structure that suggests sellers are losing strength, paving the way for a bullish breakout.

Pattern Characteristics:

✔ Prior Downtrend: The CHF/USD pair was in a sustained bearish trend before forming the wedge.

✔ Converging Trendlines: Price action squeezed into a wedge formation, showing decreasing volatility.

✔ Breakout Confirmation: The price successfully broke above the wedge resistance, signaling a shift in market sentiment.

✔ Retest Possibility: Price may revisit the breakout zone before continuing its uptrend.

A breakout from a falling wedge typically leads to a sharp bullish rally, making this a high-probability trading opportunity.

2. Key Technical Levels: Support & Resistance

Support Zones (Buying Interest):

🔵 1.0835 – 1.1000: This zone has acted as strong support where buyers stepped in aggressively.

🔵 1.1071 – 1.1095: A short-term support level that aligns with recent price action, making it a critical stop-loss area.

Resistance Zones (Profit Targets):

🔴 1.1483 – 1.1550 (Primary Resistance): Price has struggled at this level previously, making it the first target for a bullish move.

🔴 1.1600 (Major Resistance): If the uptrend continues, this level will act as the next major challenge.

🔴 1.1909 (Extended Target): A long-term resistance level where price has historically reversed.

3. Trading Strategy & Entry Setup

Now that we have identified the breakout and key levels, let’s design a strategic trading plan.

📌 Entry Points for Long Trades:

✅ Aggressive Entry: Buy at the current price after the breakout, expecting continuation.

✅ Conservative Entry: Wait for a retest of the wedge breakout zone or support near 1.1071 – 1.1095 before entering long.

📌 Stop-Loss Placement (Risk Management):

❌ Stop below 1.1071: This level is a strong support area, and a break below it may invalidate the bullish setup.

❌ Alternative Stop below 1.1000: A safer option for long-term traders to avoid stop-hunting.

📌 Take-Profit Levels:

🎯 Target 1: 1.1483 – 1.1550 (Primary Resistance Zone)

🎯 Target 2: 1.1600 (Stronger resistance where partial profits can be booked)

🎯 Target 3 (Extended): 1.1909 (For swing traders holding positions longer)

📌 Risk-Reward Ratio:

A proper Risk-to-Reward (R:R) ratio of at least 1:2 should be followed for efficient trade management. This means:

Risking 50 pips to gain 100 pips (or more) for profitable trading.

4. Market Sentiment & Confirmation Signals

✔ RSI (Relative Strength Index):

Above 50? Bullish confirmation.

Near 70? Overbought zone, potential pullback.

✔ MACD (Moving Average Convergence Divergence):

Bullish Crossover? Strengthens buy signal.

Divergence? Confirms price momentum.

✔ Volume Analysis:

High volume on breakout? Confirms strong buying interest.

Low volume? Beware of false breakout.

✔ Fundamental Factors:

Swiss National Bank (SNB) Policy: If SNB maintains dovish policies, CHF could weaken, pushing CHF/USD higher.

US Federal Reserve Stance: A strong USD could slow CHF/USD gains.

5. Conclusion & Trading Plan

🔹 Summary of Trade Setup:

✅ Bullish breakout from Falling Wedge – high-probability long trade

✅ Retest of breakout zone may offer better entry

✅ Major support at 1.1000 – 1.1071

✅ Targeting 1.1550 – 1.1909 range

🚀 Final Trading Plan:

📌 Buy CHF/USD above 1.1100 – 1.1150

📌 Stop-loss below 1.1071

📌 Take Profit 1: 1.1550

📌 Take Profit 2: 1.1600

📌 Take Profit 3 (Swing Trade): 1.1909

📢 Pro Tip:

Always confirm breakout volume before entering.

Monitor economic events affecting CHF & USD.

Use proper risk management (1-2% of account per trade).

📊 Final Verdict:

🔥 CHF/USD is in a bullish setup after breaking out from a Falling Wedge. Traders should look for buy opportunities on pullbacks while targeting resistance levels. 🚀

EURJPY Weekly Forecast: Triple Bottom Breakout & Bullish Target Overview of the Chart & Market Structure

The EUR/JPY daily timeframe chart presents a Triple Bottom Pattern, a powerful bullish reversal formation that suggests a potential shift in market sentiment. This pattern occurs when price tests a key support level three times and fails to break lower, indicating strong buying interest at that zone.

Historically, a Triple Bottom leads to a significant trend reversal as sellers lose strength and buyers gain control. If confirmed by a breakout above resistance, this setup could provide a high-probability trading opportunity for swing traders and position traders.

Key Chart Components & Price Action Analysis

1. Triple Bottom Formation

The three bottoms marked on the chart represent repeated failed attempts by sellers to push the price lower:

Bottom 1 (August 2024): The first rejection from the support zone (~155.000) led to a temporary bounce.

Bottom 2 (October 2024): Price retested the same level, but buyers stepped in again, preventing a breakdown.

Bottom 3 (March 2025): The final test of support confirmed a strong accumulation zone, setting the stage for a potential bullish breakout.

In technical analysis, a Triple Bottom is considered a stronger reversal signal than a Double Bottom, as it represents prolonged buying pressure at key levels.

2. Support & Resistance Levels

Support Zone (~155.086): This level has been tested multiple times and remains a solid demand zone, where buyers have consistently entered the market.

Resistance Zone (~166.000): This level represents the neckline of the pattern, which must be breached to confirm a bullish reversal.

Breakout Target (~179.233): If price breaks out above 166.000, the projected target is set at 179.233, based on the height of the Triple Bottom pattern.

Trading Strategy & Entry Plan

1. Entry Point – Waiting for Confirmation

A buy trade should be initiated ONLY after a confirmed breakout above the resistance level (~166.000). Traders should wait for a daily candle close above this level, preferably with high volume, to confirm the breakout.

2. Stop Loss Placement

A stop-loss should be placed below the third bottom (support level) at 155.086 to minimize risk.

This placement ensures that if price invalidates the pattern by moving below the support level, the trade is exited early.

3. Profit Target Calculation

The measured move technique is applied to estimate the target. The height of the pattern (distance from support to resistance) is projected upward from the breakout point.

Target price: 179.233, aligning with historical resistance.

4. Risk-to-Reward Ratio & Position Sizing

The risk-to-reward ratio (RRR) for this setup is favorable, making it an attractive swing trade opportunity.

Traders should adjust position sizes based on risk tolerance, ensuring proper money management principles are applied.

Additional Confirmation Factors

1. Volume Analysis

A breakout with increasing volume will confirm strong bullish momentum.

Weak volume during breakout could indicate a false breakout, requiring caution.

2. RSI & Momentum Indicators

RSI trending above 50 suggests growing bullish strength.

Bullish divergence on RSI or MACD would add further confidence to the trade.

3. Retest of Resistance as Support

Often, after breaking resistance, price retests the breakout level before moving higher.

This could offer a secondary entry opportunity for traders who miss the initial breakout.

Potential Risks & Market Conditions to Watch

False Breakouts – If price fails to sustain above resistance, the pattern could be invalidated.

Macroeconomic Events – Major news events, such as ECB or BOJ policy decisions, could impact EUR/JPY movement.

Geopolitical Uncertainty – Unexpected events may cause volatility and deviation from technical patterns.

Conclusion – High-Probability Bullish Setup

The Triple Bottom Pattern in EUR/JPY is shaping up as a strong bullish reversal setup. If the price successfully breaks above 166.000, a rally toward 179.233 is expected.

📌 Trading Plan Recap:

✅ Entry: Buy above 166.000 (confirmed breakout).

✅ Target: 179.233 (measured move projection).

✅ Stop Loss: 155.086 (below support).

✅ Risk-Reward Ratio: Favorable for swing traders.

This setup aligns well with technical and price action strategies, making it an attractive trade idea for the upcoming weeks.

NZD_CHF BEARISH BREAKOUT|

✅NZD_CHF made a bearish

Breakout of the key horizontal level

and the breakout is confirmed so we

are bearish biased and we will be expecting a

Further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD-CHF Nice Bearish Setup! Sell!

Hello,Traders!

CAD-CHF made a retest

Of the horizontal resistance

Level and is already marking

A bearish pullback while trading

In a bearish wedge pattern so

If we see a breakout then

A further move done is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Euro can exit from pennant and rebound up from support areaHello traders, I want share with you my opinion about Euro. The price was previously trading inside an upward channel, where it consistently rebounded from the support line and moved toward the resistance line. After a final bounce from the lower boundary, EUR made a strong breakout and exited the channel, triggering a powerful bullish impulse. This move brought the price directly to the current support level at 1.0745, which overlaps with the support area. After reaching the local high, the price turned around and entered a correction phase, forming an upward pennant pattern. Inside this structure, we can see how EUR respected both the resistance line and the rising support line of the pennant. Recently, the price rebounded from the support line again, showing signs of strength near the support area, and is now consolidating at the edge of the pennant. This setup often signals an upcoming breakout. I expect the price to break above the resistance line of the pennant and continue its bullish move toward TP1, which is set at 1.0950 points. Please share this idea with your friends and click Boost 🚀

Silver (XAG/USD) Rising Wedge – Bearish Breakdown Setup!A rising wedge is a pattern that typically forms when the price makes higher highs and higher lows, but the upward momentum starts weakening. The narrowing structure of the wedge indicates that buyers are losing strength, and a breakout to the downside is likely.

Key Characteristics of the Rising Wedge:

✔ Higher highs & higher lows – but with reduced momentum

✔ Trendline support (lower boundary) & resistance (upper boundary)

✔ Volume decline – suggests a potential reversal

Expected Scenario:

If the price breaks below the lower trendline, it signals bearish pressure, and Silver could see a strong decline.

2. Key Levels & Trading Setup

📌 Resistance Level ($34.50 - $34.80)

The upper boundary of the wedge is acting as strong resistance.

Historically, this zone has rejected price action multiple times, indicating sellers are defending this area.

📌 Support Level ($30.20 - $30.50)

A major demand zone where buyers previously stepped in.

If the wedge breaks down, this is the most likely target for the decline.

📌 Stop Loss ($34.81)

Placed just above the recent high and resistance zone to limit risk in case of an unexpected upside breakout.

📌 Target ($30.20)

Measured move from the wedge breakdown projects a sharp decline toward the next strong support at $30.20.

3. Trade Execution Strategy

🔴 Bearish Breakdown Scenario

If the price breaks below the lower trendline (around $33.00), we expect a strong move downward.

📉 Short Entry: Below $33.00 (after confirmation)

🎯 Target: $30.20

❌ Stop Loss: $34.81 (above resistance)

Confirmation Needed:

✅ Strong bearish candle close below support

✅ Increased volume during breakdown

✅ Retest of broken support turning into resistance

🟢 Bullish Alternative (Invalidation)

If price breaks and holds above $34.81, the bearish setup will be invalidated, and a breakout towards $36.00 - $37.00 could be expected.

4. Additional Considerations

📌 Fundamental Factors: Keep an eye on macroeconomic news, Fed decisions, and USD strength, as these impact Silver prices.

📌 Risk Management: Avoid overleveraging and use a proper risk-reward ratio (1:3 or higher).

📌 Market Sentiment: Watch volume trends and confirm breakout or fakeout before entering trades.

Conclusion

This chart presents a high-probability short trade setup based on the rising wedge breakdown.

If the breakdown occurs, Silver could drop toward the $30.20 support zone. However, traders should wait for confirmation before entering to avoid fakeouts.

Would you like me to refine this further for a TradingView post? 🚀

EURJPY Confirmed Pennant Pattern BreakoutOANDA:EURJPY Long Opportunity

Price has made a Breakout of the Falling Resistance of the Pennant Pattern it has been forming the past couple of weeks.

The Breakout meets all the requirements needed to be validated as a True Breakout!

With Price trading above the 200 EMA, this adds more confirmation that the Bulls are in-control and we can reasonably expect to see price move to the Upside.

At the Start of the Following Hour ( 09:00 CST ), I will enter a Long Position on OANDA:EURJPY with my SL below the Retest of the Break!

CAD_CHF BEARISH WEDGE PATTERN|SHORT|

✅CAD_CHF made a retest of

The horizontal resistance

Of 0.6213 which makes us

Locally bearish biased and

On top that we are seeing a

Fully formed bearish wedge

Pattern so IF we see a bearish

Breakout from the wedge

Pattern we will be expecting

A further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Free Signal! Buy!

Hello,Traders!

GOLD is trading in an

Uptrend and my bullish

Bias is reinforced by the

Trade war and a possible

Recession fear which comes

As a reaction to the Trump's

Car tariffs. So as the price

Is trying to break the all-time-high

Level of 3058$ we can enter

A long trade with the Take

Profit of 3101$ and

Stop Loss of 3027$

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAT - Falling Wedge PatternKUCOIN:CATUSDT (3D CHART) Technical Analysis Update

CAT is currently trading at $0.000008225 and showing overall bullish sentiment

Price has broken out from the falling wedge pattern and we are seeing beginning of the bullish trend. Expecting this trend to continue until the price hits the resistance zone.

Entry level: $0.000008225

Stop Loss Level: $0.000004602

TakeProfit 1: $0.000011536

TakeProfit 2: $0.000011536

TakeProfit 3: $0.000034238

TakeProfit 4: $0.000065098

Max Leverage: 2x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

SUI - Falling Wedge - Confirmed BreakoutBINANCE:SUIUSDT (1D CHART) Technical Analysis Update

SUI is currently trading at $2.77 and showing overall bullish sentiment

Price has formed nice falling wedge and we see a clear breakout from the falling wedge pattern. I'm expecting this trend to hold and read the resistance level around $5.3

Entry level: $2.7

Stop Loss Level: $1.8

TakeProfit 1: $3.1

TakeProfit 2: $4

TakeProfit 3: $5.3

Max Leverage: 2x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

SUI ANALYSIS🚀#SUI Analysis :

🔮As we can see in the chart of #SUI that there is a formation of "Falling Wedge Pattern". In a daily timeframe #SUI broke out the pattern. Expecting a bullish move in few days if #SUI retest the levels

⚡️What to do ?

👀Keep an eye on #SUI price action. We can trade according to the chart and make some profits⚡️⚡️

#SUI #Cryptocurrency #TechnicalAnalysis #DYOR

Starbucks (SBUX) Brewing a Breakout? Don’t Miss This $100 BattleStarbucks (SBUX) 2-Hour Chart Breakdown

Hey traders, let’s dive into Starbucks (SBUX) on the 2-hour chart and see what’s cooking. The price is sitting at $99.65 right now, up a tiny 0.01%, but don’t let that small move fool you—this chart has been a wild ride lately, and I think we’re at a really interesting spot for a potential trade.

What’s Been Happening with the Price?

If you look at the chart, you’ll see Starbucks hit a high of $112.38 back on March 17th. That was the peak, and man, did it come crashing down after that! The price tanked all the way to $97.34 by early April, a pretty steep drop. Since then, though, things have calmed down a bit, and we’ve been stuck in this tight range between $97.34 and $100.00. Lately, the price has been pushing toward the upper end of that range, and it’s got my attention.

Let’s Talk Trends

From mid-March to early April, we were in a clear downtrend. You can see it on the chart—lower highs, lower lows, and a descending trendline that kept the price in check as it slid down. It was a bear’s paradise, and there’s even a sell signal marked on the chart from that $112.38 peak that caught a massive 27.96% profit on the way down. Not bad at all!

But now, things are starting to shift. After hitting that $97.34 low, the price has been consolidating, and just recently, it broke above that descending trendline. That’s a big deal because it tells me the bears might be losing their grip. We’re not in a full-on uptrend yet, but the momentum feels like it’s tilting toward the bulls, especially with the price testing that $100.00 level.

Key Levels to Watch

Let’s zoom in on the levels that matter here. On the downside, $97.34 has been a rock-solid support. The price has bounced off that level a couple of times in early April, so it’s a spot I’m keeping an eye on. If we drop back down, that’s where I’d expect buyers to step in again.

On the upside, $100.00 is the big resistance we’re testing right now. The price has struggled to break through here before, so it’s a critical level. If we can get a clean break above it, I think we could see a nice move higher. The next big resistance after that would be around $107.00, which was a swing high from late March, and then up toward $111.00 or even that $112.38 peak if things really get going.

What the Past Signals Tell Us

The chart has a couple of trade signals marked, which give us some context. That sell signal at $112.38 was a home run, as I mentioned—27.96% profit as the price collapsed. Then there’s a buy signal at the $97.34 low on April 5th, but that one only managed a peak profit of 0.27%. Not exactly a big win, and it makes sense because the price has been stuck in this range since then. It’s like the market’s been taking a breather, trying to figure out its next move.

Digging into the Technicals

Alright, let’s get into the nitty-gritty of what’s happening on the chart. That break above the descending trendline is a bullish sign for me. It’s like the price is saying, “I’m done with this downtrend, let’s try something new.” We’re also in this consolidation range between $97.34 and $100.00, and when I see a range like that, I know a breakout is usually coming. The question is, which way?

One thing that’s catching my eye is the potential for a double bottom pattern. We’ve got two tests of that $97.34 support, and if we can break above $100.00, that would confirm the pattern. If that happens, I’d measure the height of the pattern and project it upward, which could take us toward $107.00 as a first target. That’s something to watch for.

I’d love to see volume on this chart to confirm the breakout, but from the price action alone, it feels like there’s some buying interest building as we push toward $100.00. If we get a strong candle closing above that level, I’ll be a lot more confident in the bulls.

How I’d Trade This Setup

So, what’s the play here? I see a few ways to approach this, depending on what the price does next.

First, let’s talk about the bullish case. If we get a solid break above $100.00—ideally with a strong 2-hour candle and some good volume—I’d be looking to go long. My first target would be $107.00, and if we get some momentum, maybe even $111.00 or $112.38. I’d set my stop loss just below the recent swing low around $98.00 to protect myself in case this breakout fails. That trendline break and the potential double bottom make me think the bulls have a shot here.

On the flip side, if the price gets rejected at $100.00—and I’ll be watching for something like a shooting star or a bearish engulfing candle—I’d consider a short. If we drop back down, $97.34 is the first target, and if that support breaks, we could even see $94.00, which is a psychological level and a spot where I’d expect some buyers to show up. For a short, I’d set my stop loss just above $100.65 to give it a little room.

If you’re more of a scalper, you could play the range while we’re stuck in it. Buy near $97.34, sell near $100.00, and use tight stops outside the range—say, below $97.00 for longs and above $100.65 for shorts. It’s a decent way to grab some quick profits while we wait for the bigger move.

A Word on Risk

One thing I always remind myself is to keep risk in check. Starbucks has been volatile—look at that 27.96% drop from the peak! So, I’d be careful with my position size and aim for at least a 1:2 risk-reward ratio on any breakout trade. Also, keep an eye out for any news that might shake things up, like earnings reports or big economic data releases. Starbucks is in the consumer discretionary sector, so things like consumer spending trends or even coffee prices could move the stock.

The Bigger Picture

Speaking of the broader market, Starbucks can be influenced by how the NASDAQ 100 is doing, since it’s listed there. If the overall market is feeling optimistic, that could help push SBUX higher. On the other hand, if there’s a risk-off vibe, we might see that $100.00 resistance hold strong. It’s always good to check the bigger picture before jumping into a trade.

Wrapping It Up

So, where does that leave us? Starbucks is at a really interesting spot right now, testing that $100.00 resistance after breaking above the descending trendline. I’m leaning toward a bullish breakout, especially with that potential double bottom pattern, but I’ll be watching closely to see if we get confirmation above $100.00. If we do, I think $107.00 is a realistic target, with $111.00 or higher in play if the bulls really take control. But if we get rejected here, $97.34 is the level to watch on the downside.

For now, I’d say be patient and wait for the price to show its hand. Whether you’re looking for a breakout or playing the range, there’s definitely an opportunity here. Just make sure to manage your risk and stay on top of any news that might move the stock. Let’s see how this plays out I’ll be watching this one closely!