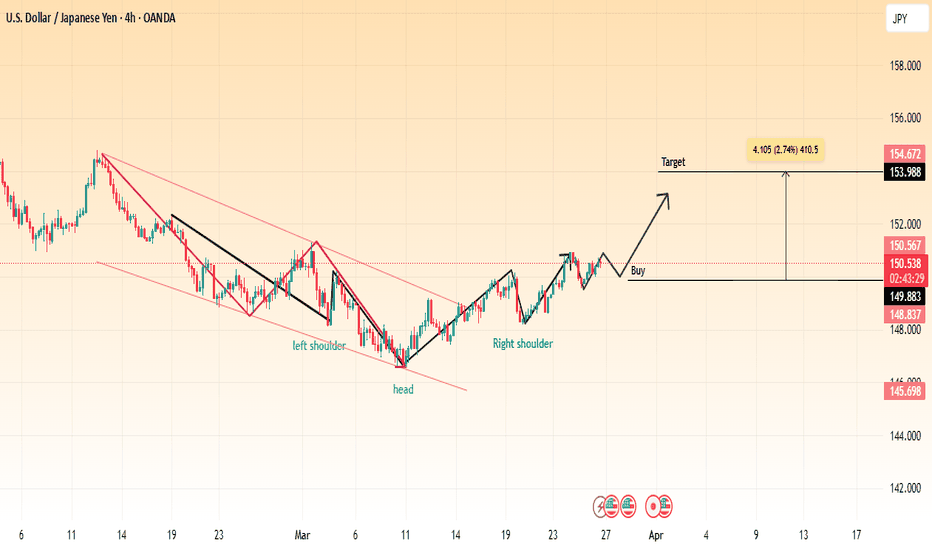

USD/JPY Bullish Reversal (Inverse Head & Shoulders)📌 Pattern: Inverse Head & Shoulders

📌 Analysis: The chart showcases an inverse head and shoulders pattern, a classic bullish reversal formation. The price has successfully broken out of the downward trendline, indicating potential upside movement.

🔹 Left Shoulder: Formed during the previous retracement.

🔹 Head: The lowest point of the pattern, marking strong support.

🔹 Right Shoulder: Completed with a breakout above resistance.

📈 Trading Plan:

✅ Entry (Buy): After a confirmed breakout and possible retest.

🎯 Target: 153.988 - 154.672 (2.74% potential gain).

🔻 Support: 149.883 - 148.837 (Stops should be placed accordingly).

📊 Conclusion:

If the price maintains above the breakout level, we may see a strong rally toward the resistance target. Watch for volume confirmation and pullback retests before entering a trade.

Breakout

Stella, is she finally ready?Stella has been in a massive downtrend since it's run in 2021.

Looking at the above chart there is a reason to be bullish now and with a massive pricetarget.

It has been trading in a bull-flag for years and has recently broken out, AND retested the upper bound of the channel.

Target: 3$ (would mean an mcap of 3B, which is doable)

Stoploss: 0.035$ (would mean re entry of the channel and invalidates this idea)

Will update frequently when asked

Rustle

Gold (XAU/USD) Technical Analysis – Triangle Breakout & Bullish Overview of the Chart

This chart presents a daily timeframe (1D) analysis of Gold (XAU/USD) and highlights a well-defined bullish trend supported by a breakout from a triangle pattern. The overall price action suggests a strong uptrend continuation, with clearly marked support and resistance levels, trendlines, and potential trade setups.

Gold has been consistently respecting key technical levels, forming higher highs and higher lows, which is a classic indicator of a strong bullish market. Traders can use this analysis to identify entry points, stop-loss levels, and profit targets for a strategic trading approach.

Key Technical Components in the Chart

1. Triangle Pattern Formation – The Setup for Breakout

One of the most crucial formations in this chart is the triangle pattern, which acts as a continuation pattern.

The triangle pattern (highlighted in green) represents a period of consolidation where price action was squeezing between higher lows and lower highs before a breakout occurred.

This pattern suggests that buyers and sellers were in equilibrium, building up momentum before gold made a decisive move to the upside.

The breakout above the upper boundary of the triangle confirms the bullish continuation, leading to a strong rally.

📌 Technical Significance: Triangle patterns are a reliable technical structure used by traders to anticipate breakouts. The breakout direction (upward in this case) determines the next trend phase.

2. Trendline Analysis – Defining Market Structure

The dashed black trendline represents the primary ascending trendline, which has been respected multiple times, indicating that the market remains in an uptrend.

Several minor support levels (highlighted in blue) have acted as strong demand zones, preventing price breakdowns and helping sustain the bullish momentum.

A major support zone (highlighted in beige at $2,300-$2,400) serves as the base of the uptrend, where price action historically reversed strongly, indicating heavy institutional buying.

📌 Technical Significance: As long as the price remains above these support levels, the uptrend remains intact.

3. Breakout & Price Action Structure – Momentum Confirmation

The breakout from the triangle pattern signaled the beginning of a new bullish impulse wave, and the price action structure confirms this move.

Higher Highs & Higher Lows: The black zig-zag pattern represents a strong bullish structure where each retracement finds support before continuing higher.

Price Movement Post-Breakout:

After breaking above the triangle’s resistance, gold started forming higher highs at an accelerated pace.

Minor pullbacks are bouncing off key support levels, providing re-entry opportunities for traders.

📌 Technical Significance: A breakout followed by sustained higher highs and strong buying pressure is a key bullish signal.

Trading Plan & Strategy

1. Entry Strategy – Ideal Buying Zones

Buy on Pullbacks:

Enter near minor support levels to take advantage of retracements.

This improves the risk-to-reward ratio and reduces exposure to sudden reversals.

Confirmation Signals:

Look for bullish candlestick patterns (bullish engulfing, pin bars, hammer candles).

Increased trading volume on bullish moves supports trend continuation.

2. Stop-Loss & Risk Management

📍 Stop-Loss: $2,661

Placed below the most recent minor support level to protect against downside risk.

If price breaks below this level, it may signal a trend shift or deeper correction.

📍 Why this Stop-Loss Level?

It ensures a tight risk control while allowing room for natural price fluctuations.

3. Take-Profit & Target Projection

📍 Target Price: $3,170

The measured move projection from the triangle breakout suggests a target near $3,170, which aligns with historical resistance.

If the price approaches $3,100-$3,170, traders should monitor for potential reversals or further breakouts.

4. Key Factors Supporting the Bullish Bias

✅ Uptrend Structure: The market is making higher highs and higher lows, which is a textbook sign of bullish momentum.

✅ Breakout Confirmation: The price has broken out of the triangle pattern and is sustaining higher levels.

✅ Support Levels Holding: Each pullback is being absorbed by buyers at well-defined support zones.

✅ Momentum & Volume: Increased volume and strong buying pressure indicate that the bullish trend is likely to continue.

5. Risk Management & Market Conditions

Market Sentiment:

If gold continues to hold above the support zones, further upside momentum is likely.

If price starts breaking below key support levels, it may signal a trend reversal or deeper correction.

Geopolitical & Economic Factors:

Gold prices are often affected by inflation data, interest rate changes, and global uncertainties.

Traders should monitor economic news that could impact gold’s trend.

Conclusion – A High-Probability Trade Setup

This analysis confirms that gold (XAU/USD) is in a strong bullish uptrend following a successful triangle breakout.

🚀 Trade Setup Summary:

✅ Entry: Buy on pullbacks at minor support levels

✅ Stop-Loss: $2,661 (Below support)

✅ Target Price: $3,170 (Next resistance level)

✅ Risk-Reward Ratio: Favorable setup with strong trend confirmation

🔹 Final Verdict: As long as gold remains above the minor support levels, the bullish bias remains strong, making this a high-probability long trade setup.

Would you like to add any additional indicators (RSI, MACD) for confirmation? 📈

ZEC/USDT: Breakout in Play – 100%+ Upside Move Incoming?🚀 Hey Traders! ZCASH Breakout Alert – 100%+ Move Loading? 👀🔥

If you’re pumped for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 ZEC/USDT – Massive Breakout in Play! 🚀

ZEC is breaking out from a symmetrical triangle on the 6H timeframe and has successfully retested it, confirming the breakout. 💥

With this solid retest, ZEC looks poised for a 100%+ upside move.

Long some here with low leverage and add more on dips to ride the wave higher. 🚀

💰 Trade Setup:

📍 Entry: CMP and add more up to $35

🎯 Targets: $41 / $52 / $63 / $72 📈

🛑 Stop-Loss: $32.80

⚡ Leverage: Use low lev (Max 5x)

🔎 Strategy:

✅ Enter with low leverage now

✅ Add more on dips and ride the breakout momentum 🚀

💬 What’s Your Take?

Are you bullish on ZEC’s breakout potential? Share your targets, analysis, and predictions in the comments! Let’s crush it and secure those gains together! 💰🔥🚀

EUR-GBP Bearish Breakout! Sell!

Hello,Traders!

EUR-GBP made a bearish

Breakout of key horizontal

Level of 0.8353 so we are

Bearish biased and after

A potential pullback we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin Breakout | Bullish Momentum Building Towards $98K+Key Observations:

Ascending Channel: BTC has been trading within an upward-sloping structure, confirming bullish momentum.

Retest Level: The price has pulled back to the trendline for a retest, a crucial confirmation point before potential upside continuation.

Target Projection: The expected breakout move suggests a 13.69% increase, targeting $97,467 - $98,630 levels.

Support Levels: Key supports are around $85,335 - $84,474, which could act as a safety zone if price rejects the breakout.

Trading Plan:

Bullish Bias: A successful retest and bullish confirmation could propel BTC to the $97,467 - $98,630 resistance zone.

Invalidation: A drop below the support zone near $84,474 may invalidate this bullish outlook.

Conclusion:

BTC/USD is displaying strong bullish potential, with a well-formed ascending structure and a possible breakout move. Traders should watch for confirmation of the trendline retest before entering long positions.

S/USDT: FALLING WEDGE BREAKOUT!! 🚀 Hey Traders! SONIC Breakout Alert – ATH Incoming? 👀🔥

If you’re excited for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 SONIC/USDT – Breakout & Retest in Play! 🚀

SONIC is breaking out of a falling wedge on the 4H timeframe and is currently retesting the breakout level. With momentum building, we’re expecting a move toward ATH soon.

💰 Trade Setup:

📍 Entry: CMP, add more up to $0.50

🎯 Targets: $0.56 / $0.62 / $0.69 / $0.78 / $0.85 / $0.96

🛑 Stop-Loss: $0.46

⚡ Leverage: Low (Max 5x)

🔎 Strategy:

Enter with low leverage now

Add more on dips and ride the wave higher

💬 What’s Your Take?

Are you bullish on SONIC’s breakout? Share your analysis, predictions, and strategies in the comments! Let’s lock in those gains and ride this pump together! 💰🚀🔥

EUR/JPY Breakdown: Falling Wedge Breakout & Bullish SetupThe EUR/JPY 4-hour chart is presenting a well-structured price action setup, featuring a falling wedge breakout, a strong bullish trendline, and key resistance and support levels. This detailed analysis will walk through each aspect of the chart to provide a professional trading perspective.

1. Market Context & Price Action Overview

At the beginning of the chart, EUR/JPY was experiencing a downtrend, characterized by a series of lower highs and lower lows, forming a falling wedge pattern. This pattern is typically a bullish reversal signal, indicating that sellers are losing strength and buyers may take control.

Once the price reached a key support zone near 156.08, it bounced, leading to a breakout of the falling wedge. Since the breakout, the price has been moving in a bullish trend, forming higher highs and higher lows, respecting an ascending trendline.

2. Technical Patterns & Key Levels

🔹 Falling Wedge Pattern – Bullish Breakout

The falling wedge is identified by two converging trendlines sloping downward.

It indicates that bearish momentum is weakening as price compresses.

A breakout above the upper wedge line confirmed the shift in trend direction.

The breakout candle had strong bullish momentum, suggesting increased buyer interest.

🔹 Support and Resistance Levels

📉 Major Support Level (~156.08):

This level acted as a demand zone, where buyers aggressively stepped in.

The price formed multiple rejections at this level before breaking upwards.

A stop-loss placement below this level is ideal for bullish trades.

📈 Resistance Level (~163.50 - 164.00):

This zone has been tested multiple times as price approaches from below.

A break and retest of this resistance would confirm further bullish momentum.

If price faces strong rejection, a short-term pullback to the trendline may occur.

🎯 Final Target (~166.79):

This is the next major resistance level, aligning with previous swing highs.

It serves as a strong take-profit (TP) level for long positions.

If price reaches this level, we may see a consolidation phase or possible reversal.

3. Trend Analysis & Market Structure

📈 Bullish Trendline:

The price has been respecting an ascending trendline, acting as dynamic support.

This trendline connects higher lows, confirming a strong bullish trend.

As long as price stays above this line, buyers remain in control.

📊 Market Structure:

Since breaking out from the falling wedge, the price is forming a classic bullish structure of higher highs and higher lows.

This indicates sustained buyer pressure and a potential continuation toward resistance levels.

4. Trading Setup & Risk Management

📌 Entry Strategy:

Aggressive Entry: After the wedge breakout with a tight stop-loss.

Conservative Entry: Wait for a pullback to the trendline support or a break and retest of resistance at 163.50 - 164.00.

🔻 Stop Loss Placement:

Below 156.08 (previous support zone) to protect against trend invalidation.

Alternatively, below the rising trendline for a dynamic SL approach.

🎯 Take Profit Targets:

TP1: 163.50 - 164.00 resistance zone (Partial profits).

TP2: 166.79 final target, aligning with historical resistance.

5. Market Outlook & Potential Scenarios

✅ Bullish Scenario (High Probability)

If price holds above the trendline and breaks 163.50 - 164.00, we expect a continuation towards 166.79.

The structure remains intact as long as higher highs and higher lows persist.

❌ Bearish Scenario (Low Probability, but Possible)

If price fails at resistance and breaks below the trendline, it could signal a deeper retracement.

A break below 156.08 would completely invalidate the bullish setup, leading to a potential downtrend.

6. Summary & Key Takeaways

Trend Bias: Bullish, supported by a falling wedge breakout and higher highs.

Key Levels: Support at 156.08, resistance at 163.50 - 164.00, final target at 166.79.

Trading Strategy: Buy on retests of trendline or resistance breakouts.

Risk Management: Use dynamic stop-loss levels to minimize downside exposure.

🔹 Final Verdict:

If price remains above support and successfully breaks 163.50 - 164.00, a strong move toward 166.79 is expected. However, traders should remain cautious of trendline breakdowns and manage risk accordingly.

📊 Stay disciplined, follow your trading plan, and always use stop-loss protection! 🚀 #EURJPY #Forex #TradingStrategy #PriceAction

EURUSD - 2 ScenariosHello Traders !

On Tuesday 11 March, Th EURUSD reached the resistance level (1.09374 - 1.09058).

So, We have 2 Scenarios:

BULLISH SCENARIO:

If the market breaks above the resistance level and closes above that,

We will see a bullish move📈

TARGET: 1.11580🎯

BEARISH SCENARIO:

If the price breaks and closes below the neckline,

We will see a huge bearish move📉

TARGET: 1.06350🎯

IP/USDT: BREAKOUT ALERT!!🚀 Hey Traders! IP Breakout Alert – 80% Move on the Horizon? 👀🔥

If you’re pumped for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 IP/USDT – Massive Breakout in Play! 🚀

IP is breaking out from a triangle on the 4H timeframe and looks primed for a 70-80% upside move. This setup has huge potential, making it a must-watch trade. 💥

💰 Trade Setup:

📍 Entry: $6.10 – $6.35

🎯 Targets: $6.96 / $7.84 / $8.92 / $11.2 📈

🛑 Stop-Loss: $5.78

⚡ Leverage: Use low lev (Max 5x)

🔎 Strategy:

✅ Enter with low leverage now

✅ Add more on dips and ride the breakout momentum 🚀

💬 What’s Your Take?

Are you bullish on IP’s breakout potential? Share your targets, analysis, and predictions in the comments! Let’s crush it and lock in those gains! 💰🔥🚀

CAD_JPY POTENTIAL LONG|

✅CAD_JPY made a bullish

Breakout of the key horizontal

Level of 104.800 and the breakout

Is confirmed which reinforces our

Bullish bias and makes us expect

A further move up after the

Retest of the new support

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CRUDE OIL Will Go Up After Pullback! Buy!

Hello,Traders!

CRUDE OIL is trading in a

Local uptrend and the price

Made a strong bullish breakout

Of the key horizontal level

Of 68.40$ so after a pullback

And a retest of the new support

We will be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTCUSD 2H | Breakout Flow + BOS Confirmation – CelestiaPipsBTC is slowly developing a breakout structure on the 2H timeframe .

Multiple bullish BOS points and a solid NY session demand base formed.

Price is currently retesting the breakout zone after sweeping short-term liquidity.

If price holds this zone, we could see continuation toward 88,900.

I’ve mapped out the entire flow – BOS, entry zone, and final target.

Watch how price reacts from this level.

— Shared by CelestiaPip

ETH/USD – Bullish Breakout & Buying OpportunityEthereum has broken out of a descending channel and is consolidating near a key support zone. The price action suggests a potential bullish continuation, with a buying opportunity forming above the $2,000 - $2,100 support level.

Key Levels to Watch:

Support: ~$2,000, ~$1,800

Resistance Zone: ~$2,250

Target: ~$2,530

Trading Plan:

Buy Entry: On breakout and retest above $2,250

Stop-Loss: Below $2,000

Take-Profit: $2,530

If Ethereum successfully breaks resistance with volume confirmation, it could rally toward $2,500+, making this a strong bullish setup. Keep an eye on price action for confirmation. 🚀

TAO ANALYSIS🔮 #TAO Analysis 💰💰

🌟🚀 As we can see that #TAO is trading in a symmetrical triangle and given a perfect breakout. But there is an instant resistance. If #TAO breaks the resistance 1 then we will see a good bullish move in few days . 🚀🚀

🔖 Current Price: $271

⏳ Target Price: $305

#TAO #Cryptocurrency #DYOR

ARC ANALYSIS🔮 #ARC Analysis

💲💲 #ARC is trading in a Symmetrical Triangle Pattern. If the price of #ARC breaks and sustain the higher price then will see a pump. Also there is an strong support zone. We may see a retest towards the support zone first and then a reversal📈

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀

#ARC #Cryptocurrency #Support #Resistance #DYOR

GOLD 1H | Demand Zone Reaction & Breakout Plan – CelestiaPipsGOLD on the 1H timeframe is reacting from a previously tested demand zone around 3000 .

Watching for a clean break & retest above 3044 for bullish continuation toward 3065.

Trendline break could act as early confirmation.

Structure-based idea shared by CelestiaPips.

(XAU/USD) Bearish Reversal After Head & Shoulders Formation."

Overview:

The price action of Gold (XAU/USD) on the 2-hour timeframe indicates a potential bearish move. A Head & Shoulders pattern has formed, signaling a possible trend reversal. The market recently tested a resistance level and is now showing signs of weakness.

Key Levels:

🔹 Resistance: $3,044 - $3,055 (Rejection Zone)

🔹 Sell Entry: Below $3,028 (Break of Support)

🔹 Support Level: Around $2,980 (First Key Level)

🔹 Target: $2,940 - $2,931 (Final Bearish Target)

Analysis:

✅ Price has broken below the neckline of the Head & Shoulders pattern, confirming a potential sell-off.

✅ A retest of the broken support as resistance could offer a better entry for shorts.

✅ If the price holds below $3,028, further downside toward $2,940 is expected.

✅ Bullish invalidation if price breaks back above $3,044.

Trade Idea:

📉 Sell below: $3,028

🎯 Target: $2,940

🛑 Stop Loss: Above $3,044

This setup aligns with technical analysis principles, with risk-to-reward favoring sellers. Monitor price action for confirmation before entering a trade.

🚀 What’s your view on Gold? Comment below!

Will this same bars pattern on CHZ repeat?Welcome back dear reader, for another Chilliz post.

As i've been analyzing the chart further my eye fell on the bars pattern from May till October 2020, and noticed that it looks ALOT like the current bars pattern.

The market structure it would form would also make alot of sense from a traders perspective. Allow me to explain while i have your attention.

The only sellers remaining now are from 2021 or earlier, so we might stay in this area for a couple of weeks for people to capitulate. Those that got in earlier are eager for a break-even and will probably get that end of this month or beginning of April. Then around the latter half of May we might see 0.20$ followed by a retest of the lower bounds forming a perfect W as traders suspect it to be the absolute end of the bullmarket. Only for it to be followed by a quick recovery and a massive blowoff top!

Target: Remains around 3$ (The fractal would indicate 17$ and a market cap of 160B, at 3$ it would be 28B which isn't too farfetched)

Stoploss: 0.032$

Final remarks: Do i know for certain that it will happen? No, but the charts tell us a different story.

Rustle

WHAT WILL BE THE NEXT MOVE OF GOLD ?🚀 GOLD (XAU/USD) – High-Probability Trade Setups! 🚀

Hey, traders! Hope you're all geared up for another exciting week in the markets! 🏆 As we get ready for the market open, let’s break down what’s next for Gold (XAU/USD).

📊 Last Week’s Recap

📈 Gold hit 3057, but before the market closed, we saw a strong rejection pushing price back down. Now, Gold is stuck in a range between 3024 resistance and 3020 support—meaning we need a breakout before taking action!

💡 No-trade zone = 3020 - 3024 ❌ Stay out until a breakout happens!

Two Possible Trading Scenarios

🔵 Scenario 1: Buy Above 3024

📌 If a 30M candle closes above 3024, we wait for the next candle to wick down while keeping the previous low safe.

📌 Once price breaks the high of the previous closed candle, we enter buys targeting 3034! 🚀

✅ Break-even after 40 pips—lock in those profits! 💰

🔴 Scenario 2: Sell Below 3020

📌 If a 30M candle closes below 3020, we wait for the next candle to wick up while keeping the previous high safe.

📌 Once price breaks the low of the previous closed candle, we enter sells targeting 3011! 📉

✅ Break-even after 40 pips—protect your capital!

📍 Final Trade Plan

📊 BUY above 3024 🎯 TP: 3034

📊 SELL below 3020 🎯 TP: 3011

📢 Don’t chase trades! Let the market confirm and follow the plan! 📈🔥 #XAUUSD #GoldAnalysis #ForexTrading #SmartMoney