EURUSD, another breakout aheadAfter offering multiple SELL opportunities over the last year, the EURUSD pair is consolidating once again on the daily timeframe.

Similarly, the RSI Exhaustion at the bottom is consolidating.

Both these consolidations mean that the pressure is increasing and ultimately the pair will break either to the upside (trend reversal) or to the downside (trend continuation).

Remember to stay patient and always look for confirmation from the indicators!

Breakoutpivotalbars

EURCHF - Consolidation opportunityAfter a significant downtrend from 1.20 down to below 1.00, the EURCHF pair is now consolidating on the daily timeframe.

Similarly, the Sentiment Index at the bottom is consolidating.

Both these consolidations mean that the pressure is increasing and ultimately the pair will break either to the upside (trend reversal) or to the downside (trend continuation).

The opportunity now is to trade the pair within the consolidation considering it's very large and clearly identifiable.

Remember to stay patient and always look for confirmation from the indicators!

Breakout opportunity on EURUSDThe EURUSD is currently in a downward channel and two alternative scenarios are possible:

The downward channel should signal a further move to the upside. This view is supported by the fact that the pair broke up a similar consolidation in late-May/early-June and the price has increased until early September when it started consolidating. The RSI Exhaustion indicator is also supporting this view. In fact, it is increasing (diverging with the price!) and became bearish exhausted twice (colored red) in the last couple of months. A break to the upside can push the price in the 1.22-1.24 area.

On the other hand, the price could continue to consolidate for some time and eventually move down at least until the 1.115 level. In such a case we should expect to see the RSI Exhaustion decreasing, becoming bearsih exhausted (colored red), and eventually becoming oversold as well.

Among the two alternatives, the first (breakup) is the one more likely but remember to be patient and always check confirmation from the indicators!

Breakout opportunity on WTICOUSDA breakout opportunity is forming on the WTICOUSD.

The pair has seen a rather significant upmove earlier this year from around 40 to about 65. Since the spring it has been consolidating between mid 60s and the low 50s.

The price is now squeezing and the indicators we use, all confirm that a new opportunity is forming.

Remember to be patient and always check confirmation from the indicators!

Breakout opportunity on BTCUSDA breakout opportunity is forming on the BTCUSD.

The pair has seen a big upmove since earlier this year. More recently it has been consolidating between the high 13000s and the low 9000s.

Currently, the price is squeezing and the indicators we use, all confirm that a new great opportunity is coming.

Remember to be patient and always check confirmation from the indicators!

Breakout opportunity on EURUSDA breakout opportunity is forming on the EURUSD.

The pair is in a downtrend since many weeks and has offered plenty of trading opportunities. More recently it has been consolidating between the high 1.14 and the low 1.12.

Currently, the price is squeezing and the indicators we use, all confirm that a new great opportunity is coming.

Remember to be patient and always check confirmation from the indicators!

A BIG MOVE IS COMING ON EURUSDI usually post 1h charts but I think this weekly chart is very helpful to every FX trader .

EURUSD is in consolidation since last May in the 1.155–1.18 area. This situation is the prelude of a breakout and a big impulsive move coming in the second part of 2018 and possibly 2019.

The indicators are currently looking good but we need to wait and see the breakout, either up or down.

Are you of the same opinion? Feel free to share your feedback below.

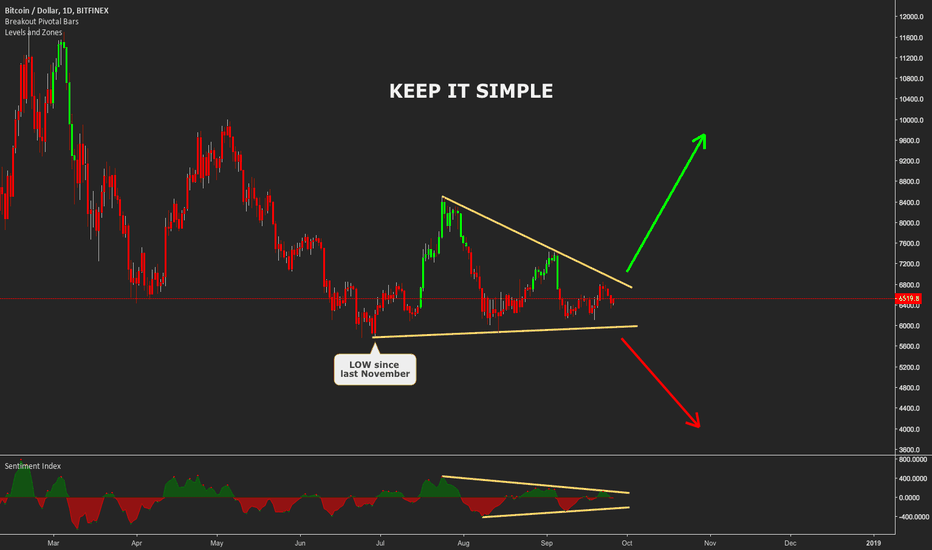

BIG MOVE COMING ON BTCUSDThe BTCUSD is due to a major move soon. The pair has been consolidating to the downside for several months now and it has been significantly squeezing until now.

During the last few months, the pair formed Lower Highs and Higher Lows, hence forming a nice pattern that is about to be broken.

The Sentiment Index is squeezing which is a great indication that something big is about to happen.

The Breakout Pivotal Bars is negative (red candles) so a breakdown seems more likely but we need to wait and see the color of the breakout candle.

Either way the price will break, we are prepared and ready to profit from the move.

Breakout opportunity on AUDUSDA breakout opportunity is forming on the AUDUSD. The pair is in a downtrend from a few weeks and has already given three very great sell opportunities. The setup was identical for all the three:

• breakdown of price

• breakdown of Sentiment Index

• opportunities below resistance

Right now the breakout could be either to the upside or to the downside so let's just wait and see when the breakout comes.

Last but not least, always check confirmation from the indicators!

HOW TO RIDE TRENDSThis educational idea refers to the last trading idea I published (linked below) and to many more I traded in the past.

The chart above shows the BTCUSD going from about 6'500 at the beginning of April up to around 10'000 in early May and all the way back down to about 6'500 in mid-June.

This idea shows how it was possible to ride the trend all the way up (4 buy opportunities) and all the way down (4 sell opportunities) with three indicators: the Breakout Pivotal Bars , the Sentiment Index and the Levels and Zones .

Here's how they work to identify setups:

Breakout Pivotal Bars

• For break-ups the candle must be coloured in green.

• For break-downs the candle must be coloured in red.

• Blue candles mean indecision so either trend continuation or imminent trend reversal. Depending on your strategy it is possible to trade them or not.

Sentiment Index

Possible situations are:

• Breakout (e.g. Bullish Sentiment in case 1 or Bearish Sentiment in case 8)

• Divergence with the price (Bullish Sentiment in case 8)

Levels and Zones

Gives a reference in real-time to where the most significant levels and their corresponding long/short zones are.

Let's see the 8 trading opportunities:

1. Break-up of consolidation (blue candle) + Break-up of Bullish Sentiment + Above Support -> GOOD OPPORTUNITY

2. Break-up of consolidation (green candle) + Break-up of Bullish Sentiment + Above Support -> GOOD OPPORTUNITY

3. Break-up of consolidation (blue candle) + Break-up of Bullish Sentiment + No Support nearby -> VALID OPPORTUNITY but pay attention

4. Break-up of consolidation (green candle) + Break-up of Bullish Sentiment + Resistance Above -> VALID OPPORTUNITY but pay attention

5. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment (divergence in Bullish Sentiment) + Below Resistance -> GOOD OPPORTUNITY

6. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment + Support is pretty far! -> GOOD OPPORTUNITY

7. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment + Support is pretty far! -> GOOD OPPORTUNITY

8. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment + Support is still pretty far! -> GOOD OPPORTUNITY

ANTICIPATING THE MARKETThis idea shows how the Sentiment Index indicator clearly anticipates big shifts in the Market.

The first situation shows the EURUSD consolidating between late 2016 and spring 2017 – the consolidation was characterized by a consistent decline in the Bearish Sentiment which ultimately led to a strong uptrend until early 2018 (1500+ pips movement).

The second situation shows the EURUSD in an opposite setup – a sligthly shorter consolidation charaterized by a decline in the Bullish Sentiment and a consequent breakdown of the pair.

Predicting market moves with JUST ONE INDICATORThis idea shows how easy it was to identify a massive opportunity on BTCUSD with the Levels and Zones indicator.

Basically, after days of sideways movement, the pressure started to build up and ultimately a massive explosion took place!

First, the Resistance Level moved significantly down (hence pushing price lower), then the Support Level made its move up (hence pushing price higher). Give it a few more time for the pressure to increase further (price is forced to move into a tight channel) and then the explosion takes place.

You can find a similar setup before most of the major impulsive movements across any asset and timeframe. First, pressure builds up then, the explosion takes place!