KPEL : Breakout stock#KPEL #swingtrade #breakoutstock #Wpattern #patterntrading

KPEL : Swing Trade

>> Trending Stock

>> W Pattern Breakout soon

>> Good Volumes & Strength

>> Good upside potential

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, Comment & Follow for more analysis

Disc : Charts shared are for Learning purpose not a Trade Recommendation, Take postions only after consulting your Financial Advisor or a SEBI Registered Advisor.

Breakoutstock

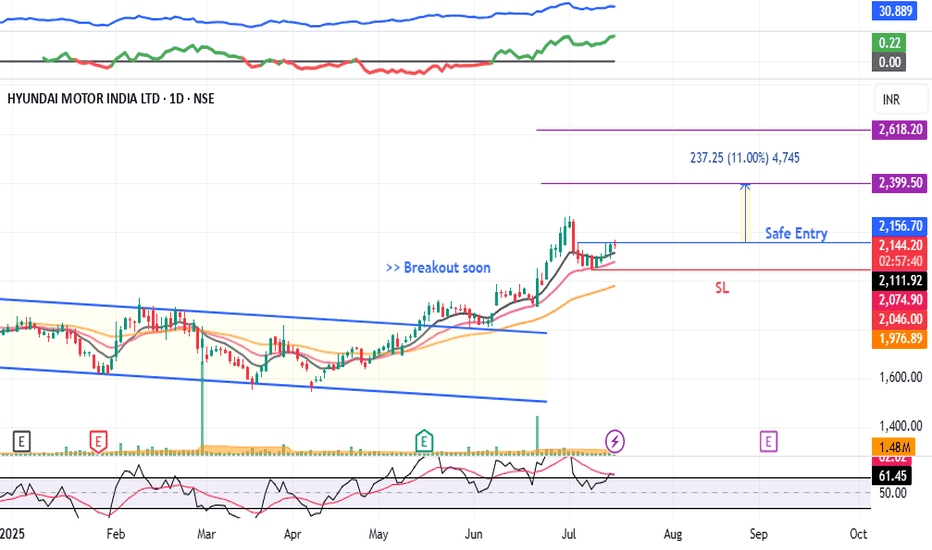

HYUNDAI - Swing Trade#HYUNDAI #swingtrade #trendingstock #momentumtrading #breakoutstock

HYUNDAI : Swing Trade

>> Breakout soon

>> Trending Stock

>> Volume Dried up

>> Good strength

>> Low Risk Trade ( RR - 1:2 or 1:3 )

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, like and comment if u like the analysis

Disc: Charts shared are for Learning purpose, Take position only after consulting ur Financial Advisor or a SEBI Registered Advisor

India's leading Provider of Technology and AI services stockHello everyone, i hope you all will be doing good in your trading and your life as well, today i have brought stock which name is R Systems and it is a leading provider of technology, artificial intelligence, analytics and knowledge services. It partners with customers to enable or elevate their digital transformation with diversified digital offerings including product engineering, cloud enablement, quality assurance testing and digital platforms and solutions.

Technicals:-

Technically stock has given breakout of falling resistance trendline.

Stock has given golden crossover of 200-DEMA.

MACD and RSI started giving bullish crossover.

Fundamentals:-

Company has delivered good profit growth of 22.4% CAGR over last 5 years

Company has a good return on equity (ROE) track record: 3 Years ROE 27.6%

Company has been maintaining a healthy dividend payout of 53.4%

Company's working capital requirements have reduced from 35.8 days to 15.7 days

Market Cap

₹ 5,683 Cr.

Current Price

₹ 480

High / Low

₹ 599 / 250

Stock P/E

43.1

Book Value

₹ 51.7

Dividend Yield

1.41 %

ROCE

26.0 %

ROE

24.2 %

Face Value

₹ 1.00

Industry PE

35.3

Debt

₹ 131 Cr.

EPS

₹ 11.1

Promoter holding

51.9 %

Intrinsic Value

₹ 218

Pledged percentage

0.00 %

EVEBITDA

21.4

Change in Prom Hold

0.00 %

Profit Var 5Yrs

22.4 %

Sales growth 5Years

19.2 %

Return over 5years

60.1 %

Debt to equity

0.21

Net profit

₹ 132 Cr.

ROE 5Yr

25.1 %

Profit growth

-9.64 %

Disclaimer:- Please always do your own analysis or consult with your financial advisor before taking any kind of trades.

Dear traders, If you like my work then do not forget to hit like and follow me, and guy's let me know what do you think about this idea in comment box, i would be love to reply all of you guy's.

Thankyou.

Shree Cement looking strong on charts supported by volumesShree Cement Ltd. engages in the manufacturing of cement and cement-related products. The company's brand names include Shree Ultra, Bangur, and Rock Strong. The firm's products include: Ordinary Portland Cement, Portland Pozzolona Cement, Portland Slag Cement, and Composite Cement.

CMP of the stock is Rs.25746.55. The Negative aspects of the company are Companies with growing costs YoY for long term projects , High PE (PE > 40), MFs decreased their shareholding last quarter and Declining cash from operations annual. The company's Positive aspects are No debt, Zero promoter pledge, Improving annual net profit.

Entry can be taken after closing above 25835. Targets in the stock will be 26000, 26733 and 27283. The long-term target in the stock will be 28317, 29210 and 30754. Stop loss in the stock should be maintained at Closing below 23767.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

RBA striving for making a come back. Restaurant Brands Asia Limited was originally incorporated as Burger King India Private Limited on November 11, 2013 at Mumbai. Subsequently, the Company converted into a Public Limited Company and name of the Company was changed to Burger King India Limited on September 25, 2019. Thereafter, name of the Company was changed from "Burger King India Limited" to "Restaurant Brands Asia Limited". The Company is engaged in the business of Quick Service Restaurants under the brand name of "Burger King" and is presently a subsidiary of QSR Asia Pte.Ltd. The Burger King brand is the second largest fast food burger brand globally as measured by the total number of restaurants, with a global network of over 18,000 restaurants in more than 100 countries.

CMP of the stock is Rs. 105.10. The Negative aspects of the company are Companies not able to generate net cash, MFs decreased their shareholding last quarter and High Interest Payments Compared to Earnings. The company's Positive aspects are Stock with Low PE (PE < = 10), Highest FII stock holdings, Company with Zero Promoter Pledge and Company with Low Debt.

Entry can be taken after closing above 107. compounding can be done after closing above 111. Targets in the stock will be 118 and 123. The long-term target in the stock will be 129 and 134. Stop loss in the stock should be maintained at Closing below 95.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

IDFC (Intraday)IDFC is on the verge of a breakout, tomorrow is the result too...

Keep this on your radar, movement is expected on either side.