ONE POINT ONE SOL LTD bullish reversal pattern✅ Trade Setup (Swing Trade)

📌 CMP: ₹62.21

🟢 Entry (Buy Zone): ₹60–₹63

🎯 Targets:

Target 1: ₹69.80 (Fibo 0.382)

Target 2: ₹78.50 (Fibo 0.5)

Target 3: ₹87.30 (Fibo 0.618)

🛑 Stoploss: ₹55 (below wedge breakout and recent support)

⚖️ Risk-Reward Ratio:

Entry: ₹62 | SL: ₹55 | Target 1: ₹70 → ~1:1

For higher targets, risk-reward improves to 2:1 or more.

for educational purposes only

Breakoutstocks

Sanathan Textiles | Breakout After Rounded Bottom Setup Overview:

The stock has formed a rounded bottom pattern, indicating accumulation and a potential breakout.

Strong bullish weekly candle with a 10% gain and breakout above resistance box.

RSI showing an upward breakout from oversold zone = bullish momentum building.

Recommendation

Buy Zone: ₹410–₹420 (current market price ₹417.60)

Stoploss: ₹378 (below last higher low and box bottom)

Target 1: ₹480

Target 2: ₹525

Target 3 (swing): ₹600+

⏳ Ideal for swing to medium-term traders (1–8 weeks holding time).

for educational purposes only

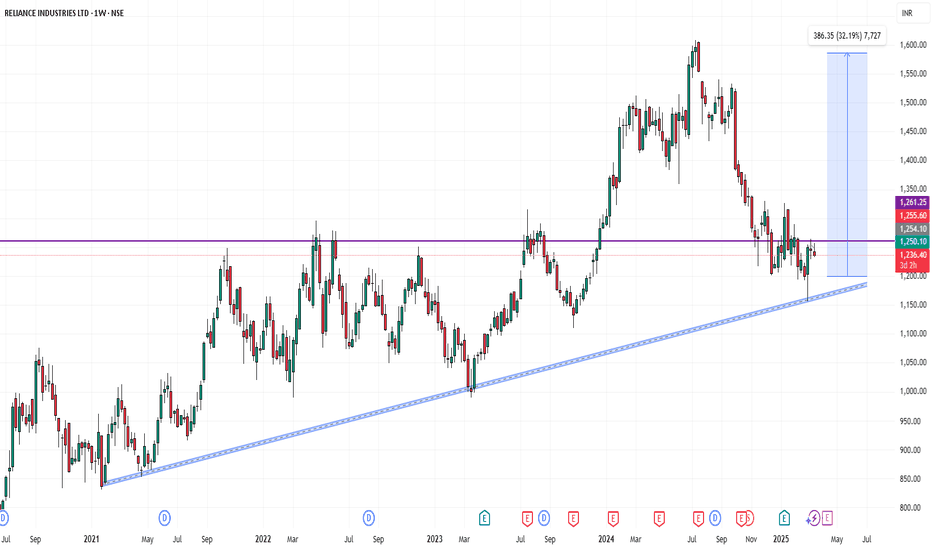

Reliance Industries📈 Reliance Industries Breakout Alert – ₹1241 Key Level Breached 🚀

Reliance Industries has successfully broken out above a strong resistance zone near ₹1241, indicating a potential bullish move ahead. This level acted as a critical supply zone in the past, and the breakout with volume confirmation adds strength to the trend.

🔍 Technical Highlights:

Breakout Level: ₹1241

Volume: Above average (confirming strength)

Trend: Bullish

Next Resistance Zones: ₹1265 / ₹1290

Support Zones: ₹1220 / ₹1200 (previous resistance now acting as support)

Harsha engineering good swing pick?Harsha engineering from fundamental pov company is debt free and has delivered a good cagr return

Now stock is at good value looks like in mid of Jan month it will pop up with good volume

Risk traders can accumulate at cmp keeping sl at 475 almost 8% while safe trader can accumulate at 485-515

Tgt 562 598 676 720

Only for educational purposes

Ask your financial advisor and broker before buying

JSW ENERGY BREAKOUT LEVELS JSW Energy - Potential Breakout Setup

📈 Analysis: JSW Energy is showing signs of building momentum. The stock is currently testing a key resistance zone at ₹ . If the price breaks above this level, we could see a strong breakout rally. A clean breakout above ₹ would confirm the bullish trend, potentially targeting ₹ in the near term.

🔑 Key Factors to Monitor:

Look for an increase in volume as confirmation of the breakout.

A close above ₹ on high volume will likely push the stock higher.

The RSI is showing strong bullish momentum, suggesting more upside potential.

Watch out for any reversal patterns or resistance re-tests after the breakout.

💡 Trade Idea:

📅 Timeframe: Watch for price action over the next few sessions to confirm the breakout.

📌 Disclaimer: This post is for educational purposes and does not constitute financial advice. Always perform your own analysis or consult a professional before making any trades.

GOLDEN Breakout setup on Nifty 50 for (30-12-24)Nifty 50 index was going sideways for 3 days, today it gave bull breakout but not sustained properly. So next trading day can become significantly important if you do breakout trades!

ANALYSIS :

On chart you can see I am using my custom build indicator named Golden Trading System (GTS) it shows two significant support and resistance zones which works like magic! as of now it is not published but you can follow us to get notified when we publish this.

How you can use it ?

Alternatively you can use standard pivot point and change the pivot type to camarilla. Here we will only use H3-H4 and L3-L4.

In the chart you can see I already marked the H3-H4 and L3-L4 for tomorrow (30-12-24) so you can use that instead.

How to TRADE ?

Tomorrow (30-12-24) three thing can happen :-

(i) If market gave breakout the green band (H3-H4) we can look Long setup.

(ii) If market gave breakout the red band (L3-L4) we can look Short setup.

(iii) Market can go sideways / range bound between green band and red band.

CAUTION :-

While taking bullish trades we should not neglect the red resistance line and also While taking bearish trades we should not neglect the red support line because form those points market can reverse so trade cautiously and with "Stop Loss".

PDSL - Near ATH - looking strongPDSL has come close to ATH and looks strong.

Volume picking up and RSI is also stronger.

Stock can goes sideway for few days or drop a little to cool down the RSI, then it should take the flight up.

I will keep updating this idea, keep a watch.

Any comment or feedback on this idea are welcome.

Tesla's Electrifying Rally: Stock Zooms to New Peaks● After facing a notable setback at the $415 mark, the stock took a dramatic plunge, dropping around 75% before finding its footing close to the $100 threshold.

● Following this, the stock entered an extended period of consolidation, eventually created a Rounding Bottom pattern.

● Recently, the stock has surpassed its previous resistance and reached all-time high.

● This breakthrough has sparked significant excitement, with optimism soaring about the stock's future growth potential.

DCAL - READY TO SOAR - A buy on DIP stockAGAINNNNNN....

with a big OPPORTUNITY in DISHMAN CARBOGEN AMCIS LTD🚀🚀

This stock has completed its correction and it's now ready to move towards north. let see how?

Technical view- a simple understanding for beginners

* The stock has given a breakout with good intensity of volume .

* The price changed its structure from lower low to higher high

* Stock price is challenging Upper Bollinger Band

* RSI ( a strength indicator) is above 60 in Daily Time Frame which indicates strong momentum

Understanding Waves

Key Elliott Wave Principles:

1. Five-Wave Impulse Pattern : The primary trend unfolds in five waves (1-2-3-4-5). Waves 1, 3, and 5 move in the direction of the trend, while waves 2 and 4 are corrective.

2. Three-Wave Corrective Pattern: After a five-wave sequence, a correction typically follows, consisting of three waves (A-B-C) that move against the primary trend.

3. Wave Relationships: Fibonacci ratios play a crucial role in Elliott Wave analysis, often governing the length of the waves.

4. Wave Characteristics: Each wave has its own set of characteristics. For example, Wave 3 is usually the most powerful, showing the strongest price movement, while Wave 5 may signal the final push before a significant correction.

Current Elliott Wave Analysis on DCAL

- The stock is currently in bigger IMPULSE Wave in which it has completed wave 1 and wave 2 (correction) now it is in the bigger and the strongest wave 3

Targets - generally the targets of wave 3 goes up to 1.618 levels with TREND FIB from wave 1 to wave 2

* In this stock, the targets as per wave theory is around 425.70

* Intermediate targets as per technical view are 247-290-375-425.70

Invalidation / stoploss - invalidation of the up-move is 80

Trade Plan-

* one can add at current levels and again if it comes down you will get an opportunity to add more till 150-140

* Invest keeping in mind for short to long term view, not for speculation.

THANK YOU

KARANN DINGRA

EPL Ltd Breakout Alert: 52-Week High + Bullish Momentum! Ready f📈 EPL Ltd (EPL) is showing explosive bullish momentum and has recently achieved a 52-week breakout, positioning it for potential short-term gains. Here’s why EPL should be on your radar:

🔑 Key Technical Highlights:

Bullish Marubozu Candle: Strong buyer dominance, signaling a solid uptrend.

RSI Breakout (63): Momentum is building; watch for continued upward pressure.

Volume Breakout: Price surge supported by heavy volume—confirming buyer interest.

Donchian Bands: New highs suggest further breakout potential ahead.

Bollinger Bands: Positive breakout confirms the strength of the current trend.

Stochastic (94) & CCI (195): Strong overbought levels indicate market strength.

MACD Bullish Crossover: A confirmed bullish signal, pointing to sustained upward movement.

200 EMA: Price above the EMA, and both price and moving averages are trending up, showing a strong uptrend.

Bullish Candlestick Patterns:

🔥 Long White Candles across the Daily, Weekly, and Monthly timeframes indicate consistent bullish pressure and potential for further upward movement.

Why This Could Be a Great Trade:

Possible Swing Trade: Targeting short-term profits with strong bullish indicators.

Possible BTST (Buy Today, Sell Tomorrow): Perfect setup for quick gains.

📢 Don’t miss out on this breakout opportunity – EPL is trending upward, and the momentum is strong! 💥

🚀 Are you ready to take action?

💬 Share your thoughts, predictions, or trade setups in the comments below!

🔔 Follow for daily stock analysis and stay ahead of the market.

Possible levels to watch out : 324-360-396-432

ALB & GPN's Reversal Breakout Could Spark Significant GainsAlbemarle Corporation NYSE:ALB

● On the monthly chart, the stock is bouncing back from a long-standing trendline support that has held firm over the years.

● The daily chart reveals the emergence of an Inverted Head & Shoulders pattern following a significant decline.

● With a recent breakout, the stock appears poised for a potential trend reversal.

● Traders should keep a close eye on this stock for potential buying opportunities.

Global Payments NYSE:GPN

● The stock has formed a Double Bottom pattern after a brief period of consolidation.

● Recently, the price broke out from this formation and has been maintaining its position above the breakout point.

● The price movement suggests a short-term buying opportunity, as the resistance level is quite distant from the current price.

Nippon India Nippon India is seen following 6 week down trendline and we have fresh Trendline breakout above 680,

also stock is trading above 20, 50, 100 and 200 EMA.

Stock bounced back from 20 EMA on weekly time frame

This stock can hit all time high in 2-3 weeks as per my analysis. Looking for 810, then 925 in 5-6 months.

Stock is having strong support at 640.

This is not a buy recommandation.

ASKAUTO strengthening Financias as well as Price Action NSE:ASKAUTOLTD

........................

KEY Performance

........................

Robust growth in both top line & bottom line

Highest ever Revenue & PAT in any quarter in past

Revenue growth outperformed Industry growth

Revenue up +31%, EBITDA up + 59%, PAT up +63%

EBITDA Margins at 11.9%, up 210 bps YoY

EBITDA margin improvement resulting from:

Higher Volume driven economies of scale

Benefit from ramp up of Karoli facility

Focus on cost optimization initiatives

EPS at Rs. 2.88, up +63% YoY

CRISIL revised outlook to Positive from Stable

CRISIL reaffirmed Credit Rating to AA- for

Long Term and A1+ for Short Term

Construction work of new Bengaluru Plant

progressing well as per plan

......................

Powertrain Agnostic product offerings in both EV and Non-EV.

4 World Class Technical Collaborations and 2 World Class Joint Ventures.

Robust financial performance with 17% Revenue growth, 26% EBITDA growth, 41% PAT growth and RoACE of 23.64% in FY24.

High entry barriers due to proprietary material formulations, in-house Engg, Designing & Tool room.

Long standing relationship with customers & established Aftermarket focused on Quality, Cost & Delivery.

ALLCARGO Logistics are Stablishing and Sustaining in PerformanceNSE:ALLCARGO

...................................................................................................................................................................................................................................................................................................................................................

KEY BUSSINESS HIGHLIGHTS

Global events coupled with high demand across trade lanes during the second quarter of 2024 (calendar year) has led toimproved volumes and increased freight rates. Demand is expected to continue through the peak season till end of theyear.

LCL volume for the quarter ended June’24 stood at 2.25 million CBM, similar on YoY basis and representing a QoQ growth of6%. FCL volume for the quarter stood at 156K TEUs, similar to last quarter and up 9% on a YoY basis.

ECU Worldwide onboarded a new leadership team in Argentina, Uruguay and Paraguay as part of growth initiatives in LatinAmerica.

Contract Logistics business has reported a revenue growth of 13% on a QoQ basis and 22% on a YoY basis on the back ofincreased wallet share from existing clients.

Express Business: Operating cost continues to get optimized to bring about future growth in EBITDA. For Q1FY25 EBITDAstood at Rs. 20 crores, up 11% YoY and 33% on QoQ basis

...................................................................................................................................................................................................................................................................................................................................................

Supply chain market is estimated to be at ₹63,000

crores.

• ASCPL is a leading pan india 3PL player with an

expansive network

• Market leadership in chemical warehousing and

dominance in western India

• Building strengths in auto & engineering and ecommerce

...................................................................................................................................................................................................................................................................................................................................................

$TSLA: Awaiting Breakout - Is Tesla Ready to Surge?

Breakout Level: Awaiting breakout above $215.66

Resistance Levels:

First Resistance: $221.05

Second Resistance: $224.85

Third Resistance: $228.26

Watch Point: Tesla is nearing a key resistance level. A breakout above $215.66 could trigger a strong bullish move.

SBIN: Watch for Breakout - Bullish or Bearish?

Bullish Breakout Level: Above ₹832.15

Potential Upside: Targeting ₹899

Bearish Breakout Level: Below ₹794.75

Potential Downside: Targeting ₹731.10

Critical Juncture: The stock is at a key decision point. Monitor closely for a breakout in either direction to plan your trade.