BTC/USD – Bearish Rejection, Targeting SupportChart Analysis:

BTC/USD is trading within a descending channel, showing a bearish trend.

Price recently tested the resistance zone but faced rejection.

A strong sell signal is indicated, suggesting a move towards the support level around $79,877.

If price breaks below support, further downside is possible.

Trading Plan:

Sell below resistance with a target at support.

Watch for confirmation signals before entering a position.

If price breaks above resistance, a trend reversal could be possible.

Breakouttrading

XAUUSD – Symmetrical Triangle Breakout or Breakdown?Gold (XAUUSD) is currently coiling within a symmetrical triangle on the 1H timeframe, indicating that a high-probability breakout or breakdown is imminent. Price is consolidating after a strong bullish trend, but volatility is compressing—typically a precursor to explosive movement.

📊 Technical Analysis

1. Symmetrical Triangle Formation

Price has been tightening within a symmetrical triangle, marked by lower highs and higher lows.

These patterns typically resolve in the direction of the preceding trend—but can also serve as reversal zones, especially at key highs.

2. Dual Scenarios Mapped Out

Bullish Breakout: If price breaks above the triangle, bulls may push toward the psychological resistance and Fibonacci extension target near 3,101.642, continuing the trend.

Bearish Breakdown: A rejection at triangle resistance and clean break below the support line could send gold down to the demand zone around 2,929, a 2.6% potential move, aligning with previous structure support.

3. Key Support Zone

The highlighted yellow block shows a strong demand zone, previously respected during a mid-March consolidation.

Price could seek this level if the triangle resolves to the downside.

🧠 Trade Setup Ideas

Bullish Bias: Break and hold above 3,020, potential long entry with TP around 3,101

Bearish Bias: Breakdown and close below 3,000, targeting the 2,930–2,915 zone

Invalidation Levels: Above 3,035 for bearish, below 2,995 for bullish

Break or Bounce? EUR/USD OpportunityHi Traders! The price is in a descending channel and is testing the lower boundary.

🔹 Scenarios:

Buy if it breaks above 1.0845, with a stop loss at 1.0790 and targets at 1.0870, 1.0900, and 1.0950.

Sell if it breaks below 1.0780, with a stop loss at 1.0830 and targets at 1.0750, 1.0720, and 1.0700.

📊 RSI is in the oversold zone—a potential bounce is possible! Watch the price action closely.

📢 Stay updated with live market movements!

🔥 Smash that like button and show some energy! Let’s trade like pros!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trade at your own risk.

Bounce from 200 EMA – Is XRP Ready to Fly?XRP is currently showing bullish momentum as it pushes toward the strong resistance zone after bouncing off the 200 EMA, which is acting as dynamic support. This move follows a consolidation phase above the strong support zone, indicating accumulation.

If the price breaks and sustains above the resistance zone, it could trigger a strong upward move.

DYOR, NFA

CHF/USD Trading Setup – Triple Bottom Reversal & Breakout Setup🔍 Overview of the Chart Setup

The CHF/USD (Swiss Franc vs. U.S. Dollar) 1-hour timeframe chart reveals a classic Triple Bottom pattern, which is a well-known bullish reversal signal. This pattern indicates that sellers have attempted to break the support level three times but failed, suggesting a potential shift in momentum from bearish to bullish.

Traders closely watch this structure as it often leads to a strong upward breakout once key resistance levels are breached. The current setup provides an excellent risk-to-reward trading opportunity, especially for those looking to capitalize on the breakout.

📊 Key Levels in the CHF/USD Chart

1️⃣ Support and Resistance Zones

🟢 Support Level (~1.1300 - 1.1280 Zone)

This zone has been tested three times, confirming strong buying interest at this price level.

The formation of long wicks on candlesticks signals strong demand and buyer dominance.

A breakdown below this level would invalidate the bullish setup and may indicate a continuation of the bearish trend.

🔴 Resistance Level (~1.1415 - 1.1430 Zone)

This level acts as a price ceiling, where previous bullish attempts were rejected.

A break and retest above this zone would confirm the Triple Bottom breakout.

🎯 Target Level (~1.1457 Zone)

The projected target is based on the height of the pattern, which is measured and added to the breakout point.

This level aligns with previous price action zones and acts as a natural take-profit area for traders.

🚨 Stop-Loss Level (~1.1243 Zone)

A stop-loss is placed below the support zone to protect against false breakouts or an invalidation of the pattern.

📉 Understanding the Triple Bottom Pattern

The Triple Bottom is a strong bullish reversal formation that occurs at the end of a downtrend. It signals that sellers are exhausted, and buyers are gradually taking control.

🔹 Breakdown of the Triple Bottom Formation

✅ Bottom 1 (First Low)

The first bottom forms when the price hits the support level and bounces back.

Sellers are still active, so price declines again to test the same support zone.

✅ Bottom 2 (Second Low - Confirmation of Support)

The second test of the support zone validates the demand area.

Buyers step in again, pushing the price upward.

The market still lacks enough momentum for a breakout, leading to a third retest.

✅ Bottom 3 (Final Low and Strong Rejection)

The third bottom is crucial because it signals the last test of support before a breakout.

The failure to break lower creates a higher probability of an upside move.

📌 Breakout Confirmation & Price Action Signals

🔵 The breakout is confirmed when:

The price closes above the resistance zone (1.1415 - 1.1430) with strong momentum.

Volume spikes during the breakout, indicating institutional buying interest.

A successful retest of the resistance zone as new support further validates the trend reversal.

If the breakout lacks volume or gets rejected, traders should be cautious of a fakeout or potential retracement.

📈 Trading Strategy & Execution Plan

🔹 Conservative Entry (Safe Approach)

Enter after a confirmed breakout above 1.1415, ensuring a strong candle close above resistance.

Look for a retest of the breakout level before entering the trade.

🔹 Aggressive Entry (Early Positioning)

Enter near the third bottom (~1.1300 - 1.1320) with a tight stop-loss.

Higher risk but better reward if the price moves upward without retesting.

🔹 Stop-Loss Placement

Conservative traders: Place the stop-loss below the support zone (~1.1243).

Aggressive traders: Place a tight stop below the recent swing low for better risk management.

📌 Profit Target Projection

Take Profit Target: 1.1457, based on the height of the pattern.

📌 Risk-to-Reward Ratio

Risk: ~60 pips (from entry to stop-loss).

Reward: ~150 pips (from entry to target).

Risk-to-Reward Ratio: 1:3, making it a high-probability trade.

📡 Additional Confirmation Indicators for Stronger Trade Setup

📊 1. Volume Analysis

A spike in volume at the breakout level suggests strong buyer interest.

Low volume on the breakout may indicate a potential fakeout.

📈 2. RSI (Relative Strength Index) Confirmation

RSI should be above 50 and trending upward to confirm bullish momentum.

If RSI is overbought (>70), watch for a pullback before entering the trade.

📉 3. Moving Averages Support

If the 50-period or 200-period moving average supports the breakout level, it adds extra confirmation.

A moving average crossover may further validate the trend reversal.

🔍 4. Beware of Fake Breakouts

If the price briefly moves above resistance but fails to hold, it may be a bull trap.

Always wait for a candle close above resistance and a potential retest before confirming the entry.

🛠️ Alternative Scenarios & Market Risks

🔺 Bullish Scenario (Breakout & Rally to Target)

Price breaks above 1.1415, confirming a trend reversal.

A retest of resistance as support gives additional buying confidence.

Price reaches 1.1457 target before facing new resistance.

🔻 Bearish Scenario (Fakeout & Breakdown Below Support)

Price fails to hold above resistance and falls back below support.

A breakdown below 1.1243 invalidates the pattern, triggering a bearish continuation.

Traders should cut losses quickly if the setup is invalidated.

⚠️ Fundamental Risks to Watch

U.S. Dollar news events (FOMC, NFP, CPI reports) can increase volatility.

Swiss economic data may impact CHF strength.

Unexpected geopolitical events can influence currency movements.

🔎 Summary of the Trading Plan

📌 Trading Strategy Checklist

✅ Pattern: Triple Bottom (Bullish Reversal).

✅ Entry Strategy: Buy after breakout confirmation above 1.1415.

✅ Take Profit Target: 1.1457.

✅ Stop-Loss Level: Below 1.1243.

✅ Risk-to-Reward Ratio: 1:3 (High-Profit Potential with Proper Risk Management).

💡 Final Thought:

This setup provides a high-probability bullish trade with strong technical confluence. However, always remain cautious of market news, economic reports, and sudden volatility that could influence price action.

🚀 Patience & discipline are key—wait for confirmation before entering! 📊

Bitcoin Inverted Cup & handle Bitcoin is forming an inverted Cup & handle pattern with a target of 63k-66k. I was surprised to see this when I inverted the chart. Just sharing with you what I see, and I hope the pattern changes and we continue to go up. However the highest probability at the moment is further downside, but we may still have a bounce toward 89k-91K before seeing the blood.

EUR/GBP Analysis – Symmetrical Triangle Breakdown & Bearish MoveThis EUR/GBP chart on the 1-hour timeframe showcases a well-defined symmetrical triangle formation, a widely recognized pattern in technical analysis that signals potential breakout opportunities. The price action has respected the converging trendlines, indicating consolidation before a decisive move. Recently, the market has broken below the support zone, confirming a bearish breakdown and providing a strong signal for potential downside movement.

This analysis will cover pattern formation, key technical levels, trading strategy, risk management, and future market outlook to provide a comprehensive professional breakdown of this setup.

1. Chart Pattern Analysis – Symmetrical Triangle Formation

A symmetrical triangle consists of two converging trendlines that squeeze price action into a narrowing range, reflecting market indecision. This pattern is considered a continuation pattern, meaning that the price is likely to continue in the direction of the prevailing trend after the breakout.

Pattern Characteristics in This Chart:

✅ Lower Highs: Price fails to break previous peaks, indicating weakening bullish momentum.

✅ Higher Lows: Buyers step in at higher points, preventing aggressive declines.

✅ Volume Decrease: Typical of consolidation within a symmetrical triangle.

✅ Breakout Confirmation: A strong bearish candle broke below the support level, signaling further downside potential.

2. Key Technical Levels & Zones

📌 Resistance Level + All-Time High (ATH) – 0.8421

This level represents the highest point in the pattern, where price faced repeated rejections.

It aligns with a historical resistance zone, indicating a strong supply area.

A breakout above this level would shift the market to a bullish bias.

📌 Support Level – 0.8379 (Now Acting as Resistance)

Previously a key demand zone where buyers defended the price.

Price has now broken below this level, confirming it as new resistance in a bearish scenario.

A successful retest followed by rejection increases downside confirmation.

📌 Stop-Loss Placement – 0.8421

Located above the upper trendline and recent highs to avoid false breakouts.

If price regains this level, the bearish scenario will be invalidated.

📌 Target Zone – 0.82926 (Major Support Area)

This is the next strong support level, acting as a potential take-profit zone for short positions.

It aligns with a previous price reaction area, making it a logical target for sellers.

3. Trading Setup & Strategy – Bearish Trade Plan

The breakdown from the symmetrical triangle structure presents an opportunity to short the pair with a defined risk-to-reward setup.

📌 Entry Strategy:

Enter short positions after price breaks and retests the 0.8379 support level as resistance.

Confirmation should come from bearish candlestick patterns like engulfing candles or pin bars.

📌 Stop Loss:

Placed above 0.8421, above the last swing high, to protect against potential false breakouts.

📌 Take Profit (TP) Target:

First TP: 0.8325 (Intermediate support)

Final TP: 0.82926 (Major support and key structure level)

Alternative Scenario – Bullish Reversal Possibility

If price reclaims 0.8379 and closes above it consistently, the bearish breakdown might be a false move.

A move above 0.8421 would invalidate the bearish setup, leading to potential bullish momentum.

4. Risk Management & Trade Confirmation

✅ Volume Analysis

A significant increase in volume on the breakdown strengthens the bearish outlook.

Low volume retests may indicate a weak reversal attempt, favoring continuation downward.

✅ Bearish Price Action Confirmation

Lower highs and consistent lower lows reinforce a bearish sentiment.

Rejections from the broken support (now resistance) validate the trade setup.

✅ Risk-to-Reward Ratio (RRR)

The Stop-Loss (SL) is tight, and the profit target is significantly larger, making this a high RRR trade.

Ideally, a RRR of at least 2:1 or 3:1 should be maintained for proper risk control.

5. Market Sentiment & Future Outlook

Bearish Bias Strengths:

Trendline break indicates strong downside pressure.

Failed attempts to break resistance suggest weakening bulls.

Global macroeconomic factors and fundamental catalysts may favor GBP strength over EUR in the near term.

Reversal Risks:

A strong bullish breakout above 0.8421 would shift momentum to the upside.

Fundamental news events (e.g., ECB or BoE statements) can impact market direction unexpectedly.

6. Summary & Conclusion

🔹 The EUR/GBP 1-hour chart has broken below a symmetrical triangle pattern, confirming a bearish breakout.

🔹 Key levels to watch: Resistance at 0.8421, support at 0.82926.

🔹 Trading strategy favors short positions, with a target at 0.82926 and a stop loss at 0.8421.

🔹 Confirmation comes from trendline breaks, volume analysis, and lower highs/lows structure.

📌 Final Verdict:

The setup is bearish unless price reclaims 0.8379 and invalidates the structure.

Traders should monitor price action, volume, and news events for further confirmations.

🔥 Potential Profit Target: 80-90 Pips 📉

⚠️ Risk Management is Crucial – Always Use Stop Loss & Proper Position Sizing

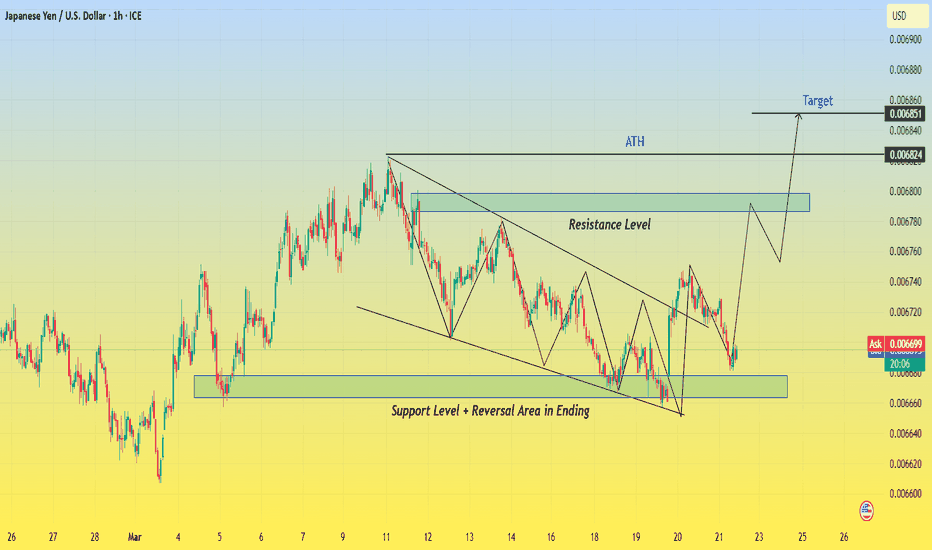

JPY/USD Trading Setup – Falling Wedge Breakout & Bullish MoveThe JPY/USD 1-hour chart is displaying a well-defined falling wedge pattern, which is typically a bullish reversal setup. This pattern forms as price action moves within converging trendlines, indicating that selling pressure is gradually weakening. The breakout from this pattern signals a potential trend reversal, and the price may be heading toward key resistance zones and an eventual bullish target.

This analysis will break down the chart structure, market psychology, key levels, and a trading setup to help traders make an informed decision.

1. Understanding the Falling Wedge Pattern

The falling wedge is a common price action pattern characterized by:

🔹 Lower highs and lower lows forming within two downward-sloping trendlines.

🔹 Decreasing volume, indicating that sellers are losing momentum.

🔹 A breakout above the upper trendline, confirming a shift in trend and signaling the start of bullish momentum.

Market Psychology Behind the Wedge Pattern:

📉 During the wedge formation, the market is in a downtrend, and sellers are in control. However, with each new lower low, the price finds strong support, and buyers start stepping in.

📊 As the wedge narrows, the downward momentum weakens, and sellers struggle to push the price lower. Eventually, demand exceeds supply, leading to a breakout to the upside, which is exactly what we see on this chart.

2. Key Levels & Market Structure

🔹 Support Zone & Reversal Area:

The support zone between 0.006660 - 0.006680 acted as a strong demand area, preventing further downside.

This is also labeled as a reversal area, meaning buyers were aggressive in this zone.

The final touch at this support led to a strong bounce, initiating the breakout.

🔹 Resistance Level:

The price is now approaching a key resistance area at 0.006780 - 0.006800, which previously acted as a supply zone.

A break and retest of this level would further confirm bullish momentum.

🔹 All-Time High (ATH) & Target Level:

The ATH region is marked on the chart as a historical resistance level where price faced strong selling pressure before.

If the current breakout holds, price action could aim for the 0.006851 target level, completing the measured move from the wedge pattern.

3. Trading Strategy & Execution Plan

📈 Entry Strategy:

There are two main ways to enter this trade:

1️⃣ Aggressive Entry: Enter immediately after the breakout above the falling wedge.

2️⃣ Conservative Entry: Wait for a breakout AND retest of the previous resistance turned support (0.006780 zone) before entering long.

🔻 Stop-Loss Placement:

To manage risk, traders should consider placing stop-loss orders:

Below the previous support zone (0.006660) to minimize downside risk.

Alternatively, below the wedge breakout point if using a tight stop-loss.

🎯 Take-Profit Targets:

1️⃣ First Target: 0.006780 (near-term resistance level).

2️⃣ Final Target: 0.006851 (based on wedge breakout projection).

4. Confirmation & Risk Management

🔎 Key Confirmation Factors for a Strong Breakout:

✅ Price breaks above the falling wedge with strong bullish candles.

✅ Volume increases, showing strong buying interest.

✅ RSI or other momentum indicators confirm bullish divergence.

⚠️ Potential Risks to Consider:

False Breakout: If price falls back inside the wedge, this could invalidate the bullish setup.

Rejection at Resistance: If buyers fail to push price above the 0.006780 resistance, it could lead to another consolidation.

5. Final Thoughts & Trading Outlook

📌 This JPY/USD chart presents a high-probability bullish setup due to the breakout from a falling wedge pattern.

📌 The breakout, strong support zone, and bullish price action indicate further upside potential.

📌 Risk management is key—waiting for confirmation can increase the probability of success.

💡 Final Verdict: Bullish Bias – Watching for Retest & Continuation to Target! 🚀

EUR/GBP Analysis – Bearish Momentum Gaining StrengthThe EUR/GBP pair has shown a significant shift in market structure, breaking below a critical support level and signaling further downside potential. After facing strong resistance near the 0.84400 region, the price struggled to maintain bullish momentum and started forming lower highs, indicating selling pressure.

Technical Breakdown:

Resistance Zone: The upper boundary near 0.84400 acted as a supply area where sellers gained control. Multiple rejection candles at this level confirmed that buyers were losing strength.

Support Breakdown: The price recently broke below a key support zone, which had previously acted as a demand area. This breakdown suggests a shift in market sentiment from bullish to bearish.

Bearish Continuation Pattern: The chart displays a clear lower high and lower low formation, reinforcing the bearish trend. The price is now retesting the breakdown zone, which could serve as a new resistance level before further declines.

Target Projection: The next major support lies at 0.82508, which aligns with a previous consolidation zone. If the bearish momentum persists, we may see a test of this level in the coming sessions.

Trading Considerations:

📌 Bearish Bias: Traders may look for sell opportunities on pullbacks toward resistance levels.

📌 Confirmation: A retest of the breakdown level with rejection signals could provide a strong entry point.

📌 Risk Management: Stop-loss placements above 0.83800 could help manage risk in case of an unexpected bullish reversal.

💡 Final Thoughts:

With the prevailing bearish momentum, EUR/GBP is likely to continue downward unless buyers regain control at key levels. Traders should watch for price action signals near support and resistance zones to confirm trade setups.

Bitcoin (BTC/USD) – Bullish Breakout in Progress📈 Chart Pattern:

Bitcoin has been trading inside a descending channel for several weeks. Recently, BTC has broken out of the channel’s upper boundary, indicating a potential shift in momentum.

🔹 Key Levels:

Support: $80,043.75 (Critical stop-loss level)

Resistance: $87,500 (Short-term)

Target: $92,944.17 (Upside projection)

📊 Trading Plan:

BTC might retest the breakout zone before continuing the upward move.

A confirmed higher low formation could signal strong bullish momentum.

If BTC remains above $85,500, further upside toward $92,944.17 is possible.

⚠️ Risk Management:

If BTC drops below $80,043.75, the bullish setup could become invalid.

Traders should wait for confirmation before entering long positions.

💡 Conclusion:

This breakout could lead to a strong uptrend, but traders should watch for a successful retest before making a move. 🚀🔍

BIKAJI : Breakout Candidate#bikaji #vcppattern #vcpsetup #trendline #breakout

BIKAJI : Swing Trade

>> Good Strength in stock

>> Volumes Dried up

>> Trendline Breakout

>> VCP Structure - Ready to Blast

>> Low Risk High Reward Trade

Swing Traders can lock profit at 10% and keep trailing

Disc : Charts shared are for Study Purpose, Do your own Analysis and consult your Financial Advisor before taking Position in it. Take Position as per Proper Risk Management.

Pls Boost, Comment & Follow us for More Learnings.

AUCTION Breakout Loading – $30+ Target?$AUCTION/USDT 1D chart shows a strong bounce from the key support zone, pushing towards the major resistance zone near the descending trendline. The price is currently at $16.39, indicating bullish momentum.

If AUCTION breaks above the major resistance and the resistance trendline, it could trigger a strong rally toward $30-$35+. However, rejection from this level may lead to another retest of support.

The Stoch RSI is mid-level, suggesting more upside potential. Watch for a breakout confirmation or a possible pullback before the next move.

DYOR, NFA

EUR/USD – Bullish Breakout Setup 🔹 Overview:

EUR/USD remains in an ascending channel and is currently near the support zone. A bullish move is anticipated toward the 1.12150 - 1.12382 resistance zone, aligning with the overall trend.

🔹 Technical Analysis:

✅ Support Zone: Holding at 1.07916, acting as a key demand area.

✅ Ascending Channel: Price structure remains bullish, with higher highs and higher lows.

✅ Target: Resistance around 1.12382 aligns with a possible breakout.

🔹 Trade Idea:

📌 Long Entry: Around the support zone if bullish confirmation appears.

📌 Target: 1.12150 - 1.12382 resistance zone.

📌 Invalidation: Break below 1.07916 could shift momentum bearish.

📊 Sentiment: Bullish bias, waiting for confirmation.

📢 Will EUR/USD hit the target? Let’s discuss! 👇

#1000XUSDT is setting up for a breakout📉 Long BYBIT:1000XUSDT.P from $0,05470

🛡 Stop loss $0,05297

1h Timeframe

⚡ Plan:

➡️ POC is 0,04229

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $0,05640

💎 TP 2: $0,05775

🚀 BYBIT:1000XUSDT.P is setting up for a breakout—preparing for an upward move!

#OIKUSDT continues its downtrend📉 Short BITGET:OIKUSDT.P from $0,0870

🛡 Stop loss $0,0909

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is N

🎯 TP Targets:

💎 TP 1: $0,0833

💎 TP 2: $0,0795

💎 TP 3: $0,0769

📢 Monitor key levels before entering the trade!

BITGET:OIKUSDT.P continues its downtrend — watching for further movement!

DEBRIDGE Breaks Trendline – Is a Major Move Coming?BYBIT:DBRUSDT 12H chart shows a breakout above the descending trendline, indicating a potential shift in market structure. The price is currently facing the nearest resistance zone, which has acted as a key level in previous price actions.

A short-term correction from this level is likely before another major move upward. The major resistance zone above could act as the next target if the price successfully holds above this breakout level

DYOR, NFA