Amazing breakout on WEEKLY Timeframe - THOMASCOOKCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Breakouttrading

Amazing breakout on WEEKLY Timeframe - TORNTPHARMCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - SAILIFECheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - GLOBUSSPRCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - TICheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

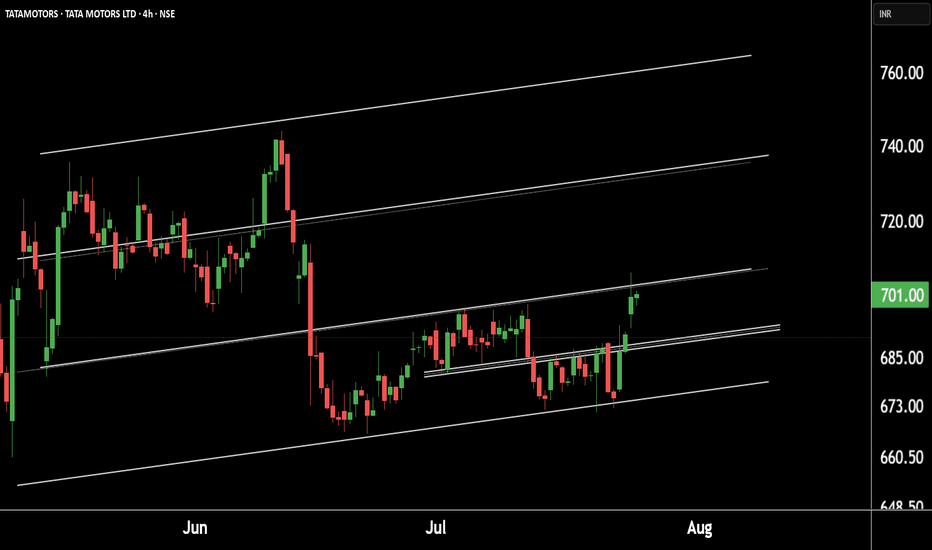

Tata Motors Gearing Up for a Fresh Rally! Technical Breakout !!This is the 4 hour chart of tata motor.

Tatamotor is moving in well defined parallel channel and bounced from it's supportt level near at 680, now ready for the breakout level at 705 .

If this level is sustain after the breakout then , we will see higher price in Tata motor.

Thank you !!

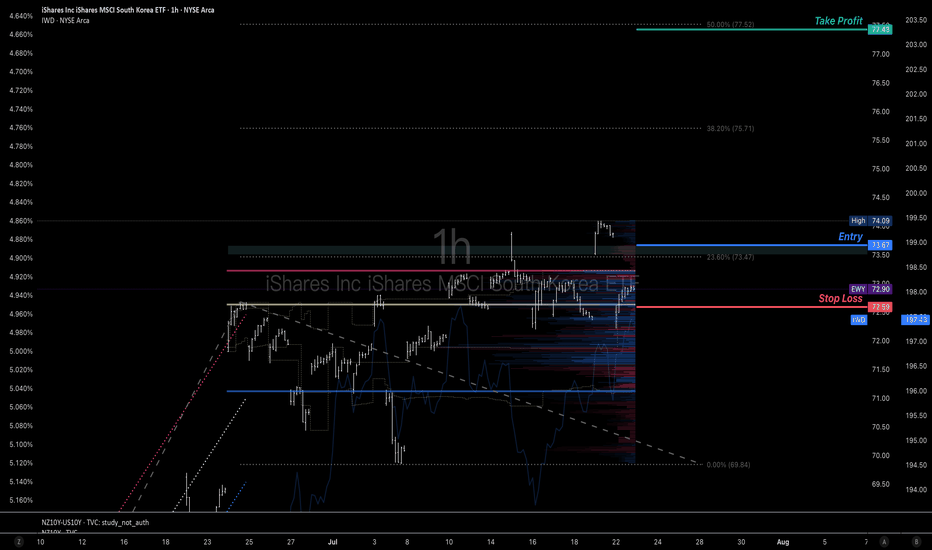

A potential chance to get long position of Korean equity marketsKorean economy and stock market emotion are well boosted by their regulation reform and new president elect. Many global traders miss the previous uptrend and the price is about to test the current resistance again.

Imma use a buy stop order @73.67 to try to get in the train to diverse my long position on equity market.

If you only do swing trades, there's a long swing trade plan on my chart. I may use the latest to take half of profit once the price hit the first or second resistance @77.43 above the current trading area to control the position size that can fit for long term trade.

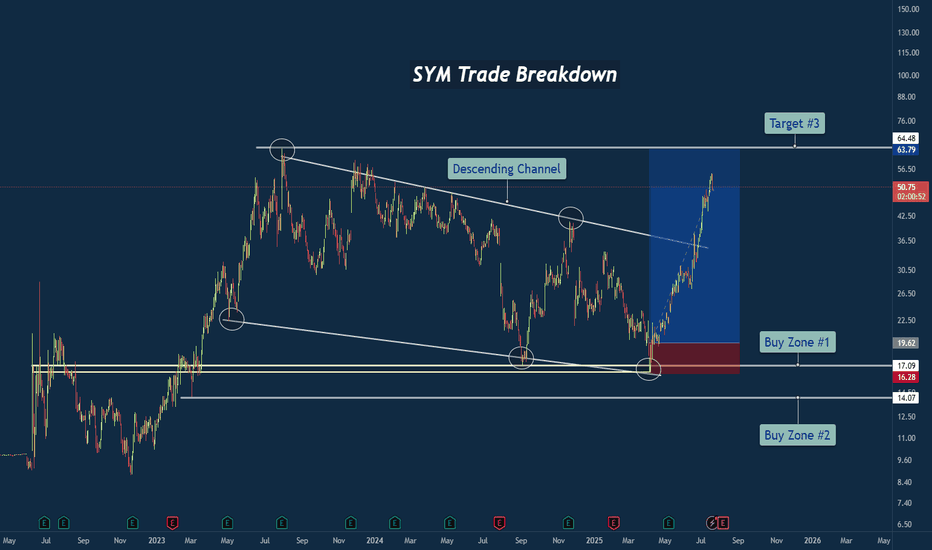

SYM Trade Breakdown – Robotics Meets Smart Technical's🧪 Company: Symbotic Inc. ( NASDAQ:SYM )

🗓️ Entry: April–May 2025

🧠 Trade Type: Swing / Breakout Reversal

🎯 Entry Zone: $16.28–$17.09

⛔ Stop Loss: Below $14.00

🎯 Target Zone: $50–$64+

📈 Status: Strong Rally in Motion

📊 Why This Trade Setup Stood Out

✅ Macro Falling Wedge Reversal

After nearly two years of compression inside a falling wedge, price finally tapped multi-year structural support and fired off with strength. This wasn’t just a bottom — it was a structural inflection point.

✅ Triple Tap at Demand Zone

Symbotic tapped the ~$17 area multiple times, signaling strong accumulation. Volume and momentum picked up with each successive test, showing institutional interest.

✅ Clean Break of Trendline

Price broke through the falling resistance trendline decisively, confirming the bullish reversal and unleashing stored energy from months of sideways structure.

🔍 Company Narrative Backdrop

Symbotic Inc. isn't just any tech stock. It’s at the forefront of automation and AI-powered supply chain solutions, with real-world robotics deployed in major retail warehouses. That kind of secular growth narrative adds rocket fuel to technical setups like this — especially during AI adoption surges.

Founded in 2020, Symbotic has quickly become a rising name in logistics and warehouse automation, serving the U.S. and Canadian markets. With robotics in demand and investors chasing future-ready tech, the price action aligned perfectly with the macro theme.

🧠 Lessons from the Trade

⚡ Compression = Expansion: Wedges like this build pressure. When they break, the moves are violent.

🧱 Structure Never Lies: The $17 zone was no accident — it was respected over and over.

🤖 Tech Narrative Boosts Confidence: Trading is easier when the fundamentals align with the technicals.

💬 What’s Next for SYM?

If price holds above the wedge and clears the $64 resistance, we could be looking at new all-time highs in the next cycle. Watching for consolidation and retests as opportunity zones.

#SYM #Symbotic #Robotics #Automation #AIStocks #BreakoutTrade #FallingWedge #SwingTrade #TechnicalAnalysis #TradingView #TradeRecap #SupplyChainTech

Amazing breakout on WEEKLY Timeframe - DCMSHRIRAMCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

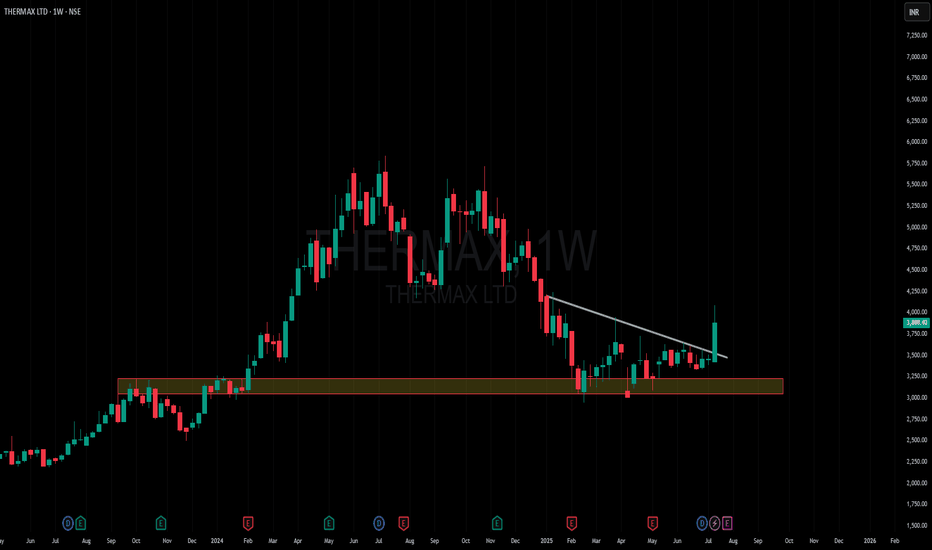

Amazing breakout on WEEKLY Timeframe - THERMAXCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - PRESTIGECheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - ABDLCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

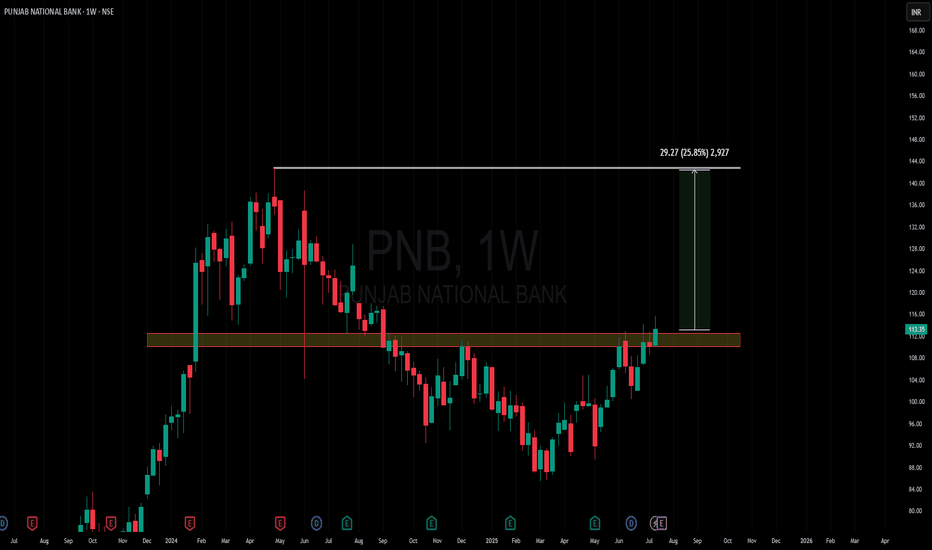

Amazing breakout on WEEKLY Timeframe - PNBCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - FLAIRCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

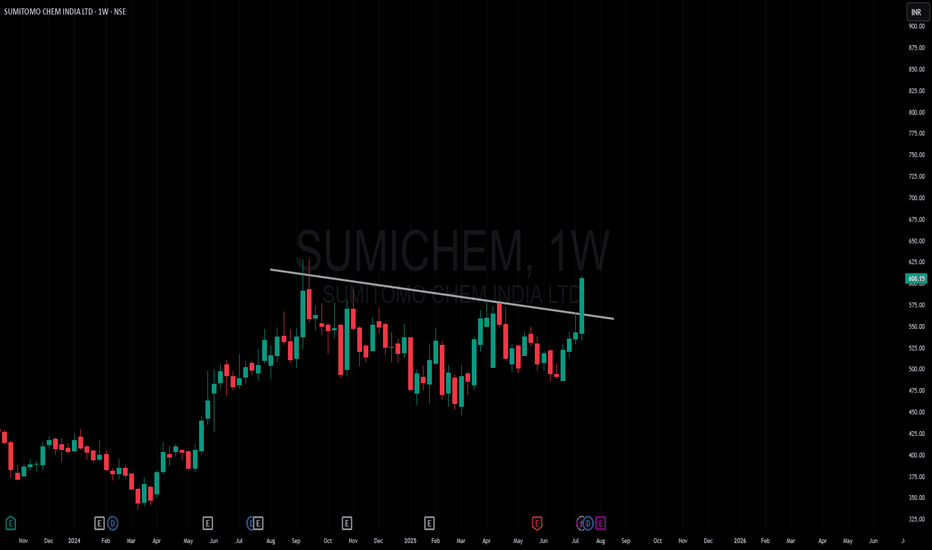

Amazing breakout on WEEKLY Timeframe - SUMICHEMCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - PARAGMILKCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - DENTACheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - IXIGOCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

BANDHANBANKNSE:BANDHANBNK

Note :

1. One should go long with a Stop Loss, below the Trendline or the Previous Swing Low.

2. Risk :Reward ratio should be minimum 1:2.

3. Plan your trade as per the Money Management and Risk Appetite.

Disclaimer :

>You are responsible for your profits and loss.

>The idea shared here is purely for Educational purpose.

>Follow back, for more ideas and their notifications on your email.

>Support and Like incase the idea works for you.