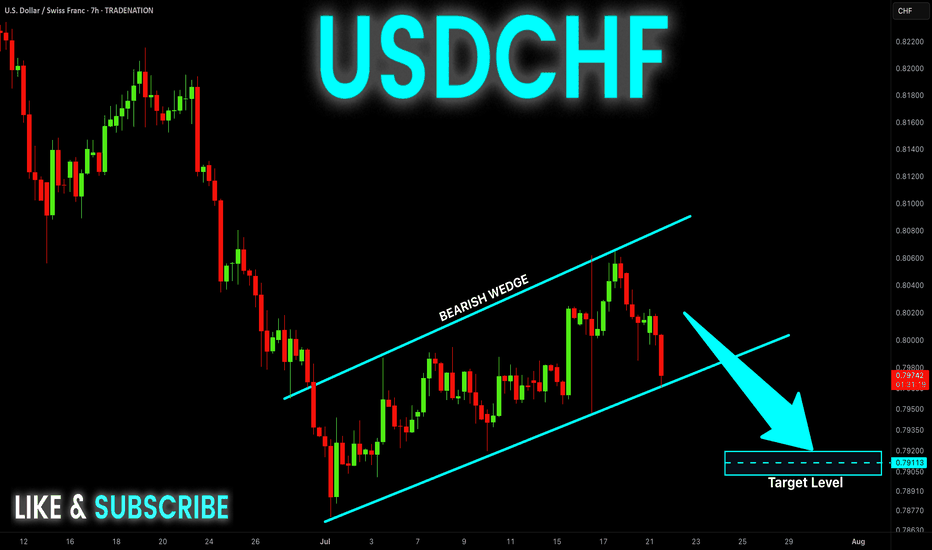

USD-CHF Bearish Wedge! Sell!

Hello,Traders!

USD-CHF is trading in a

Downtrend and has formed

A bearish wedge pattern

So IF we see a breakout

Then we a further bearish

Continuation will be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Brekaout

META to $700! Hope you bought the DIPNASDAQ:META to $700! Hope you bought the DIP

We have already broken out of the ascending triangle pattern into all time highs.

We have now came back to retest that breakout while also creating a new bull flag that is gearing up to breakout!

Two things we need the breakout and the flip to GREEN on the H5 Indicator for an entry and ride 19% higher!

Measure Move for both charting patterns is $706 with a timeframe of My birthday: 10Feb!

NFA

Silver is greatThis a long term strategy for the next couple of years. Silver is consolidating within this triangle since August 2020. Buying SLV ETF is like having silver bricks stored in a safe place. See it that way. You just don't sell silver, you accumulate it at every pull back. I may take less than a couple of years though bc the break out could be violent. I'm showing a SL just for reference but I would buy more if price drops that low (I don't think that will happen anytime soon). Check my previous post on silver down below.

✅EUR_USD WILL GO DOWN|SHORT🔥

✅EUR_USD is trading in a

Downtrend and the pair

Broke the key horizontal

Level of 1.0749 which is now

A resistance and the breakout is

Confirmed so after the pair

Retests the resistance I think

We will see a further move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

BLUR 40% Potential!I like to say that blur is a price action project. Whenever it seems to break a major resistance, It pumps a lot and this time seems no different.

A major trend line was just broken and it is showing signs of strength by holding the level above it. As long as we stay above the trend line and inch to the upside, there's nothing stopping me from believing that 40% isn't going to happen besides bitcoin possibly dumping to fill the CME Gap.

There are a few other big levels of resistance on the way up but mos of the liquidity will be above the last major high.

LETS SEE WHAT HAPPENS NEXT!

i]Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

SHIB/USDT BROKEOUT!! 40% PUMP FROM HERE!!Hello everyone, if you like the idea, do not forget to support it with a like and follow.

Welcome to this SHIB/USDT trade setup.

SHIB looks good here. Breaks out from the falling wedge-like structure. Expecting a 30-40% Pump from here. Long some here and add more in the dip.

Target1:- $0.01160

Target2:- $0.01250

Target3:- $0.01360

Target4:- $0.01510

SL:- $0.01010

Use low leverage:- 5x-6x

If you like this idea then do support it with like and follow.

Thank You!

CaixaBank (CABK.mc) bearish scenario:The technical figure Channel Up can be found in the daily chart in the Spanish company CaixaBank, S.A. (CABK.mc). CaixaBank, S.A. is a Spanish multinational financial services company. It is Spain's third-largest lender by market value, after Banco Santander and BBVA. CaixaBank has 5,397 branches to serve its 15.8 million customers and has the most extensive branch network in the Spanish market. It is listed in the Bolsa de Madrid and is part of the IBEX 35.

The company consists of the universal banking and insurance activities of the La Caixa group, along with the group's stakes in the oil and gas firm Repsol, the telecommunications company Telefónica and its holdings in several other financial institutions.

Channel Up broke through the support line on 18/03/2023. If the price holds below this level, you can have a possible bearish price movement with a forecast for the next 47 days towards 3.2770 EUR. According to experts, your stop-loss order should be placed at 4.1970 EUR if you decide to enter this position.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Breaking Resistance: Is Bitcoin (BTC) Poised to Rise Above $25K?#Bitcoin Chart Analysis

Bitcoin (BTC) has been testing the $25K resistance level three times in recent weeks. As investors wait to see what will happen if BTC tests this level again, many wonders if Bitcoin will break above $25K and continue its bullish momentum.

The current market sentiment suggests that Bitcoin could see a potential surge if it breaks above the $25K level. This could lead to a new rally and potentially a significant uptick in the cryptocurrency market.

However, the technical analysis suggests that BTC needs to break through this resistance level and sustain its momentum to confirm a bullish trend. If BTC fails to break above this level, it could lead to a bearish trend and a potential drop in the cryptocurrency market.

Despite the uncertainty, many experts remain optimistic about Bitcoin's future. With institutional investors showing more interest in cryptocurrencies, and with Bitcoin being used more frequently as a store of value, the long-term outlook for BTC remains positive.

In conclusion, the $25K resistance level is a crucial level to watch for Bitcoin investors. If BTC breaks above this level and sustains its momentum, we could see a significant uptick in the cryptocurrency market. However, if BTC fails to break through this level, it could lead to a bearish trend. As always, it's important to keep a long-term perspective when investing in cryptocurrencies like BTC and to make informed decisions based on thorough research and analysis.

Bitcoin Best Buying Opportunity Zone..?Ready for a thrilling ride in the world of cryptocurrency?

Take on the challenge of buying Bitcoin at its current level or wait for it to reach its all-time high of $160,000 ?

the choice is yours!

Don't miss out on the chance to be a part of the future of finance and potentially earn big profits.

Join the crypto revolution now!