ridethepig | UK Elections [LIVE COVERAGE] UK Election Chartbook

With longs already getting nervous ahead of the exit polls, let's get started by digging deeper on the political side first...For all those tracking and trading the main event this evening we have only two realistic scenarios in play which makes capital flows easier to track:

=> A Tory majority which will deliver the Johnson/May deal with a hard brexit via Irish sea border and less activity with the EU (70% odds).

=> A Labour minority government with a helping hand from Lib Dems et al, here we can expect a second referendum in 2020 with a choice between a soft exit or remain (28% odds).

Any further gridlock in Parliament is currently sitting at <2% and does not remain in play. This would dramatically short-circuit GBP as markets will be caught out of position.

UK markets pricing a Conservative majority as a " positive resolution " to Brexit is complacent and allows us an opportunity to capture those out of position and mis-pricing UK market access beyond 2020. To date we have traded a tremendous amount of conjecture around the Brexit chapter, yet many are quickly to forget we are yet to trade the "fact" leg.

This next chart indicates the sense of division in Britain, a fragmented society which also highlights the stupidity to have such a referendum on a complex topic. The UK is not like Swiss for example having referendum after referendum, rather it is a representative democracy. Yet sadly we are seeing a corruption of democracy via media manipulation swerving public opinion.

For example, those who remember Cameron's premiership will remember the government was at the time asking for public to remain while they were pursuing policies of austerity (decreasing consumer confidence) and served to have more damage than good. The silent revolution or protest vote (all cleverly calculated) unlocked Pandoras box with a People vs Establishment narrative:

In any case, a ruthless Downing Street (with the help of Cambridge Analytica and co) have a free pass to do what they want and say what they want with scandal after scandal yet the masses remain on mute simply wanting to " get brexit done " ... bitterness in the public will last for a very long time and history will mark the collapse of the Crown, a fall that will stretch decades turning little England into a house of economic bondage.

A quick review of the UK Election Opinion Polls :

Survation: CON: 45% (+3) LAB: 31% (-2) LDEM: 11 (-) BREX: 4% (+1) GRN: 2% (-2), 05 - 07 Dec Chgs. w/ 30 Nov

BMG: CON: 41% (+2) LAB: 32% (-1) LDEM: 14% (+1) GRN: 4% (-1) BREX: 4% (-), 04 - 06 Dec Chgs. w/ 29 Nov

YouGov: CON: 43% (+1) LAB: 33% (-) LDEM: 13% (+1) BREX: 3% (1) GRN: 3% (-1), 05 - 06 Dec Chgs. w/ 03 Dec

Deltapoll: CON: 44% (-1) LAB: 33% (+1) LDEM: 11% (-4) BREX: 3% (-) Chgs. w/ 30 Nov

Panelbase (Scotland): SNP: 39% (-1) CON: 29% (+1) LAB: 21% (+1) LDEM: 10% (-1), 03 - 06 Dec Chgs. w/ 22 Nov

Exit polls will start at 10pm (GMT) via SKY/ITV/BBC. Usually the exit poll is very accurate so it is highly likely we will be able to clear the knee jerk flows quickly unless there is a major surprise. We can draw a tree below to showcase the forward walk with Brexit:

- UK Elections (we are here) => Conservative majority => No transition extension (most likely scenario)

or,

- UK Elections (we are here) => Hung parliament => Second referendum (least likely scenario)

On the macro side, I have widely covered segments on growth, inflation and policies in the Telegram and in previous ideas in the archives (see attached). A major round of fiscal easing is coming, this will artificially keep growth supported in the short-term however the output gap will not close. Inflation will once again tick above target, however not via a robust consumer as many predict but rather via supply side constraints and uncertainty. The BOE will remain sidelined till 2H20 and provide a decent profit taking opportunity for our macro short positions.

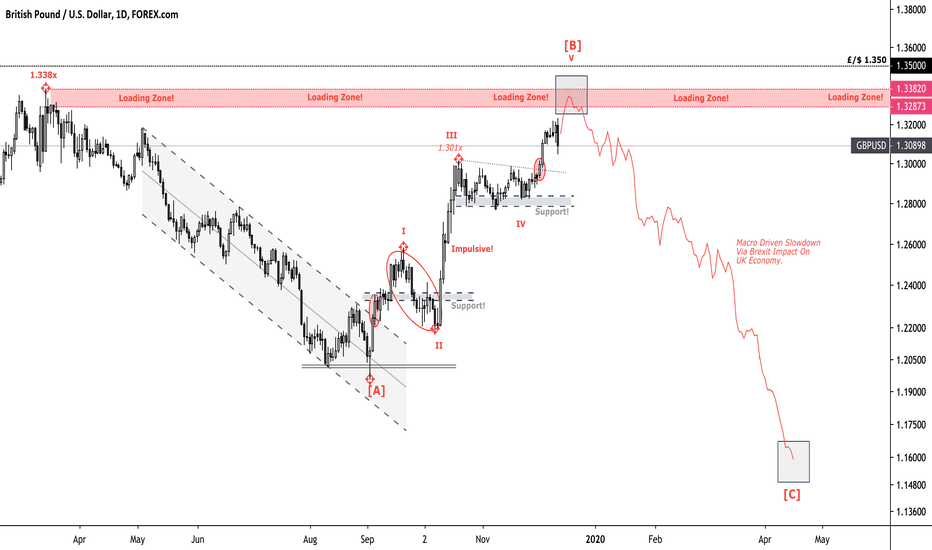

For the technical flows we are tracking the infamous 1.35xx psychological resistance. This is a great level to track for macro positions in 2020 on the sell side. Here I am tracking for a leg from 1.35xx => 1.15xx via Tory majority and the Brexit fact impact leg. A quick recap of the same levels we traded here live on tradingview earlier in the year. We are sitting at the same levels as before which we were loading into and traded a +/- 2000 tick swing !!!

Here I am becoming increasingly bearish on UK outlooks with either scenario. In my books Johnson will win by a country mile and we will immediately be able to trade the final flush in Pound (stage two of our rumour/fact impact legs). Populism is spelling danger across the global economy and shows no signs of abating.

...Best of luck to all those on the sell side and looking to increase exposure across portfolios. As usual thanks for keeping your support coming with likes and comments !!!

Brexit

0.8460 is a significant level for EURGBPEURGBP is still in a recovery trend. Negative volatility continues in British pound ahead of the release of UK Unemployment Rate (Oct). 0.8460 and 0.8495 resistance levels are significant levels for the continuity of the short-term increases in the parity. In possible retreats, on the other side, 0.8410 and 0.8370 support levels will be on our radar.

GBPAUD TRADING OPINION AND PLANPotential space for lower in my opinion and as the chart we can see price breaking lower the ascending trendline and support 1.93076 should indicate bearish in power. Boris Johnson and his friends are amending the Brexit bill to NOT allow further extensions. This means that, once the government has set a deadline, the U.K. must stick to it with or without a trade deal with the EU. On the other hand the so-called Phase One trade deal between Washington and Beijing has been “absolutely completed,” a top White House adviser said on Monday, adding that U.S. exports to China will double under the agreement which provided some positive vibe in comdolls sentiment which I think will help Aussie on this trade at the moment.

GBPNZD WEEKLY: Short-term Bullish and Long-term BearishIn the GBPNZD weekly chart above, GBPNZD sell-off impulsively from its August 2015 high.

The decline is in five-wave and labeled as 1-2-3-4-5 in wave (A). Sub-wave of wave 1 of (A) is also visible.

Since GBPNZD bottomed in November 2017, it has been in a corrective wave, which is expected according to Elliot Wave Principle. A three-wave correction follows every impulse before the price resume in the direction of the trend.

In the case of GBPNZD, the correction seems to be unfolding as a triple zigzag "W-X-Y-X-Z" pattern, and it's almost completed. Price is expected to move higher in wave (c) of Z to complete the major correction. The anticipated area for the completion of the correction is the blue zone that lined up with the upper trend channel + 50% retracement of the entire decline.

If this count is correct, the dominant trend is bearish, and once the corrective structure is completed, the market should begin a massive decline in wave (C). Wave (C) target lies below the wave (A) low.

What's your thought on GBPNZD?

Best,

Veejahbee.

GBP/USD 4Hwhat's up everyone? just started forex so all advices are welcome.

GBP/USD found a Major Resistance at Level 1.35 and didn't break it.

I expect a Retracement and a retest of the support line around 1.31.

For aggressive traders, maybe they can take the risk to go Short.

SL : 1.34300

TP : 1.31300

Good luck and dont hesitate to comment.

USDCAD ELLIOT WAVE LINED UP WITH CLASSICAL TECHNICAL ANALYSIS USDCAD rose in overlapping five-wave "leading diagonal" from the major low at 1.30422. Leading diagonal always indicates the direction of the major trend, and in USDCAD's case, it is bullish.

The subsequent decline is the corrective pattern, which unfolded as a double zigzag correction in wave B. The corrective wave retraced around 61.8 - 78.6% of wave A, and also bottomed at a demand zone + ascending trendline.

The confluence of classical technical analysis and Elliot Wave further confirms that the price should resume the advance on or from near the current market price.

The potential target for wave C is the resistance zone + Descending trendline.

What's your thought about USDCAD?

Best,

Veejahbee.

GBPCAD update Patience is key, right now waiting for good confirmation if price will hold or get back inside the up-trend channel! For my own pleasure, i would like to see scenario A happening!

What do you think? leave your opinion in the comments!

Also, if you like to discuss ideas and enjoy my analysis, join me in Telegram! Link in the bio

GBPJPY Long Term Carry Trade *BACK BORIS*I am now entered into a long term buy & hold position on GBPJPY.

Price has broken out through multiple resistance levels last week on the back of the new conservative majority. Thursday/Friday saw the fast money come in to the markets with heavy short term buying.

Price is now consolidating probably caused by profit taking on the speculation trades and the bigger buyers waiting to buy in to the continuation. I am long GBPJPY from 146.00 with a large stop loss and multiple targets.

You can see the consolidation on the 4hr timeframe chart with price being held up by the daily pivot level, fib 0.382 and lower timeframe 50EMA.

I believe we could see GBPJPY at 155.00 by June 2020.

Why GJ?

GBPJPY benefits from positive swap fees with GBP having an above zero interest rate and the Yen having negative interest. There for it pays to hold this trade with daily swaps being paid by my broker to me.

Last week results & immediate plansThe markets finally went out of “hibernation” so we could observe fluctuation not by 40-50 pips, but by 100+ (well, or 400, as is the case with the pound on Friday).

Last week began with Trump's tweet about the successful completion of the first phase of negotiations with China. Recall, on December 15, the United States threatened to introduce additional tariffs on goods from China in the amount of $ 160 billion, which kept the markets in suspense. According to Fox Business, Washington and Beijing completed the "first phase" of the trade transaction, but its terms may not be publicized at all.

Formally, this is an occasion for optimism and the start of sales in safe-haven assets. Nevertheless, we consider the current equilibrium to be extremely fragile and continue to look for points to buy yen and gold on the intraday basis.

Then there was a meeting of the Fed, which showed that the US Central Bank is serious about holding a pause in monetary policy - everything suits US Central Bank in the current state of affairs in the economy.

But at the same time, the Fed will continue to flood financial markets with money through the Repo system. The Fed’s balance sheet reduction was replaced by a sharp expansion: according to the Fed, it plans to infuse $ 500 billion. If this happens, then by mid-January the Fed’s balance will increase its balance by 10% in just a month. As a result, the balance will exceed $ 4.5 trillion and reach new record levels. Honestly speaking, instead of gradually removing this money from the system, the Fed continues to increase its amount. In the end, it will end badly.

For the dollar, this, in our opinion, is a kind of sentence. Classic demand-supply chart: with a sharp increase in supply, the price should decline. So this week and for the foreseeable future, we will sell the dollar across the entire spectrum of the foreign exchange market.

The first ECB meeting chaired by Christine Lagarde ended with nothing - the monetary policy parameters did not change. But the new head of the ECB made it clear that it was time for the Central Bank to change its strategy of action and promised to present its vision by the beginning of 2020.

The main event of the week was the victory of the conservatives in the parliamentary elections in the UK. Many have already called this a kind of second Brexit referendum since voting for Johnson is a vote for his plan to leave the EU by January 31st. The pound on this occasion rose sharply on Friday, reaching 1.35. After that, we perceive some correction as an excellent chance for its cheaper purchases. Indeed, by and large 1.35 - this is not the limit of growth and the pound could well grow to the area of 1.40 and even higher.

As for the interesting perspective positions USDRUB purchasing (this will become a kind of hedge for other positions on the sale of the dollar against the euro, pound, Japanese yen and other base currencies).

In general, the week ahead is quite eventful: the announcement of the results of the Banks of England and Japan, GDP of the USA and Great Britain and so on. This means that it makes sense to start trading after a rather long period of hibernation in the foreign exchange market.

Brexit FUD is over. Labour party worse result since 1935!I am so proud of the UK. In the 1930s they rejected the growing populism in the world, and in 2019 they did the same.

All the propaganda, all the demonizing, and the forces of anti-freedom still lost, but a huge margin!

And if europe falls, we shall go on to the end. We shall fight in France, we shall fight on the seas and oceans, we shall fight with growing confidence and growing strength in the air, we shall defend our island, whatever the cost may be. We shall fight on the beaches, we shall fight on the landing grounds, we shall fight in the fields and in the streets, we shall fight in the hills; we shall never surrender.

The short sellers got scammed hard. "Oh no the GB economy will collapse if they leave". Those shorts have started to burn.

Their will be suckers rally, which I intend to join.

But I see the pound going up in general (different pairs may have different results at least the GBP against the EURO will I am nearly certain, continue to skyrocket).

Bears are getting their faces ripped off...

The perfect move would look like this:

We need a desperate attempt by GBP bears to get filled at a high RR in a high probability area.

What is good for us, on tradingview, Boris Johnson said he wanted the UK to be a world leader in tech innovations and finance.

They totally understand and support what we do, and want more of it.

I think the UK is going to be pretty safe from extremism as it has always been.

I wonder what deal they're going to get and how things will be for Ireland, and what will happen in Scotland, for some reason alot want to stay in the EU.

The experiment is about to fall apart, they should at least wait a few years before making emotional decisions...

There are so many medium sized and small countries in europe but a huge block like what it become is too much.

Different cultures languages etc... Did they think they could create something like the United States?

Germany Austria and Hungary could merge, maybe a little more, and being bigger like this would make them more relevant, Belgium the Netherlands and Luxembourg could merge to not be as small, Denmark Sweden Norway maybe Finland, Estonia Latvia Lithuania could merge.

I think it would be beneficial to them to make unions of 3 to 5 countries, rather than have all these tiny places, who knows or cares about Slovenia seriously?

Instead of 35 irrelevant countries in Europe, it could be a place with a few large federations or unions.

Right now to me Europe is: UK - Portugal - Spain - France - Italy - Germany - Poland - Ukraine - Romania - Greece - (Sweden) - (Turkey) - (Maghreb) - (Russia) - The Rest

In () the places that are peripherical to "main" europe.

Europe maybe made sense right after WW2, but this does not make as much sense anymore (also, we built a huge empire around germany to keep their conquest ambitions tamed?).

Europe is too ambitious and makes little sense. It's so big that it doesn't work and no one outside of it takes it really seriously. The place could have around a dozen merged states instead of 35+ and they would all have a certain importance, it would make european countries more relevant and recognizable, China would speak to the Polish Lithuanian commonwealth and take them seriously, but you think they care about Latvia and Belarus? Does anyone in the USA Or SEA have any clue Belarus even exists?

Poland + Lithuania + Latvia + Estonia + Belarus + Ukraine have a combined population of 100 million and a GDP of 900 billion, close to 1 trillion, which could bring them to the table with the big boys. They would actually be in the top 20 and a force to be reckoned with not some collection of "third world dumps".

But by themselves even the biggest ones - Poland and Ukraine - bring smile to people, no one takes them seriously.

Poland lmao, it's even a joke in west europe to call someone Polish.

Europe has to fall for european countries to grow together and bloom? Because why consider some alliances if you can just join europe.

Would also be nice to be able to trade some relevant (and uncorrelated) currencies because mini currencies like the Polish Zloty let me tell you they suck!

And low liquidity, high spreads... The currency doesn't even move by itself according to its own country economy...

We live in an open world, earth is much bigger than europe, so tiny countries do not make much sense anymore. This doesn't mean they should go for the complete extreme with an union of 25 countries that speak different languages...

As usual, people are only able to think in extremes, and it failed. AS IT ALWAYS DOES. Good riddance. Long live the queen.

EURUSD potential H&S patternAfter Brexit vote and a spike in EUR, we retraced the move the next day. Now seems like a H&S is forming with divergence. Proper support in terms of the trend line 200SMA and 1.11 area. Elliott waves suggest the final leg of retracement in wave (c).

PMI data coming in this morning from Europe this morning. Negative numbers would give more probability to this trade. 1st confirmation is the close of the nice bearish candle on 1 hour. 2nd at the test of support and break.

Good Luck and have a great trading week!

GBP Pairs Might Rise Back To 2008 LevelsOn December 12th 2019, as the British polls were coming to an end, conservative Boris Johnson was winning. With Boris's the idea to get rid of the Brexit deal that was introduced back in 2008 which lead to a 29.5% crash on all GBP pairs within a year, price on GBP pairs came rising up to over 400 pips within a few hours. This leads me to believe, a good swing trade setup is in the making where market price can reach record highs since 2008 before Brexit was introduced. All in all, This would lead to about a 30% increase at over 6,800 PIPS.

Triangle Pattern Could Send CADCHF LowerCADCHF and EURCAD are negatively correlated; that is, if EURCAD is trading higher, then most of the time CADCHF will be trading lower.

I've been tracking a triangle pattern on EURCAD, but when a colleague sent me his view on CADCHF, I could easily spot an almost completed triangle pattern as well.

This further confirms that the triangle on EURCAD and the related pattern could send CADCHF lower in wave C.

See related ideas links for EURCAD analysis.

What Last Friday Sell-Off Could Mean for EURUSDThe EURUSD saw a massive sell-off last Friday, which led to the formation of a bearish Pin Bar at a critical supply zone and weekly descending trendline.

Although EURUSD seems to have resumed the advance from 1.087 major low on the chart, the correction might not be completed yet.

The price action after the advance showed a three-wave down in wave (a) and three-wave up in wave (b). This pattern could result in a complex corrective structure in wave 2.

If this count is correct, the pin bar should send the pair further lower in a five-wave pattern in wave (c) to complete an expanded Flat Elliot Wave pattern.

The blue box and 78.6% Fib is the estimated area for wave (c) to bottomed.

What's your view on EURUSD?

Thanks for reading!

Veejahbee.

GBPUSD Indraday Outlook December 16thFollowing the BBC’s Andrew Marr Show earlier this Sunday, the UK Deputy Finance Minister Rishi Sunak stated that PM Johnson is reconsidering bringing back Brexit bill to parliament before Christmas.

Key Quotes:

“The overriding mandate that we have from this election is to get Brexit done ...We will leave the European Union in a matter of weeks, by the end of January. We intend to bring the Withdrawal Bill, the legislation, back to parliament before Christmas.”

“It’s our number one internal priority and I think this piece of legislation will just underscore that promise.”

The UK government’s promise to getting Brexit done quickly is likely to add to the optimism around the British Pound. Markets could see a fresh round of buying the GBP/USD pair in Monday’s Asian trading, with 19-month highs of 1.3515 back on sight.

Outlook backed up with Poshtrader Hull Moving Average 50 and ADX Signed

Don't forget to hit the follow and like button