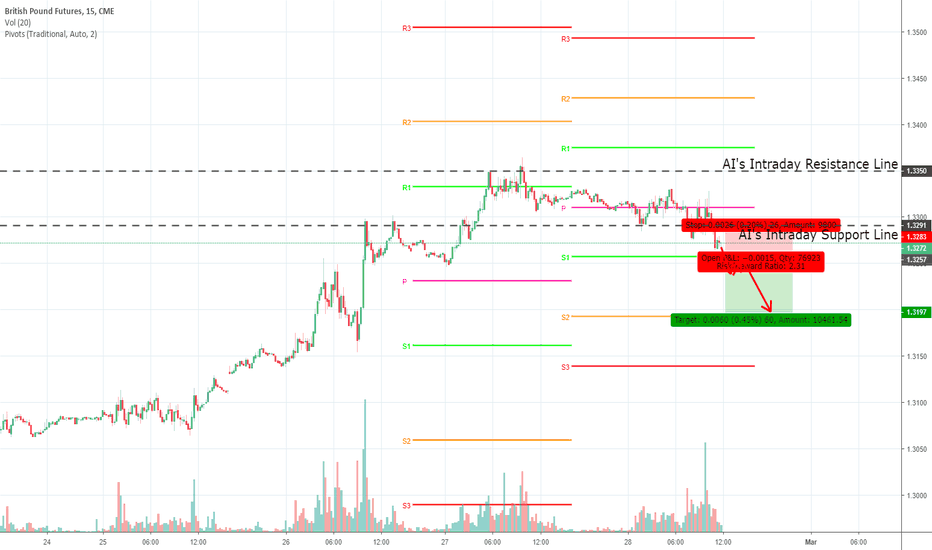

High Probability Intraday Trade Setup for British Pound FuturesThe following are trades setup ideas in 15 mins chart for British Pound Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

If price action was below the AI Daily support line AND price closed below Pivot Point S1 line, the idea is to short and take profit at Pivot S2 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

Brexittrade

GBP/USD Future Trade Idea - Pound in limbo ahead of Brexit Thesis >

GBP/USD seems to be in a macro bearish/depressed market structure, but is ranging at the moment and seeking direction. Trade idea is to short the local resistance at the beginning of March, and keep an eye on fundamentals that could push it out of this range (a referendum or an agreed deal on Brexit). Otherwise expect it to hit the local top and start falling - my target would be 4% below to the local bottom, just to be safe and risk-averse.

Best case >

You could consider adding to this trade if the UK looks set for No Deal, as you'd expect there to be the beginning of a new downtrend. In this case I would reassess the trade and Risk/Reward, and plot a new short setup.

Worst case >

Get stopped out just above the local top, at 3%. Any such rise would surely be short-lived, unless the UK is able to secure a clear economic direction during the first 2 weeks of March. The risk is there however especially due to mounting political pressure.

TA >

GBP/USD looks to be range-bound since August 2018, when a strong downward current lost momentum. RSI is rarely able to go above local resistance when it crosses into bullish territory, not does it plummet much from the 50-mark. The 200 day EMA has acted as resistance since May 2018, it is support-turned-to-resistance.

Details >

Date and time: Future trade idea (1 March 2019)

Trade no: P01

Platform: None

Type: Paper trade, short

Position size and risk management: 1000GBP, 30GBP risked

Emotional state: Tired, fatigued

Market: GPB/USD

Setup and indicators: Shorting the local resistance. Horiziontal S/R, 200 day EMA, RSI

Timeframes: 1D chart

Stop-loss: 3% above local resistance

Take-profit: 4% below resistance

Review date: 1 March 2019

Relevant past trades: N/A

Record-keeping: Record the outcome of trade in paper trade journal

GBPNZD BEARISH CONTINUATION SETUPThe GBPNZD broke out of support level that lined up with ascending trendline with a five-wave impulse labelled wave 1.

.

Currently, the price seems to be building a three-wave ABC zigzag corrective pattern labeled wave 2. The wave (c) of 2 "blue," is expected to terminate between 38.2 and 50.0 Fib ratio.

.

Considering that the Fib ratio is lined up with moving averages and resistance zone, we will wait for the price to reach the confluence area and look for a breakout of the blue Counter Trend Line (CTL) for a conservative short entry.

.

The price has the potential to move down towards the Fibonacci Extension 1 and support level at 1.81523 respectively.

.

Thanks for reading!

Veejahbee.

Red bull gives you wiiings.... GJ is about to drink someWe could see price test 142.733 area, if price tests and the bounces we can see a lovely little run upto 148.000 area, if price breaks our 142.733 support then the next area of interest is the 141.428 zone which could be used as a turning point for a bullish run.

Our view is price will bounce off our 142.733 support area and make a good run to the upside and reach our zone, but we have to keep an open mind and prepare for every outcome as GBP is very volatile at the minute around Brexit talks and news.

GBPUSD SHORT TRADE IDEA - SIMPLE BREAK & RETEST SETUPPrice broke out of the consolidation support and made a new low.

.

Price has retraced and retested the broken structure that lined up with a descending trend line, moving averages and 61.8 golden Fib ratio.

.

Considering that price has reached an important confluence level and broken out of the Counter Trend Line, the price has the potential to move down towards -27.0 Fib Extension.

.

Safe Trading!

GBPAUD liquidity gap fillAfter an explosive move down, GBPAUD left a big liquidity void and we all know how much GBP loves to fill liquidity voids, lower time frame is showing bullish price action and making a breaker on the 15 mins after taking out previous swing low on the daily.

R/R setup is great for a long, has a massive upside if trade goes in our direction

Brexit Deal or Parity: Which is First?There are a few things in life that you think will never happen. Brexit was one of those things. With the continued uncertainty surrounding the exit from the EU, will we also see Parity with the US dollar or will the UK Government strike a deal? Trading Forex / CFDs is High Risk.

GBPUSD - Downside Likely To PersistHi Traders,

GBPUSD broke out of the upside trend line and the move down has stalled within previous structure.

Price now must close below 1.122000 to confirm further downward bias.

With the Supreme Court ruling on if the British Parliment must vote on a deal to leave the EU due mid-Jan we may see price trade sideways until the verdict is delivered.

The verdict is highly expected to support Parliment needing to approve a deal to leave the EU which is expected to support Sterling, markets may 'buy the rumour' before a verdict so if price continues to stall at 1.22000 we'd be inclined to take a long position. Until we see more bias from market participants we remain neutral.