$EUR CONSOLIDATION ON THREE FRONTSAfter the sudden steep decline of the EUR yesterday during the ECB interest rate conference, the EUR seems to have gone into consolidation vs the Yen, Dollar and Pound. Both the Stochastic and the fast EMA are indicating reversal intent but we're going to have to wait and see.

Check those breakouts and don't let yourself get caught with a fakeout.

For more ideas and information, checkout my blog at pipcounting.wordpress.com.

British

GBPUSD on a major low on rsiAfter some data releases came out we see GBPUSD retrace down to 1.6441, but i see a nice pattern kicking in by looking at MACD and RSI once again. Noticing gbpusd hits a low we tend to see a recovery back in the 1.6500-1.6600 region. Noting that the 1D 1H and 1W on GBPUSD are all sitting super low to on the RSI

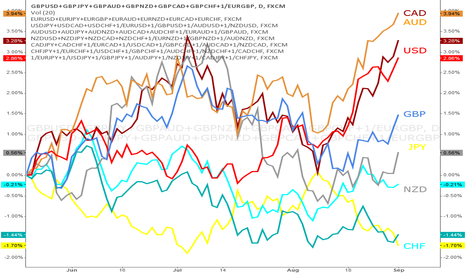

Trading the STRONG against the weak! (currency strength calc)Inspired by an indicator I found on stevehopwoodforex.com and the endless possibilities of tradingview.com I came up with this currency strength visualisation concept.

*Please hit the zoom-out button once*

(or more if you're feeling wild)

This may look like a mess, but the last few "bars" on the chart are holding some useful information!

I'm sure I'm not the first one on here to think of this. My apologies for the messy work though, because the chart gets scrambled when you move it, the text moves all over the place and the calculations are probably completely wrong, but I'm sure you get what I'm trying to do here.

Trading currencies that are gaining strength against currencies that are losing strength is obviously a good way to go, so this is an attempt to illustrate the increase/decrease in strength of a currency compared to 7 others, to help filter out those bad trades and get us into good ones for many pips of profit.

Now check out the chart. How often a year does a currency significantly change direction? Who out there was/is still shoring the USD, AUD and CAD and buying the EUR, JPY and CHF on the hourly, 4-hourly and daily TF's right now?

I know I haven't. I have been and will be only buying CAD, AUD, USD and now also GBP and NZD and I will be only selling EUR, JPY and CHF until the direction significantly changes. Which could of course happen at any time for all I know and when it does we look to trade that currency only the other way and count the money we made on the long run we just had!

The strengthening and weakening of a currency as you can see can last for months. Realising this changed my trading forever.

My interpretation of the chart: Currencies that are significantly sloping away from eachother are candidates for trend trading. Currencies that run paralel to eachother are ranging and can be traded from the top of a band or channel to the bottom with confidence.

I hope this makes sense.

Thoughts anyone?

Cheers

CHF = Aqua Blue (light)

EUR = Turqoise (darker)

GBP = Blue (dark)

AUD = Orange

NZD = Gray

CAD = Maroon Red

USD = Red

JPY = Yellow

GBP/USD Intraday Long entry Cable broke from the previous range this morning with a move above 1,6610 marked level, after disapointing manufacturing PMI data it droped back and tested that level from above. If that breakout is valid then we should follow up now towards 1,666 ressistance level. Keep in mind that manufacturing PMI's aren't influecning Pound so much beacouse of how brisitsh economy is constructed around services. Also the mortages data was good and shood boost Cable a little bit.

There's day off in USA and Canada today so eavning session might be low volume and an spike like on Friday can happen on Cable easily.

GBP/AUD with 2 possible outcomesGBP/AUD currency pair is close to an important support near 1,772 level which is 2014 low and possible wave 3 end. If we take away the fact that 5 wave structure should be in the bigger trend direction (which is an uptrend on bigger time frames for GBP/AUD) then the downside scenario is valid and if price manages to go lower then 1,772 low then way to 1,74 and 1,69 levels should be open and we might see an wave 5 which should end the downmove started in January. There's also an bearish flag present on the daily chart which was broken last week but as stated before I'd be cautious with any shorts as long as we won't get an daily close below 1,77-1,772 level.

On the other hand there's Fundamental point of view which may supports GBP recovering against Australian Dolar. The MPC rates vote which shows that 2 members wanted to rise rates on the last meeting suggest that Great Britain will be the first Big Central Bank to start normalysing the monetary policy. Also there's RBA in Australia which is not really happy with to strong Australian Dolar and trade balance data shows that's not good for Australian economy also.

To sum Up I'd rather be long from where we are now with some big targets in mind and stops below 1,77 level. IF 1,77 level is broken then more downside is expected.

BoE & GBPJPY IdeaIt remains that the ongoing improvements in unemployment, a lagging economic indicator, coupled with a solid recovery should eventually lead to a rise in wage growth. As a result, the current weak earning growth may not reflect the current health of the job market as it is an even more lagging indicator than unemployment. Furthermore, the 2-3% rise in the national minimum wage in October could be a catalyst for broader wage growth while supporting household consumption. As the recovery is expected to remain strong while the job market continues to improve, the BoE stays positioned to be the first major central bank to start its tightening cycle.

British pound weakness unlikely to continue - Eye on GBPJPY

The British pound has weakened as the odds to see a hike before year-end has decreased. However, the relative supportive monetary policy should support the Sterling in the longer-term. As a result, I do not consider this weakness as a trend reversal but as a temporary countertrend move. A long position in GBP/JPY remains an attractive vehicle to be exposed to a renewed strength in Sterling.

My recommendation : Buy GBPJPY above 171.50 stop @170.45 ,Target1 173.80 & Target1 174.60 , Good Luck

GBPUSDOn this pair here is what i think is going to happen: First the pair would go short until it reach the 382 of the july 8 2013 trend up. Now im not saying it would go beyond that but im not saying i wont. Depends on the price action, now we should take profit in that area after making some in the short trade. Observe that this is a weekly chart and if we are pattern trader this could be the B leg that determines the type of pattern depending on where it would stop. it may range 382 up to 886 wherever it wants.

For now im short on this.

GBP/JPY with two scenarios for next few daysFriday's drop opened up the Head and Shoulders scenario for the GBP/JPY currency pair, price managed to break and close under the neck line and so far it stays below. That would mean there's an posibility to enter short trade at current price level targeting levels close to 170 as that would be the H&S formation range. But there are few "IF" on that entry that make me cautious, First thing that we are still in the uptrend on higher time frames, also the Friday's bounce level 172,3-4 level. Then the whole 172-173 zone which worked as ressistance from March till June this year is not the best zone to short from in my opinion. But sometimes there's no place to think too much and just trade the setup which is present on Your chart so I'd say it's fine to short as long as 173 and 173,3 levels are not broken to the upside. If the price would manage to break above 173 and 173,3 levels then I'd be willing to go long with new highs as a target.

GBPUSD posible long trade GPB is at 78.6% fib retracement area - support area which may hold. Fridays bit disappointing US data, may see pull back GBP to resistance area - 1.7 - RSI strongly oversold being at 10.12 supports idea of retracement to 1.7 key very psychological level for GBP. worth noticing is that last week was 4th in a row of correction in GBP.

I would be looking to place SL below 1.669 as it is next support level. I see GBP still strong fundamentally and looking at weekly chart we are still in uptrend. I will be closely watching current 78.6 fib area (on the other hand we may just continue down) - what happens at this level possibly determine this week direction.

As always manage your risk and RR properly, its not a sprint - its a marathon!

Good luck!

Bullish Bat Pattern for GBPCHFBullish Bat Pattern on the 4h GBPCHF. The 886 is being hit at some decent support as well. There is a small showing of 'hidden' bullish momentum divergence (I'd like to see more of a discrepancy but not a deal breaker to see this as a good trade opportunity.) Looking for a retest of the 'B' Point.

Bullish Bat at Previous Structure lowsI'm a little late on getting this idea posted, but we had an abundance of advanced pattern trading opportunities setting up as my live trading session came to a close. Some have since rallied and some have been stopped out. This particular one is still at market and for those who like to take more of a conservative approach, may be putting in a retest of structure in the form of a double bottom. Take a look at the RSI as well, significantly oversold.

I've been doing a lot of work with this pair over the past month or so and this pattern happens to be in line with my underlying prediction for the pair. Coming back into previous outside returns provides a nice structural level to place stops. Hopefully we'll see another bounce off of this area and make our way back up to the 53 even handle.

Have a great weekend traders, and if you missed it yesterday, here's the link to my latest Weekend Review video

www.youtube.com

AKil

GBPCAD Bearish Cypher setting up good structure levelWith the CAD pairs popping today some of the longer term patterns are starting to come close to completing. Bearish GBPCAD cypher set up completes at an area of structure, with the big wick on the x leg not closing above previous resistance levels. Current set-up comes off another big winner on previous bullish cypher pattern completion!!

GBP/USD is Cable ready for resumption ?GBP/USD felt to really important level if there's an chance that it will conitnue the uptrend that we might be just getting to the entry point at the moment. There's an confluence of green marked Demand zone, 50% Fibo retracement of last swing up (1,669-1,719), daily trend line and the previous smaller leg up low at 1,685 level (red circle). Todays down move was mostly EUR/GBP strenght driven and that's not an rarity that EUR/GBP finds some demand at the end of a month with Bundes Bank selling pounds for Euro which is due to Great Britian paying it's European Union charges in Pounds. There's also an bullish divergence present on 4 Hour chart which might be another signal to go long there, the Risk:Reward ratio (around 7,5) would be great as if we get an bounce here I'd aim for another high close to 1,73 level which is an monthly time frame important Fibo level (50% retracement of down move from 2,12 to 1,35). Stop loss for long entry would be placed under the last dip towards 1,69 level (blue elipse)

Things to keep in mind~

There's Q2 GDP reading in USA tomorrow which should be around 3% q/q (which will mean that they moved nowhere in last 6 months)

There's FOMC meeting tomorrow with another tapper in "measured steps" as granny said 100 times and there's nothing much to expect from FOMC members then that. I can't find any justification to look for any hints of rate hike at tomorrows press conference after the meeting so Dolar bulls might get a little slap after that event.

On the other hand there's IMF report telling us that Pound is overvalued and that might hurt British economy and we've got NFP numbers in USA this Friday which tend to be really good last months. The thing with NFP numbers and unemployment rate is that they are not "soo" important anymore after FED stated that they will look for inflation data mostly and all other data before deciding to hike rates.

GBPUSD Set Up Allowing a Tight Stop on the Daily + 4 Hour ChartsI've shared this 4 hour chart to illustrate greater insight on the entry and exit points, but the daily chart illustrate the bigger idea of buying at support/50 SMA in a pull back. GBP is showing signs of strength -- I'm already long GBPJPY and GBPAUD -- and so I think what we're seeing here are signs of accumulation. I think the lows of this past Friday, July 25, may constitute a bullish checkmate, and thus have a relatively tight stop of 40 pips. My target profit is 180 pips away, which gives me a reward/risk of 4.5.

www.informedtrades.com

GBPAUD: Structure Trade With Amazing Risk RewardThis morning I recorded a video looking at a bullish Gartley opportunity that I missed. By the time I got my orders in price action had move well beyond the original entry point offering a much better risk/reward. Hours later we are still holding on tot he very last bit of structure and are attempting to put in a double bottom depending on the close oft his current candle.

Between the structure level, advanced pattern, RSI being overbought, the retest of structure and the RSI divergence. I'd say this is a heck of an opportunity to get long. Just look at the potential risk reward. Targets a little lower at structure still make it more than worth it.

GBPCHF Bat Pattern Retesting Previous Structure High'sI've been a bull on this pair over the last month or so but now I've got a short opportunity on my radar looking at a retest of previous structure highs on the daily. As a countertrend trader it's important to realize that I'm not looking for the big long-term move, simply a brief correction.

If this correction rolls over more than expected there's a 2nd potential bat pattern down at our previous structure lows giving true trend continuation traders an excellent spot to get involved with an outstanding risk/reward.

*Had issues posting them together but check out my ideas for the daily view of this chart relating to my comments*

GBPCHF Bat Pattern Retesting Previous Structure HIgh'sI've been a bull on this pair over the last month or so but now I've got a short opportunity on my radar looking at a retest of previous structure highs on the daily. As a counter trend trader it's important to realize that I'm not looking for the big long-term move, simply a brief correction.

If this correction rolls over more than expected there's a 2nd potential bat pattern down at our previous structure lows giving true trend continuation traders an excellent spot to get involved with an outstanding risk/reward.

*Had issues posting them together but check out my ideas for the daily view of this chart relating to my comments*

GBPCHF Bat Pattern at Daily Highs'* I tried to post another chart with this showing the advanced pattern, but think I messed up doing so. I'll keep trying but here's the daily view that was suppose to compliment my other chart** SORRY GUYS

I've been a bull on this pair over the last month or so but now I've got a short opportunity on my radar looking at a retest of previous structure highs on the daily. As a countertrend trader it's important to realize that I'm not looking for the big long-term move, simply a brief correction.

If this correction rolls over more than expected there's a 2nd potential bat pattern down at our previous structure lows giving true trend continuation traders an excellent spot to get involved with an outstanding risk/reward.

Reversal Analysis GBP/USD 4/7/14After GBP/USD broke its historical resistance from 2009 (1,71) it did not show any strong force or movements to go into the sky. It stabilized around 1,715 and showing divergences for an upcoming reversal into a Shoulder Head Shoulder Pattern for going into the old zone at 1,69.