BRN

BRN Short Scalp LongBrainchip showing signs that id usually look for for entry/reversals.

Short term scalp idea here.

Sitting and testing r3h (Range 3 high)= the daily range before a 30% up move. This is a short term range of importance.

EMA's crossed on 15 chart (not shown), at important level, and a MSB (market structure break), Pos div on RSI.

BRN/AUD - A prosperous 2020From a technical perspective, Brainchip Holdings (ASX:BRN) ticks all my boxes. I believe we're at an ideal buying location for both traders and investors looking to add to their position.

My reasoning:

Location: Bottom of range

Structure: Triple bottom, "W" price structure

Divergence: Huge OBV div, confirmed div in histogram, Willy div

VPVR: Currently sitting at the POC. Large hole in volume above price, approx 125% potential if price clears 0.076c

Weekly gap left @ 0.201c (marked by green line)

Hit the LIKE button if you like my analysis and want to support my channel. Follow to make sure you don't miss any future trade ideas.

BRN - Could we see a bounce?BRN looks like it may have found support around the 200 SMA and a possibility that we could see a bounce off soon. MACD has crossed also indicating that this could be a zone where buyers could get strong and take price higher. My target on this trade would be $0.550, a potential gain of 10%) with a stop below the swing low.

Please note these are my own notes, by no means trading advice. Please do your own research before entering into any trade.

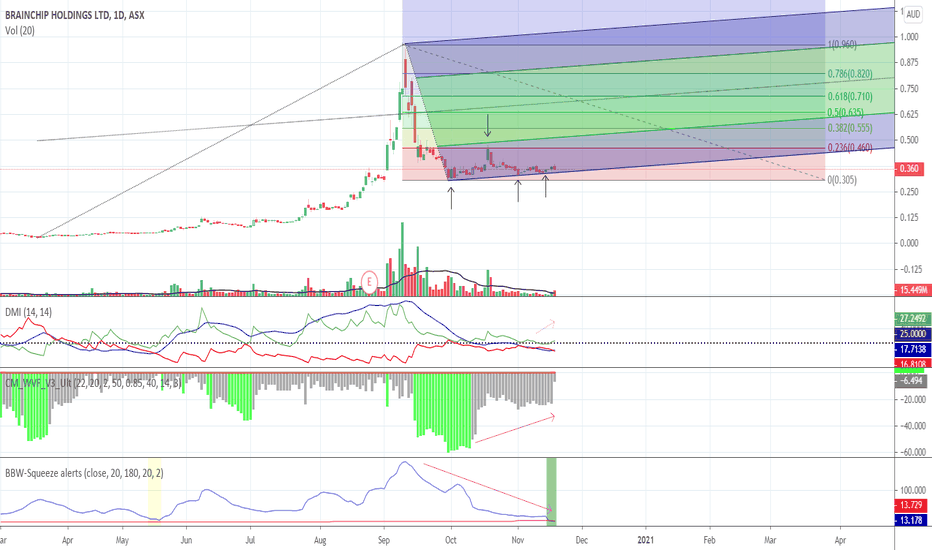

BRN consolidation over?Quick technical analysis of ASX:BRN following its rapid rise and subsequent consolidation over the past two months.

In summary:

Indicators are showing that support has been found at ~$0.31 and the .236 fib retracement level / -0.5 schiff resistance level has been tested.

As per BBW, volatility is decreasing which indicates that a breakout may be on the horizon. The BBW-squeeze also shows a potential alert for an entry point. This is supported by the Vix which hints that we have moved away from market bottoms.

Finally, DMI+ remains above ADX and has been toying with the 25 level. Movement above this level would further strengthen technical indicators for ASX:BRN .

The above indicate that BRN is in a favourable position for opting in. This would be further strengthened by positive news and / or increase in trading volume.

DYOR.

BrainChip Holdings (ASX:BRN) - What I see happening from hereLooking at the chart today from BrainChip ( ASX:BRN ) I can see they it has a couple of potential directions from here.

Over the last week or so, the stock has been retreating back from its highs of close to $1.00.

Overall though, I can see 2 possible scenarios.

Scenario A

Holding current levels (which look good considering the 61.8 fib line placement) here could see a price grab back up to above $0.50. Holding there would mean BrainChip is still maintaining an overall uptrend and also holding above the 50 fib line. Breaking through the next level of resistance at $0.64 is critical for recover efforts. A bullish scenario overall with some risk.

Scenario B

Failing to hold here would mean a fall back to previous support and older trend line around $0.34. A note here though that the old trend line has less touches, so holding it is yet to be determined. However, the fact that we have a trend line and a support line means we might see a bounce.

Options

If I was looking to gain entry, I can do so immediately, however I would be prepared for further volatility. A further fall back to $0.34 could mean a need to top up the position with more cash.

I can also choose to wait for one of the following scenarios:

- A clean break up and out of $0.64, signalling a much stronger bullish case.

- A break down and a hold at $0.34, signalling a position of relative safety to begin investment.

Risk Management

I can deploy risk management techniques including limiting the percentage exposure to this stock, applying a stop loss if it falls too far or reserving cash to purchase lower entries and reduce my average, should I want a long term position.

Hope this analysis helps!

Note - this is a record of my thoughts for personal use only. Nothing here should be taken as financial advice. Investors and traders should always do their own research before buying or selling assets.