How to Trade Doji Candles on TradingViewLearn to identify and trade doji candlestick patterns using TradingView's charting tools in this comprehensive tutorial from Optimus Futures. Doji candles are among the most significant candlestick formations because they signal market indecision and can help you spot potential trend reversal opportunities.

What You'll Learn:

• Understanding doji candlestick patterns and their significance in market analysis

• How to identify valid doji formations

• The psychology behind doji candles: when buyers and sellers fight to a draw

• Using volume analysis to confirm doji pattern validity

• Finding meaningful doji patterns at trend highs and lows for reversal setups

• Timeframe considerations for doji analysis on any chart period

• Step-by-step trading strategy for doji reversal setups

• How to set stop losses and profit targets

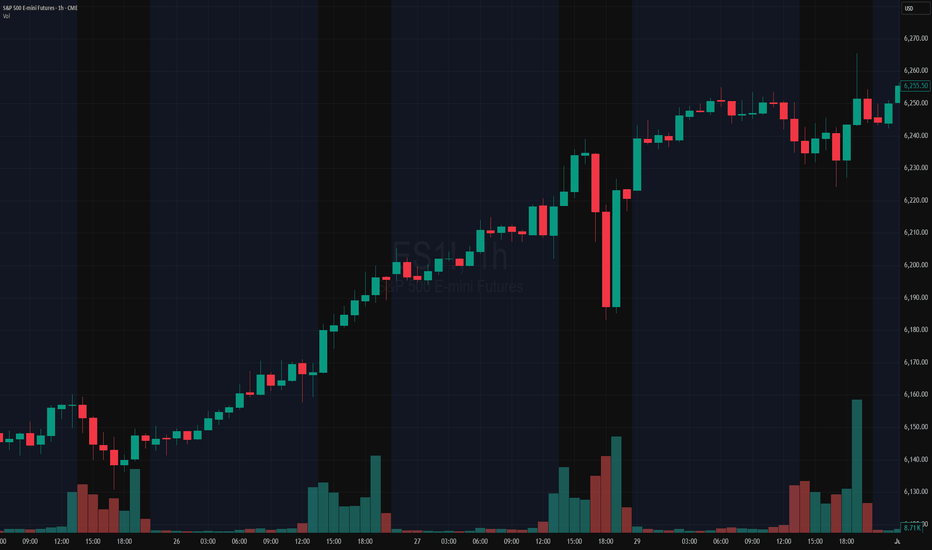

• Real example using E-Mini S&P 500 futures on 60-minute charts

This tutorial may help futures traders and technical analysts who want to use candlestick patterns to identify potential trend reversals. The strategies covered could assist you in creating straightforward reversal setups when market indecision appears at key price levels.

Learn more about futures trading with Tradingview: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

Brokers

How to Trade Double Tops & Bottoms in TradingViewLearn how to identify, validate, and trade double top and double bottom reversal patterns using TradingView's charting tools in this comprehensive tutorial from Optimus Futures. Understanding these classic chart formations can help you spot potential trend reversals and capitalize on contrarian trading opportunities in the futures markets.

What You'll Learn:

• Understanding contrarian vs. continuation trading strategies and when to use each approach

• The psychology behind buying low and selling high through reversal pattern trading

• How to identify double top and double bottom formations on any timeframe

• Key characteristics of valid double tops and bottoms, including volume confirmation

• Using TradingView's XABCD pattern tool to validate potential double top/bottom setups

• Real-world example analysis using crude oil futures charts

• Risk management techniques for trading reversal patterns

• How to calculate appropriate entry points, stop losses, and profit targets

• Setting up 1:1 risk-reward ratios for mathematical trading edge

• Understanding win rate requirements for profitable pattern trading

• How double bottom patterns work as the inverse of double top formations

This tutorial may benefit futures traders, swing traders, and technical analysts interested in contrarian trading strategies and reversal pattern recognition. The concepts covered could help you identify potential turning points in market trends and develop systematic approaches to trading these classic chart formations.

Visit Optimus Futures to learn more about trading futures with TradingView: optimusfutures.com/Platforms/TradingView.php

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

XAUUSD - Prop firm or your own account? - Trading Psychology"$100K Funded? Or $1K account you own?? Welcome to the Inside Battle of Every Trader"

You want capital, freedom and win big.

But the question is: do you do it with your own money, or someone else’s?

You’ve got the $100K funded dream on one side. Big leverage, strict rules, payout drama.

And on the other side? Your own $1K account. Zero limits, zero support, and a whole lot of emotional damage.

This is a breakdown of what really happens behind both paths — the adrenaline, the self-sabotage, the mind games, and the payouts that sometimes never come.

The Prop Firm Path: Pass, Survive, Then Pray

Phase 1: You trade with hunger.

You’ve got the goal in sight, and every move is calculated. You’re alert, focused, mechanical. The structure helps. The rules feel like a challenge. Everything feels possible.

Phase 2: You trade with fear.

Now you’re tiptoeing. The target’s smaller, but the pressure is suffocating. Hesitation.Overthink. You play defense — and that’s when you lose. You stop executing your edge and start trading to avoid failure.

Funded: The real test begins.

You go live, you trade well, you hit payout… and suddenly the firm has a problem. A new rule is “suddenly” enforced. A clause is reinterpreted. A delay happens. You’re told to wait. Or worse — your account is shut with no warning.

That’s the part no one prepares you for: the waiting, the silence, the mental snap.

Passing isn’t the end. It’s barely the middle.

✅ So, Should You Go Prop? Here's What You Need to Know

Yes — if you’re ready to treat this like a hostile contract.

If you’re trading a prop account, you are trading their rules, their terms, their timing. You are not a partner — you are a performer. And they are very comfortable pulling the plug.

If you do it:

• Be colder than the system.

• Read every rule twice.

• Trade Phase 2 like a surgeon — no ego, no rush.

• And never treat a payout like it's guaranteed — treat it like a fight you have to win more than once.

You don’t just pass. You survive.

And if you’re not ready to survive, stay out.

🚨 Do not forget — It’s Simulated Capital. And That’s the Game.

Let’s not pretend it’s hidden:

You’re NOT TRADING REAL MONEY. You’re executing on a simulated account that mirrors real conditions — nothing more.

When you get paid, it’s not because you “grew” capital. It’s because you performed better than the masses who failed their challenges and fed the payout pool.

This isn’t shady. It’s the model — and it works because most traders lose.

So don’t delude yourself into thinking you’re managing funds.

You’re monetizing discipline inside a challenge-based system.

And if you know how to work that system? You get paid.

If you don’t? You become someone else’s payout.

🔓 Trading Your Own Money: Real Freedom or Emotional Damage?

With your own capital, there’s no one watching — and no one helping.

You set the rules. You decide how aggressive, how cautious, how chaotic.

But the second you click “Buy,” your psychology comes for you like a debt collector.

Because real trading isn’t what’s on the screen — it’s what’s happening between your ears.

You lose your money, you lose your confidence.

You win big, and suddenly you think you’ve figured out the market — until the market slaps you for it.

There’s no one to blame, and that makes it ten times harder.

But here’s the part no one can take away from you: every lesson is yours.

Every win is clean. Every loss hits deep. And if you make it — you really made it.

💡 How to Make Self-Funded Work for You

✅ Start with small capital — but also invest in your trading education.

Join a group that teaches you how to trade, not signal groups that just give you orders when to buy or sell, without explaining why.

✅ Join a real trading community.

Surround yourself with people who post actual breakdowns — who teach, not flex.

Avoid ego chats. Avoid circus chats. Find people who show the why, not just the entry.

(If you’re reading this, you already found the right space.)

✅ Focus on fixing mistakes — not faking wins.

Nobody cares how many pips you caught if you blew 5 trades getting there. Get real about your risk management and lot size.

✅ Learn to stop after a win.

Don’t feed your dopamine. Protect your equity. Walk away while you’re still in control.

✅ Respect your losses. Don’t chase them.

Red days don’t destroy traders. Revenge trading does. Stop. Reset. Come back sharper.

✅ If you’re not paying yourself yet, don’t panic.

Some seasons are for building, not cashing out. Don’t force results just to feel good — let the system earn before it pays.

🔄 The Hybrid Advantage: Rent the rules. Own the skill.

Some traders don’t pick a side.

They use prop firms like a hired weapon — fast, effective, disposable and

Personal accounts like a vault — protected, scalable, sacred.

They switch between them based on market conditions, mental load, and long-term goals.

You don’t need to be loyal to a style just be loyal to your results.

🧠 Final Word:

Trading becomes real, sustainable, and successful only when your mind is at peace with the path you chose.

If you wake up anxious about your account — if you feel pressure before you even open the chart — that’s not discipline, that’s misalignment.

This doesn’t mean trading should feel easy. But it should feel right.

You should wake up curious to read price, not terrified to take a trade.

Whether you trade $100K or $1K, the real account is always in your head.

You should feel like this work belongs to you — not like you’re trying to survive someone else’s idea of success.

Whether you trade with a prop firm or your own account, or both, the goal is the same:

Mental clarity. Emotional control. Strategic confidence. You’ll know you’re on the right path the moment the stress fades — and the obsession becomes patience, structure and joy with success.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

How to Use Drawing Tools on TradingViewThis tutorial video discusses why and how traders use different types of trading tools, how to access the trading tools in Tradingview, and a few examples of how and why you might apply them.

Learn more about using Tradingview to trade futures with Optimus Futures:

optimusfutures.com

Disclaimer: There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

Institute of Intermediation and 24 Coffee LoversWhen the market is efficient, the most efficient strategy will yield zero financial return for the investor. Therefore, firstly, it is necessary to strive to find inefficiencies in the market itself to apply a strategy that will be effective for it.

What creates market inefficiency? First, there are delays in disseminating important information about the company, such as the approval of a contract with a major customer or an accident at a plant. If current and potential investors do not receive this information immediately, the market becomes inefficient at the time such an event occurs. In other words, objective reality is not considered by market participants. This makes the stock price obsolete.

Secondly, the market becomes inefficient during periods of high volatility. I would describe it this way: when uncertainty hits everyone, emotions become the main force influencing prices. At such times, the market value of a company can change significantly within a single day. Investors have too many different assessments of what is happening to find the necessary balance. Volatility can be triggered by the bankruptcy of a systemically important company (for example, as happened with Lehman Brothers), the outbreak of military action, or a natural disaster.

Third, there is the massive action of large players in a limited market - a "bull in a china shop" situation. A great example is the story of 2021, when the Reddit community drove up the price of GameStop shares, forcing hedge funds to cover their short positions at sky-high prices.

Fourthly, these are ineffective strategies of the market participants themselves. On August 1, 2012, American stock market trading company Knight Capital caused abnormal volatility in more than 100 stocks by sending millions of orders to the exchange over a 45-minute period. For example, Wizzard Software Corporation shares rose from $3.50 to $14.76. This behavior was caused by a bug in the code that Knight Capital used for algorithmic trading.

The combination of these and other factors creates inefficiencies that are exploited by trained traders or investors to make a profit. However, there are market participants who receive their income in any market. They are above the fray and are engaged in supporting and developing the infrastructure itself.

In mathematics, there is a concept called a “zero-sum game”. This is any game where the sum of the possible gains is equal to the sum of the losses. For example, the derivatives market is a perfect embodiment of a zero-sum game. If someone makes a profit on a futures contract, he always has a partner with a similar loss. However, if you dive deeper, you will realize that this is a negative-sum game, since in addition to profit and loss, there are commissions that you pay to the infrastructure: brokers, exchanges, regulators, etc.

To understand the value of these market participants and that you are paying them well, imagine a modern world without them. There is only a company issuing shares and investors in them.

Such a company has its own software, and you connect to it via the Internet to buy or sell shares. The company offers you a quote for buying and selling shares ( bid-ask spread ). The asking price ( ask ) will be influenced by the company's desire to offer a price that will help it not lose control over the company, consider all expected income, dividends, etc. The purchase price ( bid ) will be influenced by the company's desire to preserve the cash received in the capital market, as well as to earn money on its own shares by offering a lower price. In general, in such a situation, you will most likely get a huge difference between the purchase and sale prices - a wide bid-ask spread .

Of course, the company understands that the wider the bid-ask spread , the less interest investors have in participating in such trading. Therefore, it would be advisable to allow investors to participate in the formation of quotes. In other words, a company can open its order book to anyone who wants to participate. Under such conditions, the bid-ask spread will be narrowed by bids from a wide range of investors.

As a result, we will get a situation where each company will have its own order book and its own software to connect to it. From a portfolio investor's perspective, this would be a real nightmare. In such a world, investing in not one, but several companies would require managing multiple applications and accounts for each company at the same time. This will create a demand from investors for one app and one account to manage investments in multiple companies. Such a request will also be supported by the company issuing the shares, as it will allow it to attract investors from other companies. This is where the broker comes in.

Now everything is much better and more convenient. Investors get the opportunity to invest in multiple companies through one account and one application, and companies get investors from each other. However, the stock market will still be segmented, as not all brokers will support cooperation with individual companies, for technical or other reasons. The market will be fragmented among many brokerage companies.

The logical solution would be to create another market participant that would have contracts with each of the companies and universal software for trading their shares. The only thing is that it will be brokers, not investors, who will connect to such a system. You may have already guessed that this is an exchange.

On the one hand, the exchange registers shares of companies, on the other hand, it provides access to trading them through brokers who are its members. Of course, the modern structure of the stock market is more complex: it involves clearing, depository companies, registrars of rights to shares, etc.* The formation of such institutions and their licensing is handled by a regulator, for example, the Securities and Exchange Commission in the United States ( SEC ). As a rule, the regulator is responsible for legislative initiatives in the field of the securities market, licensing of market participants, monitoring violations in the market and supporting its efficiency, protecting investors from unfair manipulation.

*Clearing services are activities to determine, control and fulfill obligations under transactions of financial market participants. Depository services - services for the storage of securities and the recording of rights to them.

Thus, by making a transaction on the exchange, we contribute to the maintenance of this necessary infrastructure. Despite the fashion for decentralization, it is still difficult to imagine how one can ensure speed, convenience and access to a wide range of assets due to the absence of an intermediary institution. The other side of the coin of this institution is infrastructure risk. You can show phenomenal results in the market, but if your broker goes bankrupt, all your efforts will be nullified.

Therefore, before choosing an intermediary, it is useful to conduct a mental survey of the person you will be dealing with. Below you will find different types of intermediaries, which I have arranged according to their distance from the central elements of the infrastructure (exchanges, clearing houses, depositories).

Prime broker

Exchange Membership: mandatory

License: mandatory

Acceptance and accounting of your funds/shares: mandatory

Order execution: mandatory

Clearing and depository services: mandatory

Marginal services: mandatory

Remuneration: commission income from trades, clearing, depository and margin services

This category includes well-known financial houses with history and high capitalization. They are easily verified through lists of exchange members, clearing and depository companies. They provide services not only to individuals, but also to banks, funds and next-level brokers.

Broker

Exchange membership: mandatory

License: mandatory

Acceptance and accounting of your funds/shares: mandatory

Order execution: mandatory

Clearing and depository services: on the prime broker side

Margin services: on the prime broker side or own

Remuneration: commission income from trades and margin services

This category includes intermediaries with a focus on order routing. They delegate participation in depository and clearing services to a prime broker. However, such brokers can also be easily verified in the lists of exchange members.

Sub-broker

Exchange Membership: no

License: mandatory

Acceptance and accounting of your funds/shares: mandatory

Order execution: on the broker or prime broker side

Clearing and depository services: on the prime broker side

Margin services: on the broker or prime broker side

Remuneration: commission income from trades

This category includes brokers who have a brokerage license in their country, but do not have membership in foreign exchanges. To provide trading services on these exchanges, they enter into agreements with brokers or prime brokers from another country. They can be easily verified by license on the website of the regulator of the country of registration.

Introducing Broker

Exchange Membership: no

License: optional, depending on the country of regulation

Acceptance and accounting of your funds / shares: no

Order execution: on the side of the sub-broker, broker or prime broker

Clearing and depository services: on the prime broker side

Margin services: on the broker or prime broker side

Remuneration: commission income for the attracted client and/or a share of the commissions paid by them

This category includes companies that are not members of the exchange. Their activities may not require a license, since they do not accept funds from clients, but only assist in opening an account with one of the top-tier brokers. This is a less transparent level, since such an intermediary cannot be verified through the exchange and regulator’s website (unless licensing is required). Therefore, if an intermediary of this level asks you to transfer some money to his account, most likely you are dealing with a fraudster.

All four categories of participants are typical for the stock market. Its advantage over the over-the-counter market is that you can always check the financial instrument on the exchange website, as well as those who provide services for its trading (membership - on the exchange website, license - on the regulator's website).

Pay attention to the country of origin of the broker's license. You will receive maximum protection in the country where you have citizenship. In case of any claims against the broker, communication with the regulator of another country may be difficult.

As for the over-the-counter market, this segment typically trades shares of small-cap companies (not listed on the exchange), complex derivatives and contracts for difference ( CFD ). This is a market where dealers rule, not brokers and exchanges. Unlike a broker, they sell you their open position, often with a lot of leverage. Therefore, trading with a dealer is a priori a more significant risk.

In conclusion, it should be noted that the institution of intermediation plays a key role in the development of the stock market. It arose as a natural need of its participants for concentration of supply and demand, greater speed and security of financial transactions. To get a feel for this, let me tell you a story.

New Amsterdam, 1640s

A warm wind from the Hudson brought the smell of salt and freshly cut wood. The damp logs of the palisade, dug into the ground along the northern boundary of the settlement, smelled of resin and new hopes. Here, on the edge of civilization, where Dutch colonists were reclaiming their homes and future fortunes from the wild forest, everything was built quickly, but with a view to lasting for centuries.

The wooden wall built around the northern border of the town was not only a defense against raids, but also a symbol. A symbol of the border between order and chaos, between the ambitions of European settlers and the freedom of these lands. Over the years, the fortification evolved into a real fortification: by 1653, Peter Stuyvesant, appointed governor of New Netherland by the West India Company, ordered the wall to be reinforced with a palisade. It was now twelve feet high, and armed sentries stood on guard towers.

But even the strongest walls do not last forever. Half a century after their construction, in 1685, a road was built along the powerful palisade. The street received a simple and logical name - Wall Street. It soon became a bustling commercial artery for the growing city. In 1699, when the English authorities had already established themselves here finally, the wall was dismantled. She disappeared, but Wall Street remained.

A century has passed

Now, at the end of the 18th century, there were no walls or guard towers on this street. Instead, a plane tree grew here - a large, spreading one, the only witness to the times when the Dutch still owned this city. Traders, dealers, and sea captains met under its shadow. Opposite the buttonwood tree stood the Tontine Coffee House, a place where not just respectable people gathered, but those who understood that money makes this world go round.

They exchanged securities right on the pavement, negotiated over a cup of steaming coffee, and discussed deals that could change someone's fate. Decisions were made quickly - a word, backed up by a handshake, was enough. It was a time when honor was worth more than gold.

But the world was changing. The volume of trades grew, and chaos demanded rules.

May 17, 1792

That spring day turned out to be decisive. Under the branches of an old buttonwood tree, 24 New York brokers gathered to start a new order. The paper they signed contained only two points: trades are made only between their own, without auctioneers, and the commission is fixed at 0.25%.

The document was short but historic. It was called the Buttonwood Agreement, after the tree under which it was signed.

Here, amid the smell of fresh coffee and ink, the New York Stock Exchange was born.

Soon, deals were being concluded under the new rules. The first papers to be traded were those of The Bank of New York , whose headquarters were just a few steps away at 1 Wall Street. Thus, under the shade of an old tree, the history of Wall Street began. A story that will one day change the whole world.

Buttonwood Agreement. A fresco by an unknown artist who adorns the walls of the New York Stock Exchange.

Donchian Channel Strategy like The Turtles TradersThe Turtle Traders strategy is a legendary trend-following system developed by Richard Dennis and William Eckhardt in the 1980s to prove that trading could be taught systematically to novices. Dennis, a successful commodities trader, bet Eckhardt that he could train a group of beginners—nicknamed "Turtles"—to trade profitably using strict rules. The experiment worked, with the Turtles reportedly earning over $100 million collectively. Here’s a detailed breakdown of their strategy, focusing on the core components as documented in public sources like Curtis Faith’s Way of the Turtle and other accounts from the era.

Core Philosophy

Trend Following: The Turtles aimed to capture large price trends in any direction (up or down) across diverse markets—commodities, currencies, bonds, and later stocks.

Systematic Rules: Every decision—entry, exit, position size—was predefined. No discretion allowed.

Volatility-Based: Risk and position sizing adjusted to each market’s volatility, not fixed dollar amounts.

Long-Term Focus: They targeted multi-month trends, ignoring short-term noise.

Two Trading Systems

The Turtles used two complementary breakout systems—System 1 (shorter-term) and System 2 (longer-term). They’d trade both simultaneously across a portfolio of markets.

System 1: Shorter-Term Breakout

Entry:

Buy when the price breaks above the 20-day high (highest high of the past 20 days).

Sell short when the price breaks below the 20-day low.

Skip the trade if the prior breakout (within 20 days) was profitable—avoid whipsaws after a winning move.

Initial Stop Loss:

Exit longs if the price drops 2N below entry (N = 20-day Average True Range, a volatility measure).

Exit shorts if the price rises 2N above entry.

Example: Entry at $100, N = $2, stop at $96 for a long.

Trailing Stop:

Exit longs if the price breaks below the 10-day low.

Exit shorts if the price breaks above the 10-day high.

Time Frame: Aimed for trends lasting weeks to a couple of months.

System 2: Longer-Term Breakout

Entry:

Buy when the price breaks above the 55-day high.

Sell short when the price breaks below the 55-day low.

No skip rule—take every breakout, even after a winner.

Initial Stop Loss:

Same as System 1: 2N below entry for longs, 2N above for shorts.

Trailing Stop:

Exit longs if the price breaks below the 20-day low.

Exit shorts if the price breaks above the 20-day high.

Time Frame: Targeted trends lasting several months (e.g., 6-12 months).

Position Sizing

Volatility (N): N, or “noise,” was the 20-day Average True Range (ATR)—the average daily price movement. It normalized risk across markets.

Unit Size:

Risk 1% of account equity per trade, adjusted by N.

Formula: Units = (1% of Account) / (N × Dollar Value per Point).

Example: $1M account, 1% = $10,000. Corn N = 0.5 cents, $50 per point. Units = $10,000 / (0.5 × $50) = 400 contracts.

Scaling In: Add positions as the trend confirms:

Long: Add 1 unit every ½N above entry (e.g., entry $100, N = $2, add at $101, $102, etc.).

Short: Add every ½N below entry.

Max 4 units per breakout, 12 units total per market across systems.

Risk Management

Portfolio Limits:

Max 4 units in a single market (e.g., corn).

Max 10 units in closely correlated markets (e.g., grains).

Max 12 units in one direction (long or short) across all markets.

Stop Loss: The 2N stop capped risk per unit. If N widened after entry, the stop stayed fixed unless manually adjusted (rare).

Drawdown Rule: If account dropped 10%, cut position sizes by 20% until recovery.

Markets Traded

Commodities: Corn, soybeans, wheat, coffee, cocoa, sugar, cotton, crude oil, heating oil, unleaded gas.

Currencies: Swiss franc, Deutschmark, British pound, yen.

Bonds: U.S. Treasury bonds, 90-day T-bills.

Metals: Gold, silver, copper.

Diversification across 20-30 markets ensured uncorrelated trends.

sell xauusdThe trend of gold this week is completely downward. According to the daily and 4-hour candlestick charts, a decreasing trend and correction of the increase have been confirmed. The Fibonacci levels also indicate that all resistance levels are aligned, so it is entirely likely to continue this way until the end of the new week.

GOLD / XAUUSD UPDATE !!!!www.tradingview.com

The gold market is currently in a holding pattern, with traders reluctant to make premature decisions due to upcoming significant news. A consolidation below the level of 2315 is observed.

A false break of support has led the price to retest the 2310-2315 range, after which traders are pausing before the news release. All attention is focused on the forthcoming major events, namely the CPI and the Fed meeting. The key US CPI data will influence the Fed's stance on interest rates, which will, in turn, significantly affect the value of the US dollar and gold prices in the short term. The market anticipates neutral data (no change), which would likely maintain the same fundamental backdrop. However, the actual data is highly anticipated, especially after last Friday's unexpectedly high NFP.

Any initial reaction to the US CPI data might be short-lived as gold traders will soon turn their attention to the FOMC & Fed meeting.

Resistance levels are identified at 2315, 2325, and 2354, while support levels are found at 2305, 2291, and 2267.

From both a technical and fundamental perspective, gold appears weak at the moment. Amidst high volatility, the price may attempt to breach 2325 and test the liquidity zone of 2335-2345, then transition to a decline phase if the fundamental backdrop is conducive. The risk of further decline remains substantial, but the upcoming news could either exacerbate this decline or disrupt the market structure.

HOW TO SET TAKE PROFIT AND STOP LOSSES ON CONNECTED BROKERSOne of the best features of TradingView is all the connected brokers and how you can not only place, but also move any take profit and stop losses around on the screen to match what you are seeing on your various indicators or support levels.

Video also covers a way to gracefully exit out of a trade bit by bit if you are already up a long way and want to protect your profit by selling a little bit at a time instead of the whole lot if the price starts coming down.

It's very cool.

Charles Schwab Opportunity Charles Schwab $SCWH

Earnings info will follow in comments:

Company Market Cap: $97.8 billion

Share Price: $53.72

Dividend: $1.00 dps – Dividend per share ($0.25 per quarter)

Dividend yield: 1.94% (Annual dps divided by current share price, expressed as a percentage)

Why this Trade?

o Contrarian trade – news is so negative its hard to not to feel interested

o Price 50% down from highs in Feb 2022

o Ascending triangle base re-test on-going

o Defined risk level/stop loss makes it an easy set up

o Long term diagonal support line provides secondary support

o RSI Oversold historic returns inform us of a current opportunity and potential future opportunities.

Concerns/Risks:

o Schwab is not a Global Systemically Important Bank (G-SIB)

o The 200 week SMA has been lost

o Rumours of Bankruptcy

Company Summary

o Charles Schwab is the 17th largest bank in the world with a market cap of $94.4 billion.

o Charles Schwab is primarily a wealth management and investment bank which stands out among the investment broker realm for its customer service, $0 trade commissions and large selection of mutual funds. From its origination the company has been all about making investing accessible to everyone.

o In line with this vision, Charles Schwab acquired rival firm TD Ameritrade three years ago. TD Ameritrade now provides investing and trading services for 11 million client accounts that total more than $1 trillion in assets, and custodial services for more than 6,000 independent registered investment advisors. Many Americans actively trade on TD or manage their own ROTH IRA’s through the platform, offering them tax benefits/advice and very flexible options for managing their own retirement funds. TD's Roth IRA has zero annual account fees or management fees.

The Chart

o You can see a potential Long Term Ascending Triangle playing out.

o There is an underside diagonal support line.

o The beauty of this trade is the following:

- A defined stop loss level at $45.39

- A potential 85% upside to – 12% downside (Adjust to suit your tolerance).

- A bounce of the top of the ascending triangle is promising.

o Any time we have been this oversold on the RSI we have made a significant upside move (green circles on the chart).

o The average performance after the green oversold RSI levels is an 82% price increase within a 12 months.

o If there is one thing we can take away from this chart it is that if we reach down into RSI oversold levels again this would be a great opportunity.

o Regardless I am proposing the trade based off the pattern and recent oversold RSI. Since this recent oversold level we have had an approximate 50% increase in price and a 27% retraction/decline back down to the ascending triangle base.

o For those of you who want to lower your risk you can raise the stop loss to a 5% decline ($48.00) or you can wait until over sold levels present themselves again.

Important to note that Charles Schwab is not a Global Systemically Important Banks (G-SIB) like Citibank and the likes. This makes this a higher risk trade, especially if we are looking long term over a 52 week period. Regardless, it is a well-established bank providing some of the leading brokerage services to the US public including management of ROTH IRA’s, the cornerstone of most Americans retirement planning. One could argue, its systemically important without being a member of the G-SIB.

As always, stay nimble in this market, do not enter a trade without a stop loss at a risk level you can tolerate. Same goes with position size. With this stock 50% down from highs way back in Feb 2022 this maybe an opportunity to claw onto this long term rising trend near it lower diagonal support line.

PUKA

INFORMATIONAL : White Label Brokers: What Are They?What is a white label Broker ?

A white label broker is a particular kind of broker that grants access to a trading platform to its customers but actually outsources the platform's management to a different supplier. Typically, the third-party supplier is a bigger, more reputable broker with the hardware and setup necessary to host a trading platform. The provider charges the white label broker a fee for the use of its platform and services. A trading environment. The provider charges the white label broker a fee for the use of its platform and services.

Many Large brokers in the trading space offer this service to business clients. Simply ask the support team. The main advantage of becoming a white label broker is that it allows the broker to enter the market quickly and easily, without having to invest in developing its own trading platform and dealing with the technical and regulatory issues involved. The white label broker can focus on marketing and customer service, while relying on the provider for the execution and settlement of trades. The white label broker can also customize the platform to suit its own branding and preferences, and offer its clients a variety of trading instruments and features. If you happen to see a lot of new brokerages popping up they are likely to be white labeled.

The main disadvantage of becoming a white label broker is that it limits the broker's control and flexibility over its own business. The white label broker has to abide by the terms and conditions of the provider, which may restrict its pricing, commission, leverage, margin, and risk management options. The white label broker also has to share a portion of its revenue with the provider, which reduces its profit margin. The white label broker may also face competition from other brokers using the same platform and provider. ,and this typically means the white label broker may have higher commissions and spreads compared to other brokers in order to generate revenue. The justification for this is that in order to use the parent company's platform and brand, the white label broker must pay fees or royalties to them. They could raise the commissions and spreads they charge their clients in order to offset these expenses and turn a profit. The white label broker can make money while continuing to provide the same trading services and features as the parent company thanks to the higher cost structure.

How the higher fees affect the trader.

The profitability of a trader is directly impacted by higher commissions and spreads. A trader's transaction costs come in the form of commissions, which are fees assessed by the broker for facilitating the trade, when they execute trades. The potential gains from profitable trades are decreased and the breakeven threshold for lucrative deals is raised if commissions are high.

Second, higher spreads, or the difference between a financial instrument's buying and selling prices, might make it harder for traders to join and exit positions at advantageous prices. With wider spreads, traders must wait for the market to move more in their favor in order to break even or make a small profit. Due to the significantly higher cost of executing scalp trades, this may restrict the trader's ability to profit from minor price fluctuations. Moreover, higher costs can also discourage traders from actively participating in the market or taking advantage of certain trading strategies. For example, day traders who execute numerous trades throughout the day may find the cumulative effect of higher commissions and wider spreads to be prohibitive, making it less viable for them to pursue their trading activities.

Overall, higher costs imposed by a broker can impact a trader's profitability,

Accountability

As a white label, the small broker relies on a larger broker to provide these essential services, which means they are not directly responsible for addressing any problems that may arise. In the event of technical glitches or liquidity issues, the small broker must depend on the larger broker to resolve them. However, the larger broker is likely to prioritize their main clients over the white label brokers, as they hold a higher stake in their business. This situation puts the small broker at a disadvantage, as they may experience delays or difficulties in getting their issues resolved promptly, impacting their ability to provide quality services to their own clients.

How to know if a broker is white labeled ?

In some cases, a white label broker can be operated by a single individual, much like yourself. It is often challenging to discern whether a broker is white label since they may not have a physical location or any visible indications. However, there are some signs that can potentially suggest a broker is white label. One common indicator is when they are unable to provide an API feed.

🔹An API feed, or Application Programming Interface feed, allows traders to directly access liquidity and even create their own trading platform instead of relying on existing ones like MT5 or MT4. The ability to offer an API feed is typically associated with brokers who have direct access to liquidity providers. Therefore, if a broker cannot provide an API feed, it might indicate that they are white label and rely on a larger broker for liquidity.

🔹Another sign that a broker might be white label is if they exclusively offer payouts via cryptocurrencies. While not definitive proof, this can be a characteristic of white label brokers who use cryptocurrencies as a means of avoiding traditional banking systems and regulatory scrutiny.

🔹Additionally, another potential indication that a broker is white label is the absence of a physical location. Unlike traditional brokers who often have physical offices or headquarters, white label brokers may operate solely online without a physical presence. This lack of a physical location can make it more challenging to ascertain the true nature of the broker's operations and ownership. Traders should be aware of this factor when considering their choice of broker and take it into account when assessing the broker's credibility and trustworthiness.

Unfortunately, it can be challenging to obtain a straightforward answer from brokers about whether they are white label or not. Some may be evasive or unwilling to disclose this information. Therefore, traders should exercise caution and carefully consider these signs when evaluating a broker's authenticity and reliability.

Regulated vs Unregulated Brokers: Understanding the Differences When it comes to choosing a broker for trading, one of the most important factors to consider is whether the broker is regulated or unregulated. While both types of brokers can offer trading services, there are some significant differences between them that traders should be aware of.

Regulated brokers are licensed and monitored by regulatory authorities, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. These authorities set strict rules and standards that brokers must follow to protect investors and maintain market integrity. For example, regulated brokers are required to segregate client funds from their own operating funds, provide regular reports on their financial health, and maintain a certain level of capitalization.

Unregulated brokers, on the other hand, are not licensed or monitored by any regulatory authority. This means that they are not subject to the same rules and standards as regulated brokers, and may not provide the same level of protection for investors. Unregulated brokers may also be more susceptible to fraud and scams, as there is no external oversight to ensure that they are operating in a fair and transparent manner.

There are some potential advantages to using an unregulated broker, such as lower fees or more flexible trading conditions. However, these benefits may come at a higher risk to the investor, as unregulated brokers may not provide the same level of security and protection as regulated brokers.

In summary, choosing between a regulated and unregulated broker is an important decision for any trader. While unregulated brokers may offer some advantages, such as lower fees, they also come with a higher risk of fraud and scams. Regulated brokers, on the other hand, are subject to strict rules and standards that help to protect investors and maintain market integrity. As such, it is important to carefully consider the reputation and regulatory status of any broker before entrusting them with your investments.

Diversification using TradingView ToolsHow to diversify your portfolio and trade across different markets and asset classes using Tradingview's data and charts

Diversifying your portfolio is one of the most important strategies for reducing risk and increasing returns in the long term. By investing in different markets and asset classes, you can benefit from the different performance cycles and correlations of each asset, and avoid putting all your eggs in one basket.

However, diversifying your portfolio can also be challenging, especially if you are not familiar with the different markets and asset classes available. How do you know which assets to choose, how much to allocate to each one, and how to monitor their performance over time?

This is where TradingView can help you. TradingView is a powerful platform that provides you with data and charts for thousands of assets across various markets and asset classes, such as stocks, forex, cryptocurrencies, commodities, indices, futures, options, and more. You can use TradingView to research, analyze, and trade these assets with ease and convenience.

In this article, we will show you how to diversify your portfolio and trade across different markets and asset classes using TradingView's data and charts. We will cover the following topics:

- How to access data and charts for different markets and asset classes on TradingView

- How to use TradingView's tools and features to research and analyze different assets

- How to use TradingView's indicators and strategies to identify trading opportunities and signals

- How to use TradingView's brokers and trading platforms to execute trades on different assets

- How to use TradingView's portfolio and watchlist tools to monitor and manage your diversified portfolio

By the end of this article, you will have a better understanding of how to diversify your portfolio and trade across different markets and asset classes using TradingView's data and charts. Let's get started!

One of the benefits of diversifying your portfolio is that you can take advantage of the different performance cycles and correlations of different markets and asset classes. For example, stocks tend to perform well during periods of economic growth and expansion, while bonds tend to perform well during periods of economic slowdown and contraction. Similarly, commodities tend to perform well during periods of inflation and supply shocks, while cryptocurrencies tend to perform well during periods of innovation and disruption.

However, to diversify your portfolio effectively, you need to have access to data and charts for different markets and asset classes. This is where TradingView can help you. TradingView is a platform that provides you with data and charts for thousands of assets across various markets and asset classes, such as stocks, forex, cryptocurrencies, commodities, indices, futures, options, and more. You can use TradingView to research, analyze, and trade these assets with ease and convenience.

To access data and charts for different markets and asset classes on TradingView, you can use the search bar at the top of the page. You can type in the name or symbol of the asset you want to view, or you can browse through the categories and subcategories on the left side of the page. For example, if you want to view data and charts for stocks, you can click on the "Stocks" category on the left side of the page, and then choose from the subcategories such as "US Stocks", "UK Stocks", "Canadian Stocks", etc. You can also filter by sectors, industries, market cap, dividends, earnings, etc.

Once you select an asset, you will see its data and chart on the main page. You can customize the chart by changing the time frame, adding indicators, drawing tools, annotations, etc. You can also compare the performance of different assets by adding them to the same chart. For example, if you want to compare the performance of gold and bitcoin over the last year, you can add them to the same chart by typing in their symbols in the search bar (XAUUSD for gold and BTCUSD for bitcoin) and clicking on "Compare". You will see their data and charts overlaid on each other.

You can also use TradingView's tools and features to research and analyze different assets. For example, you can use TradingView's screener tool to scan for assets that meet your criteria based on various fundamental and technical factors. You can also use TradingView's news feed to stay updated on the latest developments and events that affect different markets and asset classes. You can also use TradingView's social network to interact with other traders and investors who share their ideas and opinions on different assets.

TradingView also provides you with indicators and strategies that can help you identify trading opportunities and signals for different assets. Indicators are mathematical calculations that are applied to the price or volume data of an asset to generate signals or patterns that indicate the direction or strength of a trend or a reversal. Strategies are sets of rules that define when to enter and exit a trade based on certain conditions or criteria. TradingView has hundreds of indicators and strategies that you can use or create your own using TradingView's Pine Script language.

To use TradingView's indicators and strategies, you can click on the "Indicators" button at the top of the chart. You will see a list of categories such as "Trend", "Momentum", "Volatility", etc. You can choose from the built-in indicators or search for custom indicators created by other users or yourself. You can also click on the "Strategies" button at the top of the chart to see a list of categories such as "Long", "Short", "Scalping", etc. You can choose from the built-in strategies or search for custom strategies created by other users or yourself.

Once you select an indicator or a strategy, you will see it applied to your chart. You can adjust its settings by clicking on its name at the top of the chart. You will see its parameters such as inputs, outputs, alerts, etc. You can change these parameters according to your preferences or needs. You will also see its performance report that shows its statistics such as net profit, win rate, drawdown, etc. You can use this report to evaluate its effectiveness and suitability for your trading style and goals.

TradingView also allows you to execute trades on different assets using its brokers and trading platforms. Brokers are intermediaries that connect you with the markets and allow you to buy and sell assets for a fee or commission. Trading platforms are software applications that enable you to place orders, manage your positions, monitor your account balance, etc. TradingView has partnered with several brokers and trading platforms that offer access to various markets and asset classes.

To start trading on TradingView, you need to connect your broker account or trading platform to your TradingView account. TradingView supports many popular brokers and platforms, such as Oanda, FXCM, Coinbase, Binance, Interactive Brokers, and more. You can find the full list of supported brokers and platforms here: www.tradingview.com To connect your broker account or platform, go to the Trading Panel at the bottom of your chart, click on the Select Broker button, and choose your broker or platform from the list. Then follow the instructions to log in and authorize TradingView to access your account.

Once you have connected your broker account or platform, you can start executing trades on different assets directly from your TradingView charts. To open a trade, click on the Buy/Sell button on the Trading Panel, select the asset you want to trade, enter the quantity, price, stop loss, and take profit levels, and click on Confirm. You can also use the One-Click Trading feature to open trades with one click on the chart. To enable One-Click Trading, go to the Settings menu on the top right corner of your chart, click on Trading Settings, and check the One-Click Trading box. Then you can click on the Bid or Ask price on the chart to open a buy or sell trade respectively.

To monitor and manage your open trades, you can use the Orders and Positions tabs on the Trading Panel. Here you can see your order history, current positions, profit and loss, margin level, and account balance. You can also modify or close your orders and positions by clicking on the Edit or Close buttons. You can also use the Trade Manager tool to manage your trades more efficiently. The Trade Manager tool allows you to set multiple targets and stop losses for each trade, as well as trailing stops and break-even levels. To access the Trade Manager tool, right-click on your position on the chart and select Trade Manager.

To monitor and manage your diversified portfolio across different brokers and platforms, you can use TradingView's portfolio and watchlist tools. The portfolio tool allows you to see your total portfolio value, asset allocation, performance, risk metrics, and more. You can also compare your portfolio with various benchmarks and indices. To access the portfolio tool, go to www.tradingview.com The watchlist tool allows you to create custom lists of assets that you want to track and analyze. You can add any asset that is available on TradingView to your watchlist, such as stocks, forex pairs, cryptocurrencies, commodities, indices, etc. You can also sort, filter, group, and customize your watchlist columns according to your preferences. To access the watchlist tool, go to www.tradingview.com

TradingView's brokers and trading platforms integration and portfolio and watchlist tools are powerful features that can help you execute trades on different assets and monitor and manage your diversified portfolio more effectively. We hope this article has given you a clear overview of how to use these features. Happy trading!

FOREX ORDER EXECUTION AND STOP LOSS Stop losses are a risk management tool that traders use to mitigate potential losses in volatile markets. However, understanding how stop losses work can be complex, especially when considering the different business models of brokers.

The broker's business model can significantly impact the execution of a stop loss. Typically, brokers operate under one of two models: the A-Book mode l or the B-Book mode l. This might also be referred to as a non-dealing desk or dealing desk brokers. Under the A-Book model (Non dealing desk), a broker routes orders directly to liquidity providers who source counterparties to take the opposite side of the trade. In contrast, the B-Book (Dealing desk/Market Makers) model involves executing orders in-house, making the broker the counterparty to all trades.

While the A-Book model provides a neutral intermediary between traders and liquidity providers, the B-Book model can lead to a conflict of interest, as the broker profits from traders' losses. Furthermore, the A-Book model may not guarantee stop-loss execution since it relies on liquidity providers to fill orders. On the other hand, the B-Book model can lead to faster order execution, but at the expense of the broker's credibility.

It's essential to understand the order execution process when placing a stop loss order. For example, when a trader inputs an order to buy or sell, the broker processes the order and returns execution information to the trader's terminal. However, the execution of stop losses is not always guaranteed since orders can experience slippage due to price movements or liquidity issues.

It's worth noting that some brokers offer guaranteed stop losses, but at an additional cost. This guarantee ensures that traders are not responsible for any losses beyond their requested exit price. However, traders should weigh the costs and benefits of this option before utilizing it.

In conclusion, stop losses are a critical tool for managing trading risk, but they are not foolproof. A trader's ability to exit a position at a specific price is subject to various factors, including the broker's business model and liquidity issues. To make informed decisions when placing stop loss orders, traders should research and understand the broker's order execution process beyond the liquidity provider.

In a future post, we will dive deeper into order execution from the A-Book broker broker's perspective and explore how it impacts traders. We will also speak on STP and ECN processing. Stay tuned for more insights and information on trading practices and strategies.

Is YOUR Broker Regulated? Find out hereHere is a list of eight of the main financial regulatory agencies that are backed with strict regulatory enforcement in other countries…

You’ll need to make sure the broker you choose is approved by one of the below.

South Africa (FSCA) - The Financial Sector Conduct Authority

USA (SEC) – Securities And Exchange Commission

Eurozone (MiFID) – Markets In Financial Instruments Directive

UK (FCA) – Financial Conduct Authority

Australia (ASIC) – Australian Securities and Investments Commission

India (SEBI) – Securities and Exchange Board of India

Japan (JSDA) – Japan Securities Dealers Association

Switzerland (FINMA) – Swiss Financial Market Supervisory Authority

Am I missing any? Let me know in the comments :)

Trade well, live free.

Timon

MATI Trader

Financial trader since 2003

How to Choose the Right Broker -10 pointsHere’s a list you may follow to help with your decision.

My top 10 list to choose the best broker

1. Only choose reputable brokers that are regulated and recognised by the main financial regulatory bodies. (See answer to question two for the list of financial regulated authorities).

2. Find a broker who offer a list of trading instruments that you prefer i.e. shares, CFDs, Spread trading or futures.

3. Make sure their cost fees are low and their withdrawing and depositing structure takes place within three working days.

4. Make sure they are insured and deal with the top banks in the world and don’t run their own finance firm where they can take your money and run.

5. Go onto Google or ‘Hello Peter’ and read as many reviews from REAL people to see their experiences.

6. Browse through their website and read through everything before you decide whether they are for you or not.

7. Avoid any broker who promises any too-good-to-be true returns or are very marketing orientated – most times these are scams…

8. Analyse their portfolio growth they’ve achieved for their clients over the last five years. This will help you see their consistency or even the validity of what they have to offer.

9. Choose a broker who meets your trading needs i.e. trading platform, available markets, trading indicators, economic calendars and even copy-trading plug-ins.

10. Make sure the broker you choose is able to help in terms of customer service needs, trading education, live videos and even trading events for their clients.

If you found this useful, let me know in the comments.

Trade well, live free.

Timon

MATI Trader

Financial Trader since 2003

Choose your Ideal Broker with a 10 Step checklistAre you looking for the right broker in 2023 and beyond but unsure what to look for?

With the high competition nowadays, each broker offers different features, instruments and advantages.

That’s why choosing one not an easy task for a beginner or even an experienced trader.

You’ll need to drill down exactly what suits your trading style, personality and risk profile.

I say this because, in the last two decades, I’ve been through a fair share of brokers. So, I know how difficult this decision can be and how it can determine whether you make money or not as a trader.

In this article, I’ll share with you an easy-to-follow checklist which you can use to help you choose the right online broker in 2020 and beyond.

What is a broker or dealer?

A broker is a company or institution that gives a trader access to a live trading account and trading platform which enables them to buy, sell and monitor different instruments and assets.

Here’s my checklist to find your ideal broker…

Checklist item #1:

Make sure the broker or dealer is regulated!

This is a must…

Whenever you sign up with a broker, make sure they are authorised, regulated and recognised by leading regulation authorities.

You will most likely find this stated on the company’s website, in the ‘About Us’ or in their ‘Disclaimer’, along with their license number they hold with that regulator.

Countries with dedicated financial regulatory agencies include:

South Africa

(FSB) – Financial Services Board.

USA

(SEC) – Securities And Exchange Commission

(FINRA) – Financial Industry Regulatory Authority

Eurozone

(MiFID) – Markets In Financial Instruments Directive

UK

(FCA) – Financial Conduct Authority

Australia

(ASIC) – Australian Securities and Investments Commission

India

(SEBI) – Securities and Exchange Board of India

Japan

(JSDA) – Japan Securities Dealers Association

Switzerland

(FINMA) – Swiss Financial Market Supervisory Authority

When you sign up with a regulated broker, you’ll at least have the security and assurance that they have met certain standards approved by the regulatory body, such as:

Having the right capital to protect the clients’ funds

Ensure the firm won’t go bust

Confirm they have met certain requirements from the financial service provider

Checklist item #2:

Check their reviews and testimonials

Before you make any decisions, you’ll need to see what others have said and are saying about the broker or the dealer company.

You can do this by searching on Google, ‘Hello Peter’, trading forums or go onto their social media pages to read what other unbiased REAL clients have written about them when it comes to reviews, testimonials and ratings.

Checklist item #3:

Broker minimum requirements

There are two minimums to take into account: Minimum balance and minimum deposit per trade.

Most brokers require you to start with a certain minimum balance to set up your trading account.

Nowadays, with the high competition, you should easily be able to find brokers or dealers who require no more than R1,000 up to R5,000 to open a trading account.

If they require any more to open your trading account, just know that there are other brokers out their where you can start with less.

As with the minimum deposit to take a trade, you can easily find reputable brokers where the minimum is under R200 per trade.

Checklist item #4:

Availability:

What they can offer you

You should have a good idea on what you’d like to trade.

This is why before you sign up with the broker, you’ll need to see the availability and range of trading instruments the company has to offer.

What assets do you want to trade?

Shares, CFDs, Options, Futures, Spread Betting etc…

What markets do you want to trade?

Stocks, currencies, commodities, indices, bonds, ETFs or crypto-currencies…

Where do you want to trade?

Via phone, mobile or computer.

What times would you like to trade?

Morning, noon or night?

What gearing and leverage would you like to trade?

Whether you’re a Forex trader or a stock trader you’ll need to find out what gearing the broker has to offer.

Such as 5:1 – 20:1 (for stocks) and 50:1 up to 200:1 (for Forex).

E.g. With gearing (or leverage) of 50:1 this means if you deposit R1,000 into a trade you can hold a position exposed and valued up to R50,000.

REMEMBER: the higher the leverage offered, the higher the reward but also the potential risk.

Do they offer a demo account or a trial period?

You should never rush into trading with real money, before getting to know your broker and your trading platform.

That’s why you should ask your broker if they have a demo trading platform or account that you can use to test out what they have to offer with your strategies

Checklist item #5:

Do they offer trading education and training?

A good and genuine broker should want you to be successful as a trader.

And to do this, they should offer you a whole range of free education, training sources and tools such as:

Training guides

Glossary

Trading videos, podcasts, forums

Written articles

Step-by-step trading tutorials

Support staff

Opinion-based resources

Live trading events and webinars

Trading calculators, tools and calendars

Checklist item #6:

The trading platform itself

Majority of your analyses, preparation and the execution of trades are going to take place on the trading platform itself.

This is why you’ll need to try it out, test it and learn how to use it, to see if it will suit your trading.

Here is a list of items to watch out for with your trading platform:

Item #1: Chart types:

E.g. Line chart and candle sticks

Item #2: Time frame options of:

E.g. 1 hour, 4 hour, daily, weekly & monthly

Item #3: Trading indicators and oscillators:

E.g. RSI, Stochastics, MACD, OBV, ADX, Bollinger Bands etc…

Item #4: Real time charts:

E.g. Not having to refresh your screen every 15 minutes or download anything unnecessarily.

Item #5: Live streaming data:

E.g. News feed, live speeches & announcements, and SENS (Stock Exchange News Service).

Item #6: Customized watch lists:

Make sure there is a functionality to create, modify and monitor a watchlist with the markets you’ll be trading.

Item #7: Trading order variety:

E.g. Market, buy, sell, limit, stops, trailing stop loss and guaranteed stop losses

Item #8: Trading journal:

E.g. Portfolio profit & loss summary of open, closed and historical trades.

Item #9: Trading order box:

Where you’ll place your entry, stop loss, take profit, margin requirements, order quantity, gain potential, risk potential and risk to reward.

Item #10: Reliability:

When you’re testing the trading platform, this is where you can ensure it’s reliable in a way that:

It runs smoothly

It saves your layout, charts and profile

It doesn’t crash

The speed is good

The features all work as they should

The web-based (java) or desktop application works great

The mobile app is easy-to-use and handle

NOTE: TradingView connects a amazing and reliable brokers.

Checklist item #7:

Customer support

It’s important to find out where you can contact your broker, in case you need help due to some technical or trading reason.

Which mediums can you contact them through?

• Phone

• Email

• Online live chat

• WhatsApp

• Skype

• Forums

Also when you give the representative a call, make sure they sound knowledgeable and confident in what they tell you.

Think about how they respond to your questions, how quickly do they solve your queries, are they friendly and approachable?

The contact support will also confirm their quality, efficiency, reliability and credibility for what the company already portrays and offers.

Checklist item #8:

Costs and fees

You will never be able to avoid costs and fees completely, but you can minimize them by choosing the right broker.

You’ll need to do a bit of research to compare the costs of buying, selling and holding trades.

Make sure you look at the following:

Spreads (Fixed or variable)

Note: The spreads should be low for high volume traded markets

Commissions (When you enter and when you exit)

Margin interest

Service charges

Minimum charge per trade e.g. R100

Checklist item #9:

Ease of deposits and withdrawals

This is an important one…

Each broker or dealer has their own measures and policies when it comes to their clients depositing into their trading accounts or withdrawing back into their bank accounts.

Ask your broker how you can make a deposit whether it be via:

EFT

Credit Card

PayPal

Wire transfer

Then confirm with your broker to send you their policies and costs on how you can withdraw your money and how long it will take whether it be:

Via email to ask for a withdraw which will take under 3 trading days.

Via the trading platform where you can withdraw through an authentication process.

Via the broker who can only proceed with a withdrawal on the phone which will take three working days.

Note: A withdrawal and deposit with a reputable and regulated broker should NEVER take more than three working days or warning bells should ring.

Checklist item #10:

Safety, security and legitimacy

There are a few ways to check if the broker is safe and secure including:

Their website starts with HTTPS: and not HTTP:

They are insured and deal with top banks around the world.

They have secured encryption processes.

They have proven to show growth for their clients over the last five years.

They have won broker awards or are listed in the top brokers in the country you’re looking at.

Final Words

You now have an idea on how to find the most ideal broker for you. Take your time to do the research and go through each line item one by one.

Never rush into choosing a broker as this can be a significant decision for your financial future.

If you enjoyed this piece then follow more daily tips and lessons on TradingView. I've been in the markets since 2003 and happy to share what I've learnt along the way.

Trade well, live free.

Timon

MATI Trader

PS: Connect with my few socials below.

GOOD BROKERS VS BAD BROKERSGood time of the day, TradingView community! The reason we decided to cover this topic are the alarming messages we’ve been receiving recently. “I am a representative for XXX, I’ll provide you with a white label brokerage, I instantly give you 50% of the loss of the customer who opened the account”. From the first glance, you can tell that there is something wrong ethically and legally. So how does one protect himself/herself and his/her capital from this danger. Simple answer: Education.

Scammy signal providers and fake mentors are much easier to identify. When it comes to brokers some might do a really good job covering up their true intent. Without further due, let’s get the broker guide started. Oh, well first of all, the word broker in this context is actually wrong to use. The so called “forex brokers” aren’t really brokers. In fact, even most of them don’t classify themselves as such. However, in order not to confuse you any further let’s keep it that way for this text.

We can break down all the forex brokers into Dealing Desk and No Dealing Desk. Dealing Desk can be classified as Market Makers and No Dealing Desk can be further broken down to “Straight-Through Processing” (STP) brokers, “Electronic Communication Network” and “Straight-Through Processing” (ECN/STP) brokers, “Direct Market Access” and “Straight-Through Processing” (DMA/STP) brokers.

To be honest, you don’t really need to know all that. Most you should know that there are 1) Good brokers looking for sustainable long-term collaboration 2) Bad brokers, not executing your trades and hoping for you to lose, so they can claim the collateral.

You may say: “Oh, Investroy, aren’t brokers waiting for us to lose anyway, so they can make profits? They automatically open a position equal and opposite to ours”. Well, that’s true. However, there is a big difference when it’s natural (there are more losing traders than winning ones) and when the broker is using mostly illegal ways to make you lose. This can be noticed when a broker has a discrepancy of more than 20 pips with the most trustworthy price outlets, suddenly increasing insanely large spreads and many other small tricks.

This all may want you think: “Oh, man, everybody wants to steal my money”. Not really, there are some honorable brokers out there with good reputation. Moreover, above in the chart we’re going to point out the main differentiations.

Ethereum CHAOS £100 Next?Ethereum cost drops lower as the current week's misfortune matches back the increases from a week ago.

ETH cost is set to proceed with its decay going into the following week.

With the mid-year, the money departure proceeds, and the ETH cost is in danger of falling toward £470.22.

Ethereum (ETH) cost is disappointing dealers attempting to focus on any break underneath £824.95 to get the cost activity and be important for a meeting that will swing them back to all-time highs into the following year. Nonetheless, that isn't how it works in exchanging, and positively not in cryptographic forms of money. Taking a gander at a week-after-week graph the £824.95 marker holds no significance and either needs a bob off $570 or a break above $1,404 before brokers can begin taking positions.

ETH cost holds 45% space to the drawback

Ethereum cost sees dealers consuming a ton of money to attempt to exchange around £824.95 to use as section level for a convention. Taking a gander at the more extensive time, it pays off to see and find that although it is a mental level, it holds no bearing at all. All things considered, it's smack in the center between £1158.69 for the potential gain and the disadvantage. With bulls consuming money, bears can undoubtedly neglect to move and watch cost activity drop further in their favor.ETH cost will tank further and could certainly still cover another 45% of space to the drawback before a huge essential level gets reached at £470.41. The new month-to-month S1 support level at £533.96 could currently be a sandbox where bears begin offloading and shutting their short positions. The message here is that bulls should make an effort not to impede the low steam roller that will crush any bull out of this endeavor to get the plunge instead of sitting tight for the bob. As currently referenced, bulls that need to be important for a more drawn-out term rally will rather need to trust that a solid bullish sign will arise. That could be conveyed once cost activity pops above £1158.69 and potentially break the red plummeting pattern line. With that move, the room gets up to £1393.07 in an underlying stage and next £1591.14, playing with £1650.56.

Bitcoin Value Forecast 2022Why 2021 Was a Decent Year for Bitcoin

More than 2021, Bitcoin partook in a lofty ascent in its fairly estimated worth. Toward the beginning of the year, a solitary coin was esteemed at $32,000, and by April that number had multiplied. Brokers were hopeful that more extensive acknowledgment of bitcoin by dealers and large banks would uphold the cost.

In any case, the guarantee beat the truth — it was basically impossible to utilize bitcoin for quite a bit of anything with the exception of speculative, dangerous exchanging. A decrease in the securities exchange in late 2021, and a fall in profoundly esteemed development stocks, conveyed cryptographic forms of money down too. Bitcoin completed 2021 at about $47,300.

As digital currency is still generally seen as a dangerous, speculative resource, this "risk-off" exchange brought bitcoin down to beneath $27,000 by early May. This addresses a deficiency of over a portion of the worth Bitcoin came to at its November 2021 pinnacle of $69,000, focusing on no indications of supported recuperation.

Worries over the high power utilization related to bitcoin mining and the forbidding of digital currency exchanges by China likewise burdened bitcoin's worth.

What Is the Fate of Bitcoin? Whales Make a plunge

The future cost of bitcoin relies upon whether advanced monetary forms can act as valuable monetary resources. There was little help for this idea among monetary newsmakers in the early years, however, some once-suspicious significant financial backers have come around.

Smorgasbord and Others Now Adherents

Warren Buffett, whose Berkshire Hathaway organization has compensated financial backers with colossal returns over many years, when depicted digital money as "rodent poison squared," and he swore he could never contact it. Be that as it may, by buying NuBank, a computerized "neobank" engaged with the crypto space, Smorgasbord has given bitcoin a handed-down demonstration of positive support.