DCF VALUATION ANALYSIS OF BSEConclusion: OVERVALUED

:-OVERVIEW

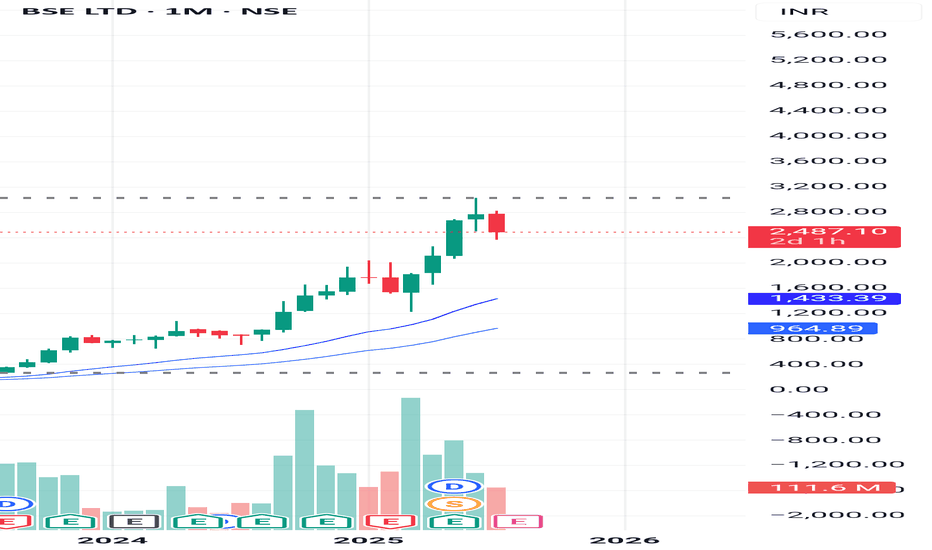

BSE Limited has shown strong financial growth in recent years. Its revenue jumped from ₹924.84 crore in FY23 to ₹1,592.50 crore in FY24 (a 72% increase), and further surged to ₹3,212 crore in FY25, doubling year-on-year. EBITDA grew impressively to ₹1,779 crore in FY25 with a 60% increase, and EBIT reached ₹1,670 crore, up 56%. Net profit also rose significantly to ₹1,112 crore, with earnings per share increasing to ₹81. Dividend per share improved to ₹23, reflecting healthy returns

DCF:

-The valuation was performed using a Discounted Cash Flow (DCF) approach based purely on verified financial data and market risk parameters without relying on user-specific growth assumptions.

-The cost of equity was calculated using an adjusted risk-free rate plus equity risk premium multiplied by beta, resulting in a discount rate of approximately 13.58%. The terminal growth rate was conservatively taken as 4%. Using these reliable inputs and actual EBIT cash flows, the intrinsic enterprise value was estimated at around ₹36,839 crore, translating to an intrinsic value per share of approximately ₹1,364.

-Currently, BSE’s market price is around ₹2,480 per share, which is substantially higher than the intrinsic value derived from fundamentals, indicating the stock is trading at a significant premium. This valuation is grounded in audited company financials and globally accepted valuation methodologies, providing a trustworthy reference point for investors.

BSE

BAJAJFINSV BUY PROJECTION Bajajfinsv - Buy View

Trade Setup :

Monthly - Strong Support and FIB 0.786

Weekly - Symmetric Triangle Breakout

Day - Higher High Formed (Uptrend)

Entry - Aggressive Trader(Entry Now)

Conservative Trader - 1588 Rs

Target 1 - 1925 Rs

Target 2 - 1971 Rs

Stoploss - 1514 Rs

Expected Return - 20 %

BSE - BUY THE FEAR, SELL THE GREED !"Buy the fear, sell on greed" is an investment strategy that means you should buy assets when most investors are scared and selling (during periods of fear), and sell those assets when most investors are excited and buying (during periods of greed).

Why does this work?

⦁ When fear dominates the market, prices often drop below their true value because people panic and sell at low prices. This creates opportunities for disciplined investors to buy quality assets at a discount.

⦁ When greed takes over, prices often rise above their real worth because people are eager to buy, hoping for quick gains. This is usually a good time to sell, as the risk of a downturn increases.

How do emotions affect markets?

⦁ Fear leads to panic selling, causing prices to fall further and often locking in losses for those who sell at the bottom.

⦁ Greed leads to speculative buying, driving prices higher and sometimes creating bubbles that eventually burst.

Why is it hard to follow?

⦁ While the idea is simple, it is emotionally difficult to buy when everyone else is pessimistic and selling, or to sell when everyone else is optimistic and buying. Most people act on emotion rather than logic, which is why few consistently succeed with this approach.

Practical example:

During a market crash, negative news and panic cause many to sell at low prices. A disciplined investor who buys during this fear can benefit when the market recovers. Conversely, when markets are booming and everyone is rushing to buy, selling at this point can help lock in gains before a potential correction.

Key takeaway:

This strategy is about removing emotion from investing decisions and taking a contrarian approach—buying when others are fearful and selling when others are greedy—rather than following the crowd. This approach has been used by successful investors like Warren Buffett to achieve long-term success by focusing on value and maintaining emotional discipline.

Fresh buying and selling entry in BSEAs we can watch it is falling 50 days moving average (green line) and fall from its support of 2509 and currently selling entry is possible in it till 2176.35 and if it more fall the next level of support is 1907.

Fresh buying is possible at near 2176.35 level and SL is 1907 and TPs are 2509 and 3048.

Adani Enterprises Weekly Chart Analysis: Bullish ScenarioAdani Enterprises Weekly Chart Analysis: Bullish Scenario

-June 23 Weekly candle close above 200EMA(Bullish)

-EMA 9/21 Bullish cross on May 26

-MACD signal line crossing above zero line -Bullish

-If next couple weeks candles close above Support level i am expecting 3070 as next Buyside target(Long)

NRB Bearing Limited - 290 CMP Short-term Looking good for 100%+Good Buy For Short- Term 1 Year Investment Horizon.

NRB Bearing Limited - 290 CMP

Expected Return - 580 (100)%

Drawdown - 205 (35%)

*This POST for educational purpose only. Concern your advisor before investing in market related instrument...*

- AB_INV_7

On the Cusp of a Breakout - Short-Term Buy OpportunityEntry Price:

Aggressive Entry: Around CMP (₹165.00) with a strict stop loss, anticipating the breakout.

Conservative Entry: On a confirmed breakout and close above ₹170 on a daily basis.

Target Price 1 (T1): ₹180

Target Price 2 (T2): ₹190

Stop Loss (SL): ₹157 (Closing basis below immediate support)

DISCLAIMER

This report is prepared for informational purposes only and is not intended as a solicitation or an offer to buy or sell any securities. The information contained herein is based on technical analysis and publicly available data, which are believed to be reliable, but no guarantee is made as to their accuracy or completeness. Investing in equities involves risks, and investors should conduct their own due diligence and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.