BTCUSD – Major Decision Point at The Edge📍 By: MJTrading |||

Bitcoin has rallied sharply from ~$98K and is now testing a critical confluence zone — the top of the descending channel and a strong supply area, known as "The Edge."

EMAs are turning up, supporting bullish momentum

⏳ What’s Next?

At this stage, two scenarios emerge:

⚠️ This is a make-or-break zone:

🟩 Breakout above the channel signals trend reversal → next resistance: $111K

🟨 Rejection leads to a move back to the $103K or $100K levels

This setup offers a high-RR opportunity for both breakout traders and mean reversion players.

🧠 Trade the reaction at the edge, not the prediction.

Thanks for your attention...

Share your thoughts...

—

#BTCUSD #Bitcoin #CryptoTrading #TheEdge #BreakoutOrBounce #CryptoSetup #DescendingChannel #SmartMoney #TechnicalAnalysis #PriceAction #SwingTrade #EMA #RiskReward #MJTrading #4hChart #TrendDecision #SupplyZone

Btc!

Bitcoin short position After my win streak from previous trades on btcusd I happy to give me to the people who followed me

Here's another great trade for you

Short Bitcoin with a limit order at 108,500

Take profit at 101k , stop loss at 109,500

A 7.5 to 1 risk reward ratio 🔥😉

You can never find anybody trade Bitcoin like me

BTC Dominance New Update BTC.D

We are at a critical juncture in Bitcoin's dominance.

A major decline in Bitcoin's dominance has likely already begun. If the green zone is lost, dominance could see a sharp decline, especially since the last wave of this diagonal pattern, Wave G, touched the 0.618 Fibonacci level.

However, there is still a possibility that the green zone could push the price back close to the previous high before we see a decline in dominance. However, there are also indicators that the major decline may have already begun. Follow the chart closely and monitor it closely.

First Target: 65.50%

Second Target: 65.30%

Third Target: 65.15%

To manage risk, don't forget about stop loss and capital management.

Bitcoin - Weekend OutlookCRYPTOCAP:BTC | 6h

Bitcoin is compressing below its all-time high, with 108k as the local resistance that must be reclaimed for a bullish continuation to retest the highs.

I expect the price to clear some poor highs around 108.8k–109.6k before taking out the bad lows around 106.3k-105.4k

As long as we hold above 104k , I believe we’re in a strong position and expect we will retest the highs.

However, losing the 103k support level would be concerning.

BITCOIN → Pause for consolidation before growth. 115K?BINANCE:BTCUSDT focus on the structure on D1. The market is forming local resistance and consolidation after growth. The fundamental background is positive. BTC is following the SP500

The market is recovering in line with the stock market (SP500, NQ) after the de-escalation of the situation in the Middle East. The fall in the DXY is also providing support.

Technically, the focus is on the consolidation phase after the distribution triggered by a false breakout of 100K. The price stopped before the resistance at 108100 and rolled back to 106500, confirming the boundaries of the local trading range, the essence of which is a pause for a breather before a possible continuation of growth. The structure on D1 is compression towards resistance. The trigger is 108100, and a breakout of this level could trigger distribution towards 110500 and ATH.

Despite the fact that the market is under a cascade of resistance (resistance: 108100, 110400, 11900 (ATH)), an important nuance is that after strong growth, the price moved into accumulation in the 100K-110K range on D1-W1, and there are no reasons for a decline yet.

Resistance levels: 108100, 108900, 110400

Support levels: 106500, 104650

If the market structure within 106500 - 108100 remains unchanged and BTC continues to storm the consolidation resistance in the “compression to level” format and stick to the level, the chances of a breakout will increase. I do not rule out the possibility of a pullback to 106500, 105650 before a possible rise to ATH.

Best regards, R. Linda!

AVAX/USDT - H4 - Wedge Breakout (29.06.2025)The AVAX/USDT pair on the H4 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming Days.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 21.77

2nd Resistance – 24.35

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

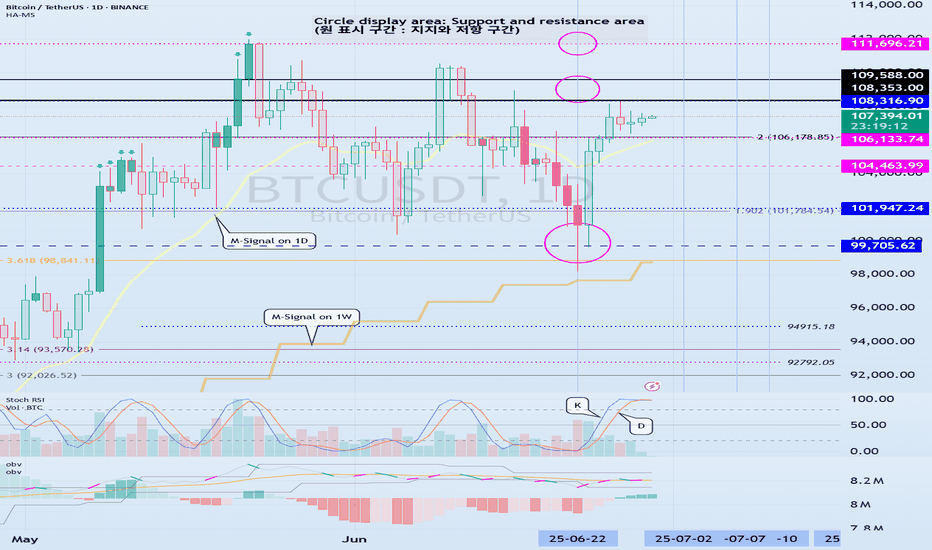

StochRSI indicator and support and resistance levels

Hello, traders.

If you "follow" me, you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

The StochRSI indicator on the left chart is slightly different from the StochRSI indicator on the right.

The StochRSI indicator on the left chart is the StochRSI indicator provided by default in TradingView, and the StochRSI indicator on the right chart is an indicator with a modified formula.

The StochRSI indicator is a leading indicator that is reflected almost in real time.

Therefore, it reacts sensitively to price changes.

Although it is advantageous because it reacts sensitively, it also increases the possibility of being caught in a fake, so I thought that a slight delay(?) was necessary, and so I created the StochRSI indicator on the left chart.

If you look at the relationship between the K and D of the StochRSI indicators on the two charts, you can see that there is a big difference.

In the end, you can predict the movement by checking whether the movement of the K line has escaped the overbought or oversold section.

However, I think that you will receive information that can determine the sustainability of the trend depending on the positional relationship between K and D.

Therefore, it is important to distinguish the inflection points that occur in the StochRSI indicator.

This is because these inflection points provide important information for drawing trend lines.

Therefore, the StochRSI indicator on the left chart, which better expresses the inflection point, is being used to draw the trend line.

(Unfortunately, this indicator was not registered on TradingView because I did not explain it well.)

-

As a new candle was created, the StochRSI indicator on the left chart is showing an inflection point on the K line.

The StochRSI indicator on the right chart is showing a transition to a state where K < D.

We will have to check whether the inflection point was created only when today's candle closes, but I think that the fact that it is showing this pattern means that there is a high possibility of a change in the future trend.

Since the next volatility period is expected to start around July 2nd (July 1st-3rd), I think it has started to show meaningful movements.

-

It is true that you want to buy at the lowest price possible and sell at the highest price.

However, because of this greed, one mistake can lead to a loss that can overturn nine victories, so you should always be careful.

Therefore, if possible, it is better to check for support and respond.

In that sense, I think it is worth referring to the relationship between K and D of the StochRSI indicator on the left chart.

This is because the actual downtrend is likely to start when K < D.

-

In order to check for support, you definitely need support and resistance points drawn on the 1M, 1W, and 1D charts.

Ignoring this and checking for support at the drawn support and resistance points can result in not being able to apply the chart you drew to actual trading.

Therefore, you should draw support and resistance points first before starting a trade.

Otherwise, if you draw support and resistance points after starting a trade, you are more likely to set support and resistance points that reflect your subjective thoughts, so as I mentioned earlier, you are more likely to lose faith in the chart you drew.

If this phenomenon continues, it will eventually lead to leaving the investment market.

-

It is important to determine whether there is support by checking the correlation between the StochRSI indicator and other indicators at the support and resistance points drawn on the 1M, 1W, and 1D charts.

Even if the inflection point of the StochRSI indicator or other indicators occurs at a point other than the support and resistance points you drew, you should consider it as something that occurred beyond your ability to handle.

In other words, you should observe the price movement but not actually trade.

As I mentioned earlier, if you start to violate this, you will become less and less able to trust the chart you drew.

-

Accordingly, the basic trading strategy I suggest is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, since the HA-Low and HA-High indicators are expressed as average values, they may move in the opposite direction to the basic trading strategy.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downward trend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise upward trend.

Therefore, the basic trading strategy mentioned above can be considered a trading strategy in the box section.

In the case of deviating from this box section, it is highly likely to occur before and after the volatility period indicated by the relationship between the trend line using the StochRSI indicator mentioned above and the support and resistance points drawn on the 1M, 1W, and 1D charts.

Therefore, special care is required when conducting new transactions during the volatility period.

This is because there is a high possibility of being caught in a fake when trading during the volatility period.

-

The DOM(60) and DOM(-60) indicators are good indicators to look at together with the HA-Low and HA-High indicators.

The DOM indicator is an indicator that comprehensively evaluates the DMI, OBV, and MOMENTUM indicators.

Therefore, the DOM(60) indicator is likely to be at the end of the high point range, and the DOM(060) indicator is likely to be at the end of the low point range.

In the explanation of the HA-Low and HA-High indicators,

- I said that if the HA-Low indicator receives resistance and falls, there is a possibility that a stepwise downtrend will begin,

- and if the HA-High indicator receives support and rises, there is a possibility that a stepwise uptrend will begin.

In order for an actual stepwise downtrend to begin, the price must fall below DOM(-60), and in order for a stepwise uptrend to begin, it must rise above DOM(60).

In other words, the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section can be seen as support and resistance sections.

-

If these correlations start to appear, I think you will be able to create a trading strategy that fits your investment style without being swayed by price volatility and proceed with trading.

The reason for analyzing charts is to trade.

Therefore, the shorter the time for chart analysis, the better, and you should increase the start of creating a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

BTC/USD 1DHello everyone, let's look at the 1D BTC chart to USD, in this situation we can see how the 3rd peak formed us and we are currently fighting to maintain the price or a potential output up if we do not see a try to break out, you can expect a stronger relief.

However, let's start by defining goals for the near future the price must face:

T1 = 108376 $

T2 = 110473 $

Т3 = 112061 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 105444 $

SL2 = 103637 $

SL3 = 100644 $

SL4 = 98285

Looking at the RSI indicator, we see

As we entered the upper part of the indicator again, however, there is still a place to try to grow.

HelenP. I Bitcoin can drop from resistance levelHi folks today I'm prepared for you Bitcoin analytics. If we examine the chart, we can see that the price has approached a significant resistance zone between 108200 and 108800. This area previously acted as a ceiling for the price, and now coincides with the retest of the broken trend line from above. After a strong bullish push from the support zone near 103000, the price is currently consolidating just below resistance, which often signals hesitation and potential reversal pressure. Earlier, we observed a period of consolidation around the support zone, followed by a breakout that broke above the trend line. However, the current structure suggests that the breakout may have been temporary. With multiple signs of slowing momentum and price failing to break convincingly through the resistance, a bearish move from this level becomes increasingly likely. Given the context, I expect BTCUSD to reject this resistance and move downward toward the 103000 support level again. That is my current goal, as I anticipate the price to complete a corrective wave in line with the overall structure. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

BRIEFING Week #26 : Are we going for a Bubble ?Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

Has Bitcoin Topped? Trump’s SBR Impact | Deep Dive Analysis🚨 Has COINBASE:BTCUSD topped? Even with Trump's Bitcoin Strategic Reserve? 🚨

In this deep dive, we analyze COINBASE:BTCUSD major factors that could point to a major reversal or breakout and to uncover whether a market top is forming.

We’ll cover:

Powerful Indicators

Bitcoin / BTC Trends

Price Action

EMA / SMA Trends

Volume Delta

Trend reversal / breakout

Bullish / Bearish / Confirmation from Indicators

order flow analysis

Timeframes (1W, 1D, 1m, 6M etc.)

Bullish and Bearish Sentiment

Strength Candles

👉 Like, comment below, and follow for more pro-level crypto insights.

MartyBoots here , I have been trading for 17 years and sharing my thoughts on COINBASE:BTCUSD .

Whether you're a short-term trader or long-term investor, this post provides the technical insight and edge to help you make better informed decisions.

📉 Stay ahead of the market. Watch the full breakdown and view charts to decide for yourself: Has Bitcoin really topped?

Watch video for more details and below I will show some powerful charts with descriptions.

Warning in near term - LARGE ORDERS

Consolidation in price with large orders above

The Red lines = LARGE ORDERS

Large orders can act as an magnet to price

Large orders can also be support and resistance

Price Above the white 100 moving average

Price strong above it

Price weak below it

Strength Candles

Still Bullish

Multiple timeframes still green

Sentiment Tool Still Bullish

Still Bullish

Multiple timeframes and settings still green

3 Drive Structure

Equal Measured moves

Implies Top Is Not In

Target = $126k

Bullish Engulfing Candle

Implies higher prices to come

👉 Like, comment below, and follow for more pro-level crypto insights.

#Bitcoin #Trump #BTC #CryptoTrading #TechnicalAnalysis #CryptoMarket #BitcoinTop #TradingView #StrategicBitcoinReserve

BTC - Will the Bears finally get their chance?Buy Side Liquidity Sweep in Progress

Price is currently climbing toward a region densely packed with resting buy side liquidity, marked by multiple previous highs. The area around 108,900 to 111,000 is especially significant, with two clear liquidity pools stacked above recent swing highs. These levels are likely to attract price as market participants seek to trigger stop orders and induce fresh buying interest—setting the stage for a potential reversal.

Weakness in the Current Impulse

The recent rally has advanced with minimal retracement and virtually no visible Gaps. This lack of corrective structure often indicates imbalance and suggests the move is overextended. When price moves upward too cleanly, it tends to leave behind thin liquidity zones, making the entire leg vulnerable to a sharper correction once exhaustion sets in.

Fair Value Gap as a Draw Below

Below current price lies a prominent bullish Fair Value Gap around 104,000. This inefficiency was left unfilled during the last leg up and may now serve as a magnet for price. These types of Gaps are often revisited by the market in an effort to rebalance supply and demand, especially after aggressive moves that break structure to the upside.

Once the higher liquidity levels are swept, watch for a clear reaction—either a strong rejection or lower timeframe structure shift—which could signal that the top is in. If that shift materializes, price may begin a downward leg targeting the unfilled Gap below. The magnitude of the move, combined with the lack of structure on the way up, leaves plenty of room for corrective action.

For those looking to engage, waiting for confirmation on a lower timeframe—such as a break of short-term bullish structure or the formation of a bearish Gap—can help time entries more precisely. In setups like these, patience is key: let the Sweep play out, observe how price reacts, and only then consider stepping in.

IRENs Incredible Surge Continue next wWeek?NASDAQ:IREN has been on a rampage since the April surging 175% and nearing all time high! A great couple of trades for us so far!

Price is likely to hit all time high next week with such a strong trend, where resistance and a pullback is a high probability.

The weekly pivot is $9.77, the most likely area for price to find support just above the 0.382 Fibonacci retracement (which will be dragged up to the weekly pivot once a new high is made).

Price discovery terminal target are the R3 & R5 weekly pivot points at $28 and $40.

Safe trading

$HUT Macro Chart Preparing for Breakout?NASDAQ:HUT looks poised for a strong breakout with a wave 3 long term target of $58 and a short term resistances of $21 and $33

HUT is moving strong almost up 100% from the recent swing low, overcoming its weekly 200EMA with ease. A test of the 200EMA as support is likely before continuation.

Price is consolidating under major resistance High Volume Node (HVN) and the weekly pivot point. Consolidation under resistance often leads to a breakout.

A series of 1-2s appears to be taking place on the Elliot Wave count finding support at the 'BTC-Miners golden pocket' of 78.6 Fibonacci retracement.

Analysis is invalidated below $10.10

Safe trading

Bitcoin Bullish But... Support Zones (Incl. Altcoins)Bitcoin is bullish right now but we know things can change. As long as the action is happening within the blue and gray space, all is good, the bullish bias remains intact. If the action moves below the gray zone and enters the orange zone, this is the danger zone. This danger zone can turn into a buy opportunity or a wait and see approach.

On the other hand, if Bitcoin remains above the blue zone this is ultra-bullish short-term. This is specially bullish for the altcoins but it is bullish for Bitcoin as it reveals consolidation at high prices, but right now we have a lower high so anything goes.

The chart is mixed when looked at up-close. Bullish long-term and on all bigger timeframes. Corrections tend to develop from high prices.

One more thing to consider

When we look at the action short-term we can miss the bigger picture, we can become clouded with noise. The bigger range is $100,000 - $110,000, this is the new long-term support zone that is being established and created before additional growth. Bitcoin can remain here for weeks or even months, if this happens, the altcoins will continue to grow.

We are in a bull market. Bitcoin is obviously in a bull market as it is trading near its all-time high after years of growth. The altcoins are just getting started after years of sideways action... Some altcoins hit new all-time lows but still part of a broad, long-term consolidation phase. Many produced higher lows, some produced lower lows, it makes no difference.

The bear market ended in mid/late 2022 and the ensuing two years we had mix growth. Bullish waves and bearish waves, with the usual variations of course.

The year is now 2025 and Bitcoin is up, most of the big projects have been growing for years now and we are getting close to the final advance, the major fifth wave and the bull market bull run. When this happens, close to its end, all the smaller projects will produce the biggest growth in their history and this will be the boom that will catapult Crypto to take over the financial world.

It won't be the first time this event happens nor the last, the market will continue to fluctuate.

I know there is a lot of information out there and we can become uncertain with every drop, but look at the price; what do you see? Bitcoin is going up.

The altcoins are set to follow, the altcoins do what Bitcoin does.

Namaste.

Bitcoin, The Next High Is The All-Time HighThe title might be a bit misleading but, the truth is that Bitcoin stays bullish short-term and this is bullish on all terms...

Good afternoon my fellow Cryptocurrency trader, how are you feeling today?

Any day, any week, any moment; every month, place or year, the market provides everything we need to know. This information is made available to us through the chart.

Bullish Bitcoin

The present signal is the fact that Bitcoin remains very high, challenging resistance, after a strong recovery and advance. This is happening with the altcoins also.

If you look at the last two peaks, as soon as resistance was hit there was an immediate crash. The next day was full red; very strong bearish action and momentum and this led to a new low. The situation is not the same today.

22-May peak. 23-May, strong bearish action.

9-June peak. 11-June, strong bearish action.

26-June lower high (not a peak). Today, neutral action. This neutral action is what I am taking as a bullish signal. Many other factors of course support this conclusion yet, this is still an early signal.

Fib support

A closer view of the daily timeframe:

4H. The grey line represents Fib. retracement. Dark blue—Fib. extension:

Conclusion

Each time there is a price peak a retrace follows, if there is no retrace then you are not witnessing a peak but rather a stop, a pause; resistance being met.

It seems that the current lower high is not the end but rather just a pause before additional growth. Market conditions can change.

It can happen that several days Bitcoin goes sideways with the bulls failing to garner enough strength. In this scenario, there would be a move lower before additional growth.

The present scenario shows a bullish chart even if prices drop, remember, the market is in no hurry.

Easy money

In September we will have lower interest rates and this is a bullish development for Bitcoin. Advanced money minds see easy money as inflationary for the currency, while Bitcoin is inflation-proof. So the dollar goes down and Bitcoin goes up.

I didn't quite develop this point, next time I'll do a better job.

Summary

The market is good even if it shakes. The market is good and isn't shaking, the recovery is already in place.

Bitcoin's price is very strong and there are many layers of support. The altcoins are in a similar situation, growing from the bottom up.

The Fed will reduce interest rates in September and then once more before the year ends, this is bullish for everything so, everything will be going up, at least everything that we are interested in, support and trade.

Thanks a lot for your continued support.

Never give up!

You are divine! You are blessed.

If you are reading this now, you will be blessed for your great timing. Hard work and dedication always pays.

Keep moving forward, keep pushing forward, never give up.

When life hits you hard, do take a break if you need it, only to comeback with new energy, a new mind and an infinite drive to achieve your goals.

You are the reason why Bitcoin exist... You are the lifeblood of the market.

Without you, nothing is possible. It is because of you that we all continue to grow.

Thanks again for taking the time to read.

I appreciate your support.

Namaste.

BTCUSD: Hasn't gone parabolic yet.Bitcoin is just now re-entering the bullish state on its 1D technical outlook (RSI = 55.820, MACD = 291.960, ADX = 15.180), being correcting/consolidating in the past 30 days. According to the Mayer Multiple Bands, it's stil inside the range (upper band) of the 1 Stdev Below-Mean-1 Stdev Above (yellow range). This suggest significant upside potential as being roughly 19 weeks before the Cycle tops, it matches the late June 2021 bottom inside that zone as well as the July 2017 bottom just over the top of that zone. The orange trendline has been the minimum target on every Cycle but looks unlikely to hit it by the end of the year. If however it goes parabolic as all Cycles had at this stage, $200,000 isn't at all far fetched before the Cycle tops.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

IBIT – Bull Flag + Trend-Based Fib Targets Lined Up🔍 Price Action Setup

IBIT is forming a tight bull flag just beneath key resistance at $64 after a strong impulsive move off the $42.75 base. Structure remains bullish with price holding above the 20 EMA, and volume compression setting the stage for a breakout.

📈 Trend-Based Fibonacci Extensions

If this flag breaks, here's how the upside unfolds based on the trend-based Fib extension:

1.27 – $82.50

1.382 – $85.75 (Measured Move Target)

1.50 – $89.50

1.618 – $93.00 (Full Extension)

These levels align with the prior flagpole projection and market structure above. If bulls step in on volume, $85.75 becomes the logical first destination.

🌊 ETF Inflows Confirm the Narrative

IBIT has pulled in roughly $3.3B in recent inflows, leading the pack during a 12-day net inflow streak across spot Bitcoin ETFs. Institutions are clearly still positioning, and that's reflected in the tape. Tuesday alone brought $436M+ into spot Bitcoin ETFs.

₿ BTC Leading the Way

Bitcoin is holding strong above prior resistance and pushing higher. IBIT looks like it’s just waiting on a breakout confirmation to follow.

📌 Key Trade Levels

Breakout Trigger: Close above $64

Target Zone: $85.75 first, then extended to $93.00

Invalidation: Break below $56 structure

—

🧠 This is not financial advice — just a look at structure and flow through the DC Trading lens.

📲 Follow the journey on IG: @dc_trading_journey

EURJPY BULLISH OR BEARISH DETAILED ANALYSISEURJPY has just broken out of a well-defined bullish pennant pattern on the 4H timeframe, confirming strong continuation potential to the upside. The price is currently hovering around 169.60 after consolidating in a tight structure, respecting both dynamic trendline support and horizontal resistance. This breakout signals renewed bullish momentum, and I'm now targeting the 172.10 zone as the next significant resistance level. The structure is clean, volume supported the breakout, and price action is aligned with the dominant uptrend.

Despite a relatively quiet start to the week—largely influenced by global risk-off sentiment surrounding Middle East tensions—EURJPY has held firm. Now that geopolitical jitters are easing slightly, yen weakness is resurfacing. The Bank of Japan remains firmly dovish, maintaining ultra-loose policy, while the Euro is supported by hawkish commentary from the ECB as inflation in the eurozone remains sticky. This divergence continues to fuel the long-term bullish bias for EURJPY.

Fundamentally, Japanese economic indicators remain soft, and there's still no clarity on when the BoJ will meaningfully shift policy. Meanwhile, EUR zone confidence indicators have stabilized, and speculation is growing around the ECB holding rates higher for longer into Q3. With widening yield differentials and a favorable risk sentiment return, this pair is positioned well for upside movement. Current momentum supports the probability of reaching the 172.00–172.10 area as risk appetite rebuilds across markets.

Technically and fundamentally aligned, EURJPY offers one of the strongest bullish continuation opportunities on the board right now. I will continue to monitor for minor dips as potential add-on areas, aiming for a full extension of the measured move from the pennant formation. Patience pays in setups like this where structure, sentiment, and macro all align.

HolderStat┆BTCUSD aiming for 112kBINANCE:BTCUSDT is forming a bullish continuation structure after bouncing from the mid-range. With support holding and consolidation patterns completing, price action suggests a rally toward the 115,000 resistance line. Triangle and consolidation behavior confirms a strong uptrend continuation setup.