Btc-bitcoin

BTC 4H VS 1D 200 EMAIt's quite a rare occurrence when the 200 EMA finds itself in a very similar position but right now BTC has that exact setup.

On the 4H BTC is fighting the moving average for the 12th time since losing the support level at the beginning in February. At this time the bearish trend channel upper limit also coincides with this level now, IMO a big move is being setup, but the direction is unsure.

On the daily we're seeing the moving average also in line with the trend resistance however the curve itself differs to the 4H in the way that it's levelling out from an uptrend, not levelling out from downtrend.

Bullish scenario - Breaking out above the moving average and trend channel with strength I believe would start to bring buyers back. Now I would not expect buyers to come flooding in at once as many have been burned too many times trying to long a breakout only for it to be a fakeout. I could see many looking for a form of confirmation, be that a retest as new support or a new HH & HL structure.

Bearish scenario - Yet another rejection off this level would be continuation of the downtrend with many adding to their shorts. This to me would be tied to the SPX/ Tradfi movements although those markets are much stronger than this time last week.

In conclusion there is no clear sense of direction just yet but I think it's coming very soon. The chop we are seeing at the moment is a symptom of a lack of confidence and uncertainty in market conditions. Naturally this lends itself to a continuation of the downtrend but all it takes is a catalyst and some big believers to push BTC out above the downtrend to continue the bullrun. I think we get our answer soon.

The Road to $100k BitcoinBitcoin is most likely forming a left-translated 60-day cycle .

Expect Bitcoin to trend downward for the next month, making a lower low in this 60-day cycle and fully scaring the market.

People will start screaming “bear market” and panic-sell their coins to market makers, institutions, and patient investors.

Once that’s done, Bitcoin will resume its bull market, heading toward a market top in Q2/Q3 2025.

This would mirror 2021’s bull market behavior, align with the 4-year Bitcoin cycle, and leave enough time for the market to fully reset by late 2026.

Bitcoin dominance is aiming to hit FIb 1.141 - Alt Season when ?Currently bitcoin dominance is around 64% and about to hit Fib 1 which is the previous high 64.34%.

We can expect bitcoin to breach this previous high easily and head towards the next resistance around the fib value 1.414. This is a strong resistance and if dominance breaks this value then next target is 70% is which around the high value achieve during the 2020 bear run.

I'm expecting dominance to reverse around 1.414 and altseason will start once dominance starts dropping.

Cheers!

GreenCrypto

Bitcoin Bullish Bat Harmonic Forming – Breakout Imminent!?Bitcoin ( BINANCE:BTCUSDT ) then reached $85,500 , as I expected in my previous post .

Today, I want to share with you a short-term analysis of Bitcoin , and Bitcoin can break the Important Resistance line !

Bitcoin is trading near the Support zone($83,880-$82,380) and Support lines .

Bitcoin is likely to start rising again with the help of the Bullish Bat Harmonic Pattern .

I expect Bitcoin to start rising again either with the help of the Bullish Bat Harmonic Pattern or near the Support lines and Cumulative Long Liquidation Leverage($82,426-$81,439) . The first target could be the important resistance line , and if it breaks, it looks like Bitcoin could break the resistance zone ($87,520-$85,840 ) as well.

Cumulative Short Liquidation Leverage: $86,624-$85,486

Note: To break the Important Resistance line , we need a candle with high volume at least on the 4-hour time frame , like the Bullish Marubozu candle ; otherwise, it is probably we will see fake break . Since this line is of great importance, it is better to look for a confirming candle on the 4-hour time frame as well ( even a Doji candle with a small green body ).

Note: If Bitcoin falls below $81,000, we can expect further declines.

Do you think Bitcoin can break the Important Resistance line!?

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

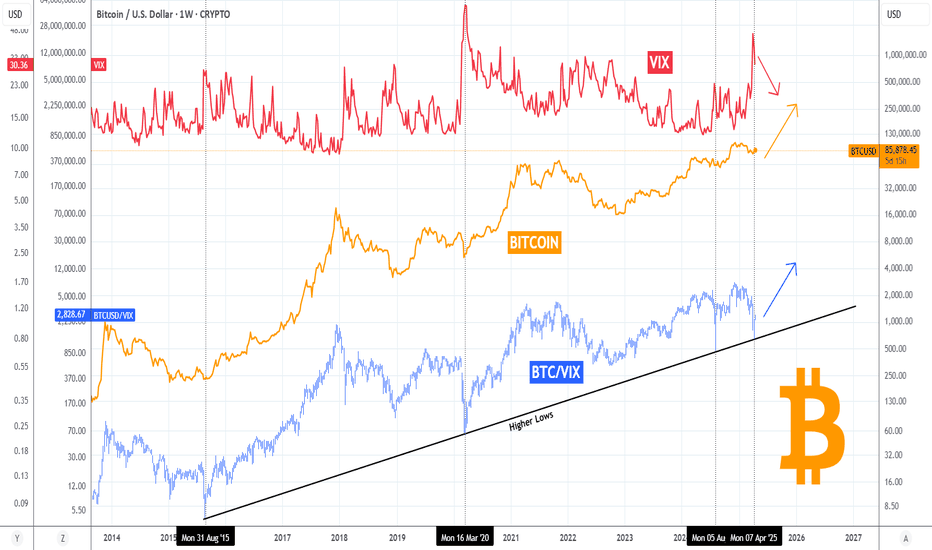

BITCOIN's ultimate VIX bottom signal-Last time gave +100% profitBitcoin (BTCUSD) is attempting to make yet another green day, yesterday not only did it close above its 1D MA50 again but was also the 4th green day in the last 6. This attempt is showing that the trend is gradually shifting again towards long-term bullish but today we'll present to you another one, this time in relation to the Volatility Index (VIX).

BTC's (orange trend-line) recent rise is naturally on a negative correlation with VIX (red trend-line) which is currently pulling back after it's most aggressive spike since the COVID flash-crash (March 2020).

Their ratio BTCUSD/VIX (blue trend-line) made a very interesting contact with the Higher Lows trend-line that has been holding since the August 24 2015 Low, which was the bottom of the 2014 Bear Cycle. Since then it made Higher Lows on March 16 2020, August 05 2024 and the most recent, April 07 2025. Every time it was a bottom indication and a massive rally followed. The 'weakest' of all was the previous one, which 'only' gave a +105% rise approximately. Based on that, there is no reason not to expect BTC to hit at least $150k by the end of this Bull Cycle.

Do you think that's a plausible target? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTC - Critical Juncture at channel and liquidity levelThe 1-hour chart reveals BTCUSDT navigating crucial price territory, with immediate focus on the 85,000.0 to 88,000.0 range. The market shows subtle but important movements, with current price action hovering near 84,260.1 after testing higher levels.

Key observations from the chart:

The volume profile indicates weakening momentum as price approaches the 88,000 resistance zone. Of particular note is the cluster of activity around 84,260.1 , which now serves as immediate support. The liquidity pockets at both 85,000 and 88,000 create clear reference points for potential breakouts or rejections.

Critical levels to monitor:

Upper resistance sits firmly at 88,000.0 , where previous reactions have occurred. Strong support emerges at 84,260.1 , with additional floors at 82,000.0 and the psychological 80,000.0 level. The 0.76% price change marker suggests some volatility brewing beneath the surface.

Trading considerations focus on two scenarios:

A hold above 84,260.1 could signal strength and potential retest of higher levels. However, failure to maintain this support may trigger moves toward 82,000.0 . The tight 0.04% to 0.02% bands indicate potential compression before the next directional move.

Market structure currently favors cautious optimism, but requires confirmation above 85,000.0 for stronger conviction. The diminishing volume at higher levels suggests some exhaustion, making proper position sizing essential.

Final Note: These price levels represent significant psychological barriers. Traders should watch for volume spikes and candle closes beyond these markers for confirmation. Always employ strict risk management in these potentially volatile conditions.

Disclaimer: Market conditions change rapidly. This analysis represents one interpretation of current price action and should not be considered financial advice.

Inversion Fair Value Gaps (IFVGs) - A Deep Dive Trading GuideIntroduction

Inversion Fair Value Gaps (IFVGs) are an advanced price action concept rooted in Smart Money theory. Unlike standard Fair Value Gaps (FVGs), IFVGs consider the idea of price revisiting inefficiencies from an inverse perspective. When price "respects" a previously violated gap from the opposite side, it creates a powerful confluence for entries or exits.

This guide will cover:

- What an IFVG is

- How it differs from traditional FVGs

- Market context for IFVG setups

- How to trade them effectively

- Real chart examples for clarity

---

What is an IFVG?

An Inversion Fair Value Gap (IFVG) occurs when price trades through a traditional Fair Value Gap and later returns to that area, but instead of continuing in the original direction, it uses the gap as a support or resistance from the other side.

Standard FVG vs. IFVG:

- FVG: Price creates a gap (imbalance), and we expect a return to the gap for mitigation.

- IFVG: Price violates the FVG, but instead of invalidation, it respects it from the other side.

Example Logic: A bullish FVG is formed -> price trades through it -> later, price revisits the FVG from below and uses it as resistance.

---

Structure and Market Context

Understanding structure is key when trading IFVGs. Price must break structure convincingly through a Fair Value Gap. The gap then acts as an inversion zone for future reactions.

Ideal Market Conditions for IFVGs:

1. Market is trending or has recently had a strong impulsive move.

2. A Fair Value Gap is created and violated with displacement .

3. Price retraces back to the FVG from the opposite side .

4. The gap holds as support/resistance, indicating smart money has respected the zone.

---

Types of IFVGs

1. Bullish IFVG: Price trades up through a bearish FVG and later uses it as support.

2. Bearish IFVG: Price trades down through a bullish FVG and later uses it as resistance.

Note: The best IFVGs are often aligned with Order Blocks, liquidity levels, or SMT divergences.

---

How to Trade IFVGs

1. Identify a clear Fair Value Gap in a trending market.

2. Wait for price to break through the FVG with momentum .

3. Mark the original FVG zone on your chart.

4. Monitor for price to revisit the zone from the other side.

5. Look for reaction + market structure shift on lower timeframes.

6. Enter trade with a clear stop loss just beyond the IFVG.

Entry Confluences:

- SMT divergence

- Order Block inside or near the IFVG

- Breaker Blocks

- Time of day (e.g., NY open)

---

Refined Entries & Risk Management

Once the IFVG is identified and price begins to react, refine entries using:

- Lower timeframe market structure shift

- Liquidity sweeps just before tapping the zone

- Candle closures showing rejection

Risk Management Tips:

- Set stop loss just beyond the IFVG opposite wick

- Use partials at 1:2 RR and scale out based on structure

- Don’t chase missed entries—wait for clean setups

---

Common Mistakes to Avoid

- Confusing IFVG with invalidated FVGs

- Trading them in low volume or choppy conditions

- Ignoring market context or structure shifts

- Blindly entering on first touch without confirmation

Tip: Let price prove the level—wait for reaction, not prediction.

---

Final Thoughts

IFVGs are an advanced but powerful tool when used with precision. They highlight how Smart Money uses inefficiencies in both directions, and when combined with other concepts, they can form sniper-like entries.

Practice finding IFVGs on historical charts. Combine them with SMT divergences, OBs, and market structure, and soon you’ll start seeing the market through Smart Money eyes.

Happy Trading!

BTC – Restabilization after this massive drop?Market Context:

BTC has broken below a key support level, indicating potential for continued downside. Price is currently retracing after a sharp sell-off, but the overall structure remains bearish unless significant levels are reclaimed.

Technical Overview:

- The previous support zone has been broken, turning it into potential resistance.

- Price is now entering a lower Fair Value Gap (FVG), which could serve as a reaction zone.

- A larger FVG higher up, aligning with the 0.618–0.65 Fibonacci retracement zone, presents a more significant area to watch for a possible reversal.

Scenario:

Price may retrace into the lower FVG and continue pushing up toward the premium FVG zone. This area coincides with the 0.618–0.65 Fib levels, where a shift in momentum or bearish confirmation could trigger a move lower.

Key Points:

- A potential rejection could occur from the premium FVG zone.

- If an Inverse Fair Value Gap (IFVG) forms in that area, it would support a short setup.

- Alternatively, if price prints a lower low before reaching the upper FVG, that would also open up short opportunities.

- Patience is key—wait for structure to align or a momentum shift before considering entries.

Outlook:

The bias remains bearish unless the structure is reclaimed decisively. Current price action suggests the retracement is corrective, and the next impulse may resume the downtrend once premium levels are met.

BTC - has she bottomed? Welp, this is the 1st structural signs of life I have seen in BTC in a long time. There is almost zero chance she can go make a new low any time soon. At worst she goes sideways. At best she works through this blue down channel, and takes a solid rally. Either way. Shorts should be closing. And long positions should be opened. Breaks over $85K become Uber bullish. But we are also right now Uber bullish short term.

Bitcoin’s 80-Day Correction Ending!?(Signs)Today, I want to share with you a mid-term analysis of Bitcoin( BINANCE:BTCUSDT ), I hope it will be useful for you.

Please stay with me.

Bitcoin started to fall last week due to the tariffs that Donald Trump imposed on countries around the world. In general, since last week, Bitcoin has become more correlated with US stock market indices (such as FOREXCOM:SPX500 ) than before.

But yesterday, Donald Trump postponed the implementation of tariffs for 90 days , except for China , which caused the US stock market indices to grow rapidly, and Bitcoin did not miss out on this growth. So, for the next 90 days , we should wait for news of bilateral tariffs between China and the US , which is likely to make an agreement between the two countries. What do you think!?

Also, just minutes ago, key U.S. inflation data was released — and it came in softer than expected.

The CPI m/m dropped to -0.1%, and Core CPI m/m slowed to 0.1% , both missing forecasts. This drop in inflation significantly reduces immediate pressure on the Fed to maintain a hawkish stance . With inflation cooling off, the market is now pricing in a more dovish Fed , which has historically been a bullish catalyst for Bitcoin .

Also, in the last 24 hours , another positive news came for Bitcoin: " China and Russia are using Bitcoin to settle energy trades ," which could be effective in increasing the price of Bitcoin .

--------------------------------------------

Now, based on the above explanation, let's focus on analyzing the Bitcoin chart on the 12-hour time frame .

Bitcoin started to rise quickly after touching the Heavy Support zone($73,780-$59,000) , Potential Reversal Zone(PRZ) , and 50_SMA(Weekly) . It seems that the Important Uptrend line breakout has NOT been successfully completed. One sign of a return could be the formation of a Morningstar Candlestick Pattern , which has also been accompanied by good volume .

Bitcoin has been moving in a descending channel for the past 80 days since its All-Time High(ATH=$109,588) , so a break of the upper line of this descending channel could be a significant sign of a rebound for Bitcoin .

Bitcoin is trying to break the Resistance zone($84,000-$81,130) . The price that is important for Bitcoin right now is $84,000 ; if Bitcoin can close a candle on the 4-hour time frame above the Resistance zone($84,000-$81,130) and $84,000 , we can hope for a breakout of the descending channel.

In terms of the Elliott Wave theory , Bitcoin appears to have been in a Double Three Correction(WXY) for the past 80 days. A break of the descending channel could reconfirm the end of this correction.

I expect Bitcoin to fill the CME Gap($85,940-$85,240) after breaking the Resistance zone($84,000-$81,130) in the first step and make the first attack on 50_SMA(Daily) . If the descending channel breaks, the second target could be around $88,000 , where there is an important Cumulative Short Liquidation Leverage($89,319-$88,375) .

Also, if Bitcoin moves in a range between $90,000 and $85,000 , we can expect an Altseason , given the conditions of BTC.D% ( CRYPTOCAP:BTC.D ). What do you think?

Note: If Bitcoin falls below $77,200, we should expect further declines.

Note: If Bitcoin can break the Heavy Resistance zone($95,000-$88,500), we should expect a new All-Time High(ATH).

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 12-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bitcoin (BTCUSDT) – Technical and Fundamental Analysis 1DBTC has formed a falling wedge pattern on the daily chart, indicating a possible bullish breakout. A clean break above the 0.618 Fibonacci level at $86,485 may trigger an impulsive move to the upside. Price is bouncing from wave (4) and challenging the descending trendline. RSI is recovering, suggesting renewed buying momentum, and MACD shows signs of a bullish reversal.

Fundamental Factors

Bitcoin remains supported by strong institutional demand and optimism around crypto ETFs. Expectations of lower interest rates and macroeconomic uncertainty continue to drive interest in BTC as a hedge. Meanwhile, on-chain data reflects accumulation, with exchange outflows increasing in recent sessions.

Scenarios:

Main scenario – breakout above 0.618 targeting $96,595 and $109,474, with a potential extension toward $125,842.

Alternative scenario – pullback toward $79,384. If this level fails to hold, further correction to $72,283 and $63,497 is possible. The $79K level remains a key support for bulls.

BTC Is Going to 85k...

Description:

Timeframe: 15m

Pair: BTC/USD

Bias: Short term Bullish (after liquidity sweep & imbalance fill)

---

Analysis:

Price is currently in a distribution phase, targeting sell-side liquidity just below recent consolidation.

We can clearly see:

Liquidity Pool: Multiple equal lows — perfect trap for retail longs.

Imbalance Zone: Price is likely to dip into the imbalance to grab orders.

Expected Move: After the sell-side liquidity is taken and imbalance is filled, a bullish reversal targeting external liquidity at higher levels (~85,000) is expected.

This setup aligns with a typical “Trap the Trapper” scenario — where smart money triggers panic selling, fills long positions, and then aggressively pushes price up.

---

Trade Plan (Example):

Entry: After confirmation near imbalance (~82,500 zone)

Stop Loss: Below 82,200

Take Profit: 84,800 / 85,000 zone

---

Hashtags:

#BTCUSD #Bitcoin #SmartMoney #LiquidityGrab #Imbalance #TrapTheTrapper #PriceAction #Forex #Crypto

BITCOIN Just like 2017 - The $300k prediction is happening!Bitcoin / BTCUSD continues to replicate the 2014-2017 Cycle, giving us a clear perspective of the bullish trend amidst the high volatility since the start of the year.

The different phases since the bottom are identical between the two Cycles and right now we are on Phase 4, supported firmly by the 1week MA50.

Hard to believe but if history continues to repeat itself, BTC may skyrocket as high as $300k by the end of this Cycle.

Follow us, like the idea and leave a comment below!!

ETH Long Term Prediction - Ethereum Game Plan ETH broke the bullish weekly structure and is currently retracing lower. I don’t see any signs of strength on the chart yet.

I expect the price to first hit $1250 and see a rejection there a possible bounce.

However, the real target is $870 (2022 low). That level holds significant liquidity, so I expect it to be taken out, triggering a potential capitulation. I’ll be looking for spot buys and long-term long setups in anticipation of another possible bull run.

1050 days of bull, 380 days of bearPlanning for the afterlife already. Each cycle fits quite neatly into ca. 1050 days of bull market and 375 days of bear. The big bounce should happen just before the summer, then consolidate, and the last leg up should come after, and we peak in late October. Let's try this

Bitcoin will continue to fall inside downward channelHello traders, I want share with you my opinion about Bitcoin. If we look at the chart, we can see how the price entered to downward channel, where it once declined to the channel's support line, which coincided with the resistance level and seller zone. Next, the price some time traded inside this area and even little declined below, but then it turned around and in a short time rose to the resistance line of the channel and made a fake breakout, after which it made a correction. Bitcoin long time traded inside seller zone and then broke 82000 level and declined to support level, which coincided with buyer zone. Then it made upward movement, after which it turned around and declined back to 75000 level. Recently, BTC bounced and started to grow, but in my mind, Bitcoin can rise a little more and then continue to decline inside a downward channel. Bitcoin will break the support level and fall to the 71800 support line of the channel, where my TP is located. Please share this idea with your friends and click Boost 🚀