Btc-e

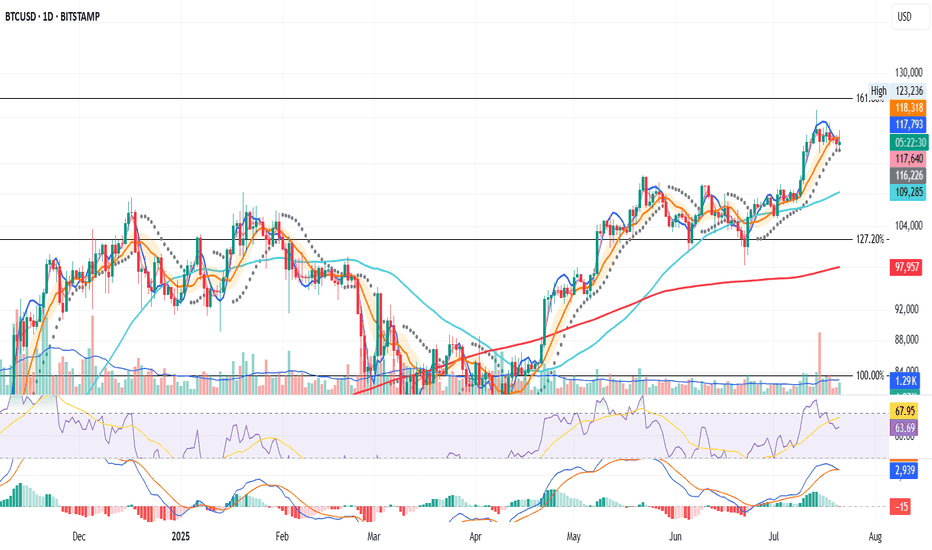

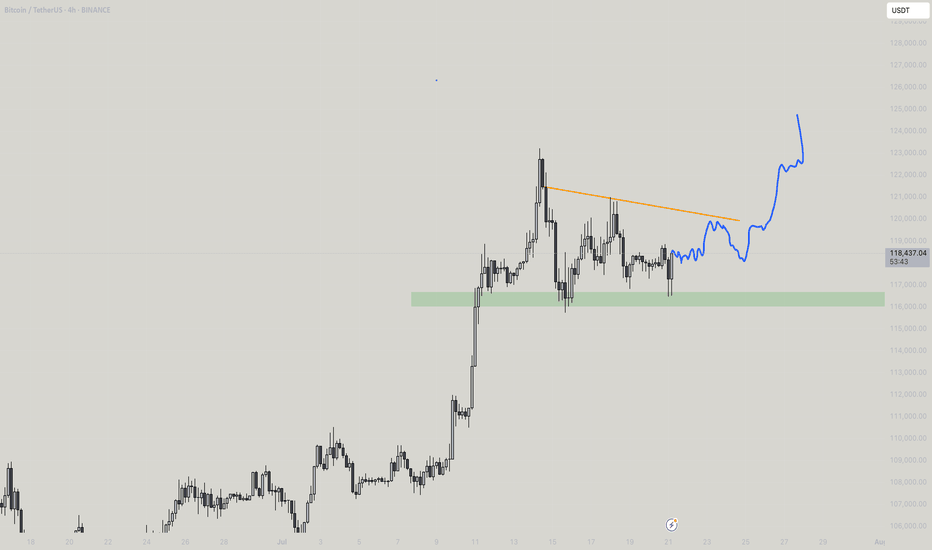

BTC Update – Short-Term Pressure Building

Bitcoin is still being pushed down below the BB center.

RSI is trending lower, and MACD is nearing a bearish crossover.

PSAR is hovering close to price, a warning sign.

This could still be a pause before the next leg up — but don’t ignore the signs.

And just a thought: Trump Media buying $2B in BTC might’ve marked a local top.

Prepare in advance.

Always take profits and manage risk.

Interaction is welcome.

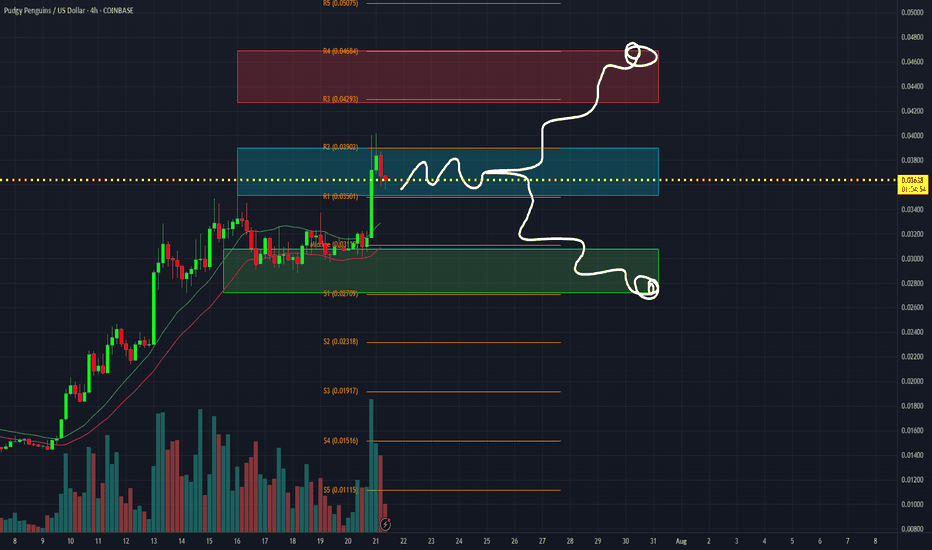

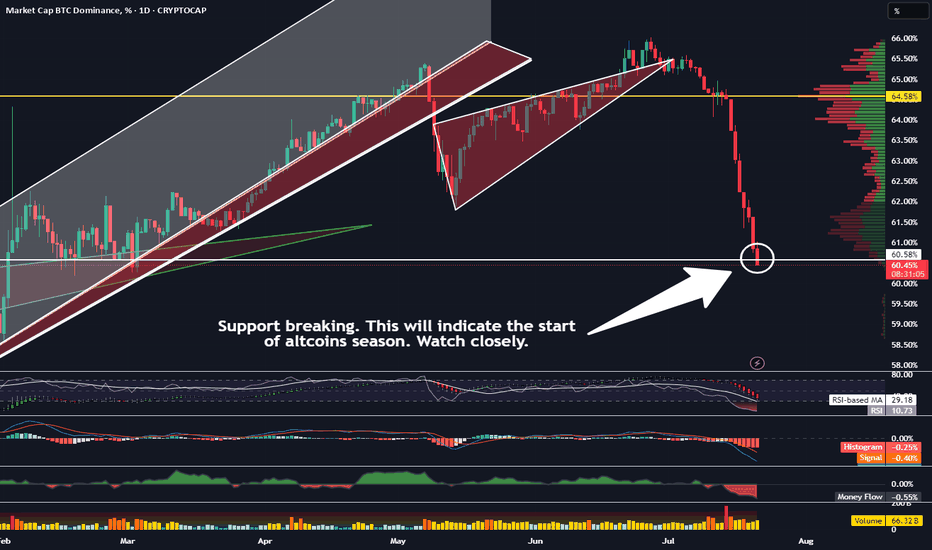

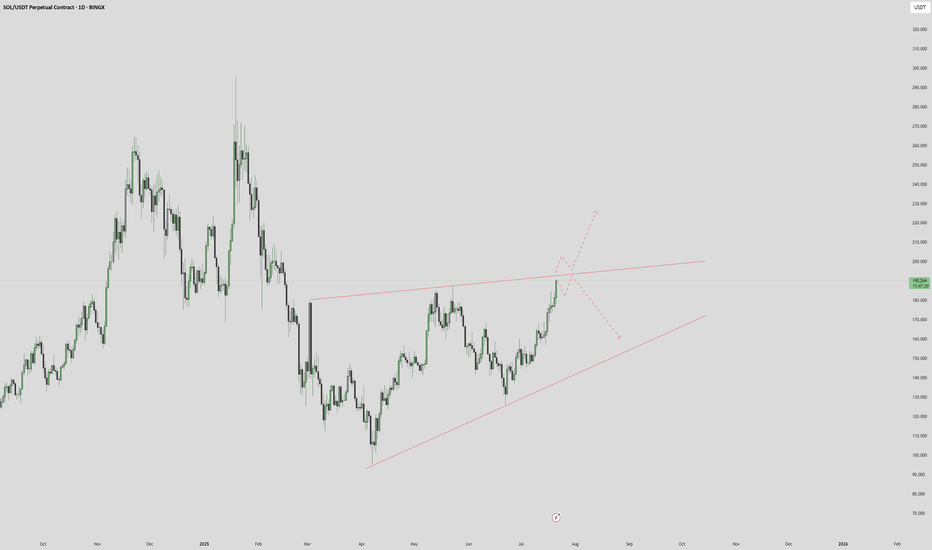

When This Support Breaks, Altcoin Season Becomes Official!Trading Fam,

We have many signs that altcoin season is almost upon us. Solana is breaking important resistance. Eth is nearing its target (both of these posts can be found below). But the most important indicator imo can be found on our BTC.D chart. Dominance has now reached an important support. I was kind of expecting a bounce here. And it still could bounce. But if it doesn't, then I feel like I can officially state that we will be in altcoin season for the rest of the year. Here's what you should be watching. If the body of that daily candle closes below our support today and then a new one opens and also closes below the support, its a wrap.

Let's go!

✌️Stew

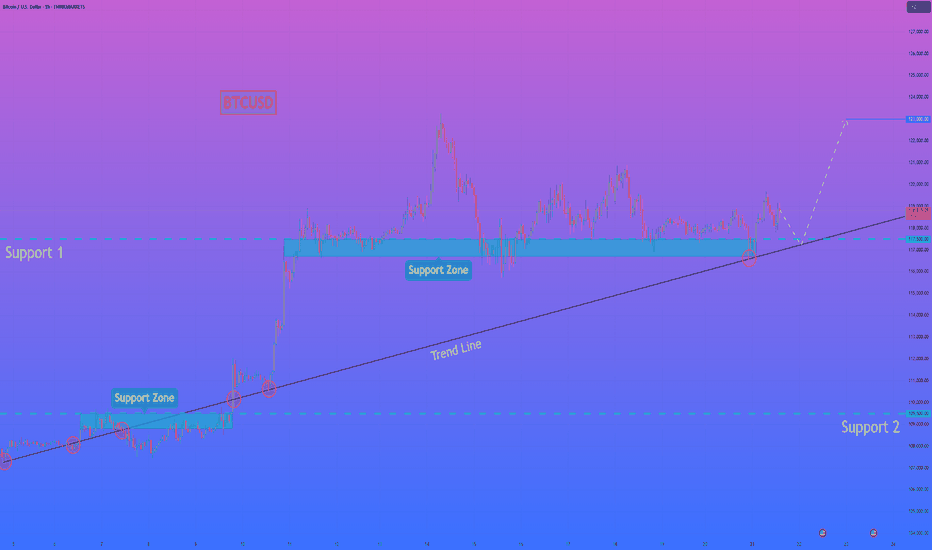

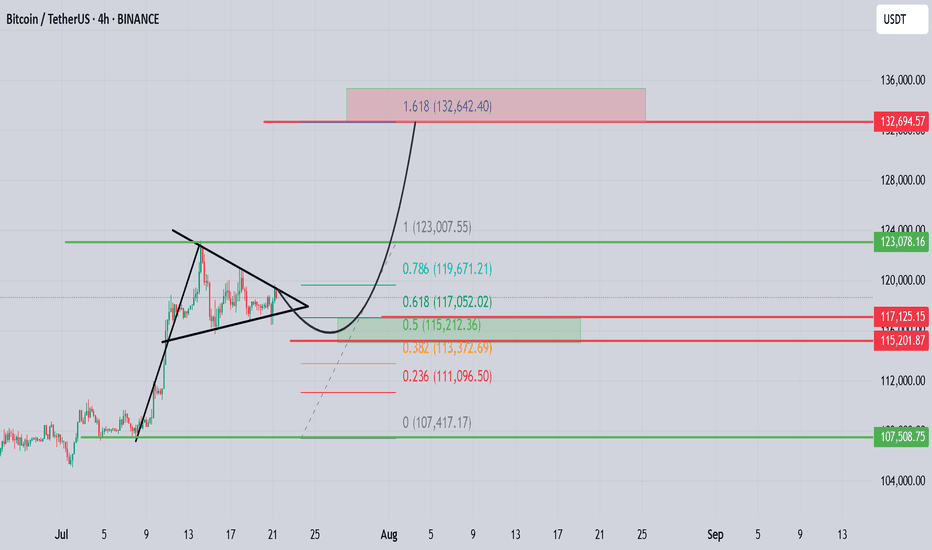

HelenP. I Bitcoin will rebound from trend line and rise to $123KHi folks today I'm prepared for you Bitcoin analytics. If we look at the chart, we can see a very clear and long-term bullish structure. The entire uptrend is supported by a major ascending trend line that has acted as a reliable foundation for the price for a significant amount of time. Currently, the price is consolidating above this crucial trend line and is interacting with the key support zone between 117500 and 116700 points. I believe that the most probable scenario here is a brief corrective move downwards for the price to properly retest the main ascending trend line. This type of retest is often a healthy sign in a strong trend, as it allows for the confirmation of support and gathers momentum for the next leg up. A strong rebound from this trend line would serve as a powerful signal that the buyers are still in control. Therefore, once the price confirms its bounce from this dynamic support, the path should be clear for a continuation of the uptrend. For this reason, my primary goal for this trade idea is set at the 123000 points. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

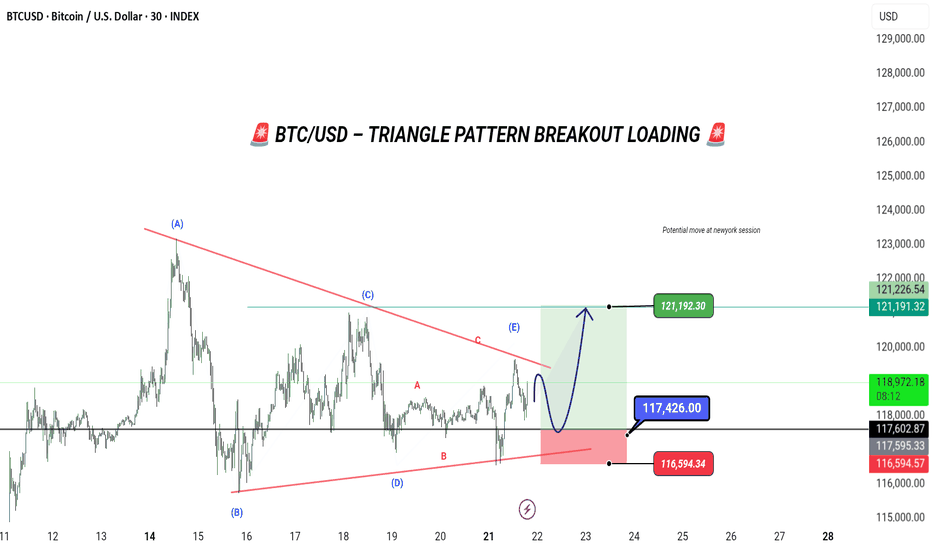

BTC/USD – TRIANGLE PATTERN BREAKOUT LOADING

We’re coiling up like a spring 🌀 inside this textbook triangle structure — and the breakout is about to go BOOM.

👀 Watch the (E) Wave closely. This is where smart money traps the late sellers.

Once price taps the 117.4K zone, expect a sharp reversal up.

🎯 Target: 121,192

📍 Entry: 117,426

❌ Stop Loss: 116,594

💡 Logic: Classic Elliott Wave triangle → ABCDE complete → final breakout wave incoming.

This setup is cleaner than a fresh fade. Don’t sleep on it 😴

🧠 PATIENCE = POWER

Let the market show its hand — then snipe your entry. 🎯

🕒 Timeframe: 30M

⚙️ Strategy: Elliott Triangle + Breakout Play

---

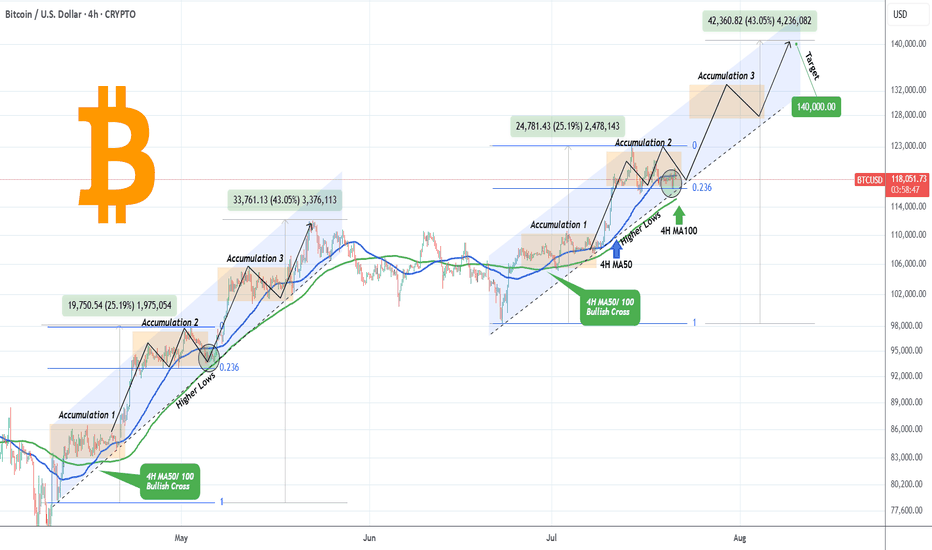

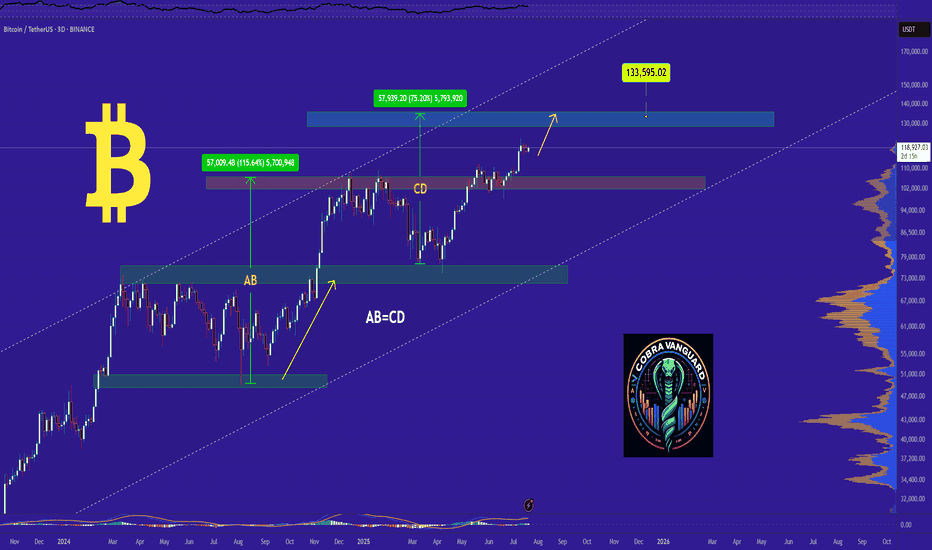

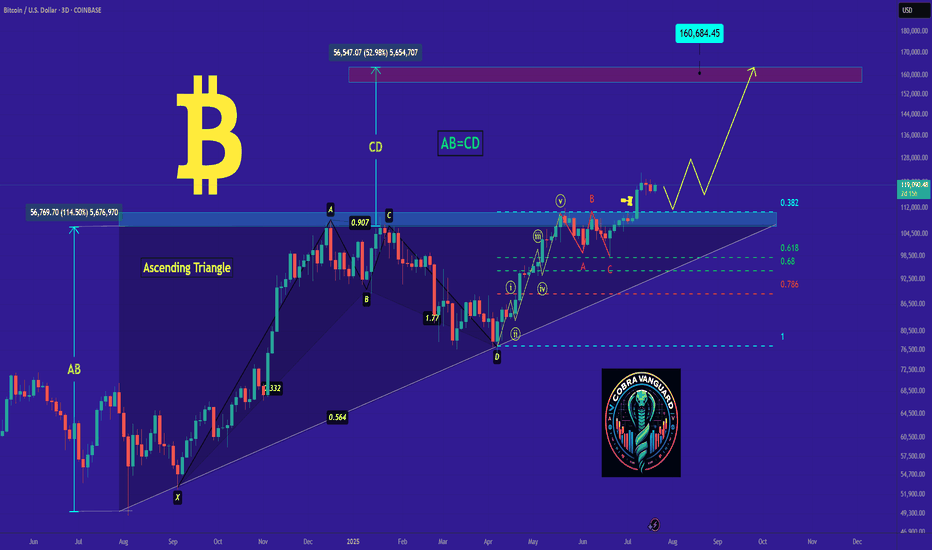

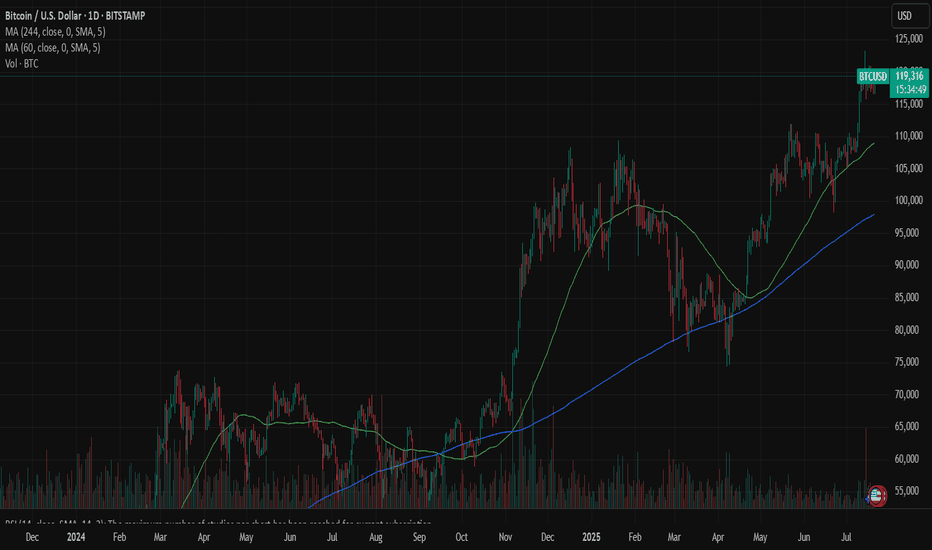

BITCOIN Accumulation Phase almost completed. Higher from here?Bitcoin (BTCUSD) is making a strong rebound on the bottom of its 1-month Channel Up and this analysis is in direct response to the one we published last week (July 15, see chart below), where we called this one-week consolidation:

We won't be going into too much detail then, as you can see the price made the Accumulation 2 Phase, after an identical +25.9% Bullish Leg, same as April's and by breaking below the 4H MA50 (blue trend-line), it hit the 0.236 Fibonacci retracement level.

As per the May 05 fractal hit, as long as the 4H MA100 (green trend-line) supports this Channel Up, the market should start Bullish Leg 3 towards Accumulation Phase 3 and eventually peak at around +43% from its start at $140000.

Do you think the pattern will continue to be repeated in the exact same order? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

The Oracle Singularity: CHAINLINK is Inevitable or Cooked?How many marines are tracking this ascending channel?

How many are watching this Fibonacci time sequence unfold?

How many are following the mirrored bar fractal that might just be a crystal ball into the future?

Today you get all three in one TA. The value here is absurdly high . Even though I offloaded most of my LINK a while back it continues to act like a compass for future macro crypto moves.

You really need to look at the TA to understand what I mean

Now look at this

The deviation in the LINK bar pattern seems to be reaching its conclusion around mid October 2025 and if you’ve seen my last Bitcoin TA you know I’ve been targeting that same mid October 2025 window for a potential BTC top. That’s a serious timeline confluence.

But here's the twist

The main chart projects a $200 LINK by April 2026. If that plays out then I have to entertain the possibility that this cycle extends past my original thesis and that my Bitcoin top call may come in earlier than Chainlink's final move.

If Bitcoin does in fact top in mid October then LINK likely won’t have the legs to hit those upper targets.

Back in 2021 when LINK was trading at a similar price it only took 119 days to reach $50 that would put us at November 2025 for a repeat. Something doesn’t quite add up

Now check the main chart again

This Fibonacci time sequence is liquid gold. It’s nailed major tops and bottoms for years (see the blue circles). Every major move has hit right on time except for the 3.618 in October 2022 which was a rare miss.

But here's the kicker

There’s no Fib time event between October and December 2025. The next ones are in August 2025 and then April 2026

So is LINK trying to tell us the cycle extends into 2026?

Maybe. All I’ll say is this

If the cycle doesn’t extend into 2026 then LINK IS COOKED

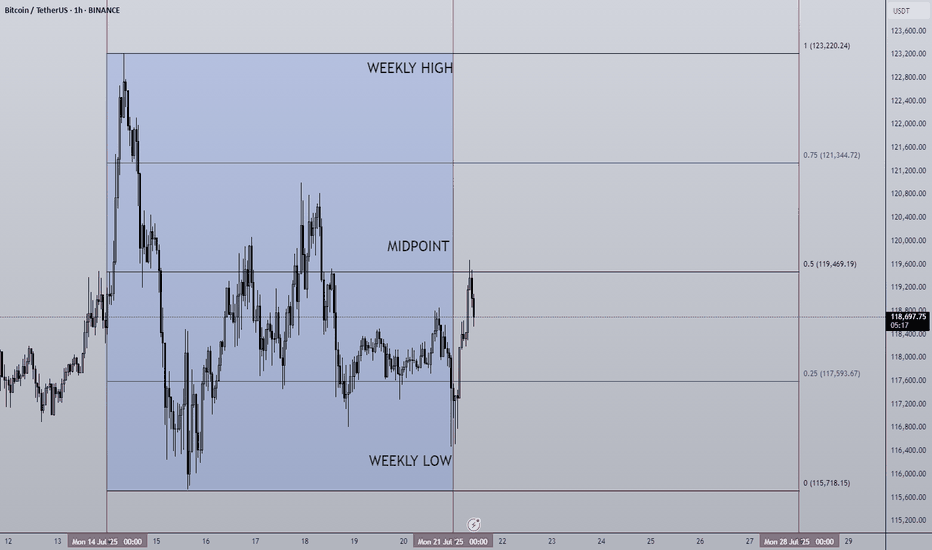

21/07/25 Weekly OutlookLast weeks high: $123,220.24

Last weeks low: $115,718.15

Midpoint: $119,469.19

New BTC ($123,220) & SPX ($6,315) ATH last week! We're really seeing progress being made on all fronts now, bitcoin saw its sixth week of net inflows into BTC ETFs ($2.39B).

The week began strong hitting the new ATH very early and then settled into a tight range to cool off. Altcoins however surged in relation to BTC to break out of HTF downtrends and begin to make up lost ground. One of the beneficiary's of this price movement has been ETH, breaking out from a multi year downtrend against BTC and hitting $3,800 in its USD pair.

For this week I do expect much of the same for BTC as momentum is with altcoins for now. However, as those altcoins reach HTF resistance levels it becomes very important for Bitcoins chop to be accumulation for the next leg up and not distribution for the way down. With so few pullbacks the threat of a sudden correction is present but the probability drops should BTC look to press higher with strong demand.

The ECB Interest rate decision takes place on Thursday but no changes to the 2.15% rate is forecast. In terms of news there are no planned upsets that I can see.

Good luck this week everybody!

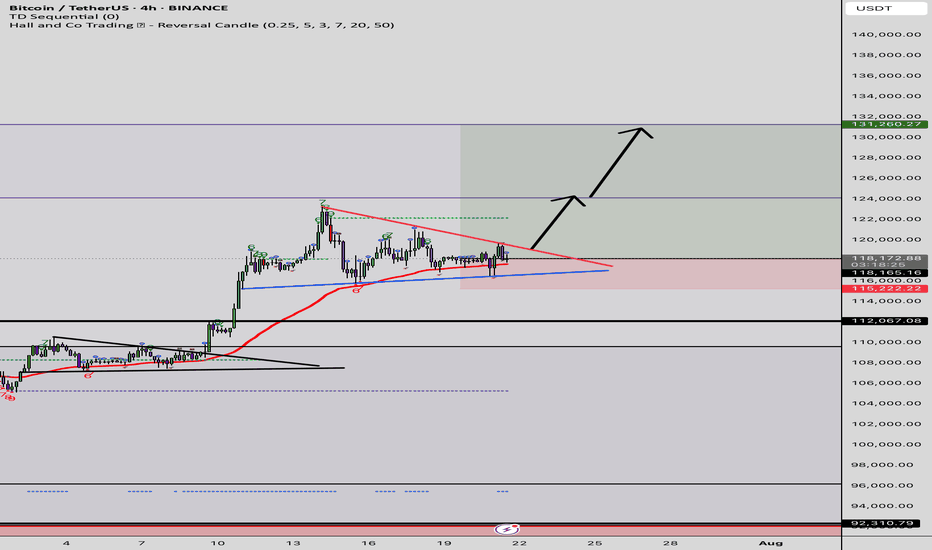

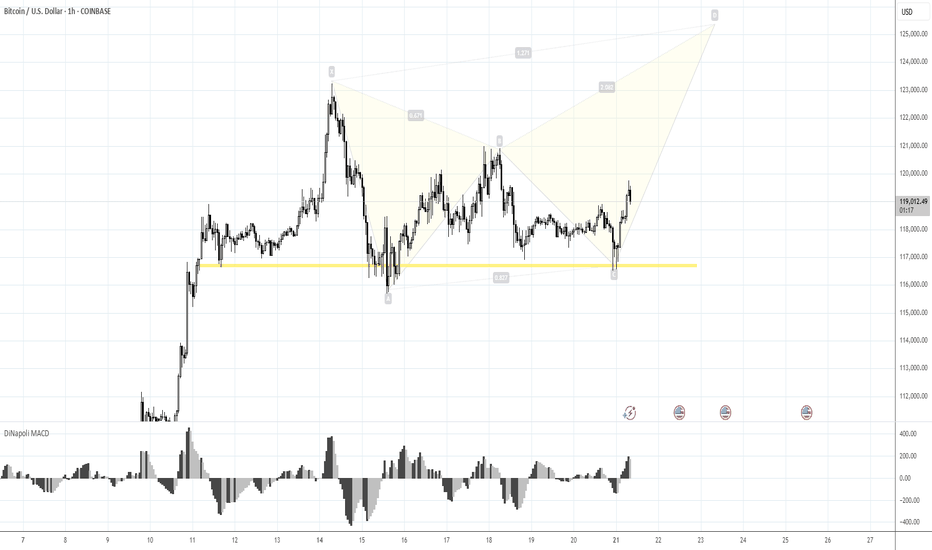

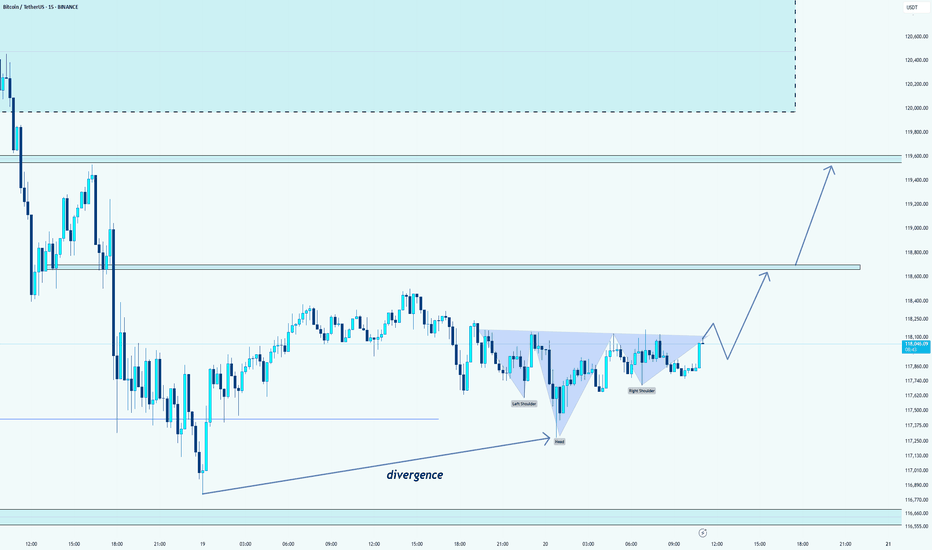

Risk 116. Target 123-125KMorning folks,

Prior 1H H&S was done, we were watching on 120K resistance area, as we said last time. Now, on 1H chart H&S is showing signs of failure - too extended right arm, no downside breakout. Price is taking the shape of triangle . All these signs are bullish. Because butterflies very often appear on a ruins of H&S, we suggest that this one could be formed here...

The risk level for this scenario is 116K lows - BTC has to stay above it to keep butterfly (and triangle) valid, otherwise, deeper retracement to 112K area could start.

Upside target starts from 123K top and up to 125K butterfly target.

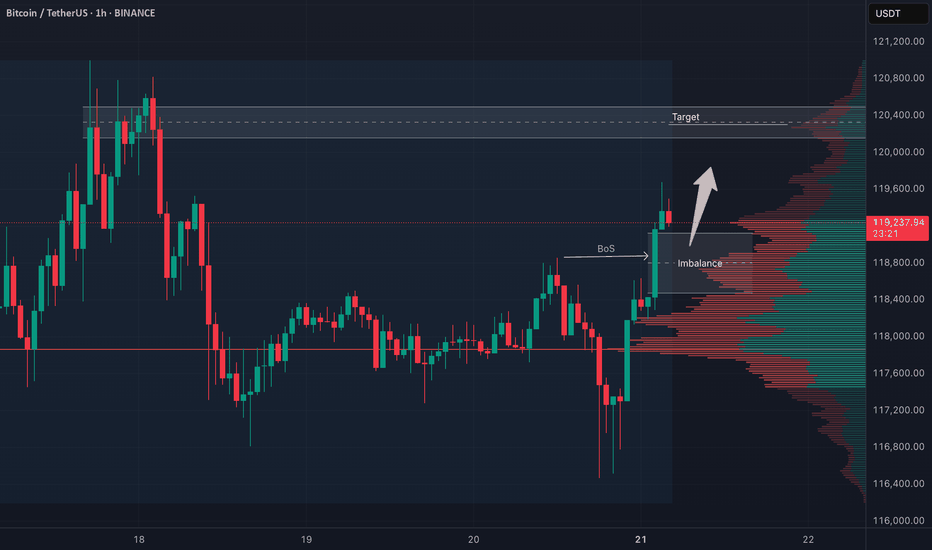

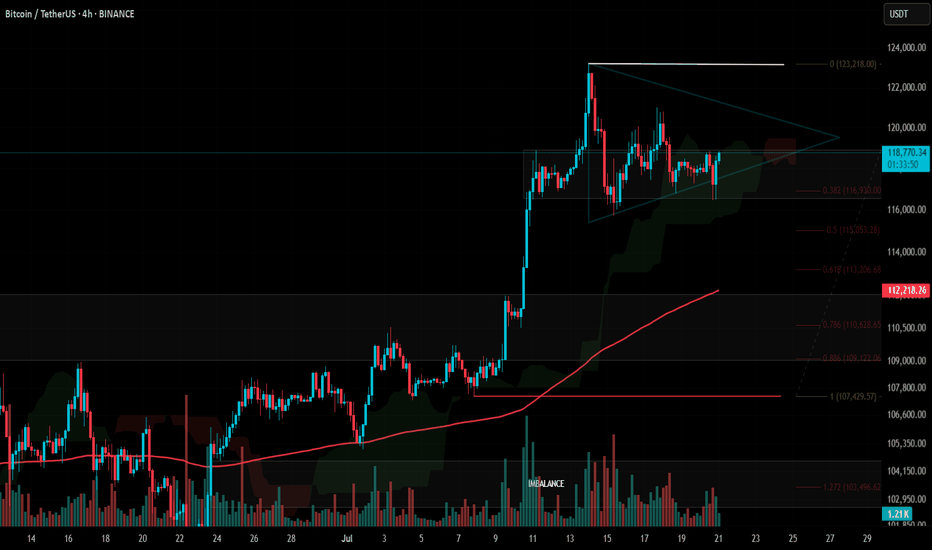

BTC 4H Structure Break – Long Bias with Conditions🚀 BTC (Bitcoin) has clearly broken bullish market structure on the 4-hour timeframe.

📈 My bias is to ride the momentum and look for a pullback to enter long.

✅ I follow a specific entry criteria — price must pull back into the imbalance, find support, and then form a bullish break of structure on a 15m chart to trigger an entry.

❌ If that setup doesn't play out, we simply abandon the idea.

⚠️ This is not financial advice.

Bitcoin: Genius is on the scene The U.S. House passed the Genius Act on July 17, following Senate approval in June. The bill sets comprehensive federal standards for stablecoins, clearing the way for banks and fintechs to issue them under clear reserve and audit rules. This represents a new milestone for the crypto market, and its leading coin - BTC. During the week, BTC managed to hold steady above the $118K. On Tuesday, there has been one attempt to push the price toward the $116, however, the price swiftly returned to the previous grounds. The highest weekly level reached was at $122,8K, reached on Monday, however, this level was also unsustainable. The majority of trades during the week were around $118,5K.

The RSI modestly moved from the overbought market side, ending the week at the level of 65. This could be an indication of a forthcoming price reversal, however, considering strong demand for BTC, such a move could be easily postponed. The MA50 started again to diverge from MA200, indicating that there will be no cross of two lines in the coming period.

BTC managed to hold levels above the $118K, which is an indication that investors are still not ready to sell in higher volumes, in order to take profits. The RSI is indicating potential for a short reversal, however, in the current circumstances, it might be postponed. A move toward the higher grounds is also quite possible, especially taking into account BTCs recent push toward the $122K. At this moment charts are pointing to equal probabilities for a move toward both sides. On one hand, the $116K support was indicated through price during the previous week, as well as the $122K. The start of the week ahead will determine which side will prevail in the week ahead.

#BTC Update #8 – July 21, 2025#BTC Update #8 – July 21, 2025

Bitcoin isn’t moving in a textbook symmetrical triangle, but it’s trading in a similar, tight range, mostly bouncing around the highlighted box area in the chart. It’s attempting a new impulsive leg, but $120,000 remains a key resistance level, having rejected price several times already.

As long as $116,500 holds, there's no major risk for Long bias. However, considering the triangle-like structure, the short-term upside is limited to about 2% for now.

A breakout above the upper edge of this structure, particularly if $123,200 is broken with strong volume — would justify a Long position. Until then, I don’t plan on entering any trades.

The last corrective move has completed, and my next major upside target is $127,900. If further correction occurs, watch for potential support around $115,000, $113,000, and the strong base at $112,000 — though I don’t expect price to fall that low.

Bitcoin- 175-200k by year's endEvery major Bitcoin move over the last decade — whether a jaw-dropping bull run or a brutal crash — has shared one silent macro trigger.

It’s not the halving.

It’s not ETF hype.

It’s not Twitter sentiment or TikTok FOMO.

👉 It’s global liquidity.

And right now, this powerful force is expanding fast — the same setup that previously drove Bitcoin from $5K to $70K in under a year.

But here’s the twist: as of today, Bitcoin is already trading near $120,000, not $20K or 30k.

That means the engine is already roaring — and if this macro thesis holds, the next stop might just be $175,000-200.000 by year's end.

________________________________________

🧠 What Is Global Liquidity, Really?

Global liquidity = the total money sloshing around the financial system.

It’s often measured through M2 money supply, combining:

• Cash

• Checking/savings deposits

• Easily accessible liquid assets

The most comprehensive view comes from Global M2, which aggregates liquidity from 20 of the world’s largest central banks.

Right now, Global M2 is not just rising — it’s breaking to all-time highs.

And if history repeats itself, Bitcoin tends to follow this wave closely.

________________________________________

📅 Past Performance: Bitcoin and Liquidity Walk Hand in Hand

Let’s break it down:

• 2016–2017: Liquidity surges → BTC +5,000%

• 2020–2021: Post-COVID easing → BTC $5K to $69K

• 2018 & 2022: Liquidity dries up → BTC crashes ~70%

It’s a recurring pattern:

Liquidity drives the crypto cycle.

________________________________________

💡 Why Liquidity Moves: Interest Rates and Central Banks

Central banks control the tap.

• 🟢 Cut rates → Easier credit → More lending → More liquidity

• 🔴 Raise rates → Tighter credit → Less spending → Liquidity contraction

In 2022, the Fed tightened hard.

🧊 U.S. money supply shrank.

📉 Bitcoin fell from $70K to $15K.

But starting August 2023, the Fed paused, then pivoted.

Since then:

• 🟢 The U.S. M2 supply rebounded

• 🟢 Global M2 began expanding again

• 🟢 Over 64 global rate cuts were made in just six months — one of the fastest global easing cycles in history

The last time we saw this much cutting? 2020.

And we all know what happened to Bitcoin then.

U.S M2

________________________________________

🟢 Today’s Setup: The Engine Is Already Running

Fast forward to mid-July 2025:

Bitcoin is no longer at $30K — it’s already testing $120K.

Intraday highs have touched $123K, with a current consolidation zone between $117K–$120K.

This isn’t a "recovery rally" — we’re already in price discovery territory.

The question now becomes:

Is $150K and above next… or are we topping out?

________________________________________

📈 Charting the Path: Bitcoin vs Global M2

When we overlay Bitcoin price over global liquidity trends, one thing becomes crystal clear:

📊 Bitcoin tracks liquidity direction.

• When money supply expands, Bitcoin rallies.

• When money dries up, Bitcoin tanks.

Given that global M2 is at record highs, and liquidity conditions are easing globally, the chart suggests there’s still plenty of fuel in the tank.

And if we follow the same growth, Bitcoin could realistically reach $175,000 before 2026 kicks in.

________________________________________

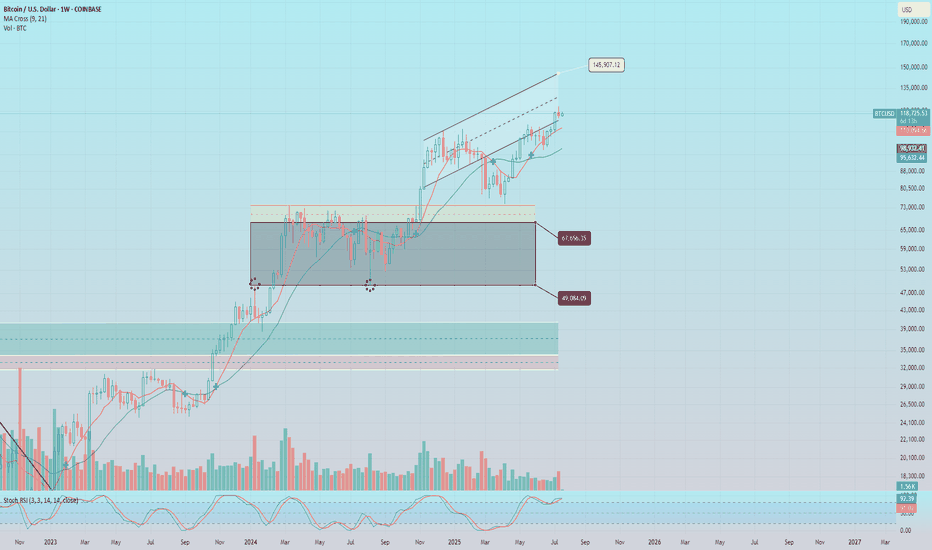

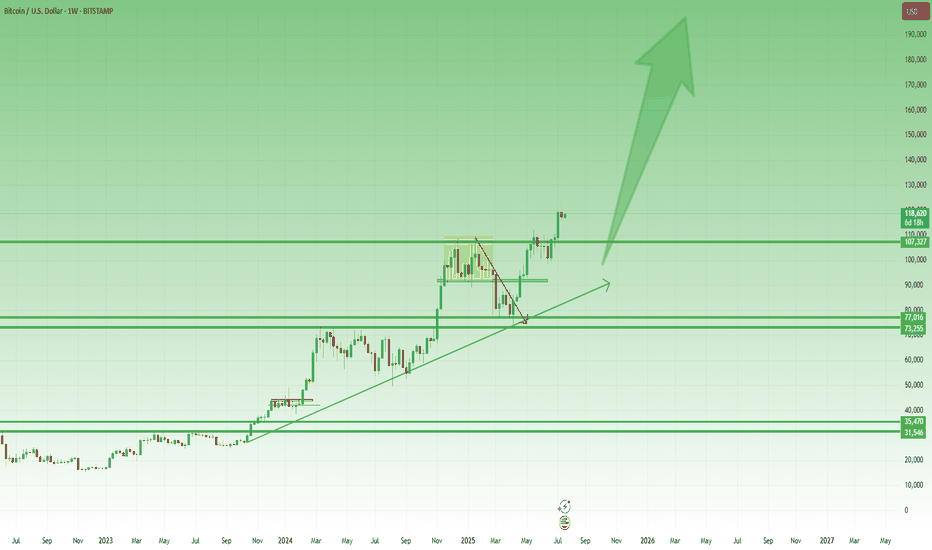

Technically:

As we can clearly see from the posted weekly chart, you don’t need to be an expert to recognize the strength of the current uptrend.

While last week printed a small bearish Pin Bar, this alone shouldn’t raise major concerns — especially considering the presence of multiple key support levels, starting from the 110K zone.

In the context of a strong and well-established trend, such candles often reflect normal short-term profit-taking, not a reversal.

🎯 Conclusion – Don’t Fight the Tide

This isn’t about hopium.

It’s not moon talk.

It’s about macro flows and monetary velocity.

Ignore the noise.

Watch what the central banks are doing.

Because Bitcoin moves not on wishful thinking, but on waves of liquidity — and the tide right now is rising fast.

Whether $175K comes by year-end, one thing is clear:

We are in the middle of a liquidity-driven expansion phase, and Bitcoin is already responding.

Stay focused, manage your risk, and don’t chase — ride the wave. 🌊

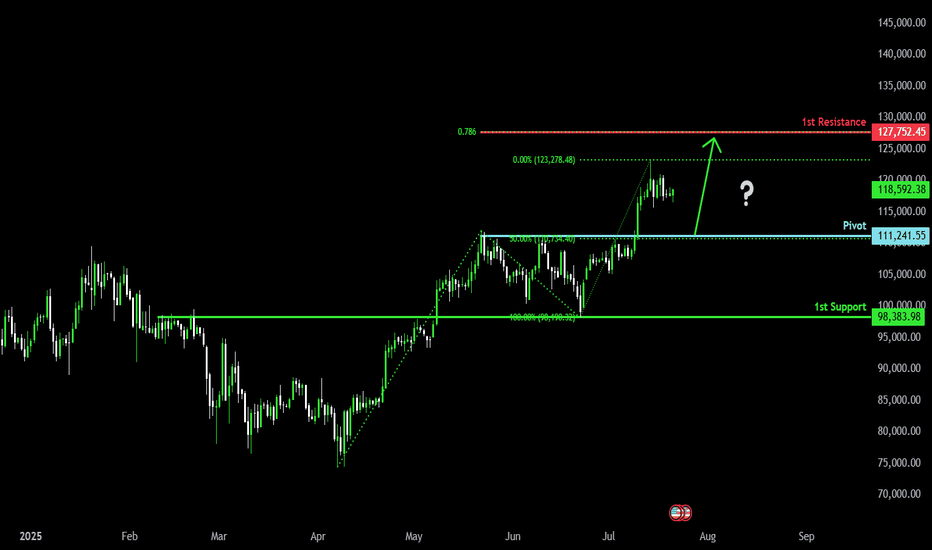

Bullish bounce?The Bitcoin (BTC/USD) is falling toward the pivot and could bounce to the 1st resistance.

Pivot: 111,241.55

1st Support: 98,383.98

1st Resistance: 127,752.45

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.