Bitcoin can rebound from resistance level and start to declineHello traders, I want share with you my opinion about Bitcoin. Recently, the price broke above a local resistance and quickly approached the key resistance level at 110000, which also aligns with the upper boundary of the seller zone (110000 - 110700 points). This area has already proven its strength multiple times, causing sharp rejections in the past. Moreover, the price has tested it again recently and failed to break through. In addition, we can see a triangle structure, which fits the logic of a pennant pattern after a bullish wave. However, the latest move upward has already lost momentum near the apex, and the price is now trading just under the upper edge of this formation. That makes this zone technically overloaded and vulnerable to a downside reversal. Based on this, I expect Bitcoin to test the resistance level one more time and then roll back down toward TP 1 at 106000 points, a zone near previous liquidity accumulation and a local consolidation range. If selling pressure increases, the price might aim for the buyer zone (103800 - 103100). Given the current rejection at resistance, the structure of the triangle, and the reaction inside the seller zone, I remain bearish and expect further decline toward the support. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Btc-short

BTC Educational Idea by 1PercentFundedBTC Update : These are the possible scenarios for BTC based on 2021

Scenario A. BTC rejects 108/109k (Purple Arrow) & retest 98k (High Probability)

Scenario B. BTC retest 110/111k (Black Arrow) & creates a double top before dumping to 88/98k

Our team will be building shorts at 108k onwards & will add if 111k is given. 117.5k invalidation.

Bitcoin can drop from wedge to 100K pointsHello traders, I want share with you my opinion about Bitcoin. After consolidating for an extended period within a triangle pattern, the price eventually broke out with strong bullish momentum. The move was supported by a solid rebound from the buyer zone and a clean breakout above the 92800 - 94200 support area. This breakout initiated a steep climb, forming a new upward wedge structure, defined by narrowing trend lines and rising local highs. Currently, the price is trading near the resistance boundary of the wedge, around the 104000 - 105000 zone. This zone has already triggered one rejection and is showing signs of weakening bullish strength. Given the rising wedge geometry and the fading impulse strength, the risk of a correction is increasing. The current structure typically leads to a pullback, especially after such a steep rise. I expect that BTC may rise to the resistance line of the wedge and then drop below the support line, thereby exiting from this pattern. That's why I set my TP 1 at the 100K points. Please share this idea with your friends and click Boost 🚀

my idea about btc in secound half of 2025Dear followers,

I’ve analyzed BTC’s recent price movements and on-chain indicators, and I’d like to share my outlook for the second half of 2025. Based on my technical and macroeconomic assessment, I anticipate a significant correction before a strong rebound later in the year.

Key Highlights:

Sell Zone: I expect BTC to reach around $108,000 during a bullish run, where I recommend taking profits and initiating a short position.

Correction Phase: Following the peak, I foresee a correction bringing BTC down to approximately $69,000. This presents a deep buy opportunity for those looking to accumulate at lower levels.

Target for Rebound: Post-correction, I project a strong rally towards $140,000, driven by renewed institutional interest and market fundamentals.

Trading Strategy:

Consider selling or reducing holdings near the $108K level.

Be prepared to accumulate during the dip around $69K.

Aim for the $140K target on the rebound, aligned with overall bullish momentum.

Please note that all trading involves risk, and it's essential to manage your positions carefully. Stay tuned for updates, and always do your own research before making trading decisions.

Let me know your thoughts or if you'd like a deeper analysis!

HelenP. I Bitcoin can make correction to trend lineHi folks today I'm prepared for you Bitcoin analytics. The market behavior of price has been quite telling recently. After a significant rally from the lower support area around 81200 points, the price gradually established an ascending trend line, forming a steady bullish structure. The rise was confirmed multiple times by the trend line acting as dynamic support, allowing buyers to push the price toward the higher zones. However, after reaching the local peak close to 95300, the bullish momentum slowed down. Price formed a range and began showing early signs of weakness. Despite attempts to move higher, each push was met with resistance, causing smaller impulses than earlier moves. Currently, Bitcoin is trading just under the 95300 - 95500 zone, near the upper boundary of the recent range. I expect BTCUSDT can face further rejection here and initiate a correction. The nearest key target is the 92000 points, located close to the ascending trend line and matching the support structure below. Given the fading momentum, recent price action, and important technical levels nearby, I anticipate a downward move toward 92000 points. If you like my analytics you may support me with your like/comment ❤️

HelenP. I Bitcoin may rebound from resistance zone and fall moreHi folks today I'm prepared for you Bitcoin analytics. After a strong rejection from the second resistance zone between 86700 and 87900 points, Bitcoin lost its bullish momentum. The price attempted to hold within the range but failed to break above the trend line, which has consistently acted as dynamic resistance. This trend line marked the turning point once again, pushing BTC down with increased selling pressure. The price then sharply declined, breaking below the first resistance zone between 78200 and 79500, which is now acting as resistance. This level was previously tested multiple times, making it a key barrier. After breaching this zone, the price dropped even lower and reached the 77000 area, where it found temporary support and began a minor bounce. Currently, Bitcoin is trading just below the resistance zone and remains under the trend line. Sellers are still in control, and the recent bounce looks weak compared to the prior impulse down. Given the rejection from resistance, the position relative to the trend line, and continued bearish pressure, I expect BTC to resume its decline toward 70000 points, which is also my goal. If you like my analytics you may support me with your like/comment ❤️

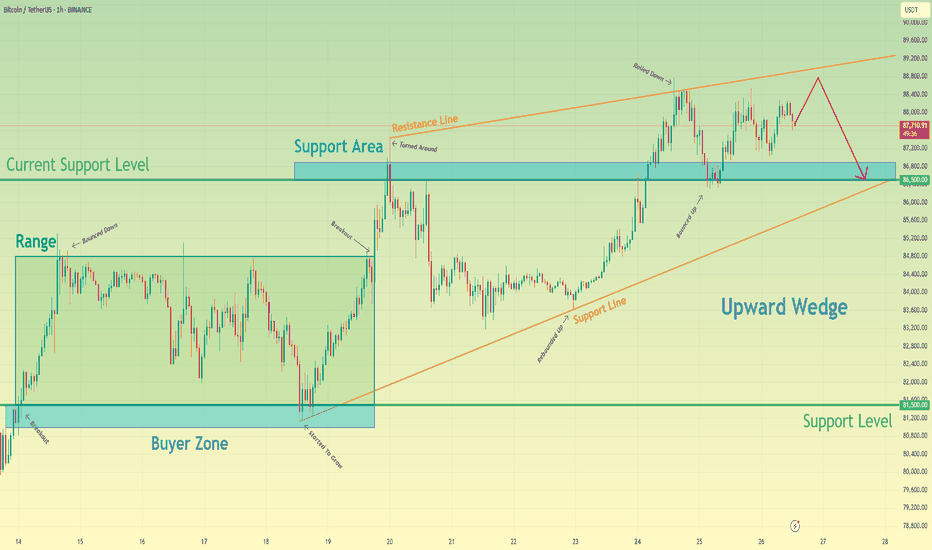

Bitcoin can make small move up and then drop to support levelHello traders, I want share with you my opinion about Bitcoin. Earlier, price was moving inside a range, where the price repeatedly bounced between the upper boundary and the buyer zone. After multiple failed attempts to break higher, the price finally broke out and started an upward movement, forming a strong bullish impulse. This upward momentum led BTC into the support area, where it consolidated briefly before continuing to rise. From there, the price began to form an upward wedge, respecting both the support line and the resistance line of the structure. Recently, BTC tested the upper boundary of the wedge and rolled down, confirming the resistance. Now, the price is trading closer to the upper half of the wedge but shows signs of weakness near the resistance line. Based on this setup, we might see that the price can one more short-term attempt to grow, followed by a rejection from the upper boundary and a move downward toward the 86500 support level. If the price fails to hold this level, the next stop could be the support line of the wedge. Please share this idea with your friends and click Boost 🚀

BTC: Overbought & Losing Momentum – Drop to Support Incoming?Almost a perfect gap fill in the 85000-86500 zone, followed by a strong reaction off the level. RSI is in overbought territory.

Expecting a quick drop to support levels at 80174 / 78947 / 76449

Short entry point: 84300

TP: 80174 / 78947 / 76449

Stay tuned for more setups, follow me so you don’t miss them. Also, check out my X profile, big things coming soon!

BTCUSDT Fresh Short Setup: Targeting Key Support Zones with SMC Description:

This trade setup presents a Bitcoin short opportunity on the 4H timeframe using the Smart Money Concepts (SMC) framework. After a significant reaction from the supply zone, Bitcoin's price structure aligns with bearish confluences, signaling potential downside. Additionally, external events, such as the recent announcement of China's AI application "DeepSeek," may have amplified market volatility, further supporting the setup.

Trade Setup:

Entry:

Between 103,300 and 104,500

Take-Profit Levels (TP):

101,897

99,825

97,565

95,208

Stop Loss (SL):

Above 105,975

Analysis and Confluences:

Market Structure:

Bitcoin remains in a bearish trend on the 4H timeframe, with consistent lower highs and lower lows.

Supply Zone:

The price is entering the 103.3k–104.5k supply zone, a key resistance area where sellers are expected to dominate.

Fibonacci Confluence:

This zone overlaps with the 0.618–0.786 Fibonacci retracement levels, a high-probability reversal area.

Liquidity Sweeps:

Liquidity above previous highs has been swept, leaving the path clear for potential downside.

Bearish Targets:

The targets align with previous demand zones and liquidity pools at 101,897, 99,825, 97,565, and 95,208.

Trade Plan:

Confirmation: Wait for bearish price action signals or smaller timeframe BOS (Break of Structure) within the supply zone before entering.

Risk Management: Adjust position size to keep risk within acceptable levels. After reaching TP1, move your stop loss to breakeven and secure partial profits.

Final Note: While bearish bias dominates, unexpected macroeconomic events can cause reversals, so use tight risk management.

The Trump DumpCaution to the sensitive bulls, you're not going to like this one...

I know we all like hopium and up-only charts, but this isn't it. Those only exist in fairytales. This is trading and we have to stay grounded if you plan to actually profit outside of the HODL philosophy.

The truth is that elections don't matter, new events doesn't matter. At least not how the majority thinks they do. These events merely mark points in time, they can be catalysts or pivots. But those time points don't care about your philosophy on the actual event.

Let the emotion and philosophy in and you'll lose, guaranteed. Close those out and look only at the charts, using those events to understand important time points to pay attention to and you might see that this one is going to be critical.

On a macro picture, this market structure has been clear, simply a series of expansions and ranges (I know, obvious, this is how all price moves). But recently we had a strong expansion beyond the all-time high, which might seem bullish at first glance but is going to be a liquidity trap in hindsight.

On a more local view, we have our range forming after this larger expansion and that range has already generated a fakeout higher and come back into the range, with the next breakout of the range to be to the downside. I do not trade blind FVGs or other ICT stuff, but there will be a lot of hindsight analysis from people claiming that this daily FVG was obvious.

Combine this with the important time events that has everyone so bullish, like elections or whatever, and you have the perfect recipe to wreck almost everyone.

From here, I am looking for AT LEAST a 30% drop . Targets may get lower as data comes in, but keeping it conservative until more high timeframe candles come in.

You may disagree with the post, but at least it has a clear bias.

VIRTUAL - 4:1 RR Short SetupThis trade setup presents a low-risk opportunity with a 1% risk for a potential 4% reward, providing an attractive risk-to-reward ratio of 4:1. The analysis is based on an ABC correction pattern, with entries laddered between the 0.618 and 0.718 Fibonacci retracement levels, SL above the high. The take-profit target is strategically placed at a well-defined confluence support zone.

A rising Wedge Formation In the 4H - Short for Short Period.So even though Bitcoin is in the middle of a huge upward move markets always gave us the opportunity to make money in the middle of every strong trending moves. For now we got a rising wedge formation with a heavy pull back based on the news from the FED and the zone which is acting as a magnet support level got more confluence points including the strong demand zone, the horizontal support line of the 2 formed triangles and the 1.27 extension fib level on the higher timeframe. All this points and some other additional insights are included in this short video and enjoy watching it. Please do consider to do your own research before making any type of investments in any type of markets and I urge you to notice that this is not a financial advice at all rather a personal view point.

Nathnael B.

Possible Top for BTC/ETHI can see a possible top on the BTC vs ETH chart. It has clearly gone up alot and if you combine that with the divergence on the RSI + BTC Dominance about to fall the possibility for this to happen gets stronger!

This means that Ethereum is about to go for a run and if that happens alot of projects based on ETH will have a big rally.

I would like to see $85k before $118k Look, you guys are morons. You are all full porting bitcoin right here so despite the logical next move being $85k i think its possible the demand is simply too strong and we must go straight up. However being rational, every star in the sky has aligned for a retest to 85k.

If we can go to 85k it will sufficiently reset the RSI to such a level that the spring will be insane, i think we will cross 100k so easily it won't even have much resistance.

Logically, i think we go to 85k, but irrationally i think bottom could already be in because the demand is simply too strong. Let's see how hyped everyone is.

Continued bearish scenario for BitcoinIn the daily time frame, as we expected in the weekly analysis, we see the formation of a reversal candle with the appropriate volume to change the upward to downward trend, and also the level of 66600, which was the last level for daily support which we say 3candle formation , has been engulfed and the price has penetrated into it, which indicates the passage. Supporting it in the next encounter is clearly visible in the 4-hour timeframe

In the 4-hour time frame, we have a change of charector and a downward range has been formed, which in the 1-hour time frame, by leaving the ascending wedge pattern, this range is placed below the 4-hour block breaker and the daily key level, which can be confirmed in the lower time frame. Enter the short trade if it is shown in the 15 minute time frame

BTC TO 45-43K BEFORE MAKING NEW ATH COINBASE:BTCUSD BINANCE:BTCUSDT

Hello everyone. Bitcoin is trading in a bearish channel. I have left alot of indicators and other chart things off to keep it clean and show my main points. But remember we are in a wave 4 of 5 and have not hit the retracement target yet.

Prices always move back toward equilibrium. As you can see on the chart in purple. This lines up nicely with the 1.618 and 1.786 fib extensions of the swing low to swing high. It also intersects with the base channel which is a typical wave 4 target. Wave 4 typically hits the top or middle base channel. The fib extensions line up nicely with the mid channel. This creates a significant area of interest and a likely spot to land before making a new ath.

If you disagree with me please use data and examples and not emotions. Thanks everyone!