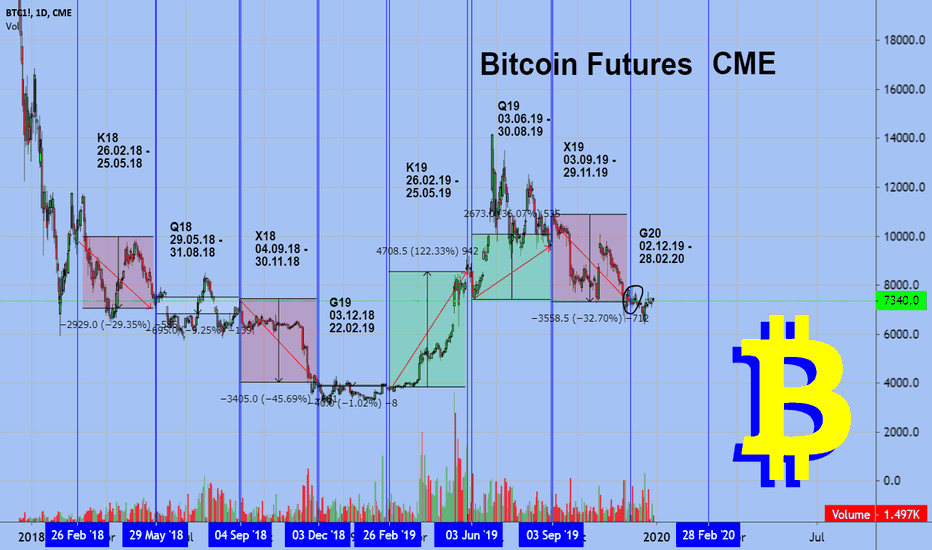

BITCOIN | Price made a Gap at CME,price can fill this Gap!....Price made a Gap at BITCOIN CME futures,last time when price created a Gap it fill about 60-70% of the Gap,

let's see if price can fill this Gap or not...

Push LIKE & SUPPORT the Idea...

- Always do your own research before opening positions...

*The content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

Btc1

Bitcoin High risk trade.

1 Everyone is bullish

2 shorting crypto

3 shorting B?TCOIN

So if you are long, maybe tighten those stoplosses. Take in some profit. Let’s see if it’s moon time......... or,

if b?tcoin just “mooned” us.

We’ve broken below the 200 simple moving average on daily followed by open and closes below. 200 is still closing higher, 🧐 keep an eye on this “rolling over” as a confirmation of weakness.

Weekly close confirmed hidden bearish divergence on the RSI and formed a possible Bearish Harami candlestick formation.

Confirmation is a tick below last weeks close @8235

Confirmation for spacesuits is a break of 9085.

LTC. Litecoin, about to get a little lighter?Not financial advice. I’m not a financial advisor. I’m learning to trade. Learn to trade!

Hidden bearish divergence confirmed on weekly close.

Below 200 simple moving average. Bearish Harami-esque candle pattern.

Price action leading into weekly close was strong. As strong as general consensus on where crypto markets are going.......... “to the moon”.

A risky trade to take (shorting crypto) so a small percentage of your average position size as a hedge.

BTC to dip furthermuch clearer on the cme chart. Looks like a bull flag. if bullflag plays out, its measured move is 9.7k. It will close gap at least.

If it cannot breach resistance of the downward channel it will drop significantly to at least 7.7k

previous idea, I discussed that BTC can dip further than my targets

CME FUTURES, WILL THE GAP BE FILLED?Inverted inverted head and shoulders appearing. Target price near the upper end of the CME gap. Will it be filled though? We have major resistance on the way up, so for me, if it is to fill, it will be a flash fill before crashing back down- unless it can close above the major EMA's on the daily.

Thanks

The Gatekeeper

BTC1!: Bitcoin Futures Confirms 100 & 200 Day Bear CrossWhile remaining neutral-bearish on the BTCUSD charts, BTC1! is looking like a shorting opportunity. There is notably an increase in buying volume over the past week, however the largest volume day was when price was rejected by both the 100 & 200 Day MA simultaneously.

Needless to say, the bear channel resistance is lined up with this MA bear-cross. With the market now closed for the weekend, I'd anticipate some sideways trading while anticipating confirmation of rejection from the bear-cross, ideally between February 5th-11th before breaking down to mid $5K area.

Note, chart posting around the $8K price mark, notably after the close of futures trading at $8,125.

This TA is a follow up from the fractal that didn't occur as expected (time-wise) but did reach it's intended target around $8,500 (price), with the expected outcome remains downside to similar levels :

February 5th-11th 2020 - The Next Swing Low:

Network Hash Gives 10th Buy Signal In 9 Years:

Extrapolating 2014 Correction - Could $6,500 Be The Low?

Two & Four Year MA's Claim It's Time To Accumulate:

Bitcoin Futures CMEOn December 15, two years ago, the largest American company CME Group launched Bitcoin futures.

CME is the only one who provides the opportunity to trade bitcoin futures in the United States and they are the first to enter the territory of derivatives instrument for the cryptocurrency market and now they have no competitors.

CME futures are one of the most manipulative instrument on the cryptocurrency market.

And the opening and closing of their futures suggests when the bottom will be.

December 15, 2017. two contracts were opened

3 months until March 29 - opening price 20631 - closing price 7070

6 months until June 29 - opening price 20631 - closing price 5800

Before bitcoin futures, large players did not have a high-quality tool for the global short market - and the Chicago exchange provided this opportunity

After 3 months, bitcoin fell by 67%

The market go up a little, but by the close of the 6-month contract, the market fell by 71%

On July 2, another 6-month contract was opened and closed on December 28

40%

detailed table of the start and end dates of all contracts.

CME does not save this data, for this you can like it under the chart

docs.google.com

And the most interesting

I think you remember the growth of November 25-26 at $ 3000 up

If you look a little in the table, then you can see the contract F20 from 10.28.19 to 01.31.20 - the conclusion from this until January 31 we will not see a price above 9200

On December 16, the first annual price contracts were opened in the $ 6,600 zone and I am sure this factor will push the price up

But already today, December 30 will be open semi-annual contracts M20 12/30/19 - 06/29/20

And today, a two-year contract opens and this fact will also push the price up.

Perhaps someone doubts that the price of bitcoin in 2 years will be lower than 7000? write a comment

Best regards EXCAVO

Bitcoin (BTC): A Good Chance of LiftoffLooking at Bitcoin (BTC) futures, we see some positive signs. The best one is a Fib speed line has been acting as support for several days. To us, this means that Bitcoin (BTC0 is finding support from large buyers. We get the sense that big players who own Bitcoin (BTC) are not going to sell, especially since the China statement was so bullish for crypto as a whole.

We also like that bigger coins like Ethereum and Litecoin (LTC) are ripping to the upside.

Bottom Line: We think the "underbelly" of the crypto market below Bitcoin (BTC) has a lot of upside. That could help push Bitcoin (BTC) higher sooner rather than later.

Bitcoin (BTC): Sideways Nirvana?Here's a question: What if Bitcoin (BTC) consolidated the recent gains with a sideways range between 8700 and 9700. While that would be boring for Bitcoin (BTC), it might give the rest of the market a chance to catch. We see decent looking charts across the crypto spectrum ranging from ETH and LTC to smaller coins like TRON, RVN, and MATIC.

Looking at Bitcoin (BTC) futures at the CME, dips may be limited, and a price gap may get filled. So, we think Bitcoin (BTC) may frustrate longs with a tight range and scare shorts with a lack of a down move.

Bottom Line: If the Trump administration can't say or do anything to stop the next rise in Bitcoin (BTC), then Bitcoin (BTC) may range trade, maybe dip, and then resume the advance. In the meantime, the rest of the crypto may play catch up.

CME Bitcoin (BTC) Futures (BTC1): Critical Inflection PointLooking at CME Bitcoin (BTC) futures, we see a crucial inflection point at 8250.

We noticed that Bitcoin (BTC) made major moves lower from this point in May and July of 2018. We also saw that 8250 is the location of a gap from back in June.

Bottom Line: Bitcoin futures are always an essential thing for crypto players to keep an eye on. Bitcoin (BTC) is at a critical point. What Bitcoin (BTC) does near 8250 may determine future direction.

BITCOIN just for fun... look at the dates millions PER BITCOIN#BITCOIN

You know i chart pretty basic and dont like btc maximilists , but just for giggles and laughs, if this chart comes true...

January seems to be a major month between bull and bear

but to be clear, its prety accurate if trend and history carry on

MILLLLIOOOOOONSSSS!!!!!!!

ANYWAY BACK TO BEAR WATCHING!! HAVE A GOOD WEEK

Bitcoin: Now or NeverHere are the bullish and bearish arguments:

The Bullish Arguement : Everyone is now in fear mode. Stops have triggered below the 200-day moving average near 8350. There is no bounce. BTCUSD trades so bad, institutions would not be brave enough to buy. We see support near the 7900-8000 level on Gann charts (not shown). The 14-day RSI is at very oversold levels. The 14-day RSI is a long-term momentum indicator. So, if BTCUSD turned up, the 14-day RSI hints bitcoin would have room to run on the upside. The dip in the hash rate the came before the decline was just a normal hick-up created by a hardware upgrade. So, there is no massive problem in the crypto system. That means the drop was just a corrective flush lower. Also, ETHUSD is sitting at support in the 160-170 zone.

The Bearish Argument : The decline is related to a bigger problem in the crypto system. Elliot work hints at a move to either ~7400. That level is the 62% retracement of the big chunk of the recent up move. Momentum algorithms have likely switched to negative and trend following players will be selling rallies. Also, a move to 7400 could start putting pressure on S9 miners, which could create more panic selling. Finally, there is an unfilled gap on the CME Bitcoin futures chart near 6400. Gaps sometimes get filled before up moves resume.

Bottom Line: If you are brave, you can take a shot at having a small long position. You can lean on support near 8k and bet that despair has reached its peak. Then if BTCUSD broke back above 8500, you could add to long positions. Conversely, you can step back and see if 8k holds. If 8k doesn't provide support, then BTCUSD could fall apart. In that scenario, you might be able to enter into long term longs at much lower prices like 7400, 6400, or 4500.

bitcoin in my opinion !OK so everything has floored, rsi, stoc, but NVT is toucning the trend line.

IMO, if i was a betting man i think october 4th to 7th could see some moves,

how ever!! if the NVT goes below the RED trend line its not good! REMEBER FOLKS, big massive btc moves come when the NVT goes green at the bottom, have a look

people need to realise futures have a big say in price, the rise to 20k came off cme news that they where setting up a futures BTC platform. it tanked the day they started.

bitcoin needs mass adoption and a use case more than anything. bakkt is just another futures platform, nothing more nothing less, bitcoin settled or not CME will still settle in cash.

any-hooooooo just my opnion folks. pretty rough few weeks ahead but everything char wise looks like over sold.

8k bottom? i actually think under 8k

POMP is saying live on tv that #bitcoin can not be manipulated .... WHAT AN ABSOLUTE KNOBHEAD

THE EVIDENCE IS THERE TO SEE!!!

AVOID BTC MAXI'S

Bitcoin: I'm Not Gonna LieWe are not going to lie.

Even the though BTC fell to a perfect spot on the chart near 9700, we would lie and tell you the move didn't scare the daylights out of us. Anybody who lived through 2018 sees those sudden lurches and fear the start of something worse.

On the flip side, we can't lie and say we weren't elated to see BTC recover. We were even more happy to see the move led by ETH.

Even though yesterday's trade was volatile and formed a great candle, BTC is still inside a tight range. That range is causing the Bollinger Band width to continue to crash. Bollinger Band width is a measure of how volatile a market has been over the last 20-days. The Bollinger Band width in BTCUSD is literally crashing. Bollinger Band width is so low that we believe BTCUSD is on the verge of a huge move.

Bottom Line: We're all out of patience, and we all know that crypto can always surprise us and crash. We continue to believe that the next big move in BTC is to the upside.

Bitcoin: Consolidation & Bollinger BandsWith the disappointing drop below 10k, it is tempting to feel like Bitcoin is in an endless range. While we agree that this range has officially become annoying, we also continue to believe consolidation will end soon.

Last night's drop to 9700 brought BTCUSD to the bottom of a triangle and the bottom Bollinger Band. A Bollinger Band is a measure of volatility. It draws line two standard deviations above and below the current price. Said plainly, when a market is volatile or making a sharp move in either direction, the width Bollinger Bands widen out. If a coin sits in a range for a long time, the width of the Bollinger Bands contracts.

Trading View has an indicator that measures the width of the Bollinger Bands. At present, the width of the Bollinger Bands has dropped to points seen near prior big bottoms in Bitcoin. In February, March, and April, it paid to buy long Bitcoin when it dropped to its bottom Bollinger Band. During those times, Bitcoin has been in a tight range.

Bottom Line : Sometimes in crypto, you have to buy when it looks terrible. While that drop was unfortunate for the day traders, the decline might be a golden opportunity for buy and hold investors to get involved. If we are wrong, then the downside is BTCUSD to 7500.

Bitcoin: Hunger GamesLooking at Bitcoin futures, we are going to stick with our idea that big institutions are going to be big buyers of Bitcoin headed into the end of the year. The recent rally in big coins and alts is creating a sense of FOMO in the crypto markets. The crypto bid should eventually spill over in Bitcoin. The idea is to stay hungry and maintain your eagerness to experience the big move to a new high.

Bottom Line: With Ethereum and Litecoin playing catch up for 2019 performance, it's a question of time before a big move higher starts in Bitcoin. We still like our head and shoulders bottom structure in Bitcoin futures. Right now, the right shoulder is forming. From a Gann point of view, a move back to 10,400 could trigger a more significant move higher.

Bitcoin: Waiting for a TableWaiting to see if our bullish idea for Bitcoin will pan out or not, seems a bit like waiting for a table in a really good restaurant. You're annoyed that you have to wait, you don't know if you'll ever get in, but you're really looking forward trying the food if you make it to a table.

In BTCUSD, we are just waiting.

Right now, the focus is on a possible head and shoulders bottom on the CME Bitcoin futures chart. We are looking closely at Bitcoin futures for a reason. We believe that this is the contract institutional players may need to buy to boost their portfolio performance if equities are rocky headed into October.

So, we wait for a table and see if that right shoulder can form and get an up move going.

BTCUSD: Tactical TrackingLooking at the 89 minute chart of BTCUSD, we see that BTC has slipped from our preferred bullish zone near 10,400.

However, that might be good news for tactical dip buyers. 10,150 seems like decent support as that is the 50% retracement of the most recent up move. If you are a short term player, this might be a chance to take a shot on the long side.

In our view, Mr. Market is not taking the situation in the Middle East as seriously as it should. When people realize the gravity of the situation, it may benefit Bitcoin.

So having a tactical long position with a reasonable stop feels like a good way to play.