BTCCAD

Could our next Bitcoin rally take us to $100,000?This is more of an experimental scenario, however there is always a probability this could happen. I just won't be too optimistic at this point since we are bearish at the moment and are still making New structure lows and Lower highs, however if we go to $2,800 and start showing signs of reversal it might be time to buy more for the long-term. This scenario calls for our bottom at $2,870; and our wave 3 top (if extended wave 3) would be $85,254 (4.236%, then a wave 4 should take us to the normal 38.2% at $49,800 followed by a wave 5 to either 1.0% ($72,399), 161.8% ($84,522) or 261.8% ($104,140).

Shaded parts of the emerald are based on Gann fann (Predicted $20,000 top - 45° from start of bull-run)

I will post a non-drawn on chart in the comments for anyone who dislikes the drawing.

Thanks.

Bitcoin Breakout Confirmed! Golden pocket target at 55k..Hi traders,

55k PRICE TARGET

As you can see on the daily chart of Bitcoin (BTC). A resistance line has been a key figure in this downtrend. However, this resistance line was just broken and we have broke out! Pulling up the Fibonacci Retracement, it's safe to say the golden pocket target is at 55k. Watch this level very closely,

Safe trading

-Pulkanator

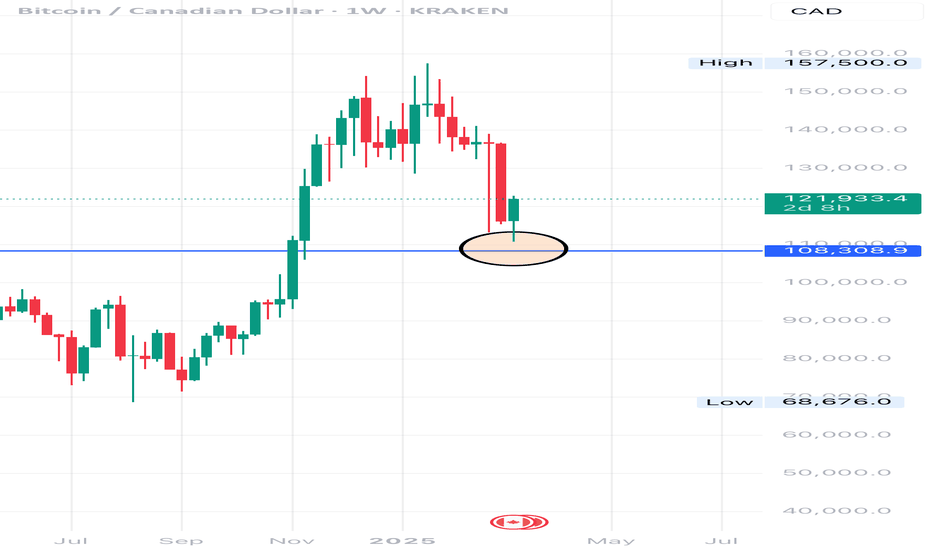

Looks Healthy and BullishI'm not seeing any signs for a short. The price tested the previous ATH and now it's in a trending channel. I would wait for more confirmation to go long for short-term, but if you have any the chart says you should hold.

CAPITALCOM:BTCCAD

TA On New BITCOIN ETF HBIT $8.50 Canadian dollars or or HBIT.U $6.36 USD

Don't be part of the mass that says "I should have bought Bitcoin when it was cheaper!" It's DIRT CHEAP! 1/40th of its stable state from my rough calculations where where 1 Satoshi is worth one penny (or so).

Watch HBIT's volume increase as institutional whales come into the the world's new BITCOIN ETF!

HBIT (Canadian dollars, TSX) or HBIT.U (US Dollars TSX). Tradable on Canadian's largest legacy stock exchange. Please comment on who you think is Canada's largest new world exchange (aka crypto exchange)? Volume is non-existant today because the ticker it too new, after 1-3 month, large, rule limited, institutions will be able to buy into Bitcoin on paper, via the Toronto Stock Exchanges.

This is a sleeping whale. And sub $7s were the all time lows... We're at bottom.

For now, if you're stuck in TFSA and RRSP self investments and can't figure out the hassles of crypto exchanges although netcoins.ca seems to be great for novices, and want the cheapest way to buy bitcoin, Horizons is not the safest custodian because ETFs are not real assets, they are paper backed by crooked paper.

This is an easy long and hold until Bitcoin is widely adopted and used on something as mainstream as Apple Pay or Visa Networks.

This ticker is getting struck by Lightning! ⚡

Caution, this is Bitcoin tracked, so expect stormy times. 🌩️ as we head to $2M Bitcoin "steady state" where 1 Satoshi is worth one penny (or so)

Bullish (green) and bearish (red) circles what to possibly look for on the MACD and Moving average cross overs on the daily charts which is the swing trading default it seems.

Zoom out on bitcoin...This market is very scary and is not for everybody. Please trade at your own risk. think long term and only use money your okay on lossing...

I've been into crypto since the 20K crash and this is very very exciting, don't watch the news, just watch the charts and zoom out. Happy profit everybody and good luck

Keeping it Simple: Bitcoin (45k Target)If we take a fib retracement from the last high to the low during the crash we get these levels. You can see these levels have consistently been major for Bitcoin, or example the 0.5 line has had a lot of price action around it. Now that we broke out we're approaching the 1.6 level at 30k. I'm posting this to show how price isn't just up in thin air, we are right below major resistance. Personally I have sold my Bitcoin and will buy back if there is a clean break at 30k. If we look at the past bull run of 2013 and take a retracement we actually paused at the 1.6 level as well and then shot through to the 2.6. History doesn't exactly repeat but it tends to rhyme, if we do break past the 1.6 level we can expect a 45k target. Until we break 30k there is just too much risk holding it here especially considering everyone who bought prior to these past few months are now in profit. Long term I think Bitcoin / blockchain will be one of the most important contributions in history and am very bullish, if there is a dip or a break of 30k I will buy back. Hope everyone is staying safe and goodluck

Bears winning [$BTC Analysis - 7/10]Seems bears have been successful in holding the last stand point for the bears, however our orange harmonic was invalidated, our blue one is still valid, the 0.886 wasn't matching until I moved XA from the preceding local top to the current one; the PRZ has been listed for that harmonic; and there is also a smaller harmonic aswell which has a point of support at this zone and one in the Aqua harmonics PRZ. I have not listed the first one since the confluence gives higher probability to the PRZ. We have also broken our previous HL so there is a bearish expectation at this point; however we can expect some sort of bounce within the 61.8% and the 78.6%. for the Aqua Harmonic PRZ.

I will no longer be labelling my analysis' as a daily analysis because sometimes there are formations that last longer than a day, and with the daily analysis it just ends up being repetitive say if there is not much movement. So will be calling my analysis' just that, analysis'. With that being said I will try to get a chart done for the times of volatility when price action is being wild. just don't want there being any confusion. Thanks!

Going.. going.. going... [$BTC Daily analysis - 7/4]Little update for those following the daily analysis , since it was on the 4hr chart it is hard to update on the structure daily, but will follow the underlying trend for the 1hr. The shark is still in play however I have removed it from the chart to de-clutter it (See 7/3). The short-term structure is still bullish but it is near a possible LH for larger structure which would be the sweet spot for shorting. The high right above our current is our last chance for the bears to keep the structure going, if not; the bulls have fully taken over and you can move from sell the rally to buy the dip for the mid-term.

There is also hidden bearish divergence on 4hr and bearish divergence on the 4hr aswell as the 1hr.

Bulls paving their way? [$BTC Daily analysis - 7/3]My apologies for no daily analysis for 7/2, am still under the weather. The harmonic I mentioned before that would probably play out if we break above our NSH has played out. However, the PRZ for the Orange shark was based off of the candle bodies, the fibs placed from the wicks have not been breached so it is not invalidated just yet and we are near a LH resistance; the TP's have been adjusted accordingly. If bulls can close above our next LH the bulls are back for the medium-term (couple of weeks most likely) - but expect a HL after a NSH is made if so.

Will update with the 15m interval as we go and plot the NSL's and LH's or NSH's and HL's

If going short, would look for exit around LH if closes above, with a physical stop above the LH above the closest LH incase the momentum is very strong and we get a huge green candle.

If we retrace here there is also hidden bearish divergence present on the 4hr.

Shaaaark! [$BTC Daily analysis - 6/29]Today was a wild day, bulls came in and painted a huge green candle that took us to the top of the megaphone resistance, however I am a bit conflicted as I mentioned before how we are making structure failures all around because of the nature of this formation (Expanding not contracting) so stops will be hunted. We are making NSH's for the new structure which gives reinforcement for anyone who is a bull right now, however we will see how long it lasts. I have spotted a potential harmonic Shark and have marked the PRZs in Aqua and Green, if we close above the 1.618 it will likely be an invalidation of the harmonic pattern and a validation of a larger harmonic. I will keep you updated as we should make a decision here fairly soon. A bullish expectation failure gives reinforcement to the harmonics PRZ's in Aqua.

Zzz [$BTC Daily analysis - 6/28]Not much to update today; price action is lingering within a range. Is resting on the top of the channel so if we should expect support a good spot would be at the retest of it. However I am still bearish over-all as I don't think bulls will have the momentum required to bring us past previous NSH's, targeting TP2 and areas around if we cannot break our green lines fairly soon. If does break the green lines we have a bullish expectation and it is safe to be long. DI- also above DI+ with ADX starting to work its way up. Will try to see if any noticeable Harmonics on the chart as well for the 6/28. Thanks!

Descending channel [$BTC Daily analysis - 6/27]The bears have taken the reigns of the megaphone as they have broken through the bottom of the range we had in our previous analysis and the HL made by the bulls. I am targetting the 61.8% ratio for the PRZ of after D for the Harmonic as TP1, and if that breaks downward, TP2 would be the bottom of the megaphone boundary (probably the last bounce we'll have on it if we do break through TP1 to produce a NSL. TP2 has confluence with an Elliot Wave count I have which lists 5.5k and 2.8k as possible long-term supports. I have posted the trendline below the price action and dragged it to the top of the price action to produce a channel, if all goes well it should follow that channel; however that means a slow descent down if we don't make any significant price dumps.

Leave a like if you'd like to follow this analysis as I will answer questions and update in the comments if anything significant happens before 6/28.

Range-bound [$BTC Daily analysis - 6/26]Seems the megaphone is still present and still vicious. Looks we might also be retesting the PRZ for D leg of the Harmonic to close in that area, if we break above our short-term harmonic will be invalidated and a larger timeframe harmonic will be validated; if this occurs the larger Harmonic will be included in tomorrows daily analysis since it is a higher timeframe harmonic . We are making NSH's and HL's but I think we still need one more strong NSH through the white upper boundary and red LH to be completely bullish since that was our NSL that broke through our bullish expectation. If the harmonic doesn't invalidate I will be aiming to take profit at the 61.8% area. If it breaks and close below 76.4% there is a high probability we will make a NSL.

NSH = New Structure High

HL = Higher Low

NSL = New Structure Low

LH = Lower High

R = Range

Leave a like if you'd like to follow this analysis as I will answer questions and update in the comments if anything significant happens before 6/27.

Thin thread [$BTC Daily analysis - 6/25]Bulls seem to have taken control for the short-term but as we are making NSL's and LH's on a smaller timeframe than 1hr it is safe to assume we will continue our bearish momentum downward to either make a HL or a NSL. There is also a megaphone formation, and a harmonic shark formation. TP1, TP2 and TP3 have all been listed. (50%, 61.8%, 78.6%) If all these TPs are broken through it is safe to short past $5,748 for a NSL, but be careful once that low is broken as price behaves like an elastic, if you stretch it one way it will snap back in the other but the NSL's would reinforce our bearish expectation. If we break above our LH before a NSL is made on the small substructure, high probability we go to retest the orange line, and if that is broken, it should be clear until around $6,700-$6,800.

If you enjoy my analysis be sure to drop a like as I will try to do one everyday for Bitcoin.

Bears back in control [$BTC - Daily analysis - 6/24]Seems bulls have lost their position in the short-term structure as we have wicked through the HL, needs to close below (aqua line) for us to have Bullish expectation failure for the short-term and back to Bearish expectation for the longer term, was expecting it to happen sooner but we retested the LH and failed to close above. Also a harmonic Shark seems to be appearing which would add a price prediction to this analysis. If in short, can take profit at the points listed and prepare for a short-term bounce.

Bears have over-powered the bulls [$BTC Daily analysis - 6/22]We have had a bullish expectation failure for the short-term structure upward, which means we have a bearish expectation and there is a high probability chance bears are good to reload shorts and continue shorting. Bearish expectation failure point has been listed.