The End of the Altcoins Bull Market? BTC.D Turns Bullish?Bitcoin Dominance produced a bullish trend that was more than 1,000 days long. While this was a major development, the action never happened just straight up. There were always fluctuations.

Bitcoin Dominance broke out of a major rising wedge pattern. A pattern that lasted years in the making.

Recently, Bitcoin Dominance produced the highest bearish volume since 2021. A strong chart signal.

The major breakdown following the multiple years long uptrend signals the start of a change of trend. A downtrend. This downtrend is extremely bullish for the altcoins market because BTC.D only goes down when the altcoins are going up and doing so faster than Bitcoin.

What we are seeing now is an inverted correction, a pullback. Simply put, BTC.D already made a strong drop and it needs some relief. This relief is not the end. Bitcoin Dominance can move just a little higher to later resume its newly developing downtrend. Which means that the altcoins market bull market has not reached its end, it is only getting started.

Thank you for reading.

Namaste.

Btcdom

Bitcoin Dominance Weekly · Highest Bearish Volume in YearsThis week Bitcoin Dominance Index is producing the highest bearish volume session since February 2021. More than 4.5 years.

This week we have the strongest bearish action since June 2022. We can say that the altcoins market bull market is not only fully confirmed but already underway. We are already experiencing the best altcoin season since 2021 but it is still early, this is only the start.

Bitcoin Dominance is set to produce the strongest drop in many years and this only happens when the altcoins go ultra-bullish.

Bitcoin is moving sideways right now near resistance. As Bitcoin does this, the altcoins continue to move forward. This is classic bull market dynamics. When Bitcoin consolidates at a high price, the altcoins tend to explode. You can expect this pattern to continue to repeat for months to come. There is more good news though.

The fact that the altcoins are growing, perfect examples right now are Ethereum and Litecoin, is a bullish signal for Bitcoin.

It is not like the altcoins will grow and then Bitcoin will drop, no. Bitcoin consolidates and the altcoins grow, when Bitcoin stops consolidating it will move forward and hit a new major high, that is a price just around $134,000 and $136,000. When Bitcoin hits this price the altcoins continue to grow, back and forth. This is the most bullish the market has been since 2021. We will have to wait and see where this will all lead but new all-time highs are expected across all major projects and then some. Bitcoin is already in new all-time high territory but we need a new all-time high on Solana, Litecoin, Ethereum, Cardano, and so on. XRP is already at a new all-time high but it has much more to give.

If you visit @MasterAnanda, you will find up-to-date analyses for all these altcoins with new updated not conservative but realistic and good optimistic targets.

I will continue to share updates throughout the entire bull market. This is only the start. Get ready because the best is yet to come.

Namaste.

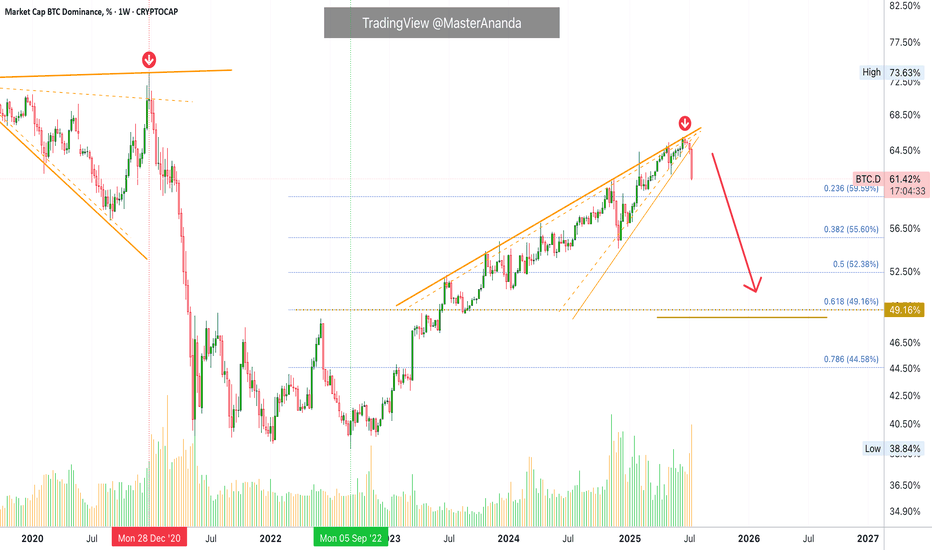

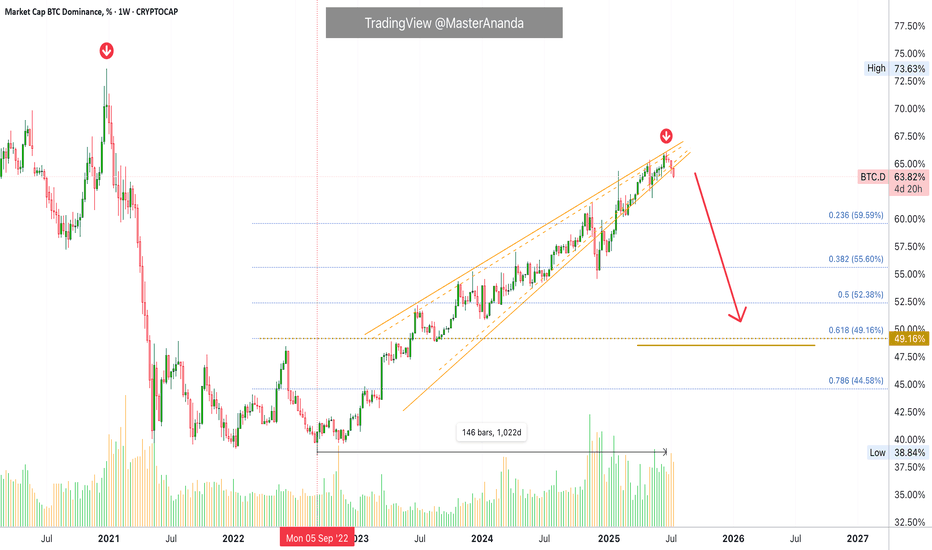

Bitcoin Dominance Long-Term · 1,000 Days Long Uptrend BreaksBitcoin Dominance Index (BTC.D) has been on an uptrend since September 2022, an uptrend more than 1,000 days long.

This uptrend produced a rising wedge pattern and this pattern is as bearish as it gets. During the entire time, from September 2022 until June 2025, BTC.D never ever produced more than 3 consecutive weeks red. Now, in July 2025, we are witnessing the fourth consecutive red week, a major bearish signal. The start of a new downtrend.

The last time BTC.D went bearish was December 2020. The index, as Bitcoin grew to new all-time highs, produced a drop from a high of 74% to a low of 39%. Reflecting strong demand for the altcoins and a very strong rising altcoins market. We are about to witness something similar, better or the same.

As Bitcoin Dominance moves down, the entire altcoins market will move up. Bitcoin will grow together with the altcoins. Everything—Crypto—will grow.

Namaste.

Bullish Altcoins · BTC.D Highest Bearish Volume Since Feb 2021The altcoins market is about to have its strongest and biggest bullish cycle since 2021, or possible ever. We are entering the strongest altcoins season in the history of the Cryptocurrency market.

Good morning my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Bitcoin will continue growing, that's old news but let's start by getting this out of the way.

The altcoins are already waking up from major lows and all-time lows and what follows is something hard to comprehend. The hottest bull market ever for the altcoins. Bitcoin is already far ahead.

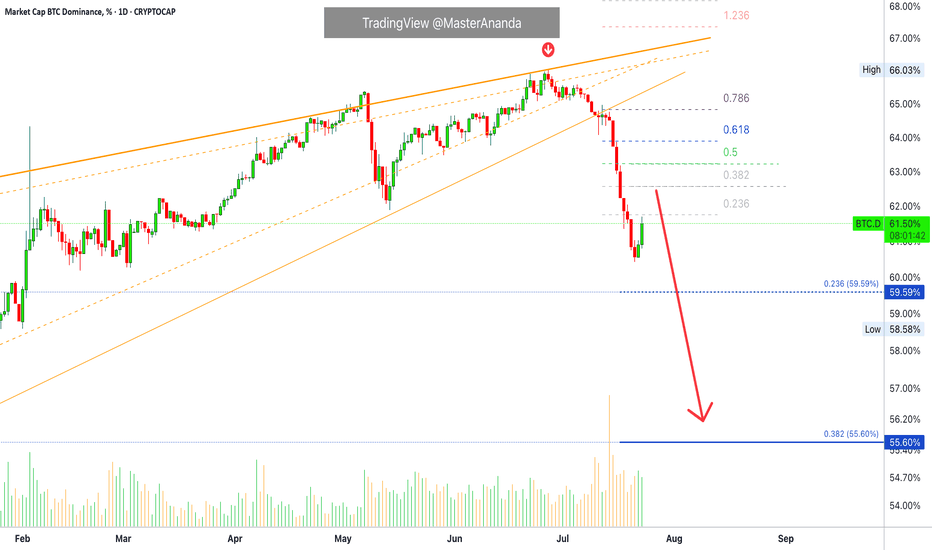

On the 14th of July BTC.D (Bitcoin Dominance Index) produced the highest volume bar in more than three years, since February 2021. This happened after a double-top and only after a drop was already confirmed. In this way this signal carries extra-strength. The 14th of July session ended up closing red.

We all know that Bitcoin Dominance Index goes down only when the altcoins move up. The fact that we have the highest volume in years on a daily basis signals the start of the altcoins market major bull-run. Sustained growth for months and months and months.

Get ready and be prepared. The confirmation is already in place.

The altcoins market is heating up. Crypto is going up.

The wait is over.

Namaste.

Dominance & Altcoins- This graph is purely based on fibonacci law.

- 61.8% is the core of the system ( check rectangles in graph to get it )

- Most of long term traders not even look at the price.

- they just wait the good time to buy using Fibo.

- in 2016 BTC was almost 100%. Altcoins were inexistant. (less than 2% of the market with ETH)

- in 2021 BTC Dominance pushed to 75% (altseason followed the push)

- in 2024 we could see BTC dominance knocks 60% ish ( Altseason will follow )

- BTC is maturing.

- Cryptos are growing.

- Don't look too much at your altcoin wallets.

- Most of the time the story repeats itself.

- Respect the cycle, be patient and eat noodles!

Happy Tr4Ding !

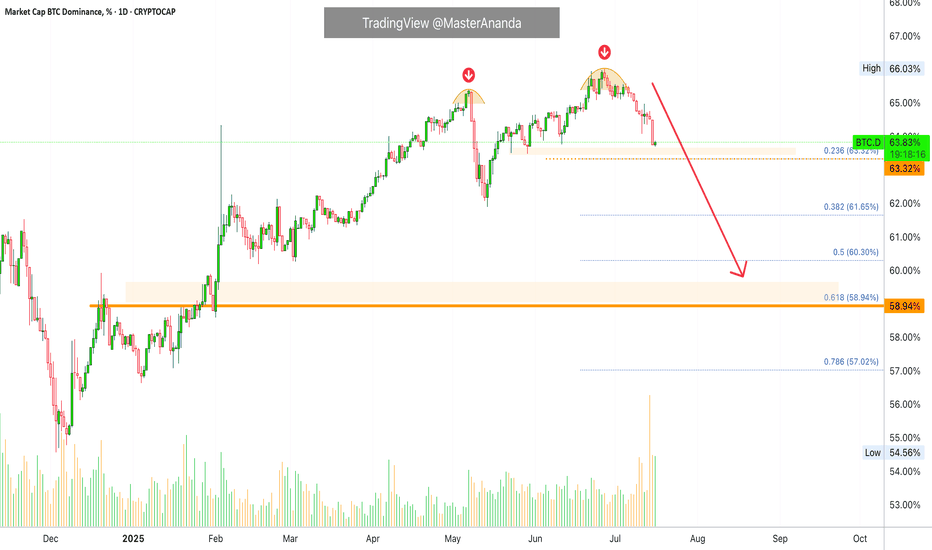

BTC.D – Distribution Confirmed. Is the Final Altseason Next?Over the past couple of months, I’ve been tracking the development of a potential high time frame (HTF) Wyckoff distribution range forming on BTC Dominance (BTC.D), and it’s now looking like that structure is starting to break down.

Back on June 14th, I noted that while we hadn’t confirmed a trend shift yet, BTC.D was showing strength and likely to push into the 65% region, with altcoin weakness to follow. The very next day, I shared my idea of a potential Wyckoff distribution forming — and since then, it’s followed that path almost perfectly.

🧠 What’s Happened Since?

✅ Sweep of the HTF range high at ~65%

✅ Second deviation of the highs

✅ Volume divergence into supply — declining volume + strong rejection candles

✅ Formation of a UTAD (Upthrust After Distribution)

✅ 1D bearish market structure break after the sweep

✅ Price now back inside the range

This is textbook distribution behaviour — even if it doesn’t follow the Wyckoff schematic to the letter, the key elements are present: deviation, volume drop-off, and structural breakdown.

🔮 What Comes Next?

BTC.D is currently holding inside a prior unmitigated daily demand, but given the structural shift, I’m expecting:

A pullback to 65–65.5% (daily supply + range high retest)

Then a continuation bearish, targeting:

🔸 49% (prior accumulation range high)

🔻 46% (FVG fill + range breakout retest)

These lower targets align with where I expect altcoins to top out — so as BTC.D breaks down, I expect capital to rotate hard into ETH and alts, triggering the final phase of altseason before the macro cycle top.

⚠️ Why This Matters

This distribution range has been developing since late 2024, and with BTC.D now showing bearish market structure, combined with:

- ETH.D flipping bullish

- OTHERS.D pushing higher

- Stablecoin dominance pairs breaking down

…we’re seeing confluence across the board for a risk-on altcoin environment.

I believe this is the setup that leads to the final euphoric altcoin rotation before the 4-year cycle top prints later this year.

📌 Watch for the retest. Watch for the rejection. The breakdown will be fast.

This is the window — time to stay sharp.

Let me know in the comments if you’ve been tracking this too, or drop your altcoin rotation picks.

— Marshy 🔥

1D:

3D:

1W:

1M:

Do you believe in miracles?Others dominance is crazily undervalued way beyond anyone's imagination, it's been a crazy 4 year bear market for alts. Big question is, when will it end. Can't fathom this industry getting killed by exchanges, just look at others.d go man, crazy low.

If this were the equivalent to 2019/2020 and 2015/2016, any buy in this range is a one in a lifetime opportunity.

If this is like December 2016, well, that would save us years of struggle. Hard to tell what's going to happen but I still believe Trump will give us an extended bullrun that will peak when the FIFA world cup is on somewhere around July 4th 2026.

Great depression? this goes way beyond that, what more of a great depression do you want. Just brutal.

Bitcoin Dominance, RSI Bearish Divergence & Decreasing VolumeThis is a classic signal and we are going to be looking at it on two different timeframes, daily and weekly.

Bitcoin Dominance (BTC.D) is producing a strong bearish divergence with the RSI. The weekly timeframe is very pronounced and I will show you the details below. This type of signal tends to support a change of trend. It appears before the reversal happens but sometimes it can take years before it goes into effect.

» BTC.D Weekly RSI

Here you can see the RSI peaked October 2023. Then a lower high October 2024, then again in April 2025 and finally last month.

As the RSI produces lower highs BTC.D is producing higher highs.

This signal is supported by decreasing volume. Bitcoin Dominance continues to climb higher while trading volume continues to drop. Both signal support a change of trend soon and together they become stronger.

» BTC.D Daily RSI

The daily RSI peaked June 2023 but we will focus on the short-term as we already have a strong signal coming from the weekly.

Here we have a peak in May 2025 and a strong lower high in June. Needless to say, BTC.D peaked 27-June thus the divergence but the action is clearly weak.

» Bitcoin daily

There is a long-term rising wedge on the weekly timeframe and this pattern can also support a reversal.

All these signals are bearish but not very strong, still, there is some weakness on the bearish side for this index. This means that the action can turn bearish tomorrow or it can continue rising for weeks or months before turning red.

These signals are pointing to a reversal but they do not give us a specific date. Can happen next week, next month or in seven months. If we focus on the altcoins, the way they are looking and how long will it take for them to grow, then this index can turn bearish within 2-4 weeks. Bitcoin will also grow as the altcoins market grow. Everything Crypto will grow in late 2025.

Thanks a lot for your continued support.

Namaste.

Bitcoin Dominance Daily Bullish Altcoins ConfirmedThere is an interesting signal here on the daily Bitcoin Dominance index chart. Four days red. This signal has not happen since February and it is most certainly bearish.

After 26-June the index went red four days after hitting the highest reading since January 2021. This highest reading ended up producing a rounded top and the action moved back below the 7-May top which was the previous highest reading since 2021.

Now notice the purple line on the chart. This is the 7-May peak price. Yesterday, BTC.D was trading above this level but moved below today. The candle ended as a Doji, lower high and today turning bearish signals growing bearish momentum.

You can check the weekly timeframe for additional signals including the MACD and RSI. You can find it by visiting my profile @MasterAnanda (Make sure to follow.)

In November 2024 BTC.D went extremely bearish and the entire altcoins market produced a major advance; Bitcoin also moved forward, the same can happen today. It is not certain the specific date, can be tomorrow, in a weeks time or within months... What is certain is that the bullish wave won't last as little as in April-May 2025 nor November-December 2024, both instances lasted only one month, this time around the bullish wave can last between 3-6 months.

Some pairs will grow straight up for months. Others will experience strong volatility but with a bullish bias. Marketwide bullish action. Bitcoin and the altcoins.

Thank you for reading.

Namaste.

Altseason isn’t cancelled, it’s just delayed. Here's WHY!CRYPTOCAP:BTC Dominance Update:

Altseason isn’t cancelled, it’s just delayed.

The key zone to watch is 69.5%–73% dominance. That’s where we’re likely to see a strong rejection if it doesn't start soon, which seems unlikely given the current circumstances.

The longer it takes to reach that level, the stronger the altcoin rally will be once it hits.

This isn’t hope, it’s exactly what the charts are showing.

Historically, 70% dominance has acted as a major reversal zone.

If there are signs of reversal before this level, I'll let you know beforehand.

So follow me if you don't and share this chart with your crypto friends.

Do not forget to keep cash/stables!

Let me know what you think in the comments.

Thank you

#PEACE

WARNING! Sell Your Altcoins, -40% Drop AheadHello, Skyrexans!

The title of this article is made specially for haters. I see euphoria on each small drop of CRYPTOCAP:BTC.D and understand that altseason now will not happen. People are still holding and dreaming Lambos. This is very bad for potential growth, so I expect only dump on risky alts with the new dominance push!

Look at the 4h time frame. As you remember from my previous analysis I expect the global wave 5. In my opinion waves 1 and 2 have been finished already. Wave 2 represented as an irregular ABC correction. Target at 0.38 Fibonacci has been reached. Now it's time for wave 3 which will reach 67%. During this dump on altcoins I wanna see total disappointment of moon boys and selling on every local bounce. I will repeat once more, market shall be cleared from the crowd to go up.

I am not an altseason hater. I am also holding some altcoins, but it's important to understand the real picture and have the right exaltations. Otherwise you will be disappointed and go out from rocket. I wish for clever, patient and realistic people to earn on the altseason, but first of all market need to persuade greedy and disrespectful people to escape altcoins.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Altseason Will NOT Start While You Are Holding Altcoins!Hello, Skyrexians!

Time for the negative article about CRYPTOCAP:BTC.D which is our favorite topic recently because I see now the euphoria again that altseason has been started. The answer is no, it has not and the main reason is the crowd which still holding altcoins. I told many times - sell altcoins and altseason will be started.

Let's go to Elliott waves. As I told you wave 4 has been finished at 0.38 Fibonacci level and with the Awesome Oscillator cross of the zero line. Now it's time for wave 5. Target is the same equals 67%. Only when we see this price and the double divergence we have a chance that liquidity will transfer from Bitcoin to altcoin. Next 2 weeks will be disaster for all altcoins holders.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Bitcoin Dominance Is Growing, But Don't Panic!Hello, Skyrexians!

When I shared last update on CRYPTOCAP:BTC.D I mentioned that not sure that altseason has been started, now I decided to go back to my first scenario where dominance shall reach 67%.

You can tell me that wave 4 shall be ABC shaped and now we will see dump to 61%, but dominance usually has the very sharp corrections, moreover 0.38 Fibonacci has been reached and Awesome Oscillator crossed zero line on 2 days time frame. Wave 4 is likely to be finished. Now wave 5 is going to the most likely target at 67%. This pump will be fast, may be in 1-2 weeks. Also wanna tell about disaster max target at 72%. This target is very very unlikely because it will break all picture on 1 week time frame, but also let's just keep in mind. This analysis perfectly correlates with ATOM analysis, which is also actual for all altcoins.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Bitcoin Dominance Double Resistance – Altcoin Breakout Ahead?Bitcoin Dominance Double Resistance – Altcoin Breakout Ahead?

Post with Emojis:

📊🚀 Bitcoin Dominance Double Resistance – Altcoin Breakout Ahead? 🌈📉

Hey Traders!

BTC Dominance just hit a critical confluence of resistance at the top of the ascending channel (62.82% to 63.53%) and is already showing early signs of rejection. History tells us this zone doesn’t hold for long—check the left side of the chart for past failures!

📚 What This Means:

If dominance rolls over here, expect altcoins to finally break free and start outperforming. 🌱

Watch for a key breakdown below 62.32% to officially kick off the next wave of altcoin dominance.

Targets for dominance on the downside: 59%, 56.9%, and possibly even 54% over the coming weeks.

📈 Probability Outlook:

✅ 70% chance BTC dominance gets rejected—altcoin rally ahead! 🚀

❌ 30% chance dominance breaks higher—remain cautious on alts.

This is the moment we’ve been waiting for. Altseason isn’t declared yet—but the gates might just be opening!

One Love,

The FXPROFESSOR 💙

Altseason Has Been Started (But I Am Not Sure...)Hello, Skyrexans!

Let's carefully make update on CRYPTOCAP:BTC.D because previous analysis where I bet for local top slightly above 65% is playing out even stronger than I supposed. Today I will show you why altseason could be already started, why I am not sure and where is the critical level.

Earlier I told that daily time frame does not suit for this Elliott waves cycle measurement, but we have 155 bars there, slightly above 140 bars, so we can count it as a valid. Moreover we can see zero line cross on Awesome Oscillator, but again only slightly. That's why I am not sure if uptrend on dominance is over or we shall wait for earlier predicted wave to 67%. But anyway I am sure that 60-61% will be reached before, so it was not a mistake to be in altcoins from 65.3%. When price will reach Fibonacci level we will see how it will approach it and make a decision about our altcoin's holdings.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Bitcoin Dominance Important UpdateHello, Skyrexians!

CRYPTOCAP:BTC.D showed rapid decrease and as a result we have some changes in the analysis. Hope you remember the yellow Elliott waves cycle which according to my previous analysis was not finished. But now looking at the Awesome Oscillator I changed my mind and now we in the higher degree wave 4.

We will switch from 12h time frame to the daily and can see that wave 4 is already in progress. This wave is going to be ABC shaped and in my opinion reach 0.5 Fibonacci level at 61% or even lower to 60%. Then the final wave 5 will reach 67%. Wait for the update I will tell you when wave 4 is finished.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

This Has Happened To Bitcoin Dominance ...And Alts Are Ripping!Trading Fam,

For the first time since December of 2024 Bitcoin Dominance has dropped from this ascending channel ...and the drop is nothing to be scoffed at! Dominance has dropped and it dropped hard, possibly signaling that finally, for the first time in 4 and a half long years, altcoin season may be starting!

Now, I know this altcoin season will probably not be like those we have seen in the past. There are simply too many altcoins out there. This will dilute the market in ways we have not experienced in the past. Nevertheless, the best of the best will shine bright and will be where money is made.

This is just the beginning. If Bitcoin dominance continues its trend downward (and I believe it will), I see the best altcoins doing 10-20x from here. And yes, some of these will be memecoins - Fartcoin, SPX6900, Trump come to mind (to name just a very small few).

If you are not in the game right now, I'd suggest preparing yourself. This stuff is going to take off so fast that it will make heads spin. FOMO will be rife. You've had 4 and a half long years to study and do your research, now it the time to put all of that knowledge to the test.

I suspect the cycle will be quick. Like 6-8 months quick. While Bitcoin continues to make steadfast gains and all the attention, headlines, and focus remain on it, Altcoins will start to scream in the background. Our new SEC chairman is crypto friendly. Age old illegal lawsuits by Gary S.(Satan) Gensler and the SEC are being lost or dropped at an exponential rate. This freeing effect will enrich the crypto community in ways never imagined.

Don't give up now. This is not the end. We are only beginning.

If there is anything that I have learned over my years of investing in future thinking products and assets it's that the collective is extremely slow in adapting technologies that will be the future. On average, the collective is often 15-20 years behind. The collective is nervous, unsure, anxious, hesitant, and doubtful. But we've known all along that crypto is the future. Believe. This is the beginning. Good things are about to happen to those who have been patient.

Best,

✌️ Stew

Bitcoin Dominance TA, Bearish SignalsRecently I spotted a very strong, long-term bearish signal on this index. A triple-bearish signal as it is present with three indicators. I am talking about a bearish divergence.

Volume has been dropping significantly as the index moves higher.

The weekly RSI peaked October 2023 and has been producing lower highs. The MACD peaked July 2023.

These are long-term, but let's have a closer look and consider the daily chart.

Here we have some interesting signals as well, let's start with the candles:

—Here we have a rising wedge ending in a rounded top and long-term double-top. The uptrend is also in risk of failing. A breakdown of this uptrend, which can happen anytime, would result in a strong crash of this index.

Next is the daily RSI:

—The peak happened November 2024. There is also a short-term lower high as the peak this month happened on the 7th of April, the index peaked on the 22nd.

—The daily RSI is already trending lower.

Clearly the most interesting and revealing of all three indicators is the daily MACD. Let me show you the chart first and then I'll describe the signals:

—Here the lower high is so strong that reveals what is coming to this index. The MACD peaked in February and produced a lower high this month, April. Notice the bearish cross, it happened yesterday.

The daily MACD and RSI trending down with short-term, mid-term, long-term and long long-term bearish divergence all point towards a lower reading on these oscillators.

The last major drop for this index happened in November 2024 with the bottom hitting a month later, December 2024. At this time Bitcoin produced a very strong advance as well as the entire Altcoins market, it was awesome.

It is surely interesting to notice that the index recovers and moves higher while Bitcoin continued to grow. But at that time the Altcoins were starting their correction. Most of the Altcoins peaked late November 2024 and some in early December 2024. So this index is more related to how the Altcoins behave rather than Bitcoin.

When it drops, it does not mean that Bitcoin will drop but that the Altcoins will grow. When it grows, it does not necessarily means that Bitcoin is moving up but that the Altcoins are moving down.

We know the Altcoins are set to produce their strongest growth period since 2021. This Bitcoin Dominance index works as confirmation. It leaves no room for doubt.

» Doubt can remain open as to whether the start of this rise will happen tomorrow or within a few weeks. Short-term, anything goes; the market can become erratic and produce some strong shakeouts, specially preceding a major wave of growth. But after 2-3 weeks, it is 1,000% certain that the entire Cryptocurrency market will be bullish and up. Regardless of what this index does or anything else for that matter. When the time is ripe, the market grows.

The time is ripe right now... You will be happy with the results.

Namaste.

The Most Important Bitcoin Dominance Analysis!Hello, Skyrexians!

This CRYPTOCAP:BTC.D analysis can be a little bit complicated, but this is very important update on our previous analysis. Dominance is next to the top, but now the period of unexpected moves has been started.

Today we have 12h time frame to look at the internal wave structure. Tonight dominance hit the higher degree wave 3 target at 65.3% like I told you in previous article, but the subwave inside the wave 5 inside wave 3 is not finished. Let's count the waves for yellow cycle and we can see that there were no the wave 4 because Awesome Oscillator is still above zero. When it will cross it the yellow waves 5 will finish wave 5 inside wave 3. Now I expect the move to 63-63.5% then retest of recent high again then more significant correction and then another one wave to the upside - final big shakeout.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

No Altseason Until BTC.D Hits 70%?Bitcoin Dominance (BTC.D) is currently climbing and approaching a major resistance zone between 71.38% and 73.06%. This area has proven to be a strong turning point in the past, acting as a top back in December 2017, September 2019, and again in 2021. These repeated rejections suggest that this zone is likely to remain a key resistance.

Right now, BTC.D is sitting around 64.66% and still has room to push higher. However, if it enters the resistance zone again, there’s a strong chance it may face selling pressure and start reversing. The white arrow on the chart shows the possible move into resistance, while the red projection outlines the expected rejection and potential decline back toward the 54.63% level—another important support zone from the past.

In simple terms, BTC dominance might be nearing its peak, and once it reaches the upper zone, we could start seeing altcoins gain more strength as dominance falls. This chart helps anticipate when the market might shift from BTC-led rallies to altcoin outperformance.

Bitcoin Dominance: My Global Overview Hello, Skyrexians!

Yesterday we made a local update on CRYPTOCAP:BTC.D where pointed out that waves order has been changed a little bit, today we will take a look at this chart globally. Soon we can have a great reversal but we will feel pain before it because target above 66% will happen.

This is monthly chart. The first greatest altseason looks like an impulsive wave 1. Then correction has been started. The first pullback finished inside 0.61 Fibonacci zone and it contains on 5 waves. This is the sign that it's wave A. If wave A has 5 waves it means that global wave 2 will be zigzag ABC or triangle ABCDE. We will exclude the zigzag because wave C has almost reached the wave A bottom, and it cannot be flat correction because wave A is impulsive, so we are in huge triangle. Waves A, C, E shall be impulsive.

Current wave is wave C which can reach any target next to the wave A top. Our earlier predicted 66-67% looks reasonable and we need to focus on internal counting. This chart is just to make us sure that we are next to reversal.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Bad News From Bitcoin Dominance: Pain AheadHello, Skyrexians!

I got sick for these 5 days that's why has not shared updates, but market was very boring so we didn't miss any significant move. CRYPTOCAP:BTC.D concerns me now because to end this trend we need to see any significant correction, but we didn't. On the 12h Awesome oscillator was not able to cross zero line and reversed to the upside, so our main change is that daily time frame measures the wave 3 inside the major impulse.

If we count waves inside this impulse price is approaching 1.61 Fibonacci level at 65.3% and trust me it's much better to see it's reaching before the drop. When this wave will be finished, wave 4 will happen. It can bounce significantly to 61%. This is strong target area and I am sure we will be there soon. Wave 5 can be extended, can be not. The max target is 71%! Sounds awful. The likely target at 66-67%, to make it more precise let's wait for wave 4 finish.

I plan to close in profit those part of trades which has been opened after Feb 3 dump on this potential bounce to have money to add on the last huge shakeout. People believe in altcoins too much, very unlikely to have altseason now. Ready for hate!

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!