BTC/USDT 1DAY UPDATE BY CRYPTOSANDERSHello, welcome to this BTC/USDT 1DAY chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

Show some support, hit the like button, and follow and comment in the comment section. this motivates me to bring this kind of chart analysis on a regular basis.

CHART ANALYSIS:-Bitcoin (BTC) was once again trading lower to start the weekend, as the token moved back towards a recent price floor.

BTC/USD fell to an intraday low of $16,564.61 in today’s session, which comes less than a day after hitting a high of $16,795.20.

The move sees BTC move closer to this week’s support point of $16,000, which has been in place since the FTX collapse.

Looking at the chart, today’s drop in price comes as a hurdle was hit on the 14-day relative strength index (RSI).

This wall of 38.00 on the indicator has seemingly prevented bulls from recapturing the $17,000 mark, and in turn, opened the door to a bearish reentry.

Should Saturday’s bearish momentum continue to intensify throughout the course of the weekend, BTC will likely edge closer to $16,000.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

Btceth

BTC/USDT 1DAY UPDATE BY CRYPTOSANDERSHello, welcome to this BTC USDT 1DAY chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

Show some support, hit the like button, and follow and comment in the comment section. this motivates me to bring this kind of chart analysis on a regular basis.

CHART ANALYSIS:-Bitcoin (BTC) rebounded on Friday, as the token moved towards the $17,000 mark heading into the weekend.

Following a low of $16,479.99 in Thursday’s session, BTC/USD raced to an intraday high of $16,947.06 earlier today.

The move sees BTC move further away from its recent floor of $16,200, which was a point of stabilization following the volatility caused by the FTX collapse.

Looking at the chart, this surge has pushed BTC closer to a ceiling of 38.30 on the 14-day relative strength index (RSI).

As a result of this collision, prices have since dipped, with the token currently trading at $16,720.43.

In order to extend its earlier run, bitcoin bulls will need to break the current ceiling on the RSI indicator.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

Bitcoin - The FTX's domino effectWith BlockFi added as another troubled company to our long list, we continue to be bearish on Bitcoin and the overall cryptocurrency market. We believe that FTX's domino effect is still underway, and more companies will start coming forward to announce damages incurred in this cryptocurrency exchange fiasco. As a result, the industry will see the rise of more regulation in parallel to the 2008 crisis and Lehman Brothers' bankruptcy.

In our opinion, that will lead to the final capitulation in the market and drag the price of Bitcoin much lower from the current level. Over time, however, it might be positive as it will increase transparency and provide more safety for a consumer, potentially luring more institutional players and mass adoption. With that being said, we do not expect it to happen right away or anytime soon.

We believe Bitcoin and other cryptocurrencies still have a long way to go before reversing their primary trend. Accordingly, we stick to our price target for BTCUSD at 15 000$.

Illustration 1.01

Illustration 1.01 displays the daily chart of BTCUSD. The yellow arrow indicates a bearish crossover between 20-day SMA and 50-day SMA; now, these SMAs act as alternative resistance levels.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are bearish. Overall, the daily time frame is bearish.

Technical analysis - weekly time frame

RSI, MACD, and Stochastic are bearish. DM+ and DM- are also bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

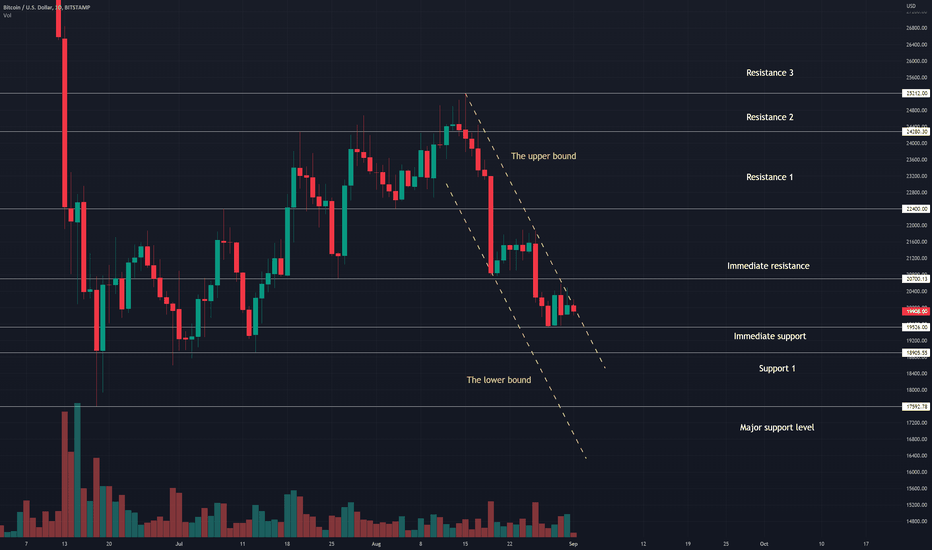

Bitcoin - The market is poised to go SouthTwo days ago, we projected the downward sloping channel on the daily chart of BTCUSD. Since then, the price broke to the upside and retraced back to the channel, increasing the upper bound's significance (and again validating the pattern). Meanwhile, the market sentiment started to turn bearish, with many market participants giving up on hopes of the FED's pivot. As we also do not believe the FED will backtrack on its monetary policy in 2022, we think the mood is set to turn very grim in the month of September.

Because of that, we will pay close attention to the FED's decision on the 21st September 2022. We expect the FED to raise interest rates from 50bps to 75bps, which will negatively affect the economy. As a result, we think the risk-on appetite will deteriorate and lead to high selling pressure. However, we will update our thoughts on that before the meeting.

In terms of other fundamental factors, we see mounting evidence that the world has entered a global recession, with many real economies starting to feel it. Moreover, with central banks around the globe pursuing the destruction of demand, we think the evidence over the coming months will be even more apparent.

Meanwhile, technical factors also point to the downside across various sectors; and across daily, weekly, and monthly time frames. That bolsters our bearish conviction and makes us stick to our price targets at 17 500 USD and 15 000 USD. However, we think the cyclical low might lie far below our price targets. Again, though, we will reassess our thoughts as the trend unravels.

Illustration 1.01

Illustration 1.01 shows the most recent technical developments on the daily chart of BTCUSDT. Yellow arrows indicate two bearish breakouts below prior support levels, a bearish crossover between 20-day SMA and 50-day SMA, and a bullish breakout above the channel followed by the retracement. Additionally, the green arrow indicates increasing volume, which is ideal for confirming our bearish thesis. Now, we will pay close attention to the price action; ideally, we would like to see it take out its recent low at 19 510 USD.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

Illustration 1.02 shows the daily chart of BTCUSD. Additionally, several bearish developments are indicated by yellow arrows. Declining and increasing volume is shown by red and green arrows. We would like to see a breakout below the immediate support to confirm our bearish thesis.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Illustration 1.03

The chart above shows simple support and resistance levels for BTCUSD; for this pair, the low needed to be taken out is 19 526 USD.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

BTC/USDT 1HOUR UPDATEHello, welcome to this BTC /USDT 1Hr chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

Show some support, hit the like button, and follow and comment in the comment section. this motivates me to bring this kind of chart analysis on a regular basis.

#BTC/USDT ANALYSIS

BTC is moving in a symmetrical triangle and currently holding above its support trendline. A breakdown of the symmetrical triangle will confirm a move toward the horizontal support which is also the current low from where we can expect a good bounce.

An effective breakout of the symmetrical triangle will confirm a move toward the horizontal resistance around $18,700 and a strong breakout of it will confirm the further bullish pattern in the market.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

#BTC/USDT 12Hr UPDATE BY CRYPTO SANDERS !!Hello, welcome to this BTC /USDT 12Hr chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

Show some support, hit the like button, and follow and comment in the comment section. this motivates me to bring this kind of chart analysis on a regular basis.

CHART ANALYSIS:-Bitcoin (BTC) moved higher on Friday, as the token rebounded following a recent spell of relatively large sell-offs.

Following a low of $16,290.27 on Thursday, BTC/USD surged to an intraday peak of $18,054.31 earlier in the day.

The move came as the world’s largest cryptocurrency continued to move away from a key support point of $15,800.

As can be seen from the chart, this surge occurred as the 14-day relative strength index (RSI) also rebounded from a recent six-month low.

Currently, BTC is trading at $16.880.58, with the index tracking at 36.89, which is below a long-term resistance point of 39.00.

In order for BTC/USD to continue this current momentum, the RSI ceiling will first need to be broken.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

BTC/USDT 1DAY UPDATE BY CRYPTO SANDERS !Hello, welcome to this BTC /USDT 1D chart update by CRYPTOSANDERS.

I have tried to bring the best possible outcome to this chart.

Show some support, hit the like button, and follow and comment in the comment section. this motivates me to bring this kind of chart analysis on a regular basis.

CHART ANALYSIS:-Market is falling apart as Bitcoin broke the major support level. The weekly support is $15,000-$15,500 area and $12,000-$13,000 area. Binance backs off from the FTX deal and leaves the exchange on verge of collapse. If FTX is not rescued soon then we see more dumps in the market. Better to wait for a clear decision on FTX.

This is not a piece of financial advice.

Hit the like button if you like it and share your charts in the comments section.

Thank you

Bitcoin - The downtrend is confirmed by several developmentsRight after Jerome Powell's speech, the stock market dropped sharply, dragging cryptocurrencies with it. As a result, Bitcoin fell approximately 6%, dropping below 21 000 USD and subsequently below the immediate support. That is particularly bearish as this development constitutes a new low for BTCUSD, further confirming the downtrend. As if it was not enough, volume continues to grow while the price declines, suggesting a strengthening selling pressure.

As for the fundamental factors, it is clear now that the FED's pivot is dead, and there is no reversal in the central bank's monetary policy. As we previously noted, this will inadvertently drag the global economy into a deeper recession, leading to even a higher risk aversion. Consequently, we expect this to pull Bitcoin below its 2022 lows.

Concerning technical factors, these are flashing warning signs across the board. We expect a heavy selloff in the short-term future. Indeed, we would not be surprised to see Bitcoin break below 20 000 USD over the weekend. Accordingly, we stick to our price target of 17 500 USD and 15 000 USD.

Illustration 1.01

Illustration 1.01 shows the daily chart of Bitcoin and simple support/resistance levels. Yellow arrows indicate bearish breakouts. The green arrow indicates growing volume, which supports our bearish thesis; indeed, in our previous post, we stated that this would be an ideal picture to confirm our hypothesis.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

The picture above shows the monthly chart of BTCUSD. Again, extremely shallow volumes hint at brewing troubles for Bitcoin.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - No longer bullish, top in for the rally During the last week, we gave market participants an ultimate warning about the impending reversal in the market. Soon after we argued the top of the bear market rally might be in, Bitcoin fell more than 15%.

A change in our short-term view is mainly influenced by technical factors, which point to the return of intense selling pressure. Indeed, we believe the current selloff will soon escalate into panic mode in the cryptocurrency sector. As a result, we expect highly elevated volatility and Bitcoin to drop to a new low.

Our medium-term and long-term views remain unchanged as we expect bearish fundamental factors to stay persistent throughout 2022 and 2023. Additionally, we believe that the recession will bring risk-off sentiment, wreaking chaos in the stock market as well as the cryptocurrency market.

Because of these reasons, and the ones described in our previous ideas, we stick to our price targets at 17 500 USD and 15 000 USD.

Illustration 1.01

The picture above shows two bearish breakouts below prior support levels. Additionally, a build-up in volume accompanying a price drop is indicated on the bottom; this development is the ideal picture we wanted to see in order to confirm our bearish thesis.

Technical analysis - daily time frame

RSI is very bearish. MACD and Stochastic are bearish. DM+ and DM- performed bearish crossover. Overall, the daily time frame is very bearish.

Illustration 1.02

Illustration 1.02 shows another bearish breakout below the sloping support, further bolstering the bearish case for BTCUSD.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Illustration 1.03

Above is the setup we introduced recently.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - BTCUSD is headed to new lows!Over the weekend, Bitcoin's deceitful price action left many bulls hoping for a bounce on a Monday. Indeed, many analysts rushed to forecast another bottom and continuation of the rally, basing their calls merely on little gains during Saturday and Sunday. However, right after the futures market opened, Bitcoin and other cryptocurrencies quickly erased their early gains.

At this point, Bitcoin erased approximately half of its recent rally. It is currently down about 17% from its peak on 15th August 2022 (when we argued that the top of the bear market rally was in). Today, we maintain the same notion and are extremely bearish in the short term. Indeed, several technical developments support our opinion and point to the impending acceleration of the selloff.

As for the medium-term and long-term outlook, fundamental factors like higher interest rates, quantitative tightening, and the global economy slowing down do not allow us to change our bearish view.

Now, we will pay close attention to the support level at 20 700 USD. If it is broken to the downside, that will further bolster the bearish case for BTCUSD. Additionally, we will watch a volume level; ideally, we would like to see more build-up in it, accompanying further price drop.

In accordance with our outlook, we maintain price targets for BTCUSD at 17 500 USD and 15 000 USD.

Illustration 1.01

Illustration 1.01 shows our assessment of particular price levels and how bearish they are. Yellow arrows indicate developments we used as confirmations for our thesis. The green arrow shows an ideal picture of volume and what we would like to see occur again.

Technical analysis - daily time frame

RSI is very bearish. MACD and Stochastic are bearish. DM+ and DM- is bearish too. Overall, the daily time frame is very bearish.

Illustration 1.02

Illustration 1.01 shows another bearish breakout that helped us to assess BTCUSD.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

eth update Hi, I'm sorry, I'm late to post analysis, it's because of the conditions in Iran, I'm not feeling well to work

I think the situation of Ethereum is interesting

If it completes the pullback to this line in the weekly time frame, there will be very good bullish conditions for Ethereum and altcoins.

If the pullback is 1324, it will be great, but in the worst case, it can be 1100, and below that, this analysis will be canceled.

Bitcoin - Risk appettite is not picking up muchTwo days ago, Bitcoin broke above the sloping resistance, which is bullish in the short term. However, then it quickly erased gains, and the breakout became invalidated. So far, despite the ongoing rally in the stock market, the price action in Bitcoin has remained muted. We believe that reflects a lack of risk appetite among market participants.

Indeed, at the current stock market value, we would expect BTCUSD to trade much higher from the current level; yet, it merely continues the choppy price action near the 19 300 USD price tag. That tells us something is not exactly right. Therefore, we are very cautious. As for the price targets, they remain unchanged at 17 500 USD and 15 000 USD due to the persistence of macroeconomic factors.

Illustration 1.01

Illustration 1.01 shows the daily chart of BTCUSD and simple support/resistance levels. The yellow arrow points to the bullish breakout above the sloping resistance; volume is declining throughout the rise, which is not particularly bullish.

Technical analysis - daily time frame

Stochastic is bullish. MACD is rising but still below the 0 points; if it breaks above, it will be a bullish sign. RSI is neutral. DM+ and DM- are causing whipsaws, with the ADX hinting at the neutral trend. Overall, the daily time frame is neutral.

Illustration 1.02

Simple moving averages on the daily chart of BTCUSD reflect the neutral nature of the prevailing short-term trend that is currently in place.

Technical analysis - weekly time frame

RSI and Stochastic are trending sideways in the lower bound of the bearish zone. MACD points to the upside but stays in the bearish zone as well. DM+ and DM- are bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - "A rally" in disguiseWith the stock market rising more than 7% from its 2022 lows, cryptocurrencies also enjoy a time of relief. However, so far, Bitcoin's reaction has been relatively muted compared to U.S. market indices, reflecting a hesitation among market participants and their lack of appetite for risk assets.

We believe the current bounce-up in the price is once again merely “a rally” in disguise. In accordance with that, we expect the market sentiment to turn irrationally bullish for the short term, with many analysts rushing to forecast the market bottom and trend reversal on every front.

This phenomenon will further highlight the characteristic bear market instability in behavior and opinions among investors. However, we expect these same people to realize in early November 2022 that the FED is still pursuing its tightening path and not backing down, sparking panic and subsequent selling.

Despite that, in the short-term, we will pay close attention to the sloping resistance, price action, and volume. A breakout above the sloping resistance will bolster the bullish case in the short term; however, we do not expect it to impact the primary trend.

Therefore, we think there is no point in backtracking on our price targets of 17 500 USD and 15 000 USD. Moreover, our views are supported by fundamental factors concerning global recession, high inflation combined with economic tightening, and geopolitical issues.

Illustration 1.01

Illustration 1.01 displays the daily chart of BTCUSD and the short-term setup. A breakout above the sloping resistance will be bullish, while the inability of the price to break above this level will suggest otherwise. Therefore, we will pay close attention to this area.

Technical analysis - daily time frame

MACD points to the upside but stays in the bearish territory. RSI is neutral. Stochastic is rising, which is bullish. DM+ and DM- are close to performing a crossover; if successful, it will bolster the bullish case in the short term.

Illustration 1.02

Illustration 1.02 displays the daily chart of BTCUSD and simple support/resistance levels.

Technical analysis - weekly time frame

RSI and Stochastic are neutral. MACD points to the upside but stays in the bearish zone. DM+ and DM- are bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - Low volume foreshadows upcoming liquidity issues The price of Bitcoin stayed flat over the weekend. Additionally, nothing significant has occurred in the cryptocurrency market; therefore, we have no reason to change our bearish views on BTCUSD. This week, we will continue to pay close attention to volume levels hovering around monthly lows and reflecting a little interest in Bitcoin among new investors, making it impossible to reverse the primary trend from bearish to bullish.

Despite that, we continue to see an increase in false calls for the market bottom. That confirms no capitulation has occurred, and indeed, retail investors continue to buy dips, feeding wild rallies predestined to fall later. We expect this behavior to persist throughout the second stage of the bear market, increasing overall volatility.

Additionally, we expect the same from the FED pursuing another rate hike in November 2022. Accordingly, we think this will worsen economic conditions and lead to another selling frenzy. Thus, we remain committed to our price targets and expect them to be hit by the year's end. After that, we expect the market to start slowly progressing into the third stage of the bear market, characterized by the distress selling and abandonment of hopes and dreams among those who once fed the bubble.

Our price targets are 17 500 USD and 15 000 USD.

Illustration 1.01

Illustration 1.01 displays the daily chart of BTCUSD. The red arrow shows declining volume, hinting at liquidity issues in the system. To confirm our bearish thesis, we would like to see a pick-up in volume accompanying a decline in the price.

Technical analysis - daily time frame

RSI, MACD, and Stochastic are all bearish. DM+ and DM- are neutral. Overall, the daily time frame is slightly bearish; however, the trend is still weak.

Illustration 1.02

Illustration 1.02 shows the daily chart of BTCUSD. The yellow arrow points to the exhaustion we presented a few days ago. Interestingly, the price halted its rise slightly above the 50-day SMA.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - Do not get ahead of the marketWith Bitcoin jumping above 20 000 USD, we again see a rise in bullish ideas all over the place, claiming bottoms, new all-time highs, and even trend reversal in spite of bearish macroeconomic factors. Despite that, however, elevated volatility and wild swings in the price do not concern us. Quite the contrary, they give us confidence as the market sentiment reflects what it should be in the bear market - constant swings in the mood of market participants, people trying to get ahead of the market, and tremendous moves in single stock/cryptocurrency titles.

As grim as it sounds, we believe these signs will grow more apparent in the coming weeks as the volatility is set to continue higher, sparking more risk-aversion and another leg down in the market. Our thesis comes from the premise that the FED will increase interest rates in November 2022, further crashing the market in order to beat high inflation.

In our opinion, these macroeconomic factors, combined with technical ones, foreshadow a new low for Bitcoin in 2022 and a continuation lower in 2023. Additionally, the lack of liquidity reflected in low monthly volumes suggests Bitcoin is not gaining any interest among new investors, which is an obstacle for the trend to reverse; meanwhile, this lack of liquidity has been responsible for wild moves up and down in the past months.

At the moment, we pay close attention to the resistance level at 20 381 USD, which is the 27th September 2022 high. For the short-term, it would be bullish if the price managed to break above this level and stay there. However, a failure of the price to hold above the resistance will suggest a return to the lower end of the range, in which Bitcoin has been trading for the past few weeks.

Despite the short-term bullish potential in Bitcoin, we have no reason to backtrack on our bearish views. Accordingly, we stick to our price targets at 17 500 USD and 15 000 USD. We will update our thoughts as time progresses.

Illustration 1.01

Yesterday, we showed several signs of exhaustion accompanying the price rise and subsequent breakout above the resistance level. We said that the breakout would be bullish; however, it became quickly invalidated when the price fell back below the resistance level. That is yet another sign of exhaustion. Despite that, the short-term trend is neutral/slightly bullish; therefore, we will remain very cautious today and closely monitor the price action and volume levels.

Technical analysis - daily time frame

RSI is slightly bullish; however, it is showing signs of exhaustion already. MACD is neutral; if it breaks above the mid-point, it will be bullish. Stochastic is bullish. DM+ and DM- are bullish. The daily time frame is slightly bullish, with a very weak trend.

Illustration 1.02

Illustration 1.02 displays the daily chart of BTCUSD and particular levels of interest.

Technical analysis - weekly time frame

RSI is neutral. Stochastic is also neutral. MACD points to the upside but stays in the bearish zone. DM+ and DM- are bearish. Overall, the weekly time frame is bearish; but the trend grew substantially weaker over the past few weeks.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

ETH/USDT 1DAY UPDATE BY CRYPTOSANDERSHello dear traders, we here new so we ask you to support our ideas with your LIKE and COMMENT, also be free to ask any question in the comments, and we will try to answer for all, thank you, guys.

ETH/USDT UPDATE:-ETH was supported by the ascending line (in green) again, and increased investor confidence prevented the price from closing below it. The chart currently shows no notable signs of bullish momentum as the sideways trend continues for a second week.

The first obstacle is to break $1,500. (in red). This resistance results from the descending line (in yellow) and the 100-day moving average line (in white) colliding. If the ETH can clear this hurdle, the path to $2000 will be clearer.

As long as Ethereum trades below $1,500, a retest of the green support is not ruled out. Closing below this level may take the asset to the next support level at $1,000.

Sorry for my English it is not my native language.

Hit the like button if you like it and share your charts in the comments section.

Thank you

btcHello, I am an Iranian and I was in a bad mood these 12 days and I did not trade at all and I did not concentrate.

I did this analysis now because of your insistence, the current conditions are good for Bitcoin and there is no problem

We have to see Kendal Mahane

I hope this analysis gives you a nice view of the market

Short term blue line

Long-term white line

Bitcoin - BTCUSD to mark new lows by the end of Q4 2022Just hours after our last post, in which we warned about the unsustainability of the up move, Bitcoin erased all of its early gains and retraced below 19 000 USD. This development aligns with what we highlighted as a bear market behavior, characteristic of wild swings from one side to another and market participants trying to fish for a bottom.

That and a looming decrease in corporate earnings and a slowdown in the global economy will further reinforce our narrative about the progression into the second stage of the bear market. As a result, we think the risk aversion will rise, causing more weakness in the stock and cryptocurrency markets over time.

Indeed, we think what market participants have seen up until now, regarding erratic moves and elevated volatility, is just a pretext for what will unravel over the coming months. We believe we will see a dramatic increase in volatility, which will cause even more people to jump back and forth between bullish and bearish narratives.

However, as we did for the past year, we plan to stay unshaken by the high volatility and focus on the market's primary trend. Therefore, we remain bearish and committed to our price targets at 17 500 USD and 15 000 USD. Technical and fundamental factors support our view.

Illustration 1.01

Illustration 1.01 shows simple support and resistance levels. To confirm our bearish thesis, we want to see the price break below the Support 1.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

Illustration 1.02 displays the weekly chart of BTCUSD and two SMAs in a bearish constellation.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - BTCUSD eyes 2022 lowsDuring the weekend, the price of Bitcoin traded mainly flat. For that matter, we have no reason to change our bearish bias. Just like over the past months, fundamental factors will continue to slow down the global economy, resulting in the declining economic performance of the stock market and companies slashing their economic projections.

In accordance with the Dow Theory, that will reflect the market transitioning from the 1st stage of the bear market into the 2nd stage. In our opinion, the cryptocurrency market will continue to drift to new lows, with many speculative coins going bust and never returning to the market.

We believe the persistence of bullish sentiment does not signal a market capitulation. Quite the contrary, we think it perfectly illustrates the vicious nature of the bear market, with retail investors addicted to buying dips and subsequently causing volatile movements up and down.

Because of that, we will continue to filter these movements and focus on the primary trend to the downside (as we do since November 2021). More details are described below in the text and the attached articles.

Illustration 1.01

Illustration 1.01 displays the hourly chart of BTCUSD. Two yellow arrows indicate bearish breakouts, which constitute new lows for Bitcoin since the end of the bear market rally.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

Illustration 1.02 shows the simple support and resistance levels for BTCUSD. If the price breaks below the immediate support level and stays there, it will further bolster the bearish case for Bitcoin.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Bitcoin - No crypto island is happening For some time before the FED meeting, we warned investors that another rate hike would spook the market, leading to weakness across all sectors. Additionally, we speculated that an irrational and short-lived bounce in the price of BTCUSD could occur after the decision due to retail investors buying a dip in hopes of the FED pivot in 2022 or 2023.

However, that was not a message Jerome Powell sent to the market. Instead, he reiterated his hawkish stance toward continuing interest rate increases throughout 2022 and 2023. Based on the dot-plot presented by the chair of the Federal Reserve, the first decline in interest rates can be expected in 2024. That suggests the economy will remain under significant tightening pressure throughout 2023 and likely during the first half of 2024. In turn, that leads us to speculate about the continuation of worsening economic conditions and data, further deepening a recession and risk aversion.

In addition to that, yesterday's price action proved our assessment about the initial bounce and dump correct, with Bitcoin halting its rise slightly below 20 000 USD (right after the decision) and then retreating to the vicinity of 18 000 USD.

In our opinion, this elevated volatility only highlights the bearish sentiment in the market and the high level of anxiousness among market participants. Furthermore, technical indicators across the daily, weekly, and monthly time frames also support the bearish notion. Because of that, we have no reason to backtrack on our bearish views, and we stick to price targets of 17 500 USD and 15 000 USD.

Illustration 1.01

Illustration 1.01 shows the immediate price action of BTCUSD on the 1-minute chart after the FED decision.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Illustration 1.02

Illustration 1.02 shows the daily chart of BTCUSD, two SMAs, and simple support/resistance levels. A new low below the immediate support was constituted, bolstering the bearish case for BTCUSD.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Ethereum - Downtrend continuesOnce again, the price action proved our prediction correct, and Ethereum fell below 1300 USD over the weekend. This bearish development confirms our narrative about the downtrend continuation. Simultaneously, fundamental and technical factors also support this thesis. Therefore, we have no reason to change our thoughts on ETHUSD and stick to our price targets of 1000 USD and 900 USD.

Illustration 1.01

The picture above shows the daily chart of ETHUSD. The breakout below the immediate support/resistance adds to the bearish sentiment. White horizontal lines indicate particular support and resistance levels.

Technical analysis - daily time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the daily time frame is bearish.

Technical analysis - weekly time frame

RSI, MACD, Stochastic, DM+, and DM- are all bearish. Overall, the weekly time frame is bearish.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.