This Is Why The Bitcoin Is Going To Hit $300K After HalveningHi friends hope you are well. Today I'll show you the most significant move by the Bitcoin that can lead it to hit 300K. But before that I would like to show you some developments on the small time charts because these moves are interconnected with the biggest move that I'm expecting in the next one or two years.

The bull flags on daily chart:

As in my last article we have observed that the leading cryptocurrency is aggressively forming a different bull flag on the daily char. And in previous post we were expecting the 3rd bull flag. At that time the candlesticks were being consolidated to form the next bull flag. And now we can see that the priceline has moved up and now it is confirmed that the third bull flag has been formed. Now after reaching the $10,000 level the price action may consolidate at this level to form the next bull flag or it will move a little bit more up and then consolidate.

The Bitcoin may re-test the resistance block as support:

We have already seen that on the daily chart the priceline was trying to breakout the resistance block from $9,000 to $9500 level. This is the most strongest support and resistance block that the Bitcoin could breakout since after the drop off Dec 2017. Once in the month of February 2020 we have witnessed that a Bitcoin broke out this resistance block. After breaking out this resistance block the Priceline tried to retest previous resistance as support but this re-test was unsuccessful and the priceline dropped down all the way up to $4000. Now again the priceline is breaking out this resistance level. The current candlestick is opened above this block. And once the complete candlestick will be opened and closed above this bock like the priceline did this in the month of February then the first step of the breakout will be confirmed. But the final confirmation for breakout will be received when price action of BTC will retest this previous resistance as support and after a successful retest priceline will be moved up from here.

Bitcoin is likely to be failed in breaking out the up channel resistance:

On the daily chart the priceline has formed an up channel. That was started from 13th of March 2020. And this time the price action of BTC is trying to hit hard to break out the resistance of this channel. At this time we have the 3rd candlestick that is hitting at the resistance to have a breakout. Before this we had candlestick of 30th April that was reached up to $9,485 at the resistance of the channel for the breakout. Then the price action reached at $10,000 level on 7th and 8th May 2020. And now there was a strong hope that the priceline will break out the resistance. But again the price action is likely to be consolidated at this level. Now there are two possibilities that the priceline may form a bull flag at this level and move up to break out the resistance or move down again to re-test the support of this channel that is almost at $8,500.

This combination of indicators can give us best signal for bearish move:

As in my previous post I told you that I am using the combination of three indicators to watch the bullish and bearish trend of BTC on daily chart.

1st: Vervorrt heikin-ashi long-term candlestick oscillator.

2nd: MACD custom indicator multiple time frame , this is the same MACD indicators that we use normally but this indicator shows the buying and sell signals with crosses.

3rd: Stochastic indicator.

Ater placing these three indicators I came to know that since October 2019 the Bitcoin is following a certain pattern for the correction rally or bearish move.The Vervorrt heikin-ashi long-term candlestick oscillator is a powerful indicator that shows whether the priceline is in bullish or bearish trend . When it turns green it means that we are in bullish trend and when it turns in red color then it means that we are in bearish trend . Now after observing closer the daily chart it can be seen that whenever this vervoort indicator turns green then the MACD indicator 1st gives the sell signal and then again it gives buy signal and again it gives sell signal and on this third sell signal if the stochastic also gives the bear cross then the leading cryptocurrency turns bearish and starts the bearish move. It can be witnessed form 24th of October to 25th of November 2019. Then from 23rd of Jan up to 13th of March 2020. And if we see the current situation then the vervoort is again in green color and giving indication that we are in bullish trend , and the MACD has given a sell signal and after that we have received the buying signal and at this time the MACD has turned weak bullish so its mean that it is turning bearish. Once it will give a complete sell signal with stochastic bear cross then we can expect that the BTC will again repeat the same move and start a bearish rally.

The down channel on long term:

On the long term weekly chart the Bitcoin has formed a down channel and at this time the price action of BTC is trying to breakout the resistance of this channel. Once the bearish move will be started then the Bitcoin can retest the 100 simple moving average support at $7100, or the 200 simple moving average support is at $5700. But in my opinion if the price action will be dropped from here then first it will retest the support of an up channel that has been formed on the daily chart and that support is around at $8500 once that support will be broken down then we can expect the further downward move upto 100 SMA and then 200 simple moving average on the weekly chart.

The most significant signal is going to be appeared soon that can lead the BTC price to 300K:

Now I want to show you the most significant signal that is going to be appeared after the Bitcoin halving that can lead the BTC price upto $30000. For better understanding we need to see the history of this signal so let's move back to the first Bitcoin halving event in 2012.

The Bitcoin halvening 2012:

For this purpose I have used long term weekly chart and placed the four simple moving averages with the time period of 25, 50, 100, and 200. In 2012 the 100 and 200 simple moving averages were not available therefore we will find this signal using only 25 and 50 SMAs, then we can see that just before the Bitcoin halving the 25 simple moving average form the golden cross with 50 simple moving average then after the Bitcoin halving we had the strong supports these two SMAs. Further in July 2013 the 100 simple moving average was also appeared below the 25 and 50 simple moving averages. Here we had a complete a opened alligator mouth formed by these three simple moving averages. And all these SMAs lifted the price action up very aggressively and the Bitcoin started more than 10000% bullish rally and produced ROI (return on investment) with 1 : 10K ratio within one year.

The Bitcoin halvening 2016:

Now let's move forward to the next halvening event in the year of 2016. Then we can see that just before the halvening the simple moving averages formed an opened alligator’s mouth for forming goden crosses with each other, as we can see that the 200 smple moving average was below all other simple moving averages then 100 moving average was above 200 moving average, then the 50 SMA was above the 100 SMA and the smallest moving average with the time period of 25 was above all four SMAs. And after halvening all these simple moving averages lifted the Bitcoin up very aggressively and the price line of BTC produced more than 3000% return on investment ratio within one and a half year.

The Bitcoin halvening 2020:

Now when almost three days are left in the 2020 halvening event then we can observe that almost an opened alligator mouth by these four simple moving averages is formed. Only the golden cross between 25 and 50 moving averages is due. Once the smallest moving average with the time period of 25 will cross up the 50 simple moving average then we will have the order of these moving averages like 25 simple moving average above all then we will have the 50 SMA below the 25 after that we will have the 100 simple moving average below 50 and the 200 SMA will be below all other SMAs. Then a complete opened alligator mouth will be formed and after completion of this alligator mouth we can expect a really very powerful bullish rally that can be continued for next two years. If we compare the ROI ratio that was produced in the after 2016 halvening then it is 70% less than the ROI ratio that was produced after the halvening of 2012. As we have seen that in 2012 the return on investment ratio was more than 10000%.

Now in order have an estimate the next ROI ratio we can expect 70% less ROI than the ROI after halvening of 2016. And in my point of view that will be very conservative approach. And in this way the next return on investment ratio would be e 1000%. Its mean that Bitcoin can easily hit $100,000. But it is also possible that the Bitcoin will produce up to 3000% rally as it has already produced after the previous halvening of 2016.

And it this time it will be difficult for the moving averages to form a complete opened alligator mouth before the halving event. Because one candlestick is representing one week and there are only approximately 3 days are left in the next halving event. However it doesn't matter whether this alligator mouth will be oepened before the halvening or after. Whenever it will be formed it will produce a very powerful gleefully that can be continued for atleast next two years.

Conclusion:

On the daily time period chart if the price line of BTC will not break out the up channel and we will receive strong bearish signal by the MACD indicator then there are strong chances that the price action may start a correction rally, however on the long term the Bitcoin will be remain bullish and after having event it can turn more strong bullish.

Btchalving

BTCUSD - I don't know!BTC about to meet resistances.

RSI also looks as if it changed direction in the bigger picture.

RSI trendlines sometimes do work and there is a resistance at these levels.

I am expecting a spike to 11800$ in the next 72 hours to fill the GBTC gap. And from there, it's time for a correction with the Halving Hype hopefully ending.

To get a bigger correction the Daily Candles shall not close above 10158$ (trendline closes) to be able to take a short in the next days.

At the end of the day, noone knows what Bitcoin does.

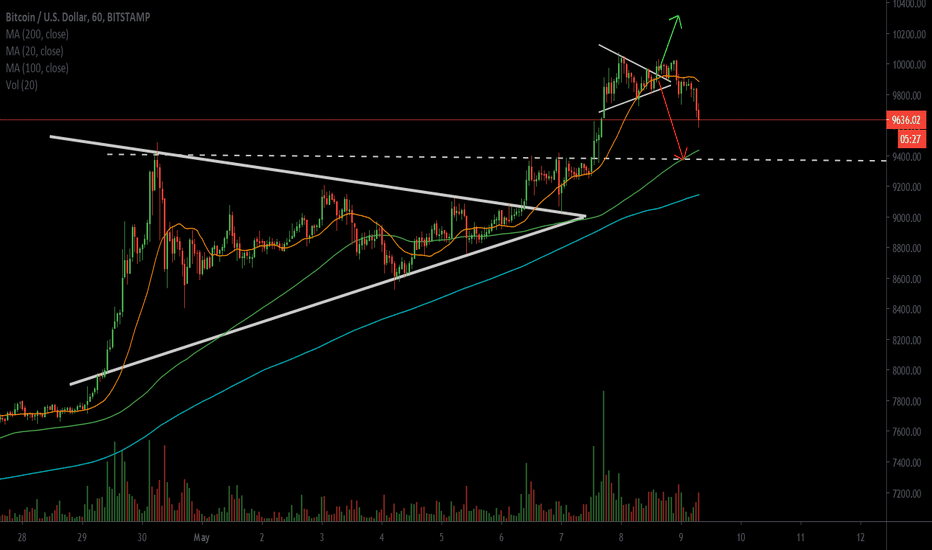

BTCUSD Double Top Resistance|Structural Support| No Man’s Land Evening Trader’s

Today’s Technical Analysis – BTCUSD – entering a new range by breaching structural resistance, a trade will only be valid with a retest of structural support (long) and or break (short) with a bearish retest.

Points to consider,

- Strong bull trend

- Retest of High time frame structure

- RSI overbought

- Stochastics momentum up

- Strong bull nodes

BTCUSD’s trend is extremely bullish breaking multiple structural resistances with the next cluster of support being situated at around $9450 - $9650 (HTF Support).

A retest of the high time frame support is probable for a confirmation of an S/R flip

Break and failure of structural support will increase the likelihood of testing the next trade location at $8500 (local support), for a confirmation, a bearish retest will be probable.

The RSI is trading at overbought conditions, due to the bullish nature of the trend; the RSI can and has reached the 80 level as a pivot.

Stochastics is trading in the upper regions with no clear sell cross, momentum is stored for the bears if a trend reversal is confirmed.

The volume is quite solid, consecutive bull nodes above average; a climax that engulfs all previous nodes will mark the temporary top.

Overall, in my opinion, the higher time frames are extremely over extended; a correction will only be healthy. BTCUSD may trend to test the double top resistance before correcting and confirming the S/R flip.

A short position will only be valid if a breach of structural support occurs with a bearish retest as entry.

What are your thoughts?

Please leave a like and comment,

And remember,

“Don't ever make the mistake of believing that market success has to come to you fast. Trade small, stay in the game, persist, and eventually, you'll reach a satisfying level of proficiency.” ― Yvan Byeajee

CRPT Complete Analysis | 1W 1D 4H1D Chart

Local Support has been tested and the quickness of the tests enhances the quality of the Support zone. Buying 30% position here with stoploss below the Local Support.

If price action do not hold the Local Support then we are most likely to see price in Accumulation Zone.

4H Chart

Price breaking below parallet channel and if it reclaims it and breaks above the falling channel then a buy position has been explained.

Weekly Chart

Accumulation zone have been defined using Lower time frames (1D) and is containing untapped buy orders.

Disclaimer

This is not a financial advise. Trade at your own risk.

Bitcoin Scenarios for Halving and BreakoutCurrent scenarios on the 3 day chart:

After the big 3 day candle which closed yesterday, we're now waiting 3 days for the current candle to close. A close near current price will create a spinning top or indecision candle, which will suggest a strong move upwards (see blue box)

Alternatively as per red box: possible dip to find support around $7425 as a launching pad for breaking through long-term strong resistance trendlines above.

Shorter time-frame analyses to follow to track the scenarios as they develop.

BTC Haveling, and long term analysisLooking at past BTC halvings, we see that we do not have a trend. For something to become a trend you need 3 times to have same-similar results, and we only had 2 evenings so far.

That said, I was convinced, till I did not look myself, that BTC had fallen 50%+, but it looks like it was not the case. We had fall little earlier than halving, and on the second time, we had small retracement for BTC.

Now, if we only do analysis, and this is not a trading idea, maybe it is, but you need to determine your exit points on your losses and gains; we can only see that last 2 times we were above 21 EMA on weekly, and for now we are under 21EMA (yellow line).

My general rule for all charts, I am not generally looking for something to go up if we are under 21EMA weekly, and if we are above 21EMA weekly I love to look for longs and do the Elephant Walk strategy my way.

So for me personally, I look to see, can we pass 21 EMA, and make a positive slope on it, or we will get rejection now.

With this strategy, you will not get ultimate low, or ultimate top, (but combining other methods, you can), but you will stay out from most bad trades, trying to determine low or high.

Happy trading and stay safe and SAFU :)

Bitcoin Before Halving | $5500 or $6200 ? Please Like and Follow First.

Buy Back I - $6425 - $6280

Bull Flag Support + Bullish Gartely Pattern + Previous Trenline + 0.382 Fibonacci Retracement

are coinciding a Support Zone ( $6425 - $6280 )

It's Targets are ( $7450-$7650 )

If Breakout of Bull Flag then Target extends to $10,000 +

Stop Loss : $6100-$6000

Buy Back II - $5900-$5560

Break below from Support Trendline + Weekly Pin Bar Target + 0.618 Fibonacci Retracement

Price acion aims to fulfille the Break out tragets from ascending Support Trendline and Area Between 0.618-0.5 is a important area for a Spot Buy for Bitcoin.

Higher time frame is strongly supporting ( $5900-$5560 )

Stop Loss : $5250

Both Scenario can be Trade with a High Risk/Reward ratio.

So,

$5500 or $6200 is the Low Before Halving ?

What do you think ?

Let me know in the comments.

BTC/USD LONG (SNIPER ENTRY TO THE MOON)BTC/USD LONG

ENTRY 1 $7,148 & ENTRY 2 $6,994

SL $6,713

TP.1 $8,268 & TP.2 $8,768

TP.3 $9,086 & TP.4 $9,468

BTC/USD moved higher to the 8158.25 area during yesterday’s North American session, a shallow retracement that was well below the 38.2% retracement of the depreciation from 9214.67 to 7630.00. The resurgence of BTC/USD weakness was hastened by the election of many Stops related to the downturn from the 10030 area and subsequent upturn from the 8400.00 area. Stops were triggered below the 8901.53, 8741.24, 8635.31, 8592.26, 8552.95, and 8320.67 levels during the depreciation lower. This sharp sell-off increased the likelihood of a move to test bids around the 7793.31, 7574.71, 7265.95, and 6613.45 areas. Another important technical level that traders are closely monitoring is the 7987.25 area.

Price activity is nearest the 50-bar MA (4-hourly) at 8639.32 and the 50-bar MA (Hourly) at 7934.74.

Technical Support is expected around 7630.00/ 7417.31/ 6993.10 with Stops expected below.

Technical Resistance is expected around 8366.39/ 8760.76/ 9121.40 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

BTC, Halving and the 200MA-BTC could bottom, as usual, on the 200 weekly MA - before, during (on the same day) or shortly after halving

-Halving is over-hyped socially, but no one will FOMO or market buy BTC just because of it

-Daily oscillators look like they want to go down

-Volume is decreasing

-Halving would bring volatility, so a quick dip to 200 MA could wake bulls for the start of new parabolic run

-Halving could bring nothing, so many could sell shortly after it due to lost patience/hope