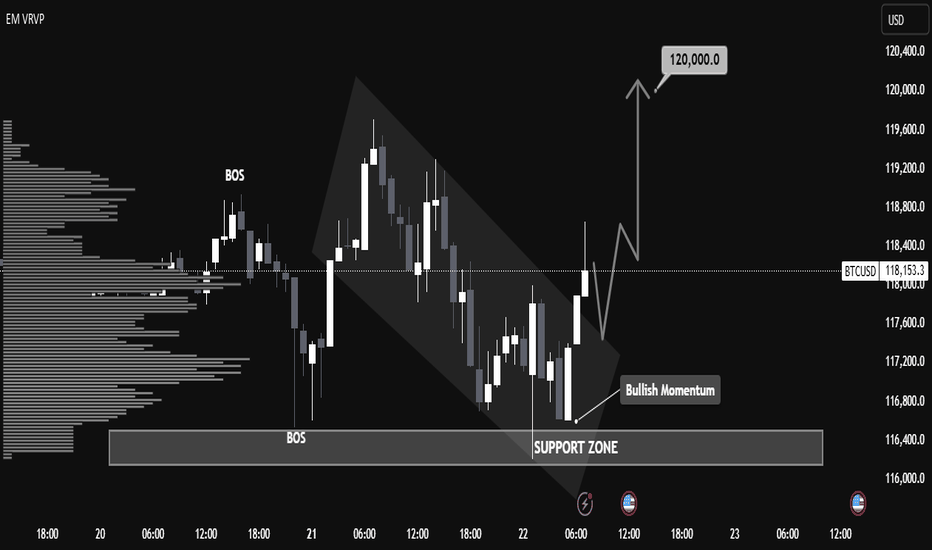

"BTC/USD Breakout Strategy: Identifying Bullish Momentum BTC/USD Technical Analysis – July 22, 2025

📈 Market Structure Overview:

The chart illustrates a recent Break of Structure (BOS) both to the upside and downside, indicating volatility and a shift in market sentiment. The price action formed a descending channel, followed by a breakout with strong bullish candles, suggesting a momentum reversal.

🧱 Support Zone (Demand Area):

Key Level: $116,400 – $116,900

This zone has acted as a strong demand level, with clear evidence of buying pressure pushing BTC higher after testing this area. The volume profile (VRVP) supports this, showing heightened trading activity at this price.

🔄 Bullish Breakout Confirmation:

A bullish breakout from the descending channel occurred just above the support zone, aligning with the label "Bullish Momentum".

The breakout candle has closed above minor resistance, which increases the probability of a trend reversal.

📍 Price Target:

The projection points toward $120,000, aligning with previous resistance and psychological round-number resistance.

This target is highlighted by an expected bullish leg after a possible retest of the breakout zone around $117,500 – $117,800.

🧭 Key Levels to Watch:

Support: $116,400 – $116,900

Retest Zone (Buy Opportunity): $117,500 – $117,800

Immediate Resistance: $118,400

Major Resistance / Target: $120,000

📊 Summary:

BTC/USD has shown a bullish reversal signal from a well-respected support zone after a descending correction phase. The current price structure, volume buildup, and breakout momentum suggest a high probability of continued upside movement toward the $120,000 mark. A successful retest of the breakout zone would provide a strategic entry for long positions with tight risk management.

Btclongterm

The Path to $158K – A Two-Phase Bull RunBitcoin (BTC/USD)

Bitcoin is on track to reach $134,000 by April 2025, following the natural progression of the bull market cycle. However, as BTC approaches this key level, profit-taking and market dynamics will likely trigger a pullback phase, setting the stage for the second and final leg of the bull run.

Phase 1: The $134K Target and Pullback (April–July 2025)

BTC’s bull market momentum is expected to push the price toward $134,000 in April 2025, marking a critical milestone.

As this level is reached, a selling phase will emerge, leading to a correction between $62,000 and $72,000 from May to July 2025.

This retracement will serve as a healthy market reset, allowing for renewed accumulation before the next explosive move.

Phase 2: The Final Bull Run to $158K (Nov–Dec 2025)

After the correction, BTC will enter the second phase of the bull cycle, characterized by renewed investor interest and fresh capital inflows.

A new wave of hype and adoption will propel Bitcoin toward its final bull market peak of $158,000 by November–December 2025.

This mirrors historical market cycles, where a strong initial rally, followed by a correction, leads to an ultimate parabolic run before the market cools down.

Key Price Levels to Watch:

Target 1: $134,000 (April 2025) → Key milestone before the pullback.

Pullback Range: $62,000–$72,000 (May–July 2025) → Profit-taking phase and market reset.

Final Bull Run Target: $158,000 (Nov–Dec 2025) → Peak of the bull market before a potential cycle shift.

Summary: History Will Repeat Itself

Bitcoin's bull market progression follows a well-established pattern of rapid price appreciation, sharp corrections, and a final euphoric rally. With $134K as the first major target, a pullback to $62K–$72K will act as the foundation for the second explosive phase, ultimately driving BTC to its anticipated $158K peak by late 2025.

As always, market cycles repeat, and this time, history appears to be following the same script once again.

BTCUSDT 4h-8h long updatelast BTC idea was a succes check it out for reference. we managed to find good support on the SND after some bloody absorption which made me take a nice and easy 2rr trade. it might not seem much to some of you but this is how real trading goes. actual analysis, actual trading rules, actual entry criteria and a good amount of backtest data to back it up. this is what makes a profitable trader. I tried to look for a re-entry on the second SND touch but it didnt match my entry criteria so i sat on my hands.

I'll be looking for new trades now since another big MB was formed which needs to be mitigated ofcourse.

BTC Bounce from $58,000: Heading Towards ?I've been closely tracking Bitcoin's price action, and my latest analysis suggests that we may be witnessing a significant bounce from the $58,000 level, a strong support zone. After a recent dip, BTC is currently trading at $65,655, and based on key technical indicators, I expect it to rally toward $74,000 with a couple weeks.

however It's only a matter of price breaking above the 67000k resistance level as shown on chart. So this is a key level to watch

Key factors driving this prediction:

Support at $58,000:

This level has historically acted as a strong floor for Bitcoin, with previous bounces leading to upward moves to retest 63k +- 1000points resistance range.

Volume and Momentum:

Increasing trading volume and momentum indicators are pointing to a potential upward continuation.

Moving Averages:

BTC is currently holding above key moving averages, reinforcing the possibility of bullish momentum.

Market Sentiment:

With recent developments in the fundamental space, sentiment is leaning bullish, adding further conviction to the potential for this move.

If this analysis plays out, we could see BTC pushing through resistance levels and reaching $74,000 in a couple weeks time frame ideally. Keep an eye on these key levels as the price action unfolds.

MCG

BTC Bullish BAT Harmonics 42000-38000 coming soon1. Market Analysis:

Asset: Bitcoin (BTC)

Pattern: Bullish BAT Harmonic

Key Price Levels: $42,000 - $38,000

2. Harmonic Pattern Details:

BAT Pattern Overview: The BAT pattern is a harmonic pattern that consists of specific Fibonacci retracement levels. It is considered bullish when it completes near the 88.6% retracement level of the XA leg.

X to A: The initial move, which could be a sharp rally in this case.

A to B: A retracement to 38.2% or 50% of the XA move.

B to C: Another rally or drop that retraces 38.2% to 88.6% of the AB move.

C to D: The final leg that completes the pattern, retracing 88.6% of the XA move, typically signaling a potential reversal.

Completion Zone (D): The pattern suggests that BTC could find strong support between $42,000 and $38,000, which is where the pattern completes. This zone is critical for the potential bullish reversal.

3. Trade Setup:

Entry Point: Consider entering a long position if BTC reaches the $42,000 - $38,000 zone and shows signs of a reversal, such as bullish candlestick patterns, increased buying volume, or confirmation from other technical indicators.

Stop-Loss: Set the stop-loss slightly below the $38,000 level to protect against a deeper move down. This placement accounts for potential market noise while safeguarding your capital.

Take-Profit: Determine your take-profit target based on key resistance levels above $42,000. Possible targets could be around $48,000, $52,000, or even higher, depending on the market structure.

4. Risk Management:

Position Size: Calculate your position size based on your risk tolerance and the distance between your entry point and stop-loss level. Only risk a predetermined percentage of your trading capital per trade (e.g., 1-2%).

Risk-Reward Ratio: Aim for a favorable risk-reward ratio, ideally 1:2 or higher. This means if your stop-loss is $4,000 below your entry, your take-profit should be at least $8,000 above your entry.

5. Additional Confirmation:

Volume Analysis: Look for increased volume as BTC approaches the $42,000 - $38,000 zone. A spike in volume could indicate strong buying interest and confirm the potential reversal.

Fibonacci Levels: Use Fibonacci retracement levels to identify potential resistance zones for take-profit targets.

6. Trade Execution:

Place Orders: Set your buy order, stop-loss, and take-profit levels according to the above criteria.

Monitor the Trade: Keep an eye on the trade to manage it effectively. Adjust the stop-loss to break even or trail it as the trade progresses in your favor.

7. Review and Adjust:

Post-Trade Analysis: After the trade is closed, review the outcome to learn from the trade. Evaluate what worked well and what could be improved for future trades.

Alert!🚨 Bitcoin Update 🚨

In the past day, not much has happened in the crypto market. On the four-day timeframe, we still see a bearish signal indicated by the Supertrend indicator on the Bitcoin chart. As I've mentioned before on the channel, this suggests that the trend on the four-day timeframe remains bearish, with the price forming lower highs and lower lows. However, it's important to note that during this bearish trend, we may occasionally see pumps to the upside.

While the price has been following this bearish trend, it is also forming a massive descending broadening wedge pattern. I've recently discussed this on the channel, with resistance around $68.5K and support around $53.5K. As long as the price stays between this support and resistance, and particularly while it remains below resistance, the trend is still forming lower highs and lower lows.

If we eventually see a confirmed breakout with candles closing above this resistance, it would set up a major bullish price target for this descending broadening wedge pattern. However, as of now, we have not confirmed a breakout, which means we do not yet have a confirmed bullish price target. Instead, the trend remains bearish as the price continues to sit below this resistance.

#Bitcoin

Current BTC Analysis: July 2024As of July 2024, BTC has been showing signs of recovery after a period of decline. The price recently experienced a strong upward movement, breaking through a downward trend line without encountering significant resistance. This indicates potential bottoming out and a possible start of a new upward trend.

Wyckoff's Accumulation Phases:

Wyckoff's accumulation consists of several phases:

Phase A: Stopping the Downtrend

This phase is marked by preliminary support (PS) and a selling climax (SC), followed by an automatic rally (AR) and secondary test (ST).

Phase B: Building a Cause

This is the phase where the market moves sideways, creating a cause for the next move. It includes upthrusts (UT) and springs to shake out weak hands.

Phase C: Testing Supply

This phase typically features a final shakeout or spring, testing the remaining supply before the price moves higher.

Phase D: Markup Begins

The phase where the price begins to trend upward with higher highs and higher lows, breaking out of the trading range.

Phase E: Trend Establishment

The price moves consistently higher, confirming the beginning of a new uptrend.

Current Phase of BTC.

Based on the recent price actions:

Preliminary Support and Selling Climax: These might have occurred in the recent past when BTC experienced significant sell-offs and subsequent recoveries.

Automatic Rally and Secondary Test: BTC has shown a strong upward movement, which could be an automatic rally. The lack of significant resistance suggests that it might be transitioning out of Phase B.

Testing Supply: The price behavior indicates a possible phase where the final tests are occurring. The strong upward momentum could be a sign that BTC is moving into Phase D, where the markup phase begins.

Given these observations, BTC appears to be in late Phase B or early Phase C of Wyckoff's accumulation. This suggests that BTC is likely building a cause for the next major move and is preparing for a potential breakout into an upward trend.

BITCOIN: HISTORICAL AND LOGARITHMIC CHART!This chart is based on historical data and is logarithmic.

I believe that the correct fit is a square root function in the logarithmic chart, meaning that the growth is slowing down on long timescales. BTC cannot continue to grow exponentially; this would lead to insane prices of many millions in 2025. While I am a long-term Bitcoin bull, one has to remain realistic.

The cause of these growth cycles is the halvings, which lead to a supply shock followed by a subsequent rally—every time. These are all guesstimates, of course, but I think this chart is realistic.

The long-term goal for BTC in 2025 is around 150K to 180K USD, in my opinion. It won't go much higher afterward and can be seen as the final asymptotic price.

Important Things to Note

- During the 2016 bull run, after breaking its previous ATH, BTC had a 303-day bull run and reached a new ATH of $19,666.

- During the 2020 bull run, after breaking its previous ATH, BTC had a 337-day bull run and reached a new ATH of $69,000.

- In the 2024 bull run, BTC broke its previous ATH in just 500 days, which was not expected. The current situation is that BTC broke out of its previous ATH and is currently retesting it. Based on historical data, we can expect a bull run lasting between 303 and 337 days.

I hope this chart helps people understand the long-term growth dynamics of BTC. This idea is presented in a probabilistic manner.

Longterm BTC is still bullish 🚀🚀🚀Bitcoin seems to be trading within an ascending channel, which is typically considered a bullish pattern. The price is currently testing the upper boundary of the channel. If it holds, we could expect a pullback towards the lower boundary. However, if the price breaks and holds above the upper boundary, it might signal a continuation of the bullish trend.

Looking at the Fibonacci extension levels drawn from a significant swing low to a high, the price is hovering around the 1.272 extension level. The next key levels to watch according to these extensions are the 1.618, which often acts as resistance, and the 2.618 level, which is a more optimistic target and less commonly reached.

The volume profile on the left shows a high volume node just below the current price, indicating a potential area of support. If the price were to decline, this area could act as a barrier against further drops.

BTC price movement, would likely depend on whether the price respects the current channel pattern and the reaction at key Fibonacci levels. If bullish momentum continues and the price breaks above the channel, the focus would shift to the 1.618 extension level as the next target. But if the price rejects at the channel's upper boundary, a retracement towards the lower boundary of the channel or the high volume node could occur.

BTC ANALYZE WEEKLY Greetings, trader friends

Bitcoin is near the resistance level on the weekly time frame

It seems that there is insufficient liquidity behind this level

Also, the rising channel has broken from the top, which shows the pressure of buying and consumption of liquidity

According to the designed chart, we will expect a correction in Bitcoin

If a good pivot is formed on the resistance, we expect the analysis to take place.

BITCOIN: HISTORICAL CYCLES AND HEALVING ROADMAPE!THIS CHART IS BASED ON HISTORICAL DATE

In the first cycle, after the ATL,

> BTC took 532 days to break above it’s previous ATH.

> In the second cycle, it’s taken 546 days to break above its previous ATH.

> If history repeats itself, we could see a new ATH around 385 days from today, possibly by December

2024.

ROADMAP FOR BITCOIN HEALING

> First Halving: July 9, 2016

546 days of the bull market!

> Second Halving: May 11, 2020

546 Days of Bull Market after Halving 3

> Third Halving: April 25, 2024 (Expected)

Likely to last 528 days to 546 days of bull market.

Important THING TO BE NOTED

After every halving, BTC always does a slight dump.

As we can see in the chart, BTC dumped after the Helving on 2016.

In 2020, BTC dumped before the Helving

IMO, this time too, we may see a slight dump, but the question is before or after?

Based on fractal analysis and chart data, it is anticipated that Bitcoin will reach its next bull market peak in September 2025. Subsequently, a shift back into the bear market is expected. Consequently, a decision to exit the market before September is considered, given that these projections are assumptions derived from fractal chart data.

I hope this graph clarifies how BTC's long-term growth dynamics work.

Only in a probabilistic approach, this concept is.

This chart is likely to help you make better trade decisions if you consider upvoting it.

I would also love to know your charts and views in the comment section.

Thank you

Long-term bullish trend for Bitcoin. (3-EMA) with periods of 50, 100, and 350 days creates a bullish configuration, where shorter averages are above the longer ones, signaling a potential continuation of the uptrend.

The strength of the trend is also supported around events such as Bitcoin halvings, which historically have been associated with periods of intense price increases. The upcoming fourth halving may be another catalyst for price movements. Equally important could be market events like the approval of a Bitcoin ETF , which could bring new institutional capital to the market.

Increased trading volume during clear price movements indicates significant interest at these price levels, which can be interpreted as confirmation of the trend's strength. The analysis may also point to key resistance levels, which, if broken, could pave the way for further price increases.

Current technical configuration indicates a strong bullish trend, which, if maintained, could lead to testing and breaking through successive price levels. It is always important to remember that the cryptocurrency market is characterized by high volatility and unpredictability, therefore any technical analysis should be regarded as one of many tools for making investment decisions.

$BTCUSD 3.5 Year Cycle Forecast - LONGCurrent Market Phase:

As we navigate through BITSTAMP:BTCUSD pairs first phase reminiscent of October 2015, our focus is on achieving the crucial milestone of Target #1, positioned around the $128,000 mark. It is imperative to recognize that this level serves as a pivotal juncture in the trajectory of the current market cycle. Successfully reaching Target #1 will signify the completion of the prebullish phase, potentially setting the stage for the subsequent movements.

Anticipated Correction and Second Bullish Phase:

Upon reaching the $128,000 mark, a robust correction is anticipated, with the target range identified between $23,000 and $24,000. This correction aligns with historical market patterns and provides an opportunity for market participants to reassess their positions. It is important to approach this correction as a natural and healthy part of the market cycle, serving to realign valuations and pave the way for sustainable growth.

The subsequent phase is characterized by a Bullish Pennant formation, indicative of a continuation of the upward trend. This phase is poised to initiate the long-awaited bullish cycle, a significant market event that holds the potential for substantial gains. Investors and traders should position themselves strategically to capitalize on the opportunities presented during this phase.

Extended Projections:

Looking ahead, our analysis suggests that the bullish cycle is expected to culminate in new highs, with a target around $220,000 projected to materialize around mid-2027. This forecast is based on a comprehensive evaluation of current market conditions, historical trends, and potential catalysts. However, it is essential to remain vigilant and adapt strategies to evolving market dynamics, acknowledging that unforeseen factors may influence the trajectory.

External Corroboration:

Our analysis finds support in external sources, such as the article from CMC Markets titled "Is Bitcoin in a New Round of Bull Run?" ( www.cmcmarkets.com ). The article reinforces the observed chart patterns and highlights the potential for a new bullish cycle, adding credibility to our analysis.

Conclusion:

In conclusion, the BTCUSD pair on the weekly timeframe is currently navigating the early phases of a potentially robust market cycle. Strategic positioning, risk management, and a keen awareness of market dynamics are essential components for investors and traders seeking to capitalize on the opportunities presented by this evolving chart pattern. As the market progresses, continuous monitoring and adaptation of strategies will be paramount to navigate the inherent volatility and uncertainties associated with cryptocurrency markets.

Bitcoin (BTC) Price Forecast Bitcoin (BTC) has recently struggled to surpass the $38,000 mark but maintains a comfortable position above the $35,000 support zone as the market awaits the next significant move.

Notably, part of the prevailing consensus among most market participants is that Bitcoin is poised for a rally towards a new all-time high. This optimism is fueled by developments surrounding a potential spot Exchange-Traded Fund (ETF) approval and next year’s halving event.

Bitcoin is in the pre-and post-halving phase, with the fourth halving event expected to occur in April 2024. During this phase, Bitcoin’s price tends to touch or surpass the 0.786 Fibonacci retracement level, with the 0.382 Fibonacci level acting as a crucial support, excluding exceptional circumstances such as the pandemic crash in early 2020.

Currently, Bitcoin is positioned at the 0.786 Fibonacci level, set at $50,000. The cryptocurrency is expected to reach this level imminently or within 3-4 months following the upcoming halving event. This also underscores the importance of maintaining support above the 0.382 Fibonacci level of $27,000.

It is worth noting Bitcoin’s recent rally was primarily fueled by developments related to ETF approval. In the meantime, the Securities and Exchange Commission (SEC) has again delayed approval for a spot ETF. In the latest update, the SEC postponed decisions on approvals for Franklin Templeton’s and Global X’s spot Bitcoin ETF applications.

At the same time, reports on the approval have intensified following indications that the SEC has been engaging with exchanges regarding numerous spot Bitcoin ETF applications. However, it is key to note that nothing has changed despite the speculation around the approval.

Bitcoin price analysis

Bitcoin was valued at $36,359 by press time with daily gains of about 0.20%. On the weekly chart, Bitcoin has plunged by almost 2%.

Macro BTC pattern shows path to 42-44K then 32KThe chart is self-explanatory. All I have done is taken the Bar Patterns at the 15K lows and matched them with the lows at 25K, there are astonishing similarities. Go ahead and have a look at all the similarities I have highlighted.

This pattern suggests, we should soon have a pump to 39K region, then a dump to 34K region followed by a pump to 42 to 44K region and then a large dump to 32K region.

The dump to 32K would be akin to dump at 19.5K from 25K and then 32K region could act a strong S/R flip to push the btc price to new highs.

It's possible that this may not repeat exactly like before, but when there are so many similarities, we should pay attention.

This is not at all surprising to me, Infact I have been targeting 40K from past 8 to 9 months while most traders were bearish and calling for severe downside.

I also call the 15K bottom Macro bottom when others were expecting more downside.

I am again saying 25K is a major bottom in the BTC cycle.

I have added links to those posts where you can find details about the above claims.

Note: Even though patterns tend to repeat on macro timeframes, there is no guarantee that they will, all these similarities can go out the window. I personally will start taking this pattern seriously if we Pump to 39K region withing next 5 to 7 days, which is what we can see from the BAR feed copied from 15K region.

Bitcoin Analysis - Will History Repeat Itself?Hi traders..

Bitcoin's October Rally: Will History Repeat Itself?

October has traditionally been a bullish month for Bitcoin, with notable price surges since 2013. The only exceptions were in 2014 and 2018.

This year follows a similar pattern. Bitcoin showed stability leading up to the October 1st weekly close, having surpassed the previous month's end with minimal volatility.

However, as the week concluded, Bitcoin experienced a sudden surge, propelling its price just shy of $28,000. Shortly after, it reached new heights, hitting $28,451 on Bitstamp.

As of October 1st, the leading cryptocurrency has seen a 4.5% increase, based on data from allmost markets on TradingView.

A closer look at the numbers reveals not only positive returns for Bitcoin in October but also an impressive average return rate of over 15% during this month historically.

Considering this data and the average return rate, there is a compelling argument for Bitcoin's price potentially reaching approximately $32,500. Following this, it might reach a price between $34,000 and $35,000 in October.

However, it's crucial to note the volatility of the crypto market. Bitcoin's price fluctuates due to factors such as supply and demand, investor sentiment, government regulations, and media hype, all contributing to its volatility.

Note:

In essence, while Bitcoin has a strong historical performance in October, there are no guarantees for this year. Investors must conduct thorough research before making any investment decisions.

BINANCE:BTCUSDT BITSTAMP:BTCUSD Bitcoin vs US Dollar

⚠️ Disclaimer: The following insights reflect my personal perspective on the market, relying on publicly available information and historical data. While some opinions stem from my actual trades, others do not. I am not a financial advisor, and I bear no responsibility for your trading choices.

✅ Feel free to reach me out with any questions or recommendations. I am more than willing to assess and analyze any currency pair or index that piques your interest.

😱 BITCOIN PRICE PREDICTIONI thought it was time to make a long-term chart, with all these wrong charts going around, hehe.

I think that the correct fit is a square root function in the logarithmic chart, meaning that the growth is slowing down on long timescales. BTC cannot just continue to grow exponentially. This would lead to insane prices of many millions in 2025.

I am a long-term bitcoin bull, but one has to remain realistic.

The cause of these growth cycles is the halvings, which lead to a supply shock with a subsequent rally—every time.

These are all guesstimates of course, but I think this chart is realistic.

The long-term goal of BTC, in 2025+, is at around 150K USD imo. It won't go much higher afterwards, it can be seen as the final asymptotic price.

CURRENT SITUATION

$BTC broke out of the downtrend on the monthly chart.

The bull and bear market after the halving lasted approx 1000 days. If we take the historical data we can see that $BTC entered the next halving with ≈ 50% down from the top. Considering this, the price of Bitcoin could be around $35k going into the next halving.

I hope this chart helps people understand the long-term growth dynamics of BTC :)

This idea only in the probabilistic way

Next BTC ATH , What and WhenThe chart posted is very simple to understand.

Bascially I have manually fitted a curve around the cycle highs and lows of bitcoin on a logarithmic scale and have measured the time it took for btc to tap the top curve once it has tapped the bottom curve, and it comes around 850 days approx.

This measure estimates the next BTC high to be approx 112000 USD around mid of 2025.

This curve also indicates the bottom is in for bitcoin at 15000 USD for this cycle , it can only be violated , in case of a black swan event like it did in march 2020.

Current Market Status AND September Outlook. !!Hello, welcome to this BTC monthly update by CRYPTO SANDERS.

CHART ANALYSIS:- Current Market Status

The first fortnight of September has been largely non-eventful, with bitcoin mostly

consolidating below 26,500.

This comes as volatility in the market hovered close to a five-year low in August, with trading volume amongst exchanges falling by 52 billion.

as we move into the fall, there has been a slight rise in volatility, mostly led by a rise in both inflation and retail sales in the United States.

Markets have used this as confirmation that the Federal Reserve will hike rates later this week, which could lead to dollar strength.

September Outlook

Bitcoin peaked at 27,414.73 earlier in today’s session, following a low of 24,900 exactly a

week ago.

This has seen BTC/USD reach its highest level since August 31, 2023, and comes as the 10-day (red) and 25-day (blue) moving averages near an upward cross.

From the chart, the potential for this move has been on the cards for a while, however, it has finally taken place as volatility returned to the market.

Additionally, the relative strength index has now also moved past a key point of resistance at 53.00, which has been a thorn in the sight of bulls for the past few weeks.

The next real ceiling lies at 65.00, and should bulls be targeting this, there is a chance bitcoin (BTC) ends the month above 28,300.

I have tried to bring the best possible outcome to this chart.

Hit the like button if you like it and share your charts in the comments section.

Thank you