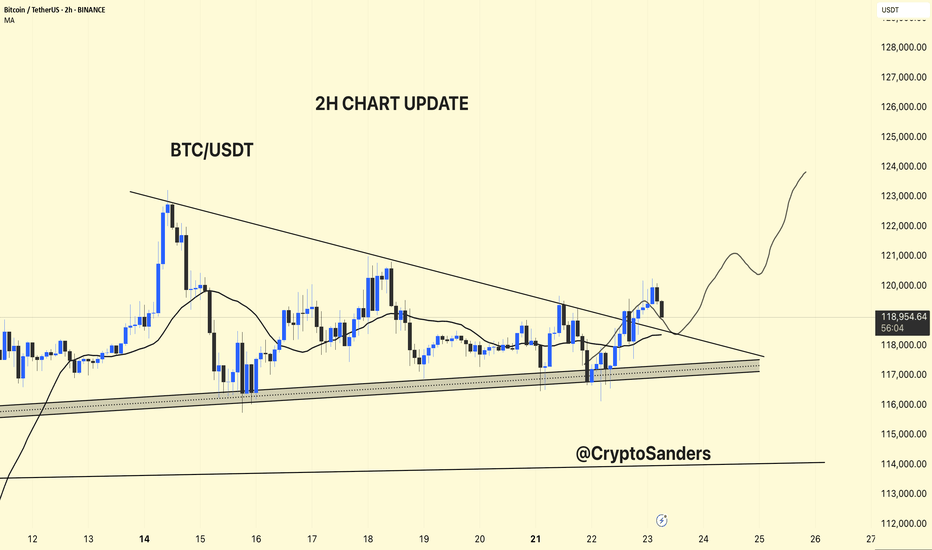

BTC/USDT – 2H Chart Update!!BTC/USDT – 2H Chart Update

Breakout Confirmed:

BTC has broken above the descending trendline but is currently facing resistance at around $ 119,500.

Support Zone:

Strong ascending support between $ 117,000 and $ 118,000 remains intact.

Moving Average:

Price is currently testing the 2H MA (~$118.3). Holding above this could confirm bullish continuation.

Outlook:

If BTC holds above $ 118,000, a move toward $ 123,000–$ 125,000 is likely.

Failure to hold may retest $117K support.

Bias: Short-term bullish unless price breaks below ascending trendline.

Thanks for your support!

DYOR. NFA

Btcmarket

BTC/USDT 4H Analysis.

BTC remains in a retest phase after breaking out of the first descending broadening wedge.

The price has returned to test the upper wedge trendline, which is now acting as support around ~$105,500.

The purple 1 00-period MA (~105,570) overlaps this retest zone, adding additional confluence to the support.

Ichimoku

BTC is inside a green cloud, indicating indecision but not a confirmed trend reversal.

The cloud provides dynamic support in the ~$104,500–105,500 area.

Stay alert!

BTC/USDT Chart Analysis.

BTC has been in an uptrend since early April 2025, breaking above a strong horizontal resistance line (visible in the chart).

However, we can now observe a descending channel (falling wedge) after the peak, indicating a potential pullback.

Support Levels:

The price has tested the 50-day SMA (red) and is approaching the 200-day SMA (green), which is a strong dynamic support (around $94,740–$98,000).

Horizontal support lines are around the $103,000 and $100,000 levels, acting as immediate support.

Price Pattern:

The pattern resembles a bullish flag or descending wedge, suggesting a possible continuation of the previous upward move if a breakout occurs.

Before a bullish reversal, a retest of support levels (highlighted in the blue circle) near the moving averages is possible.

Future Path (as drawn on the chart):

Possible pullback to around $100,000–$98,000 levels.

Reversal and breakout are expected to be between $112,000 and $115,000 initially, and possibly higher to $125,000–$130,000.

Volume & Momentum:

No volume data is shown, but the price action indicates a correction with weakening momentum.

Trend lines are sloping upwards, indicating underlying strength despite the correction.

Trade Setup Based on This Analysis

Entry Zone: Around $100,000–$98,000 (if price tests support and forms reversal patterns like a bullish engulfing or hammer).

Stop-Loss: Below $94,000 (below the 200 SMA and the trendline support).

Short-Term Target: $112,000–$115,000.

Mid-Term Target: $125,000–$130,000.

Risk Considerations

If BTC breaks below the 200 SMA and horizontal support near $94,000, the trend may weaken.

Thanks for your support!

DYOR. NFA

Bitcoin and 50 SMA on a WEEKLY chart - UPDATE Following on from the sharp drop in the beginning of the week, where PA dropped Below the 50 SMA ( RED) , PA has recovered and, as you can see, the candle Body is currently sitting ON the 50 SMA

We may need to remain in this area to bring back the Bullish Sentiment and then move higher.

It can be said that a bullish sentiment remains with Bitcoin as its did NOT crash as sharply as Stock Markets.

We are also now waiting on the MACD to fully enter the "Bounce Zone"

The Weeks candle on the histogram has returned to RED and so some caution is required here, while we wait.

It is the next few days that are crucial now. The "Tariff" dust us settling and countries are reacting to Trumps Tariff impositions.

My Gut feeling is VERY positive right now.

But that is just me,

Watch that candle on the 50 SMA like a Hawk. If we loose that again and the week closes below, THEN we need to think carefully

#BTC/USDT Analysis Update Bitcoin is consolidating within an ascending triangle, a classic bullish continuation pattern.

BTC is respecting the ascending trendline as support.

Horizontal resistance is forming around $93,000, acting as a breakout level.

The price currently trades above the Ichimoku Cloud, indicating underlying bullish momentum.

The cloud acts as dynamic support, reinforcing the possibility of an upside breakout.

Decreasing volume during consolidation indicates preparation for a significant move.

Watch for a volume spike on the breakout.

The RSI is in a healthy range and is moving upwards.

The MACD shows the possibility of a bullish cross, indicating upward momentum.

Resistance Zone: $93,000 – $93,500 (Breakout Level)

Support Trendline: $89,000 – $90,000 (Triangle Base)

A close above $93,500 confirms the breakout.

Possible Upside Targets: $95,000, $98,000, and $100,000.

A drop below $89,000 could signal bearish momentum.

Downside Targets: $87,000 and $85,000.

BTC is building momentum and could break out of the triangle soon. A breakout above $93,000 with rising volume would confirm bullish dominance. Stay alert and prepare for confirmation! 🚀

Disclaimer: This analysis is for informational purposes and is not financial advice. Always stay updated with market movements and adjust your trading strategies as needed.

You can DM us for information on any other coin.

@Peter_CSAdmin

FRIGHTENING DEVELOPMENT ON MARKETIn the 4-hour logarithmic chart, the Dollar index has completed a 'head and shoulders' (Tobo) formation and a horizontal resistance breakout. It is currently retesting. If it closes the week like this, there could be a deepening correction in BTC and Altcoins next week.

We will follow up.

This is not investment advice.

Rising wedge + bullish shark on BTCBTC is moving inside a rising wedge (bearish pattern). Price needs to hold the ascending trendline level, upon breakdown technical target of the pattern is $19,096.

Bullish shark is developing which will complete at rising wedge technical target or $18,826.

Right now, we are at critical situation due to CZ planning to sell FTX tokens and many people building up big shorts on FTX. If this happens then whole crypto market will face the consequences not just FTX. This will be another LUNA like situation, SBF is already selling his Solana bags to control FTX price reminds of how Kwon was selling BTC to control LUNA and UST price but failed miserably so be careful with your trades as fundamentals + technical are looking bearish as hell. We have mid-term elections in USA on 8th plus CPI data coming on 10th.

BTC making Double Bottom on dailyWe have a double bottom on BTC on daily chart which already broke out and currently trying to retest, if this plays out then technical target of this bullish pattern is $22,805.

Another important thing to notice is that we hidden bearish divergence on RSI and MACD under development which will be confirmed at daily closure. Invalidation of this requires BTC to close above $21k and if divergence plays out then we will see sub $20k levels once again.

Wedge target $19274 shark target $18929BTC was unable to hold its major support of ascending broadening wedge and broke down. Next possible target is at demand zone of $19,274 whereas final technical target of broadening wedge is $17,737.

A bullish shark harmonic is in process of developing which will complete at $18,929. Invalidation of that will be $17950.

Avoid futures trading for some days, Sometimes no trading is the best the strategy

BTC Relief RallyBTC is making a lower low on daily so we have a chance of a relief rally by making a lower high so based on that we have 2 scenarios. We are halfway to the bear market and second half is on the line.

Scenario 1

BTC will range between $20300 to $23000 for sometime and then break out towards $25k to $28k possibly making a bear flag and goes down towards $19k-$15k.

Scenario 2

BTC will simply break down from here towards $15k-$19k and we will bounce back up for a relief rally towards $30k levels or higher and then we go down again.

BTC bearish butterfly 1H target $30,824BTC is in process of developing a bearish 🦋 harmonic, It will complete at $30,824. Invalidation of this will be if price goes below $28K level. We have strong resistance levels at $30,500 and $31,500 so chances of this harmonic playing out upon completion are very high.

BTC Bearish BAT harmoninc target $65KWe see a bearish bat forming on a daily chart and we can take this as future price projection. I suspect that this pattern will surely complete once 0.382 level is reclaimed.

To add confluence to this analysis, Weekly oscillators are pretty much flipping bullish.

Another confluence is that on 12H chart we see a possible golden cross happening in coming days (Golden cross occurs when 50 days moving average crosses above 200 days moving average) Last time this occurred on 12th august 2021 and price made ATH $69k.

I am biased bullish, Lately I was biased bearish since before November. Capitulation doesn't seem to be happening and it seems that cycle is changing i.e., No more 4 year cycles.

Bearish Scenario : If price goes below $38K level ONLY then it will be total bloodshed.