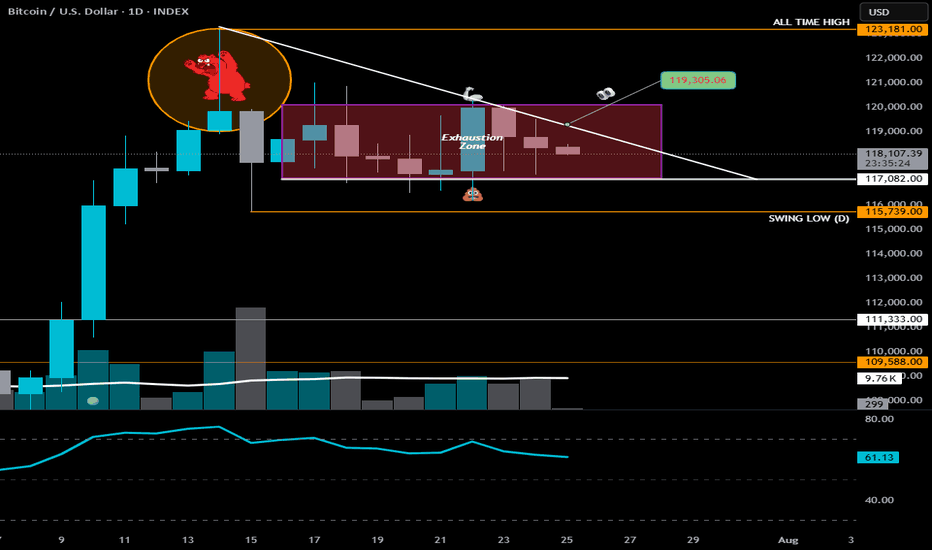

BTC-Alpha-"Exhaustion Zone" Update📍All Eyes on $119,300

Why? Because that’s the line that could break the bearish narrative.

A clean push above = bulls showing real strength — not just surviving, but swinging.

It might look like BTC is doing nothing… but under the hood, the chart is very much alive.

If bulls can’t break the descending trendline, it’s not just hesitation — it’s exhaustion.

And when bulls run out of gas?

The High-Powered Short Zone starts pulling like gravity.

—

🔸 Chart Patterns in Play

🟥 Bear Flag / Distribution Box

• Price is consolidating beneath a lower high + descending trendline

• Every rally attempt has fizzled inside the Exhaustion Zone

• Repeated failures at $119,300 = a clear ceiling

🟩 Coil Within Compression

• Higher lows pushing up against downtrend resistance

• Price is coiling tight — and compression always precedes expansion

• A breakout (or breakdown) is coming… the spring’s loaded

—

🧭 What to Watch

🔓 Break above $119.3K with volume = bull momentum resumes

❌ Break below $117K = bear flag confirmed → welcome back to the High-Powered Short Zone

—

Stay Sharp. Don’t confuse quiet charts with quiet outcomes.

BTC is gearing up for a move that won’t whisper.

Btcsetup

Bitcoin May See Short-Term Pullback After Hitting $108,000📊 Market Overview:

Bitcoin surged to $108,000 amid renewed risk-on sentiment, a softer US dollar, and slightly declining bond yields. However, weekend trading sees lower liquidity, and some profit-taking has emerged. Traders are also cautious ahead of next week’s Fed-related news.

📉 Technical Analysis:

• Key Resistance: $108,500 – $110,000

• Nearest Support: $106,200 – $105,500

• EMA 09 (1H): Price is above EMA 09, indicating bullish momentum remains.

• Candlesticks & Volume: Doji candle and falling volume in 1H → suggests weakening upside momentum and possible retracement.

📌 Outlook:

Bitcoin may face a short-term pullback if it fails to break above $108,500 and no fresh catalysts emerge. Holding above $106,200 would keep the broader bullish structure intact.

💡 Suggested Trade Setup:

🔻 SELL BTC/USD at: 108,200 – 108,500

🎯 TP: 106,800

❌ SL: 109,300

🔺 BUY BTC/USD at: 106,200 – 105,500

🎯 TP: 107,800

❌ SL: 104,800

BTCUSD Set to Reclaim This Weak High,Watch This Smart Money Zone📊 BTCUSD 30-Min Smart Money Concept Setup

Let’s dissect this high-probability Smart Money setup on BTCUSD, which just tapped into a premium-to-discount range retracement and looks ready to reverse from demand.

🔻 1. Market Context

We saw a strong impulsive move up earlier today, followed by a corrective move pulling back into the 61.8–79% fib zone, lining up with internal liquidity and support zones.

Price just respected that 61.8% level with multiple bullish rejection wicks, indicating a potential bounce.

🧱 2. Key Zones Identified

Strong Low: 102,757.05 — protected for now

Entry Zone: 103,646 – 103,758

Weak High Target: 104,800+

Final TP: 105,788.51 (aligned with -27% fib extension)

The confluence of internal trendline support and fib levels supports the bullish narrative.

📈 3. Trade Setup + RRR

✅ Entry: Around 103,750

❌ Stop Loss: Below 102,800 (beneath strong low)

🎯 Take Profit: 105,780

📊 RRR: ~4:1+

This setup offers a clean low-risk, high-reward opportunity with minimal drawdown.

🔥 4. Why This Is Smart Money Approved

✅ Deep retracement into discount zone

✅ Strong bullish structure + weak high liquidity above

✅ Trendline support confluence

✅ Smart Money targeting liquidity

✅ Higher timeframe bullish bias still intact

💬 Type “⚡️BTC Weak High Raid Loading” if you’re riding this wave too!

🚀 Follow @ChartNinjas88 for more precision Smart Money plays like this.

BTC Reversal Starts Here – Smart Money Filled Up the OB! 🔄 Market Context:

Clear uptrend structure, forming higher highs

Pullback starts ➝ Lower timeframe shows bearish BOS

BTC wicks deep into bullish OB between 103,277 and 102,646

Liquidity sweep below the strong low @ 102,646 triggered ✅

Price now printing rejection from the OB zone 🚨

🧱 Key Order Block Zone:

Marked between 103,277 – 102,646 USD

Aligned with the golden zone (61.8%–70.5%)

Thick purple OB shows Smart Money’s interest 🎯

💸 Liquidity Zones:

Sell-side swept via wick under strong low

Next liquidity magnet: Buy-side Liquidity @ 107,141.59

Weak High @ 105,141.76 ➝ probable first stop 🛑

🚀 Trade Plan:

Entry: Tap and bullish rejection from OB

Stop Loss: Below strong low (102,646)

Take Profit: Partial @ 105,000 → Full @ 107,141 ✅

RRR: Estimated at 1:5+

📉 Why This Setup Rocks:

OB sits perfectly at fib retracement level

Strong low protected → Likely shift in structure next

Liquidity engineered before reversal ➝ Classic SMC recipe

📢 Pro Tip for Ninja Traders:

BTC loves to grab lows before sending price through the roof. If this 30M OB holds, higher TF (4H or 1D) could shift bullish again. This is not random—it’s engineered 📐

⚔️ Mindset Reminder:

"Patience is profit." You waited for the sweep, got OB confirmation, and now you're riding with the institutions 🧠💰

BTC Short Setup – High Leverage Precision Trade (30x)Description:

Shorting BTC with a tight strategy and calculated risk:

Entry: $105,200

Leverage: 30x

Margin: $400

🎯 Targets:

TP1: $104,600 → Book 25%

TP2: $102,800 → Book 50%

TP3: $10,000 → Close Remaining

⚠️ High-risk, high-reward play. Use proper risk management.

THE ROAD TO 68K BTC.P/USDT 4 HOUR In this idea I expand upon my previous idea posted in December on the 8th. The previous idea showed the rudimentary course we would take according to the formation set of Ascending scallops.

In this chart I outline the key supports, resistance, and the projected bottom point we will bounce from to head back up.

Seems we have fallen from a large scale rising wedge and are now inside of descending broadening wedge. This is all in line with my previous idea and is moving as expected. We do not have long to go before we reach our bottom target if we do in fact move as projected.

Only time will tell, Happy Hunting - TND

BTC Long back to the MeanBitcoin has recently broken out of its prior range, sweeping liquidity below key levels.

This setup presents a potential mean reversion opportunity, expecting price to revert back into the range. The target for this trade is around 96,785.2, aligning with the previous consolidation area.

Key Levels:

Entry: Current price region (~89,310)

Target: 96,785.2 (Mean reversion level)

Stop-Loss: 85,969.9 (Below liquidity sweep)

Trade Execution:

Entry Confirmation: Signs of rejection from the liquidity grab area / MSB on 2h

Risk/Reward: Favorable setup with a good R:R ratio.

Stop Placement: Below the liquidity sweep to prevent early invalidation.

Conclusion:

The market has grabbed liquidity and is now positioned for a move back into the range.

If bullish momentum continues, we expect price to revert toward the 96,000 level.

BTC/USDT at a Make or Break Moment Analysis Bitcoin is currently forming an inverse cup and handle pattern on the hourly timeframe, signaling potential bearish continuation. The price is testing the neckline support around 96,480 USDT, and a confirmed breakdown below this level could trigger further downside momentum. However, the most critical support level to watch is 92,000 USDTit is essential for Bitcoin to hold this level to maintain any bullish momentum. If BTC closes below 92K, we can expect further declines, possibly towards 88,500–89,000 USDT or even lower. On the upside, 97,500 USDT remains a key resistance, and only a sustained recovery above this level would invalidate the bearish structure. For now, all eyes are on the 92K support zone, as losing this level could lead to a deeper correction in the market.

BTC on the Edge Falling Wedge Breakout & CPI Impact Awaited !The chart shows Bitcoin (BTC/USDT) on the 4-hour timeframe, moving within a falling wedge pattern

The falling wedge pattern is a bullish continuation/reversal formation, where the price compresses within converging trendlines. BTC has been respecting the pattern's boundaries, suggesting a potential breakout. The immediate resistance zone at $97,200 has been tested multiple times, but the price has faced consistent rejections, indicating strong selling pressure in this area.

For a bullish breakout, we need a 4-hour candle close above $97,200. If this happens, it could trigger a strong upward momentum, with a target potentially extending towards the $104,000 region, aligning with previous highs.

The presence of CPI (Consumer Price Index) data release today adds an external factor of volatility. Economic data like CPI can significantly impact the market sentiment, especially in crypto, as it reflects inflation levels and can influence risk-on or risk-off market behavior.

Traders should exercise caution and consider these key factors

Monitor the wedge breakout closely.

Await a confirmed 4-hour candle close above $97,200 before entering a long position.

Use proper risk management, as the market is expected to be volatile due to the CPI data.

BTC is on the verge of a potential breakout. However, external factors like CPI data can amplify volatility. Wait for confirmation and trade cautiously.

BTC Chart Analysis - Bullish Bias for next couple of monthsBTC has now filled the weekly fair value gap around the GETTEX:48K - GETTEX:49K range in the first week of August, which was originally formed in February earlier this year. Interestingly, during that same week after 2014, whales accumulated most of the BTC. The weekly closing candle has printed a pin bar candle to the upside, indicating a strong potential for bullish momentum. I believe the consolidation phase is ending, and we could see parabolic upward movement within the next week or so. My first target for the breakout of this weekly bull flag is $100k within the next couple of months. Ideally, we could hit this target before the elections. Let’s see if this analysis plays out or not.

Not financial advice! DYOR

BTC Chart - Bullish / Bearish in short termBTC chart looks confusing one right now. I am super bullish in next 2-3 months. However, there are two scenarios which I would like to share with you all here could play out in short term.

Scenario 1:

BTC breaks down one more time from this diagonal resistance and daily 200 EMA, and get the liquidity from 50k-52k zone before moving back up.

Scenario 2:

BTC breaks out from this daily downward resistance, test or break the 64K zone and go back to test the 72k zone again.

We need a good positive news like ETH ETF launch and institutions inflows etc. in order to go from this zone. Otherwise, we are going to test the lows first before going back up.

Would love to hear other traders opinions and thoughts...

BTCUSDT, Thu 01 Aug, Updated 1!Please see my Idea on SOLUSDT, Thu 01 Aug, Updated 1!

If you traced the price of BTC from 1st April,

You can find how its moving!

Result:

Regardless of what levels of Fibonacci the price touches (32, 50 or 62%), but the price will definitely return to the FVG (between the second and fourth day) and you can get a good High profitably short!

This is not a buy or sell or trade offer, this is just an analysis and an idea!

BTC - NOT THE HISTORICAL MOMENT YOU ARE THINKING OFFunding reached the historical mark as it was at the end of 2021 after which there was a strong downward price movement. Considering my analysis described in previous posts I would also like to note the huge liquidity clusters at 20k and 30k levels which were not touched at all although there was every opportunity to do so.

Based on this we can conclude that these levels could be confidently left as fuel for a downward hike. Do not overlook the levels below 15k where there is also a lot of liquidity.

Wait for the asset to reverse and look for an entry point. It's going to be an interesting downward slide

BTCUSDT Analysis and Price Outlook 📈In the weekly timeframe, BTCUSDT has reached a key resistance level and is attempting to break above it to move higher. The convergence of the MACD indicator indicates buyer commitment. The fact that Bitcoin is still trading above $60,000 shows the strength of this trend.

On the 4-hour timeframe, a triangular pattern has formed, and a breakout above this pattern can confirm the uptrend continuation and the breach of resistance. If the pattern is broken to the downside, the key support at $52,000 could propel Bitcoin higher again. 🚀

What happens when Crypto Chessboard flips?In-depth analysis considers various factors:

Despite the approaching Bitcoin halving.

We consider the following:

Acknowledging the historical price surge before the Bitcoin ETF launch, making it resistant to substantial capital investments.

Recognising the lack of momentum post-ETF launch and the struggle to breach the upper resistance around 51-52k.

Taking into account the challenging global economic situation, particularly in the United States.

Highlighting the potential impact of a Black Swan Event, investigating the consequences of a fictitious ETF post.

Addressing uncertainties following CZ's departure from Binance as CEO, posing another potential Black Swan event that could push prices below the Wyckoff distribution phase boundary at 24-22k.

Speculating a third logical move by corporate traders to increase market liquidity, creating a massive bull trap to attract influencers and optimists anticipating a significant Bitcoin ETF-driven price surge, leading to widespread doubt in Bitcoin and a gradual decline to the Wyckoff lower support.

Related Financial News:

- Bitcoin's halving event draws attention from traders, with speculation on its potential impact.

- Historical price patterns show resistance before major events like ETF launches, impacting capital flow.

- Global economic uncertainties, especially in the U.S., contribute to the overall market sentiment.

- Increased scrutiny on potential Black Swan events, emphasizing the need for risk assessment.

- Binance's CEO change introduces an element of uncertainty, potentially affecting market dynamics.

- Corporate traders strategizing for liquidity boosts, creating opportunities for market manipulation.

- Influencers and optimists fuel expectations of a Bitcoin ETF-driven surge, but skepticism prevails due to historical patterns and external uncertainties.

#BTC Long Possible#BTC Buy Setup

Even though experts and traders don't want it, the cryptocurrency market is more focused on real-world factors instead of technical analysis. Everyone is waiting for the SEC's decision, and it's likely they'll approve spot BTC-ETF applications. The initial market reaction can be predicted, but we'll have to see how things unfold in the long run.

It's surprising that the cryptocurrency market is paying more attention to real-world factors. This could be because of institutional investors getting involved, decentralized finance (DeFi) becoming more popular, and new cryptocurrency projects emerging.

The SEC's decision on spot BTC-ETFs is highly anticipated. A positive decision could lead to a surge in Bitcoin and other cryptocurrency prices, but a negative decision could cause a market crash.

Ultimately, the future of the cryptocurrency market will depend on factors like the SEC's decision, the overall economy, and new technologies. One thing's for sure: the cryptocurrency market is here to stay and will become even more complex and exciting in the future.

i Will Remove my Stop Loss because i Believe BTC will pump more before the BIG DROP comes.

Keep Save and don't over Leverage! 👍🏼