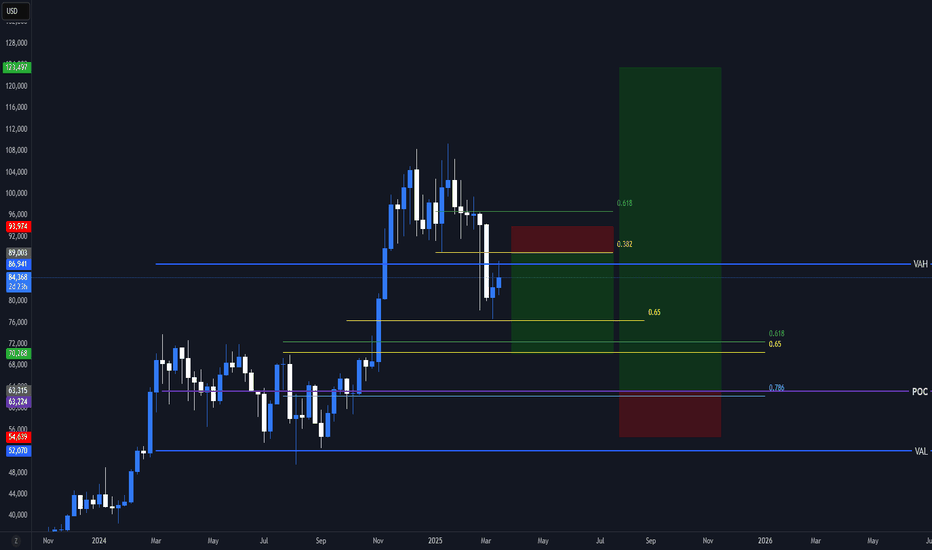

Bitcoin Next two SwingMy next two swing for btc, is simple, I am using the basic strategy of a fibonacci retracement, combined with VAH, VAL, POC.

I want to clarify that I am short from 98k, this is just road plays for me

Remember that trading is a game of probabilities, stick to the highest probabilities.

Btcswing

Future Swings On BTCThe monitor is purposely divided in two, 2H time frame on the top side and Daily time frame on the bottom side, to illustrate the “Mother” Resistance of 55 EMA at 23361$ on the daily time frame (highlighted with an orange circle) approaching to price channel. This may indicate that bullish momentum is not over yet until the 23361$ is not tested. Therefore, we may expected a possible swing on bullish direction to this resistance and a subsequent correction around previous support levels of 19239$. However, the reversal may be not as the strong as previous ones as the channel is on bullish direction confirming up trust. In fact, we notice a bullish crossover of the EMA55 over the EMA 200 on the 2H time frame as well as the crossing of the MACD line above the signal moving towards a positive divergence. For this reasons we expect an upward swing with target price to 23361$ followed by a correction towards price range of 19985-19239$.

BTC daily chartGot some daily support acting as clear resistance now, in and around the 33,800 mark. We all know it's going up but if we can't break above and hold to close that 33,800 zone I'm going to be looking for shorts back down to the weekly 21ema, which would be around 27,000 ish. That would be a nice curl around on the weekly until heading back up for another run, could be a really nice weekly setup, we shall see...

Bitcoin says " Every dollar $ lost is a price for a lesson" If you miss the profit, don't miss the lesson! As a Trader you can never be right all the time, We think differently from holders. Basically meaning, Every dollar lost is a price paid for a lesson learnt on each trade.

SWING TRADING set up

Trade:

The wedge discovered above can easily be found by using trend lines to connect the "higher- highs and lower lows, which can result to a breakout to the up side at any point in time on the Falling Wedge.

here is my personal set up for swing trading this Falling wedge.

My last analysis I talked about shorting 9600 to 7500.

Trade set up

Entry ; Enter a "short" as price hit the top of the broadening wedge at 9565,

TARGET: Place the targets close to the higher "swing high level of the wedge pattern for breakout traders, with a second target set at the depth from the breakout level

For swing trading,

Target for Swing shorts:

9204

9050

8840-8750

8425

7960-7500

(reversal will occur around this numbers

Target for Swing Long:

9440

9240

10500

Stop Loss ; place a stop order below the highest level of the wedge for shorts and below the lowest level of the wedge for longs.

Support me with your LIKES if you can, thank you in Advance.