#BTC/USDT Bitcoin Recovers Above 108,000 $#BTC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 107600.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 107217, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We are looking to hold above the Moving Average 100.

Entry price: 108337.

First target: 108844.

Second target: 109275.

Third target: 109728.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Btctry

Long positions have achieved profits, BTC market outlook📰 News information:

1. Pay attention to the trend of gold and US bonds

📈 Technical Analysis:

At present, BTC has rebounded and profited, and rebounded to around 108,000 again. 109,000 is also the upper track of the Bollinger Band. There is a certain suppression in the short term. Before the suppression fails to break through effectively, BTC may still fall into a weak and volatile market. If BTC hits resistance and pressure above 108,000-109,000 during the day, you can consider shorting. In view of the current volatile market, everyone must strictly control their positions, use leverage prudently, and do a good job of risk management to cope with market uncertainties.

🎯 Trading Points:

SELL 108,000-109,000

TP 107,000-106,000-105,000

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD FXOPEN:XAUUSD

BITCOIN - Price can continue grow inside flat to $107933 level#BTC

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 106500, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 106000.

Entry price: 106736

First target: 106996

Second target: 107434

Third target: 107933

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#BTC/UST#BTC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 106,000.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 106,600

First target: 106,750

Second target: 107,000

Third target: 107,291

BTC is expected to retreat in the short term, focus on 104500📰 Impact of news:

1. The ceasefire agreement reached earlier did not take effect, and Trump believed that both sides violated the agreement

2. Federal Reserve Chairman Powell delivered a speech 3 hours later

📈 Market analysis:

I haven't updated BTC for a while. Today I want to share my views on BTC with you. BTC is currently encountering resistance and pressure at the 106,000 level and is beginning to retreat. From the technical indicators, MACD is in a dead cross, and RSI is retreating after reaching the overbought area. There is no problem with the short-term bearish trend, and it is expected that it will be able to retreat to the 104,500 level without much problem. However, the recent decline in the gold market, DXY market, and crude oil market may cause funds to flow into the BTC market.

🏅 Trading strategies:

SELL 106000-105500

TP 105000-104500

BUY 140500-103500

TP 105000-106000

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

Bitcoin (BTC/USD) 2-Hour Candlestick Chart2-hour candlestick chart displays the recent price movement of Bitcoin (BTC) against the U.S. Dollar (USD), showing a current price of $103,904.89 with a gain of $595.12 (+0.58%) as of 01:22:41. The chart highlights a volatile period with significant price fluctuations, including a sharp drop followed by a recovery, and includes key price levels such as $106,099.25 and $102,803.95. The chart also features a highlighted support zone in pink and a resistance zone in light blue

Bitcoin (BTC/USD) 2-Hour Candlestick Chart2-hour candlestick price movement of Bitcoin (BTC) against the U.S. Dollar (USD) as of June 20, 2025. The current price is $106,004.49, reflecting a 2-hour increase of $1,317.33 (+1.26%). The chart highlights a recent upward trend with a support level around $105,082.06 and resistance near $108,009.17. A shaded area indicates a potential price range, with a bullish projection suggested by the overlaid trendline.

#BTC/USDT#BTC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 103141.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 105268

First target: 106500

Second target: 107405

Third target: 109006

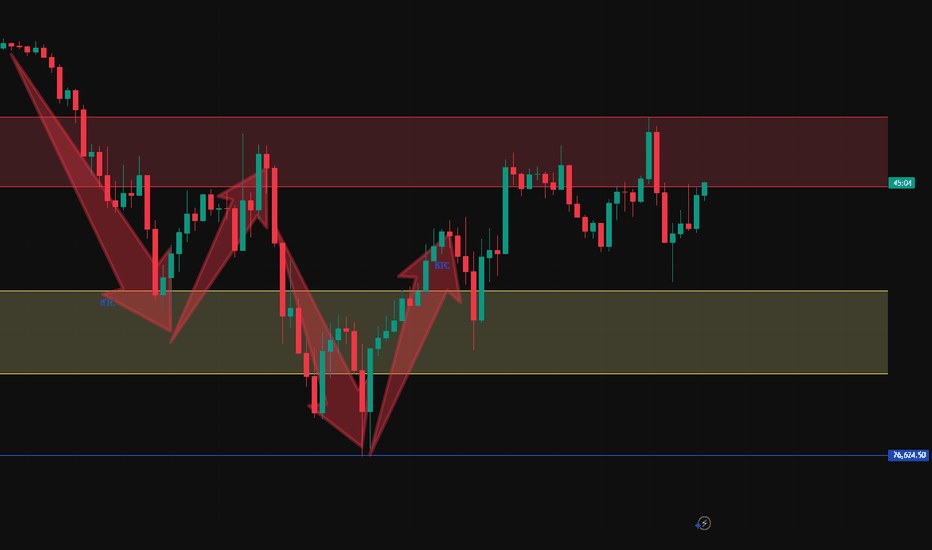

BTCUSDT | No Rejection Yet, Higher Targets in SightThe current price action is still leaning bullish. We haven’t seen a sharp rejection or breakdown from key structure — and until that happens, I expect the move to stretch toward the 107,600 region.

Volume remains consistent, and there’s subtle support in the lower timeframes. Buyers are holding their ground, and as long as that continues, the path of least resistance remains up.

Wait for price to disprove the idea before abandoning it. That’s how you stay ahead.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#BTC/USDT#BTC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 104090.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 104619

First target: 105128

Second target: 106128

Third target: 107091

#BTC/USDT#BTC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 103200.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 103708

First target: 104152

Second target: 104900

Third target: 105900

Bitcoin 4H Technical Analysis– Bullish Continuation Toward $111KCurrent Price Context:

BTC/USD: $103,696.63

EMA (70): $96,211.07

Trend: Bullish 📈

---

Key Zones & Analysis:

1. RBR Zone (Demand Zone) 💙

Price Range: $95,435.39 – $97,986.81

This area is a bullish support zone where price previously consolidated before the breakout.

Potential entry/buy zone 📍

If price pulls back: Bounce expected here 🔁

🟦 RBR Zone:

🔵 97,986.81

🔵 96,211.07 (EMA support)

🔵 95,435.39

---

2. Resistance / Short-Term Supply 🟥

Small blue box above current price

May cause a minor rejection before a breakout

Keep an eye out for price action signals here 👀

🟥 Resistance:

🟥 ~103,700 – 105,000

---

3. Target Zone 🎯

Main Target Point: $111,415.32

Target Range: $111,281.04 – $112,959.60

If price breaks above resistance, this is the next major target

Take profit zone 💰

🎯 Target Area:

🔵 111,281.04

🔵 111,415.32

🔵 112,959.60

---

Possible Price Path:

1. 🔼 Break above current resistance

2. 🔁 Or pull back to RBR zone

3. 🎯 Final move toward target zone

BTC H4 Analysis | Key Support Zone: | Watch for ReactionBitcoin is approaching a significant support area between 88,277 and 86,850 on the H4 timeframe. This zone has historically acted as a demand region, and price action within this range will be critical to monitor.

Technical structure shows a potential for volatility, and traders should keep an eye on how BTC behaves around this level. A clear reaction here could offer insight into the next directional move.

No trade setup provided — this is a technical observation for analysis purposes only.

Just In: Bitcoin ($BTC) Reclaims $90,000 The world's renown digital asset Bitcoin ( CRYPTOCAP:BTC ) surged nearly 4% today to reclaim the $90k resistant zone, amidst breaking out of a bullish symmetrical triangle pattern enroute to $100k.

Bitcoin for almost 1 month now has been swinging within the $80k price range, since losing it's $100k resistant in the month of February, 2025 but with increasing momentum a move to the $100k resistant doesn't seem far fetch because CRYPTOCAP:BTC has already broken the ceiling of the symmetrical triangle.

With the 4-hours RSI at 79, we may experience a respite before the major leap to $100k price point. Notable firms like Micro strategy and Michael Saylor the CEO were integral in this price movement.

The company purchased 6,556 CRYPTOCAP:BTC for ~$555.8 million at ~$84,785 per bitcoin and has achieved CRYPTOCAP:BTC Yield of 12.1% YTD 2025. As of 4/20/2025, Micro strategy holds 538,200 CRYPTOCAP:BTC acquired for ~$36.47 billion at ~$67,766 per bitcoin.

Notably, financial bodies like Standard Chartered Bank says Bitcoin ( CRYPTOCAP:BTC ) could reach a new all-time high due to concerns over the Federal Reserve's independence.

As of the time of writing, CRYPTOCAP:BTC is up 3.70% currently trading at $90,715 per CRYPTOCAP:BTC setting the coast for $100k resistant.

However, on bearish tone, should CRYPTOCAP:BTC fail to pull up that stunt, a price correction might send CRYPTOCAP:BTC back to FWB:83K support.

BTC/USD Daily Technical Outlook – Approaching Cycle Top?Bitcoin is currently trading around $85,500, maintaining short-term bullish momentum within a well-formed ascending structure on the daily chart. The price is now entering a mid-phase rally, with a clear target of $98,000, a key resistance level that coincides with the upper boundary of a rising wedge formation and historical trend extension zones.

Key Technical Levels:

Immediate Resistance: $88,800 (local supply zone)

Major Target Zone: $97,000–$98,000 (macro resistance + psychological round number)

Short-Term Support: $82,000

Key Breakdown Level: $78,500

While the momentum suggests BTC may continue to push higher in the near term, the $98,000 resistance is likely to act as a distribution zone, where buying may slow and profit-taking increases. This level could falsely signal a breakout, leading to a spike in retail long positions before the market enters a longer-term correction phase.

If rejection occurs at or near $98,000, BTC could begin a multi-month correction, with the primary downside target set at $49,000 by July 2025. This level aligns with previous weekly support, volume profile lows, and would represent a typical deep retracement following a major cycle top.

Outlook:

Near-term bias: Bullish toward $98,000

Macro bias: Bearish reversal expected from resistance zone

Cycle correction target: $49,000 (Q3 2025)

"BTC/USD Short Setup: Supply Zone Rejection & 5% Drop Target!"BTC/USD 15-Min Chart Analysis

Trade Setup by EA_GOLD_MAN_COPY_TRADE

---

🔼 SUPPLY ZONE (Resistance)

🟣 Price Area: $83,427.80 – $84,313.06

This is where sellers might step in

Price is expected to reverse or slow down here

🔽 ENTRY POINT

🔵 Sell Entry: $83,427.80

Entering short trade just below the supply zone

Aiming to catch a reversal move down

⛔ STOP LOSS

🔴 Stop: $84,313.06

Placed above the supply zone

Limits risk in case of breakout upward

❗ Protects the trade from loss beyond this point

🎯 TARGET / TAKE PROFIT

🟣 Target: $79,071.05

Major support zone / demand area

Potential Drop: -$4,434.27 (-5.31%)

Big reward zone if price dumps from supply

📈 Trendline & Moving Averages

🔵 Blue = Likely 50 EMA

🔴 Red = Likely 200 EMA

Bullish momentum leading into the supply zone

Trendline supports the prior uptrend, now testing reversal

💡 Conclusion

✅ Trade Bias: Bearish (short)

⚖️ Risk-to-Reward: ~1:5 (Great!)

If price reacts at supply, this setup could pay big

But if it breaks up, stop loss keeps you safe

Grasp the trend and analyze the full range of BTC longsTechnical analysis: Based on in-depth technical analysis, the current BTCUSD decline has slowed down, and there are signs of building double bottom support. The 50-day moving average and the 200-day moving average form a golden cross, the MACD indicator continues to strengthen and the bar chart continues to expand. As BTCUSD stops falling, market sentiment is gradually warming up, institutional funds continue to flow in, fundamental support is solid, and the upward momentum may gradually strengthen. It is the right time to go long.

BTCUSD operation strategy: Go long in the 82500-81500 area. Target 83000-84000

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions, operate according to your own operation plan, market information is complicated, and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. During the transaction, we will continue to pay attention to news and technical changes, inform us in time if there are changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

Buy@85500 - 86500Presently, Bitcoin is firmly ensconced within a robust upward trajectory. Having transitioned from a sideways trading phase at 84000 last week, it has executed a remarkable rally, surging directly into the resistance corridor in the vicinity of 89000. With the current trading price hovering at 87000, the market exudes a palpable sense of bullishness.

Should BTC sustain a stable sideways oscillation between 87000 and 88000, the bulls stand to methodically amass upward momentum. Once primed, a breakthrough of the 89000 threshold by BTC appears all but inevitable.

From a technical vantage point, Bitcoin has convincingly breached the sideways trading range. Its moving averages exhibit a distinct bullish configuration, with the 85000 level solidifying as a crucial support.

On the fundamental front, a confluence of factors—including the prevailing global economic uncertainties, the buoyant market sentiment, and the relatively permissive regulatory environment—collectively conspire to propel the continued ascent of its price.

💎💎💎 BTCUSD 💎💎💎

🎁 Buy@85500 - 86000

🎁 TP 87000 88000 89000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

BTC Today's analysisDuring the recent continuous and close tracking of the cryptocurrency market dynamics, I have always maintained an optimistic view on the price trend of BTC.

As it turns out, this prediction has been strongly validated by the market. Since the last market analysis, the price of BTC has shown a strong upward momentum, steadily climbing from an initial price of around 84,000 to the current remarkable 85,200.

💎💎💎 BTC 💎💎💎

🎁 Buy@83500 - 84000

🎁 TP 86000 - 87000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Bitcoin (BTC/USD) Short Trade Setup – March 15, 2025This is a Bitcoin (BTC/USD) trading setup on a 30-minute timeframe from TradingView. Here's a breakdown of the analysis:

📌 Entry Price: 84,375

📌 Stop Loss: 85,500 (Red Zone - Risk Area 🚨)

📌 Take Profit Levels:

TP1: 83,429

TP2: 82,640

Final Target: 81,259

🔍 Analysis:

The trader is setting up a short position (expecting BTC to decline).

Risk-to-Reward Ratio (RRR) seems favorable, as the target is much lower than the stop loss.

If BTC drops below 83,429, further declines toward 81,259 are expected.

If BTC breaks above 85,500, the trade is invalidated.

🛑 Conclusion:

A bearish trade setup looking for BTC to decline. 📉

Watch for confirmation of downward movement before entering.

Bitcoin's market share rises despite decline in active usersThe data shows that Bitcoin's dominance has been rising steadily since 2022. It also highlights that Bitcoin's market share of active users has fallen over time. The data shows that on-chain activity in Ethereum and other layer 1 (L1) networks has increased.

OnChain data shows that Bitcoin's dominance has increased since 2022, and the upward trend is the longest in history. The data also shows that Bitcoin's active user market share has fallen as on-chain activity on the Ethereum network has increased.

Amid declining users, Bitcoin dominance has increased;

Matrixport shows that Bitcoin dominance has increased to a new high of over 61%. The analytics platform put the dominance higher, which was stronger than expected in the US jobs report. It said that the increased job rate indicates that the economy is recovering. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT

Cold thinking on Bitcoin's "pullback moment"This morning, Bitcoin prices fluctuated again, falling below the $77,000 mark and currently fluctuating around $80,000. The market seems to have entered the "pullback moment" again. Faced with price fluctuations, I believe many friends are thinking about the same question:

Is it "getting off the train to avoid risks" or "entering the market at a low point" now?

This question seems simple, but it is actually complicated. Especially in the cryptocurrency market, short-term fluctuations are drastic, and various information noises are intertwined, which can easily make people lose their way. When we are in the "pullback moment", we need a calm thinking, and we should take our eyes off the price fluctuations in front of us and put them into the larger "trend" and "cycle" framework to examine.

Let's take a closer look at what a trend is and what a cycle is.

1. What are trends and cycles?

To understand any market, we should first distinguish between the two key concepts of "trend" and "cycle", and the crypto market is no exception.

Trend: Trend is the long-term direction of the development of things and a grand and lasting force. It represents the most essential and core trend of things, just like a surging river, once formed, it is difficult to reverse.

Cycle: The cycle is the short-term fluctuation in the development of things, and it is the rhythmic change of swinging around the trend line.

Simply put, the cycle is in the trend. However, simple inclusion is not enough to express the complex relationship between them. If the "trend" is compared to the trunk of a tree, the "cycle" is like the rings on the trunk.

When 96% of the world's population does not yet hold Bitcoin, when sovereign funds begin to include crypto assets in their balance sheets, and when blockchain technology becomes a new battlefield for the game between major powers - this galloping "digital ark" has just sailed out of the dock where it was built. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P PEPPERSTONE:XAUUSD BINANCE:BTCUSDT