Btcusdanalysis

BTC : The future of Bitcoin...Hello friends🙌

👀According to the price history, the price has always been bullish and is in a long-term bullish channel.

📈Now that the price is struggling in the middle of the channel and is gathering strength for a big move, which is expected to break the middle of the channel in the form of a resistance or middle channel, the price will move to the ceiling of the channel.

⚠Don't forget risk and capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

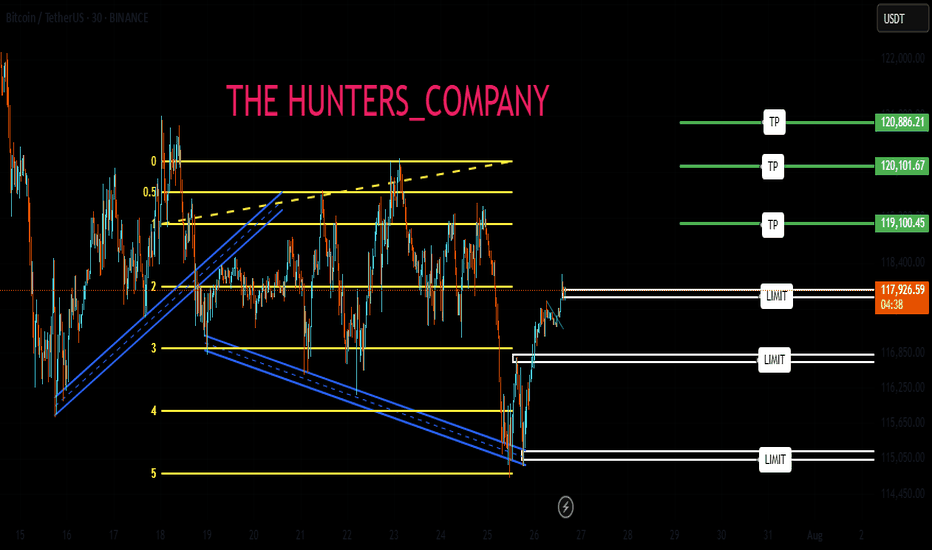

BTC:LIVE TRADEHello friends🙌

📉Given the decline we had, we now had a good price rebound in the specified support area, which shows the power of buyers. Now, with capital and risk management, we can buy at the specified points in a stepwise manner and move to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

BTC not looking pretty....even with lipstickBTC just crossed every meaningful SMA technical indicators and has been lingering at the top of the house like an unwanted guest. Awaiting an UltraBear signal, but watch out on this as massive dips repeat themselves and we are in an overheated market. Also, IMHO don't short as it could back-fire. It will naturally go back to it's support levels....fun times!

Accumulate waiting for btc price increase💎 BTC PLAN UPDATE – End of July (31/07)

📊 BTC Technical Analysis (4H Timeframe – End of July)

✅ Positive Signals:

• BTC has broken out of the consolidation triangle pattern (blue diagonal line), indicating a potential strong uptrend.

• The current price is retesting the breakout support zone around 117,800–118,000 → showing a good reaction and creating upward momentum.

• MA50 and MA200 are starting to slope upwards → confirming increasing buying strength.

📈 Bullish Scenario:

• If BTC holds above 118,000, it is likely to move toward the nearest resistance zone at 119,900.

• After breaking 119,900, the next targets are:

→ 122,792 (Fibonacci 1.618)

→ Further target: 127,900 (Fibonacci 2.618)

🛑 Risk Note:

• If the price drops below 117,000, it’s important to monitor again, as it may retest a deeper support zone around 114,500.

BITCOIN- Charging Towards 122k Momentum Building BTC/USD Long Setup – Targeting 122K 🔥

Bitcoin is holding strong above 118500, signaling bullish momentum.

✅ Price broke key resistance & forming higher lows.

🟢 Current structure favors buy-side continuation with next major target at 122000.

Support Zones:

🔹 117800 – intraday bullish retest

🔹 116500 – strong demand zone

Resistance Ahead:

🔸 120200 – short-term reaction

🔸 122000 – major target

🚀 Expecting bullish wave continuation.

If momentum sustains above 118K, 122K breakout highly probable!

#BTC #Bitcoin #CryptoSetup #BTCUSD #CryptoTrading #BTC122K #ChartAnalysis #BullishBreakout

Bullish Flag Forming on BTCUSDT – Is the Next Big Move Coming?🧠 Complete and Insightful Technical Analysis:

The 12H BTCUSDT chart is currently showcasing a textbook Bullish Flag pattern, a powerful continuation structure that often precedes major upward moves.

---

🏗️ Pattern Breakdown: Bullish Flag

1. Flagpole:

The sharp breakout from around $107,000 to $123,000 marks the impulsive rally — this is the flagpole, created by strong bullish momentum.

Represents the "lift-off" phase where buyers dominate the market.

2. Flag (Consolidation Phase):

After the strong rally, price consolidates inside a downward-sloping parallel channel, forming the flag.

This pullback is healthy, characterized by declining volume, a key feature of the Bullish Flag.

Indicates temporary profit-taking before continuation.

3. Confirmation:

A breakout above the flag's upper boundary (around $123,000 – $124,000) with strong volume would confirm the pattern.

Breakout traders often use this as a high-probability entry.

---

📈 Bullish Scenario (High Probability):

If BTC breaks above the flag structure:

🎯 Measured Move Target (Based on Flagpole Height):

$123,000 + ($123,000 - $107,000) = $139,000

🚀 Potential for further upside if macro conditions and sentiment support the move, possibly reaching $135,000+ in the medium term.

Confirmation Required: A strong candle close above $123,500 with volume spike.

---

📉 Bearish Scenario (If Breakdown Occurs):

If BTC breaks down below the flag (~$117,000):

Retracement likely toward previous breakout zones at $112,000 – $109,000

Such a breakdown could turn the current structure into a fakeout or bear trap

However, this zone may present a strong re-entry opportunity for long-term bulls.

---

📚 Educational Insight for Traders:

Bullish Flags often appear during strong uptrends, acting as a pause before the next leg up.

A healthy pattern shows shrinking volume during the flag and rising volume at breakout.

Traders should monitor key horizontal resistance and volume behavior for confirmation.

---

🧭 Conclusion:

BTCUSDT is at a critical technical juncture. The formation of a clean Bullish Flag suggests the potential for a major continuation rally. Confirmation through a breakout is key — this is the time to prepare, not react.

#BTCUSDT #Bitcoin #BullishFlag #BTCBreakout #CryptoTechnicalAnalysis #CryptoTrading #PriceAction #BTCAnalysis #BitcoinPattern #CryptoEducation #BTCFlag #ContinuationPattern

Bitcoin at a Decisive Moment! Rising Wedge Formed — Breakout?🧠 In-Depth Technical Analysis (BTCUSDT – Weekly Timeframe)

Bitcoin is currently trading within a large Rising Wedge pattern, formed over the long term from late 2022 to mid-2025. This structure is typically a bearish reversal formation, although it can also lead to a breakout in strong bull markets.

The wedge is defined by:

Consistently higher lows on the lower trendline

A gradually rising upper resistance line that currently caps price around $123K–$125K

Decreasing volume, indicating consolidation and energy buildup near the apex

This wedge reflects a period of euphoric price action post-2022 bear market accumulation, with price now testing the top of a historically significant resistance zone.

---

📊 Key Price Levels:

🔹 Current Price: ≈ $118,436

🔹 Recent Weekly High: $123,226

🔹 Critical Resistance (Wedge Top): $123,000–$125,000

🔹 Dynamic Support: Rising wedge base (~$90,000–$95,000)

---

🐂 Bullish Scenario: “Historic Breakout Incoming”

If BTC successfully breaks above the wedge’s upper resistance and closes a weekly candle above $125K with strong volume, it would signal a confirmed breakout from the long-term wedge structure.

📈 Upside Targets:

🎯 Target 1: $140,000

🎯 Target 2: $155,000+ (based on Fibonacci extension and macro targets)

🚀 A breakout of this magnitude may trigger a new parabolic rally, especially if accompanied by:

Increased institutional adoption

Spot ETF inflows

Favorable macroeconomic shifts (e.g., rate cuts)

---

🐻 Bearish Scenario: “False Breakout or Breakdown Risk”

If Bitcoin fails to break out and faces strong rejection from the resistance zone (possibly a false breakout), the rising wedge formation may break down — leading to a steep correction.

📉 A breakdown from this structure often leads to sharp drops due to:

Overextension of the current trend

Distribution phase by smart money

🎯 Downside Targets:

Support 1: $95,000–$90,000

Support 2: $76,000

Major Support: $54,000 (historical demand & EMA zones)

---

🔍 Optional Indicators for Chart Confirmation:

Weekly RSI: Watch for bearish divergence

Volume Profile: Can highlight distribution or accumulation zones

EMA 21/50: Ideal for identifying dynamic support levels in retracements

---

📌 Conclusion:

Bitcoin is at a crucial inflection point within this multi-year Rising Wedge. A confirmed breakout could lead to new all-time highs, while a breakdown may trigger a broad correction. Traders should prepare for high volatility, wait for clear confirmation signals, and manage risk wisely in this pivotal zone.

#Bitcoin #BTCUSDT #RisingWedge #BTCBreakout #TechnicalAnalysis #CryptoMarket #PriceAction #BearishReversal #CryptoSignal #ChartPattern #BitcoinAnalysis #Cryptocurrency

BTC/USDT Buy Setup – VSA & Demand Zone Reaction✅ Entry: Current price action near 117,297

🎯 Target: 119,078 (+1.22%)

🛑 Stop Loss (SL): 116,944 (below demand zone)

📊 Technical Insight (Volume Spread Analysis):

Stopping Volume at Lows:

The recent down move halted with a wide spread down-bar on high volume, followed by an immediate rejection. This indicates potential professional buying absorbing supply.

No Supply Confirmation:

After the stopping volume, several narrow spread candles on low volume formed, suggesting weak selling pressure and a lack of commitment from bears.

Bullish Reaction:

Price rebounded from the demand zone with increasing volume on up-bars, showing early signs of demand dominance.

The current consolidation just above the support is typical of absorption before a markup phase.

Risk-Reward Structure:

The setup offers a favorable 2.2:1 R:R ratio, with the stop placed just below the zone to avoid false breakouts while allowing the trade room to breathe.

📌 Trade Plan:

Bias remains bullish as long as price holds above 116,944.

A breakout above the minor resistance (117,828) with volume expansion would confirm the next leg up toward the 119,078 target.

If volume fails to support the move, reassess before committing additional capital.

Bitcoin's Natural Correction and the $141K Target Based on Fibonhello dear trader and investors

The cryptocurrency market is always accompanied by strong fluctuations and natural corrections. Bitcoin, as the market leader, requires corrections and liquidity accumulation after each significant rally to pave the way for higher price targets. In this article, we analyze Fibonacci structures and harmonic patterns to demonstrate that Bitcoin's next target could be $141K.

1. Bitcoin Corrections: A Natural Part of an Uptrend

Price corrections in bullish trends are a normal phenomenon that helps shake out weak hands and allows major players to accumulate liquidity. Historically, Bitcoin has experienced 20-30% corrections before resuming its upward trajectory. The current correction is no different and may serve as a base for the next strong move toward higher targets.

2. The $141K Target Based on Fibonacci

Fibonacci levels are among the most reliable tools for predicting price targets. Assuming Bitcoin's recent high was around FWB:73K and the ongoing pullback is a healthy retracement, we can use harmonic AB=CD pattern to project potential upside targets. Based on these levels, Bitcoin could reach $141K in the next bullish phase.

Confirmation Through Harmonic Patterns

Harmonic patterns like Butterfly and Gartley suggest that the current correction is forming a potential reversal structure. If this correction completes within the PRZ (Potential Reversal Zone), Bitcoin could see a strong continuation of its uptrend. The Fibonacci ratios in these harmonic structures indicate that the final price target for this bullish wave could be around $141K.

Volume and Liquidity: Key Drivers for the Rally

Bitcoin needs increased volume and liquidity inflows to reach higher levels. On-chain data shows that trading volumes are rising and large investors (whales) are accumulating rather than selling. This behavior typically precedes a strong bullish move.

Bitcoin's current correction is entirely natural, and technical structures suggest that it could be laying the foundation for a new bullish wave. Based on Fibonacci and harmonic pattern analysis, Bitcoin's next major target is around $141K. Traders and investors should consider these levels in their analysis and avoid emotional decisions during market corrections

good luck

mehdi

Have been warned multiple times....BTC will FALL on retailersBTC has been consolidating at the top for a while, which is not very common. Have a feeling that crypto bros have been getting the scratch for more profit taking, but no sensible person will keep buying at the top when the market is already WAY overheated. Picked up early UltraBear signal on this, don't be the person holding to the bag for years. This bubble will burst, just like every other time! Always do your own due diligence, stay safe and get out if you can....

Bitcoin Are We Heading to 140K or 80K ??? Here is the Analysis Based on what is happening here is what we currently see with Bitcoin

Idea 1: If we can break 119K then here are the following levels Bitcoin can go to :

122K

126K

135K

140K

Idea 2: If we continue and break further bearish here are the levels BTC can go to

115,600

114,500

112,800

If we go below this level then a larger correction thesis would point us with a deeper bearish level

Happy Trading

Trade Smarter Live Better

Mindbloome Exchange

Kris

BTC FOMCOnce Again Ive the same view on BTC

There is a chance that it will go down now towards 113.500 straight so the internal buy towards 122.600 should be taken with low risk

if that level is reached the sell to 113.500 is prettyu much asured and also on 113.500 the buy to all time highs 127.500 and 133.000

GG

BTC AI Prediction Dashboard - 6h Price Path (30.07.25)

Prediction made using Crypticorn AI Prediction Dashboard

Link in bio

BTCUSDT Forecast:

Crypticorn AI Prediction Dashboard Projects 6h Price Path (Forward-Only)

Forecast timestamp: ~10:45 UTC

Timeframe: 15m

Prediction horizon: 6 hours

Model output:

Central estimate (blue line): -118,306

Represents the AI’s best estimate of BTC’s near-term price direction.

80% confidence band (light blue): 118,086 – 118,670

The light blue zone marks the 80% confidence range — the most likely area for price to close

40% confidence band (dark blue): 117,520 – 119,603

The dark blue zone shows the narrower 40% confidence range, where price is expected to stay with higher concentration

Volume on signal bar: 80.50

This chart shows a short-term Bitcoin price forecast using AI-generated confidence zones.

Candlesticks reflect actual BTC/USDT price action in 15-minute intervals.

This helps visualize expected volatility and potential price zones in the short term.

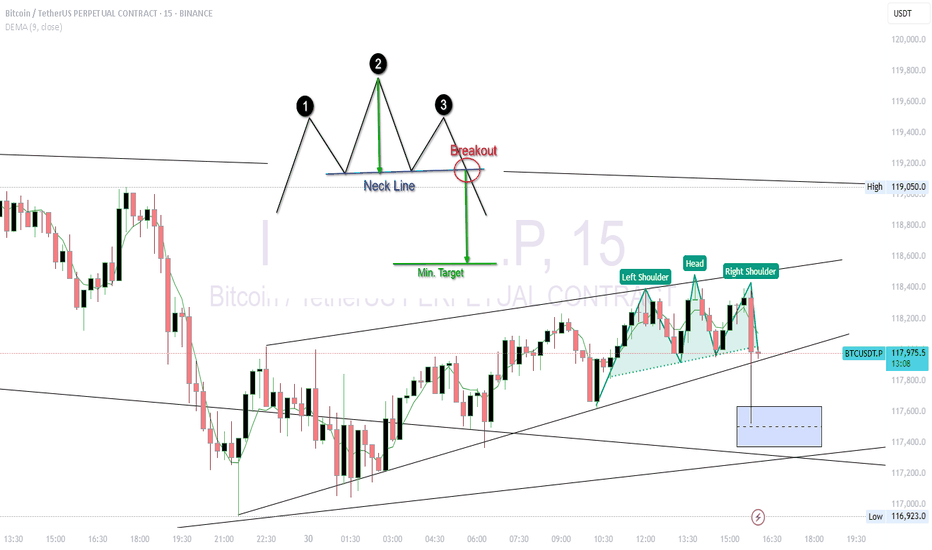

BTC USDT Forming Head and shoulder in 5 MinChart Breakdown

🟢 Pattern:

Left Shoulder: 118,450

Head: ~118,600

Right Shoulder: ~118,400

Neckline: Sloping slightly upward, around 118,050

📌 Bearish Breakdown Scenario

If BTC breaks below the neckline (~118,000) with volume, the expected drop (measured move) is:

Height of pattern:

Head (118,600) – Neckline (118,000) = 600 pts

Target on breakdown:

118,000 – 600 = ~117,400

🔻 Target: 117,400–117,300

🔒 Invalidation: Price closes above 118,300 with strong volume.

Chart Analysis (2h Timeframe)✅ Chart Analysis (2h Timeframe)

MY using Ichimoku Cloud, support/resistance zones, and trend lines.

Price is currently around 118,319 USD.

It has broken out of the Ichimoku cloud and is respecting the trendline support, indicating bullish momentum.

---

🎯 Upside Target Levels

🔵 Target 1:

Level: ~120,000 USD

Reason: Horizontal resistance (clearly marked)

Action: Minor profit-taking or partial exit

🔵 Target 2 (Main):

Level: ~122,000 USD

Reason: Second resistance zone & projected move from breakout

Action: Ideal full target zone

---

🔻 Support & Invalidations

🟡 Immediate Support Zone:

Levels:

118,404

118,296

118,065

These are dynamic Ichimoku & short-term support levels

Bitcoin - The cycle is just starting!⚔️Bitcoin ( CRYPTO:BTCUSD ) just created new highs:

🔎Analysis summary:

Bitcoin is currently - especially with the new all time high breakout - just perfectly following previous cycle behavior. Since there is no real resistance above current price, apart from psychological levels, I do expect a substantial rally back to the upper channel resistance trendline.

📝Levels to watch:

$300.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader