Btcusdanalysis

BTC/USD – Short-Term Rejection at Supply Zone! Bitcoin just tested and got rejected from a high-volume supply zone around $84,940 (marked by LuxAlgo's Supply & Demand Visible Range). The price formed a wick rejection right inside the zone, and we’re now seeing early bearish signs.

---

Key Levels:

Immediate Resistance: $84,940 (supply zone top)

Support 1: $84,140

Support 2: $82,997 (previous demand zone)

Target (if breakdown continues): $82,800 area

---

Bearish Clues:

Wick rejection in a major supply zone

Strong bearish engulfing candle forming after rapid move up

RSI (not shown) was likely overbought during this quick rally

Lower timeframes suggest a potential pullback or short opportunity

---

Scalp Idea (Short-Term Traders):

Short Entry: Near $84,900–$84,940

TP1: $84,140

TP2: $83,000

SL: Above $85,100

Risk/Reward: 1:2+

---

What Do You Think?

Is this a healthy retracement or the start of a deeper dump?

Comment your thoughts below!

Smash that like if you caught this rejection or love clean supply/demand setups!

#Bitcoin #BTC #CryptoTrading #Scalping #ShortOpportunity #LuxAlgo #TechnicalAnalysis #TradingView #DayTrading

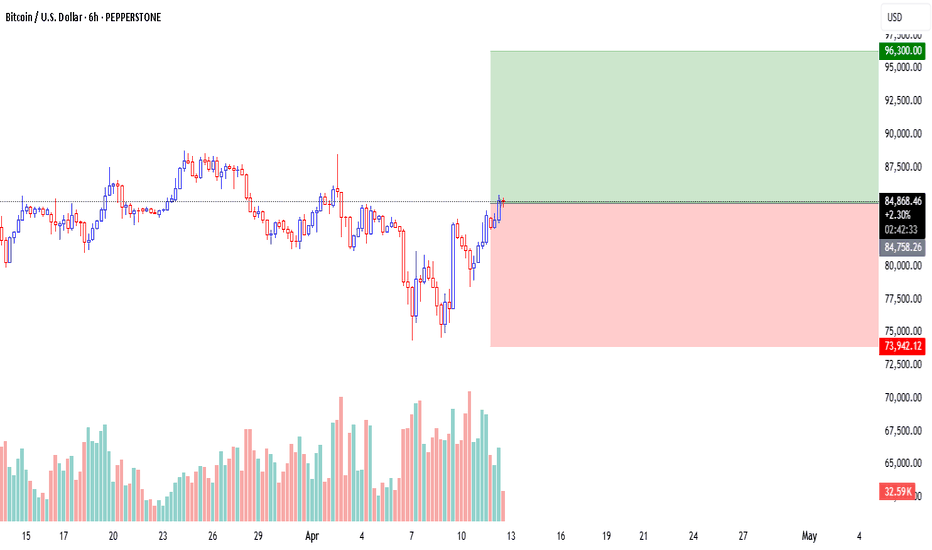

Bitcoin (BTC/USD) Long Trade Setup – Breakout Strategy with TargCurrent Price: $80,724.28

Entry Point: $80,671.23 (just above current price)

Stop Loss: $78,052.44

Target Point: $88,573.60

Resistance Point: $82,260.90

📈 Trend & Moving Averages

EMA 30 (red): $80,220.87 — Short-term trend.

EMA 200 (blue): $80,788.61 — Long-term trend.

The price is currently between the EMAs, indicating potential indecision or a shift in trend. A break above both EMAs with momentum would confirm bullish strength.

🔑 Trade Setup Summary

Element Level

Entry 80,671.23

Stop Loss 78,052.44

Target (TP) 88,573.60

Resistance 82,260.90

Risk-Reward ~1:2.7 (approx)

📊 Analysis & Expectations

Bullish Bias: The chart suggests a long trade with a breakout strategy.

Volume and momentum confirmation will be key above resistance.

Resistance at 82,260.90 may cause a brief pullback before continuation to the target.

The stop loss is well-placed below a support zone and the most recent swing low.

✅ What to Watch For

Break and close above EMA 200 and resistance at 82.2K.

Bullish volume increase on breakout.

Price action around the entry zone (wait for confirmation candle if unsure).

BTCUSD - Liquidity Grab Above Resistance? Potential Reversal ?BTCUSD – Liquidity Grab Above Resistance? Potential Reversal Ahead

Timeframe: 1H

Pair: BTC/USD

---

Analysis Summary:

As per Our Previous Analysis,Bitcoin has broken above the major resistance near 85,000, tapping into an imbalance zone and grabbing external liquidity above previous highs. This move appears to be a classic liquidity grab, rather than a true breakout.

Key observations:

Price wicked above resistance into imbalance.

Potential trap for breakout traders.

Bearish signs developing with a possible trendline break.

---

Trade Plan:

Short on confirmation of trendline break or bearish structure.

Targets:

TP1: 80,000 (internal liquidity)

TP2: 78,000 (ex-liquidity)

TP3: 77,000 (external liquidity zone)

Stop Loss: Above recent swing high / 86,000

---

Market Sentiment:

Short-term bearish bias due to liquidity collection and imbalance reaction.

Also Keep In Mind :

Their is a Major Resistance above the Imbalance So If the Price break it then we have to be prepared for the other scenario of BTC

---

#Bitcoin #BTCUSD #CryptoTrading #SmartMoneyConcepts #LiquidityGrab #Imbalance #SupportResistance #TrendlineBreak #BearishSetup #Forex #CryptoAnalysis #PriceAction #TradingView #MarketStructure

BITCOIN - We've done it, We Broke over resistance and tested

WE ARE FREE

The dashed line is that line of resistance we been stuck under since ATH

Last week, we broke away from the Fib circle that has also held us down recently and we Shot up to theline of resistance and we broke over it.

~The 4 hour shows us more detail

You can see how we have broken over previously and Lost the line as support.

This time, we seem to be holding and the 1 hour chart shows this in more detail

However, we should take note of the MACD, that on lower time frames is now falling bearish on 1 hour and about to on the 4 hour.

We are Almost vertainly going to come back down and test that dashed line as support again.

I expect a possible range of PA 79K -80K lowest and then hopefully a stronger bouce to take us over that line os resistance we are surrently under.

Time will tell.....BUT I FEEL GOOD ;-)

BTC bottom at 2D 200MA?I think we're following the fractal of 2021 bull market, and I was looking for similarities between the consolidation phase that came after the sharp decline. And in fact, there are some similarities.

The first test of the 200MA on the 2D chart and the build-up of a bullish divergence with a fakeout below the trend line on the RSI. It's not exactly the same, but I would say it's very similar.

This week should give a good bounce from the 2D 200MA for the fractal to remain relevant. In case of a breakdown, this idea is canceled.

BTC-----Sell around 81600, target 80500 areaTechnical analysis of BTC contract on April 11:

Today, the large-cycle daily level closed with a small negative line yesterday, and the K-line pattern was a single negative and a single positive. The price was at a low level, and the attached indicator was dead cross. However, the price fluctuation seemed large, but in fact there was no amplitude. Yesterday, the price fell, and the support rebounded in the early morning, basically smoothing out the decline. In this way, the current trend is still in correction, but it does not mean that you can take risks to go long. I think shorting at high levels is still the best choice; the short-cycle hourly chart showed that the decline in the European session continued in the US session yesterday, but it did not continue in the early morning but was a correction of the trend. The current K-line pattern is continuous positive, and the attached indicator is running in a golden cross. Yesterday, the high point of the opening of the decline was near the 82,500 area. Today, we still rely on this position for defense.

Today's BTC short-term contract trading strategy: sell at the rebound of the 81,600 area, stop loss at the 82,100 area, and target the 80,500 area;

Bitcoin Trade Setup: Bullish Breakout Targeting $87K!🔹 Key Levels Identified:

📌 Target Point: 87,008.21 USD 🏁🔵

👉 Expected price move (+9.07%) 🚀

📌 Entry Point: 79,719.00 USD ✅

👉 Suggested buying level in demand zone 🏦

📌 Stop Loss: 78,213.25 USD ❌🔻

👉 Risk management level 📉

📊 Technical Analysis:

📈 Trendline Support:

🔵 The price bounced off the trendline 📊, confirming an uptrend 📈

🔵 Demand Zone:

🟦 Marked blue area = Buyer interest 📊

💰 Expected reversal zone if price retests

📊 Moving Average (DEMA 9):

🔸 82,343.85 USD (current level)

🔺 Price slightly below DEMA ➝ possible bullish reversal 🚀

⚡ Trade Setup:

✔️ Risk-to-Reward Ratio:

🟢 Potential profit: +7,220.76 USD

🔴 Risk: -1,500 USD

📊 Favorable trade setup with high reward vs low risk ✅

✔️ Momentum Confirmation:

🟢 Above 79,719 USD = 🚀 Bullish breakout

🔴 Below 78,213.25 USD = ❌ Stop Loss triggered

🔮 Conclusion:

🔥 Bullish setup if price holds demand zone!

🚀 Target: 87,008 USD

⚠️ Manage risk with stop loss! 📉

BITCOIN weekly and 50 SMA - has VERY good newsAs you can easily See, despite all the unsettled News and events in recent days, the current Week candle has returned to GREEN having hit that 50 SMA.

To remind you, we began the week with a RED candle BELOW that 50 SMA.

This is Very important for sentiment. We bounced off that 50 back in 2024 and went to ATH.

To remind you, we have hit the 50 at the same time as the weekly MACD has entered a Bounce Zone, very near Neutral.

The MACD chart above shows you that the Histogram bar has also returned to White, showing a possible turn of favour from Bearish to Bullish.

BITCOIN IS SO READY TO GO

We just need the investors that are pouring money into the Snail called GOLD, to realise the Future is BITCOIN

We wait

BTC-----Sell around 82100, target 80800-80300 areaTechnical analysis of BTC contract on April 10: Today, the large-cycle daily level closed with a big positive line yesterday. The K-line pattern was single negative and single positive. The price stood above the MA5 daily average line, but the attached indicator was dead cross. A single rise is difficult to become a trend and difficult to continue. In addition, when the large trend is still weak, there is no room for rise, so the current trend can only be regarded as a correction trend; from the four-hour chart, the current K-line pattern is continuous negative, and the pressure high point after the pullback is 83,600 area, and the price has not broken the correction high point position of the previous stage-by-stage decline. This is very obvious. The current K-line in the short-cycle hourly chart is continuous negative, and the attached indicator is dead cross, so whether the European session can continue is the key.

Today's BTC short-term contract trading strategy: sell directly at the current price of 82,100 area, stop loss at 82,600 area, and target 80,800 area and 80,300 area;

BTCUSDT | Waiting for Precision – Not Just Price LevelsMany were tempted to short BTCUSDT around the $83,000 region, and I was closely watching it too. However, as always, I don’t take trades based solely on price levels. What separates professional trading from guesswork is the data behind the scenes, and in this case, CDV (Cumulative Delta Volume) did not show any bearish divergence. That’s why I completely passed on this level without hesitation.

🎯 What’s Next?

Upper Blue Box is My Focus: I’ve now shifted my attention to the next key upper blue box, where I’ll be looking for serious short opportunities, but only if LTF confirmations such as orderflow shifts, CDV divergences, or volume traps appear.

Why I Wait: Just because a price hits a “zone” doesn’t mean we react. Professional traders wait for confluence, confirmation, and controlled risk.

🔒 Smart Trader Checklist:

No CDV divergence = No trade.

Wait for price to enter the upper blue box and react.

Short only with proper lower time frame confirmation.

If price breaks above with strong momentum and retest, I will not insist on shorts. I will shift and look for longs.

💡 I trade with precision and patience—not emotion. These levels are not random lines, but key zones mapped with advanced tools and strict discipline. That’s why my followers consistently win, and why my success rate is among the highest you’ll find here.

If you want to trade with clarity, confidence, and data-backed precision, just keep following me. You’ll see the difference.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Bitcoin (BTC/USD) Technical Analysis – Bullish Setup🔵 Key Levels:

🎯 Target Point: 87,050.22 (🔼 Expected upward move)

🔵 Support Zone: 79,833.82 (🛡️ Strong demand area)

🔴 Current Price: 82,254.27

📊 Analysis:

🔵 RBS + RBR Zone (🔄 Role Reversal Support & Rally Base Rally) - Possible entry point for a long position.

🟠 Stop Loss: Below 79,833.82 (🚨 Risk Management)

🟣 Resistance Zone: Near 83,000 (🔄 Possible short-term pullback)

📈 Strategy:

1️⃣ Price might retrace to the blue zone (support) before continuing upward.

2️⃣ If it holds, 🚀 potential rally towards 87,050.22 🎯

3️⃣ If it breaks below support, ⚠️ possible downside risk.

✅ Conclusion:

A bullish setup with a 7.45% profit target 📊

Risk managed with a stop loss below support ⚠️

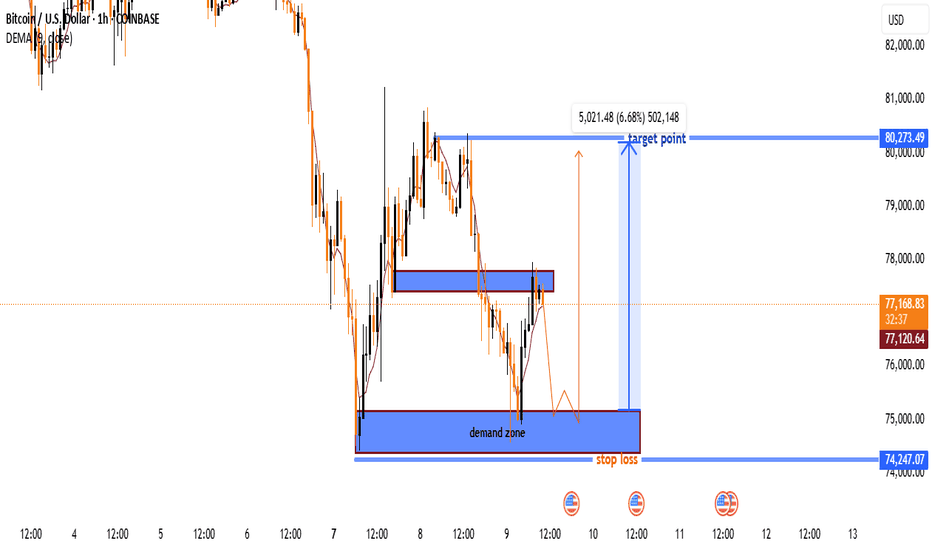

BTC/USD Long Setup – Bounce from Demand Zone Towards $80K TargetKey Zones

Demand Zone (Buy Zone)

🔵 $74,250 – $75,000

Strong support area

Buyers previously stepped in here

Marked for potential entry

Resistance Zone

🟣 $77,300 – $77,600

Mid-level resistance

Could cause a short pullback

Watch for breakout or rejection

Target Point

🎯 $80,273.49

Potential upside: +6.68% gain

Previous supply/structure zone

Take Profit (TP) zone

Stop Loss

⛔ $74,247.07

Just below the demand zone

Protects against invalid setup

Trade Idea

1. 🔽 Price expected to drop into demand zone

2. 🔄 Wait for bullish confirmation (e.g. bounce or engulfing candle)

3. 📈 Enter long position near $75,000

4. ⬆️ Ride it up through resistance

5. ✅ Target = $80,273 | ❌ Stop = $74,247

Bitcoin Is About To SkyrocketHello, Skyrexians!

It looks like BINANCE:BTCUSDT has finally finished its correction. On the daily time frame we have the confirmation, now we are waiting for weekly close to make sure. With our prediction next wave to the upside is going to be the altcoin season wave, a lot of negative around the Trump's tariffs also confirms that.

Let's take a look at the weekly chart and remember our global forecast. The wave which has been finished in March 2024 was just a wave 1. Now price is printing wave 3. Notice that the minimal target for the wave 3 has been completed. This is the Fibonacci 1 level. Even if wave 3 has been already finished we will see higher high in the wave 5. But the main scenario is that this wave will be finished at 1.61 Fibonacci level, approximately at $140k. Anyway we will see which scenario market choose when Bitcoin will breaks $110k. Now we want to see the confirmation on the weekly by the green dot on Bullish/Bearish Reversal Bar Indicator .

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

BTC/USD Bullish Breakout Setup – Targeting $85,477 with 5.62% UpThe price has recently surged above both the 30 EMA (red) and 200 EMA (blue), signaling a strong bullish move.

The EMAs are beginning to turn upward, particularly the 30 EMA, suggesting short-term bullish momentum.

Key Levels Identified

Entry Zone (Purple Support Zone):

Around $80,105 – a potential buy zone after a pullback.

Labeled with STOP LOSS, indicating the invalidation level if price drops below this zone.

Target Zone (Purple Resistance Zone):

Around $85,477 – this is the target level, marked as “EA TARGET POINT”.

Offers a potential move of +5.62% or 4,551.83 points.

Price Action

Price broke above a previous resistance (now support) and has pulled back slightly.

The projected move suggests a bullish continuation after a minor pullback and consolidation.

Risk-Reward

Good risk-reward ratio implied with the large gap between the stop loss and target.

Stop loss is tight, just below the purple support zone (~$80,105).

Projection

The blue lines and annotations suggest a bullish play, with an expected upward movement after retesting the support.

✅ Possible Trade Idea

Buy Zone: ~$80,105 (on a confirmed retest)

Stop Loss: Slightly below $80,105

Target: ~$85,477

Expected Move: +5.62%

🔍 Additional Notes

Keep an eye on price behavior around the support zone—confirmation (e.g., bullish candle pattern or rejection wick) strengthens the entry.

The strong move leading to the breakout suggests high momentum, which could mean limited pullback.

News or macro developments could invalidate technicals—be aware of external factors.

BTC Bullish Setup Incoming? Watch This Key Level!15-Minute Timeframe Analysis

Hey Traders!

#Bitcoin has just formed a potential harmonic pattern on the 15-min chart, signaling the early stages of a bullish setup.

What we're seeing:

Harmonic pattern completion

Possible Bullish Divergence building up

Price approaching a strong resistance level

Plan of Action:

We’re watching closely for a clear breakout above the resistance—that’s our confirmation signal for a bullish trend continuation. Once confirmed, we’ll be looking to enter a long position with strict risk management in place.

Pro Tip: Patience pays! Wait for confirmation to avoid false breakouts.

What do you think? Will #BTC break resistance or get rejected? Drop your thoughts in the comments!

Follow me for more real-time trade ideas, technical setups, and risk-managed strategies!

#Bitcoin #BTCUSD #Crypto #TechnicalAnalysis #HarmonicPattern #BullishDivergence #PriceAction #BreakoutStrategy #CryptoTrading #RiskManagement #TradingView

Bitcoin - Watching For CapitulationI'm not going to try and predict whether not Bitcoin has begun what I believe to be its inevitable long term bear market, but I will look at some important trends and horizontal levels. For years, I've speculated that Bitcoin would have a hard time sustaining a significant new all-time high. It turns out, for the mean time, I've been correct in that assumption.

Bitcoin has now broken down from the ascending broadening wedge pattern that began in November, 2022. Here's the chart zoomed out:

There is still a chance for this to be a false breakdown, if buyers show up soon and take price back above that $87-90K resistance, which has become quite strong. However, ongoing global market news continues to remain bearish fundamentally, as many commodities and material objects will have to be repriced to the upside. At the same time, the FED is in a bind because if this causes a spike in unemployment, they will be more hesitant to lower rates, fearing greater inflation. This is the definition of stagflation.

In any case, zoomed in you can see that Bitcoin is in a downtrend channel - often a bullish pattern. My speculation is that Bitcoin will attempt to break down BELOW the channel, leading to a cascade of liquidations. This kind of drop can end around $69-71K on the shallow end, though can go much deeper from a structural standpoint. Outlined are all the support levels, and circled in red is a potential capitulation area.

If Bitcoin manages to bounce from the $60-70K level on high enough volume, depending on economic news, price can even make a new high. But we're not there yet by any means. This possibility is shown with the green arrow. On the other hand, if Bitcoin cannot bounce at the previous trend resistance (light blue line below the red local downtrend), price can retrace all the way towards $48-50K.

Let's see what happens!

Thanks for reading.

-Victor Cobra

BITCOIN NEW SWING UPDATESHello folks, crypto folks. bitcoin might go to 3.168 fibs. but only if price can go lower 60k below.

THe idea of zoning for entries are a big risk for it.

This is only my view, this is a continuation pattern.

lets trade it to swing.

check my comments below I post some cool. stuff

THis is not a financial advice.

FOllow for more

BTC/USD Long Setup – Bounce from Demand Zone Towards $80K TargetKey Zones

Demand Zone (Buy Zone)

🔵 $74,250 – $75,000

Strong support area

Buyers previously stepped in here

Marked for potential entry

Resistance Zone

🟣 $77,300 – $77,600

Mid-level resistance

Could cause a short pullback

Watch for breakout or rejection

Target Point

🎯 $80,273.49

Potential upside: +6.68% gain

Previous supply/structure zone

Take Profit (TP) zone

Stop Loss

⛔ $74,247.07

Just below the demand zone

Protects against invalid setup

Trade Idea

1. 🔽 Price expected to drop into demand zone

2. 🔄 Wait for bullish confirmation (e.g. bounce or engulfing candle)

3. 📈 Enter long position near $75,000

4. ⬆️ Ride it up through resistance

5. ✅ Target = $80,273 | ❌ Stop = $74,247