BTC/USD 1H Chart Analysis – Bearish Setup with SBR Rejection🔵 Key Zones & Levels:

🔷 SBR Zone (Support ➡ Resistance):

Price Range: ~$81,000–$83,000

🛑 Stop Loss: $83,002.31 (Just above resistance)

Expecting sellers to step in here if price retests this level

🟠 Mid-Range Zone:

Current price is consolidating just below SBR zone

Could form a lower high before dropping

🟦 Target Zone (Support Area):

🎯 Target Price: ~$75,000

Previous demand area – price bounced hard from here before

🔁 Trade Plan:

📉 Bias: Bearish

📍 Entry: Near current price or after retest of SBR zone

🛑 Stop Loss: $83,002.31

🎯 Target: $75,000 (approx -8.33%)

✅ Summary:

Risk-Reward: Appears solid (R:R > 2:1)

🕵️♂️ Watch for: Fakeouts or rejections in the SBR zone

🔻 Potential Move: -6,804 points if plan plays out

Btcusdanalysis

Daily BITCOIN Bull Bear candles showing return of the Bulls ?I have used this chart often and have posted it here on a number of occasions with out the Bull Power Bear Power Histogram by CEYHUN active.

This is how the chart Looks when it is active.

This indicator calculates trading action to determine if a Candle is Bullish or Bearish and is VERY ACCURATE

And, Currently, Today's candle is GREEN, for the first time in a LONG TIME.

We can see how the candles have remained RED for most of the Drop in channel.

But now, while we sit on support on a Fib Speed Resistance Fan, we are GREEN.

Long Term, we can see that the climb back to current ATH could be tough. The VRVP on the right is clearly showing rising levels of resistance we climb higher.

Currently, we need to watch closely, to see that candle remain Green and that we do not loose support here.

I feel Bullish

Bitcoin and 50 SMA on a WEEKLY chart - UPDATE Following on from the sharp drop in the beginning of the week, where PA dropped Below the 50 SMA ( RED) , PA has recovered and, as you can see, the candle Body is currently sitting ON the 50 SMA

We may need to remain in this area to bring back the Bullish Sentiment and then move higher.

It can be said that a bullish sentiment remains with Bitcoin as its did NOT crash as sharply as Stock Markets.

We are also now waiting on the MACD to fully enter the "Bounce Zone"

The Weeks candle on the histogram has returned to RED and so some caution is required here, while we wait.

It is the next few days that are crucial now. The "Tariff" dust us settling and countries are reacting to Trumps Tariff impositions.

My Gut feeling is VERY positive right now.

But that is just me,

Watch that candle on the 50 SMA like a Hawk. If we loose that again and the week closes below, THEN we need to think carefully

BTC - 4 Different Wider Looks at BTC1️⃣ Weekly EMA 55. Many legit touches.

2️⃣ Possible Elliot Wave in Log chart.

3️⃣ 4H EMA 200.

4️⃣ A valid Pitchfork since Dec 2024

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

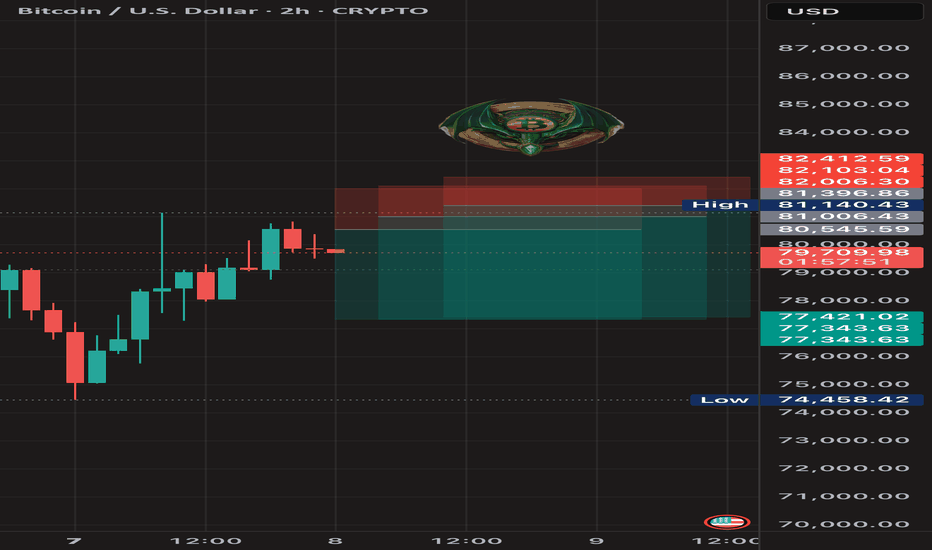

BTC SHORT TP:77,200 07-04-2025⚠️ Despite its recent recovery, Bitcoin is showing bearish patterns on the 1-hour and 2-hour timeframes. That's why I'm targeting a short at 77,300.

This analysis is based on those timeframes, so we expect it to develop in the next 12 hours; otherwise, it will be invalidated.

Follow me to stay updated and keep stacking those greens together! 💰🔥

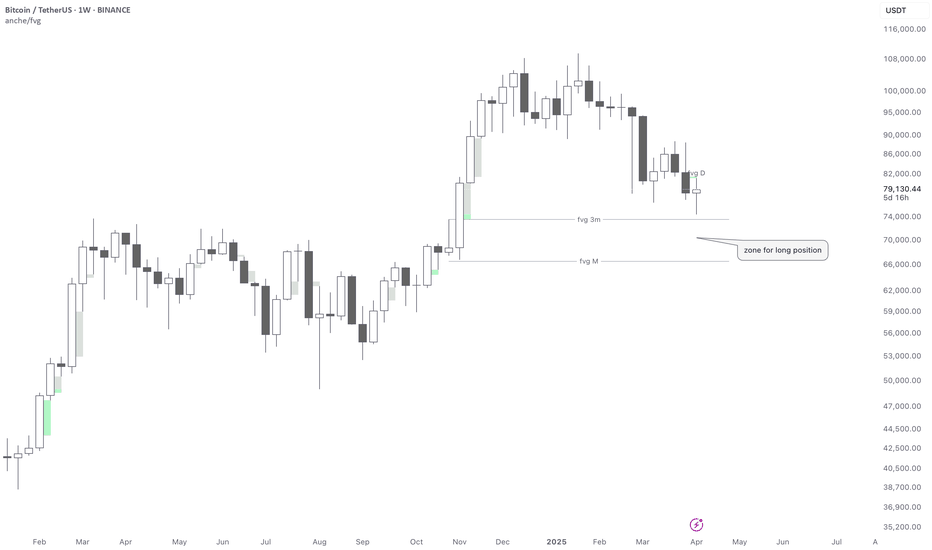

$$$ BTCUSD MACRO-BULLISH $$$ 1W CHART $$$BITFINEX:BTCUSD 1W Chart

There are many reasons to look at this weekly chart and see that there's absolutely no reason to be bearish on Bitcoin yet.

Holding strong r/s flip support.

Holding regression trend.

Holding parabolic trend.

Stoch RSI at the bottom.

Weekly bullish divergence.

Assuming this plays out in a way that's similar to the last local bottom, the current target is around $134k-$135k.

It would take a lot to invalidate all of these bullish indicators, but if that does somehow happen, with a CLOSE of the weekly candle that invalidated these, then It's pretty much definitely over for a loooong time.

NFA blah blah blah..

Were To Buy BITCOINMartyBoots here , I have been trading for 17 years and sharing my thoughts on COINBASE:BTCUSD here.

.

BTC is very interesting chart for now that it has dipped 30% and trying to find support.

Do not miss out on BTC at the important levels as this will be a great opportunity

Watch video for more details

BTC-----Sell around 80700, target 79000 areaTechnical analysis of BTC contract on April 8: Today, the large-cycle daily level closed with a small positive line yesterday, and the K-line pattern was a single negative and a single positive. The main reason for the decline was the stimulation of the news, so there was no continuous negative pattern, but the price was below the moving average, and the attached indicator was dead cross and running downward. The decline in the general trend was very obvious. The current moving average pressure position was near the 81000 area. Although the current trend is very clear, we still need to remind everyone to pay attention to the risk of retracement. Risk control must be strictly done, because many friends have gambling nature and do it with large positions. Once the risk is not controlled, there will be a situation of liquidation; the short-cycle hourly chart has been continuously rebounding since yesterday's day. The current K-line pattern is the same, and the attached indicator is running in a golden cross. There is no signal of pressure, so we have to wait during the day, and use the daily moving average pressure as a defensive position.

Therefore, today's BTC short-term contract trading strategy: sell at the rebound 80700 area, stop loss at the 81200 area, and target the 79000 area;

Bitcoin Technical Breakdown – Bearish Channel in Motionhello guys.

🔻 1. Bearish Channel

Bitcoin is currently respecting a downward-sloping channel with lower highs and lower lows.

Every attempt to break the upper boundary has been met with rejection, confirming bearish pressure.

🔁 2. Retest of Former Trendline

The former ascending trendline (drawn from 2023’s bottom) was broken and recently retested as resistance, failing to flip it back to support.

This retest often signals confirmation of trend reversal.

🧱 3. Critical Support Zone: $62K– FWB:65K

This zone served as a strong accumulation range in the past and aligns with the current downside target.

____________________________

🔮 What’s Next?

Based on this pattern and price behavior:

Bitcoin may continue its bearish descent, following the projected zig-zag pattern in the channel.

The next significant bounce area lies around $64,000, aligning with both volume-based support and previous breakout zones.

BTC/USD) Bullish reversal analysis Read The ChaptianSMC Trading point update

This is a bullish reversal analysis on BTC/USD (Bitcoin to USD) on the 4-hour chart, suggesting a potential long opportunity after a sharp corrective move.

---

Key Breakdown of the Chart:

1. Strong Downward Move with Potential Reversal:

Bitcoin experienced a sharp drop from the 88k region to ~74,387.50, now hitting a key demand zone (marked as "Orderblock").

2. Bullish Reaction Expected:

From the Orderblock support zone, a bullish reversal is anticipated.

The projected move aims to fill the imbalance and test the target zone between 87,152.94 and 88,557.14.

3. RSI Oversold:

RSI is around 32.27, indicating oversold conditions and adding confluence for a potential bounce.

4. EMA (200):

The 200 EMA lies around 85,153.85, which may act as dynamic resistance on the way up.

Mr SMC Trading point

5. Price Target:

The expected upside move is approximately +13,722.85 points (+18.75%), aiming for the supply zone above 87k.

---

Conclusion / Trade Idea:

Entry Zone: Near 74,387.50, the orderblock/demand area.

Target Zone: 87,152.94 – 88,557.14

Bias: Bullish short- to mid-term reversal.

Confluences: Oversold RSI, clean support zone, potential trendline bounce, and price inefficiency above.

---

Pales support boost 🚀 analysis follow)

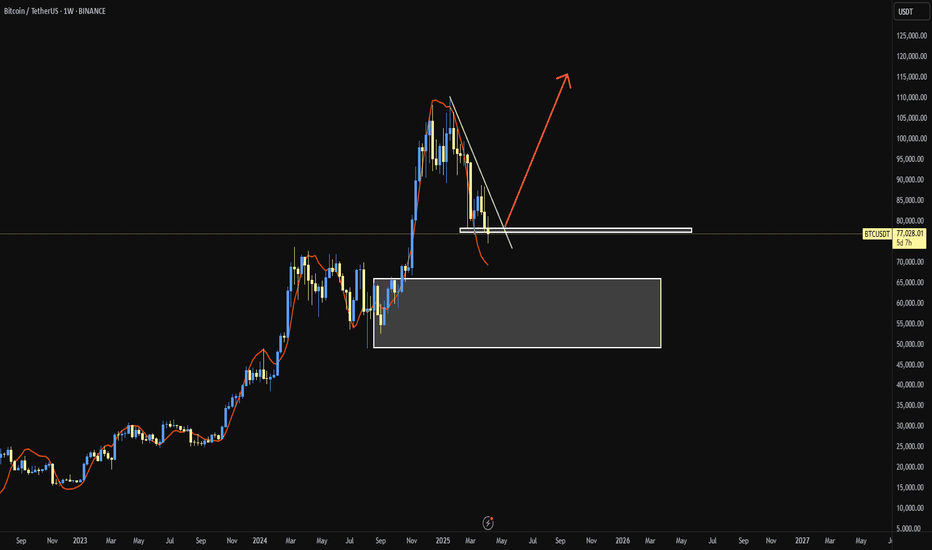

BTCUSDT📊 Bitcoin Weekly Analysis – Smart Money Concept (SMC)

On the 1W BTC/USDT chart, we are currently observing a corrective move after a strong bullish impulse. The price is approaching a high-probability demand zone formed between two significant Fair Value Gaps (FVGs):

• 🔹 FVG 3M around $74,000

• 🔹 FVG M around $66,000

🟩 Long Setup Zone:

The area between these FVGs represents a discounted price zone where smart money is likely to step in. This is labeled as a “zone for long position” on the chart.

⸻

🧠 Smart Money Perspective:

• The market is in a retracement phase, targeting inefficiencies (FVGs).

• If price taps into this zone and shows signs of bullish intent (e.g., weekly bullish engulfing, BOS/CHOCH on lower timeframes), we can expect a strong upward move.

⸻

🎯 Mid-to-Long Term Target:

• Based on the current market structure and SMC model, the next major target is $130,000.

⸻

🔐 Risk Management:

• Ideal entry: within the FVG zone

• Stop-loss: below the lower FVG (around $65,000)

• Confirmation: bullish price action on lower timeframes or weekly candle close with strong momentum

⸻

📌 Conclusion:

This setup offers a potential high-reward opportunity if smart money reacts to this discounted zone. Patience and proper confirmation are key.

⸻

BTCUSDT - It's breakout? What's next??#BTCUSDT - perfect move below our region as you can see our last idea regarding #BTCUSDT

Now market have 81100 as a resistance area and if market sustain below that then we have further drop to downside.

Expected areas below are 74k, 69k and 65k

Good luck

Trade wisely

Breaking: Bitcoin Loses $80,000 Support The price of Bitcoin ( CRYPTOCAP:BTC ) today saw a noteworthy downtick of 2.24% today making it down 7% since last week losing the $80k grip. This move came days after Donald Trump the recently elected president, on Wednesday, announced a minimum tariff rate of 10% and higher rates for 57 economies like China (34%), the European Union (20%), and Japan (24%). Fitch Ratings estimated that the effective tariff rate could hit 25% on average — the highest in more than 115 years.

The asset has tanked to the $76,000- $74,000 support point, placing CRYPTOCAP:BTC on the brink of a selling spree should CRYPTOCAP:BTC break below the $70k support, possible retracement should be around the $60- $50k support points.

Similarly, with CRYPTOCAP:BTC trading below key Moving Averages (MA), and the RSI at 35, CRYPTOCAP:BTC is gearing up for a reversal albeit the market is still volatile. If Bitcoin ( CRYPTOCAP:BTC ) should break the 1-month high resistant a possible uptick to $120k is feasible.

Bitcoin Price Live Data

The live Bitcoin price today is $77,615.23 USD with a 24-hour trading volume of $78,391,741,615 USD. Bitcoin is down 5.64% in the last 24 hours. The current CoinMarketCap ranking is #1, with a live market cap of $1,540,502,278,162 USD. It has a circulating supply of 19,847,937 BTC coins and a max. supply of 21,000,000 BTC coins.

#BTCUSDT.. single supporting area, holds or not ??#BTCUSDT. perfect move as per our last couple of ideas regarding #btcusdt

Now market have current supporting area that is around 82300

Keep close that level because if market clear that level then we can expect a further drop towards downside next areas.

Good luck

Trade wisely

Bitcoin Lost 50 SMA overnight, what next ? - still BULLISH.In a week where I am still expecting the beginnings of a bounce, we saw a Major Drop overnight.

This has pushed PA below the 50 SMA that I was hoping PA would bounce off, as it had previously.

So, Whats Next ?

It is not as bad as it may appear but CAUTION is a Very Very good idea.

There are a number of lines of support below and if we do not find any soon, 73K is the next line of Support. then down to 71K and ultimately, the long term line at 64K, though I still doubt we will get that low.

But FEAR is BIG...be a Vulture..Buy the remains of people Fear...Bitcoin IS a Scarce asset and people Still want it.

The Weekly MACD

The MACD is now in the bounce Zone. Yes, it may drop below neutral if this "Tariff Fear" continues. But Technically, We now have the ability to bounce once sentiment turns

On a slightly more bearish side is the fact that Histogram has dived deep and Red. The Bears are biting and has momentum

The RSI Relative Strength Index

Like the MACD, the RSI is now in an area where it has bounced in the past and yet, it can still drop further before we reach Neutral ( 30 line ) . It has to be said, the RSI is a bit behind the MACD in that it has a later date when it could reach Neutral. There is no guarantee that Neutral will hold RSI up....

Other Markets are struggling also

The DXY $ has had a sustained drop but is near an area of support. I am watching this closely.

Normaly, we see DXY and BTC move in opposite directions but we have seen both Recover at the same time, The lines between the teo are getting blurred.

GOLD - has been doing well for some omnths

However, in th elast 2 weeks, Gold has been selling off also and saw a steep drop towards the end of last week. Will be very interesting to see where this goes this week

The fact that Gold was selling, shows that investors were comfortable to leave a safe haven.

Lets see if that changes this weel

Conclusion for BITCOIN HOLDERS

This could all sound a little scary for Bitcoin and it should be taken as a HUGE Warning that we Lost the 50 SMA Support. This does open up the possibility of further drops and it may well happen

We are currently heading towards major support at 73K

This is an area I said we could hit a few weeks back and so I am not in a bad state of mind just yet.

If we Loose 71K, I will get uncomfortable.

The Lower timeframes are very much heading to OVERSOLD and so we shold get some support here and then we wait to see if Fear takes hold further.

This week, we Get the FOMC minutes and then Inflation data coming out of the USA

Thsi could Tip the balance either way, depending on the data

For me, I am NOT Selling Just yet.

I imagine many Short term holders will be and these coins will be snapped back up

We wait to see how today plays out

BUY THE DIP