Bitcoin Technicals Flash Warning – Smart Money Watching!Bitcoin has been forming a series of lower highs and lower lows since its all-time high (ATH) of $109,568, indicating a potential downtrend. The support level, which previously held strong, has now been broken and is acting as resistance. The recent price movement suggests a retest of this broken support, which could confirm further downside if rejected.

The 100 EMA is positioned above the price, reinforcing bearish pressure. If BTC fails to reclaim this level, the price may continue to decline. RSI is hovering around 41.51, indicating weak momentum, with no strong bullish signals yet.

Bullish Scenario: A reclaim of the broken support and a move above $90,000 could invalidate the bearish setup.

Bearish Scenario: A rejection from this level could lead to further downside, potentially targeting $75,000-$72,000.

Btcusdanalysis

Bitcoin BTC - Buy The News, Correction Is Almost Over Hello, Skyrexians!

The anticipated move has happened, BINANCE:BTCUSDT has retested the recent low and its dominance continues growing, alts are bleeding. When this nightmare will be finished and do we have any chance to see the reversal now?

Let's take a look at the daily time frame. As we pointed out earlier Bitcoin has printed wave 1 inside larger degree wave 3 and after that dropped in the wave 2. We have already told you 2 times that correction is over when price was next to $77-78, but multiple retests are not forbidden. 0.61 Fibonacci zone is the place where correction can be finished, so it can dump up to $73k. Two facts we need to rely on to find the correction bottom are: bullish divergent bar and the first green column on Awesome oscillator in conjunction with the divergence.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Bearish Flag, Bitcoin (4H)Bitcoin has broken a bearish flag in medium time frames. If a rebound comes would be an opportuinty to get short positions.

The problem with Bitcoin is not only the bearish flag currently working on. It has a change of character in daily time frame which I posted a lot about it another of my analysis.

I don't think the values of assest is cheap at the moment. In fact, they're about to get cheaper a lot in coming days.

For now, 76400 is looking like a specific target for the main flag formation.

Thanks for reading.

Short position openedI invest in Bitcoin, and don’t usually trade. However, I can see a pretty bearish setup unfolding.

Trade set up:

Entry price: 85341.66 (black line in 4H)

Stop loss: 87,962 (red line in 4H chart, just above the previous week high)

Target 1 - 80.971 (green line, previous week low and Fib 0.5 level in Daily chart)

Target 2 - 78, 253 (green line in 4H chart, previous month low, approx 50% encroachment zone of fair value gap in daily chart .

Reasons:

Weekly:

MACD is still in the bull territory but MACD lines are clearly moving to the downside.

The price has retraced to 50% of the massively bearish red candle of(March 3rd weekly candle) and now resuming to move to the downside.

Daily:

RSI and MACD are both in the bear territory and it looks like they are rolling back to the downside in the bear territory, which is pretty bearish.

The price has dropped and closed below the ascending trend line.

4H:

The price has been travelling inside the ascending parallel channel, but it is dropped and closed below the bottom line.

Both MACD and RSI are deep in the bear territory.

Bitcoin Bullish Idea I'll be buying for that point of interest 78544.71 if I see confirmation for reversal. Though H8 zone 79100.20 looks valid too as the price has triggered it and rejects it awesomely.

My projection is this new week is going to be Bullish not just for Bitcoin but some other. Crypto pairs too.

I'm bullish on Eth as well.

Kindly boost if you find this insightful 🫴

Is Bitcoin about to touch the 50 SMA and BOUNCE ?

Just a Quick Idea - But the 50 SMA has been a Good Lauch pad previously in 2024 - Is it about to do so again ?

We also have the MACD ( Weekly ) nearing Neutral, It also bounced off this level in 2024

We will know by tomorrow or Tuesday, Just what is happening

HANG ON

Could Bitcoin Crash 60%—But Only 20% of Traders Lose?Analyzing the current BTC/USDT chart, we see that Bitcoin is hanging just above a critical support zone—what many traders recognize as “the most important support level” from a volume perspective on Binance. The chart illustrates a potential 60.37% drop, which would pull BTC down nearly $49,000, back toward the high-volume range near $30K.

This sounds catastrophic, right? But here’s the twist...

🔍 Why Only 20% of Traders Might Actually Lose

According to Binance's volume profile data:

The majority of buying activity and position accumulation happened below $35,000.

Most long-term holders and smart money entered during the 2022-2023 accumulation range.

The Volume Profile Visible Range (VPVR) shows significant support below the current price, with minimal trading volume at higher levels.

💡 That means only a minority (approx. 20%) of traders bought BTC during its late-stage bull run above $70K. These are the traders most at risk if a drop occurs.

In contrast, the majority are still sitting in profit—or near break-even—even if Bitcoin retraces back to its base.

📊 So while the price could drop 60%, 80% of holders might remain safe, having entered at lower levels.

🧠 What This Means for You:

If you're a late bull, it’s time to assess risk.

If you're a smart accumulator, the pullback could offer another golden entry.

If you're a bear, this chart supports your thesis—but don't forget the whales are watching this zone closely.

Stay sharp. Stay informed.

BTC/USD Weekly Analysis – Cup and Handle Breakout Toward Target🔍 Overview

The chart displays a classic Cup and Handle pattern on the weekly timeframe, a well-established bullish continuation formation often found in long-term uptrends. This pattern, combined with major technical confluences such as trendline support and strong horizontal levels, provides a high-conviction long setup with defined risk and reward.

☕ 1. The Cup Formation

Timeframe: Mid-2021 to early 2024

Shape: Rounded bottom, a hallmark of slow accumulation.

After reaching an all-time high in late 2021, BTC entered a bear market, dropping sharply and eventually bottoming out between $15,000–$20,000.

A gradual recovery followed, forming a wide and symmetrical base—indicating accumulation by institutional and long-term holders.

This phase represents a shift in market sentiment, from bearish to neutral, and eventually bullish, as buyers stepped in around key demand zones.

🔧 2. The Handle Formation

Timeframe: Early 2024 to late 2024

After reclaiming its previous high resistance area near $69,000–$75,000, BTC formed a short-term consolidation or pullback, creating the "handle" portion of the pattern.

The handle appeared as a descending channel, a healthy correction that typically precedes a breakout in this pattern.

This correction also aligned with a trendline retest, offering dynamic support and further strengthening the pattern's reliability.

💥 3. Breakout Confirmation

The breakout from the handle occurred above the descending resistance of the handle pattern.

Weekly candles showed strong bullish momentum, backed by rising volume and rejection from lower trendline levels.

BTC is now trading near $83,000, just above the trendline, confirming both pattern validation and support holding.

🎯 4. Target & Projection

The measured move of the Cup and Handle pattern is calculated by measuring the depth of the cup and projecting that from the breakout point.

Cup Depth: Approximately $60,000

Breakout Point: ~$75,000–$80,000

Target Price: ~$123,000–$125,000

This target aligns with historical Fibonacci extensions and psychological round-number resistance.

🔐 5. Key Levels

Support Zone: $20,000–$30,000 (multi-year accumulation base)

Trendline Support: Drawn from 2022 lows, holding well through handle correction

Resistance Zone: $100,000 psychological barrier

Stop Loss: Placed just below trendline and swing low at $76,340 to protect against downside volatility

🧠 Why This Setup is Strong

Multi-year Base Formation (2.5+ years of consolidation)

Pattern Reliability: Cup and Handle is a well-tested bullish continuation pattern

Confluence of Support: Both horizontal and dynamic trendline support levels

Momentum Structure: BTC has resumed higher highs and higher lows

Volume: Breakout occurred with a noticeable spike in volume, a key validation point

🏁 Conclusion

Bitcoin is displaying strong bullish potential through a large-scale Cup and Handle pattern. This technical setup is supported by:

Long-term accumulation

Structural breakout

Strong support levels

A clear roadmap toward $120K+ targets

As long as BTC maintains above the trendline and doesn't invalidate the handle's structure, the bulls remain firmly in control.

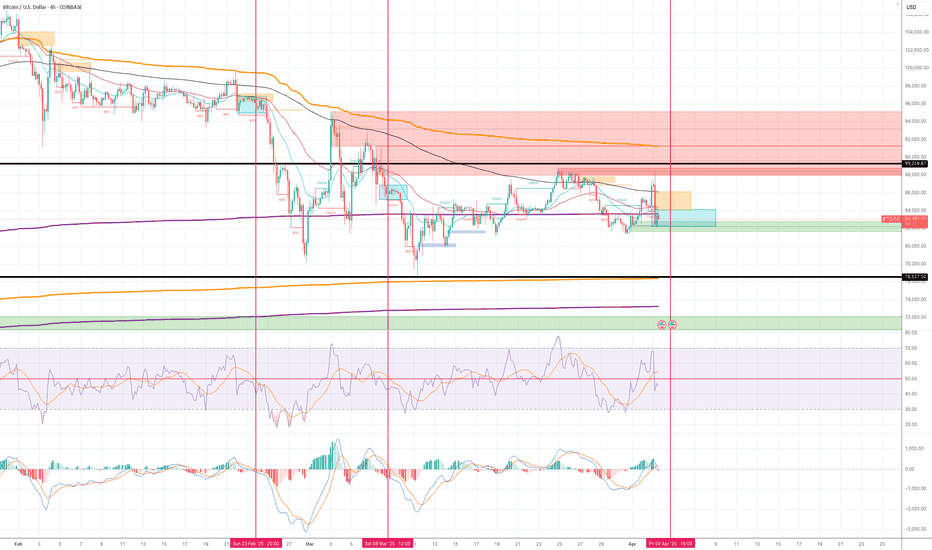

Short The price is consolidating between 89,000 and 76,500 zone. But I can see another downward move to 76,500 is developing.

Where I drew blue rectangular blocks and red vertical lines in the chart (Feb and March 2025) are the very similar set up as the current situation as follows:

1) The market creates the set up where it looks like the price is slowly recovering and pushes above EMA200.

2) The reverses aggressively to the downside (liquidity sweep).

3) The price consolidates in the very tight range.

4) Momentum indicators move into the bear zone.

I already have one small short position, but once RSI and MACD enter the bear zone and the price stays below VWAP (purple line drawn from the August 24 low) and also closes below the buy order block (green box), I will open another short position.

Stop loss - above EMA 200 in 4H chart.

Target - 76,540

COTI ANALYSIS 📊 #COTI Analysis

✅There is a formation of Descending Channel Pattern in weekly time frame in #COTI.

Also there is a perfect breakout and retest. Now we can expect a bullish move from major support zone. If not the we will see more bearish move and then a reversal in #COTI.

👀Current Price: $0.06390

🎯 Target Price : $0.08660

⚡️What to do ?

👀Keep an eye on #COTI price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#COTI #Cryptocurrency #Breakout #TechnicalAnalysis #DYOR

BTC SHORT TP 82,600 04-04-2025🚨 Bitcoin is showing weakness on the lower timeframes, specifically the 1-hour and 2-hour charts, so I'm looking for a short position with a take profit (TP) set at 82,700, giving us a solid 3RR.

You can start entering now and average your position as it develops. Since this analysis is based on the 1-hour timeframe, we should see results within the next 15 to 19 hours. If we run out of time, I'll keep you updated with the latest analysis!

Make sure to follow me to stay in the loop and keep generating those green profits! 💰🔥

BTC-----Sell around 83500, target 82500 areaTechnical analysis of BTC contract on April 5: Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern was single negative and single positive, the price was below the moving average, and the fast and slow lines of the attached indicator were glued and flattened. The overall trend yesterday fluctuated in the range. If the rhythm is well grasped, the profit will be very good. If the rhythm is not good, it will also be a painful loss, but the general trend is still firmly bearish; the short-term Thursday hourly chart yesterday US market price fluctuated severely, the K-line pattern was continuous negative in the early morning, and the price was suppressed below the moving average. The hourly chart continued to fall during the day after the pressure in the early morning. The current K-line pattern fell continuously, and the attached indicator was dead cross running, so the probability of continuing to fall during the day is still high, but today is the weekend, the strength is not expected to be large.

Today's BTC short-term trading strategy: directly maicjhu in the current price area of 83,500, stop loss in the 84,000 area, and target the 82,500 area;

Bitcoin Bullish Continuation Towards $128KBTC/USD | 1D Chart | April 2025

📊 Technical Analysis:

Bitcoin is maintaining its bullish structure within a well-defined ascending channel. The price has bounced off the lower trendline (green), which has provided strong support multiple times (see green arrows).

Currently, BTC is consolidating near $83,800, and a breakout from this zone could initiate the next impulsive move towards the midline and upper trendline resistance (~$128,000).

Support Levels: ~$80,000 (trendline)

Resistance Levels: ~$90,000, ~$110,000, and ~$128,000

Bullish Trigger: A confirmed breakout above $90,000 could signal strong continuation

🌍 Fundamental Analysis:

Bitcoin Halving (April 2024): Historically, BTC rallies post-halving due to reduced supply. The next supply shock could fuel a rally.

Institutional Demand: Spot Bitcoin ETFs continue to see record inflows, with firms like BlackRock and Fidelity accumulating BTC aggressively.

Macroeconomic Factors: With inflation concerns persisting, investors are turning to Bitcoin as a hedge, pushing prices higher.

📈 Trade Idea:

Entry: $84,000 (Breakout Confirmation)

Stop Loss: $79,000 (Below Trendline)

Target Range: $110,000 – $128,000 (Channel Resistance)

Bitcoin Breaks Free from the S&P 500: The Start of a New EraWe may be witnessing a historic moment in the evolution of Bitcoin. On April 3rd, 2025 at 15:00 UTC, Bitcoin officially broke its correlation with the S&P 500 a connection that had persisted for years.

Since that moment, the divergence has become clear:

• The S&P 500 has continued its sharp decline, now down over 7%, amid rising macroeconomic uncertainty and trade tensions.

• Meanwhile, Bitcoin has held strong, even climbing up to 4%, and has now entered a period of sideways consolidation rather than following the broader market into panic.

As of April 4th, 2025 at 20:00 UTC, this trend is holding and it might just signal the start of a new era for digital assets.

📉 A Shift in Market Psychology

Historically, BTC has mirrored traditional markets, especially during moments of fear. But this time is different. Bitcoin is resisting the gravitational pull of global financial weakness.

This could mean that investors are starting to see Bitcoin not as a high-risk tech bet, but as a legitimate hedge against global instability a digital store of value.

🔍 Why It Makes Sense

• 🌐 Borderless: Bitcoin is not tied to any single economy or government.

• 🏛️ Decentralized: No central authority can manipulate its supply.

• 💎 Scarce and predictable: With a fixed max supply of 21 million, Bitcoin offers transparency and reliability.

In a world of rising protectionism and financial tension, Bitcoin offers what traditional systems can’t: a neutral, incorruptible asset available to anyone, anywhere.

🔮 What’s Next?

If the decoupling continues, we could see:

• 📈 Capital shifting into Bitcoin for protection, not just speculation.

• 🚀 A new wave of adoption, as institutions and individuals look for safe havens.

• 🔁 Altcoin markets gaining momentum, once confidence trickles down from Bitcoin's stability.

🧠 Final Thoughts

This moment could be a turning point. While traditional markets falter, Bitcoin holds firm. While governments talk tariffs and trade wars, Bitcoin offers freedom.

If this trend continues, it may redefine the role of Bitcoin in the global economy — not just as a volatile asset, but as a truly global store of value and pillar of financial independence.

Bitcoin vs. Nasdaq: BTC Shows Signs of Decoupling Amid US Stock

For years, the narrative surrounding Bitcoin’s price action has been inextricably linked to the performance of traditional financial markets, particularly the tech-heavy Nasdaq Composite. Often moving in lockstep, Bitcoin was viewed by many as a high-beta asset, amplifying the gains during bullish periods and suffering even steeper losses when risk sentiment soured in equities. However, recent market movements have sparked a crucial question among investors and analysts alike: is Bitcoin finally beginning to forge its own path, decoupling from the gravitational pull of U.S. stocks as they face mounting headwinds?

The past few weeks have witnessed a notable divergence. While U.S. stock markets, reeling from a confluence of factors including escalating geopolitical tensions stemming from a potential “Trump tariff war,” persistent inflation concerns highlighted by Federal Reserve Chair Jerome Powell’s hawkish warnings of “higher inflation and slower growth,” and broader macroeconomic anxieties, have experienced a significant downturn – shedding a staggering $3.5 trillion in value – Bitcoin has demonstrated a surprising degree of resilience, even posting gains in some instances. This nascent divergence has ignited a wave of optimism among Bitcoin proponents who have long yearned for the digital asset to be recognized and traded based on its own fundamental merits, rather than as a mere proxy for risk-on sentiment in the equity markets.

The concept of Bitcoin decoupling from traditional assets has been a recurring theme in the cryptocurrency space. The original thesis for Bitcoin, after all, positioned it as a decentralized, censorship-resistant store of value and a hedge against traditional financial system vulnerabilities. Its finite supply, its independence from central banks and government policies, and its inherent scarcity were touted as key differentiators that would eventually lead it to trade independently. However, the reality of the past few years has often painted a different picture, with institutional adoption bringing increased correlation with established asset classes.

The current shift, however tentative, offers a glimmer of hope for those who believe in Bitcoin’s unique value proposition. The factors contributing to the stock market slump – trade war anxieties, inflation fears, and the prospect of tighter monetary policy – arguably strengthen the case for Bitcoin as an alternative asset. In times of economic uncertainty and currency debasement concerns, the fixed supply and decentralized nature of Bitcoin could become increasingly attractive to investors seeking a safe haven outside the traditional financial system.

Furthermore, the increasing maturity of the Bitcoin market, with the development of more sophisticated trading instruments, greater institutional participation, and a deeper understanding of its underlying technology, may be contributing to its growing independence. As Bitcoin gains broader acceptance as a legitimate asset class, its price discovery mechanisms may become less reliant on the sentiment driving traditional equity markets.

However, it is crucial to approach this apparent decoupling with a degree of caution. While the recent divergence is encouraging for Bitcoin bulls, it is too early to definitively declare the long-awaited break has finally arrived. Market correlations can be fluid and influenced by a multitude of factors. A sudden shift in global risk sentiment or a significant negative event specific to the cryptocurrency space could easily re-establish the link between Bitcoin and traditional assets.

Adding a layer of complexity to the current narrative is the warning from some analysts regarding a potential Bitcoin price correction. Despite the recent resilience, multiple BTC price forecasting models have pointed towards a scenario where Bitcoin could fall back to its 2021 all-time high of around $70,000 in a relatively short timeframe – some even suggesting this could occur within the next ten days. This potential “crash risk,” as one analyst termed it, is attributed to various technical and market cycle indicators.

The notion that $70,000 could represent Bitcoin’s “practical bottom,” as suggested by some, highlights the inherent volatility and speculative nature of the cryptocurrency market. Even if Bitcoin is beginning to decouple from traditional equities, it remains susceptible to its own unique set of risks and price swings. Factors such as regulatory developments, network security concerns, and shifts in investor sentiment within the crypto space can still exert significant influence on its price.

Therefore, while the current divergence between Bitcoin and the struggling U.S. stock market offers a compelling narrative and fuels the hopes of long-term Bitcoin holders, it is essential to maintain a balanced perspective. The confluence of factors driving the stock market decline could indeed be creating an environment where Bitcoin’s unique characteristics become more appealing, leading to a sustained period of independent price action. However, the inherent volatility of the cryptocurrency market and the potential for a significant correction remind investors that the journey towards true decoupling is likely to be a complex and potentially bumpy one.

In conclusion, the recent market dynamics present a fascinating juncture for Bitcoin. The initial signs of decoupling from the crumbling U.S. stock market, driven by a confluence of macroeconomic anxieties and the potential for Bitcoin to act as an alternative store of value, are undeniably encouraging for those who believe in its long-term potential. However, the warnings of a potential price correction underscore the inherent risks within the cryptocurrency space. Whether this nascent decoupling marks a definitive shift in Bitcoin's market behavior or proves to be a temporary divergence remains to be seen. Investors would be wise to monitor these trends closely, remaining cognizant of both the potential for independent growth and the ever-present risks associated with this dynamic and evolving asset class. The coming weeks and months will be crucial in determining whether Bitcoin can truly forge its own path in the face of traditional market turmoil.

BTC(20250404) market analysis and operationTechnical analysis of BTC contract on April 4: Today, the large-cycle daily level closed with a small positive line yesterday, and the K-line pattern was a single negative and a single positive. The price was still at a low level. The fast and slow lines of the attached chart indicator were glued together and flattened, but it was obvious that the rising price was suppressed, and the pullback was not strong. On the contrary, there seemed to be more opportunities for decline. From the overall technical indicators, the decline in the big trend is still very obvious, so the idea remains unchanged and continue to sell; in the short cycle, the current price is still in a volatile trend. The four-hour chart has a single negative and a single positive, and the attached chart indicator is dead cross, but the strength has not come out. The hourly chart corrected the high point position of 84,000 after the sharp drop this week. The current attached chart indicator is golden cross running, and there is no room for rise or fall, so wait and see during the day, pay attention to the strength and weakness of the European market and the impact of the evening data

Bitcoin (BTC/USD) Trade Setup & Analysis🔹 Trend Analysis:

📉 The chart shows a downtrend followed by a reversal attempt.

📈 The price bounced off a support zone and is moving upwards.

🔹 Indicators:

📊 The 9-period DEMA (83,805.38) is slightly above the current price, acting as a resistance level.

🔹 Trade Setup:

🟢 Entry Zone: Around 82,943 (Current Price)

🔴 Stop-Loss: 81,183.22 ❌ (Below support level)

🎯 Target Point: 85,563.52 ✅ (Upper resistance level)

🔵 Strategy: The trade anticipates a price dip before

BTC/USDT Analysis – 30-Minute Chart (OKX)BTC/USDT Analysis – 30-Minute Chart (OKX)

Key Support Levels:

Immediate support: 82,596 USDT

Stronger support: 81,900 USDT (Potential entry point)

Stop-loss: Below 79,426 USDT (Risk management)

Key Resistance Levels:

First resistance: 84,326 USDT

Next resistance: 85,726 USDT (Major supply zone)

Higher targets: 87,702 – 88,547 USDT

Indicators & Market Structure:

BTC is testing a short-term support after a bearish move.

The Stochastic RSI shows an overbought condition, signaling a potential retracement.

The EMA 20, 50, 100, and 200 are showing mixed signals; BTC needs to break above EMA 100 to confirm bullish momentum.

The MACD histogram is showing early signs of bullish momentum.

Trade Plan:

Bullish case: If BTC holds 82,596 – 81,900 USDT, a reversal towards 84,326 – 85,726 USDT is possible.

Bearish case: If BTC drops below 81,900 USDT, further downside towards 79,426 USDT may happen.

📌 Summary:

BTC is at a crucial level, consolidating around support. If it holds above 82,596 USDT, we could see a bounce toward 85,726 USDT. However, a break below 81,900 USDT could trigger more downside. Monitor price action carefully before entering a position. 🚀

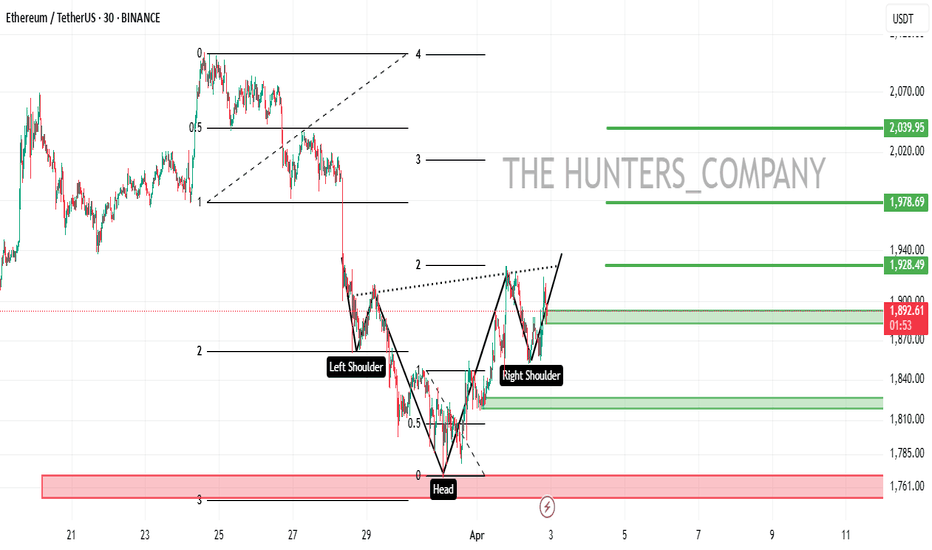

ETH/USDT:UPDATEHello dear friends

Given the price drop we had, a head and shoulders pattern has formed within the specified support range, indicating the entry of buyers.

Now, given the good support of buyers for the price, we can buy in steps with capital and risk management and move towards the specified targets.

*Trade safely with us*

Navigating BTC Volatility Storm: Buy, Hold, or Flee?Bitcoin's recent price action has been reminiscent of a rollercoaster, leaving investors grappling with a whirlwind of conflicting signals. From sharp drops mirroring stock market turmoil to the looming "death cross," the cryptocurrency's trajectory is shrouded in uncertainty. Is this a prime buying opportunity, a warning to retreat, or simply another bout of the volatility that defines Bitcoin?

The past few days have been a stark reminder of Bitcoin's inherent volatility. Reports of an 8% drop, coupled with the US stock market shedding $2 trillion in value, sent ripples through the crypto sphere. The catalyst? Concerns surrounding potential US tariffs and their impact on the global economic outlook. This sudden shift in market sentiment triggered a sell-off, reminiscent of the COVID-19 crash in 2020, during which Bitcoin’s pre-pandemic gains evaporated.

Adding to the unease is the looming "death cross," a technical indicator that occurs when the 50-day moving average crosses below the 200-day moving average. Historically, this pattern has signaled bearish momentum. The 2022 death cross, for example, precipitated a significant price drop of nearly 20%. Conversely, "golden crosses," where the 50-day moving average crosses above the 200-day moving average, have historically signaled bullish momentum, triggering rallies of over 500% in 2020 and 2021.

Currently, Bitcoin's 50-day moving average is edging closer to this critical crossover, prompting widespread speculation. Is this a repeat of 2022, or will the market defy historical patterns? The answer, as always, is complex and contingent on a confluence of factors.

One significant factor is the strength of the US dollar. While the dollar's strength can often negatively impact Bitcoin, the current increase in the money supply could potentially counteract this effect, creating a bullish flag pattern. The dollar's inflation may become a catalyst for Bitcoin as a store of value. The global market dynamics are currently shrouded in uncertainty, making it difficult to predict the long-term impact of these factors.

The recent price drops have pushed Bitcoin towards the $80,000 mark, with some analysts predicting a potential fall to $71,000. However, this level could also represent a "sizeable bounce," acting as a strong support zone for Bitcoin. The concept of an "oversold bounce" also comes into play. After a period of intense selling pressure, markets often experience a relief rally as traders capitalize on discounted prices. Whether this materializes remains to be seen.

Is it a Good Time to Buy Bitcoin?

The decision to buy, hold, or sell Bitcoin depends on an individual's risk tolerance, investment strategy, and understanding of the market. Here's a breakdown to consider:

• For the Long-Term Investor:

o Bitcoin's long-term potential remains a compelling narrative. Its decentralized nature, limited supply, and growing adoption continue to attract institutional and retail investors.

o Price volatility is an inherent part of the Bitcoin journey. Historically, periods of sharp declines have been followed by significant rallies.

o Dollar-cost averaging (DCA) can mitigate the impact of volatility by investing a fixed amount at regular intervals, regardless of the price.1

o The strength of the US dollar may become a catalyst for Bitcoin as a store of value.

• For the Short-Term Trader:

o The current volatility presents opportunities for skilled traders to profit from price swings.

o Technical analysis, including monitoring moving averages and support/resistance levels, is crucial for identifying potential entry and exit points.

o However, short-term trading is inherently risky and requires a deep understanding of market dynamics.

o The "death cross" should be monitored carefully.

• For the Cautious Investor:

o The current market uncertainty may warrant a more conservative approach.

o Diversifying investments across different asset classes can help mitigate risk.

o Staying informed about market developments and avoiding emotional trading decisions is essential.

The Death Cross: A Warning or a False Alarm?

The "death cross" is a significant technical indicator, but it's not a foolproof predictor of future price action. Historical data show that while it can signal bearish trends, it's not always accurate. Market conditions, investor sentiment, and macroeconomic factors can all influence Bitcoin's trajectory.

Ultimately, the Bitcoin market remains highly speculative. The current volatility, driven by a confluence of factors, underscores the importance of careful research, risk management, and a long-term perspective. While the "death cross" and market fluctuations may cause short-term panic, the long-term potential of bitcoin, and it's reaction to the weakening dollar, may still produce long-term gains.