Btcusdbuy

Bitcoin (BTC/USD) Technical Analysis: Breakout or Rejection at K200 EMA (Blue Line): 84,124 – This is a long-term trend indicator.

30 EMA (Red Line): 83,925 – A short-term trend indicator.

Key Levels

Resistance Point: Around 83,925 (marked in blue).

Support Zone: Around 82,184 (Stop Loss zone).

Target Point: 88,197, indicating a potential 6.34% upside.

Potential Trade Setup

Scenario 1 (Bullish Case):

If price breaks above resistance (83,925) and EMA 200, then a move towards 88,197 is expected.

A breakout confirmation might lead to an uptrend continuation.

Scenario 2 (Bearish Case):

If price rejects at resistance (83,925) and falls back below the support zone (82,184), a downward move could happen.

Pattern Analysis:

The chart suggests a potential accumulation phase before a breakout.

Possible retest of resistance before a rally.

Conclusion

Bullish above 83,925, targeting 88,197.

Bearish below 82,184, with potential downside.

Price action near the 200 EMA is crucial for the next move.

BTC already has the conditions to hit the 90000-95000 zone!A few days ago, I mentioned that BTC had the potential to surge towards the 90000-95000 range. Currently, BTC has already climbed above 87000 during its rebound, effectively opening the door to the 90000-95000 zone.

From a fundamental perspective, with bearish factors becoming clearer, if Trump adopts a more lenient stance on tariffs, BTC could extend its rebound. On the technical side, BTC has successfully broken through the short-term resistance around the 85500 level, turning the 85500-84500 area into a short-term support structure. This transition further supports BTC’s continuation to the upside, potentially testing the 90000-95000 range.

For short-term trading, we can consider waiting for a technical pullback and looking to go long on BTC once it retraces to the 85500-85000 region. The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Bullish Breakout from Falling Wedge | Upside Potential Ahead!Market Overview:

The Bitcoin (BTC/USD) 4-hour chart is displaying a Falling Wedge pattern, a well-known bullish reversal structure. This indicates that the downtrend is weakening, and a potential breakout could lead to a strong upside move.

🔹 Key Technical Analysis

1️⃣ Falling Wedge Formation & Breakout

Bitcoin has been trading inside a falling wedge, marked by lower highs and lower lows, signaling a contraction in volatility.

A breakout above the upper trendline of the wedge is forming, suggesting a bullish reversal and the start of an uptrend.

Falling wedges typically lead to a rally equal to the height of the pattern, giving a measured move target of $114,334.

2️⃣ Price Action & Confirmation Levels

A clean breakout above $87,000 would confirm bullish momentum.

If price successfully retests the wedge’s upper boundary and holds support, further bullish continuation is expected.

The psychological level of $100,000 could act as an interim resistance before the final target is reached.

3️⃣ Upside Target & Resistance Zones

The measured move suggests a potential rally towards $114,334, aligning with previous resistance zones.

This target represents a 30.55% gain from the breakout level.

Traders should watch for pullbacks and retests as part of the breakout confirmation.

📈 Trading Plan - Long Setup

🔹 Entry: Look for a confirmed breakout above $87,000, or a retest of support.

🔹 Stop Loss: Below $84,000, protecting against false breakouts.

🔹 Take Profit: $100,000 - $114,334 (previous resistance & measured move target).

🔹 Risk-Reward Ratio: Strong bullish setup with favorable upside potential.

🛑 Risk Factors to Consider

⚠️ A failed breakout and a drop below $83,000 would invalidate the bullish setup.

⚠️ External factors such as macroeconomic events, regulatory news, and BTC ETF developments could influence volatility.

Final Thought

The breakout from the falling wedge signals a potential bullish continuation for Bitcoin, with targets set around $114,334. Traders should watch for confirmation above $87,000 and manage risk accordingly.

Can it hit 89,000 again?The price trend of BTC has once again become the focus of global investors' attention.

Previously, BTC experienced a period of consolidation, during which the bulls and bears engaged in repeated games. Now, the bulls of BTC have risen strongly, unleashing powerful upward momentum.

With a swift and fierce move, it has broken through the key resistance level of 85,000 at one stroke. This breakthrough is like a fuse igniting the market, and the upward trend has spread rapidly. It is expected that it will further challenge the range of 87,000-89,000 in the future.

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

BTC/USD Bullish Breakout from Rectangle PatternOverview:

The chart represents Bitcoin's price action against the US Dollar on the 1-hour timeframe, highlighting a Rectangle Pattern Breakout with a well-structured trade setup. This analysis will break down the pattern, key levels, and possible trading scenarios.

1️⃣ Chart Pattern Breakdown – Rectangle Consolidation

The price has been moving within a rectangle pattern (range-bound movement), where Bitcoin found support at lower levels and faced resistance at the upper boundary.

Rectangle Pattern: A continuation/consolidation pattern where price fluctuates between horizontal resistance and support before breaking out.

Curve Formation: The price action within the rectangle also forms a rounding bottom, indicating a potential shift from bearish to bullish sentiment.

Breakout Confirmation: BTC has broken out from the rectangle, suggesting bullish momentum.

2️⃣ Key Technical Levels

🔹 Support Level ($84,110)

This zone has acted as a strong demand area, preventing the price from falling further.

Buyers consistently stepped in at this level, making it a significant psychological floor for Bitcoin.

🔹 Resistance Level ($86,850 - $87,000 Zone)

This level had previously rejected upward movements, leading to multiple price pullbacks.

After the breakout, this area is expected to act as a new support level upon a retest.

🔹 Target Price ($89,931 – Next Resistance Zone)

If the breakout sustains, the next key target for bulls is around $89,931, based on prior resistance zones and technical projections.

🔹 Stop Loss ($84,110 – Below Support Zone)

A stop loss below the support zone ensures risk management in case of a false breakout.

3️⃣ Trading Strategy & Execution

📌 Entry Point – After price confirms the breakout above the rectangle’s resistance. Traders should wait for:

A pullback and retest of the broken resistance, which should now act as support.

A strong bullish candle confirming continuation.

📌 Take Profit (TP) – $89,931, based on historical resistance levels and price projection from the rectangle range.

📌 Stop Loss (SL) – Placed at $84,110, below the rectangle’s previous support zone to minimize downside risk.

📌 Risk-to-Reward Ratio (RRR) – The setup offers a favorable RRR, meaning potential profits outweigh the risks.

4️⃣ Market Sentiment & Additional Factors

✔ Bullish Outlook – The breakout signals strong buying interest and potential upside continuation.

✔ Volume Confirmation – Traders should monitor volume spikes during the breakout to confirm institutional participation.

✔ Economic Events & News – External factors like macroeconomic data or Bitcoin-related news can impact price action.

Conclusion – BTC/USD Trading Setup

Pattern Identified: Rectangle Pattern Breakout

Current Trend: Bullish breakout from consolidation

Trade Type: Long position (Buy setup)

Key Levels:

✅ Support: $84,110

✅ Resistance: $86,850 - $87,000

✅ Target: $89,931

✅ Stop Loss: $84,110

🔥 Final Thought : Bitcoin has broken out of a key consolidation range, signaling a bullish move towards $89,931. Traders should wait for confirmation and manage risk accordingly! 🚀📈

Continue to believe in BTCI. Technical Analysis

(1) Support and Resistance Levels

BTC has a strong support at $80,000. It’s withstood selling pressure multiple times. When the price dropped to $82,000, it rebounded, validating this support. $85,000 and $87,000 act as resistance levels. Failed attempts to break through these thresholds show strong selling above these price points.

(2) Moving Average System

While BTC short - term moving averages are down due to price drops, long - term ones stay upward. This means the long - term uptrend isn’t disrupted. A golden cross may form when short - term averages recover and cross long - term ones, supporting upward movement.

(3) Technical Indicators

RSI shows BTC is in oversold zone, hinting at excessive selling. Market recovery may trigger a price rebound. Although MACD gives a bearish signal, the bearish momentum is weakening, indicating a possible reversal.

💎💎💎 BTC 💎💎💎

🎁 Buy@80500 - 81000

🎁 TP 83000 84000 85000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

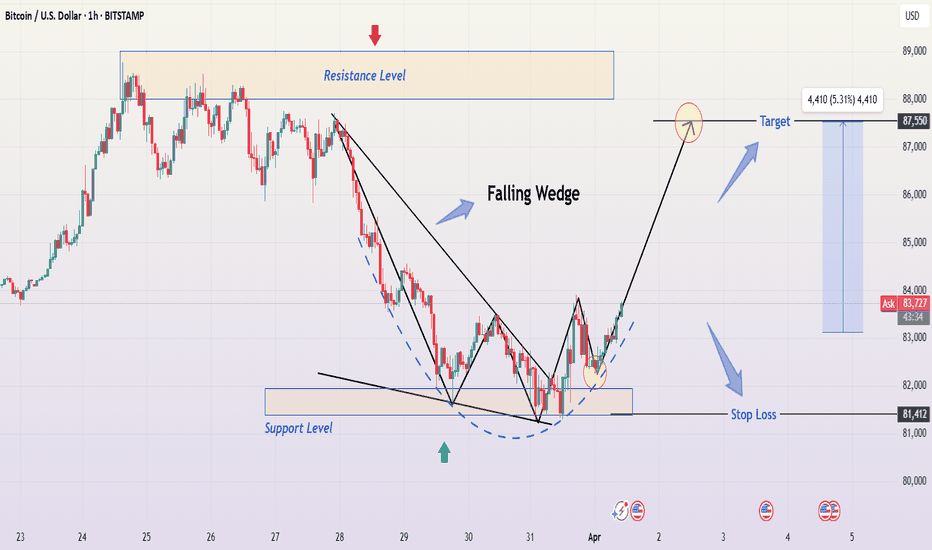

Bitcoin (BTC/USD) 1-Hour Chart Analysis – Professional BreakdownThis BTC/USD 1-hour chart showcases a falling wedge breakout, indicating a potential bullish reversal after a downtrend. The analysis suggests that Bitcoin could move toward its next resistance target of $87,550, offering a profitable long setup for traders. Let's analyze the chart in detail.

1️⃣ Market Context: Understanding the Trend

📉 Previous Downtrend

Before the wedge formation, Bitcoin was in a strong downtrend after reaching a resistance level near $87,000–$88,000.

Sellers took control, creating lower highs and lower lows, forming a descending wedge pattern.

The price declined sharply, reflecting profit-taking, increased supply, and weak demand.

📊 Current Market Setup

Bitcoin found strong support around $81,412, a level where buyers have stepped in multiple times.

The price action compressed into a falling wedge, a classic bullish reversal pattern, indicating that bearish momentum was weakening.

The breakout from the wedge suggests that bulls are regaining control, signaling a potential uptrend.

2️⃣ Key Technical Levels & Market Structure

🔹 Resistance Level ($87,000–$88,000)

This zone has acted as a strong supply area where Bitcoin previously struggled to break through.

If Bitcoin approaches this level again, a break and retest scenario would be ideal for further continuation.

🔹 Support Level ($81,412)

This area has provided multiple bounces, confirming it as a demand zone where buyers are actively defending.

A break below this support would invalidate the bullish setup and could lead to a downward move.

📍 Breakout Confirmation

The falling wedge breakout is confirmed by bullish price action and strong buying pressure.

Bitcoin is now forming higher lows, indicating a potential trend reversal.

3️⃣ Technical Chart Pattern: The Falling Wedge

📌 What is a Falling Wedge?

A falling wedge is a bullish pattern that forms when price consolidates between two converging downward-sloping trendlines before breaking out upward.

✅ Characteristics of a Falling Wedge in This Chart

Series of lower highs and lower lows, forming a contracting price range.

Decreasing bearish momentum, seen by smaller candles near the support zone.

Bullish breakout with strong momentum, signaling a reversal.

💡 Implication:

A breakout from a falling wedge often leads to a strong upward move, especially if volume supports the breakout.

4️⃣ Trading Setup & Strategy

📍 Entry Strategy

A confirmed breakout above the wedge with a strong bullish candle.

A pullback and retest of the breakout level can provide a high-probability entry point.

🎯 Target Levels

Primary Target: $87,550 (Projected based on wedge height).

Extended Target: Above $88,000 if momentum continues.

🛑 Stop-Loss Placement

Below the support zone at $81,412 to minimize risk.

If Bitcoin falls below this level, it invalidates the bullish setup.

5️⃣ Risk & Considerations

⚠️ Potential Risks to Watch

Fake Breakouts: If BTC fails to hold above the breakout level, it could result in a bull trap, causing a price reversal.

Market Volatility: Crypto markets are highly volatile, and external factors (such as macroeconomic news or regulatory updates) could impact price movements.

Resistance Pressure: The $87,000–$88,000 zone could act as a strong resistance, leading to possible consolidation before a decisive move.

✅ Risk Management Tips:

Keep a tight stop-loss below key support.

Adjust position size based on volatility.

Wait for confirmation before entering trades to avoid false breakouts.

6️⃣ Conclusion: Bullish Bias but Caution Advised

📈 Bitcoin is showing signs of a potential uptrend after breaking out from the falling wedge pattern. However, traders should watch for a confirmation of strength before entering long positions.

Key Points to Watch:

BTC needs to hold above $83,500 to sustain bullish momentum.

A strong candle close above $85,000 will further confirm bullish control.

The $87,550–$88,000 resistance zone will be a crucial test for the next move.

🚀 Bullish outlook remains valid unless BTC drops below $81,412.

Hashtags for TradingView Idea

#Bitcoin #BTCUSD #CryptoTrading #TechnicalAnalysis #FallingWedge #CryptoSignals #TradeSetup #TradingStrategy

BTC is expected to hit 85000-86000 again, or even higherBTC has once again built a strong double bottom structural support in the 82000-81000 zone. BTC is likely to continue to rise. Once it breaks through the short-term resistance area near 83600, BTC may usher in a wave of accelerated rise and has the potential to continue to the 85000-86000 zone.

So we can still go long on BTC in the 82500-81500 zone. In addition, once BTC rises as expected, it is likely to grab the market share of gold, so it may also accelerate the decline of gold to a certain extent. This is a point we must be careful about next.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Grasp the trend and analyze the full range of BTC longsTechnical analysis: Based on in-depth technical analysis, the current BTCUSD decline has slowed down, and there are signs of building double bottom support. The 50-day moving average and the 200-day moving average form a golden cross, the MACD indicator continues to strengthen and the bar chart continues to expand. As BTCUSD stops falling, market sentiment is gradually warming up, institutional funds continue to flow in, fundamental support is solid, and the upward momentum may gradually strengthen. It is the right time to go long.

BTCUSD operation strategy: Go long in the 82500-81500 area. Target 83000-84000

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions, operate according to your own operation plan, market information is complicated, and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. During the transaction, we will continue to pay attention to news and technical changes, inform us in time if there are changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

Bitcoin is so close to falling into a Bear, repeating Aug 2023First off, this maybe the last time I post this chart. Binance are Stopping USDT use from tomorrow morning. I have used this chart since around March 2020 and it is my most trusted,. A sad day for me. This chart saw me through Bulk Run, Deep Bear and now this Recovery and Bull run.

ANYWAY, the Arrow points towards a time in 2023 when we were so close to dropping into a Bear market for a number of reasons. Lets just say that Long Red Candle shoiwed a sudden weakening of Sentiment, A Lot of selling and confidence went.

It took a number of weeks for confidence to return.

And Now, we have a Similar thing. FEAR is high

AND I AM BUYING MORE BITCOIN - this is excellent...because when the price rises again, this maybe the last we see this price range.

We have Loads of support below.

It is that RED 236 Fib circle that is dragging PA down, as I mentioned last week. This and the Fact that the Weekly MACD is still falling Bearish

As you can see, the weekly MACD hits Neutral around 21 April, in 3 weeks time. It is from this point forwards that I believe we will see major shift's in Sentiment and PA action. Possibly earlier but maybe not strongly.

Also note how the Histogram is levelling out. We need to see a White candle in the coming weeks or we could be facing bigger issues maybe.

The Daily version of this same chart shows us very clearly where we are.

This is Great News. We have broken through that 236 Red Fib circle. It is now Support. though we are under a line of resistance. But we broke through that in the recent past.

I still think we will visit 78K again for a very short period of time. ( Hopefully, nothing is certain)

Currently, the shorter term charts show Support found on the 618 Fib retracement line. And we need to see if this holds

Over all, We are near the end of the first phase of this pause in Pushes higher. We have that wall at 109K to break through in the longer Term. Once Weekly MACD is on neutral, we will wait fo rthe daily to get there also and then we can push higher with Strength.

This push maynot be a single push. the Weight of BTC with its current price holds back the sprints to ATH we once saw.

Patience is a Virtue

HOLD and BUY MORE

Is Bitcoin going to start rising?The latest U.S. economic data has brought significant impacts. The core PCE inflation witnessed a 0.4% month - on - month increase, hitting the highest growth in a year, with a year - on - year rise of 2.8%, exceeding market anticipations. Meanwhile, the long - term inflation expectation from the University of Michigan has soared to a 32 - year high, intensifying market concerns about inflation's resurgence. Currently, the market remains enveloped in macro - risks, pending a softening of market sentiment.

Turning to the Bitcoin market, as depicted in today's price trend (the current BTCUSDT price is $82,338.01, dropping by $2,086.37, a 2.47% decline), the K - line chart analysis indicates a downward trend. The Williams indicator signals an oversold condition. Additionally, trading volume has contracted recently, with both price and volume decreasing, suggesting a sluggish and inactive market.

Nevertheless, if Bitcoin can stabilize above $82,000 and there are signs of capital reflux, gradual position - building may be considered, with a target price set above $90,000. Investors must recognize that the Bitcoin market brims with uncertainties. Variables such as forthcoming U.S. economic data, regulatory policies, and geopolitical scenarios will all sway Bitcoin prices. In this volatile financial landscape, meticulous analysis and judicious decision - making are of utmost importance for investors navigating the Bitcoin market.

BTCUSDT

buy@82000-83000

tp:84500-86500

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Analysis of Bitcoin’s Price MovementsI. Technical Analysis

(1) Support and Resistance Levels

BTC has formed a strong support level at $80,000. Judging from past market performances, this price level has successfully withstood selling pressure multiple times, demonstrating the market's recognition of its value at this price. When the price dropped to $82,000, a certain degree of rebound occurred, indicating the presence of buying support below. This also indirectly confirms the effectiveness of the $80,000 support level. As a resistance level, $87,000 restricts the upward movement of BTC. The failure of this attempt to break through $89,000 indicates that selling pressure is relatively strong above this price level.

(2) Moving Average System

Although the short - term moving averages of BTC have turned downward to some extent due to price declines, the long - term moving averages still maintain an upward trend. This indicates that, in the long run, the upward trend of BTC has not been completely disrupted. Short - term price fluctuations may just be normal market adjustments. When the short - term moving averages gradually recover and cross above the long - term moving averages again, a golden cross is expected to form, providing technical support for the upward movement of BTC.

(3) Technical Indicators

The Relative Strength Index (RSI) shows that BTC is currently in the oversold zone, which means there may be excessive selling in the market. Once market sentiment recovers, the price of BTC is expected to rebound. In addition, although the MACD indicator shows a bearish signal, the bearish momentum is gradually weakening, suggesting that the market may be on the verge of a reversal.

💎💎💎 BTC 💎💎💎

🎁 Buy@80500 - 81000

🎁 TP 83000 84000 85000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

BTC(20250329) market analysis and operationTechnical analysis of Bitcoin (BTC) contracts on March 29: Today, the large-cycle daily level closed with a medium-yin line yesterday, and the K-line pattern continued to fall. The price was below the moving average, and the attached indicator was golden cross and the volume was shrinking. The general trend is still firmly bearish; we should note that the price will still fluctuate over the weekend, and the probability of continuous decline is relatively small, but it does not mean that it will not fall, but just let everyone not expect too much of the weekend trend; the lower support position focuses on the two previous lows of 80,000 and 76,600. The short-cycle hourly chart shows that the European session fell and the US session continued to break the low position. The current K-line pattern is continuous and positive, and the attached indicator is golden cross. It is likely to be corrected first during the day.

Today's BTC short-term contract trading strategy: sell at the 85,200 area, stop loss at the 85,700 area, and target the 84,200-83,800 area;

Bitcoin (BTC/USD) Trade Setup – Potential Reversal & Target Leve🔵 Entry Point:

🔹 Around $83,678.04 – The suggested buying zone.

🛑 Stop Loss:

🔻 $82,998.62 – The price level where the trade will be exited if it moves against the plan.

🎯 Target Points:

✅ TP1: $84,144.23 – First profit target.

✅ TP2: $84,787.10 – Second profit target.

🏆 Final Target: $85,560.84 – The ultimate goal for the trade.

📈 Technical Overview:

🔹 The price is at a support level, with a potential reversal to the upside.

🔹 Risk-Reward Ratio is favorable, with a clear uptrend target.

🔹 DEMA (9) at $83,776.52 indicates a possible trend shift.

Bitcoin Daily UPDATE - something for the weekend sir ?Chances are we will see PA Drop over the weekend if what has happened today is anything to go by

As mentioned in apost this morning, Pa fgot rejected off the upper trend line of the descending channel and currently Sits on the POC ( point of control ) on the VRVP ( Vivible Range Volume Profile )

The Drop if we loose this support could be swift but we do have support lines below to try and hold up the fall

But again, as mentioned, a drop is NOT such a bad thing....unless we loose 73K, in which case I will seriously think again about what I Hold.

The 4 hour chart shows the current situation more clearly

If we do bounce of this, remain cautious....we need to get over and Hold 91K before we start screaming "ATH"

For me, I have opened anotehr Spot order at 74K

I go higher than the expected Low incase the visit to the low is a Very quick wick down and the order does not have time to fill.

DO NOT PANIC

Have a good Weekend

Buy BTC,it still has the potential to reboundBTC experienced a sharp short-term decline, breaking lower; however, the downward momentum has significantly slowed. Importantly, the recent pullback has not disrupted the broader upward consolidation structure, with the 84500-83500 zone continuing to provide strong support.

Once the bearish sentiment fully subsides, I anticipate a relief rally or a technical rebound. Therefore, this pullback could present an excellent opportunity to go long on BTC.

Consider entering long positions around the 84500-83500 support zone, targeting an initial upside move toward the 86000-86500 range.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

BTC(20250328) market analysis and operationTechnical analysis of Bitcoin (BTC) contracts on March 28: Today, the large-cycle daily level closed with a small negative line yesterday, and the K-line pattern continued to be negative, but the price did not break or continue. The attached indicator golden cross was running with a shrinking volume, but the price was relatively weak, and the overall trend was volatile, so there were not many signals in the big trend. As mentioned earlier, after the correction, wait for the second round of large price declines; the short-cycle hourly chart fell under pressure yesterday, and the European session continued to accelerate in the US session, but the price did not break. In the early morning, the correction pulled back to wipe out the decline, maintaining range fluctuations, with a high of 87,800 and a low of 85,800; the current K-line pattern continued to be negative, and the probability of a retracement trend should be observed first.

Today's BTC short-term contract trading strategy: sell directly at the current price of 87,300, stop loss at 87,800, and target at 86,000;