BTCUSDC

Bitcoin Pullback or Opportunity📊 Bitcoin Analysis – Pullback or Opportunity?

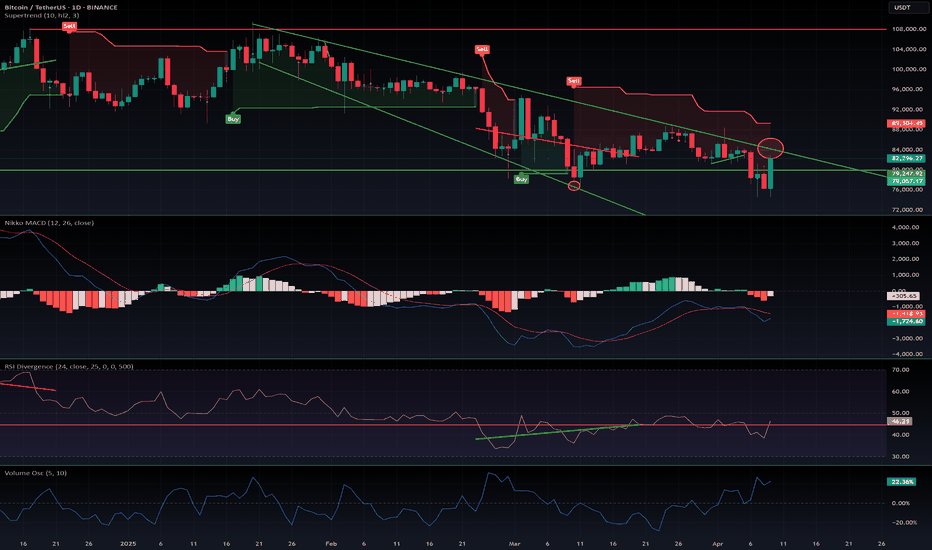

CRYPTOCAP:BTC hit strong resistance at 94,000 $ failed to push higher, entering a correction phase 📉. Key support zones now lie at 91,200 $ 87,500 $ , both of which have shown solid reactions in the past 🛡️. If price holds one of these levels, the next target could be around 98,500 $based on the previous move’s momentum 🚀.

📌 Price is still holding above the 200 MA, suggesting bullish momentum is alive but needs further confirmation ✅.

👇 What’s your take on the next move?

🔁 Save this if you're watching the next targets

📩 Share with a friend who's trading BTC right now

Bitcoin (BTC) $95K Target? ETF Inflows & Supply Shock Key Signal

Bitcoin Flashes Bullish Signals: Record ETF Flows and Supply Shock Fuel $95K Target Hopes

Bitcoin, the original cryptocurrency, is demonstrating renewed vigor, capturing investor attention with a confluence of bullish indicators. After a period of consolidation and sideways movement following its all-time high earlier this year, recent data suggests underlying strength is building. Significant inflows into U.S. spot Bitcoin ETFs, a tightening supply on exchanges, strong relative performance against traditional markets, and key technical levels being tested are painting a picture that has analysts eyeing the next major psychological and technical hurdle: $95,000.

ETF Demand Roars Back: A Sign of Renewed Institutional Appetite

One of the most significant developments fueling recent optimism is the resurgence of demand for U.S.-based spot Bitcoin Exchange Traded Funds (ETFs). Launched in January 2024, these products marked a watershed moment, providing traditional investors with regulated and accessible exposure to Bitcoin. After an initial explosive launch, inflows moderated. However, recent weeks have seen a dramatic turnaround.

Reports indicate that these ETFs recently experienced their largest single-day net inflows since their early days in January, signaling a powerful return of institutional and potentially broader retail interest. This influx of capital into regulated vehicles is crucial. It represents sticky, long-term demand rather than just short-term speculative trading. Each dollar flowing into these ETFs effectively removes Bitcoin from the readily available market supply, contributing to a potential supply squeeze.

This sustained demand has also propelled Bitcoin's overall market capitalization significantly. While direct comparisons fluctuate daily and depend on methodology (e.g., including gold, different equity classes), Bitcoin's market cap has grown to rival that of major global corporations and even some traditional asset classes. Its ascent up the ranks of the world's largest assets underscores its growing acceptance and integration into the broader financial landscape. While claiming a specific rank like "5th largest" can be debated based on what's included, there's no denying Bitcoin is now a multi-trillion dollar asset class demanding attention.

The Supply Squeeze: Coins Vanish from Exchanges

Complementing the demand surge is a notable trend on the supply side: Bitcoin reserves held on cryptocurrency exchanges are dwindling rapidly. Data reveals that the amount of BTC available for immediate sale on major trading platforms has plummeted to levels not seen since November 2018. This marks a multi-year low, indicating a strong preference among holders to move their coins into self-custody or long-term storage solutions, rather than keeping them poised for sale.

What's driving this exodus from exchanges? Analysts point to several factors, including the aforementioned ETF accumulation, where authorized participants acquire Bitcoin on the open market to meet ETF share creation demand. Furthermore, there's growing anecdotal and on-chain evidence suggesting accumulation by long-term holders ("HODLers") and potentially public companies adding Bitcoin to their balance sheets. While large-scale corporate buying sprees like MicroStrategy's haven't been widely replicated across the board, the cumulative effect of sustained institutional buying (via ETFs) and dedicated HODLers consistently pulling supply off exchanges creates a powerful dynamic.

Lower exchange reserves typically correlate with reduced selling pressure. When less Bitcoin is readily available to be sold, even moderate increases in demand can have an outsized impact on price. This scarcity factor is a core tenet of Bitcoin's value proposition, underpinned by its fixed supply cap of 21 million coins, and the current trend highlights this dynamic in action.

Relative Strength: The "Cleanest Shirt in the Dirty Laundry"

Bitcoin's recent performance also stands out when compared to traditional financial markets. Over the past 30 days (as per the provided context), Bitcoin has posted significant gains (e.g., +7.68%), while major equity indices like the S&P 500 and the tech-heavy Nasdaq have experienced notable pullbacks (e.g., -6.79% and -8.14%, respectively).

This divergence has led some commentators to describe Bitcoin as the "cleanest shirt in the dirty laundry pile." In times of macroeconomic uncertainty, geopolitical tension, or wavering confidence in traditional financial systems, Bitcoin can attract capital seeking alternatives or hedges. While its correlation with risk assets like tech stocks has often been high, periods of decoupling, like the one observed recently, suggest investors may increasingly view Bitcoin through a different lens – perhaps as a non-sovereign store of value or a bet on future technological disruption, rather than just another high-beta risk asset. This relative outperformance can attract momentum traders and further bolster positive sentiment.

Technical Hurdles: The Road to $95K

From a technical analysis perspective, Bitcoin's price action is generating significant discussion. One key metric analysts watch is the "realized price," particularly for short-term holders (investors who acquired BTC relatively recently). When the market price surpasses the average acquisition cost of these recent buyers, it can signal a shift in market psychology. Those who bought recently are now in profit, potentially reducing sell pressure and encouraging further buying. Bitcoin recently surpassed this level, leading to speculation about whether this marks the beginning of a sustained rally or potentially sets up a "double top" scenario – a bearish pattern where an asset fails twice to break above a certain resistance level.

Analysts are closely watching specific price levels. There appears to be a consensus around a key resistance zone that, if decisively reclaimed and held, could signal that "all bets are off" for the bears, potentially opening the door for a significant upward move. Conversely, failure to break through these levels, or a strong rejection from them, could lead to a pullback, validating the warnings from more cautious analysts.

The $95,000 mark looms large as the next major psychological and potential technical resistance area should the current momentum continue and key lower resistance levels be overcome. Reaching this target would likely require a confluence of the factors already discussed: continued strong ETF inflows, further depletion of exchange supply, supportive macroeconomic conditions (or continued relative strength despite macro headwinds), and a decisive break through established technical resistance zones.

What Triggers the Breakout?

Achieving a breakout towards $95,000 isn't guaranteed and likely requires several catalysts:

1. Sustained ETF Demand: Continued, consistent net inflows into spot Bitcoin ETFs are paramount to absorb supply and signal ongoing institutional conviction.

2. Supply Shock Intensification: If exchange reserves continue to fall sharply, the scarcity narrative strengthens, potentially triggering FOMO (Fear Of Missing Out) buying.

3. Macroeconomic Shifts: A dovish pivot from central banks, renewed inflation fears driving demand for hard assets, or further instability in traditional markets could push more capital towards Bitcoin.

4. Technical Confirmation: A convincing break and hold above currently watched resistance levels would give technical traders confidence and potentially trigger algorithmic buying.

5. Positive Regulatory Developments: While the ETFs were a major step, further regulatory clarity or positive developments globally could reduce perceived risk.

Conclusion: Optimism Tempered with Caution

The current Bitcoin landscape presents a compelling bullish case. Resurgent ETF demand, dwindling exchange supply creating a scarcity effect, and strong relative performance against traditional assets paint an optimistic picture. Technical indicators, such as surpassing the realized price of recent buyers, add fuel to the fire, bringing targets like $95,000 into the conversation.

However, caution remains warranted. Bitcoin is notoriously volatile, and technical resistance levels often prove formidable. The risk of a "double top" or rejection at key levels is real, and regulatory headwinds or negative macroeconomic shifts could quickly alter sentiment. While the confluence of positive factors is undeniable and the path towards $95,000 seems plausible given the current dynamics, investors will be keenly watching whether ETF flows remain strong, supply continues to tighten, and crucial technical levels can be decisively overcome. The interplay between institutional adoption, HODLer conviction, and market technicals will ultimately determine if Bitcoin can conquer its next major milestone.

BTC-----Sell around 92600 area, target 91800-91500 areaTechnical analysis of BTC contract on April 24: Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern continued to rise, the price was at a high level, and the attached indicator was running in a golden cross. The general trend is still rising, but after yesterday's price surged, it did not continue this morning but began to retreat under pressure. This is a correction. The four-hour chart K-line continued to be negative, and the price was near the moving average pressure level. In this way, the decline should be seen first during the day. The short-cycle hourly chart started from yesterday's European session. The price continued to fluctuate at a high level. The price began to retreat under pressure in Asian time. The current K-line pattern is a single positive line with a continuous negative line, and the attached indicator is running in a dead cross, and the strength of the four-hour chart has not yet come out.

Today's BTC short-term contract trading strategy: sell directly at the current price of 92600, stop loss in the 93100 area, and target the 91800-91500 area;

WARNING: Something feels off...🚨 Something feels off... While CRYPTOCAP:BTC looks bullish on the surface, this pump shows signs of heavy manipulation:

🔸 Michael Saylor just bought $500M in Bitcoin.

🔸 The purchase was made during Easter weekend, when institutions were closed.

🔸 Today is still a holiday in the UK, and yet the pump occurred during Asian hours — highly unusual.

🔸 Meanwhile, the SPX500 is plunging, while CRYPTOCAP:BTC is rising — a rare decoupling.

🔸 Over SEED_TVCODER77_ETHBTCDATA:2B in leveraged longs are sitting between GETTEX:82K –$85K, vulnerable to liquidation.

📉 This could be a classic FOMO trap — pushing price high on low volume to lure in retail before a long squeeze.

Yes, CRYPTOCAP:BTC may be gearing for another leg up…

But an all-time high this week? Highly unlikely.

⚠️ Stay cautious. The confidence is getting excessive.

DYOR – Do your own research.

#Bitcoin #BTC #CryptoWarning #LongSqueeze #MarketManipulation #CryptoNews #MichaelSaylor #Altcoins #DYOR

Do you think I'm joking ???Chart is speaking itself...

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Bitcoin bull run ends in 6 months?The above chart presents a macro view of Bitcoin’s monthly price action, showcasing the historical pattern of bull and bear market cycles. Each green box highlights a bull run lasting approximately 35 months (or 1,066 days), a consistent duration seen in the previous two cycles from 2015–2018 and 2019–2022. The current cycle, which began in late 2022 or early 2023, is now entering its final phase, suggesting that if the pattern holds, the BTC bull run may have around 5–6 months remaining before a potential peak.

The price action continues to mirror previous cycles, indicating that history may once again be repeating itself. If this cyclical behavior continues, traders and investors should consider the possibility of a cycle top approaching and plan accordingly,.

$BTC: We Are in a Bear Market Until Proven Otherwise🚨 CRYPTOCAP:BTC : We Are in a Bear Market Until Proven Otherwise 🚨

📌 Follow-up to my December 2024 post:

🔗

Despite record-breaking bullish news, Bitcoin is not at an all-time high. Why? Because we’re still in a bear market—until the charts say otherwise.

✅ Bullish Factors:

Michael Saylor continues buying billions

President Trump & family pushing crypto/meme coins

Rumors: Fed buying CRYPTOCAP:BTC with gold?

Trump pinned the Bitcoin white paper at the White House

U.S. banks fully onboard with crypto

ETFs accumulating CRYPTOCAP:BTC

National crypto reserve announced

❌ Bearish Signals:

Fear & Greed Index in "extreme fear" for 30+ days

Price is below the EMA50 on weekly

Monthly MACD nearing bearish crossover

Trading volume decreasing

Crypto search interest at multi-year lows

Retails not buying — this is all institutions

Powell confirmed we're in a recession

Desperate whales calling for $5M–$9M BTC to bait retail

🧭 Monthly chart check the MACD:

🔗

⚠️ Key Insight:

Every cycle, people confuse a relief rally for a new bull run. This isn't new.

A relief rally = short-term price recovery in a bear market.

(AKA a dead cat bounce or sucker rally)

📊 Past relief rallies (check the chart):

+45% (Feb 2022)

+32% (June 2022)

Current one: only +16% — still within bear territory.

📉 Price could hit $91k and still drop lower while staying in an ongoing bear Market..

🧨 Bear Market Target: GETTEX:25K – FWB:27K

📈 Invalidation? Only if we close above $101K

Don’t trade your emotions. Trade the charts. They never lie.

#Bitcoin #CryptoMarket #BTC #BearMarket #CryptoAnalysis #SPX500 #CryptoTrading #Recession2025 #BTCPrice #CryptoCrash #CryptoNews #MichaelSaylor #TrumpCrypto #BTCBearMarket

Just In: Bitcoin ($BTC) Reclaims $90,000 The world's renown digital asset Bitcoin ( CRYPTOCAP:BTC ) surged nearly 4% today to reclaim the $90k resistant zone, amidst breaking out of a bullish symmetrical triangle pattern enroute to $100k.

Bitcoin for almost 1 month now has been swinging within the $80k price range, since losing it's $100k resistant in the month of February, 2025 but with increasing momentum a move to the $100k resistant doesn't seem far fetch because CRYPTOCAP:BTC has already broken the ceiling of the symmetrical triangle.

With the 4-hours RSI at 79, we may experience a respite before the major leap to $100k price point. Notable firms like Micro strategy and Michael Saylor the CEO were integral in this price movement.

The company purchased 6,556 CRYPTOCAP:BTC for ~$555.8 million at ~$84,785 per bitcoin and has achieved CRYPTOCAP:BTC Yield of 12.1% YTD 2025. As of 4/20/2025, Micro strategy holds 538,200 CRYPTOCAP:BTC acquired for ~$36.47 billion at ~$67,766 per bitcoin.

Notably, financial bodies like Standard Chartered Bank says Bitcoin ( CRYPTOCAP:BTC ) could reach a new all-time high due to concerns over the Federal Reserve's independence.

As of the time of writing, CRYPTOCAP:BTC is up 3.70% currently trading at $90,715 per CRYPTOCAP:BTC setting the coast for $100k resistant.

However, on bearish tone, should CRYPTOCAP:BTC fail to pull up that stunt, a price correction might send CRYPTOCAP:BTC back to FWB:83K support.

$BTC: Last 2 months pump before the bear market starts.On the chart, you can clearly see the similarities between the last cycle and the current one.

First, this cycle is already longer, so I don’t expect another top in 2026, as some are suggesting.

Based on my analysis, we are currently in the equivalent stage of the last cycle where two strong monthly candles appeared before the market dropped into a bear phase.

Why is this happening?

We are resetting the weekly MACD — it's at the bottom and needs to push into overbought territory before it can turn down alongside the monthly MACD.

As shown in the chart, the monthly MACD is close to turning bearish. If the weekly MACD also flips bearish, that could mark the end of the bull market.

Additionally, volume is dropping, and the RSI supports this scenario. It looks like we’re setting up for one last pump, just like last time — likely followed by a rejection in 2 months.

📊 Check the chart — I’ve laid it out as clearly as possible.

💬 If you agree or disagree, let’s discuss in the comments!

🧠 DYOR — Do Your Own Research!

#Bitcoin #CryptoAnalysis #MACD #RSI #CryptoCycle #BullMarket #BearMarket #BTC #CryptoTrading #TechnicalAnalysis #DYOR #Altcoins #MarketUpdate #CryptoCommunity #Cryptocurrency

#BTC/USDT#BTC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 82900.

We have a downtrend on the RSI indicator that is about to break and retest, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 83240

First target: 85150

Second target: 86435

Third target: 87858

#BTC/USDT#BTC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 74,300

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 79,056

First target: 80,422

Second target: 81,950

Third target: 84,000

$BTC is facing a systemic threat—and it's becoming real.This post is a follow-up to my highly controversial idea from last year:

Back then, many laughed and called me a fool. But it's happening:

Forbes: "Quantum Leap or False Alarm? Bitcoin’s Fate in the Quantum Age"

www.forbes.com

CoinDesk: "Bitcoin Developer Proposes Hard Fork to Protect BTC from Quantum Threats"

www.coindesk.com

Key points:

Bitcoin is not digital gold. It can be hacked.

We have about 5 years to move to quantum-resistant encryption.

This requires a hard fork, forcing all BTC holders to move their coins to a new wallet.

Those who don’t move their coins? They’re burned—permanently lost.

How?

Quantum computers can use a “long-range attack” to derive private keys from public keys. In early BTC transactions, public keys were visible—around 2 million BTC are at risk.

Consequences:

Two chains will coexist: BTC (legacy) and BTC (quantum-safe).

SegWit adoption took 2 years. Expect similar delays.

2 million BTC could be lost forever (≈10% of supply).

Satoshi’s coins? Gone.

We'll have BTC, BTCQ, and BCH side by side.

Why would whales support this?

Removes inactive or lost coins

Doubles their holdings across chains

Protects their assets from being hacked

Is this bullish? Should you buy BTC?

Not sure. This is a systemic risk. The panic from Bitcoin developers says it all.

I warned you. Read my original post. Follow me to stay ahead of what’s next.

📉 Potential consequences

Bitcoin chain split: Legacy chain vs. upgraded chain (like BTC/BCH but even messier).

Burned coins: Could cause a deflationary shock if millions of old coins become inaccessible.

Temporary loss of trust: Confusion = market panic. Price volatility could spike.

Regulatory scrutiny: Governments could use this as an excuse to push CBDCs or new crypto laws.

New “Bitcoin” brand wars: Just like the BCH/BSV split, there may be competing narratives.

Can the developers fix this problem?

Yes, developers can upgrade Bitcoin to be quantum-safe.

But the real danger lies in:

Coordination failure

Loss of user trust

A messy migration

Potential devaluation of old BTC

Legal and branding chaos

#Bitcoin #BTC #CryptoNews #QuantumComputing #CryptoRisk #HardFork #Blockchain #CryptoSecurity #SatoshiNakamoto #CryptoWarning #DYOR #Altcoins #BTCFork #BitcoinUpdate #QuantumThreat

Do you think I'm joking ???Now that Bitcoin is returning to the cup-and-handle support, one can expect a strong pump up to 130k . it might happen.

⚠️ Disclaimer

Blockchain X has artificial intelligence technology that can make smart trades, allowing you to continuously make profits in the crazy world of cryptocurrency. Come and try it!

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

BTC.D - Still in the ascending channelCRYPTOCAP:BTC.D remains firmly within its long-standing ascending channel. The recent “fake breakout” below the channel has been invalidated as dominance swiftly returned to the channel, showing a strong reaction and confirming the channel’s validity.

This suggests:

✅ Bullish Implication for BTC: Bitcoin is likely to continue gaining dominance in bullish moves, outpacing altcoins in performance.

✅ Bearish Impact on Altcoins: In downturns, altcoins are expected to experience sharper declines compared to Bitcoin.

Traders should monitor this channel as a key indicator for market behavior, especially for Bitcoin and altcoin strategies.

Bitcoin BTC price analysisThis is approximately the roadmap we have "imagined" for the coming weeks for the movement of the CRYPTOCAP:BTC price:

1️⃣ The most optimistic scenario is that the OKX:BTCUSDT price stays above $76100 - 77100, which means that the “bottom” has finally been found, and we can organize at least a rebound to $94k.

2️⃣ Not a pleasant scenario, but not the worst either, is another update of the local lows of #Bitcoin to $71100 and from there a rebound to the above-mentioned $76100-77100 zone, where we will have to "looking out" again: where to go next...

3️⃣ The most pessimistic, and maybe the most realistic scenario in times of total uncertainty, when it is not clear what the "rusty can" will wake up with in. ✊

All market participants will delay their "buying" decisions as much as possible until it becomes clear whether the Fed will cut the rate or not. The next FOMC meeting is on 07.05.25.

To understand what will happen to altcoins during this time, you need to at least monitor and analyze the #BTC.D and #USDT.D indicators, which we do daily in our reviews in...

✍️ It is your right, if not your duty, to follow this plan or make your own adjustments!)

And we will be happy to read and see your charts, with your forecasts for the near future in the comments below the idea.

BTCUSDT | Waiting for Precision – Not Just Price LevelsMany were tempted to short BTCUSDT around the $83,000 region, and I was closely watching it too. However, as always, I don’t take trades based solely on price levels. What separates professional trading from guesswork is the data behind the scenes, and in this case, CDV (Cumulative Delta Volume) did not show any bearish divergence. That’s why I completely passed on this level without hesitation.

🎯 What’s Next?

Upper Blue Box is My Focus: I’ve now shifted my attention to the next key upper blue box, where I’ll be looking for serious short opportunities, but only if LTF confirmations such as orderflow shifts, CDV divergences, or volume traps appear.

Why I Wait: Just because a price hits a “zone” doesn’t mean we react. Professional traders wait for confluence, confirmation, and controlled risk.

🔒 Smart Trader Checklist:

No CDV divergence = No trade.

Wait for price to enter the upper blue box and react.

Short only with proper lower time frame confirmation.

If price breaks above with strong momentum and retest, I will not insist on shorts. I will shift and look for longs.

💡 I trade with precision and patience—not emotion. These levels are not random lines, but key zones mapped with advanced tools and strict discipline. That’s why my followers consistently win, and why my success rate is among the highest you’ll find here.

If you want to trade with clarity, confidence, and data-backed precision, just keep following me. You’ll see the difference.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

$BTC consequences of the Trump 90 days tariff pauseCan It Last? Is This a Trend Reversal?

Today, #Bitcoin surged over +8%, but surprisingly, #Tesla outperformed with a massive +20%—almost as much as $FARTCOIN! 🤯

History is being written, and we’ll remember this day… but is this truly the end of the consolidation phase?

What to Watch:

📈 Price Action: Bitcoin must break above the descending trendline (in green) and close a daily candle above it to flip resistance into support. The price to watch is $84.5k. Closing under 80k would invalidate this pump.

📊 RSI: Currently in mid-range—could swing either way.

🔁 MACD: Was turning bearish. We need a clear bullish crossover to confirm a trend continuation.

Conclusion:

With all the recent global tensions, many investors are feeling a sense of relief, especially as the trade war appears paused until September. This gives markets some breathing room to recover.

However, it’s not all clear skies yet:

Bitcoin is still stuck inside the descending bearish channel.

The recession risk hasn't gone away.

Trump may have been pressured to offer good news to avoid a full-blown market crash.

🕵️♂️ Let’s see how the weekly candle closes after this sharp move to the upside.

$BTC is at a critical pointThis is a follow-up to my previous warning about a potential CRYPTOCAP:BTC correction, published in December 2024:

🔗

At this stage, CRYPTOCAP:BTC is at a critical juncture. If we compare the current situation to previous corrections, we can observe that the RSI has reached a potential reversal zone, and price action is currently showing some resilience.

📍 The $81K level appears to be strongly defended by the bulls.

Two scenarios are now in play:

1️⃣ Bearish Continuation

If the MACD continues its downward move and the RSI drops below 30%, we could see this consolidation phase extending until July 2025. In this case, CRYPTOCAP:BTC may revisit the $72K zone.

2️⃣ Bullish Reversal

If the MACD has already bottomed out, we could witness a bullish rally over the next 3–4 months. This would likely propel CRYPTOCAP:BTC to a new all-time high.

Unfortunately, the SPX500 correction adds a layer of uncertainty. Had the traditional markets not started to retrace, the odds of a solid bounce from current BTC levels would have been near 100%.

For now, everything depends on how strong and well-funded the bulls are—can they offset macro pressure and prevent CRYPTOCAP:BTC from sinking with the TradFi indices?

🚨 Do Your Own Research (DYOR)

Bitcoin Holding Strong — Next Stop: $150K?BTCUSDT Technical analysis update

BTC price is currently retesting its major support zone, which was previously a strong resistance area, now acting as support at the $70K–$75K level. The price has just touched the $75K support zone, and we can expect a consolidation above the $70K level followed by a potential bounce back or a V-shaped recovery from the current level.if we see a strong bounce from the current support level, the next potential target could be around $150K