Let's always put our trust in BTC, mate.Bitcoin Market Analysis

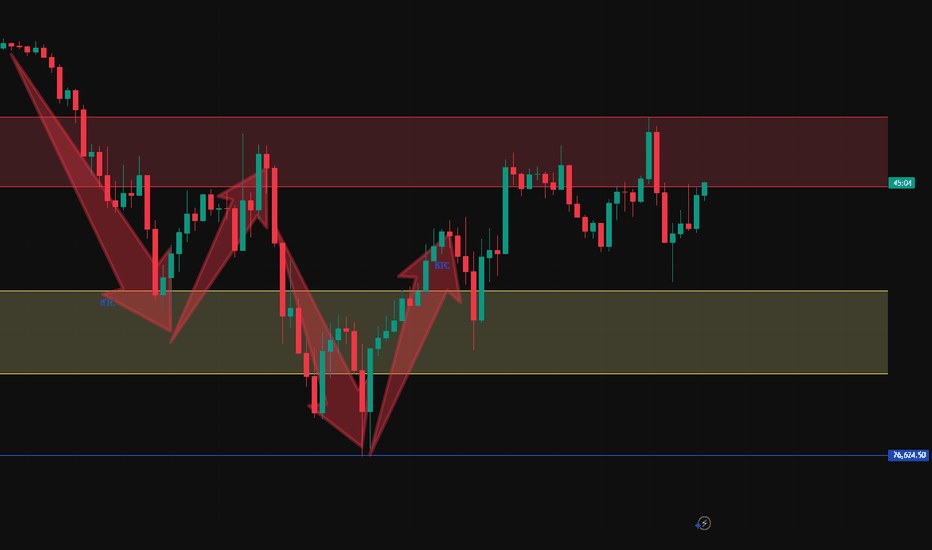

BTC price hovers around 84,000 in consolidation. Bulls and bears battle at this price.

Support Level

Support is in 81,000 - 82,000. Strong buying emerges there. It stopped drops in past corrections. Dense holdings mean many cost - bases are in this range, propping up support.

Resistance Level

Resistance at 87,000. K - lines show heavy selling near it. Past break - throughs failed. Trapped or profit - taking positions sell as price nears, creating resistance.

Bullish Outlook

I'm bullish. Global recovery raises risk appetite for BTC. More institutions hold BTC, boosting price. Positive sentiment on long - term prospects, due to blockchain growth, helps. Upward - diverging moving averages show uptrend. Lower volume in consolidation, but activity stays. New positives may push price to resistance.

💎💎💎 BTC 💎💎💎

🎁 Buy@83500 - 84000

🎁 TP 86000 - 87000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

BTCUSDC

Global Tensions, Market Manipulation, and BTC Uncertainty The cryptocurrency market, a realm notorious for its volatility, is currently grappling with a confluence of factors that are forcing investors to reassess their strategies. Global trade tensions, macroeconomic uncertainties, and the intricate dance of market manipulation are all contributing to a complex and unpredictable landscape. Specifically, Bitcoin, the flagship cryptocurrency, is experiencing a period of intense scrutiny, with analysts offering a range of perspectives on its potential future.

A recurring theme in recent analyses is the notion of "whale manipulation." Reports suggest that large holders, or "whales," are engaging in strategic trades on exchanges like Binance to influence Bitcoin's price. This "liquidity massaging" is seen as a deliberate attempt to create artificial price ceilings, with some analysts predicting that Bitcoin's upward momentum could be capped below $90,000, and more conservatively, $87.5K. Such manipulations introduce uncertainty, making it difficult to discern genuine market sentiment from artificially inflated or deflated prices.

Adding to the complexity is the debate surrounding retail investor participation. Contrary to the prevailing narrative of retail investors being absent, some crypto executives argue that they are already actively involved. This perspective challenges the notion that a surge in retail interest is needed to propel Bitcoin to new heights. If retail participation is already significant, the anticipated catalyst for a bull run may have already materialized, leaving investors to wonder what new catalyst is needed for further price appreciation.

Data from Bitcoin's Realized Cap and UTXO (Unspent Transaction Output) analysis is also signaling a "major shift." These metrics, which offer insights into the actual value stored within the Bitcoin network and the movement of coins, are crucial for understanding the underlying health of the market. Changes in these indicators can foreshadow significant price movements and shifts in investor behavior. Traders are closely monitoring these metrics for clues about Bitcoin's future direction.

However, despite recent attempts to pare losses, Bitcoin is struggling to maintain a consistent uptrend. This instability has led some traders to adopt a bearish stance, with predictions of a potential drop to as low as $65,000. These bearish sentiments are fueled by the inability of Bitcoin to decisively break through resistance levels and the persistent volatility that characterizes the current market.

Conversely, some analysts are finding bullish signals by examining indicators that also correlate with the Nasdaq. The correlation between traditional financial markets and the cryptocurrency space has become increasingly evident, and analyzing these relationships can provide valuable insights. If the Nasdaq shows signs of strength, it could potentially buoy Bitcoin's price. However, this correlation is not always consistent, and the inherent volatility of both markets can lead to unpredictable outcomes.

The performance of U.S. spot Bitcoin ETFs is another critical factor influencing market dynamics. The collapse of the "cash-and-carry" trade, a popular arbitrage strategy, has had significant implications for investors. The stagnation of inflows into these ETFs, compared to the initial surge earlier in 2024, has raised concerns about the sustainability of institutional interest. While there have been recent reports of net inflows returning, questions remain if this is a temporary blip, or a sustained uptrend. This fluctuation in ETF inflow signals a wavering confidence from institutional players.

The combination of these factors creates a challenging environment for investors. Global trade tensions, which can disrupt economic stability and investor sentiment, add another layer of uncertainty. Fluctuations in traditional markets, geopolitical events, and regulatory developments can all have a ripple effect on the cryptocurrency market.

In this tumultuous landscape, investors are advised to exercise caution and adopt a diversified approach. Relying solely on technical analysis or market sentiment can be risky. Instead, a comprehensive strategy that incorporates fundamental analysis, risk management, and a deep understanding of market dynamics is essential.

The current situation highlights the inherent volatility and complexity of the cryptocurrency market. While Bitcoin remains a dominant force, its future trajectory is far from certain. The interplay of whale manipulation, retail participation, technical indicators, and macroeconomic factors creates a dynamic and unpredictable environment. Investors must remain vigilant, adapt to changing conditions, and prioritize risk management to navigate this challenging terrain successfully.

BTC Breaks Structure - Key Levels to Watch PLUS Trade Idea!Bitcoin has broken structure to the upside on the daily timeframe, confirming a bullish trend 📈. I’m considering a buy opportunity, but only if the key conditions discussed in the video align.

Right now, BTC is in a strong uptrend, with a well-defined higher highs and higher lows structure on the 4-hour timeframe 🔍. In this video, we break down the trend, price action, market structure, and other essential aspects of technical analysis to navigate this setup effectively.

⚠️ Not financial advice.

Bitcoin BTC price analysis, FOMC 19/03 - FED rateOur previous idea for OKX:BTCUSDT worked out 10 out of 10

Well, let's try to hit it again !)

Yesterday, CRYPTOCAP:BTC price showed growth despite the fact that the Fed left the rate unchanged yesterday #FOMC

In short, Powell said that he was "hesitant" to cut the rate now because it is not known how the economy will be affected by the new "economic tariffs and economic wars" that come into effect in early April. In the US, one "grandfather" does not know what to expect from the other "grandfather" ))

Nevertheless, #BTCUSD price has every chance of reaching $94k in the coming days.

And then, I would like to see a decline in BTC.D and USDT.D, which in turn will allow altcoins to "stop collapsing", and some low-liquid ones, which are easier to pump, will show good growth, such as X Empire.

👀 In general, the last 2 months have been: "not about making money, but about surviving and keeping the deposit, even with a drawdown", but the next 3 months may be very much about making money.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

BTC Current situationCurrently BTC has not reached the resistance point of 85000, we can directly choose to go short。

BTC

🎁 Sell@84900 - 85000

🎁 SL 86000

🎁 TP 83900 - 83500

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

$9.4M Bitcoin Short Squeeze and its Market ImplicationsThe volatile nature of the cryptocurrency market is a well-established fact, but the sheer scale of some trades can still send ripples across the entire ecosystem. Recently, a Bitcoin whale executed a masterful maneuver, closing a $516 million short position with a staggering 40x leverage, pocketing a cool $9.4 million profit in just eight days. This event, occurring shortly after a lower-than-expected Consumer Price Index (CPI) reading, highlights the intricate interplay between macroeconomic indicators, market sentiment, and the strategic actions of large players.

The whale's decision to close the short position immediately following the CPI release is particularly noteworthy. The lower-than-expected inflation figure signaled a potential easing of monetary inflation concerns, a development that is generally viewed favorably by Bitcoin investors. This optimistic signal likely triggered a shift in market sentiment, prompting the whale to capitalize on the impending price surge.

The use of 40x leverage amplified both the potential gains and the risks associated with the trade. While it allowed the whale to generate a substantial profit in a short period, it also exposed them to significant losses if the market had moved against their position. This high-risk, high-reward strategy is characteristic of whale activity, where large players leverage their capital and market insights to execute impactful trades.

The timing of the trade also underscores the importance of macroeconomic indicators in shaping Bitcoin's price trajectory. The CPI reading, a key measure of inflation, directly influences monetary policy decisions by central banks. Lower inflation can lead to a more dovish stance, potentially resulting in lower interest rates and increased liquidity, both of which are conducive to asset price appreciation, including Bitcoin.

Interestingly, Tuesday has emerged as Bitcoin's most volatile day in 2025.2 This heightened volatility can be attributed to the release of key economic data, including the CPI, as well as the influence of global economic trends. Market participants anticipate increased activity on Tuesdays, making it a crucial day for traders and investors to monitor market developments.

Despite the recent correction, Bitcoin's long-term outlook remains a subject of intense debate. While some analysts believe the bull run is over, citing on-chain metrics and expecting up to 12 months of bearish or sideways price action, others maintain a more optimistic perspective, predicting a potential rally to over $200,000.

The recent whale trade, coupled with the resumption of Bitcoin accumulation after three months of distribution, suggests that underlying demand for Bitcoin remains strong.3 This accumulation, particularly by long-term holders, can act as a stabilizing force, mitigating the impact of short-term price fluctuations.4

The "Bitcoin Price Prediction 2025: BTC Eyes Breakout, But Sellers Still In Control" sentiment accurately reflects the current market dynamics. While the potential for a breakout remains, the presence of significant selling pressure cannot be ignored. The interplay between bullish and bearish forces will continue to shape Bitcoin's price trajectory in the coming months.

The notion that the "Bitcoin bull cycle is over" is supported by some on-chain data, which can reveal information about investor behavior and market trends. However, interpreting on-chain metrics requires a nuanced understanding of the underlying data and its limitations. While these metrics can provide valuable insights, they should not be the sole basis for investment decisions.

Bitcoin's resilience in the face of market corrections is a testament to its growing adoption and acceptance as a mainstream asset. Despite the current correction, the cryptocurrency's ability to outperform global assets post-Trump election further reinforces its potential as a long-term investment.

The whale's $9.4 million profit is a reminder of the potential for substantial gains in the cryptocurrency market. However, it also highlights the inherent risks associated with high-leverage trading. Investors should exercise caution and conduct thorough research before engaging in such strategies.

In conclusion, the Bitcoin whale's strategic short squeeze and the subsequent market reactions underscore the complex interplay of factors influencing Bitcoin's price.

Macroeconomic indicators, market sentiment, and the actions of large players all contribute to the cryptocurrency's volatile nature.5 While the long-term outlook remains uncertain, the resumption of Bitcoin accumulation and the potential for a breakout suggest that the market is far from stagnant. Investors should remain vigilant, closely monitoring market developments and adapting their strategies accordingly. The story of the whale's successful trade is a potent reminder of the fortunes that can be made, and lost, in the dynamic world of cryptocurrency.

The current BTC chart, incorporating my 'flash-crash' thesisThis chart illustrates the current Bitcoin pattern, with my 'April flash crash thesis.'

I believe we will see another thrust lower into the green box ranges before a spring into the fifth wave. However, the fifth wave will be a "false breakout," as a flash crash in mid to late April is likely to occur, intentionally designed to sweep liquidity by liquidating overleveraged positions and triggering stop losses—driving price past the previous low set in the green box, only for the market to recover shortly thereafter and continue its breakout to the upside. This breakout will likely push beyond the pattern, taking out the all-time high, and setting a new high somewhere in the 20K to 25K range.

There could be some opportunities in the next 4 to 6 weeks, but with opportunity comes risk. Always use a proper risk management strategy suited to your skill level and wallet size.

Good luck, and always use a stop loss!

BTC Today's analysis

BTC has been fluctuating at 84000 to 84500 yesterday, very stable, like a crocodile waiting for food to come, so we should always be vigilant

BTC 🎁 Buy@83000 - 83200

🎁 SL 83500

🎁 TP 84500 - 84800

If you're struggling to find direction or generate profits in finance,

I'm here to help. As a seasoned financial analyst,

I'm great at decoding market signals for profit - making chances.

I'll customize a plan for you. Contact me now to start seeing financial gains!

Bitcoin’s Monthly RSI Nearing Danger Zone – Time to Sell?The chart above illustrates Bitcoin’s price action alongside the Relative Strength Index (RSI) on a monthly timeframe, which helps identify overbought and oversold conditions. Historically, Bitcoin’s major bull cycle peaks in 2013, 2017, and 2021 coincided with the monthly RSI reaching between 85-95, as highlighted by the blue circles. A downward trendline connects these peaks, suggesting that each cycle has seen slightly lower RSI highs, indicating a potential long-term momentum decline.

Currently, the RSI is approaching this historical resistance zone, signaling that Bitcoin may be nearing its market peak. If this trend continues, it could mark the final phase of the bull run, making it a strategic period for profit-taking. Traders should closely monitor RSI behavior, as a rejection from this level could indicate the start of a correction.

Historically, a monthly RSI of 85-95 has been a strong sell signal, marking the end of Bitcoin’s bull markets. If Bitcoin follows this pattern again, a distribution phase followed by a downturn could be expected.

Bitcoin's 1065-Day Bull Run Nearing Its End – A Cycle ComparisonThis chart illustrates Bitcoin’s historical price action over three major market cycles, each lasting approximately 1065 days (35 months). The pattern suggests that Bitcoin follows a well-defined four-year cycle, influenced by its halving events. Each cycle begins with a bearish phase (marked in red), followed by a strong uptrend (green), leading to a peak before another correction phase starts.

A key observation is that the duration of each bull run remains consistent, lasting around 35 months (~1065 days) before reaching its peak. Historically, Bitcoin has followed a similar trajectory, with price action mirroring previous cycles. If this pattern holds, the current bull run may reach its peak within the next 6-8 months, placing the market top around late 2025.

Additionally, past cycles show that altcoins tend to experience their strongest moves after Bitcoin peaks, meaning an altseason could emerge by Q3–Q4 2025.

Bitcoin Reversal or Dead Cat Bounce? Here's My Trading Plan! Analyzing BTC on the higher timeframe, we observe a clear structural shift in the prevailing trend 📊. Dropping down to the 4-hour chart, there is a decisive bullish break 📈, leaving behind an imbalance following the initial move—an area that could serve as a retracement target 🎯. Notably, this imbalance aligns with a Fibonacci retracement into equilibrium 📐, adding confluence to the setup.

I am considering a long position 💰, but only if the key conditions outlined in the video materialize ✅. If those conditions fail to align, I will discard this trade idea ❌.

⚠️ Not financial advice.

$BTC MACD on weekly show a bearish trend. Read.You can see on the chart that in May 2024 I issued a warning, and look at what happened over the next five months.

The same pattern is repeating now, and there’s a high probability we’ll see a similar result.

Back in May 2024, the usual crowd—MMCrypto, That Martini Guy, Ash, Crypto Rover, etc.—were all saying things like, “We’re going to 110k,” “To the moon,” or “A huge bullish breakout is coming.”

What did we actually get? Five months of consolidation and an -80% drop for most altcoins.

So consider this a warning. The MACD on the weekly chart is a reliable indicator of the trend. Exchanges aren’t going to go against the trend. Even if there’s a ton of liquidity at 107k, they won’t risk buying billions worth of Bitcoin just to get wrecked by the prevailing trend and be forced to sell at a lower price than they purchased.

Those pointing to the liquidity map at 107k are missing the point. Exchanges take the easier path. Going from 97k to 107k is plausible in an uptrend, but in a downtrend? No chance.

What to Expect Now?

Since this chart is on the weekly timeframe, there will be daily bounces. Some altcoins may see 10-20% gains if you time the bottom and top correctly.

However, for holders, this is not a good time to hold.

Is Invalidation Possible?

Yes, but consider this: they’ve tried to break the trend five times and failed. The chance of a reversal now is about 1 in 9. It’s possible, but unlikely.

Key Support Levels

Support levels to watch are 95k, 91k, 85k, and 70k. While we might not drop as low as 70k, it’s better to be prepared.

What’s Next?

By May 2025, we’ll likely reach the end of this bearish trend, followed by a one-month altseason and a big BTC pump. However, starting in July 2025, we’re likely to face another five months of bearish consolidation.

The introduction of ETFs has shifted the crypto cycle into a new paradigm of five months of consolidation followed by one month of pumping.

As always, DYOR (Do Your Own Research).

$84K BTC Battle, ETF Resilience, and Macroeconomic ShadowsBitcoin's journey remains a captivating saga of volatility, resilience, and the interplay of technical indicators and macroeconomic forces. Recently, the cryptocurrency surged past $84,000, reigniting bullish sentiment, but faces a critical test at a key resistance level.1 This surge, fueled by a broader rebound in risk assets, pushed BTC above its 200-day moving average, a pivotal benchmark for assessing long-term trends. However, this bullish momentum is juxtaposed with significant selling pressure, ETF outflows, and lingering concerns about regulatory and macroeconomic landscapes.

The 200-Day Moving Average: A Battleground for Bulls

The 200-day moving average is a widely recognized technical indicator that provides insight into the long-term trend of an asset. For Bitcoin, consistently closing above this level signifies a potential shift from bearish to bullish momentum. The recent breach is a positive sign for bulls, indicating renewed confidence and potentially attracting further investment. However, a sustained close above this level is crucial to solidify the bullish outlook.

The importance of this level is highlighted by the narrative that a weekly close above this average would confirm a market bottom. This emphasizes the significance of longer timeframes in validating trends in the highly volatile cryptocurrency market.

$86K or $65+K: A Price at a Crossroads

Bitcoin's price currently finds itself at a critical juncture. The immediate challenge is breaching the $86,000 resistance level. A successful breakout could pave the way for further gains, potentially pushing Bitcoin towards new all-time highs. Conversely, failure to overcome this resistance could lead to a pullback towards the $65,000 support level. This range represents a crucial battleground for bulls and bears, with the outcome likely to determine the short-term trajectory of Bitcoin's price.

MVRV Ratio: A Potential Reversal Indicator

The Market Value to Realized Value (MVRV) ratio is another key metric that investors closely monitor. It compares Bitcoin's market capitalization to its realized capitalization, providing insights into potential overbought or oversold conditions. A high MVRV ratio suggests that Bitcoin is overvalued and prone to a correction, while a low ratio indicates undervaluation and potential for a rebound. The MVRV ratio nearing a key level suggests that a major reversal could be imminent, adding another layer of complexity to Bitcoin's current price action.

ETF Resilience Amidst Volatility

Despite a 25% price drop, Bitcoin ETF investors have maintained a relatively strong stance. This resilience is reflected in the collective $115 billion in assets under management by US Bitcoin ETFs. This demonstrates the growing institutional adoption of Bitcoin and the increasing acceptance of cryptocurrencies as a legitimate asset class. However, since mid-February, Bitcoin ETFs have witnessed total outflows of nearly $5 billion. This outflow points to a potential shift in investor sentiment, possibly driven by concerns about market volatility or macroeconomic uncertainties.

The strength of the ETF market is a double edged sword. While significant holdings demonstrate institutional buy in, large outflows can increase sell pressure on the underlying asset.

Selling Pressure and Macroeconomic Shadows

Bitcoin's recent decline is attributed to intensified selling pressure, reflecting a broader trend of risk aversion in the market. This selling pressure is exacerbated by concerns about the potential impact of digital currencies on traditional banking systems. Banks are increasingly weighing the implications of Bitcoin and other cryptocurrencies, leading to regulatory scrutiny and potential policy changes.

Furthermore, macroeconomic factors continue to weigh on investor sentiment. Concerns about inflation, interest rate hikes, and geopolitical tensions are contributing to market volatility and impacting the demand for risk assets, including Bitcoin.

Presidential Policy and Market Sentiment

A presidential policy aimed at creating a strategic Bitcoin reserve initially sparked optimism among investors. However, this initial enthusiasm waned, highlighting the complex interplay between policy announcements and market reactions. While such policies can signal government acceptance of cryptocurrencies, they may not always translate into immediate price appreciation.

The market's reaction suggests that investors are more focused on broader macroeconomic trends and regulatory clarity. The lack of sustained positive impact from the policy announcement underscores the importance of addressing fundamental concerns about Bitcoin's long-term viability and regulatory framework.

Navigating the Volatility

Bitcoin's current situation highlights the inherent volatility and unpredictable nature of the cryptocurrency market. Investors must remain vigilant and adapt to rapidly changing market conditions. The interplay of technical indicators, ETF flows, and macroeconomic factors creates a complex landscape that requires careful analysis and strategic decision-making.

In conclusion, Bitcoin's battle at $84K, coupled with the resilience of ETF investors and the shadow of macroeconomic uncertainties, paints a picture of a market at a critical juncture. The coming weeks will be crucial in determining whether Bitcoin can sustain its bullish momentum or succumb to renewed selling pressure. Understanding the interplay of these factors is essential for navigating the volatile world of cryptocurrency investing.

Reasons for and against a Push higher by Bitcoin SOON sin November 2022, PA has almost become predictable.

Running on a Pattern of Steps and Always paying attnetion to the Weekly MACD

I have posted in detail about the weekly MACD in other posts so I will not expain much now but here is the chart again, It explains itself really.

We are, once again, Waiting for the weekly MACD to reset to Neutral, were we hope it will bounce again. BUT, as you can see, a 3rd bounce would be unusual but , on this occasion, Highly probable

On the main chart, we can see that PA began running on a Rising trendline and, after ranging for a while, it bounced off it in Mid October 2023. It has Never returned to that line.

PA began Ranging again in March 2024. Note that date on the MACD chart. MACD Peaked and began turning Bearish and fell till it hit neutral in Sep.

At that same moment, in Sep 2024, PA bumped into the 50 week SMA ( RED) and bounced up to a New ATH in Dec 2024

So, we had 2 bounces after ranges, seemingly unconnected - until you look at the day count of each range.

1st -April 2023 to Sep 2023 - 196 days

2nd - March 2024 to Sep 2024 - 189 days

Now also note the Double Tops and then the retrace on Both those Range dates AND on the current Range

And so NOW, Currently, we are in a Range, again, MACD Peaked High and is falling Bearish

But this Range began in DECEMBER 2024

So why do we have a possibility of a push higher soon ?

Look where that RED 50 week SMA is - Just below PA.

Could PA Bounce of it if we bump into it ?

We have come VERY Close in recent days. The 50 is around 75500 - PA got to 76500

If PA touches it, I am sure we will bounce Higher

And so This leads us to why we may NOT bounce soon

I think the Bulls are trying to keep PA off the 50 till MACD is reset. If true, that 50 will level out.

PA will have to touch it BEFORE it begins to fall or PA will have to drop below 70K to reach it.

And THIS Leads us to what I think could Very well happen

IF PA were to have a bounce higher soon , maybe to Top of Range, around 109 ( but probably Lower) this would give PA room to drop back to Bottom of Range while MACD continues to Fall. A Quick push up , say over 10 days, would hardly effect the MACD reset but gives PA room to move without loosing to much more value, Keeping Market CAP stable and Sentiment happy

MACD is expected to reach neutral, at current rate of descent, around May / June.

And Look..that happens to be around 189 days since range began. The same approx day count as the previous 2 ranges this cycle.

We may see a drop lower this month, nothing is for sure but if we fall below that 50 SMA, I will be changing my Bullish Tune and Screaming CAUTION

All to play for in the next few months

Bitcoin's market share rises despite decline in active usersThe data shows that Bitcoin's dominance has been rising steadily since 2022. It also highlights that Bitcoin's market share of active users has fallen over time. The data shows that on-chain activity in Ethereum and other layer 1 (L1) networks has increased.

OnChain data shows that Bitcoin's dominance has increased since 2022, and the upward trend is the longest in history. The data also shows that Bitcoin's active user market share has fallen as on-chain activity on the Ethereum network has increased.

Amid declining users, Bitcoin dominance has increased;

Matrixport shows that Bitcoin dominance has increased to a new high of over 61%. The analytics platform put the dominance higher, which was stronger than expected in the US jobs report. It said that the increased job rate indicates that the economy is recovering. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT

ETH at a Critical Support Level! Market Poised for a Big Move?Ethereum ( CRYPTOCAP:ETH ) is currently trading at a 261-week-old support level, making this a crucial zone for the market.

Earlier, ETH dipped to $1,754, a price level that has historically been significant. This could very well mark the bottom for ETH and potentially for altcoins. However, it's still too early to confirm.

The next two weekly candles will be key, if this support holds, we could see a strong altcoin recovery in the coming months.

Macro Factors at Play:

The broader geopolitical and macroeconomic landscape isn't great, despite this potential setup. Markets in the US, China, and India are facing turbulence, and the crypto market is experiencing low volume and liquidity. These factors could impact price action in the short term.

That said, as the chart develops over the next few weeks, we might witness significant shifts in market sentiment.

Sooner or later, BTC will make its move—either consolidating or attempting to reclaim $90K—while altcoins could start rebounding rapidly. When this happens, the market could turn bullish in a matter of weeks.

Stay Alert, The Opportunity Is Coming:

Now is the time to pay close attention to the charts and fundamentals. Stay sharp, monitor key levels, and prepare for potential opportunities.

I'll be sharing a handpicked list of altcoins that could perform well in the coming days.

DYOR , Not Financial Advice.

Stay tuned.

Do show your support buy hitting that like button.

Thank you

#PEACE

The impact of the decline in Tesla's stock price on the BTCUSDThe change in Tesla's stock price has an impact on BTCUSD, mainly in the following aspects:

Investor sentiment transmission: As a highly influential listed company, a significant drop in Tesla's stock price will undermine investors' confidence in technology and innovative assets. This negative sentiment may spread to the cryptocurrency market, causing investors to lose confidence in investing in Bitcoin. Consequently, they may sell off Bitcoin, leading to a decline in the price of BTCUSD. For example, on March 10, 2025, Tesla's stock price plummeted by more than 15%, closing at $222.15, marking its worst single-day performance since 2020. During the same period, the price of Bitcoin also saw a significant drop.

Fund flow transfer: When Tesla's stock price drops, investors may withdraw funds from Tesla stocks and related investment portfolios to seek other more attractive investment opportunities. If there are no obvious other investment targets with high returns and low risks in the market, some funds may flow into the cryptocurrency market, such as Bitcoin, pushing up the price of BTCUSD. However, if the overall market risk appetite decreases, funds are more likely to flow into traditional safe-haven assets, such as gold and bonds, rather than Bitcoin, resulting in a decline in the price of Bitcoin.

BTCUSD sell @84000-84500

tp: 78500-78000

BTCUSD Buy @78000-78500

tp: 82000-82500

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

Bitcoin is gearing up to drop to $50-$55K.Bitcoin is gearing up to drop to $50-$55K:

Hey everyone!

As you’ve probably noticed, this week altcoins and meme markets have been falling aggressively, including names from Murad's list like $SPX.

➖ The broader market also shows signs of a downturn. If you check monthly charts for the Dow Jones, S&P 500, and other indices, they’re aligning for a drop.

➖ The catalyst could be anything—from the wildfires in California to a potential strike by Iran on Israel.

Take note of the prepared orders on Coinbase targeting $50-$55K.

➖ Binance’s BTC/USDT Liquidation Heatmap over the past 6 months (Model 3 from CoinGlass) also highlights liquidation interest in this area.

When you put all the pieces together, the odds favor a drop. Market makers would likely want to shake out recent buyers of altcoins, meme coins, etc., before any significant rally.

Avoid leverage or futures trading—it’s the easiest way to lose your deposit in this environment.

No Financial Advice, Do Your Own Research.

Cold thinking on Bitcoin's "pullback moment"This morning, Bitcoin prices fluctuated again, falling below the $77,000 mark and currently fluctuating around $80,000. The market seems to have entered the "pullback moment" again. Faced with price fluctuations, I believe many friends are thinking about the same question:

Is it "getting off the train to avoid risks" or "entering the market at a low point" now?

This question seems simple, but it is actually complicated. Especially in the cryptocurrency market, short-term fluctuations are drastic, and various information noises are intertwined, which can easily make people lose their way. When we are in the "pullback moment", we need a calm thinking, and we should take our eyes off the price fluctuations in front of us and put them into the larger "trend" and "cycle" framework to examine.

Let's take a closer look at what a trend is and what a cycle is.

1. What are trends and cycles?

To understand any market, we should first distinguish between the two key concepts of "trend" and "cycle", and the crypto market is no exception.

Trend: Trend is the long-term direction of the development of things and a grand and lasting force. It represents the most essential and core trend of things, just like a surging river, once formed, it is difficult to reverse.

Cycle: The cycle is the short-term fluctuation in the development of things, and it is the rhythmic change of swinging around the trend line.

Simply put, the cycle is in the trend. However, simple inclusion is not enough to express the complex relationship between them. If the "trend" is compared to the trunk of a tree, the "cycle" is like the rings on the trunk.

When 96% of the world's population does not yet hold Bitcoin, when sovereign funds begin to include crypto assets in their balance sheets, and when blockchain technology becomes a new battlefield for the game between major powers - this galloping "digital ark" has just sailed out of the dock where it was built. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P PEPPERSTONE:XAUUSD BINANCE:BTCUSDT

Bitcoin BTC price analysis😕 Yesterday's news of a higher-than-expected CPI increase seems to have been "digested" by the market.

We liked that most of the alts held up quite well (all compared to last week) - there was no more panic.

1️⃣ On the one hand, the CRYPTOCAP:BTC price is being pushed to the “critical triangle” below which the OKX:BTCUSDT price may go to close the CME GAP formed last year.

But BTC.D is also dropping, albeit reluctantly, a little bit.

2️⃣ On the other hand, maybe it's time to stop focusing on that bourgeois #Bitcoin ).

It's time for the altcoins to take "the pitchforks" into their own hands!)

😱 Some #CAKE and #Bake are showing good growth and even the “heavy” CRYPTOCAP:BNB is climbing despite them.... and all because #CZ decided to return to the “big” game and will present a photo of his dog in a few hours....

We are re-reading this sur and our eyes are twitching.... but these are the realities of the crypto world now...)

⁉️ So, what do you think, which memecoin from СZ will blow up the information space and pull all the market liquidity to itself in the coming hours/days?)