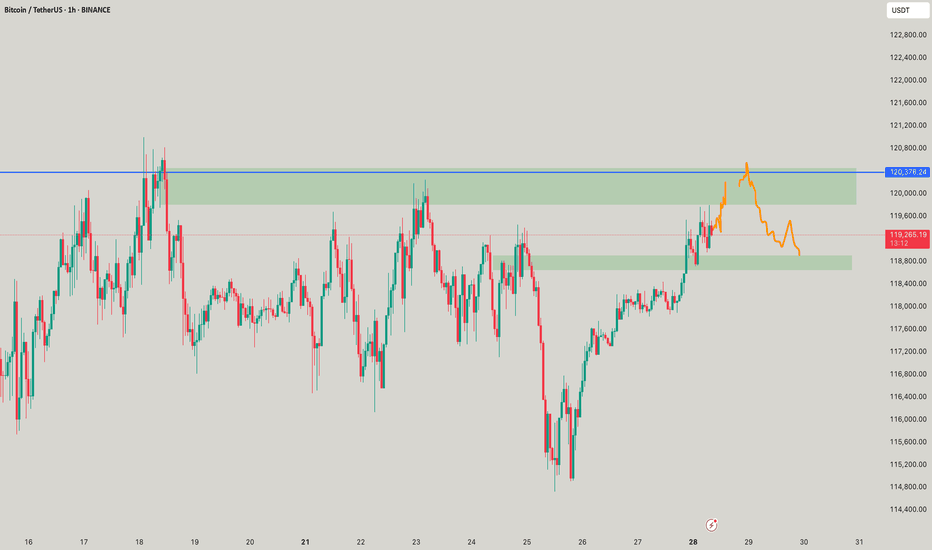

Bitcoin Rejected Near $120K – Bears Wake Up!First of all, I have to say that Bitcoin’s movements over the last 12 days have been a bit difficult to trade , generally, the hardest market to make a profit in is the range market with a swing movement .

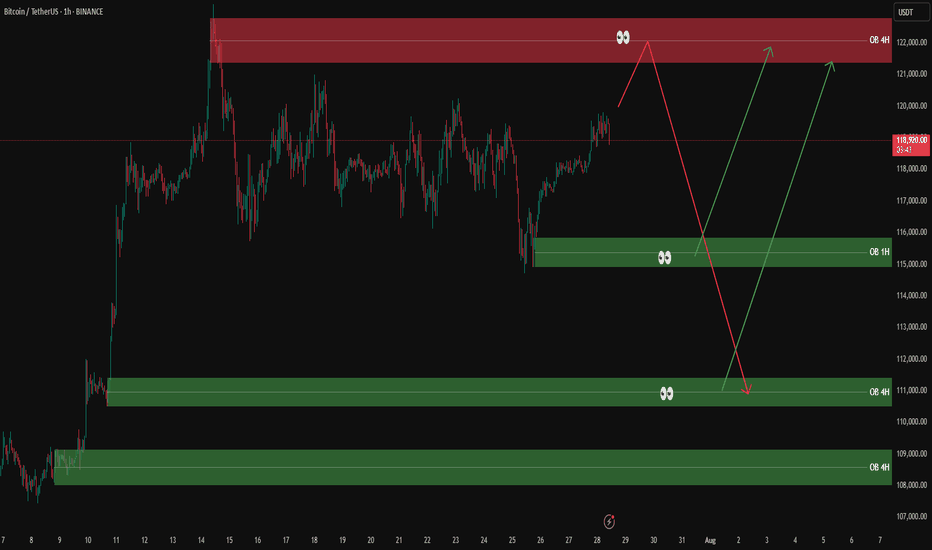

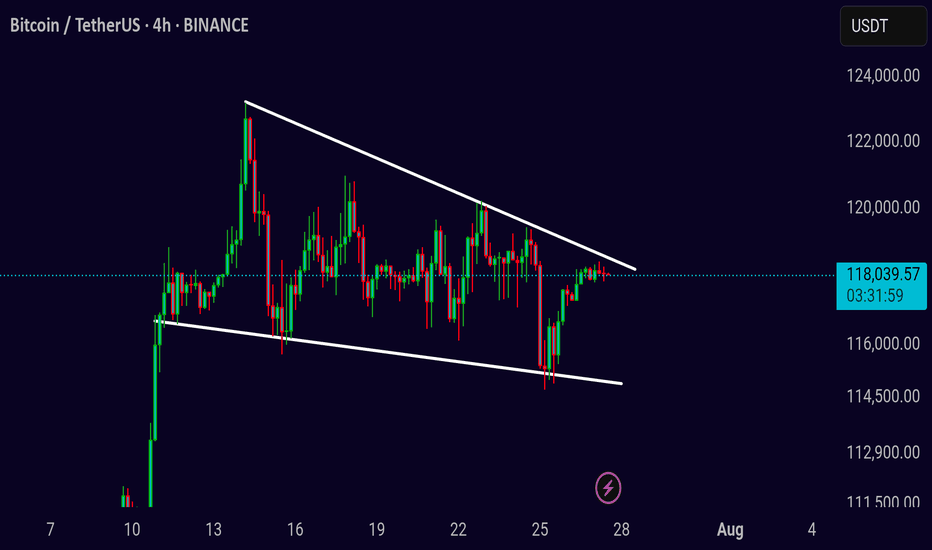

Bitcoin( BINANCE:BTCUSDT ) is currently trading near the Resistance zone($121,000-$119,500) , Cumulative Short Liquidation Leverage($121,336-$120,000) , and the upper line of the descending channel .

Since Bitcoin has lost support lines , we can consider this increase in Bitcoin over the last two days as a pullback to the support lines(broken) . Do you agree with me!?

In terms of Elliott Wave theory , it appears that Bitcoin is still completing the main wave B. The main wave B is a Regular Flat(ABC/3-3-5) . The structure of the microwave B of the main wave B was a Double Three Correction(WXY) .

Additionally, the SPX 500 index ( SP:SPX ), which Bitcoin is correlated with , is poised for a correction in my opinion, which could also impact Bitcoin .

Also, unlike previous Mondays, MicroStrategy has NOT purchased Bitcoin , and the company currently holds 607,770 BTC .

Old Bitcoin wallets also seem to be waking up to the fact that they can create movements in the crypto market . " In recent days, 471,867.8 BTC worth $56.39 million have been transferred from old wallets from 2012 to 2017 . ".

I expect Bitcoin to decline to at least the Support zone($116,900-$115,730) and fill the CME Gaps in the coming hours .

New CME Gap: $119,500-$118,295

CME Gap: $115,060-$114,947

Cumulative Long Liquidation Leverage: $117,401-$116,615

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTCUSDT

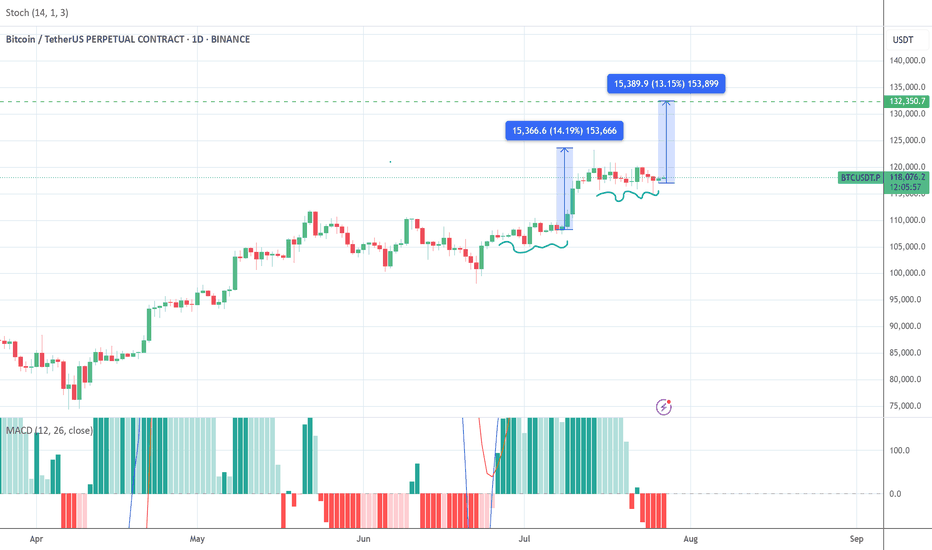

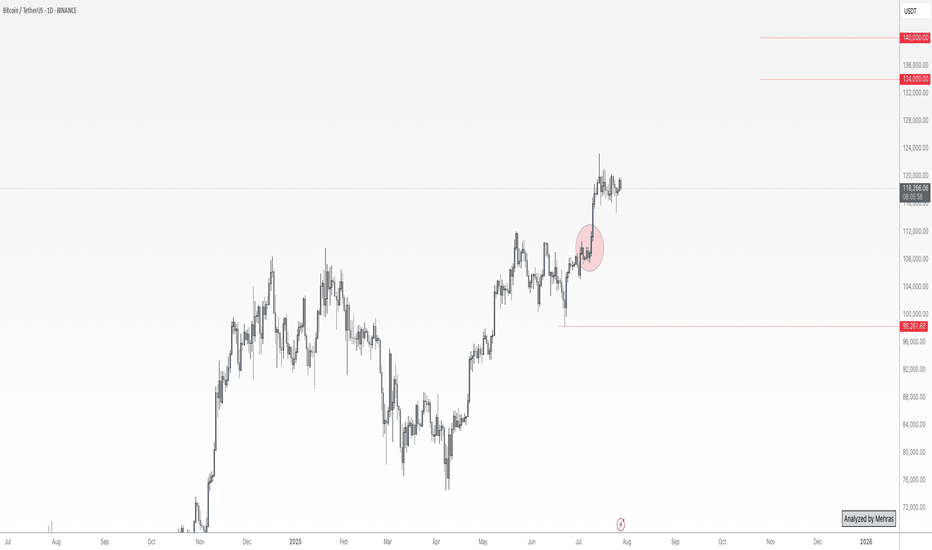

#BTCUSDT: Minor Correction In Price Then $150,000?Hi everyone,

Hope you are doing great we are witnessing some minor bearish correction in the price and think this might be a sellers trap. We think $110,000 can be a good area to buy. Our target is at $150,000 area which look possible after looking at how price recently behaved.

BTCUSDT analysis – 1H & 4H OB setups✅ The overall market trend is still bullish on the 1H and 4H timeframes. However, we’re watching the red 4H supply zone (around 122,000) closely for a possible short-term sell setup.

🟥 If price reaches this red OB, we’ll look for a light short position only with confirmation on the 5M or 3M timeframe.

🟩 On the downside, we are mainly interested in buy setups from the following key green OB zones:

🔹 OB 1H around 115,000

🔹 OB 4H around 111,000

🔹 OB 4H around 108,000

📌 Possible scenarios:

1️⃣ Price reaches the red OB → short with confirmation

2️⃣ Price pulls back to lower green OB zones → long with confirmation

3️⃣ Market bias remains bullish unless proven otherwise.

❌ No entry without confirmation.

BTC | ALT Season, then BEARISH CYCLE BeginsBitcoin is likely moving in to the beginning of a bearish cycle.

I'm not saying this is immediate, we first need to see altseason - however, if BTC increases it may not go any higher than the last high of $123k. We could easily see the price hover around this zone with a few small increases and decreases for the next few weeks as alts make their respective moves.

I have been talking about the 2021 fractal for a couple of months, where BTC took its time to correct and then made another ATH which was only slightly higher.

We already see a similar pattern playing out in the monthly timeframe if we overlay bars pattern from 2021:

Although Bonce zone 3 may only be in several months, these are the major support zones where BTC could bounce from. Ideal for a swing:

____________________

BINANCE:BTCUSDT

TradeCityPro | Bitcoin Daily Analysis #138👋 Welcome to TradeCity Pro!

Let’s get into the Bitcoin analysis. Today is the start of the week, and it’s very important to begin our trading week with the right analysis and outlook.

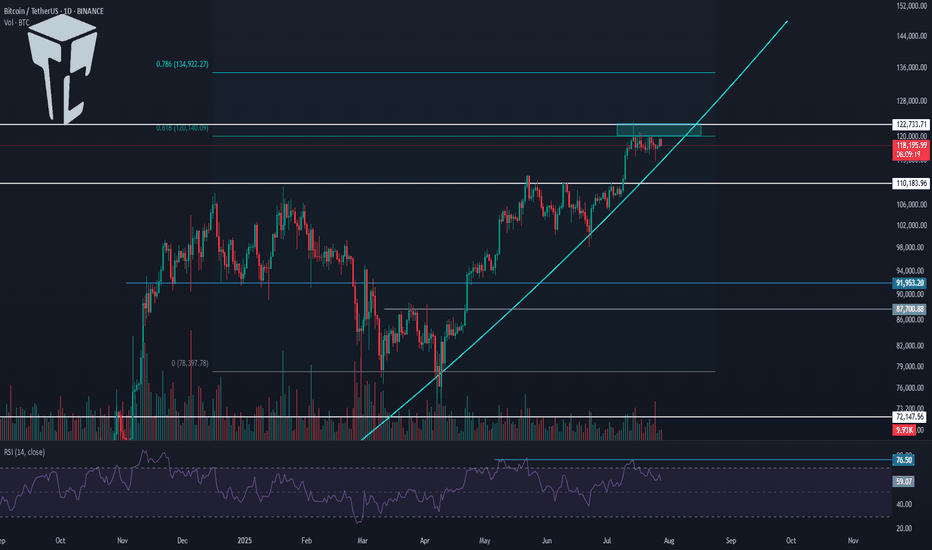

📅 Daily Timeframe

On the daily timeframe, as you can see, not much has changed compared to the previous analysis, and the price is still ranging near the supply zone.

✔️ The fact that no price correction has occurred so far shows the strength of the buyers, and even if a correction does happen, as long as the price stays above 110183, the trend will still be considered bullish.

🧩 The main trigger for trend continuation is either the price reaction to the curved trendline or the break of 122733. We can find more optimal triggers in the lower timeframes.

⏳ 4-Hour Timeframe

In this 4-hour timeframe, after a fakeout below 116829, the price corrected down to the 0.5 Fibonacci level and now has returned again to the box between 116829 and 120041.

🔍 The fakeout trigger is 120041, and I’ll try to have at least two positions open in the market when this level breaks — whether on Bitcoin or altcoins.

📈 The main trigger for the next bullish leg is 122733.

If RSI also breaks the 61.67 resistance alongside 120041, the likelihood of the move continuing will increase.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTC/USD) bullish trend analysis Read The captionSMC Trading point update

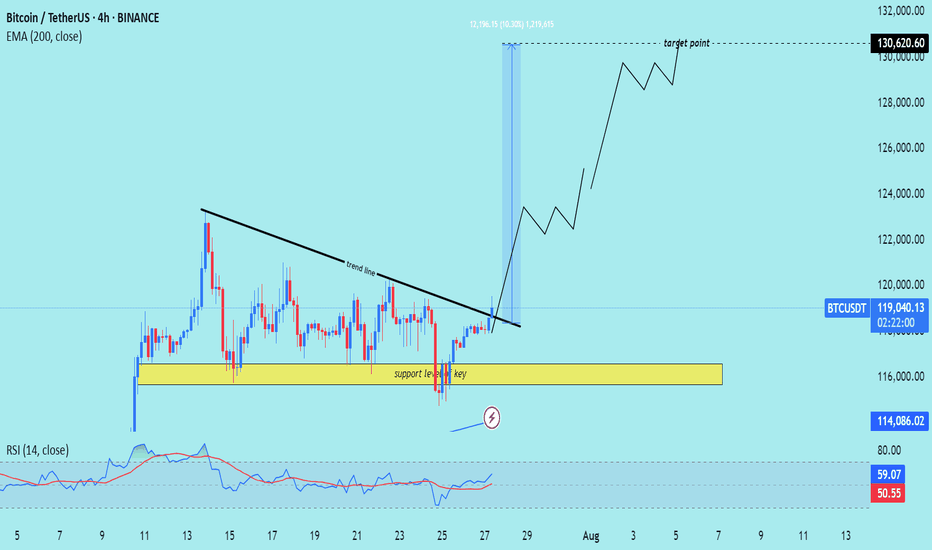

Technical analysis of Bitcoin (BTC/USDT) on the 4-hour timeframe, indicating a potential rally toward the $130,620.60 target zone. Here's the detailed breakdown:

---

Technical Analysis – BTC/USDT (4H)

1. Key Support Level Holding

The yellow zone highlights a strong support zone around $116,000, which has been tested multiple times without breaking.

Marked as “key support level,” it has acted as the foundation for a bullish reversal.

2. Trendline Breakout

A descending trendline was broken decisively with strong bullish candles, signaling a trend reversal.

The breakout was followed by increased momentum and volume, supporting the move higher.

3. Target Projection

The chart shows a projected move up to $130,620.60, labeled as the target point.

This target aligns with a measured move or prior resistance, suggesting a potential swing high objective.

4. 200 EMA Support

Price is well above the 200 EMA (at $114,088.52), confirming the uptrend and acting as dynamic support.

5. RSI Confirmation

RSI is at 60.62, reflecting bullish strength with more room before reaching overbought levels.

Momentum supports the continuation of the uptrend.

Mr SMC Trading point

---

Summary

Bias: Strong Bullish

Current Price: $119,291.13

Support Zone: $116,000 (key area)

Trendline: Broken with bullish confirmation

EMA 200: Acting as solid dynamic support ($114,088.52)

Target Zone: $130,620.60

RSI: 60.62 – bullish with upside potential

---

Please support boost 🚀 this analysis)

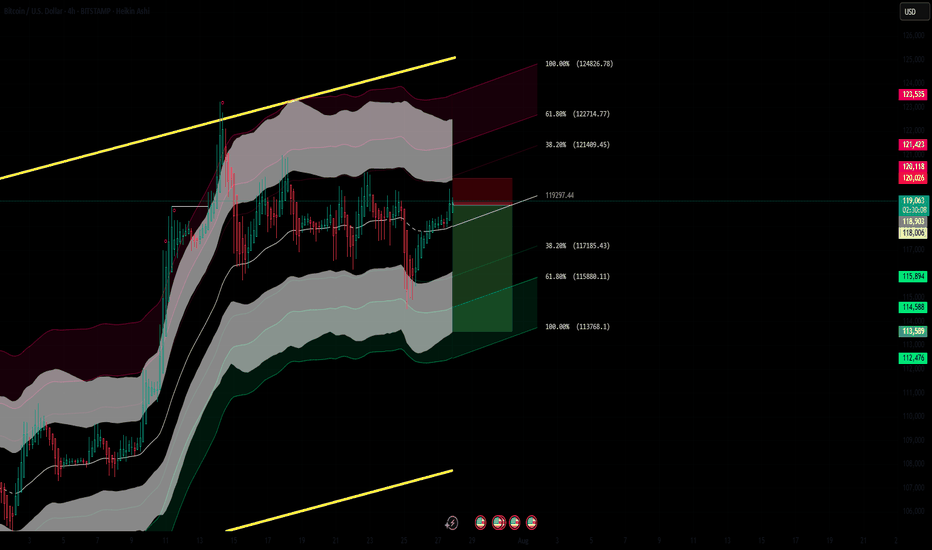

BTC/USD – 4H Short Setup AnalysisBitcoin is currently trading within a defined range under macro resistance. The chart shows price stalling below a key supply zone, with rejection from the upper Keltner Channel and diagonal resistance (yellow trendline). A local bearish divergence appears to be playing out as momentum fades.

📉 Short Position Setup:

Entry: $119,275 (supply retest)

Stop Loss: Above local high / top channel boundary

Targets:

TP1: $117,163 (38.2% Fib)

TP2: $115,858 (61.8% Fib)

TP3: $113,746 (full measured move)

Confluence:

Bearish rejection near multi-touch trendline resistance

Lower high formation after extended consolidation

Heikin Ashi candles showing loss of bullish momentum

Watch for: Breakdown of the white trendline support to confirm momentum shift. Invalidation if BTC closes strongly above $120,000.

Timeframe: 4H | Strategy: Range Reversal + Fib Confluence

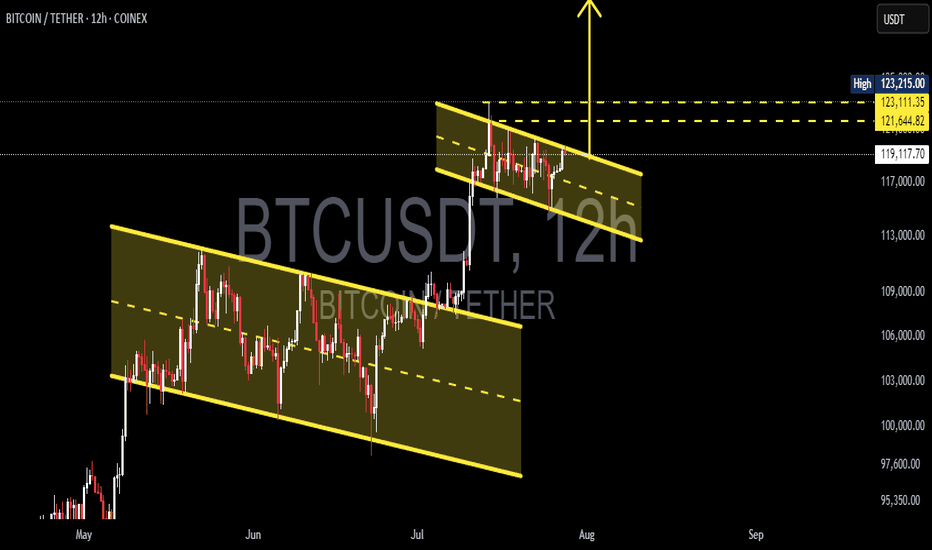

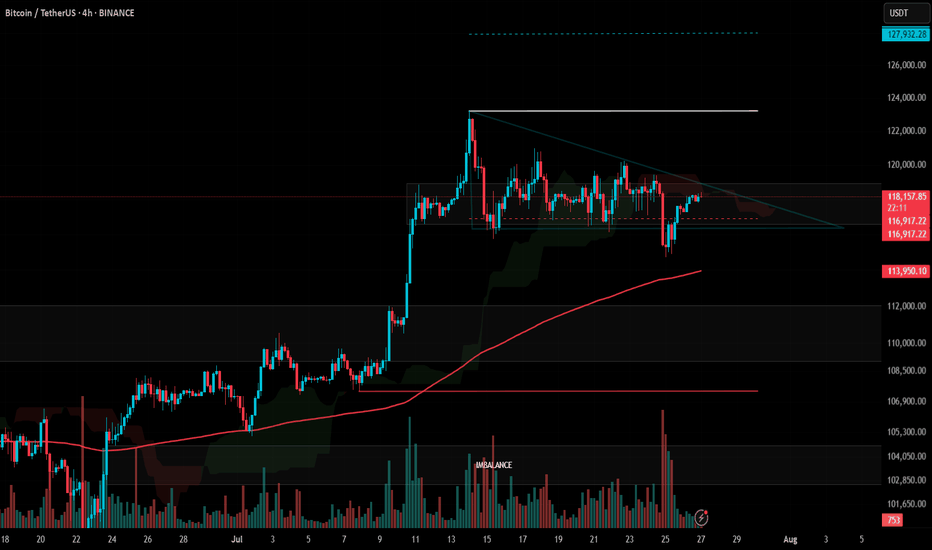

Double Bullish Flag on Bitcoin — Next Rally to $135K?📊 BTCUSDT (12H) In-Depth Analysis: Major Momentum Brewing

Bitcoin (BTC) is currently exhibiting a very promising technical structure — a Double Bullish Flag, a rare yet powerful continuation formation that often precedes strong upside momentum.

This dual-pattern structure reflects market strength and smart accumulation, with bulls maintaining control while allowing for healthy pauses before potential expansion to higher levels.

---

🔍 Technical Breakdown: Double Bullish Flag Structure

🔸 1. Primary Bullish Flag:

Formed after a sharp rally from around $95,000 to $113,000 (flagpole).

Price then consolidated within a clear descending channel, forming a classic Bullish Flag pattern.

Breakout from this pattern occurred in early July, confirming bullish continuation.

🔸 2. Secondary Bullish Flag (Mini Flag):

After the breakout from the main flag, BTC formed a second smaller flag pattern — a narrow descending channel from ~$123K to ~$119K.

This is known as bullish flag stacking — a pattern of "flag on top of flag", signaling trend strength and smart consolidation.

This mini-flag now acts as a launchpad for the next potential breakout.

---

🚀 Bullish Scenario: Preparing for a Breakout

If BTC breaks above the upper resistance of the mini flag (~$123,200), it will signal a fresh bullish continuation.

🎯 Potential Upside Targets:

Conservative target: $126,000 – $128,000

Full measured move target (from flagpole): $132,000 – $135,000

✅ Confirmation criteria:

Strong candle close above $123.2K

Accompanied by rising volume and upward RSI momentum (but not overbought)

---

🧨 Bearish Scenario: Breakdown and Retest

If BTC fails to break above the flag and instead drops below the flag support (~$119,400), we may see a short-term correction.

🔻 Key Support Levels:

$117,000 – minor horizontal support

$113,000 – $115,000 – strong demand zone and previous breakout area

⚠️ As long as price holds above $113K, the broader bullish trend remains intact. A pullback to this zone could offer a prime retest-buying opportunity.

---

📌 Key Price Levels to Watch:

Level Role

$123,200 Mini-flag resistance (breakout trigger)

$121,600 Mid-range resistance

$119,400 Flag support

$117,000 Horizontal retest zone

$113,000 Major support (trend invalidation if lost)

$132K – $135K Projected breakout target

---

💡 Conclusion: BTC in Critical Zone Before Potential Expansion

This Double Bullish Flag formation is one of the most technically constructive setups BTC has shown in weeks. It reflects a strong, patient market — with bulls preparing for another leg higher.

If the breakout from the second flag confirms, Bitcoin could rally toward $135,000, backed by momentum, volume, and clean structure. However, a breakdown would only signal a short-term cooldown unless support at $113K is lost.

🧭 Stay focused on breakout confirmation, volume spikes, and market sentiment. This could be the calm before a bullish storm.

#BTCUSDT #BitcoinBreakout #BullishFlag #TechnicalAnalysis #DoubleBullFlag #BTCMomentum #BitcoinRally #CryptoOutlook #BitcoinTo135K

Bitcoin Correction Maturing – Long Setup Brewing!Bitcoin ( BINANCE:BTCUSDT ) has fallen by more than -4% over the past day.

Let's take a look at the reasons for the decline.

One of the key reasons behind Bitcoin’s decline in the past 24 hours ( July 25 ) could be the reduced likelihood of Jerome Powell being replaced as Chair of the Federal Reserve.

In recent days, market participants were speculating that Donald Trump might replace Powell — a scenario that was considered bullish for risk assets like Bitcoin. However, recent reports of a meeting between Trump and Powell, and signs that Powell might not be dismissed, have weakened this fundamental narrative.

This meeting may signal a truce or reduced tension between Trump’s team and Powell , which could imply a continuation of current Fed policies. That’s bad news for Bitcoin, as it removes a potential psychological tailwind from the market and dampens speculative sentiment.

As a result:

Over $500 million in liquidations(Long Positions) occurred

Weak inflows into Bitcoin ETFs

A stronger U.S. Dollar Index ( TVC:DXY )

And declining Gold( OANDA:XAUUSD ) prices over the past two days

all added additional selling pressure on BTC. Now let's take a look at Bitcoin's conditions on the 4-hour time frame .

Bitcoin currently appears to have broken the Support zone($116,900-$115,730) , Support lines , 100_SMA(4-hour TF) , and the lower line of the Symmetrical Triangle Pattern with a bearish Marubozu candle .

Note : In general, trading was difficult when Bitcoin was inside a symmetrical triangle (about 10 days).

It also seems that the pullback to these zones has ended and Bitcoin is waiting for the next decline .

In terms of Elliott Wave theory , Bitcoin appears to be completing microwave 5 of microwave C of major wave 4 . There is a possibility that main wave 4 will create a descending channel and complete at the bottom of the descending channel (at Potential Reversal Zone(PRZ) ).

I expect Bitcoin to start rising again after completing the CME Gap($115,060-$114,947) from Cumulative Long Liquidation Leverage($114,480-$114,000) or Cumulative Long Liquidation Leverage($113,284-$112,603) near the PRZ and Heavy Support zone($111,980-$105,820) .

Cumulative Short Liquidation Leverage: $117,904-$116,665

Cumulative Short Liquidation Leverage: $121,046-$119,761

Do you think Bitcoin has entered a major correction, or does it still have a chance to create a new ATH?

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

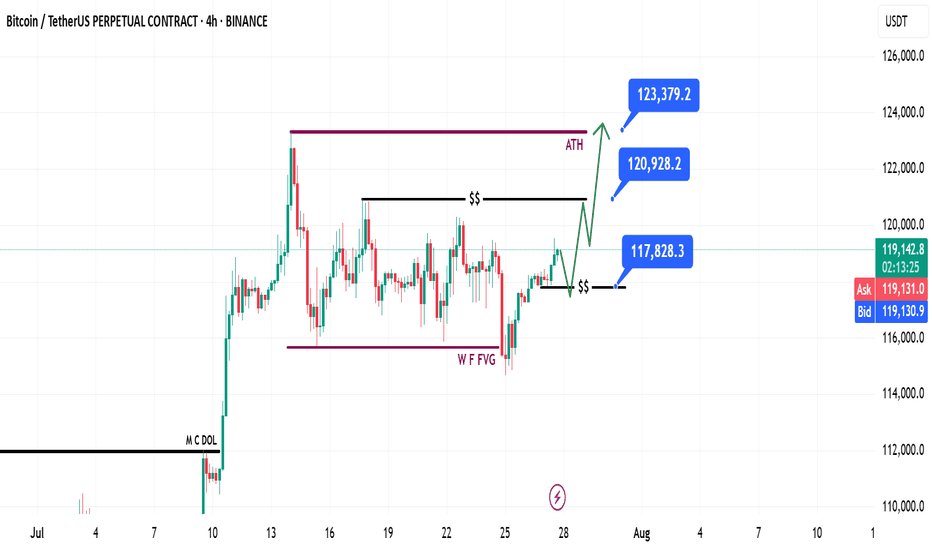

Why Everyone’s Stop Loss Gets Liquidated?!!...Why does your stop loss always get hit first?

Is it possible that everyone else placed theirs exactly where you did?

Maybe it's time to face an uncomfortable truth about the market and crowd psychology.

Hello✌️

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on Bitcoin:

BINANCE:BTCUSDT has established a well-defined range in this zone, triggering multiple stop hunts and now approaching a fresh daily resistance. A confirmed breakout above this level could open the door for an 8% upside move toward the 128,000 area. 📈🧠

Now , let's dive into the educational section,

🎯 Crowd Psychology: The Fixed Target of the Market

In crypto markets, when everyone thinks the same, they tend to lose the same way. One of the clearest signs of this is where stop losses are placed. When a level becomes too obvious to too many traders, it becomes a magnet for liquidity hunters.

Public stop losses are usually placed right below obvious lows or above clear highs. These are areas that everyone has mentally marked as strong support or resistance. Ironically, that’s exactly where a sudden wick appears, takes out stops, and then the market goes right back in the original direction.

🧠 Your Brain Wants Safety, The Market Wants Liquidity

New traders search for “safe” places to hide their stops. That very logic makes those places unsafe. The market needs liquidity to move, and the most liquidity sits right where people feel safe placing their stops.

Remember: stop losses are actual market orders, buy or sell triggers. When yours gets hit, someone else enters a position. Your loss is their entry. This is a zero-sum game.

🐋 Whale Activity Before the Trap

Ever noticed how, just before your stop gets hit, there’s a small move in the opposite direction? That’s bait. Right after, a strong wick sweeps through, takes out public stops, then reverses. It’s not an accident. It’s planned.

If you observe these small shifts with suspicion rather than trust, you’ll often catch the trap before it happens.

💡 Your Trigger Shouldn't Be Where Everyone Else Sets It

There’s a smarter way to manage your stops, ways that avoid the obvious traps:

Use ATR to dynamically calculate distance

Place stops based on candle structure, not just price levels

Wait for confirmed reversal patterns before setting stops

Consider mental stops based on invalidation logic, not fixed price points

⛔️ Blind Trust in Repeated Zones

When a support or resistance level holds multiple times, people begin to trust it blindly. That collective trust becomes a weakness. The market doesn’t respect obvious levels, it exploits them.

If you see it, everyone else sees it. And so does the market. But the market plays a different game. You seek safety, it seeks liquidity.

🎲 Is It Really Your Fault?

Many traders blame themselves when their stop gets hit. The truth? You’re not the problem, your thinking pattern is. Most traders make the same decisions because they learned the same textbook strategies. That’s what makes their stops predictable.

It’s not always about poor analysis. Sometimes, it’s just about being part of the herd.

📉 Practical TradingView Tools to Track Public Stop Zones

Here are a few powerful TradingView tools and indicators you can use to figure out where stop loss clusters are likely hiding. Use them together for better accuracy:

Session Volume (Fixed Range)

Apply this tool to recent ranges or high-volatility zones. Peaks in volume often reveal where most traders are entering or exiting, which means stops are likely nearby.

Liquidity Pools Finder

This indicator estimates areas with potential liquidity pools. These are often the next targets for large moves.

Horizontal Ray or Box Tool

Use these to mark the areas just above highs and below lows. These zones are where most public stops typically sit.

Fair Value Gap (FVG)

Gaps in price action can act as magnets. It's no coincidence that public stops often get hit in these areas during fakeouts or trap moves.

📌 Final Thoughts

When everyone looks at the same level, the market attacks it. Public stop losses are a primary fuel source for liquidity-based moves. Use TradingView tools, train your eye, and place your stops where no one else dares. That’s how you stay out of the trap.

✅ Wrap-Up

If your stop always gets hit right before the big move, it’s not a coincidence, it’s a mindset issue. Stop thinking like the crowd, and the market will stop treating you like one.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

$BTC.D: Cycle tops are in. $ETH.D: Bounce form the all-time lowsIn my opinion the most important chart in all Crypto is the $BTC.D. We have been writing and observing CRYPTOCAP:BTC.D for almost 6 months. I predicted here that we will see CRYPTOCAP:BTC dominance @ 66% before the end of this cycle. And we saw CRYPTOCAP:BTC.D touch 65.9% on June 23 as visible from the weekly chart, which is close to our cycle target of 66%. See my blog from April 14.

CRYPTOCAP:BTC.D to 66%, CRYPTOCAP:TOTAL2 / BTC down to 0.43 for CRYPTOCAP:BTC.D by RabishankarBiswal — TradingView

But since then, CRYPTOCAP:BTC.D is going through reversal. Currently @ 61% the dominance has tumbled in July. Even if CRYPTOCAP:BTC is holding on to its ATH with price near to 118K $ the dominance is clearly in a downtrend.

But then we see something which CRYPTOCAP:ETH.D has not done since 2019. In the chart below we have super imposed the CRYPTOCAP:ETH dominance on the CRYPTOCAP:BTC Dominance. CRYPTOCAP:ETH Dominance as the name suggests is the % of Crypto Market Cap that can be attributed to $ETH. The CRYPTOCAP:ETH.D double bottomed in 2019 @ 8% and then went on for a reversal with CRYPTOCAP:ETH.D peaking @ 22% on Nov 21. Both the Dominance charts have an inverse correlation but have one thing in common. The trend in the Dominance charts is lower. In each cycle the CRYPTOCAP:BTC.D makes a lower low peaking at 95% in 2017 cycle, 73.5% in last cycle and 66% in this cycle. The same is true for CRYPTOCAP:ETH.D , starting @ 26% in 2017, 21.5% in the last cycle. So, the obvious question in your mind is where will the CRYPTOCAP:ETH.D peak this cycle. If we draw the downward slopping wedge in the CRYPTOCAP:ETH.D and assume the cycle end by Dec 2025, then we can see the CRYPTOCAP:ETH.D will peak around 17% in this cycle. Currently at 12%, I am predicting another 40% upside form here. Pricewise BITSTAMP:ETHUSD may give a higher return than the $ETH.D.

Verdict: CRYPTOCAP:BTC.D top for this cycle is 66%. CRYPTOCAP:ETH.D can top @ 17% this cycle. BITSTAMP:ETHUSD can double from here for CRYPTOCAP:ETH.D to top @ 17%.

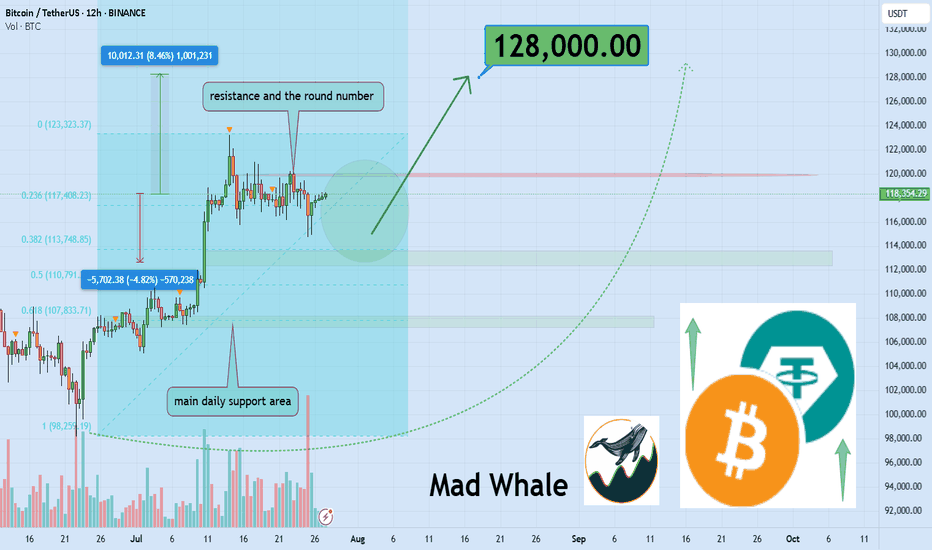

Bitcoin Weekly Recap & Gameplan | 27.07.2025📈 Market Context:

Bitcoin maintained its bullish momentum, driven by continued institutional demand and a supportive U.S. policy backdrop.

Last week’s gameplan played out well — solid profits were captured (see linked chart below).

🧾 Weekly Recap:

• Price made a bullish retracement into the Weekly FVG (purple line) exactly as projected in last week's post.

• From here, I expect continuation toward new all-time highs.

📌 Technical Outlook:

→ First, I expect a short retracement and a 4H swing liquidity grab at 117,828$.

→ Then, a strong continuation move toward ATH targets.

🎯 Setup Trigger:

Watch for:

✅ 4H liquidity sweep

✅ 15M–30M bullish break of structure (BOS)

This is the confirmation zone for potential long setups.

📋 Trade Management:

• Stoploss: Below confirmation swing low

• Targets:

– 120,938$

– 123,400$

💬 Like, follow, and drop a comment if this outlook helped — and stay tuned for more setups each week!

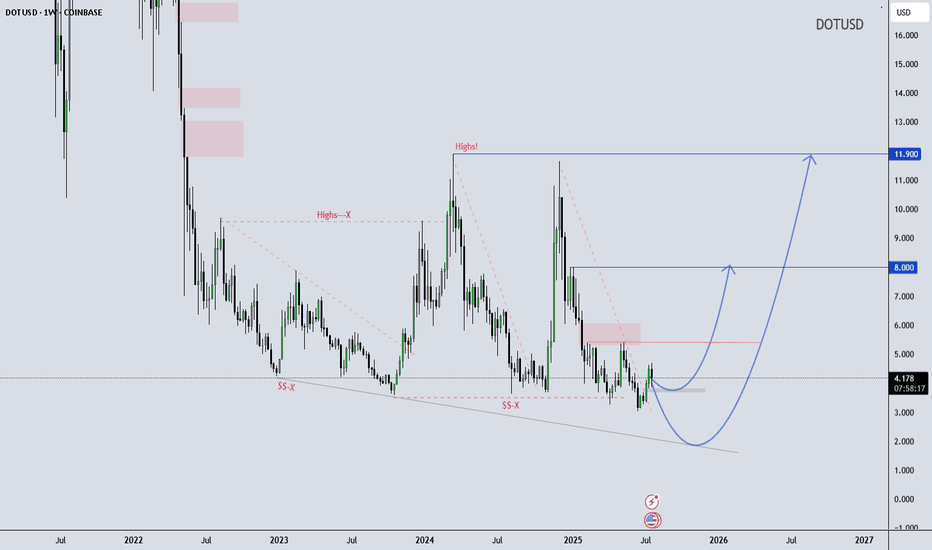

DOT/USD Weekly Structure - - Reversal Possibility Developing DOT/USD Weekly Outlook – Educational Perspective

Polkadot (DOT) is trading near the lower boundary of a long-term falling wedge structure, showing early signs of stabilization around the $4.20 support zone. Price has respected this level multiple times, potentially forming a rounded bottom, which often suggests shifting momentum.

If the structure holds, it may continue developing a macro reversal pattern. This kind of formation is typically monitored by swing traders looking for high risk-reward setups in longer timeframes.

Key Technical Levels to Watch:

$8.00 – Mid-range structural resistance

$11.90 – Historical supply / macro pivot zone

This chart is shared for educational purposes only to support market structure learning. Always follow your own analysis and risk management plan.

Wave Trader Pro

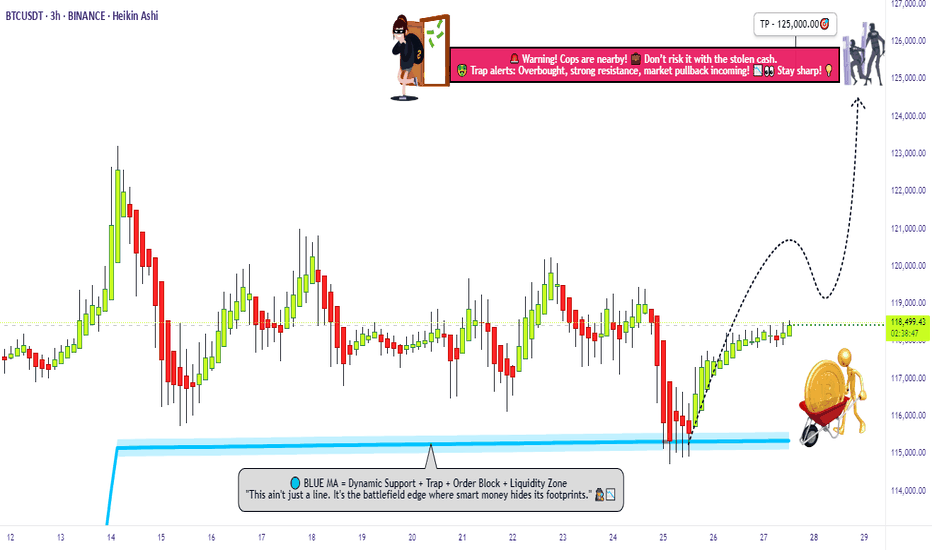

Learn & Earn

"Bitcoin’s Big Heist – Are You In or Out?"🚨 BTC/USDT HEIST MISSION – SWIPE THE BULL RUN BEFORE THE BEARS WAKE UP 💰💣

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Money Makers & Robbers, assemble! 🤑💰✈️💸

Here’s your decoded BTC/USDT “Bitcoin vs Tether” Crypto Market Heist Plan, fully loaded with Thief Trading Style 🔥 TA + FA combo. We’re prepping for a bullish breakout loot – eyes on the vault, ignore the noise.

🎯 PLAN OF ATTACK:

🎯 ENTRY (BUY ZONE):

💥 “The vault’s open—time to sweep!”

DCA/Layer your buy limit orders near the 15–30 min swing lows/highs for sniper pullback entries.

Use multi-entry method to stack positions (layering / DCA) as per your ammo (capital 💵).

🛑 STOP LOSS:

Set SL at the nearest swing low wick (4H TF) — around 115000.00, adjust based on your risk/load.

SL = insurance. Not optional.

🏁 TARGET:

Lock sights on 125000.00

🎉 Or… vanish with profits before the bear cops arrive.

🔎 MARKET BACKDROP & ANALYSIS:

📈 BTC/USDT currently signals bullish vibes on the swing/day horizon — fueled by:

Macro Fuel & Fundamentals

Sentiment Radar

COT Reports

On-Chain Pulse

Intermarket Clues

🚀 Connect the dots. The smart money's already prepping a breakout move.

🧲 Scalpers Note:

Stick to the long side only. No shorting the beast — unless you’re made of diamonds.

Secure your bag with trailing SLs.

⚠️ NEWS TRIGGER ZONE – TRADE WITH TACT:

📢 Upcoming high-volatility news events can spike charts.

Avoid new entries during releases and guard open trades with trailing SLs.

Protect the loot. Always.

💖 SUPPORT THE HEIST GANG: BOOST IT!

Smash that ❤️ to boost our thief squad’s momentum!

Every click powers this underground mission – making money with style, one pip at a time. 🎯💣💵

🚀 See you in the next heist drop.

Until then – Stay stealthy. Stay profitable. Stay legendary. 🐱👤💸🏆

BITCOIN next target 130000-134000 pattern repeatedHi guys, this is my analysis for BTCUSDT in the next few days.

Feel free to check it and write your opinion in the comments.

BITCOIN had been consolidating for two weeks before it reached the ATH 123500 and I think bitcoin has proven to repeat itself. This happened before, and it will happen again.

After reaching the ATH, Bitcoin has been consolidating for the last two weeks.

Therefore, I think that BITCOIN will reach

130000-134000

In the next few days.

Please respect each other's ideas.

This is not financial advice, it's just my humble analysis.

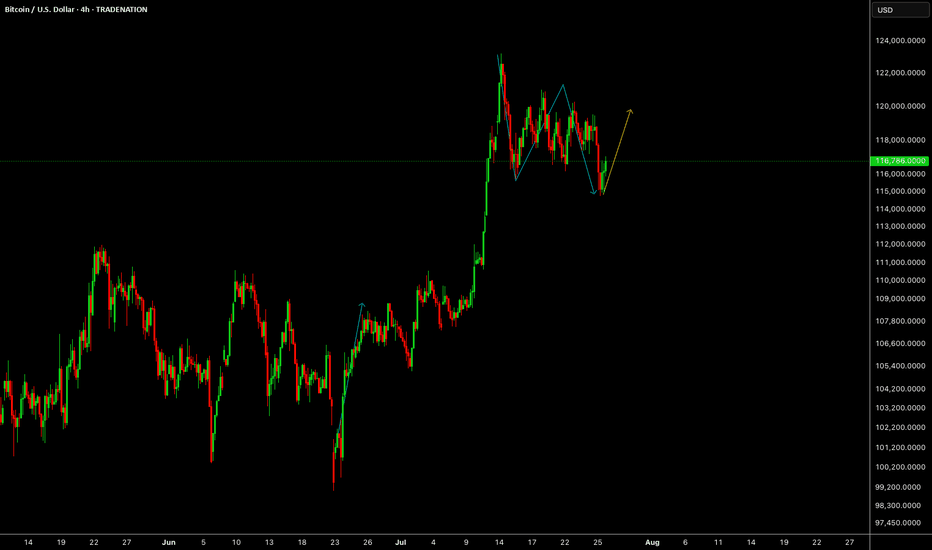

The move is up to the buyersHi traders and investors!

The price has already played out the upper boundary of the scenario, rising above 120,500. Then it also reached the lower boundary by dropping below 115,222.

Now we are at an interest moment: will the price continue to move upward or not?

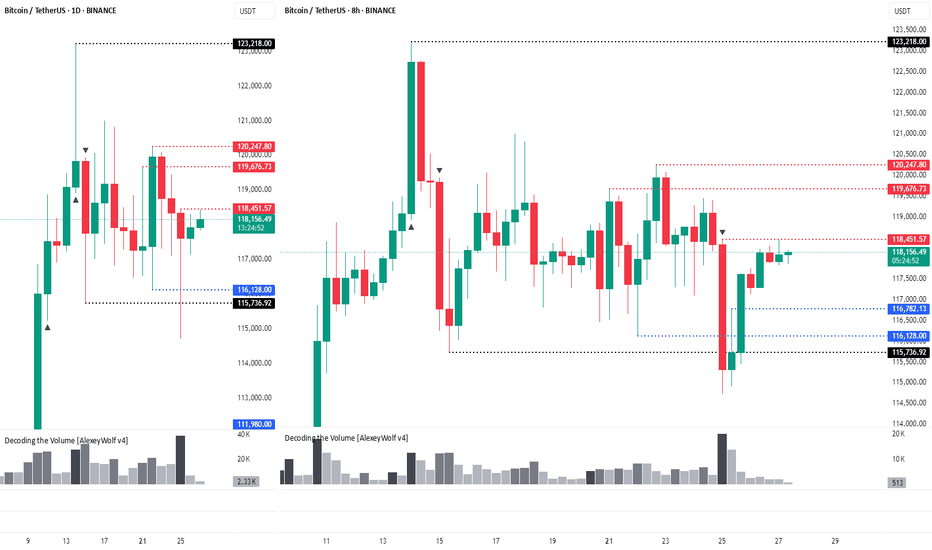

This situation is clearly visible on the 8-hour timeframe.

On the 8H chart, we see a sideways range, similar to the 1D timeframe. The lower boundary is 115,736 and the upper boundary is 123,218. The active initiative is currently with the buyers, and their target is 120,998 и 123,218.

There is a notable bar attacking the lower boundary (115,736) with very high volume. The high of that bar is 118,451. We’re watching to see whether buyers absorb this bar — that will determine how the next move plays out.

There are three key levels where buyers may step in: 116,782, 116,128, and 115,736. If the price drops to any of these, we can look for a long setup.

Above, we also have three resistance levels from the sellers: 118,451, 119,676, and 120,247. We’ll be watching how sellers react if the price tests these zones.

This analysis is based on the Initiative Analysis concept (IA).

Wishing you profitable trades!

#BTC Update #10 – July 27, 2025#BTC Update #10 – July 27, 2025

Bitcoin continues to move between $116,400 and $118,900, and staying within this range is actually a positive sign, even in bearish scenarios. A decisive close below $114,000, however, could open the door for a deeper and more prolonged correction.

Although BTC hasn’t broken to new highs yet, its ability to hold here means the trend isn’t broken. A strong breakout above $118,900 could lead to a rally toward $123,300 and possibly even $128,000.

🔹 On the 4H chart, BTC seems to have completed its minor correction.

🔹 On the daily chart, the correction remains incomplete – despite dipping to $114,700, the key $112,900 zone hasn’t been tested.

In lower timeframes, BTC remains squeezed within a symmetrical triangle. While it occasionally pokes out, it quickly returns inside — showing indecision.

📌 Direction is unclear at the moment. There’s no strong signal for Long or Short. Waiting for confirmation with volume and a clear breakout is the safer play.

BTCUSD trading signal. False break of bottom line✏️ CRYPTO:BTCUSD just False Break the lower band and is establishing a bullish wave structure in the H4 time frame. 119700 will be the top of wave 1 if the current bullish wave exceeds the top it will form a bullish DOW pattern heading towards a new ATH.

📉 Key Levels

BUY Now BTCUSD: Confirmation of candle when retesting Fibonacci 0.5

Target 127000

Leave your comments on the idea. I am happy to read your views.

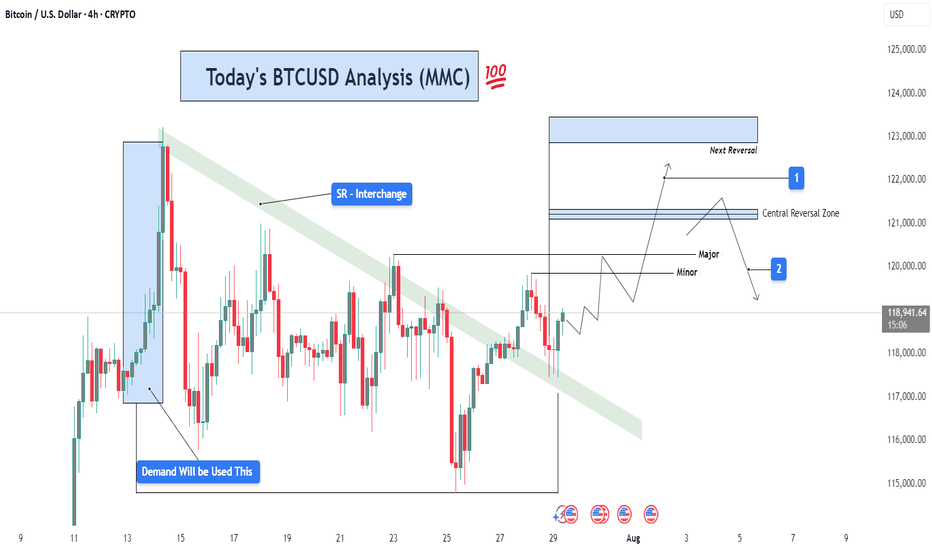

BTCUSD Analysis (MMC) – Breakout Confirmed + Target Next Zone⚙️ Chart Context (4H BTC/USD)

As part of our Mirror Market Concepts (MMC) strategy, today's BTCUSD 4H chart is a textbook representation of market structure shift, SR interchange, demand reaction, and target projection. After consolidating within a compressed range under a key descending structure, Bitcoin has successfully broken out of bearish control, signaling a fresh phase of bullish momentum.

🧩 Breakdown of Technical Structure

🔹 1. Demand Zone Reaction (July 13–14)

The initial impulse move originated from a well-defined demand zone, marked by a strong accumulation and breakout. This zone—highlighted on the chart—acted as the institutional demand base, where buyers stepped in with volume and aggression. Price respected this zone precisely, confirming it as a valid MMC "Power Base."

Why this matters: Demand zones like these reflect institutional footprints. Once price reacts from such zones, they often become foundational for future bullish legs.

🔹 2. SR Interchange Zone – Structure Flip Confirmed

The descending green channel acted as dynamic resistance for several sessions. Every touch along this zone resulted in a lower high, confirming bearish order flow. However, BTC has now closed decisively above this structure, transforming this zone from supply to support—this is our classic SR Interchange concept in MMC.

Interpretation: This structure flip implies a strong change in sentiment. What was once a zone of rejection now becomes a potential support for continuation.

Expect retests of this zone before price resumes to higher reversal levels.

🔹 3. Minor and Major Resistance Zones

Above current price, two critical zones have been mapped:

Minor Resistance (~$120,000):

Acts as the first liquidity grab area. This is where early sellers may place stops or where short-term traders could book profits. MMC logic expects minor resistance to either cause a pause or a fakeout to lure in shorts.

Major Resistance / Central Reversal Zone (CRZ):

Spanning roughly $121,000 to $121,800, this is a key zone where price will likely meet decision-making. This CRZ is derived from previous structure congestion, imbalance fills, and projected Fibonacci confluence.

Next Reversal Zone (Final Target Area):

Located near $123,000, this is the outer reversal box where the bullish wave may either end, consolidate, or reverse entirely. This is the final target for swing traders or MMC practitioners looking for exhaustion.

🧭 Price Forecast Structure – Predictive Pathway

The forecast path shown on the chart illustrates a stair-step rally, with bullish impulses followed by shallow pullbacks:

First, price may pull back slightly to retest the breakout zone (green SR area).

Then a leg upward to minor resistance (~$120K).

A healthy rejection or small correction before breaking into the CRZ (~$121.2K).

Final move toward the outer reversal zone at ~$123K.

This fractal progression is a common MMC pattern seen during structure shifts—not impulsive straight-line rallies, but controlled, zone-to-zone movements.

🔍 Strategic Insights & Trade Plan

📌 Conservative Entry:

Wait for a retest of the breakout zone (SR Interchange) around $118,200–$118,500.

Look for bullish rejection candles or order flow confirmation on LTF (lower timeframes).

📌 Aggressive Entry:

Break and close above $120,000, confirming liquidity clearance and path toward CRZ.

🎯 Target Zones:

TP1: $121,200 – Central Reversal Zone

TP2: $123,000 – Outer Reversal Zone

❌ Stop-Loss Ideas:

Below $117,000 (structure invalidation)

Below recent bullish impulse candle low

🧠 MMC Concepts in Action:

SR Flip: Strong indication of market shift

Demand Rejection: Institutional footprint detected

Zone Mapping: Controlled zone-to-zone movement

Liquidity Logic: Price moves where orders rest – CRZ = likely reaction

Reversal Framing: Structure analysis ahead of time, not after the move

📊 Conclusion:

This BTCUSD 4H analysis showcases a strong MMC-style breakout scenario. The reaction from demand, shift in SR structure, and projected reversal zones give us a clean roadmap. As long as the structure remains valid and price respects the new SR zone, this bullish move remains high-probability.

Trade with structure. Trust the zones. Mirror the Market.

BTC Roadmap Ahead: Ideal Entry, TP Zones & What to AvoidAs long as Bitcoin stays above the ~$98,200 zone on the daily timeframe, I believe the bullish trend remains intact.

No need to panic — what we need now is rational decision-making, not emotional reactions.

Since price has reached a key area around $118K–$120K, I’ve already taken partial profits at this level.

If no major fundamental changes occur and conditions remain stable, I see the maximum target for this leg somewhere between $134K and $140K, where I plan to secure additional profits.

Right now, my main objective is to increase my Bitcoin holdings.

The first buy zone I’m watching is around $110K, clearly marked with a red circle on the chart.

When price reaches this zone, I won’t enter immediately — I’ll wait for consolidation and confirmation, as a deeper correction is still possible.

There’s no need to rush — patience is power.

📌 All I’m trying to do is accumulate as much Bitcoin and sats as I can — because I know one day, I’ll be proud of it.

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.