Analysis and layout of BTC trend in the third quarter📰 News information:

1. Pay attention to the movement of the cryptocurrency market

2. The impact of DAA, etc.

📈 Technical Analysis:

As demand weakens and supply pressure rises, BTC's network valuation exceeds the speed of activity. Exchange inflows and negative DAA divergences indicate that despite price stability, the risk of selling remains. Currently, BTC is experiencing a retracement after a rebound. In the short term, it is still possible to retrace to 106,500 and then rise after stabilizing.

🎯 Trading Points:

SELL 108000-107500

TP 107000-106500

BUY 106500-106000

TP 107500-108000

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

BTCUSDT

BTCUSDT:Sharing of the Latest Trading StrategyAll the trading signals last week have resulted in profits!!! Check it!!!👉👉👉

Bitcoin Technical Analysis (4-Hour Chart):

Price remains within an ascending channel. The MACD above the zero line with expanding red histograms indicates bullish dominance. After firmly breaking above the key resistance at $105,000, price is testing $110,000.

Caution: The RSI near 70 has entered overbought territory, increasing short-term pullback risks.

Support levels: $106,000 and $105,000.

Trading Recommendation for Aggressive Traders

Consider light long positions near $106,000 on pullbacks, with stop-loss set below $105,000.

Trading Strategy:

buy@105000-106000

TP:108000-110000

BTC buying power is gradually increasing💎 Update Plan BTC at the beginning of the week (June 30)

Notable news about BTC:

Anthony Pompliano has merged Procap BTC with Columbus Circle Capital I, established Procap Financial - a Bitcoin warehouse company up to $ 1 billion. The company will deploy lending activities, derivatives ... in order to create a collection line from BTC, according to the similar model

Bitcoin price is stable at about $ 107.4K on June 27, before the expiry date of options worth up to US $ 40 billion, capable of causing strong fluctuations. At the same time, on June 29, BTC exceeded $ 108k, up ~ 0.68% compared to the previous day

In the past 7 days, BTC maintained around $ 104–107K despite tensions in the Middle East and the US economic data is not heterogeneous. Reduce slightly but receive support from organized cash flow and global trade progress.

Technical analysis angle

Overview of trends - many signs of increasing

Looking at the candle is signaling "Strong Buy" on many time frames, especially healthy momentum, the ability to breakout $ 116k if surpassed the $ 110k resistance

ETF liquidity and organizational capital flows are supporting the trend of increasing, strengthening the possibility of breakthrough.

Moving Averages:

Frame 1H: 64% Bullish signal (MA20 reversed), but there is a neutral signal from short -term ghosts

Daily/Weekly: Golden Cross (Golden Cross) between 50‑ and 200‑ MA, is a long -term trend increase signal

Oscillators:

RSI frame Daily ~ 55, showing neutral momentum, not too much purchased but there is a rise. Double Rounded Top model on the chart Daily, the current trend is neutral - Bearish if the breakdown supports Neckline ~ $ 106k; In contrast, strong recovery above $ 114k will invalid this model

Long -term / Swing Trade: Keep the position if the price is maintained> $ 106k, use $ 103–104K as a spare hole stop.

Short -term / Scalp Trade: can be in order when the test price is $ 106k–107k, small latches around $ 110k.

==> Comments for trend reference. Wishing investors successfully trading

Bitcoin BTC price analysis BTC.D and events calendar for JulyToday is the last day of the month and the last day of the second quarter, so there may be some volatility in the markets between 🐂 VS 🐻

💰 The CRYPTOCAP:BTC chart shows an interesting picture — the price has reached the upper limit of the consolidation channel, and now:

1️⃣ The scenario with an upward breakout is quite clear: a breakout from the channel upward and consolidation above $108-110k= a move to $125k during July.

2️⃣ A correction to $99k will mean that buyers have taken control of the OKX:BTCUSDT price, preventing it from updating its lows. This will be a clear signal to buy, because further growth is inevitable.

3️⃣ A deep correction to $91,660 (filling the GAP that formed on the CME BTC chart) or slightly lower. This is the last “unclosed” GAP, which, according to TA rules, should be filled for a full-fledged growth trend to begin.

So which scenario is closer to your heart, which one do you believe in?

Or write your version of events in the comments.

Interesting observations to think about:

◆ Over the past two weeks, the inflow of funds to #BTCETF has exceeded $5 billion, but the price of #BTCUSD on CEX exchanges has not been able to “break out” upward. Is this just ETF "property of numbers", or are spot #Bitcoin sales that strong?

◆ The BTC.D indicator has reached a critical level of 66%, and it will be interesting to see whether it will give altcoins some breathing room next month.

(If there are a lot of likes and comments under the idea, we will additionally describe our thoughts on BTC.D and USDT.D.)

◆ SP 500, by the way, has updated its highs, and the last few months on the stock market are very similar to the beginning and middle of the COVID-19 pandemic in 2020.

◆ And in principle, July promises to be very eventful:

👉 By July 9, Trump is expected to make a statement regarding the tariff wars with the rest of the world, which he has put on hold.

👉 July 18 marks the beginning of Mercury retrograde, which “influences” people's behavior and ‘superstitions’ and forces them to be “more cautious” when making trading decisions (and trading bots don't care about emotions and beliefs)

👉 And on July 30, there will be a FOMC meeting, where Mr. Powell may announce a rate cut, as the US is in a recession, which is time to acknowledge.

If we have forgotten anything, please add it in the comments!

Bitcoin: a decision week Previous week brought some relief among market participants, when it was announced that the U.S. Administration and China completed the deal regarding trade tariffs. Details of this deal have not been publicly disclosed, however, the markets reacted positively to it. The U.S. equity market gained significantly, while the crypto market managed to hold higher grounds. BTC started the week with a break of $105K toward the upside, testing the resistance at $108K. The majority of trades occurred between $106K and $107K.

The RSI continued to move above the 50 level, indicating that the market is still not ready to seek the oversold market side. The indicator is ending the week at the 56, bringing some probability for the overbought market side in the coming period. The MA50 continues to diverge from MA200, without an indication that the cross might come anytime soon.

Charts are showing that the BTC is currently on the cross road. There are equal probabilities that the coin might be traded toward both sides in the week ahead. On one hand, trades from the last week showed enough buying orders, which were holding the coin at the higher grounds, continuously seeking the break of the $108K level. However, if this market strength does not manage to support the BTC in the week ahead, then the reversal will be inevitable. In this case, the $105K will be the first stop.

BTCUSDT Hello traders. Wishing you a great start to the week!

This week’s first trade opportunity comes from the BTCUSDT pair. Over the weekend, the pair showed significant volatility, dropping from 108,776 to 107,565 in just a few hours. However, I see this drop as a potential buying opportunity.

In my view, the price is likely to bounce back towards the 108,930.12 level in the short term. Therefore, I’ve activated the trade and I’m sharing the details with you below:

🔍 Trade Details

✔️ Timeframe: 1-Hour (H1)

✔️ Risk-to-Reward Ratio: 1:3.20

✔️ Trade Direction: Buy

✔️ Entry Price: 107,590.73

✔️ Take Profit: 108,930.12

✔️ Stop Loss: 107,181.36

🕒 If momentum weakens or price consolidates in a tight range, I will keep this trade open only until 23:00 (UTC+4). After that, I’ll manually close it—whether in profit or loss—based on how price action evolves.

🔔 Disclaimer: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

Bitcoin Weekly & $120,000This weekly Bitcoin chart says it all... Please, allow me to reveal to you what the future holds!

Good evening my fellow Cryptocurrency trader, what a wonderful day.

Only one week ever produced a higher close than the current price. Only once, 19-May, Bitcoin managed to close above $107,000... What happens if Bitcoin closes above $107,000? New all-time high confirmed.

Two days remain for the week to close and we—the bulls—only need to maintain a price of $107,000 or higher to send such a strong bullish signal that everybody will come out and start buying.

The next target on this timeframe is $120,000.

Bitcoin is using EMA13 as support. This level was tested and holds, the same for EMA8. When Bitcoin moved above these levels in April, it produced an advance from $83,000 to $112,000, more than 33%. The price now is $107,000 but instead of recovering from below EMA8/13, BTCUSDT is trading above; this means that the bullish bias is fully confirmed.

The weekly timeframe looks great. We can expect higher prices soon, with growth happening for an extended period of time. Bitcoin is very strong now and this is only the start.

I will continue to share proof that shows the entire Cryptocurrency market going up.

Thank you for reading.

Leave a comment with your questions.

Thanks a lot for your support.

Namaste.

Analyzing the new month, new week, new day

Hello, traders.

If you "follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

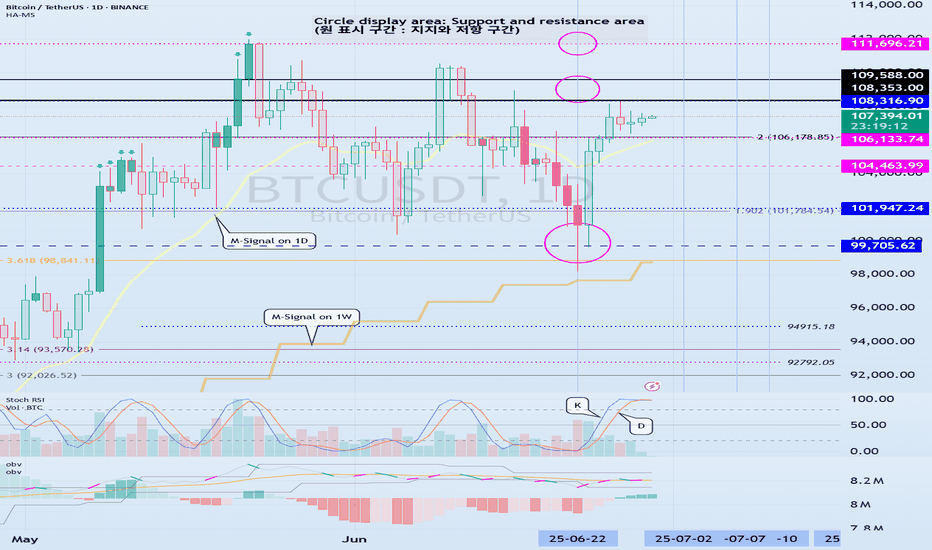

(BTCUSDT 1M chart)

A new month begins in one day.

The key is whether it can hold the price by rising above 109588.0.

If not, there is a possibility that it will fall below the 94172.00 StochRSI 50 indicator point that the arrow is pointing to.

We need to see if it can rise with support near the Fibonacci ratio of 1.618 (89050.0).

Since the current low-point trend line is not complete, it is not surprising that it can show a downward trend at any time.

However, if it rises above 109588.0 and maintains the price, it is expected that there will be an attempt to rise near the Fibonacci ratio of 2.618 (133889.92).

I think it is likely to be the last target of the target bull market in 2025.

-

(1W chart)

It is a period of volatility around the week including June 23.

That is, from June 16 to July 6 is the volatility period.

The key is whether it can rise to the right Fibonacci ratio 2.24 (116940.43) during this volatility period.

Even if it fails to rise, if the price maintains above 104463.99, it is expected to show an upward trend around the next volatility period.

The next volatility period on the 1W chart is expected to be around the week of August 18.

-

When it falls below 104463.99, we need to check whether the HA-High indicator is newly generated.

If not, it is important to check whether there is support around the current HA-High indicator point of 99705.62.

Since the M-Signal indicator on the 1W chart is passing around 99705.62, its importance can be said to be high.

If it falls below the M-Signal indicator of the 1W chart, it is expected to determine the trend again when it meets the M-Signal indicator of the 1M chart.

-

(1D chart)

The key is whether it can maintain the price by rising above the HA-High indicator point of 108316.90 on the 1D chart.

If it fails to rise,

1st: 104463.99

2nd: 99705.62

You should check for support near the 1st and 2nd above.

If it falls below the M-Signal indicator of the 1W chart,

1st: 89294.25

2nd: M-Signal of the 1M chart

There is a possibility that it will fall near the 1st and 2nd above.

-----------------------------------------

(1W chart)

The chart above is a trend line chart drawn on the 1W chart.

It looks complicated, but what's important to look at is the correlation between the high-point trend line and the low-point trend line.

That is, even if the price rises above 109.588.0, if it doesn't rise above the high-point trend line, it is likely to fall near the low-point trend line.

Fortunately, since it is forming an upward channel, it is expected that the price will eventually rise even if it falls.

-

(1D chart)

Unlike the trend line on the 1W chart, the high-point trend line on the 1D chart forms a downward trend line.

Accordingly, the period around July 7, when the low-point trend line and the high-point trend line intersect, can be considered an important period of volatility.

However, the volatility period starts around July 2nd and is expected to end around July 10th.

----------------------------------------------

As shown above, many lines were drawn to analyze the chart.

I have roughly explained which of the lines drawn in this way should be prioritized.

Since chart analysis is for creating a trading strategy, the support and resistance points drawn on the 1M, 1W, and 1D charts are ultimately the most important.

Therefore, it is most important to check how the support and resistance points were created and find the reason for them.

Other analyses are only additional elements.

As I always say, chart analysis that does not show support and resistance points is only an analysis chart that can be used for trading.

You cannot trade with such analysis charts.

Also, if support and resistance points are shown, you should check the basis for setting the support and resistance points.

In order to serve as a support and resistance point, there must be a basis.

When you cannot confirm the basis for the support and resistance point, it is important to ask questions and find out the basis.

Fibonacci ratios are not suitable for actual trading.

However, when the ATH or ATL is updated, it is valuable enough for analysis.

Other than that, there must be support and resistance points drawn on the 1M, 1W, and 1D charts.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Thief Trader Setup: Robbing the BTC/USD Market Reversal🏴☠️💰 Bitcoin Heist Blueprint: BTC/USD Robbery Plan by the Thief Trader Crew 💰🏴☠️

(Swing & Day Trade Outlook – Clean Entry, Clean Exit, No Fingerprints Left Behind)

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

To All Market Raiders & Silent Money Makers 🤑💸💰✈️

This isn't your average BTC/USD analysis — this is a strategic market heist, crafted from the Thief Trading Playbook.

We're planning a clean operation based on both technical setups and fundamental awareness.

Let’s enter smart, exit faster, and leave no trace — just profit. 🏆

🎯 THE GAME PLAN: Unlocking the BTC/USD Vault

📈 Entry – “The Vault’s Cracked Open!”

The plan kicks off with retest entries on the 15 or 30-minute chart.

Sell limits should be placed around recent highs or lows where market momentum pulls back.

Precision and patience are your tools.

🛑 Stop Loss – Backup Escape Route

Use the 1D swing high/low (e.g., 104.500) as your SL zone.

Position size smartly, factoring in risk %, lot size, and number of active orders.

🏁 Target – 94.000 (Or Bail Out Before It Gets Hot)

Don’t stick around too long — cash out near the zone or before if price slows or traps emerge.

Secure the bag, vanish before resistance bites back.

🧲 Scalpers – Quick In, Quick Out!

Stick to the short side only — short the bounces, trail your SL, and move with stealth.

Big players can strike straight; others can shadow the swing crew and trail behind with protection.

🧠 Why This Works – Market Pulse

BTC/USD is facing overbought pressure, consolidation traps, and is nearing a critical MA Zone where reversals tend to form.

Momentum shows signs of weakening, and the bears are regrouping — that’s where we slip in and out.

Supporting Factors Include:

Macro trends

Fundamental sentiment

COT positioning

On-Chain signals

Intermarket flow

Key psychological levels

🔍 All these build the narrative behind this bearish setup. This is more than just price action — it's a calculated move.

⚠️ Trading Risk Alert: Stay Off the Radar During News Drops 📰🚨

Avoid new entries during major news events — increased volatility = increased risk.

Use trailing stop-losses to lock in profits while staying protected during spikes.

❤️ Like the Plan? Power the Crew!

If this setup helped you see the market differently, hit the 💥Boost Button💥.

Every like supports the effort and helps sharpen our future plans.

Trade with style, move with purpose — Thief Trader Style.

🚀 Stay tuned for the next setup from the shadows. Until then — stay sharp, stay strategic, and always protect your profits. 🐱👤💰📉📈

BTC Slumps Below 100000, Rebounds to Test 109500 Short Zone💎 BTC Rebounds After 100000 Drop, Eyes Short at 109500 Resistance 📊

BTC dipped below the 100000 threshold 🔻 before rebounding near 98000 🔺—a move tied to DXY weakness and easing geopolitical tensions. Now challenging the 110000 mark 🔼, it faces stiff resistance at 109500. First-time 110000 tests often spark pullbacks, making shorts the favored play here 📉.

🚀 Sell@108500 - 107500

🚀 TP 106500 - 105500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Analysis of Bitcoin Market StrategyTechnical Analysis of Bitcoin (BTC) Contracts: In terms of today's market, the daily chart of the large cycle closed with a small bullish candle yesterday. The K-line pattern shows consecutive upward movements, with the price above the moving averages. The attached indicators are in a golden cross, indicating an obvious upward trend in the long term. However, the current upward momentum and sustainability are relatively weak. Therefore, it is recommended to maintain short-term trading and strictly control risks.

In the short-term hourly chart, the overall price has been consolidating at high levels. The current K-line pattern is in consecutive bullish candles, with the price above the moving averages, and the attached indicators are in a golden cross. Therefore, an upward movement is highly probable today, with the support level near the 106,300 area.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

buy@106300-106500

TP:108000-108500

This is a deception or maybe a technique !!!I think this head and shoulders pattern is trying to deceive us and is fake. I expect the price to drop to the support line and then rise to $109k. WAIT FOR IT....

Give me some energy !!

The Crypto Market Game: How to Win Against Fear and Manipulation

Did you really think profiting from the current bull run (a comprehensive upward market) would be easy? Don't be naive. Do you think they’ll let you buy low, hold, and sell high without any struggle? If it were that simple, everyone would be rich. But the truth is: 90% of you will lose. Why? Because the crypto market is not designed for everyone to win.

They will shake you. They will make you doubt everything. They will create panic, causing you to sell at the worst possible moment. Do you know what happens next? The best players in this game buy when there’s fear, not sell—because your panic gives them cheap assets.

This is how the game works: strong hands feed off weak hands. They exaggerate every dip, every correction, every sell-off. They make it look like the end of the world so you abandon everything. And when the market rises again, you’re left sitting there asking, “What just happened?”

This is not an accident. It’s a system. The market rewards patience and punishes weak emotions. The big players already know your thoughts. They know exactly when and how to stir fear, forcing you to give up. When you panic, they profit. They don’t just play the market—they play you. That’s why most people never succeed: they fall into the same traps over and over again.

People don’t realize that dips, FUD (fear, uncertainty, doubt), and panic are all part of the plan. But the winners? They block out the noise. They know that fear is temporary, but smart decisions last forever.

We’ve seen this play out hundreds of times. They pump the market after you sell. They take your assets, hold them, and sell them back to you at the top—leaving you with nothing, wondering how it happened.

Don’t play their game. Play your own.

BTC Is Replaying a Bullish Fractal >>> Are You Watching?Hello guys!

I see a deja vu here! Let’s look at the historical daily chart (Jan–May 2025):

What happened?

Initial Drop (Yellow Oval): Bitcoin approached a key S&D zone but didn't touch it, triggering a short-lived bounce before dropping again.

Second Drop (Red Ovals): This time, price precisely touched the demand zone, triggering a clean bullish reversal.

What followed was a strong trend breakout, sustained higher lows, and an eventual surge past prior resistance levels.

Current 4H Chart Setup: A Mirror Image?

Yellow Highlight: Once again, we saw a bounce that didn't quite touch the key demand zone ($98K–$100K).

Red Zone Prediction: If this mirrors the historical move, the price is likely to return and touch this S&D area before launching a bullish leg.

Blue Path Projection: A sharp reversal is expected post-touch, aiming toward $111K–$113K as the next key resistance zone.

The descending trendline adds confluence

___________________

History Doesn’t Repeat, But It Often Rhymes

Based on this fractal analysis, Bitcoin is likely forming the same bullish base seen earlier in 2025. The setup hinges on one key event: a return to the $99K–$100K zone, where demand is likely to step in aggressively.

If the pattern repeats, the current market may offer one last high-reward long opportunity before a parabolic rally.

Bitcoin - Weekend OutlookCRYPTOCAP:BTC | 6h

Bitcoin is compressing below its all-time high, with 108k as the local resistance that must be reclaimed for a bullish continuation to retest the highs.

I expect the price to clear some poor highs around 108.8k–109.6k before taking out the bad lows around 106.3k-105.4k

As long as we hold above 104k , I believe we’re in a strong position and expect we will retest the highs.

However, losing the 103k support level would be concerning.

StochRSI indicator and support and resistance levels

Hello, traders.

If you "follow" me, you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

The StochRSI indicator on the left chart is slightly different from the StochRSI indicator on the right.

The StochRSI indicator on the left chart is the StochRSI indicator provided by default in TradingView, and the StochRSI indicator on the right chart is an indicator with a modified formula.

The StochRSI indicator is a leading indicator that is reflected almost in real time.

Therefore, it reacts sensitively to price changes.

Although it is advantageous because it reacts sensitively, it also increases the possibility of being caught in a fake, so I thought that a slight delay(?) was necessary, and so I created the StochRSI indicator on the left chart.

If you look at the relationship between the K and D of the StochRSI indicators on the two charts, you can see that there is a big difference.

In the end, you can predict the movement by checking whether the movement of the K line has escaped the overbought or oversold section.

However, I think that you will receive information that can determine the sustainability of the trend depending on the positional relationship between K and D.

Therefore, it is important to distinguish the inflection points that occur in the StochRSI indicator.

This is because these inflection points provide important information for drawing trend lines.

Therefore, the StochRSI indicator on the left chart, which better expresses the inflection point, is being used to draw the trend line.

(Unfortunately, this indicator was not registered on TradingView because I did not explain it well.)

-

As a new candle was created, the StochRSI indicator on the left chart is showing an inflection point on the K line.

The StochRSI indicator on the right chart is showing a transition to a state where K < D.

We will have to check whether the inflection point was created only when today's candle closes, but I think that the fact that it is showing this pattern means that there is a high possibility of a change in the future trend.

Since the next volatility period is expected to start around July 2nd (July 1st-3rd), I think it has started to show meaningful movements.

-

It is true that you want to buy at the lowest price possible and sell at the highest price.

However, because of this greed, one mistake can lead to a loss that can overturn nine victories, so you should always be careful.

Therefore, if possible, it is better to check for support and respond.

In that sense, I think it is worth referring to the relationship between K and D of the StochRSI indicator on the left chart.

This is because the actual downtrend is likely to start when K < D.

-

In order to check for support, you definitely need support and resistance points drawn on the 1M, 1W, and 1D charts.

Ignoring this and checking for support at the drawn support and resistance points can result in not being able to apply the chart you drew to actual trading.

Therefore, you should draw support and resistance points first before starting a trade.

Otherwise, if you draw support and resistance points after starting a trade, you are more likely to set support and resistance points that reflect your subjective thoughts, so as I mentioned earlier, you are more likely to lose faith in the chart you drew.

If this phenomenon continues, it will eventually lead to leaving the investment market.

-

It is important to determine whether there is support by checking the correlation between the StochRSI indicator and other indicators at the support and resistance points drawn on the 1M, 1W, and 1D charts.

Even if the inflection point of the StochRSI indicator or other indicators occurs at a point other than the support and resistance points you drew, you should consider it as something that occurred beyond your ability to handle.

In other words, you should observe the price movement but not actually trade.

As I mentioned earlier, if you start to violate this, you will become less and less able to trust the chart you drew.

-

Accordingly, the basic trading strategy I suggest is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, since the HA-Low and HA-High indicators are expressed as average values, they may move in the opposite direction to the basic trading strategy.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downward trend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise upward trend.

Therefore, the basic trading strategy mentioned above can be considered a trading strategy in the box section.

In the case of deviating from this box section, it is highly likely to occur before and after the volatility period indicated by the relationship between the trend line using the StochRSI indicator mentioned above and the support and resistance points drawn on the 1M, 1W, and 1D charts.

Therefore, special care is required when conducting new transactions during the volatility period.

This is because there is a high possibility of being caught in a fake when trading during the volatility period.

-

The DOM(60) and DOM(-60) indicators are good indicators to look at together with the HA-Low and HA-High indicators.

The DOM indicator is an indicator that comprehensively evaluates the DMI, OBV, and MOMENTUM indicators.

Therefore, the DOM(60) indicator is likely to be at the end of the high point range, and the DOM(060) indicator is likely to be at the end of the low point range.

In the explanation of the HA-Low and HA-High indicators,

- I said that if the HA-Low indicator receives resistance and falls, there is a possibility that a stepwise downtrend will begin,

- and if the HA-High indicator receives support and rises, there is a possibility that a stepwise uptrend will begin.

In order for an actual stepwise downtrend to begin, the price must fall below DOM(-60), and in order for a stepwise uptrend to begin, it must rise above DOM(60).

In other words, the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section can be seen as support and resistance sections.

-

If these correlations start to appear, I think you will be able to create a trading strategy that fits your investment style without being swayed by price volatility and proceed with trading.

The reason for analyzing charts is to trade.

Therefore, the shorter the time for chart analysis, the better, and you should increase the start of creating a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

BTC/USD INDEXEach cycle typically spans 4 years. Historically, the cycle peak occurs near the end of year 3, followed by a year-long market downturn in year 4, with the cycle bottom forming closer to the end of that final year.

Based on previous cycles, a reasonable peak for Bitcoin in this cycle would be around $120K–130K, followed by a correction down to the $45K–50K range.

BTC's Mid 2025 OutlookBitcoin is currently trading around $107,000 on the 4-hour 4H timeframe, navigating a consolidation phase following a sharp rally that culminated in a new all-time high of $111,900 in May 2025. Despite recent price corrections, BTC remains up 3% on the week, reflecting underlying bullish momentum. This sustained strength hints at continued confidence in the market, particularly among larger players.

A notable development supporting this view is the increase in the number of Bitcoin wallets holding at least 10 BTC, which has surged to a three-month high of 152,280. This metric is widely regarded as a proxy for whale activity and may indicate renewed institutional interest, especially amid accelerating inflows into spot Bitcoin ETFs.

On the 4H chart, Bitcoin appears to be consolidating within a tight range, hovering just beneath a key supply zone at $107,000, which could act as short-term resistance.

Several potential outcomes are currently in play:

Bullish scenario:

A breakout above the $107,000–$108,000 range could clear the path toward the critical resistance at $115,000. A successful move above this threshold would likely signal resumption of the broader uptrend, with some technical analysts eyeing a potential cup and handle formation that could project long-term targets up to \$180,000

Bearish scenario:

If BTC fails to hold above the current level, it may correct toward the first major support at $102,800, with further downside risk to $98,500. In a more pessimistic setup, price could extend losses toward $96,000, especially if macroeconomic or geopolitical pressures intensify

Key levels to watch:

Resistance: $107,000 - $115,000

Support: $102,800 - $98,500 - $96,000

Market Sentiment and External Drivers:

Bitcoin's price is being shaped not only by technical dynamics but also by powerful external forces

Spot Bitcoin ETFs:

The US regulatory greenlight for spot ETFs has dramatically altered market dynamics. With projections of $190 billion in assets under management AUM for these products by the end of 2025, institutional access to BTC has become more streamlined, providing strong tailwinds for long-term accumulation

Geopolitical risk and macro conditions:

Global uncertainty, particularly due to escalating tensions in the Middle East and potential US military involvement, has introduced volatility. At the same time, rising inflation and economic instability in developed markets is a double-edged sword, either undermining risk assets or conversely boosting Bitcoin’s narrative as digital gold and a hedge against fiat devaluation

Forward-Looking Outlook:

Bitcoin is at a critical juncture. The ability to sustain above $107,000 and reclaim the $115,000 resistance will be pivotal. A confirmed breakout could open the door to price discovery and possibly a surge toward $130,000 to $150,000, with $180,000 as an extended target in more bullish scenarios

However, a failure to hold key support levels could shift momentum toward the bears, prompting a deeper correction toward the $96,000 zone. Traders should monitor:

- Price reaction around $107,000 and $115,000

- ETF inflow data and AUM growth

- Macro news especially inflation reports and central bank commentary

- Developments in global conflict zones impacting risk appetite

Conclusion:

Bitcoin’s medium-term direction hinges on a delicate interplay of technical consolidation institutional flow and macro geopolitical signals. While the bullish structure remains intact for now a decisive move in either direction above $115,000 or below $98,000 could set the tone for the next major trend.