BTC Rebounds After 100000 Drop, Eyeing Short at 109500 Resistanc📈 BTC Rebounds After 100000 Drop, Eyeing Short at 109500 Resistance

BTC dropped below the 100000 threshold 🔻 and then rebounded near 98000 🔺. This movement is related to the decline of DXY and the reduction of geopolitical risks. Now, BTC is challenging the 110000 level 🔼. The overhead resistance is around 109500. First - time tests of the 110000 level typically trigger pullbacks, so we favor short positions here 📉

🚀 Sell@109500 - 108500

🚀 TP 107500 - 106500 - 105500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Btcusdtanalysis

Here is an analysis of the latest Bitcoin market trendBitcoin has surged to around $106,700 at its peak and hovered around $104,800 at its low. Overall, the trend remains relatively stable, continuing to stay at a relatively high level. What is driving the market?

First, institutional funds have flowed in again. Recently, many investors have bought Bitcoin through ETFs, with substantial capital inflows, which has formed support for this price level.

Second, the technical outlook is promising. Various technical indicators suggest that it is still a bullish market, meaning the price may continue to rise.

Third, regarding support and resistance levels: if the price declines, it may first find support near $104,000. If it breaks upward, the next target is roughly between $108,000 and $110,000.

What about the short-term trend? If it can break through $107,000, it may then surge toward $109,000 or even the high of $112,000. If it fails to break through, it may fluctuate repeatedly within the range of $104,000 to $106,000 for a period.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

buy@104300-104800

TP:107000-107500

BTCUSD 4-Hour Chart Analysis: Range Bound with Bearish BiasFrom the 4 - hour chart of BTCUSD, the price movement shows obvious range - bound fluctuation characteristics 📊.

Currently, it is necessary to focus on the key resistance and support zones 🎯:

From a technical perspective, BTC is likely to oscillate repeatedly within the range in the near term 🔄, yet the overall trend leans bearish 🐻.

In the short term, opportunities for buying low and selling high within the range can be monitored 📈📉

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Sell@106500 - 105500

🚀 TP 104500 - 103500

🚀 Buy@102500 - 103500

🚀 TP 104500 - 105500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

SUSDT Forming Falling WedgeSUSDT is currently displaying a textbook falling wedge pattern, a bullish reversal formation often seen at the end of a downtrend. This setup is known for signaling a breakout to the upside once the price compresses within the narrowing range. In the case of SUSDT, the wedge has been forming with consistent downward sloping resistance and support lines, accompanied by steady volume — a key confirmation of this pattern’s strength. The current technical outlook suggests that a bullish breakout could be imminent.

Technical indicators and chart structure support a possible breakout that could deliver a substantial move. Based on historical wedge breakout performance, SUSDT has the potential to rally with a projected gain of 140% to 150%+ from current levels. This would place the asset in a prime position for traders looking to capitalize on early-stage momentum. The increasing volume profile further adds conviction, signaling active accumulation and growing market interest.

Recent activity and sentiment around SUSDT indicate that investors are starting to pay attention to this opportunity. As capital flows into smaller-cap altcoins showing strong technical setups, SUSDT stands out with its clean wedge formation and bullish potential. If the price breaks above the wedge resistance with volume confirmation, it could trigger a strong upward rally, attracting both short-term traders and long-term holders.

This pattern-driven setup, combined with bullish market behavior and investor activity, puts SUSDT in a favorable zone for significant upside. Keep an eye on key resistance levels and watch for bullish engulfing candles or breakout confirmation to enter at optimal points.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

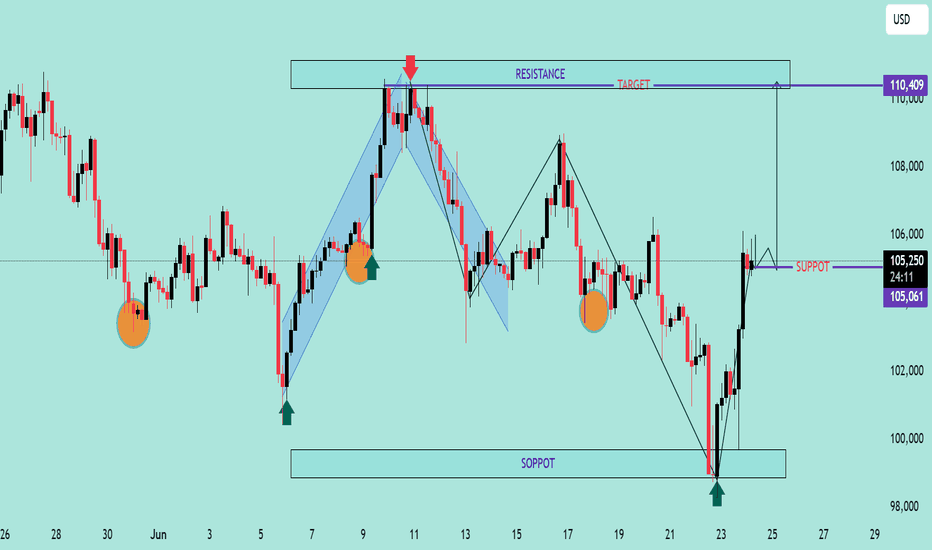

USD Index (DXY) Bullish Reversal & Breakout PotentialThe DXY chart displays a strong bullish reversal structure from the support zone near the 99,800–100,200 area. Here’s a professional breakdown of the technical setup:

🔍 Key Observations:

🟢 Bullish Reversal Formation

The price rebounded aggressively from a strong demand zone (support), marked by a green arrow and orange highlight.

Multiple historical reaction zones confirm this level's validity as a reliable support.

📉 Previous Decline & Correction

After reaching the resistance area near 110.400, the price corrected with a bearish channel.

This pullback formed a classic bull flag, a bullish continuation pattern, eventually leading to the current breakout.

🟦 Current Price Action

The market has broken out of the recent downtrend and is forming higher highs and higher lows.

A strong bullish impulse candle confirms renewed buying interest.

🧱 Support & Resistance Levels:

🔵 Resistance Zone (Target): 110.409 — a historically respected area and target for the bullish move.

🟣 Current Support Zone: 105.061 — previously resistance, now likely to act as support after the breakout.

🎯 Bullish Target Projection

If price retests and holds the support at 105.061, the next potential leg can extend towards 110.409, offering a strong risk-to-reward setup.

⚠️ Caution

Watch for a pullback and retest near the support level.

A failure to hold above 105.061 could invalidate the bullish structure.

🧠 Conclusion

The DXY is showing a bullish trend continuation after a breakout from a corrective structure. A successful retest of support could propel price towards the 110.400 target zone 📊.

Bias: ✅ Bullish above 105.061

Invalidation: ❌ Below 105.000

#BTC Bounced, 100EMA saved the day!100 EMA saved the day.

But the one concern? We’ve printed a new Lower Low, not a great sign.

The chart looks bouncy, but the overall structure still feels uncertain.

No point guessing or forcing trades here, I’d rather wait for clear confirmation.

I’ll share updates if I spot any changes or interesting altcoin setups.

For now, patience is our best edge. I know many altcoins might look great, but BTC Dominance is not yet done. I'll be sharing that chart tomorrow.

Stay sharp.

Hit that like button if you find this short update useful.

Thank you

#PEACE

A bearish trend is gradually taking shape.From a technical perspective, the complete breakdown of the box bottom, coupled with the MACD indicator about to fully crossing below the zero axis, both indicate that bullish momentum is weakening and a bearish trend is gradually forming. Short-term bulls need to take a temporary break and wait for the construction of a stabilizing platform. For bears, according to the current trend, they can lay out short positions on rallies. The ideal entry position is near the lower edge of the box, and they can try to lay out positions boldly after setting stop-losses.

On the news front, "Laote"'s policies change frequently, with extremely high uncertainty. The market needs global stability, and there has been no bull market in history built in a turbulent environment. Therefore, we need to treat market conditions cautiously, avoid blind and radical operations, and only by maintaining rationality can we respond to market changes.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@102300-102800

TP:100000-100500

BTCUSDT Hello traders.

The BTCUSDT trade I shared the other day played out just as expected, with BTC experiencing a significant drop in value shortly after. The price fell all the way down to the 98K level.

Following this decline, I anticipate a short-term rebound toward the 102K–103K range, after which I expect the downtrend to resume. Therefore, I’ve placed a Sell Limit order at 102,350, and I’m currently waiting for the price to reach that level.

If you'd like, you can consider this opportunity in the same way.

🔍 Trade Details

✔️ Timeframe: 1-Hour

✔️ Risk-to-Reward Ratio: 1:2

✔️ Trade Direction: Sell Limit

✔️ Entry Price: 102,350.24

✔️ Take Profit: 100,250.08

✔️ Stop Loss: 103,399.62

🕒 If the trade doesn’t gain strong momentum, I will keep the position open only until 23:00 (UTC+4) today. Otherwise, I will manually close the trade—either in profit or at a loss—depending on price action.

🔔 Disclaimer: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

Pullback Correction after a Sharp DeclineTechnical Analysis of BTC Contracts: As of today, on the daily timeframe (major cycle), yesterday closed with a small bearish candle, showing consecutive bearish declines. The price remains below moving averages, and attached indicators are in a death cross, clearly indicating a downward trend. With the trend being evident, two key points should be noted: First, guard against significant pullback corrections; Second, risk control must be prioritized under any circumstances, which is of utmost importance.

On the hourly timeframe (short cycle), the price fell under pressure during the US session yesterday, breaking below the 100,000 level. It rebounded after hitting the intraday low in the morning. The breakdown level is near the 102,700 area. Currently, the K-line shows a large bullish rebound, and attached indicators form a golden cross, suggesting that corrective movements will prevail today. However, the breakdown level (102,700) must not be breached; otherwise, the corrective trend may fail to sustain, which aligns with typical price movement patterns.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@102300-102800

TP:100000-100500

Need to wait for the key turning point.The Bitcoin market has currently broken below the key support level of 100,300, confirming a downward trend reversal. A daily-level recovery rally is now underway, and the 4-hour wave structure has not yet concluded. First, the downside target is seen at 95,000 to 98,000. Next week, the key turning point at 92,000 will likely determine the low of a rebound. Although this rebound low is not the ultimate bottom, it will trigger a relatively strong rebound after formation.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

buy@95000-95500

TP:97500-98000

BTCUSDTHello traders. Wishing each of you a great weekend ahead!

Even though it's the weekend, I’ve spotted a sell opportunity on the BTCUSDT pair and decided to share it with you. However, we should also keep in mind that weekend markets tend to have lower volume. That said, I will still proceed with this trade based on my own risk parameters and trading strategy.

🔍 Trade Details

✔️ Timeframe: 30-Minute

✔️ Risk-to-Reward Ratio: 1:2

✔️ Trade Direction: Sell

✔️ Entry Price: 103815.32

✔️ Take Profit: 102640.12

✔️ Stop Loss: 104402.06

🕒 If the trade does not continue with strong momentum, I will keep the position open only until 23:00 today. Otherwise, I will close it either in profit or at a loss depending on the price action.

🔔 Disclaimer: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

BTC Consolidates 104000-105000: Bearish Breakdown Looming?BTC Technical Update: Bitcoin has been consolidating within the 104000-105000 range for an extended period, with the overall trend showing a downward bias. With the overall trend tilting bearish, traders should watch for a break below 103500 to confirm the next leg down. 📉

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Sell@ 105000 - 104500

🚀 TP 102500 - 101500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Future market trend predictionIn the short term, the price trend of Bitcoin is full of uncertainties. On the one hand, if the global macroeconomic environment continues to deteriorate, with slower economic growth and increased inflationary pressures, it may prompt more investors to seek safe-haven assets. As an asset with certain safe-haven properties, Bitcoin may attract some capital inflows, providing support for its price. However, if regulatory policies are further tightened in the short term, especially if more stringent restrictive measures are introduced in countries and regions where Bitcoin trading is active, then the price of Bitcoin may face significant downward pressure.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

BTC/USD Bearish Outlook AnalysisBTC/USD Bearish Outlook Analysis 📉🧠

📊 Technical Overview:

The BTC/USD chart is showing signs of a bearish structure formation, suggesting increased downside momentum in the short term.

🔻 Resistance Zone:

Clear resistance is identified near $110,345, marked by multiple price rejections (🔴 red arrows).

Price failed to break above this zone several times, indicating strong selling pressure.

🔸 Support Zone:

Strong support lies near the $100,000 psychological level.

Price has respected this zone multiple times (🟠 orange circles), indicating buyer interest.

📉 Current Price Action:

A descending trendline breakout attempt failed and price is now consolidating just below $105,000.

Price is forming a bearish flag/consolidation structure after recent rejection.

A breakdown from the current box range is likely to push BTC toward the support zone at $100,000.

📉 Bearish Scenario:

If BTC breaks below $104,000, expect continuation towards $100,000.

A daily candle close below support could signal further downside.

📈 Invalidation:

Bullish invalidation occurs if BTC reclaims and closes above $108,000, with volume, retesting resistance at $110,345.

🧭 Summary:

BTC/USD is exhibiting a lower highs structure within a descending channel. Unless it breaks above the resistance zone, the bias remains bearish with a high probability of retesting support.

Bitcoin's Latest Market AnalysisThe recent escalation of the situation in the Middle East has triggered a surge in risk - aversion sentiment across global financial markets. As a risk - on asset, Bitcoin has faced certain selling pressure in a market environment dominated by risk - off sentiment.

From a technical chart perspective, Bitcoin has made multiple attempts to break through the key resistance range of $108,800 - $110,000 in the recent period, but has encountered significant selling pressure each time. On the other hand, the area between $105,000 - $103,000 forms an important support zone. When the price drops to this area, it attracts some bargain - hunting capital inflows, which provides a certain degree of support for the price.

The price of Bitcoin is expected to fluctuate within a relatively narrow range. If it can hold the key support level of $105,000 and the bulls can regain strength, the price is likely to rebound to the range of $106,000 - $108,000. However, if the $105,000 support level is effectively breached, it may trigger additional selling pressure, potentially driving the price down further to $103,000. In extreme cases, if market panic sentiment spreads further, it may test the psychological threshold of $100,000.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Bitcoin - The Elevated Cycle and the Silence Before Powell.⊢

⟁ BTC/USD – Bitstamp – (CHART: 1M) – (June 18, 2025).

⟐ Analysis Price: $104,044.00

⊢

⨀ I. Temporal Axis – Strategic Interval – (1M):

▦ EMA90 – ($39,909.00):

∴ Rising steadily, serving as long-cycle structural support since 2020;

∴ Price remains well above this average, with no signs of downward pressure;

∴ The positive slope confirms ongoing bullish macro structure.

✴️ Conclusion: EMA90 holds the foundational base of the long-term uptrend with ample buffer.

⊢

▦ SMA50 – ($48,924.00):

∴ Key axis of mid-to-long-term structure, validated by multiple touches during 2022–2023;

∴ Current price distance suggests technical room for retracement;

∴ Still rising with no sign of flattening or decay.

✴️ Conclusion: SMA50 confirms trend integrity, though overextension calls for caution.

⊢

▦ Ichimoku (Kumo & Lines) – (85,434 | 68,378 | 104,044 | 76,906 | 63,740):

∴ Price remains well above the Kumo cloud – full bullish confirmation;

∴ Tenkan and Kijun are aligned in bullish configuration, widely spread;

∴ Future cloud projects bullish momentum continuation.

✴️ Conclusion: Complete Ichimoku structure signals dominant cycle strength.

⊢

▦ MACD (12,26,9) – (2,344 | 16,426 | 14,083):

∴ MACD line remains above the signal, maintaining a monthly buy signal;

∴ Histogram shows mild expansion, but slower than previous bull cycles;

∴ Momentum is positive but decelerating.

✴️ Conclusion: Momentum remains intact, but peak cycle force may have passed.

⊢

▦ RSI (14) – (68.82 | MA: 67.35):

∴ RSI approaching overbought threshold, hovering near 70;

∴ Momentum is firm but shows resistance to further extension;

∴ Historical comparison to 2020 suggests possible ignition or exhaustion point.

✴️ Conclusion: RSI signals potential tension zone - breakout or reversal ahead.

⊢

▦ VPT (14,8) – (100):

∴ Volume Price Trend has plateaued at its max threshold;

∴ Lack of new highs despite price advance suggests fading directional volume;

∴ Often a signal of accumulation slowdown or redistribution.

✴️ Conclusion: Buyer strength may be waning beneath the surface.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ Market structure remains bullish across all core indicators;

∴ Overextension from key moving averages and flattening momentum call for tactical caution;

∴ Any macroeconomic pressure could trigger a local top, without compromising the broader trend.

⊢

∫ II. On-Chain Intelligence – (Source: CryptoQuant):

▦ Realized Price & LTH – ($47,000):

∴ Market price is well above the realized price baseline;

∴ Indicates majority of holders are in profit — structurally bullish;

∴ However, this also creates a risk of profit-taking if confidence drops.

✴️ Conclusion: Strong support floor, but latent pressure exists.

⊢

▦ SOPR - (Spent Output Profit Ratio) – (1.013):

∴ Above 1 means active profit-taking;

∴ Downward slope shows this is starting to cool;

∴ Critical to monitor for a break below 1 - would shift dynamic.

✴️ Conclusion: Still healthy, but at the edge of distribution risk.

⊢

▦ NUPL – (Net Unrealized Profit/Loss) - (0.554):

∴ Unrealized profit remains dominant;

∴ Readings above 0.5 historically precede consolidation or pullbacks;

∴ Still distant from euphoric tops, but entering alert zone.

✴️ Conclusion: Market still in profit expansion phase - but under surveillance.

⊢

▦ MVRV - (STH vs LTH) – (STH: 1.0 | LTH: 3.1 | Global: 2.2):

∴ STH neutral, LTH moderately elevated but not excessive;

∴ Market is mature, but not overheated;

∴ Still in a zone that supports further upside with restraint.

✴️ Conclusion: Healthy balance between holders - no imminent top confirmed.

⊢

▦ CME Futures Open Interest:

∴ Sharp rise in open interest across expiry horizons;

∴ Sign of speculative leverage building;

∴ Historically correlates with volatile price action post-FOMC or macro events.

✴️ Conclusion: Liquidity pressure is rising - extreme caution warranted.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ On-chain structure mirrors technical signals - strong trend, but cautious undertone;

∴ No major signs of reversal, but profit saturation could act as gravity if macro shocks occur;

∴ Market is exposed, not exhausted.

⊢

⧉ III. Contextvs Macro–Geopoliticvs – Interflux Economicus:

▦ Fed Chair Powell (Upcoming):

∴ Powell speaks today (June 18); core expectation is rate hold;

∴ Market bracing for hawkish tone: fewer projected cuts and emphasis on inflation resilience;

∴ Historically, Bitcoin has reacted with -2% to -5% dips to hawkish FOMC tone.

✴️ Conclusion: Macro tension peak. Powell’s tone may dictate the next 30-day candle.

⊢

⚜️ 𝟙⟠ Magister Arcanvm – Vox Primordialis!

⚖️ Wisdom begins in silence. Precision unfolds in strategy.

⊢

⊢

⌘ Codicillus Silentii – Strategic Note:

∴ The technicals are strong, the on-chain base is stable, and the macro setup is explosive;

∴ This is a tension point, not a resolution point - silence before decision;

∴ Precision now is not found in action, but in observation.

⊢

⌘ Market Status:

✴️ Position: " Cautiously Bullish. "

✴️ Tactical Mode: Observation Priority – No immediate entry without Powell clarity.

⊢

Technical Analysis of Bitcoin

From a market analysis perspective, the daily chart of the large cycle has closed with consecutive declines, the price is below the moving averages, and the indicator is in a death cross, indicating a bearish trend. However, it is necessary to be wary of the stimulation from the news and data caused by the current unstable national situation. In operation, risk control should be paid attention to, and the moving average pressure level near 106,000 on the daily chart should be focused on.

In the hourly chart of the short cycle, the decline continued in the European session after the morning decline yesterday, the U.S. session broke the low of the previous day, and the price rebounded and corrected at the support in the early morning. Currently, it is still in a corrective trend. Today, focus on the high pressure level in the 106,000 area, as well as the impact of the strength of the European session and the unemployment benefit data in the evening on the trend.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

BTC/USD Potential Bullish ReversalBTC/USD Potential Bullish Reversal 🟢📈

🔍 Technical Overview:

The chart shows a potential bullish reversal pattern forming near a key support zone. Price action has consistently bounced from the support range between $100,000 – $103,700, marked by multiple higher lows (🟠 orange circles), suggesting strong buyer interest.

📌 Key Levels:

Support Zone: $100,000 – $103,700 🛡️

Immediate Resistance: $110,384 🔼

Current Price: $105,202 💰

📊 Pattern Observed:

The price structure shows a possible inverted head and shoulders pattern forming, with the right shoulder currently developing. If this structure completes and breaks the $106,000–$107,000 neckline region, we can expect a bullish breakout toward the resistance target of $110,384 or higher.

📈 Bullish Confirmation:

Bullish rejection from support area ✅

Clean structure with repeated higher lows 📈

Potential breakout arrow suggests move toward the top resistance zone

⚠️ Watch For:

Price must hold above $103,700 to maintain bullish bias

Break below this level may invalidate bullish setup and retest the broader support zone near $100,000

📌 Conclusion:

BTC/USD is setting up for a potential upside breakout if the neckline is broken. Traders should monitor for bullish confirmation before entering long positions.

🔔 Strategy Suggestion:

Buy Zone: $103,700 – $104,500 (on bullish confirmation) 🛒

Target Zone: $110,000 – $111,000 🎯

Stop-Loss: Below $103,000 🛑

Test the crucial round-number threshold of $100,000.Affected by sudden news factors, the Bitcoin market has seen sharp fluctuations. The price started a significant downward trend from the $108,900 level and has dropped to around $104,000 as of now. This decline has caused Bitcoin to break through multiple key support levels.

On the daily timeframe, the originally important support range of $106,000 - $107,000 was easily breached, with market bearish forces gaining absolute dominance. Bitcoin is facing significant downward risks and is highly likely to continue falling to test the crucial psychological level of $100,000.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@104000-104500

TP:102000-1025000

Safello Group AB - Bullish Outlook - Small Cap Crypto Firm Safello is starting to show signs of a breakout from its weekly triangle. If Bitcoin or altcoins start to show life, I believe this stock could outperform most crypto stocks. The company is constantly innovating its offerings and is regulated under Swedish law.

I have been DCA’ing into this stock for quite a while now and will continue to do so until the consolidation is over.

Current market cap is about 10 Million USD.

Nothing here should be considered financial advice. Always do your own research and make your own decisions.

OMXSTO:SFL

CRYPTOCAP:OTHERS

CRYPTOCAP:TOTAL

COINBASE:BTCUSD

NASDAQ:COIN

COINBASE:ETHUSD

Bitcoin Market Analysis and Future Trend ForecastThe Bitcoin market has once again become the focus of investors. The price of Bitcoin has shown a significant upward trend, successfully breaking through the key resistance level of $106,000 per coin with an intraday increase of over 2%, demonstrating the strong vitality of the market. This price movement not only reflects the warming of positive sentiment in the cryptocurrency market but also indicates the gradual recovery of investor confidence, which has become the core driving force behind Bitcoin's current rally.

Currently, the Bitcoin price is at a critical juncture. From a daily chart perspective, after reaching an intraday high of $107,265, Bitcoin failed to effectively break through the key resistance level of $108,000 and has since retracted to fluctuate around $106,940. On the 4-hour timeframe, the MACD indicator shows that the histogram remains in positive territory, but the rate of increase has slowed, suggesting a short-term weakening of bullish momentum. Meanwhile, the RSI indicator stands at around 65, approaching the overbought zone, indicating that the market faces short-term correction pressure.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@107500-108000

TP:106000-106500