Btcusdtidea

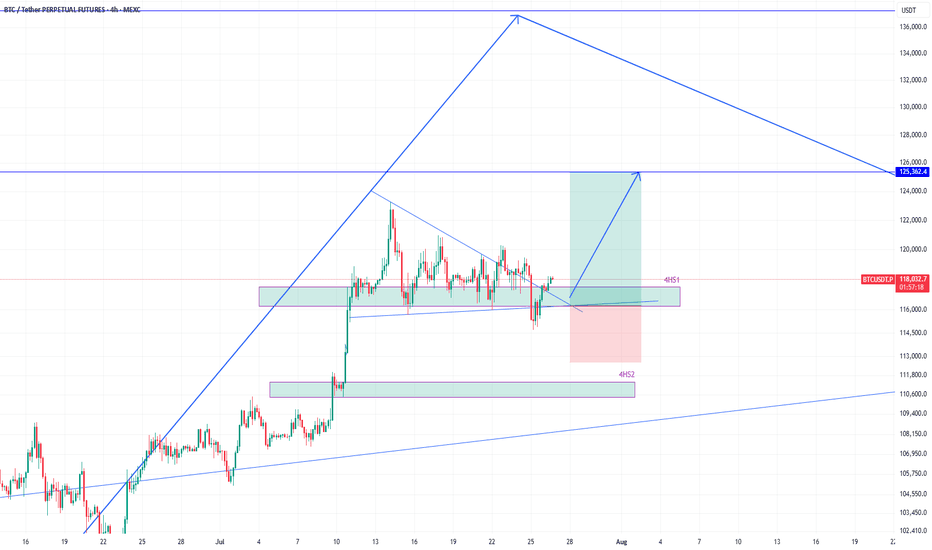

BTCUSDT eyeing 125k next after bounce from 116k zoneEarlier I shared the high time frame view of #BTCUSDT. We know that its heading higher and that helps in holding spot positions.

However, the move to the high frame target will not happen in a straight line, instead with various push to the upside and then subsequent corrections to the down side.

Therefore, as a trader, we must profit from those movements as we see some good high probability setups.

And there is one right now which is a long position.

The price broke 4h support 4HS1, but quickly reclaimed it. That is a sign of demand and strength required to move higher.

Therefore, this presents a long opportunity where the target of this long position should be 125k.

As the price enters into 4HS1 zone, I will scale into long position.

It is quite likely that the price will bounce hard once it taps into 4HS1 zone.

I am talking this long position targeting 125k. What about you? Share with me what you think.

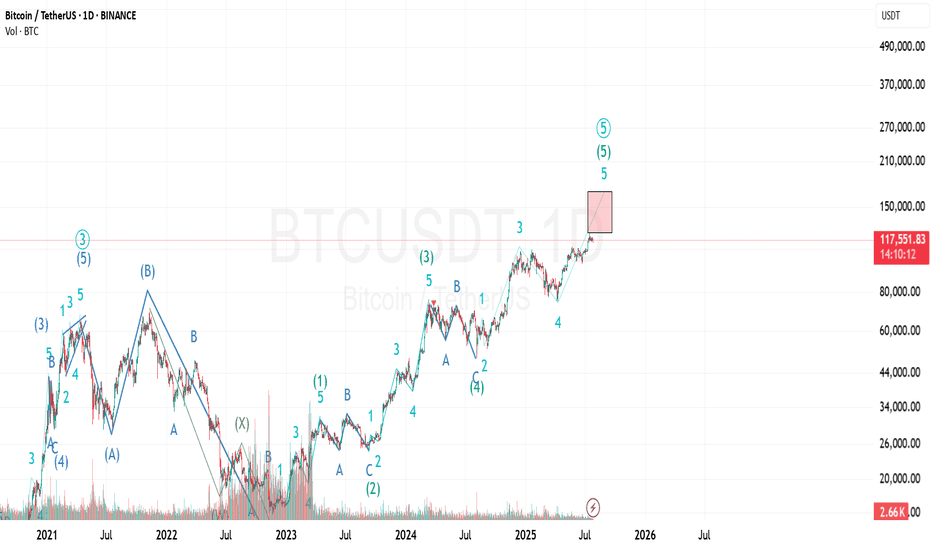

BTCUSDT ready to march towards 140k zoneHere is once again a view of what I had shared when BTCUSDT was trading around 95k in may 2025.

The price action has been similar to our expectation. A push towards 106k-110k and then drop around 95k-98k before boucing towards 137k.

So the next stop for the current upward move is 137k. The push from 98k has brought us into 120k zone and currently we were holding in that range from 114k-120k for a while.

However, this is going to change now. I believe the last drop towards 114k was a false breakdown from 4h support 4HS1 since the price quickly grabbed this region again by moving towards 117k.

I believe the path to 137k-144k is clear now and we see that in coming weeks. After that we shall likely see a correction towards 120k area before move to the target around 150k.

Lets see how the price moves. We will keep monitoring it time to time and I will provide updates. But till now it has been moving according to the plan.

#BTC #BTCUSD #BTCUSDT #BITCOIN #CRYPTO CRYPTOCAP:BTC $crypto

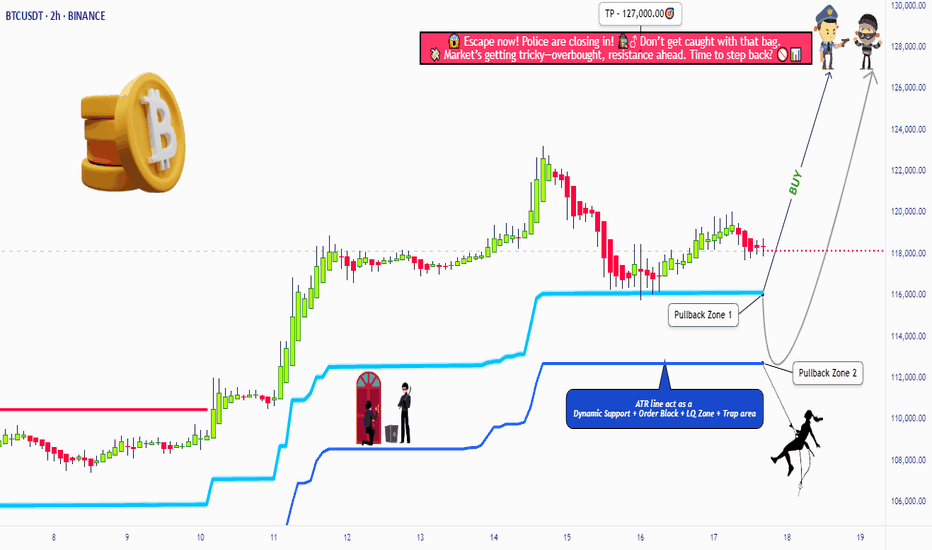

BTC/USDT Heist Mode: Buy Low, Escape Rich🏴☠️"Bitcoin vs Tether" Crypto Market Robbery Blueprint 🔥 | Thief Trading Style (Swing/Day Plan)

🌍 Hey Money Makers, Chart Hackers, and Global Robbers! 💰🤑💸

Welcome to the new Heist Plan by your favorite thief in the game — this time targeting the "Bitcoin vs Tether" Crypto Market like a smooth criminal on the charts. 🎯📊

This is not your average technical analysis — it's a strategic robbery based on Thief Trading Style™, blending deep technical + fundamental analysis, market psychology, and raw trader instincts.

💼 THE SETUP — PREPARE FOR THE ROBBERY 🎯

We're looking at a bullish operation, setting up to break into the high-value vaults near a high-risk, high-reward resistance zone — beware, it's a high-voltage trap area where pro sellers and bearish robbers set their ambush. ⚡🔌

This plan includes a layered DCA-style entry, aiming for max profit with controlled risk. Chart alarms on, mindset ready. 🧠📈🔔

🟢 ENTRY: "The Robbery Begins"

📍 Zone-1 Buy: Near 116200.00 after MA pullback

📍 Zone-2 Buy: Near 112600.00 deeper pullback

🛠️ Entry Style: Limit Orders + DCA Layering

🎯 Wait for MA crossover confirmations and price reaction zones — don’t chase, trap the market.

🔻 STOP LOSS: "Plan the Escape Route"

⛔ SL for Pullback-1: 113000.00 (2H swing low)

⛔ SL for Pullback-2: 110000.00

📌 SL placement depends on your position sizing & risk management. Control the loss; live to rob another day. 🎭💼

🎯 TARGET ZONE: “Cash Out Point”

💸 First TP: 127000.00

🏁 Let the profit ride if momentum allows. Use a trailing SL once it moves in your favor to lock in gains.

👀 Scalpers Note:

Only play the long side. If your capital is heavy, take early moves. If you’re light, swing it with the gang. Stay on the bullish train and avoid shorting traps. Use tight trailing SL.

🔎 THE STORY BEHIND THE HEIST – WHY BULLISH?

"Bitcoin vs Tether" shows bullish momentum driven by:

💹 Technical bounce off major support

🌏 Macroeconomic & geopolitical sentiment

📰 Volume + sentiment shift (risk-on)

📈 Cross-market index confirmation

🧠 Smart traders are preparing, not reacting. Stay ahead of the herd.

👉 For deeper insight, refer to:

✅ Macro Reports

✅ COT Data

✅ Intermarket Correlations

✅ CHINA-specific index outlooks

⚠️ RISK WARNING – TRADING EVENTS & VOLATILITY

🗓️ News releases can flip sentiment fast — we advise:

❌ Avoid new positions during high-impact events

🔁 Use trailing SLs to protect profit

🔔 Always manage position sizing and alerts wisely

❤️ SUPPORT THE CREW | BOOST THE PLAN

Love this analysis? Smash that Boost Button to power the team.

Join the Thief Squad and trade like legends — Steal Smart, Trade Sharp. 💥💪💰

Every day in the market is a new heist opportunity — if you have a plan. Stay tuned for more wild robbery blueprints.

📌 This is not financial advice. Trade at your own risk. Adjust based on your personal strategy and capital. Market conditions evolve fast — stay updated, stay alert.

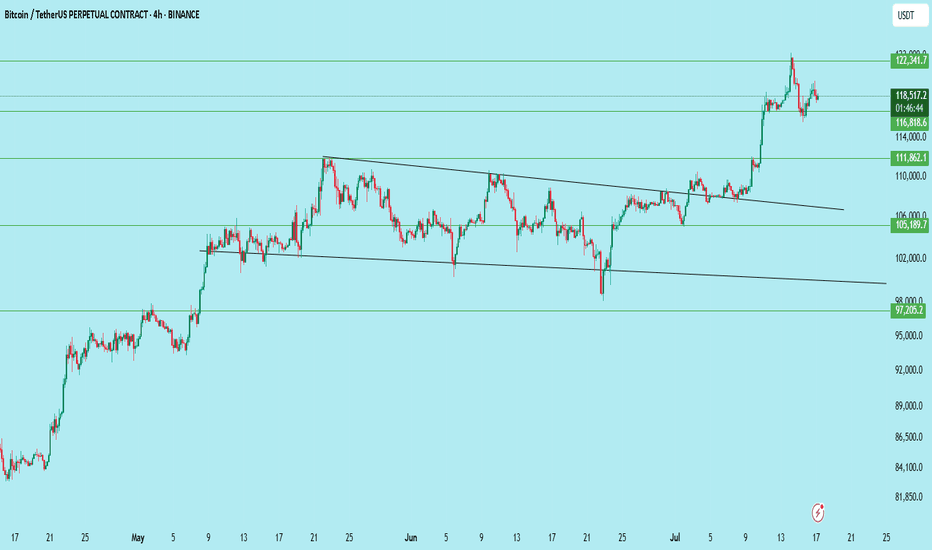

#BTCUSDT | Massive Breakout – Now What?Bitcoin has broken out of a multi-week descending wedge on the 4H chart — a classic bullish reversal pattern. Price is now consolidating just above $116,818 support, forming a base for the next leg up.

What Just Happened:

Clean breakout above the wedge resistance

Strong momentum candle above $111,862

Immediate rejection near $122,341

Currently retesting the previous breakout zone

Key Levels:

Resistance: $122,341

Support: $116,818 → key short-term level

Breakout Support: $111,862

Deeper Support: $105,189

Invalidation Level: $97,205

Bullish Outlook:

If BTC holds $116,818 and breaks above $122,341 with volume, the next leg could extend toward $128,000–$132,000.

Bearish Risk:

Losing $116,818 with volume → look for retest near $111,862 or even $105,189 for a stronger bounce.

Bias:

Bullish above $116,818 — watching for consolidation before continuation.

Trade Setup (if planning to enter):

Entry on retest of $116,818–$117,000

SL: Below $114,000

TP1: $122,341

TP2: $128,000

TP3: $132,000

DYOR | Not Financial Advice

BTCUSDT[BITCOIN]:Price is Likely to be Heading Towards $144,000.Recently, Bitcoin has shown extreme bullish price behaviour, and there’s no sign of bearish influence in the market. After monitoring the price since May 4th, we believe there’s a high possibility of price hitting the 120k region first. This could be followed by a small correction around 105k, where a strong bullish price influence will lead the price to our final target at 140k. Both fundamental and technical factors support this view, but it doesn’t guarantee the price will follow our expectations.

Before investing or trading cryptocurrencies, do your own research as they carry significant financial risk. This chart analysis is for educational or secondary purposes only.

Good luck and trade safely.

If you want to support and encourage us, you can do the following: ❤️

-Like the idea

-Comment the idea

-Share ;)

Team Setupsfx_

BTC: Price to 134,500$ , FVG, Fib 0.5 and 0.618 ratio ?Price to 134,500$:

Bitcoin is now moving in a triangle pattern, which is getting smaller. The price is around $107,758. Here is possible move is a breakout to the downside first, where the price may drop to fill the "Fair Value Gap" area, which is marked in purple. This area is between the Fibonacci levels of 0.5 and 0.618. After that, Bitcoin could go up again and reach the price of $134,000.

Trade Ideas:

I marked 2 areas with arrow let the price reach here and wait for confirmation in both areas. Specially in Fair Value Gap area.

Trade Signal:

I will provide both trade signal here so follow my account and you can check my previous analysis regarding BITCOIN. So don't miss trade opportunity so follow must.

BINANCE:BTCUSDT BITSTAMP:BTCUSD COINBASE:BTCUSD COINBASE:BTCUSD BINANCE:BTCUSDT.P CRYPTO:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSD

BTCUSDT:Sharing of the Latest Trading StrategyAll the trading signals last week have resulted in profits!!! Check it!!!👉👉👉

Bitcoin Technical Analysis (4-Hour Chart):

Price remains within an ascending channel. The MACD above the zero line with expanding red histograms indicates bullish dominance. After firmly breaking above the key resistance at $105,000, price is testing $110,000.

Caution: The RSI near 70 has entered overbought territory, increasing short-term pullback risks.

Support levels: $106,000 and $105,000.

Trading Recommendation for Aggressive Traders

Consider light long positions near $106,000 on pullbacks, with stop-loss set below $105,000.

Trading Strategy:

buy@105000-106000

TP:108000-110000

BTCUSDT Hello traders. Wishing you a great start to the week!

This week’s first trade opportunity comes from the BTCUSDT pair. Over the weekend, the pair showed significant volatility, dropping from 108,776 to 107,565 in just a few hours. However, I see this drop as a potential buying opportunity.

In my view, the price is likely to bounce back towards the 108,930.12 level in the short term. Therefore, I’ve activated the trade and I’m sharing the details with you below:

🔍 Trade Details

✔️ Timeframe: 1-Hour (H1)

✔️ Risk-to-Reward Ratio: 1:3.20

✔️ Trade Direction: Buy

✔️ Entry Price: 107,590.73

✔️ Take Profit: 108,930.12

✔️ Stop Loss: 107,181.36

🕒 If momentum weakens or price consolidates in a tight range, I will keep this trade open only until 23:00 (UTC+4). After that, I’ll manually close it—whether in profit or loss—based on how price action evolves.

🔔 Disclaimer: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

BTCUSD Trade Setup - 28/Jun/2025Hi Traders,

I expect this pair to go Down after finishing the correction.

1) Need to wait for market to show changing of the direction.

2) The first reaction zone foe me will be at 95000 level followed by 89000 level.

3) Need to observe the characteristic of the move coming down in order to understand if market is planning to go up without coming to those levels.

Current expectation for investing is to see market dropping to 89000 level and then start to look for entry.

I only invest in BTC so no shorts for me but market shows potential to give a reversal soon and give a decent down move.

BTC/USD Technical Outlook – Potential Bearish Continuation BelowBTC/USD Technical Outlook – Potential Bearish Continuation Below Resistance 📉🧊

Chart Overview:

The chart illustrates a clear bearish rejection from a major resistance zone (⚠️ 110,000–111,000 USD), followed by the emergence of a bearish engulfing candle 🔻 marked in orange. This move suggests selling pressure has returned after a short-term bullish rally.

Key Zones & Levels:

🔵 Resistance Zone: 110,000–111,000 USD

Price was rejected from this region with a strong bearish reaction.

🟣 Mid-level Support: 105,531 USD

Currently acting as an interim level — if broken, it may lead to deeper declines.

🔵 Support Zone: 100,500–101,500 USD

This is the next strong demand area — price previously rebounded strongly from here.

Technical Signals:

✅ Double Top Structure formation at the resistance zone, indicating trend exhaustion.

❌ Bearish Engulfing Candle near resistance, confirming reversal strength.

📉 Downward Momentum Arrow suggests possible continuation toward support.

🔻 Lower Highs Formation reinforces bearish sentiment after failed breakout attempts.

Projection 🎯:

If the price closes below 105,531, a bearish continuation is likely, targeting the support zone at 101,000–100,500.

Conversely, a strong bounce above this level could delay the drop, but upside is capped below 110,000 unless a breakout occurs.

Summary:

🧭 Bias: Bearish below 105,531

📍 Targets:

Immediate: 105,531 (key level)

Bearish Target: 101,000

Invalidated if: price reclaims and closes above 110,000 with strength

📊 Trader's Note: Look for confirmation of breakdown with volume or candle close before short entry. Set tight risk management due to volatility.

BTC/USD: The Big Player’s Pullback Strategy – Steal Profits!🚨 BITCOIN HEIST ALERT! 🚨 The Ultimate Bullish Raid on BTC/USD (Master Plan Inside)

🌟 Hola! Bonjour! Hallo! Marhaba! Money Makers & Market Robbers! 🤑💸🔥

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting the GREAT BTC/USD HEIST! Time to LONG & escape near the Red Zone—where bears lurk & traps snap shut! Overbought? Risky? Perfect for a slick exit. 🎯 Take profits & treat yourself—you’ve earned it! 💰🏆

🔑 Heist Blueprint:

🎯 Entry: "The raid begins!"

Buy MA Pullback near Big Players’ Zone (102,000)

OR Buy above pullback—bullish momentum = green light! 📈

🛑 Stop Loss:

Thief’s SL = Nearest swing low (or under wick) → 4H candle rules!

Adjust based on risk, lot size & multiple orders.

🏴☠️ Target: 115,000 (Cha-ching! 💵)

⚡ Scalpers’ Quick Strike:

LONG ONLY!

Rich? Strike hard. Not? Join swing robbers!

Trailing SL = Your money’s bodyguard. 🔒

💥 Why BTC/USD?

Bullish fuel pumping! Fundamentals + Macro + COT + On-Chain Data = 📈🚀

👉 Full analysis? Check our bio links! 🔗

⚠️ WARNING: News = Market Chaos!

Avoid new trades during news.

Trailing SL = Profit protector!

💖 Support the Heist!

💥 BOOST THIS IDEA! 💥 Help us steal more profits & grow stronger!

🚀 Daily market heists = Easy money. Stay tuned—next raid coming soon! 🤑🐱👤

BTCUSD Wave Count: Bitcoin Unfolding Wave ((5)) ?Hello Friends,

Welcome to RK_Chaarts,

Let's analyze the Bitcoin chart today using Elliott Wave theory. As we can see, Bitcoin recently made a high around $112,000 on 23rd May 2025. We've marked this as the completion of Primary Degree Black Wave ((3)). After that, it dropped to complete Wave ((4)) on 31st May 2025. Now, it's moving up, possibly unfolding Wave ((5)). According to Elliott Wave principles, Wave 2 cannot retrace more than 100% of Wave 1. So, our nearest invalidation level is the 31st May's low at $103000. If the price sustains above this level, we can expect it to move towards $115,000 as a Projected Target of wave ((5)). However, if it breaks below the invalidation level, we'll need to re-analyze the wave counts. We've also drawn some trend lines, marked in black dotted lines, which act as support and resistance. This is a 1-hour time frame chart. The red line marking the nearest invalidation level is crucial. If it breaks, we'll need to adjust our wave counts. If it holds, we can expect the price to move up towards $115,000. Let's see how the market unfolds. Please note that this is an educational analysis and not a trading tip or advice.

Analysis Summary

- Analyzing Bitcoin chart using Elliott Wave theory to understand market trends and potential price movements.

- Recent high around $112,000 on 23rd May 2025, & Recent Low around $103,000 on 31st May 2025 indicates a significant turning point in the market.

Wave Count

- Completed Primary Degree Black Wave ((3)) suggests a major uptrend has concluded.

- Completed Wave ((4)) on 31st May 2025 indicates a correction phase has ended.

- Possibly unfolding Wave ((5)) implies a new uptrend may be emerging.

Key Levels

- Nearest invalidation level: 31st May's low at $103,000 serves as a crucial support level.

- Projected Target: $115,000 represents a potential upside target based on Elliott Wave principles.

Elliott Wave Principles

- Wave 2 cannot retrace more than 100% of Wave 1: a key rule governing wave relationships.

- Wave ((5)) projection based on Fibonacci ratios and wave extensions.

Chart Details

- 1-hour time frame chart provides a detailed view of recent price action.

- Trend lines marked in black dotted lines highlight key support and resistance levels.

- Red line marking nearest invalidation level is crucial for validating the wave count.

Important Notes

- Breaking below the invalidation level would require re-evaluation of the wave count.

- Sustaining above the invalidation level increases confidence in the projected target.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

BTCUSDT to bounce from 4h supportHere is an idea for trade on BTCUSDT. The price is coming close to the 4h support zone 4HS1.

It is likely that it will find support there and bounce from there towards 4h resistance 4HR1 and possibly towards 4HR2.

We will take some profit at 4HR1 level if the price reaches there and look to refill the position on any pullback.

We will also reevaluate if the price is really heading towards 4HR2 or likely to go around 96k-97k before fueling up for upward move.

Still bullish, it is recommended to focus on going long.Earlier, Bitcoin reached a weekly high of $106,518 before pulling back due to market liquidation, with total market liquidations exceeding $669 million. Bitcoin has closed higher for five consecutive weeks on the weekly chart, forming a "higher highs and higher lows" upward pattern, rising nearly 43.75% from its recent low. However, it encountered resistance near the all-time high of $109,588 and failed to break through. Currently, Bitcoin is trading in the $100,000-$110,000 range, with strong support at $100,000 and $90,000, and key resistance at $110,000.👉👉👉

After Bitcoin previously broke through $105,500, the moving averages showed an upward trend, and the RSI was in the overbought zone, indicating strong bullish momentum.

Overall, under the combined influence of news and technical factors, the Bitcoin market on May 19th showed a short-term volatile but long-term optimistic trend. Investors need to closely monitor changes in key support and resistance levels, as well as the impact of market news, and make investment decisions cautiously.

BTCUSD Trading Strategy

buy @ 102500-102700

sl 101000

tp 103800-104000

If you think the analysis helpful, you can give a thumbs-up to show your support. If you have different opinions, you can leave your thoughts in the comments. Thank you for reading!👉👉👉

Bitcoin still has strong supportThe RSI index is in a neutral-to-strong zone but has retreated from earlier levels, indicating that short-term upward momentum has weakened. The MACD indicator still maintains a bullish pattern, though the height of the bars has decreased. The price remains well above both the 50-day and 200-day moving averages, with the medium-to-long-term upward channel intact, keeping the overall structure in a strong bull market. However, there are signs of a potential short-term pullback.👉👉👉

On the daily chart, the Bitcoin price remains above the long-term trend breakout point since April. The 20-day moving average is at $103,260, forming a direct resistance level, while the 50-day moving average at $101,904 coincides with a key support level. As long as the Bitcoin price stays above this dynamic range, bulls still have opportunities.

In view of the current market conditions, short-term trading is recommended for investors to closely monitor the breakthrough of key support and resistance levels. If the price pulls back to the $100,000-$101,000 range and finds support, while forming daily K-line doji or long lower shadow patterns, appropriate position increases can be considered, with targets set at $105,000. After a breakthrough, the target can be further adjusted to $110,000. At the same time, due to market uncertainties and short-term pullback risks, investors should control their position sizes and avoid excessive leverage and blind chasing of gains or panic selling.

BTCUSD Trading Strategy

buy @ 102500-102700

sl 101000

tp 103800-104000

If you think the analysis helpful, you can give a thumbs-up to show your support. If you have different opinions, you can leave your thoughts in the comments. Thank you for reading!👉👉👉

Bitcoin remains fluctuating at a high levelThe overall market trend is largely in line with my analysis chart. Today, the Bitcoin market shows a pattern of high-level fluctuations and a slight decline. The RSI index is 40.47, having retreated from the overbought area, indicating short-term pullback pressure. However, although the momentum of the MACD indicator has weakened, it still maintains a bullish trend.Moreover, the price is far above both the 50-day moving average and the 200-day moving average, and the medium- and long-term upward channel remains intact, with the overall market in a strong bullish structure.

The operation suggestion is mainly to go long on the pullback, and patiently wait to enter the market at the key position.👉👉👉

BTCUSD Trading Strategy

buy @ 103000-103200

sl 101000

tp 104200-104500

If you think the analysis is helpful to you, you can give a thumbs-up to show your support. If you have different opinions, you can leave your thoughts in the comments. Thank you!👉👉👉

Strategic Analysis of Bitcoin for Next WeekRecently, Bitcoin has broken through the $100,000 mark, and its market dominance has risen to over 60%. Investors are highly bullish. Such a positive market sentiment is likely to attract more investors to enter the market, further driving up the price. 👉👉👉

In the short term, the price of Bitcoin has continuously broken through multiple key technical resistance levels. For example, on May 8th, it broke through the psychological barrier of $100,000, demonstrating strong bullish momentum. The market dominance has risen to over 60%, and investors are highly bullish. Such a positive market sentiment is likely to attract more investors to enter the market, further driving up the price.

BTCUSD Trading Strategy

buy @ 103500-103200

sl 101000

tp 104300-104600

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!👉👉👉

BTC/USDT Crypto Heist - Bullish Breakout Blueprint!🔥 Thief Trading Style: BTC/USDT Bullish Heist Plan 🔥

Greetings, Money Makers & Market Robbers! 🤑

Ready to execute a daring heist in the Bitcoin vs. Tether (BTC/USDT) crypto market? 📈 Our Thief Trading Style combines technical precision and fundamental insights to target a bullish breakout. Follow this charted strategy to ride the wave and exit before the risky Red Zone. Let’s grab those profits together! 💪🎯

---

📊 Trade Setup: The Heist Plan

- Market: BTC/USDT (Crypto) 🌐

- Bias: Bullish Breakout 🌟

- Timeframe: 1D (Swing Trade) ⏰

Entry 📈:

- Breakout Entry: Wait for a clean breakout above the Moving Average (MA) at 108000. Place Buy Stop orders just above 108000 to seize the momentum. 🚀

- Pullback Entry: For lower-risk entries, set Buy Limit orders at the recent 15M/30M swing low (e.g., 105000-106000) to catch pullbacks. 📍

- Trader Tip: Set a TradingView alert for the 108000 breakout to stay ahead of the move! 🔔

Stop Loss 🛑:

- Breakout Traders: After the breakout confirms, place your Stop Loss below the recent 1D swing low at 96000 to guard against reversals. ⚠️

- Pullback Traders: Tailor your Stop Loss to your risk appetite (e.g., 1-2% of account). Adjust based on lot size and multiple orders. 📏

- Risk Alert: This heist is high-stakes! Stick to disciplined position sizing to protect your capital.🔥

Target 🎯:

- Aim for 122000, near the risky Red Zone (an overbought area prone to consolidation or reversal). 🏴☠️

- Exit Strategy: Consider taking profits early if bearish signals (e.g., high volume, reversal candles) emerge near 122000. 💸

Scalpers 👀:

- Stick to Long-side scalps with tight trailing stops. Join swing traders for the full heist or scalp quick moves if your capital allows. 💰

---

📡 Why This Heist Has Potential

BTC/USDT is in a neutral trend with strong bullish prospects, driven by:

- Technicals: A breakout above the 108000 MA, backed by higher lows on the 1D chart, signals robust momentum. 📊

- Fundamentals: Institutional buying and positive crypto sentiment (check COT reports) fuel upside potential. 📰

- Seasonal Trends: Bitcoin often rallies in Q2, aligning with our setup. 📅

- Intermarket Factors: USD weakness and altcoin strength could lift BTC higher. 🌎

---

⚠️ Risk Management: Secure Your Gains

- News Caution: Skip new trades during major news events (e.g., CPI, FOMC) to avoid volatility spikes. 🗞️

- Trailing Stops: Use trailing Stop Loss to lock in profits as price nears 122000. 🔒

- Position Sizing: Limit risk to 1-2% of your account per trade for a safe heist. 🚨

---

💥 Power Up the Heist! 💥

Join our Thief Trading Style crew by liking, commenting, and following for more high-energy trade plans! 🚀 Your support strengthens our market raids, helping us profit with precision. Let’s conquer BTC/USDT together! 🤝🏆🎉

Stay Sharp: Another heist plan is on the horizon. Keep your charts locked and loaded, traders! 🐱👤😎

#BTCUSDT #Bitcoin #Crypto #Bullish #SwingTrading #Breakout

BTCUSDT: Drops Towards $53000 region may help us hitting $80000.BINANCE:BTCUSDT price currently in making of AB=CD pattern, it is likely to touch and reject at the $53000 which area remain crucial for most of the swing investors. The following news we can significant impact in the crypto market also 50k to 53k area remain extremely bullish. With accurate entry at 530000 area when we can target 80-100k possibly.

Bitcoin has pulled back after a substantial riseThe price of Bitcoin showed a trend of rising first and then making a small correction. On that day, the price rose after getting support near $93,500 and reached around $97,500 at its highest point, before pulling back somewhat.👉👉👉

The bulls in the market have shown strong performance, and the price has significantly increased at one point. However, we still need to be cautious about the potential pullback risks brought by the bearish divergence at the top and the resistance level above.

BTCUSD Trading Strategy

buy @ 94000-94370

sl 93000

tp 95000-95500

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!👉👉👉