#BTC ideal target zone has been achieved📊#BTC ideal target zone has been achieved✔️

🧠From a structural perspective, the ideal target zone of the hourly bullish structure has been fully achieved, so the corresponding decline is very reasonable. Moreover, the daily closing price of the candlestick chart is lower than the downward trend line, so we failed to successfully break through and stabilize. The downward trend at the daily level is still intact, so we need to be alert to the risk of further decline.

➡️Because of the risk of further decline, I closed the long position in advance yesterday. Although I finally reached the ideal target zone, I would also feel distressed, but trading is like this, there are gains and losses. When the market goes crazy, what we need is not a more sophisticated technical analysis, but a calm observation of the greedy self in the mirror.

➡️If the market rebounds further, then the resistance zone we can pay attention to is 84576-86000. 📉

➡️If the market falls further, then the support zone we can pay attention to is 78363-79500. 📈

Let’s see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

BTCUSDTPERP

"Bitcoin vs Tether" Crypto Market Heist Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USDT "Bitcoin vs Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (87000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 2H timeframe (83000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 93000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

BTC/USDT "Bitcoin vs Tether" Crypto Market Heist Plan (Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BTCUSDT, We were moved like ...Hello everyone

According to the chart that you can see the price movement was exactly moved to our route but at this time we expect because of the reason in world and US Reciprocal Tariffs at this time Gold movement is important after the Gold start the corretion wave the smart money comes to the cryptocurrency market and we expect the excitement movement.be patient until ...

Be Lucky

AA

#BTC #BTCUSD #BTCUSDT #BITCOIN #LONG #SWING #Analysis #Eddy#BTC #BTCUSD #BTCUSDT #BITCOIN #LONG #SWING #Analysis #Eddy

BTCUSDT.P Swing Long Analysis With Entry Point

This is my first possible scenario and analysis of Bitcoin's future trend.

This Analysis is based on a combination of different styles, including the volume,ict & Price Action Classic. (( Head & Shoulder Pattern ))

Based on your strategy and style, get the necessary confirmations for this Swing long to enter the trade.

Don't forget risk and capital management.

Entry point already touched : 🟢 79285.50

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

🗒 Note: The price can go much higher than the first target, and there is a possibility of a 500% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

Spot Investing : ((long 'buy' position)) :

🟢 Entry 1 : 79285.50

🟢 Entry 2 : 61845.77 (( This Entry is for secound scenario ))

First entry point calculations :

⚪️ SL : Behind the last shadow created.

⚫️ TP1 : 250000 ((215.32%))

⚫️ TP2 : 500000 ((530.63%))

⚫️ TP3 : 999000 ((1160.00%))

‼️ Futures Trading Suggested Leverages : 3-5-7

The World Let it be Remembered...

Dr. #Eddy Sunshine

4/4/2025

Be successful and profitable.

Do you remember my first Bitcoin swing long signal entry & targets?

My first swing long signal was provided on BTC, which was spot pumped by more than 150% and was profitable :

Bitcoin (BTC/USD) Technical Analysis: Breakout or Rejection at K200 EMA (Blue Line): 84,124 – This is a long-term trend indicator.

30 EMA (Red Line): 83,925 – A short-term trend indicator.

Key Levels

Resistance Point: Around 83,925 (marked in blue).

Support Zone: Around 82,184 (Stop Loss zone).

Target Point: 88,197, indicating a potential 6.34% upside.

Potential Trade Setup

Scenario 1 (Bullish Case):

If price breaks above resistance (83,925) and EMA 200, then a move towards 88,197 is expected.

A breakout confirmation might lead to an uptrend continuation.

Scenario 2 (Bearish Case):

If price rejects at resistance (83,925) and falls back below the support zone (82,184), a downward move could happen.

Pattern Analysis:

The chart suggests a potential accumulation phase before a breakout.

Possible retest of resistance before a rally.

Conclusion

Bullish above 83,925, targeting 88,197.

Bearish below 82,184, with potential downside.

Price action near the 200 EMA is crucial for the next move.

#BTC tests the resistance zone again!!📊#BTC tests the resistance zone again!!

🧠From a structural perspective, the bullish structure is still intact, bullish expectations still exist, and the ideal target zone (86500-88188) has not yet been achieved, so we can still keep a small number of positions to look forward to this possibility.

➡️However, at present, we are testing the downward trend line at the daily level again, and whether it can be successfully broken through is still unknown, so we are conservative and lock in 80% of the main profits, and don’t chase the resistance zone.

➡️If it breaks through successfully, it will also reach the ideal target zone of the bullish structure, so new long transactions need to observe whether it can stabilize above the downward trend line, otherwise it should not be too optimistic.

⚠️Note that if the downward trend line cannot be successfully broken through, we need to be wary of the risk of further decline.

Let’s see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

#BTC reaches resistance zone📊#BTC reaches resistance zone✔️

🧠From a structural point of view, we have built a bullish head and shoulders structure in the green buy zone, so such a rise is very reasonable. And the market reached the resistance zone of 85000-86000 as expected.

➡️It is no problem to lock in profits after the target is achieved. Although it is currently in the resistance zone, there is no short signal, and the ideal target zone of the bullish head and shoulders structure (86500-88188) has not been achieved, so there will be some contradictions.

➡️Therefore, we need to pay attention to the short signals that appear in the resistance zone, or try to participate in some short trades after the ideal target zone is achieved, otherwise wait patiently for the callback to appear before participating in long trades, and do not chase the rise in the resistance zone.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

Bitcoin (BTC/USD) Short Trade Setup: Resistance Rejection & TargThis chart is a Bitcoin (BTC/USD) 15-minute price chart from TradingView, showing a potential short trade setup based on technical analysis. Here’s a breakdown of the key elements:

1. Resistance Zone & Short Setup

The purple highlighted area represents a resistance level around $85,358.

Price is consolidating within this resistance zone, suggesting a potential reversal.

The expected scenario involves a price rejection from this resistance, leading to a downward move.

2. Moving Averages

EMA (200, blue line) at $83,433: A long-term trend indicator suggesting a strong support zone.

EMA (30, red line) at $84,657: A short-term trend indicator, currently above the price, indicating a potential bearish setup if the price moves below it.

3. Target & Stop-Loss Le

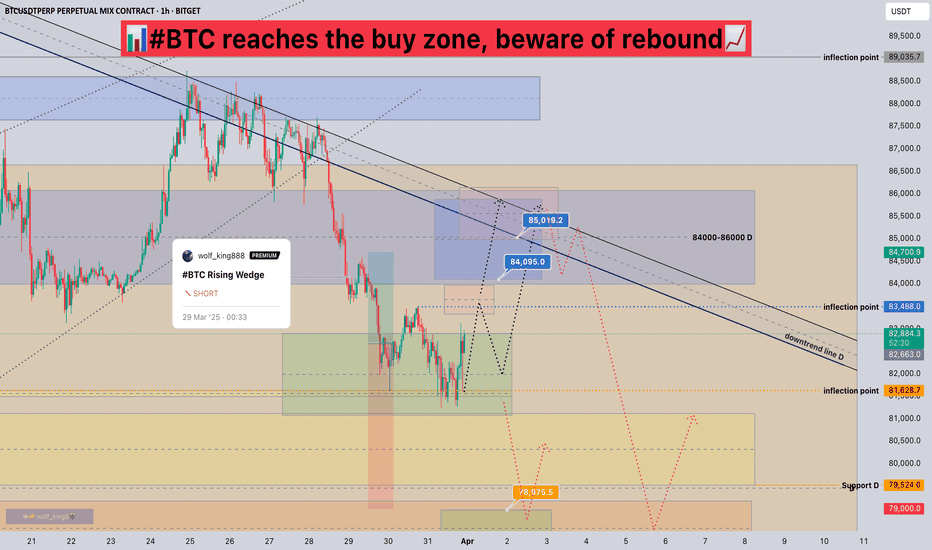

#BTC reaches the buy zone, beware of rebounds📊#BTC reaches the buy zone, beware of rebounds📈

🧠From a structural perspective, the goals of the short structure we built in the resistance zone have all been achieved, so we need to be wary of the risk of rebounds. If a bullish head and shoulders structure can be built near the buy zone in the future, then we expect the downtrend to reverse from here.

➡️If we go straight up from here, the resistance zone worth our attention is 85000-86000.

➡️If we continue to fall, the next support zone worth our attention is 78000-79000.

⚠️Note that overlapping support and resistance zones will change as the structure changes, so we need to keep an eye on the changes in the structure to update the trading plan.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

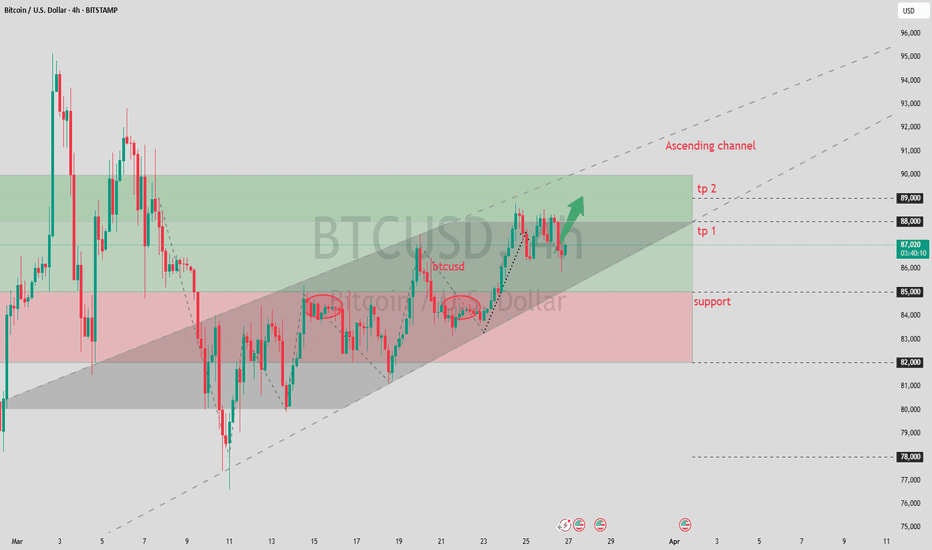

#BTC Rising Wedge📊#BTC Rising Wedge📉

🧠From a structural perspective, we started to fall after building a short structure near the blue resistance zone and the downward trend line. Because it is a downward trend line at the daily level, we need to be wary of a deep pullback of at least $5,000+.

The first support area can be watched around 82,662-83,800.

The second support area can be watched around 81,112-81,628.

➡️From a graphical perspective, the previous 4-hour upward trend has ended because a classic rising wedge model has been formed, and we generally fall according to this model.

➡️From a cyclical perspective, the daily downward trend may be coming to an end. Because we are currently in the daily support area and have been consolidating here for a long enough time, a healthy pullback is a good time for us to participate in long trades.

Let's take a look👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

U.S. Econ Shocks: Bitcoin & Profit SignalsThe latest U.S. economic data has brought significant impacts. The core PCE inflation witnessed a 0.4% month - on - month increase, hitting the highest growth in a year, with a year - on - year rise of 2.8%, exceeding market anticipations. Meanwhile, the long - term inflation expectation from the University of Michigan has soared to a 32 - year high, intensifying market concerns about inflation's resurgence. Currently, the market remains enveloped in macro - risks, pending a softening of market sentiment.

Turning to the Bitcoin market, as depicted in today's price trend (the current BTCUSDT price is $82,338.01, dropping by $2,086.37, a 2.47% decline), the K - line chart analysis indicates a downward trend. The Williams indicator signals an oversold condition. Additionally, trading volume has contracted recently, with both price and volume decreasing, suggesting a sluggish and inactive market.

Nevertheless, if Bitcoin can stabilize above $82,000 and there are signs of capital reflux, gradual position - building may be considered, with a target price set above $90,000. Investors must recognize that the Bitcoin market brims with uncertainties. Variables such as forthcoming U.S. economic data, regulatory policies, and geopolitical scenarios will all sway Bitcoin prices. In this volatile financial landscape, meticulous analysis and judicious decision - making are of utmost importance for investors navigating the Bitcoin market.

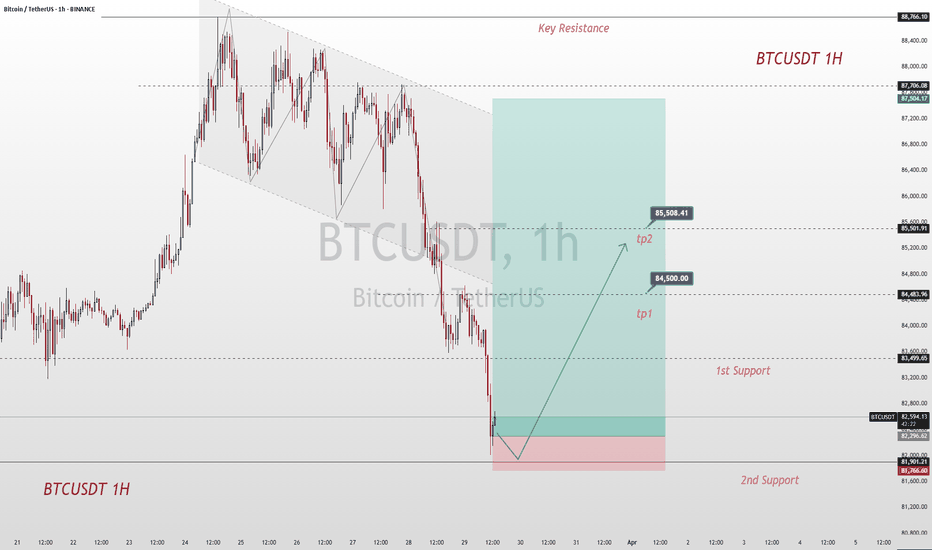

BTCUSDT

buy@82000-83000

tp:84500-86500

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

15-Min Bitcoin Setup – Quick Scalping Opportunity?First of all, I must say that this is a short-term analysis in a 15-minute time frame . Please be careful .

Let's take risks while respecting capital management. Be sure to respect capital management.

Bitcoin ( BINANCE:BTCUSDT ) is currently trading in the support zone($84,120_$81,500) , Potential Reversal Zone(PRZ) near the lower line of the ascending channel .

In terms of Elliott Wave theory , it seems that Bitcoin could complete its 5 bearish waves near the lower line of the ascending channel .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect Bitcoin to be able to rise to at least $85,400.

Cumulative Short Liquidation Leverage: $86,397_$85,760

Cumulative Long Liquidation Leverage: $84,262_$83,336

Note: One of the reasons for Bitcoin's decline is the decline in US indices such as CME_MINI:NQ1! , SP:SPX , and TVC:DJI .

Note: If Bitcoin falls below $83,000, we can expect more dumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

The Global BTC Shake out is coming before 1 million BTC in 2037I believe it worth stating that we might be in a moment where bitcoin is gonna shake everyone out and make everyone sell or at least all those who think 1 million BTC is coming soon. The great Bitcoin reset cycle will occur eventually before true mass adoption... we could very well retest $15,000 as bottom sometime next year.. if true BUY and hodl and invest consistantly for a whole decade and reap the reward of a 1 million bitcoin probably in 2037-38 and Bitcoin by then will be nearly on par with golds market cap by then or below it. And youll become among the weathiest of the wealth.

XLMUSDT, We are near buy zone areaHello everyone

According to the chart that you can see , the price is in correction wave and we think the price should come and do the end of corretion in buy zone area and after that is ready to move up , you can buy in 2 part in each of the buy zone area and after that at least 50% percent profit is near to us.

Be lucky

AA

BTCUSDT - Low Time Frame Support Level I believe that BTCUSDT is at a critical level right now, and this blue box combined with the blue line is where we could see some price reaction. However, don't expect a major move, this is a low timeframe zone that might only give us smaller, more precise opportunities.

🔹 What To Watch For:

Reaction Potential: If the price touches this blue box and blue line, there may be a short-term reaction, but don't overestimate it.

Low Timeframe Focus: Keep an eye on the lower timeframes for breakouts or rejections around these areas.

Patience Is Key: This isn't a large move zone, so we will wait for confirmation before acting.

💡 Stay Smart: Always trade with confirmation. If the price moves fast and unexpectedly, we won't chase it. Stay in control, and wait for the right signals!

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..