#BTC Ascending Triangle📊#BTC Ascending Triangle📈

🧠From a structural perspective, we have been consolidating sideways in the blue resistance area to digest the selling pressure here, so we need to be alert to the risk of further surges. The resistance to note is around 89,000-90,000.

➡️From a graphical perspective, the price is gradually being compressed to form an ascending triangle. Generally, we regard this model as a signal that the trend is about to end. We are currently in an upward trend at the 4h level, so we need to be alert to the correction after the trend ends.

⚠️Note that if we fall below the yellow turning point 86,984, the market will choose to break down, which means that the correction phase will start early.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

BTCUSDTPERP

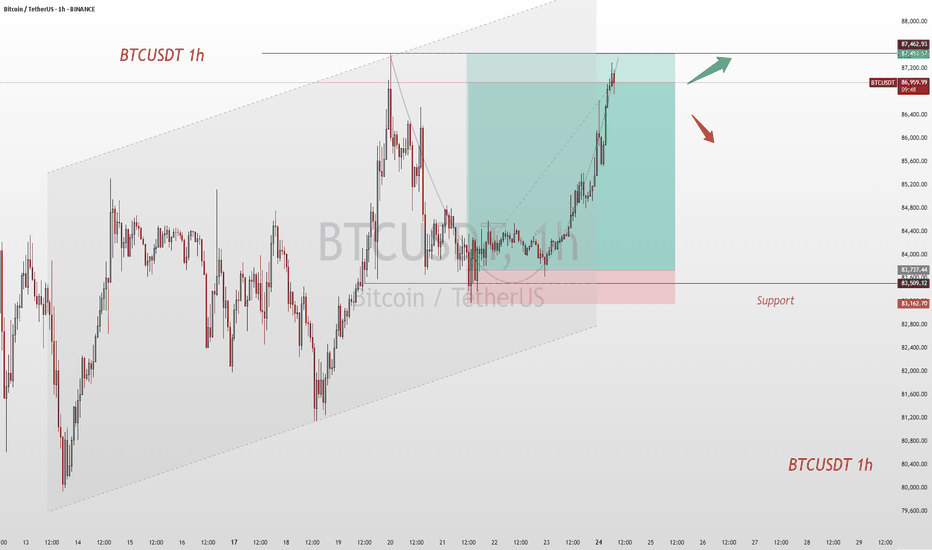

BTC's Bull Run: Profit Realized, Resistance AheadCurrently, BTC is hovering around $88,000. We had already achieved our profit target yesterday. Ever since BTC broke through the $85,000 mark, it has been rising continuously. The market is in a bullish - dominated trend, with strong buying power driving the price up steadily. Although it's in an uptrend, there's uncertainty about its future movement as it hasn't broken through the $89,000 - $90,000 resistance range. If it fails to break through this resistance zone effectively, the price may decline again eventually.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

BTC/USDT:Pay attention to the resistance zone.BTC fluctuated within the forecast and reached the profit point. However, the 88K-89K resistance area needs to be watched, and if it cannot be effectively broken this week, then it will fall

This week, the BTC trading strategy was completely correct and the account made more than 200% profit in two weeks

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income,You can follow the link below this article

BTC OVERVIEW AND TRADE IDEA.BTC has break through previous high and with strong volume and now trading at 87200, expecting price to fill bearish FVG at 87700 and then drop to our next buy zone which is 85600 and target will be 92k. This buy zone is an internal liquidity as FVG and its also below sell side liquidity and important fibb levels.

BTC Rejected at $89K, Uptrend Holds. Bullish Bets?BTC faced rejection at the $89,000 resistance level yesterday, triggering a pullback. However, the overall uptrend remains intact. Investors may consider long positions on signs of stabilization after this corrective move.

BTCUSDT

buy@84500-85500

tp:87000-88000

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

BTC Today's strategyYesterday's chart already shows an upward channel for BTC, let's continue to hit the resistance area of 88K-89K

btcusdt buy@85.5K-86K

tp:88K-89K

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income, you can contact me

Bitcoin (BTC/USD) Bullish Momentum: Key Levels and Trade Setupuddy'S dear friend 👋 SMC Trading Signals Update 🗾 🗺️

Technical Analysis:

Timeframe: 4-hour chart

Current Price: $88,244

Trend: Uptrend within an ascending channel

Supply Resistance Zone: $92,721 (Potential reversal area)

Fair Value Gap (FVG) Support Zone: $87,200 - $87,600

200 MA Resistance: Price is approaching the 200 Moving Average, which could act as resistance.

Key Levels:

1. Support:

FVG Zone (~$87,200 - $87,600) – Potential buy zone

Major Support: $86,649

2. Resistance:

$92,721 (Supply Zone) – Key target level

$90,000 Psychological Resistance

3. RSI Indicator:

Currently at 76.37, indicating overbought conditions.

A potential pullback could occur before further upside.

Mr SMC Trading point

Risk Management Strategy:

Long Entry: Near FVG Zone (~$87,200 - $87,600) if price retraces.

Stop Loss: Below $86,649 to limit downside risk.

Take Profit: Around $92,721 for a risk-reward trade.

Market Outlook:

Bitcoin remains bullish, but the RSI suggests a possible pullback before continuation.

A retracement into the FVG Zone may provide a better buying opportunity before the next leg up.

If price breaks below the FVG zone, the uptrend could weaken.

Pales support boost 🚀 analysis follow)

BTCUSDT: Target Achieved, What's Next for 87,500 Resistance?Upon reviewing the trading strategy devised last week, the current market price has successfully rallied to the targeted level. Bitcoin against Tether (BTCUSDT) is quoted at 86,780, registering an intraday gain of 0.84%. From the vantage points of technical analysis and market dynamics, the robust resistance level in the vicinity of 87,500 above emerges as a pivotal factor in determining whether the price can sustain its upward trajectory.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

BTC Today's strategyHi guys, it's a new week and the charts show it's moving up the channel

Looking back on the trading strategy we developed last week, we were undoubtedly successful. Now that the price has exceeded 87K, we still need to pay attention to the resistance of 88K, as it is the determinant of whether the upside can be

btcusdt buy@84.5K-85K

tp:87.5K-88K

We share various trading signals every day with over 90% accuracy.

Fans who follow us can get high rewards every day

If you want stable income, you can contact me.

#BTC reaches the second resistance zone📊#BTC reaches the second resistance zone✔️

🧠From a structural perspective, our goal of building a long structure from the second support zone has been achieved, so we continue to reduce our holdings by 30% here, locking in a total of 80% profit.

➡️After reducing holdings in the same cycle structure, we can try to use a small position to expect the continuation of the long force. Because we have not yet reached the upper edge of the rising channel and the downtrend line, I think we can still expect more.

⚠️The closer we are to the downtrend line, the more we should be wary of the risk of a pullback. If we start to fall directly from here, then we can pay attention to the buying opportunities in the yellow support zone.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

BTC/USDT "Bitcoin vs Tether" Crypto Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USDT "Bitcoin Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : The heist is on! Wait for the breakout of (80000) then make your move - Bearish profits await!"

however I advise placing Sell stop below the MA line or Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in swing/retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (84000) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 68000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, On Chain Analysis, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

The BTC/USDT "Bitcoin Tether" Crypto Market is currently experiencing a Neutral trend (there is a higher chance for Bearishness).., driven by several key factors.

⭐Fundamental Analysis

Fundamental analysis assesses Bitcoin's core metrics and market position. Here are the key factors:

Market Capitalization: Approximately 1.68 trillion USD, calculated using the circulating supply of 19.83 million BTC multiplied by the current price of 85,000 USDT. This reflects Bitcoin’s significant presence in the crypto market.

Trading Volume (24h): Around 31.44 billion USD, indicating robust liquidity and active trading activity over the past day.

Circulating Supply: 19.83 million BTC, out of a maximum supply of 21 million BTC, meaning 94.4% of the total supply is already in circulation.

Price Context: Bitcoin’s current price of 85,000 USDT is below its all-time high of 109,356 USD (reached on January 20, 2025), suggesting it is in a corrective phase but still well above historical lows (e.g., 2 USD on October 20, 2011).

Key Insight: Bitcoin’s fundamentals remain strong with a high market cap and active trading volume, but the price being below its recent peak indicates potential vulnerability or a consolidation period.

⭐Macroeconomic Factors

Macroeconomic conditions influence Bitcoin’s price as a global asset. Here are the relevant factors:

Global GDP Growth: Forecasted at 3.0% to 3.3% for 2025, suggesting moderate economic expansion worldwide. This level of growth may support risk assets like Bitcoin but isn’t strong enough to trigger significant inflation concerns.

Commodity Prices: Expected to decline by 5% in 2025, potentially reducing Bitcoin’s appeal as an inflation hedge since falling commodity prices signal lower inflationary pressure.

Stock Market Performance: U.S. stock indices are up 5% year-to-date (YTD) as of early 2025, reflecting a positive risk-on sentiment that often correlates with Bitcoin’s performance as a speculative asset.

Interest Rate Policies: The U.S. Federal Reserve is anticipated to cut interest rates in 2025, which could weaken the USD and make Bitcoin more attractive relative to USDT (a USD-pegged stablecoin). Conversely, the Bank of Japan may raise rates, though this has a limited direct impact on BTC/USDT.

Key Insight: Macroeconomic conditions are mixed—declining commodity prices may dampen Bitcoin’s inflation-hedge narrative, but stock market gains and potential Fed rate cuts could bolster its price.

⭐Global Market Analysis

Global market trends and events provide context for BTC/USDT’s performance:

Geopolitical Events: No significant geopolitical tensions are currently reported as of March 5, 2025. This reduces demand for Bitcoin as a safe-haven asset, unlike during periods of global unrest.

Central Bank Policies:

Federal Reserve: Expected rate cuts could weaken the USD, potentially driving BTC/USDT higher as investors seek alternatives.

Bank of Japan: Anticipated rate hikes may strengthen the JPY, but this has minimal direct influence on BTC/USDT unless it triggers broader currency shifts.

Commodity Trends: A projected 5% decline in commodity prices may ease inflation fears, indirectly reducing Bitcoin’s appeal as a store of value.

Global Risk Sentiment: Mixed stock market performance globally suggests a neutral stance on risk assets, with no strong directional push for Bitcoin.

Key Insight: Without major geopolitical catalysts, Bitcoin’s price may hinge on central bank actions, particularly Fed rate cuts that could weaken the USD and support BTC/USDT.

⭐Commitment of Traders (COT) Data

COT data offers insights into large trader positions, though specific BTC/USDT COT reports are not directly available. Here’s an inferred analysis:

Technical Ratings: Current indicators for BTC/USDT show a “sell” signal, with oscillators (e.g., RSI, MACD) and moving averages (e.g., 50-day, 200-day) trending strongly bearish.

Trader Positioning: The bearish technical outlook suggests large traders (e.g., speculators) are likely net short, anticipating further price declines.

Market Implications: This positioning could amplify downward pressure if selling continues, though a reversal in sentiment could trigger a short squeeze.

Key Insight: The inferred COT data points to bearish sentiment among large traders, aligning with technical signals and suggesting a downward bias.

⭐On-Chain Analysis

On-chain data reflects Bitcoin’s blockchain activity and holder behavior:

Unmoved BTC: Approximately 151,000 BTC, acquired at an average price of 97,800 USDT, has not moved despite recent volatility. This indicates strong conviction among holders at higher levels, potentially acting as resistance.

Accumulation Patterns: Some accumulation occurred near 83,000 USDT, suggesting buying interest at lower levels. However, rapid selling has dominated, with one-third of BTC accumulated between 96,000–97,500 USDT redistributed during the recent decline.

Supply Concentrations: Thin supply exists between 93,000 and 83,000 USDT, with notable clusters at 84,200 USDT (23,000 BTC), 86,900 USDT (25,800 BTC), and 88,900 USDT (46,000 BTC), indicating key price levels where holders may act.

Key Insight: On-chain data shows a mix of strong holding at higher prices and selling pressure at current levels, hinting at capitulation but also potential support forming near 83,000–85,000 USDT.

⭐Market Sentiment Analysis

Market sentiment reflects trader and investor psychology:

Social Media Sentiment: Posts on platforms like X reveal a split outlook—some traders predict a drop to 75,000–73,000 USDT, citing technical weakness, while others see a potential bullish reversal if support holds.

Sentiment Index: Total positive sentiment is estimated at 0.75 (on a scale from -1 to 1), suggesting moderate optimism despite recent declines.

Fear and Greed Index: Specific data is unavailable, but the mixed sentiment aligns with a neutral-to-slightly bullish stance.

Key Insight: Sentiment is mixed but leans slightly bullish, indicating cautious optimism amid uncertainty.

⭐Positioning

Positioning reflects how traders are aligned in the market:

Speculative Positions: Likely net short, inferred from bearish technical signals and COT-like trends, suggesting traders are betting on a decline.

Institutional Positioning: Hedge funds have increased exposure to Bitcoin ETFs, indicating growing long-term interest that could counterbalance short-term selling.

Market Dynamics: Short positions may dominate near-term price action, but institutional buying could stabilize or reverse the trend.

Key Insight: Short-term bearish positioning contrasts with potential long-term bullish institutional interest.

⭐Next Trend Move

The next likely price movement is based on current data:

Direction: Downward pressure is favored, driven by technical sell signals and bearish positioning.

Key Levels:

Support: 80,000 USDT; if breached, 75,000–73,000 USDT becomes the next target.

Resistance: 95,000 USDT, a level that would need to be overcome for a bullish reversal.

Triggers: A break below 80,000 USDT could accelerate selling, while holding above 85,000 USDT might signal stabilization.

Key Insight: The next trend move likely tests lower support levels, with a potential drop to 75,000–73,000 USDT if momentum persists.

⭐Other Data

Additional factors impacting BTC/USDT:

Institutional Adoption: Hedge funds are increasing exposure to Bitcoin ETFs, a bullish signal for long-term price support as institutional capital flows in.

Regulatory Changes: The SEC’s employee buyout program in 2025 could lead to shifts in crypto regulation, introducing uncertainty and potential volatility.

Market Trends: Bitcoin’s limited supply (21 million BTC cap) and growing mainstream acceptance bolster its long-term value proposition.

Key Insight: Institutional interest is a positive wildcard, but regulatory uncertainty could shake confidence in the near term.

⭐Overall Summary Outlook

Overview: On March 5, 2025, BTC/USDT at 85,000 USDT exhibits a cautiously bearish outlook. Technical sell signals, bearish trader positioning, and recent on-chain selling pressure point to downside risks. However, strong holding behavior at higher levels (e.g., 97,800 USDT), potential institutional support via ETF exposure, and a slightly bullish market sentiment suggest a reversal is possible if support holds. Macroeconomic factors like expected Fed rate cuts could weaken the USD and provide tailwinds, though declining commodity prices may temper Bitcoin’s inflation-hedge appeal. Risks include a drop below 80,000 USDT or volatility from regulatory shifts.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BTC/USD "Bitcoin vs Tether" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USD "Bitcoin vs Tether" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 93000

🏁Sell Entry below 84000

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 88000 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 92000 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 11000 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 68000 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future Prediction:

BTC/USD "Bitcoin vs Tether" Crypto market is currently experiencing a Neutral Trend (slightly Bearish🐼),., driven by several key factors.

1. Fundamental Analysis⭐⚡🌟

Fundamental analysis evaluates Bitcoin’s intrinsic drivers:

Adoption Trends:

Institutional inflows via Bitcoin ETFs remain strong, with $1.5 billion added in Q1 2025. MicroStrategy holds 300,000 BTC, reinforcing corporate adoption—bullish.

Regulatory Environment:

The U.S. signals a pro-crypto stance with talks of a strategic Bitcoin reserve, boosting confidence—bullish. However, global regulatory uncertainty (e.g., EU tax proposals) adds mild bearish pressure.

Halving Impact:

Post-2024 halving (April), supply issuance dropped to 450 BTC/day. Historical patterns suggest price appreciation 12-18 months later, supporting a bullish outlook for 2025.

Network Usage:

Transaction volume is up 10% year-over-year, driven by Layer 2 solutions (e.g., Lightning Network)—bullish for utility and value.

Inflation Hedge Narrative:

With U.S. inflation at 3.0%, Bitcoin’s appeal as a store of value grows—bullish, though tempered by short-term risk-off sentiment.

Detailed Explanation: Fundamentals are strongly bullish long-term due to adoption, supply scarcity, and macro trends. Short-term bearish pressures from regulatory uncertainty and profit-taking explain the current dip to 87,000.

2. Macroeconomic Factors⭐⚡🌟

Macroeconomic conditions influencing BTC/USD:

U.S. Economy:

Fed rates at 3.0% with no immediate cuts signal tighter conditions—bearish short-term as capital favors yield-bearing assets.

Unemployment steady at 4.2% supports economic stability—neutral.

Global Growth:

China’s GDP growth slows to 4.2%, reducing demand for risk assets like Bitcoin—bearish.

Eurozone PMI at 47.8 indicates contraction, pressuring global markets—bearish.

Currency Markets:

USD strength (DXY at 106) weighs on BTC/USD, as a stronger dollar reduces Bitcoin’s appeal—bearish short-term.

Commodity Prices:

Oil at $68/bbl and gold at $2,950 reflect a mixed risk environment—neutral for Bitcoin.

Geopolitical Risk:

Middle East tensions elevate safe-haven demand, but Bitcoin’s correlation with gold is weakening—neutral to mildly bearish.

Detailed Explanation: Macro factors tilt bearish short-term due to USD strength and global slowdown, countering Bitcoin’s long-term bullish fundamentals. This tension explains the current downward trend from higher levels.

3. Commitments of Traders (COT) Data⭐⚡🌟

COT data reflects futures positioning:

Speculative Traders:

Net long positions at 15,000 contracts, down from 25,000 at the 95,000 peak. Reduced bullishness suggests caution—bearish signal.

Commercial Hedgers:

Net short at 20,000 contracts, stable. Hedgers locking in gains indicate no panic—neutral.

Open Interest:

45,000 contracts, down 10% from February highs. Declining participation hints at fading momentum—bearish.

Detailed Explanation: COT data supports a bearish short-term view. Speculators unwinding longs and falling open interest align with the downward trend, though hedgers’ stability prevents a sharper collapse.

4. On-Chain Analysis⭐⚡🌟

On-chain metrics provide insights into Bitcoin’s network activity:

Exchange Balances:

2.6 million BTC on exchanges, up 5% in March. Rising supply suggests selling pressure—bearish.

Transaction Volume:

Daily volume at $10 billion, flat month-over-month. Lack of growth signals reduced buying interest—neutral to bearish.

HODLing Behavior:

70% of BTC unmoved for over a year (13.8 million coins). Strong holder conviction limits downside—bullish long-term.

Miner Activity:

Miners hold 1.8 million BTC, with minimal outflows. Stable miner behavior supports price floors—mildly bullish.

Realized Price Levels:

Realized cap indicates a cost basis of 78,000 for recent buyers, acting as support—bullish if held.

Detailed Explanation: On-chain data is mixed. Short-term bearish signals from exchange inflows contrast with long-term bullishness from HODLing and miner stability, suggesting a correction rather than a collapse.

5. Intermarket Analysis⭐⚡🌟

Correlations with other markets:

USD Strength:

DXY at 106 pressures BTC/USD inversely—bearish short-term.

S&P 500:

At 5,900, down 2% this week, reflecting risk-off sentiment. Bitcoin’s 0.6 correlation with equities adds downward pressure—bearish.

Gold:

At $2,950, gold rises as a safe haven, decoupling from Bitcoin—neutral to bearish.

Bond Yields:

U.S. 10-year yields at 3.8% attract capital away from risk assets—bearish.

Altcoins:

ETH/BTC ratio at 0.035, with altcoins underperforming Bitcoin, reinforcing BTC’s relative strength—mildly bullish.

Detailed Explanation: Intermarket signals are bearish short-term due to USD strength, equity declines, and yield competition. Bitcoin’s resilience versus altcoins offers some support, but broader risk-off trends dominate.

6. Market Sentiment Analysis⭐⚡🌟

Investor and trader mood:

Retail Sentiment:

Social media analysis shows 45% bullish sentiment, down from 60% at 95,000. Fear of further drops prevails—bearish.

Analyst Views:

Consensus targets range from 80,000 (short-term support) to 100,000 (Q3 2025), reflecting uncertainty—mixed.

Options Market:

Call/put ratio at 0.9, with balanced positioning. No strong directional bias—neutral.

Fear & Greed Index:

At 40 (neutral), down from 70 (greed) in February, indicating cooling enthusiasm—bearish shift.

Detailed Explanation: Sentiment has turned bearish short-term as retail investors react to the decline from 95,000. Analysts’ mixed views and neutral options activity suggest a wait-and-see approach, aligning with the current trend.

7. Next Trend Move and Future Trend Prediction⭐⚡🌟

Price projections across timeframes:

Short-Term (1-2 Weeks):

Range: 84,000 - 88,500

Likely to test support at 86,000-84,000 if selling persists; a bounce to 88,500 possible on relief rally.

Catalysts: U.S. economic data (e.g., CPI on March 12), ETF flows.

Medium-Term (1-3 Months):

Range: 80,000 - 92,000

Below 84,000 targets 80,000 (realized price support); above 88,500 aims for 92,000 if risk appetite returns.

Catalysts: BOJ policy update, institutional buying.

Long-Term (6-12 Months):

Bullish Target: 100,000 - 110,000

Driven by halving cycle, adoption, and inflation hedging—65% probability.

Bearish Target: 70,000 - 75,000

Triggered by global recession or regulatory crackdown—35% probability.

Catalysts: U.S. strategic reserve decision, Q3 GDP data.

Detailed Explanation: Short-term downside to 84,000 aligns with current bearish momentum. Medium-term consolidation reflects macro uncertainty, while long-term upside to 100,000+ hinges on fundamentals prevailing over temporary setbacks.

8. Overall Summary Outlook⭐⚡🌟

BTC/USD at 87,000 is in a short-term bearish correction within a broader bullish cycle. Fundamentals (adoption, halving) and on-chain HODLing support long-term gains, but macro headwinds (USD strength, global slowdown), COT unwinding, and risk-off sentiment drive the current downward trend. Exchange inflows and declining sentiment reinforce near-term weakness, with support at 84,000-80,000 likely to hold. Medium-term recovery to 92,000 and long-term growth to 100,000+ remain plausible if catalysts align.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#BTC reaches the second support, beware of rebound📊#BTC reaches the second support, beware of rebound⚠️

🧠From a structural point of view, we have built a short structure within the 1h level, so a pullback is reasonable. However, there is a long structure at the 4h level, so it is difficult for the structure within the small level to reverse the upward trend of the large level. And we have reached the second support level near 83545, so we need to be wary of the rebound.

➡️If the support here continues to be broken, then the next support area worth our attention is 80000-82000.

➡️If the rebound occurs, then the resistance area worth our attention is 85400-86000, and the extreme pressure is near 90000.

Let's see👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

3/24 BTCUSD Trading Signal: LongThis is a relatively healthy rebound. After breaking through the first resistance, it slowly rose to the second resistance, where it has been tested many times. The current shape is good and there is room for further rise.

Therefore, in the current transaction, it is recommended to take long as an important reference direction, and the target is near the resistance of 86K.

When the price rises to this point, the market is likely to confirm the validity of the area near the 85K support. If the support is confirmed to be valid, the price may rise to 86.8K-88K.

This chart represents a Bitcoin (BTC/USD) price analysis on a 30This chart represents a Bitcoin (BTC/USD) price analysis on a 30-minute timeframe. Here’s a breakdown of the key elements:

Supply Zone (Resistance) at ~$85,599

The price has approached this supply zone, which could act as a resistance level.

The expectation is that the price may struggle to break above this level and could reverse downward.

Demand Zone (Support) at ~$81,500 - $81,755

This is labeled as the "diamond zone," which could act as a strong support area where buying interest may emerge.

The price is anticipated to decline towards this level.

Projected Price Movement

The blue arrows suggest a bearish scenario.

The price might initially react to the supply zone, then break below the trendline, confirming a downtrend.

The target for this downward move is the demand zone around $81,500.

Trendline Break

A rising trendline is drawn, which currently acts as support.

If the price breaks below it, it would confirm a bearish momentum shift.

Conclusion

This chart suggests a short-selling opportunity near the supply zone, targeting the demand zone. However, traders should watch for confirmations such as a rejection from resistance and a break below the trendline before entering a trade.

BTC Nears Key Breakout: Can It Push Past 84.5K?Right then, BTC/USDT is at a bit of a crucial point at the moment. The buying range we flagged earlier, 82,000 - 83,500, has been left behind, with the price now sitting at 84,139.51 – up 0.06% on the day.

The target for taking profits is still 84,500 - 86,000, and we’re currently hovering near the lower end of that at 84,500. If it manages to break through that level, there’s a decent chance it could push higher – but it’s worth keeping an eye on whether the rally’s got enough steam to keep going.

Things to watch:

84,500 Breakout: If it cracks this level and holds, we could be in for more upside.

Momentum: Keep tabs on volume and market sentiment to see if this move’s got legs.

Pullback Risk: If it doesn’t break through, don’t be surprised if we see a bit of a dip.

BTCUSDT

Buy82000-83500

tp:84500-86000

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

BTC Today's strategySo far, BTC has fluctuated around 84K today, and it still fluctuates within our marked range. The strategy of selling high and buying low still works.

Today's BTC trading strategy:

btcusdt buy@83K-83.5K

tp:84.5K-85.5K

There is no large-scale selling by long-term holders in the market. Short-term holders have a significant impact on short-term movements. At present, geopolitical conflicts continue, trade frictions continue, and bitcoin and gold have historically performed well in times of economic uncertainty

Our investment strategy has achieved significant returns in the past two weeks. If you also want to double your capital, you can click on my link to get my trading strategy

BTC Today's strategySo far, BTC has fluctuated around 84K today, and it still fluctuates within our marked range. The strategy of selling high and buying low still works.

Today's BTC trading strategy:

btcusdt buy@83K-83.5K

tp:84.5K-85.5K

There is no large-scale selling by long-term holders in the market. Short-term holders have a significant impact on short-term movements. At present, geopolitical conflicts continue, trade frictions continue, and bitcoin and gold have historically performed well in times of economic uncertainty

Our investment strategy has achieved significant returns in the past two weeks. If you also want to double your capital, you can click on my link to get my trading strategy

BTCUSDT , we near to bullish runHello everyone

According to the chart that you see , we were in correction wave from the top until now , but the wave of correction is weakness and we think that the price wanna re-check the downward trendline and after that is ready to start bull run.

if you have any question and need help for managing your portfolio send us messages

Thank you

AA