#BTCUSDT: Minor Correction In Price Then $150,000?Hi everyone,

Hope you are doing great we are witnessing some minor bearish correction in the price and think this might be a sellers trap. We think $110,000 can be a good area to buy. Our target is at $150,000 area which look possible after looking at how price recently behaved.

Btcusdtsignal

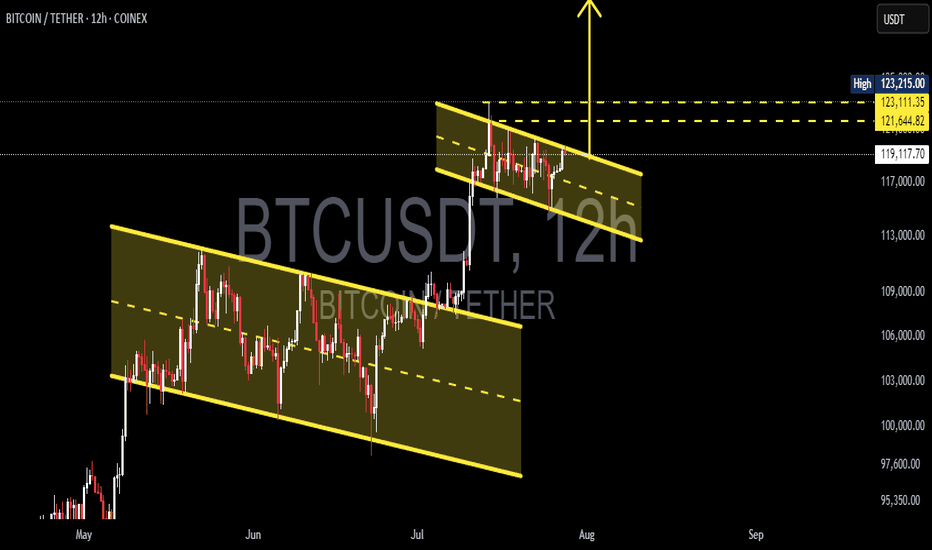

Double Bullish Flag on Bitcoin — Next Rally to $135K?📊 BTCUSDT (12H) In-Depth Analysis: Major Momentum Brewing

Bitcoin (BTC) is currently exhibiting a very promising technical structure — a Double Bullish Flag, a rare yet powerful continuation formation that often precedes strong upside momentum.

This dual-pattern structure reflects market strength and smart accumulation, with bulls maintaining control while allowing for healthy pauses before potential expansion to higher levels.

---

🔍 Technical Breakdown: Double Bullish Flag Structure

🔸 1. Primary Bullish Flag:

Formed after a sharp rally from around $95,000 to $113,000 (flagpole).

Price then consolidated within a clear descending channel, forming a classic Bullish Flag pattern.

Breakout from this pattern occurred in early July, confirming bullish continuation.

🔸 2. Secondary Bullish Flag (Mini Flag):

After the breakout from the main flag, BTC formed a second smaller flag pattern — a narrow descending channel from ~$123K to ~$119K.

This is known as bullish flag stacking — a pattern of "flag on top of flag", signaling trend strength and smart consolidation.

This mini-flag now acts as a launchpad for the next potential breakout.

---

🚀 Bullish Scenario: Preparing for a Breakout

If BTC breaks above the upper resistance of the mini flag (~$123,200), it will signal a fresh bullish continuation.

🎯 Potential Upside Targets:

Conservative target: $126,000 – $128,000

Full measured move target (from flagpole): $132,000 – $135,000

✅ Confirmation criteria:

Strong candle close above $123.2K

Accompanied by rising volume and upward RSI momentum (but not overbought)

---

🧨 Bearish Scenario: Breakdown and Retest

If BTC fails to break above the flag and instead drops below the flag support (~$119,400), we may see a short-term correction.

🔻 Key Support Levels:

$117,000 – minor horizontal support

$113,000 – $115,000 – strong demand zone and previous breakout area

⚠️ As long as price holds above $113K, the broader bullish trend remains intact. A pullback to this zone could offer a prime retest-buying opportunity.

---

📌 Key Price Levels to Watch:

Level Role

$123,200 Mini-flag resistance (breakout trigger)

$121,600 Mid-range resistance

$119,400 Flag support

$117,000 Horizontal retest zone

$113,000 Major support (trend invalidation if lost)

$132K – $135K Projected breakout target

---

💡 Conclusion: BTC in Critical Zone Before Potential Expansion

This Double Bullish Flag formation is one of the most technically constructive setups BTC has shown in weeks. It reflects a strong, patient market — with bulls preparing for another leg higher.

If the breakout from the second flag confirms, Bitcoin could rally toward $135,000, backed by momentum, volume, and clean structure. However, a breakdown would only signal a short-term cooldown unless support at $113K is lost.

🧭 Stay focused on breakout confirmation, volume spikes, and market sentiment. This could be the calm before a bullish storm.

#BTCUSDT #BitcoinBreakout #BullishFlag #TechnicalAnalysis #DoubleBullFlag #BTCMomentum #BitcoinRally #CryptoOutlook #BitcoinTo135K

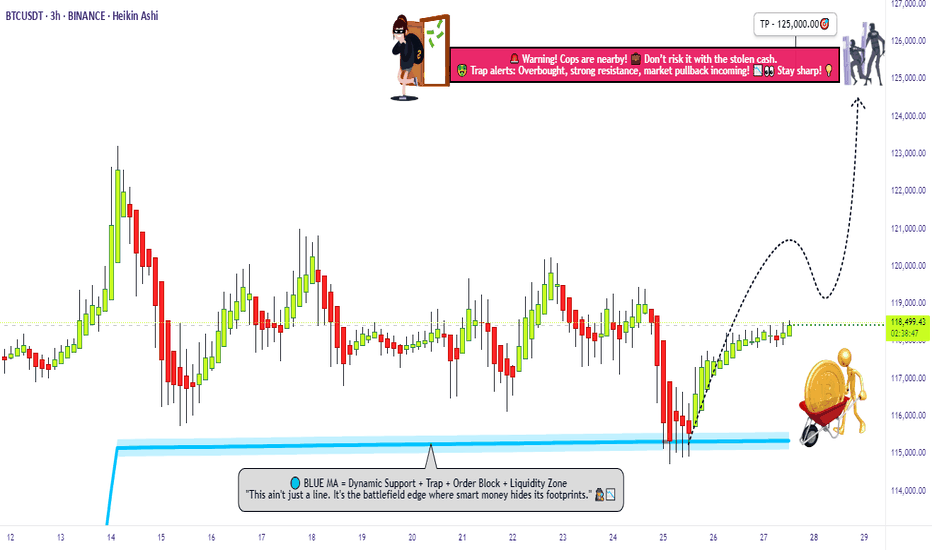

"Bitcoin’s Big Heist – Are You In or Out?"🚨 BTC/USDT HEIST MISSION – SWIPE THE BULL RUN BEFORE THE BEARS WAKE UP 💰💣

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Money Makers & Robbers, assemble! 🤑💰✈️💸

Here’s your decoded BTC/USDT “Bitcoin vs Tether” Crypto Market Heist Plan, fully loaded with Thief Trading Style 🔥 TA + FA combo. We’re prepping for a bullish breakout loot – eyes on the vault, ignore the noise.

🎯 PLAN OF ATTACK:

🎯 ENTRY (BUY ZONE):

💥 “The vault’s open—time to sweep!”

DCA/Layer your buy limit orders near the 15–30 min swing lows/highs for sniper pullback entries.

Use multi-entry method to stack positions (layering / DCA) as per your ammo (capital 💵).

🛑 STOP LOSS:

Set SL at the nearest swing low wick (4H TF) — around 115000.00, adjust based on your risk/load.

SL = insurance. Not optional.

🏁 TARGET:

Lock sights on 125000.00

🎉 Or… vanish with profits before the bear cops arrive.

🔎 MARKET BACKDROP & ANALYSIS:

📈 BTC/USDT currently signals bullish vibes on the swing/day horizon — fueled by:

Macro Fuel & Fundamentals

Sentiment Radar

COT Reports

On-Chain Pulse

Intermarket Clues

🚀 Connect the dots. The smart money's already prepping a breakout move.

🧲 Scalpers Note:

Stick to the long side only. No shorting the beast — unless you’re made of diamonds.

Secure your bag with trailing SLs.

⚠️ NEWS TRIGGER ZONE – TRADE WITH TACT:

📢 Upcoming high-volatility news events can spike charts.

Avoid new entries during releases and guard open trades with trailing SLs.

Protect the loot. Always.

💖 SUPPORT THE HEIST GANG: BOOST IT!

Smash that ❤️ to boost our thief squad’s momentum!

Every click powers this underground mission – making money with style, one pip at a time. 🎯💣💵

🚀 See you in the next heist drop.

Until then – Stay stealthy. Stay profitable. Stay legendary. 🐱👤💸🏆

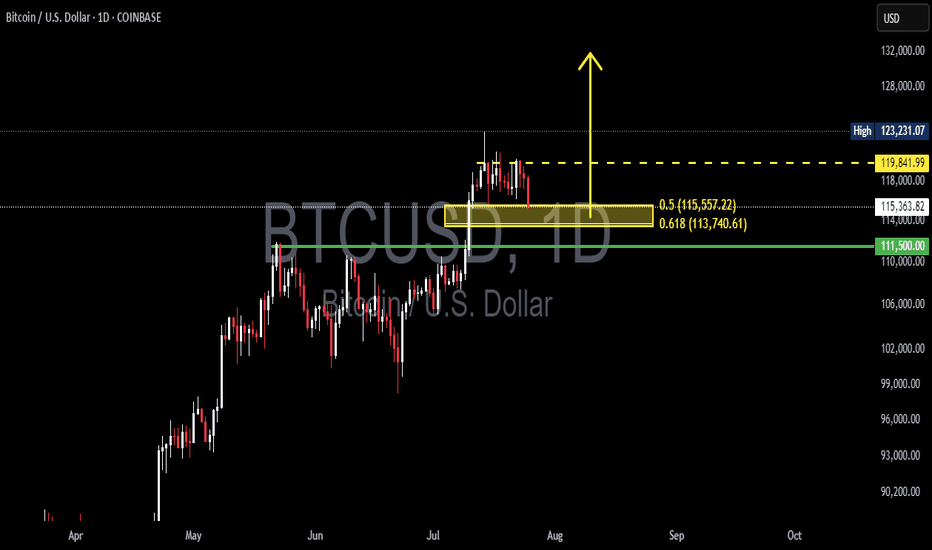

BTCUSD Daily Analysis – Golden Pocket Hold Before a Bullish?🧠 Chart Description & Market Structure:

The BTCUSD daily chart is showing a consolidation phase after forming a local high near $123,231. Currently, the price is retracing and approaching a key Fibonacci retracement zone between the 0.5 level ($115,557) and 0.618 level ($113,740) — also known as the Golden Pocket, which is often a strong reversal area.

---

📈 Bullish Scenario:

If the price holds within or just above the 0.5–0.618 Fibonacci zone (highlighted in yellow) and forms a bullish reversal candlestick (like a hammer, bullish engulfing, or pin bar), there’s a high probability for BTC to resume its uptrend.

Bullish upside targets include:

$119,842 as minor resistance.

$123,231 as the previous swing high and a key breakout confirmation.

A successful break above $123,231 could send BTC toward the next major targets around $128K–$132K.

---

📉 Bearish Scenario:

If the price fails to hold the 0.618 Fibonacci level ($113,740) and breaks down below the key psychological support at $111,500, a deeper correction may occur.

Downside targets:

$108K–$106K as the next major support zone.

A break below this could lead to the formation of a lower high structure and potentially trigger a bearish continuation.

---

📊 Pattern Observations:

Potential Bullish Flag or Rectangle Consolidation: The price action suggests horizontal consolidation after a strong rally — possibly a re-accumulation zone before a bullish continuation.

Golden Pocket Retest: Price is currently testing the Fibonacci 0.5–0.618 zone, often targeted by institutional buyers and technical traders as a potential entry point.

---

🧭 Key Levels to Watch:

Major Resistance: $123,231 (swing high)

Minor Resistance: $119,842

Fibonacci 0.5: $115,557

Fibonacci 0.618: $113,740

Key Support: $111,500

---

🔖 Conclusion:

BTC is currently in a decision zone. Price action within the $115,500–$113,700 range will be crucial. Will this be a healthy retracement before the next leg up — or the beginning of a deeper correction?

#BTCUSD #BitcoinAnalysis #CryptoTA #FibonacciRetracement #CryptoChart #BitcoinDaily #BullishSetup #BearishSetup #CryptoMarket

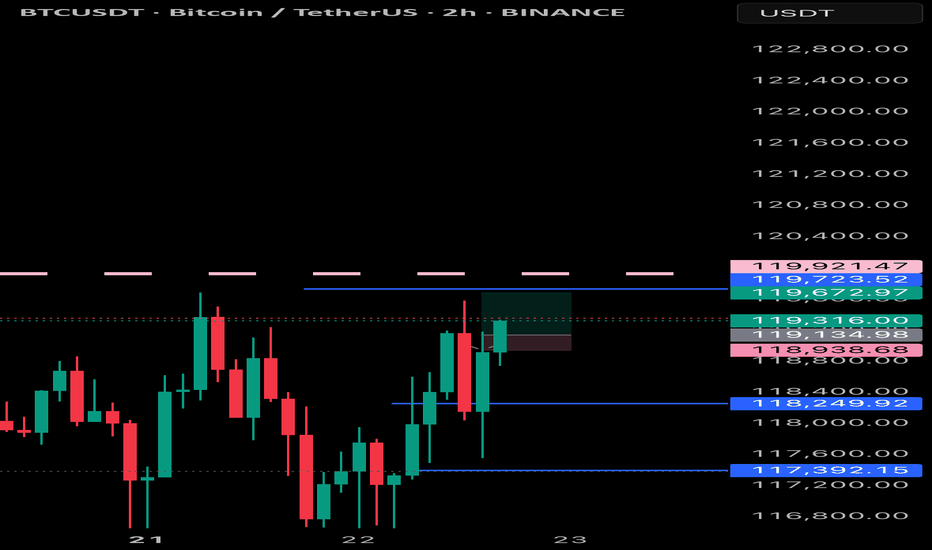

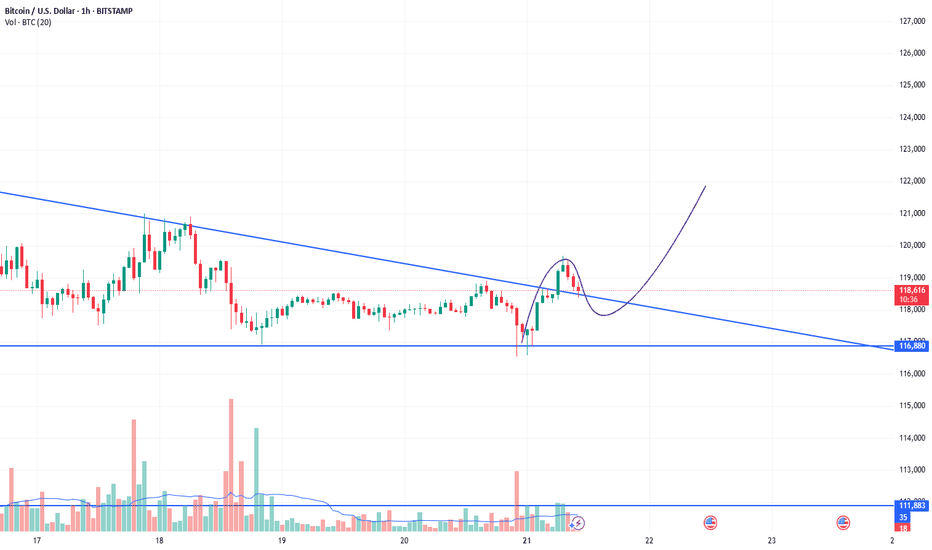

Btcusd:Huge trading opportunities and ideasBTCUSD's rebound after touching the position near 116180 this time is fast. From the trend observation. BTCUSD is still in a high consolidation stage. It has not broken the oscillation range for the time being. It can maintain selling near 120k. Buying near 11600 for range trading. It is expected that there will not be many trading opportunities in the London market. It will take until the New York market opens to see better trading opportunities.

BTCUSDBTCUSD also fell from a high level, reaching a high of around 119700, only 300 points away from the target of 120k. The price after the decline is now around 118600. Buying at a low level is the main focus. The reference buying point is 118500-118000. The target is above 120k. Stop loss 117300

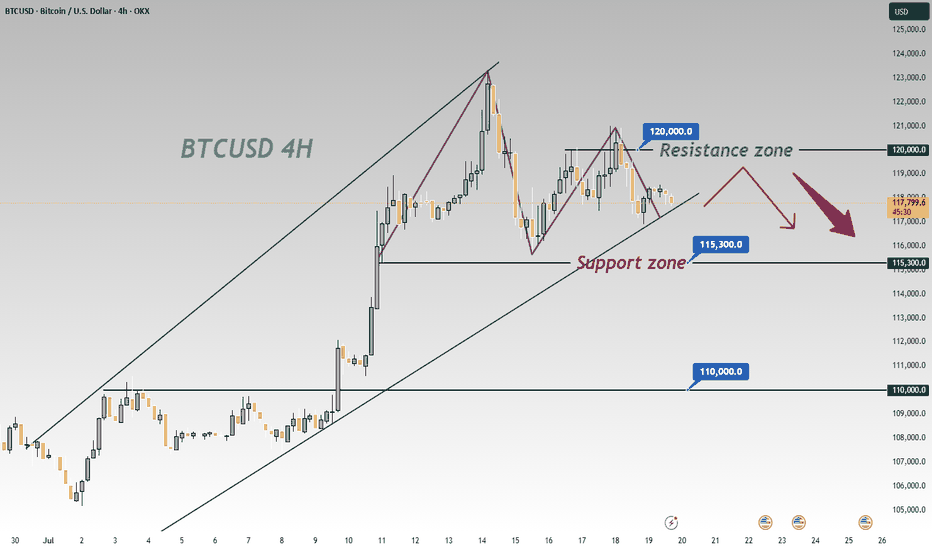

BTCUSD 4-Hour Chart Analysis: Range-Bound Trends & Key LevelsFrom the 4-hour chart of BTCUSD, the recent price movement shows obvious range-bound characteristics 📊. The upper zone around 120000 forms a key resistance level 🛑, where the bullish momentum has waned after encountering resistance 💨.

The lower level of 115300 is a significant support zone 🛡️. Previously, there was some buying support when the price retraced to this zone 👀. However, as the current price is pulling back from the resistance zone ↘️, if the bearish force takes the lead subsequently 🐻, the possibility of breaking below the 115300 support will increase ⬆️. Once it breaks below effectively 💥, the next key support level of 110000 will most likely become the target for the price to decline towards 🎯.

In terms of the short-term trend 📈, due to the obvious suppression from the resistance zone 🚧, the price will most likely continue the rhythm of testing the support downwards 🔽. In operation, one can pay attention to the breakdown situation of the support zone and layout trades accordingly 📝. Meanwhile, be alert to the possibility of a rebound after the price finds support in the support zone 🚀, and further confirmation of the direction needs to be combined with real-time K-line patterns 📊, trading volume 📈

🚀 Sell @119500 - 118500

🚀 TP 116500 - 115500

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

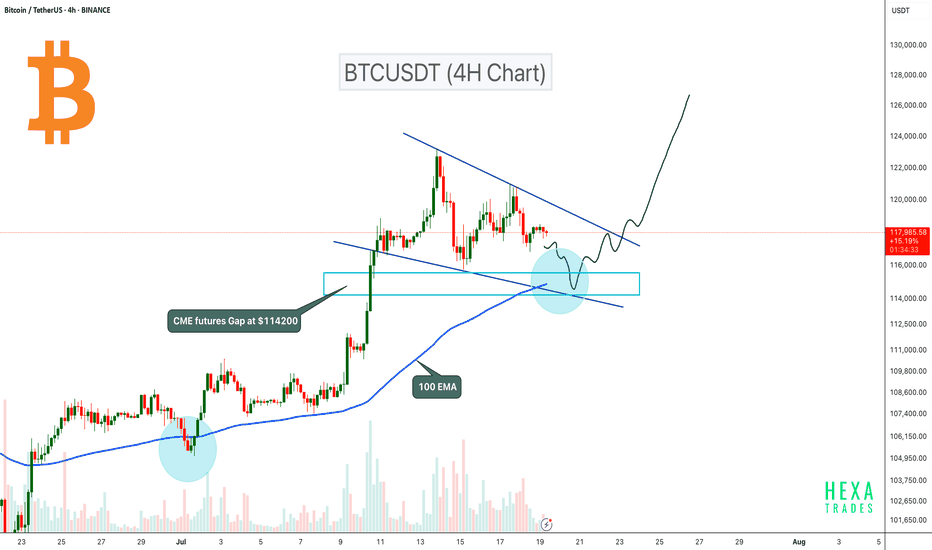

BTC Pullback Expected to $114K Before Next Leg Up!Bitcoin is currently consolidating inside a bullish flag pattern on the 4H timeframe. The price could retest the flag support, where the 100 EMA will act as dynamic support. Additionally, there is a CME futures gap at the $114,200 level, which also aligns with the 0.5 Fibonacci retracement level. Therefore, a retest to the $114,200 zone is likely before the next potential upward move.

A potential bullish reversal could occur if BTC retests this zone and confirms a bounce. A breakout from the bullish flag pattern could signal the next leg up.

Cheers

Hexa🧘♀️

BITSTAMP:BTCUSD CRYPTOCAP:BTC

Bitcoin Struggles Below $120K:Will the CME Gap Pull Price Lower?Bitcoin ( BINANCE:BTCUSDT ) has been experiencing a high momentum bullish trend in recent days, which few people expected, especially when it crossed $120,000 . However, in the past 24 hours , Bitcoin has fallen back below $120,000 .

Bitcoin is currently trading in the Resistance zone($119,720-$118,240) and Cumulative Short Liquidation Leverage($118,757-$117,829) on the 1-hour time frame .

In terms of Elliott Wave theory , Bitcoin appears to be completing a main wave 4 . Main wave 4 is likely to have a Zigzag Correction(ABC/5-3-5) .

I expect Bitcoin to attack the Support lines and fill the CME Gap($115,060-$114,947) in the next hour.

Cumulative Short Liquidation Leverage: $123,087-$120,922

Cumulative Long Liquidation Leverage: $116,305-$114,325

Do you think Bitcoin can create a new ATH again?

Note: Stop Loss(SL)= $121,000

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

#BTCUSDT(BITCOIN): Another Small Correction And Bounce Straight Bitcoin reached a record high of 125k, but then its price started to drop and is currently trading at 115k. We expect the price to reverse from the 110k area and continue its bull move towards the potential next target of 150k. Keep an eye on the price to see if it falls below our area of interest.

Good luck and trade safely!

Team Setupsfx_

BTC/USD Thief Breakout at $107K – Eyeing $115K!🚨 Thief Entry Setup: BTC/USD Breakout Play 🚨

Overview:

Jump in after the $107 000 breakout—aiming for $115 000 with a tight “Thief SL” at $102 500. Adjust the stop‑loss to match your personal risk tolerance.

🧠 Setup Summary

Pair: BTC/USD

Entry trigger: Breakout above $107 000

Stop‑Loss: “Thief SL” at $102 500 (use your own risk‑based SL)

Target: $115 000

🎯 Why This Setup?

Clear breakout level at $107 000 = fresh momentum

Tight SL cushion (≈‑4.3%) = defined risk

Target ≈ +7.5% potential = strong reward-to-risk (~1.75:1)

📏 Risk Management Tips:

Only risk a small % of your capital—never exceed your comfort zone.

Move your SL to breakeven once mid‑target is hit to lock in profits.

Trailing your stop‑loss could secure bigger gains if BTC surges toward $115 000.

BTCUSDT[BITCOIN]:Price is Likely to be Heading Towards $144,000.Recently, Bitcoin has shown extreme bullish price behaviour, and there’s no sign of bearish influence in the market. After monitoring the price since May 4th, we believe there’s a high possibility of price hitting the 120k region first. This could be followed by a small correction around 105k, where a strong bullish price influence will lead the price to our final target at 140k. Both fundamental and technical factors support this view, but it doesn’t guarantee the price will follow our expectations.

Before investing or trading cryptocurrencies, do your own research as they carry significant financial risk. This chart analysis is for educational or secondary purposes only.

Good luck and trade safely.

If you want to support and encourage us, you can do the following: ❤️

-Like the idea

-Comment the idea

-Share ;)

Team Setupsfx_

#BTCUSDT: Major Bearish Correction?Bitcoin is currently undergoing a correction following its recent peak. While the initial price decline appeared insignificant, it has since experienced a substantial drop, suggesting a substantial volume of selling activity in the market.

We anticipate two potential areas where the price could reverse and resume its upward trajectory. These areas could lead to a price of 110,000, followed by 120,000, and ultimately reaching 150,000.

We strongly recommend that you implement rigorous risk management measures and conduct your own analysis before making any investment decisions.

Best regards,

Team Setupsfx_

Bitcoin Macro Cycles: Sell Signal at RSI 90Bitcoin’s historical market cycles, using monthly RSI data to identify previous bull market peaks. Notable tops in 2013, 2017, and 2021 are highlighted, with the next potential peak projected around October 2025. A consistent pattern emerges where each market top aligns with the monthly RSI reaching or nearing the 90 level, indicating extremely overbought conditions.

Sell when the monthly RSI hits 90. This has consistently marked previous market tops and can serve as a reliable signal for long-term investors.

BTC Long / Buy SetupBTC is strongly Bullish towards 120k liquidity level, I'm not seeing any healthy correction before hitting the 120k level. If BTC strongly breaks and closes below 106.9k then chances are high that it will touch the weekly level and again come to 107k level, but this time it will struggle to break the 107k level because it will become bearish fvg, if it holds the 107k level and give any strong reaction from the zone then the next level is 120k. even a wick towards 105k or below doesn't matter, any body closing below the 106.9k (at least 4hrs) will lead short term weakness to the trend.

BTC/USD Breaks Out, Eyes Fresh Highs Above $116,000📉 Technical Structure

BITSTAMP:BTCUSD BTC/USD confirmed a bullish breakout above the $111,000–$111,350 resistance zone, which has now flipped into support. Price action shows a clean retest and bounce from this level, indicating a bullish continuation. Key support lies at the $110,600–$109,000 demand zone. If the price clears $116,800, bulls may target $118,000–$120,000 next.

📈 Long Trade Setup

Entry: $111,350

Stop Loss: $109,000

Take Profit 1: $116,800

Take Profit 2: $118,000

Invalidation: Break below $109,000 and trendline

🌐 Macro Background

BINANCE:BTCUSD Bitcoin rallied above $116,000 to a new all-time high after clearing the $111,000 resistance. The breakout was supported by strong momentum and optimism following a technical trendline breach. Despite some selling pressure and rising funding rates, the broader trend remains bullish. A sustained move above $116,800 could open the door toward $120,000.

📌 Key Technical Zones

Resistance: $116,800 / $118,000

Support: $110,622–$111,350, $109,006–$109,572

📘 Trade Summary

As long as BTC/USD remains above $111,350, the bullish structure is valid. Short-term pullbacks into the $109,006–$109,572 zone may offer buying opportunities.

⚠️ Disclaimer

This analysis is for informational purposes only and does not constitute investment advice.

BTCUSDT: Cup and Handle Breakout! BINANCE:BTCUSDT is forming a powerful bullish breakout from a cup and handle pattern on the daily chart. Price has cleared key horizontal resistance around $110,000, signaling strength and the potential for a continuation move toward $144,444.

Stop Loss: $98K

Target : $144k

CRYPTOCAP:BTC

BTCUSDT Forming Bullish WaveBTCUSDT is currently setting up a promising bullish wave pattern, showing signs of steady upward momentum that could deliver a healthy 10% to 20% gain in the near term. After a period of consolidation and healthy correction, Bitcoin’s price is starting to push above key resistance levels, indicating strong buying interest and renewed confidence among long-term investors and institutional traders alike. This setup has caught the attention of market participants looking to capitalize on Bitcoin’s next potential leg up.

Recent on-chain data and technical indicators show a robust foundation for this bullish wave pattern, with increasing trading volume supporting the upward move. Bitcoin continues to hold above crucial support zones, which adds further confidence for buyers aiming to ride the trend towards its next major psychological levels. The overall sentiment remains positive as Bitcoin’s dominance in the crypto market signals strength, helping to drive capital inflow from altcoins back into the king of crypto.

As we know, Bitcoin’s market behavior often sets the tone for the entire crypto ecosystem, so this bullish scenario could spill over into other major altcoins as well. Traders and investors should keep an eye on key resistance zones, potential breakout levels, and any sudden surges in volume that confirm the wave pattern is playing out as expected. Patience and disciplined risk management will be essential to maximizing profits during this phase.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Evening BTC Trend Analysis and Trading SuggestionsLet's review this afternoon's market performance. The BTC price, as we anticipated, rebounded to around 109,000 in the afternoon before plummeting sharply. Living up to "Black Friday", this violent drop was well within our expectations. In the afternoon's live trading, we also reminded everyone that as long as there was a rebound to the upper zone, it was a good opportunity to go short. This drop has created a space of nearly 1,500 points. Currently, the BTC price has pulled back to around 107,800.

From the current 4-hour K-line chart, after a strong upward surge, the market encountered significant resistance near the upper track of the Bollinger Bands. As bullish momentum gradually faded, the price started to come under pressure and decline, suggesting that the short-term upward trend may come to a temporary halt. At present, the market has recorded multiple consecutive candlesticks with large bearish bodies. The price has not only effectively broken below the key support level of the Bollinger Bands' middle track but also caused the Bollinger Bands channel to switch from expanding to narrowing, indicating that market volatility is decreasing. In terms of trading volume, it showed a moderate increase during the price pullback, which further confirms the authenticity of the bearish selling pressure.

BTCUSD

sell@108000-1085000

tp:107000-106000

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

#BTCUSDT: First $120,000 Then $140,000 Swing Move.Bitcoin has accumulated successfully and is currently on the verge of entering the next price zone, which is 120k, followed by 150k. There’s only one entry zone to consider. We’re confident that the price will move as planned, but it’s not guaranteed. Before taking entry, please conduct your own analysis.

If you like our work, please like, comment, and share.

Team Setupsfx_

❤️🚀