Bitcoin Daily HEADS UP - Nice start to Week But RESISTANCE NOW

The daily chart shows the line of resistance we now hit

This is the line that has rejected PA since january

It is Strong.

We May break through but we have to wait and see but it is certainly Wise to be prepared for rejection

Even more so when you look at the Apex we are coming to with in the next 7 days

PA ALWAYS REACTS BEFORE THE APEX

The Volume profile on the right suggests resistance overhead is strong but we do sit above the POC ( point of control )

All to play for this week and it coulf get emotional

And YES, that is a Fib circle we are hitting too

Double resistance could lead to a Drop in the near future and yet, it is also worth knowing that PA can pick an intersection of two lines of resistance to break through. Kind of 2 birds with one stone attitude.

We need to wait and see

What ever happens, I feel this week may be VERY interesting.

Enjoy

Btcweekly

Bitcoin (BTCUSDT) – Multi-Timeframe AnalysisDaily (1D) Chart Analysis

Trend Overview: BTC has been in a downtrend since its recent peak above $100K, trading below the 100 EMA (yellow) and 200 EMA (white).

Support Zones: The key support zone is around $75,000 - $77,000, where buyers could step in.

Resistance Zones: The major resistance sits near $91,000 - $95,000.

Momentum Indicators:

RSI: Around 40, showing a lack of bullish momentum.

MACD: Bearish crossover, suggesting more downside pressure.

Conclusion: BTC remains under bearish pressure unless it reclaims the 100 EMA. Watch for a possible liquidity sweep below $75K before a bullish reversal.

4H (4-Hour) Chart Analysis

Structure: BTC has been trending below the 200 EMA, confirming a bearish bias.

Resistance: The $85,500 - $88,700 zone acts as a critical resistance.

Support: The nearest key support zone is $79,000.

Indicators:

RSI: Below 50, confirming weak momentum.

MACD: Attempting a bullish crossover, but still below the signal line.

Conclusion: BTC needs to break above $85,500 for a bullish shift. Otherwise, we could see further downside to $79,000.

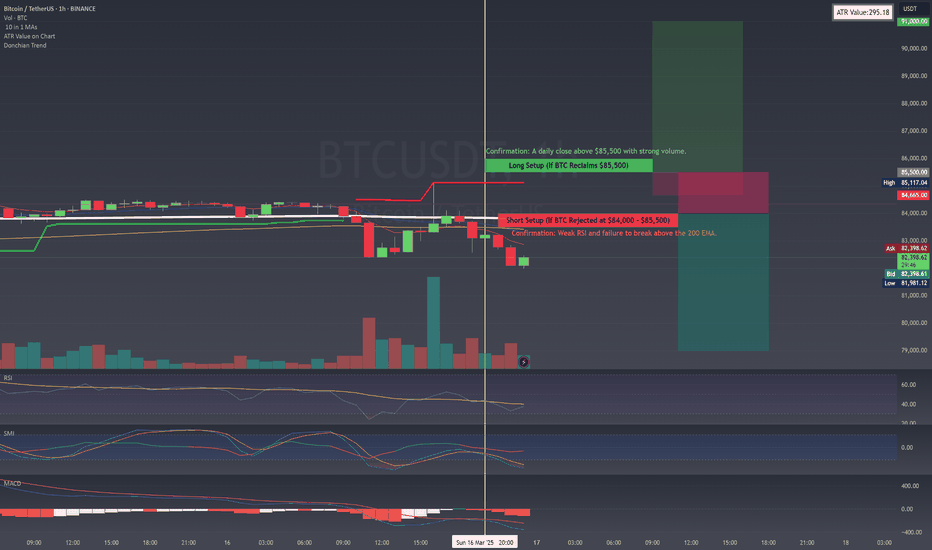

1H (1-Hour) Chart Analysis

Short-term Structure: BTC is testing resistance at the 200 EMA, which could act as a rejection level.

Potential Play:

If BTC fails to break above $84K, a short trade towards $79K makes sense.

If BTC closes above $84,000, a bullish setup towards $88,000 - $91,000 could form.

Indicators:

RSI: Hovering near 40, not showing strong buying momentum.

MACD: Still bearish but showing signs of a possible crossover.

Conclusion: BTC needs a break and retest of $84,000 for longs; otherwise, bears remain in control.

📈 My Trade Setups for the Week:

🔴 Short Setup (If BTC Rejected at $84,000 - $85,500)

📉 Entry: $83,500 - $84,000

📉 Stop-Loss: $85,500

📉 Take Profit:

TP1: $80,000

TP2: $79,000

💡 Confirmation: Weak RSI and failure to break above the 200 EMA.

🟢 Long Setup (If BTC Reclaims $85,500)

📈 Entry: $85,500 - $86,000

📈 Stop-Loss: $83,500

📈 Take Profit:

TP1: $88,500

TP2: $91,000

💡 Confirmation: A daily close above $85,500 with strong volume.

📌 Final Thoughts

🔹 BTC remains in a bearish structure, with a possible liquidity grab below $79,000 before any strong reversal.

🔹 If bulls reclaim $85,500, it opens room for a run towards $91,000.

🔹 Best approach: Wait for confirmation at key levels before entering trades.

⚠️ Risk Warning: Always use proper risk management—crypto markets are highly volatile.

💬 What do you think? Are you considering any trades this week? 👇

BITCOIN Weekly Chart Update !!Bitcoin has completed a cup-and-handle breakout on the weekly timeframe, accompanied by strong volume, which signals robust bullish momentum. This pattern is typically a bullish continuation pattern, suggesting that BTC has the potential to enter a strong uptrend following this breakout.

The Ichimoku Cloud is also showing a bullish signal, with price action above the cloud, confirming a trend shift in favor of buyers. The cloud's bullish alignment suggests that the current rally has further room for upward movement, potentially setting BTC on course for new highs.

However, pullbacks are common after breakouts as the price retests the previous resistance as support. A pullback to the handle or prior resistance zone would provide an opportunity for bulls to gather strength before pushing Bitcoin to new peaks. Key support levels to watch include previous highs or areas around the handle region, which should act as a launching point for the next leg up if bulls hold steady.

Disclaimer: This analysis is for informational purposes and is not financial advice. Always stay updated with market movements and adjust your trading strategies as needed.

You can DM us for information on any other coin.

@Peter_CSAdmin

BTC USDT 1W Shorthello everyone.

Due to the following reasons, I predict a downtrend of Bitcoin in the Weekly time frame :

1- as you see from now 2022 until aug 2024 , price and volume trend is opposite.

2- Mfi has moved below the 50 line.

3- in large channel we can see that price can move down at least to midline ( about 54000) and in the other zones ( 48 , 42 , 32 )

4- in small channel we can see that the price easily can move down to about 48.

As you know the market has no definite trend but in my idea , probability of a downtrend is greater than the probability of an the probability of an uptrend.

BTC Weekly Analysis - Will the price fall to $25,000?BTC has made contact with the top of the Weekly Bull Channel and has come up against some resistance. In my previous 4HR analysis, I showed the potential for a measured move from the 4HR Bull Channel to the Weekly Bull Channel Resistance, we have reached that price of about $38,000. Where do we go from here?

Key Points

1. Bull Channel means we should always be Long.

2. Bitcoin has touched Weekly Channel Resistance

3. Wait for the weekly candle to close below the channel top

4. There is a gap between the current price and 30EMA/200EMA

5. RSI is overbought. A weak indicator on its own but supports #2-#4.

Before trading this chart, the weekly candle needs to close tomorrow to confirm whether or not we are breaking out of the bull channel. I remain neutral until we see that result; however, I am slightly more bearish on the price given #2-#5 of the key points. Also refer to my BTC lifetime analysis where I argue that before every new all-time high, BTC touches lifetime support. We have not yet made contact with lifetime support and believe we have one more fall to $20,000-$25,000 before new all-time highs.

As always, trade at your own risk, you are responsible for your trades. I hope this analysis was insightful and useful.

Trade wisely and let us know what you think in the comment section below!

BTC 1W ✅Possible path ⠀⠀⠀⠀⠀⠀⠀⢀⣠⣤⣴⣶⣶⡦⠤⠤⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

⠀⠀⠀⠀⠀⠀⢰⣿⣛⣉⣉⣉⣩⣭⣥⣤⣤⣤⡤⢀⡀⠀⠀⠀⠀⠀⠀⠀⠀

⠀⠀⠀⠀⠀⠀⠀⠈⠀⠉⠉⠁⠀⠀⠀⠀⠀⠀⠈⠉⢢⠆⠀⠀⠀⠀⠀⠀⠀

⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⢀⠤⠤⠤⠄⢀⣀⣀⣀⡘⡄⠀⠀⠀⠀⠀⠀⠀

⠀⠀⠀⠀⠀⠀⠀⠀⠀⡠⠐⠁⠀⠀⠀⠀⡀⠀⠀⢴⣶⣧⡀⠀⠀⠀⠀⠀⠀

⠀⠀⠀⠀⠀⠀⠀⡠⠊⠀⠀⠀⠀⠀⠀⠀⠹⡄⠀⠨⣿⣿⣷⡄⠀⠀⠀⠀⠀

⠀⠀⠀⠀⠀⠀⡸⠁⠀⠀⠀⠀⠀⠀⢰⠀⠀⠙⣤⣶⣿⣿⣿⣿⡄⠀⠀⠀⠀

⠀⠀⠀⠀⠀⡐⠁⠀⠀⠀⠀⠀⡠⣴⠾⣷⡆⠀⢿⣿⣿⣿⣿⣿⣧⠀⠀⠀⠀

⠀⠀⠀⠀⠀⠇⠀⠀⠀⠀⠀⠀⠀⠀⠀⢀⣧⣴⡄⢻⣿⣿⣿⣿⣿⠀⠀⠀⠀

⠀⠀⠀⠀⢸⠀⠀⢠⠀⠀⠀⠀⠀⠀⠈⠉⢉⠿⢿⣆⢿⣿⣿⣿⣿⡀⠀⠀⠀

⠀⠀⠀⠀⠎⠀⠀⣿⡄⠀⠀⠀⠀⠀⠀⠘⠋⢛⣟⠛⠃⠙⠻⠿⣿⡇⠀⠀⠀

⠀⠀⠀⢸⡄⠀⠀⡘⠋⠉⡀⢠⣾⡰⢶⣶⡖⠁⣤⣳⣿⣶⢶⣶⡌⠳⠤⣀⣀

⠀⠀⠀⢸⢠⠀⢀⣿⣿⣶⣿⣿⣿⠇⠀⠁⣷⣄⣈⣙⣛⣿⣿⣿⡲⡒⠒⠒⠊

⠀⠀⠀⠀⣿⣾⣿⣿⣿⣿⣿⣿⡟⠀⠀⣰⣿⣿⣿⣿⣿⣿⣿⣟⣿⣶⡄⠀⠀

⠀⠀⠀⢠⣿⣿⣿⣿⣿⣿⣿⣿⣇⠀⠐⣿⠿⣿⣿⣿⣿⡿⠋⠀⠙⣿⡇⠀⠀

⠀⠀⠀⣿⣿⡿⠁⠸⣿⣿⣿⣿⣿⣦⠸⠋⢸⣿⣿⣿⡿⠁⠀⠀⠀⢸⣷⡀⠀

⠀⠀⠀⣻⣿⡇⠀⠀⠀⣹⣿⡿⢻⣿⢠⡀⠸⣿⣿⣿⣧⠀⠀⠀⠀⠘⣿⣧⠀

⠀⠀⢠⠉⣿⠇⠀⠀⢰⠋⣿⣰⣁⡟⠀⠁⢼⣿⡿⠿⠏⠀⠀⠀⠀⠀⠋⠟⠀

⠀⠀⢰⣿⠋⠀⠀⠀⢀⣿⡏⠛⠐⠁⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

⠀⠀⣾⡇⠀⠀⠀⢀⠎⢹⠃⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

⠀⠜⢹⡇⠀⠀⠀⠾⣶⡾⠃⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

⠮⣿⠿⠁⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀

BTCUSDT warning!In February 2020, Bitcoin experienced a falling wedge pattern and subsequently experienced a 60% increase from it's low. However, it encountered resistance at the $10,000 level and subsequently experienced a 61% decrease. Currently, a similar pattern is emerging, with Bitcoin experiencing a 60% increase from its current low. If it again encounters resistance at the $25,000 level, it is possible that it may repeat the same pattern as in February 2020. Therefore, it is important for Bitcoin to breach the $25,000 level to invalidate this fractal. What is your opinion on this matter?

BTC CME Weekly Breaks 200 EMABTC IS way overbought on the daily time-frame, but on CME Weekly Chart Overbought is not hit till $29955 and trading above the top side Bollinger Band on the Weekly which still shows strength. Just Crossed the Weekly 200 EMA today on CME. but... BTC Daily did kiss the 200 Simple today, so... pull-back to the 23.6 or 38.2 could be expected, below 38.2 watch for point of control at $19150 approx... on TradingView.. Chefrusty will publish my convoluted chart

BITCOIN WEEKLY UPDATE !!Hello, welcome to this BITCOIN WEEKLY update by CRYPTO SANDERS.

CHART ANALYSIS:-Bitcoin weekly candle closed above the descending trendline resistance. Bulls reclaimed 2017 bull run highs after bouncing off historic trendline support, demonstrating bull strength.

The current short-term resistance is near the $23,500 level. A retest above the descending trendline or making a higher low could also be a possible scenario.

A solid breakout above $23,500 or a successful retest of the descending trendline will confirm the continuation of the market's bullish momentum.

I have tried to bring the best possible outcome to this chart.

Hit the like button if you like it and share your charts in the comments section.

Thank you

$BTCUSD – Price and Volume Contraction On Weekly Chart$BTCUSD (Bitcoin / USD) – Price and Volume Contraction On Weekly Chart Continue to Reflect Bearishness

Bitcoin ($BTCUSD) posted a substantial gain of of +5.38% for the week, successfully reclaiming three of its key moving averages during week (10, 20, and 50-day moving averages).

$BTCUSD’s Bearish Pennant pattern is violated but with price consolidation and volume contraction remaining in its weekly chart, a longer term Bearish Flag channel is now morphed out, prompting the risk of a a further accelerated sell off in near term remains.

The level of support to watch for $BTCUSD this week is revised up to $18,800, a level that undercuts the existing three key moving average that was recaptured.

Bull Case: Violation of existing Bearish Flag channel at $22,000.

Bear Case: Breakdown of $18,800, a level that undercuts the existing three key moving average that was recaptured. Next support level at $18,157.

BTC weekly zoomed in...take a look!BTC weekly chart:

I called this as the bottom and published on Trading

View on the exact morning of that day. I believe

BTC has had that bottom "unless" a black swan event

were to occur like MT GOX

release of all the BITCOIN, but looking

at the chart and staying true to what data the

BTC chart is giving me, the RSI has never been

oversold at that bottom quite that low as well

as the "BTC SUPER CYCLE INDICATOR" read MARKET BOTTOM

and the DeMARK 9 INDICATOR also showed high probability

it was the bottom....The Fear and Greed chart

also showed a BOTTOM and had to move up.

that being said, BTC is still holding the Bullish

ascending trendlne and even tho its like a Bear

flag, the RSI is also holding support and just

came from the furthest oversold position in history.

Bitcoin making a wedge!this is simply obvious in the chart, the lines I mean.

I think for breaking this wedge, it will form a reverse h&s

I hope I have lots of moneys before the time Bitcoin goes between 12000 $ and 14000 $

then, I am bullish on it until 50000 $

it will eventually be 100k $ , but takes long time.

DYOR

BTC ranging in an upsloping flag/ Watching levelsWaiting for the levels to play out, I personally will be scalping more coins once testing the support level as a DCA. NFA

Simply break below for a continued downtrend to nearest support, traders will have their eyes set at the resistance level for shorts once if that area is ever met. Something to consider when wanting to take profits.

Bitcoin Weekly Chart Analysis WARNINGHi guys I was looking at the weekly chart for bitcoin and I noticed something on the rsi. A huge hidden bearish divergence can be seen from last year's top to this year's top. I am still very bullish on bitcoin and do hope that this does not affect the price action of bitcoin in the following weeks to months even though we have had a massive break out to the 40k levels. Just a warning to be cautious. Just wanted to point that out in the case bitcoin dumps back down lower.

#BTC/USDT WEEKLY UPDATE BY CRYPTOSANDERSWelcome to this quick BTC/USDT WEEKLY analysis in the chart

I have tried my best to bring the best possible outcome in this chart.

Hello folks,

Welcome to our Btc/Usdt weekly update, as we can see a rising wedge pattern create that from 15th March 2021 to 10th May 2021 btc was in an uptrend and from 10th May 2021 to 12th July 2021 was in downtrend.

After that Btc bounced on 19th July and moved up till 8th November 2021.

After that, we saw some correction in the market and a downtrend till 17th January 2022. After the 17th Jan market is still in a sideways move.

According to the current scenario, I think Btc will move in a sideways trend till 21st March 2022.

After that, we can see bullish movement which can continue till 11th July 2022 according to this chart and also can claim the new ATH.

As we all know that in 2024 btc halving is going to happen. so we can assume that the market will bounce on the 3rd week of March and we can see a good rally.

This is not a piece of financial advice.

Sorry for my English it is not my native language.

Do hit the like button if you like it and share your charts in the comments section.

thank you.

BTC Weekly, The Bottom Isn't In.BTC Weekly not showing us any sign of a reversal just yet, the Blue wave momentum indicator hasn't printed a buy signal just yet and is almost hit the oversold area.

This bullish support is the last line of defense for the bullrun IMO.

That is the worst case scenario for BTC to come and retest before a reversal. Otherwise we have to accept the fact we are in a bear market and look to start setting up shorts in the market.

And if we do come this low I will be looking to buy large position of BTC with a SL around 27k.

The VPVR is showing a massive support where we are, but as the Market Makers are in control they love to dip outside the support and liquidate longs. So I am not going to be surprised by a 29k BTC wick down.

Not Financial Advice. Crypto is extremely risky right now. DYOR.

Use Risk Management please guys.

Bitcoin at the first level of hope#Bitcoin is in the first support range and buying in this area is a good step.

This range lasts up to $ 36,650 .

If $ 36,500 is broken, a head and shoulders pattern will be formed and up to $ 30,500 can be corrected.

The $ 30,500 area is the second support area . If it breaks, we will have a drop of up to $ 20,000 , which is very unlikely .