BTCXRP FLIPHello,

The graph shows that Bitcoin begins to fade in the face of the Ripple XRP; the party will begin but do not panic, because the price of BTCUSD is quite low.

Being the reference currency in the Crypto market, I think that it is very important to refer first and foremost to the altcoins prices against Bitcoin, a bit like the major currencies in the Forex market.

With a BTCUSD price of 8000 ~ 8200 :

The break of our trend line in dotted green, sends us to a price of approximately $ 0.32 in 1st target, then to $ 0.46 for a second target.

I think the 2 targets will be reached by the end of the week provided that the RSI continues its descent into the sales zone, as you can see on the graph, in the same way that the slow average has just passed over the fast average on the MACD and the histogram is switched to negative, represented by the first red bar of the histogram circled in yellow.

October is decided as the flipping month of this trend and the next quarter could be very positive for our 2 pairs XRP / USD and XRP / BTC which I am particularly fan.

Guys If you have constructive comments, please let me know, it helps me to improve my trading.

If you like the idea, do not forget to like it, it will give more visibility, and so we can have the opinion of several traders.

I wish you a good trade at all.

BTCXRP

Watch out for a mean 30% correctionDear all,

I don't think we should expect any shuttle launch to "moon" as long as 0,23$ area (Stamp) is not re tested. If breaking lower we could see 0,19$ levels. BTC which is set to dump to sub 9K levels could drive most alts down.

Lets see how it plays out. Trade safe all.

XRP correction Grand final = sub 0.23 - Valid for most AltsI have spent some time now trying to make sens out of present move based on the past ones.

Lots of people thought bear market was over and correction done last September (Yellow wave count) however, fractal from top April 2018 to bottom August 2018 is perfectly aligning on top of June 2019 till now indicating couple of days sideways and a severe drop to sub 0.23 level. Which would equal to the grand final of wave 5 ending THE correction before we actually enter bull market.

Maybe I'm wrong but this combined to my indicators makes it valid.

If you want to play it safe, take out your monies now or at 0.32. Place a buy order at 0.35 and be patient. Should we reach 0.21 or lower... enter from there and cancel your order. That simple.

XRP/BTC to ZeroNot advice for your financials, only for entertainment, my opinion.

A few months ago I made an XRPBTC Chart that had a little bit of potential and optimism, but even to my surprise it sunk below 3850 sats significantly into the mid 2000s. Even with Ripple announcing slower dumps on the market, I think it's too little too late and enough people have realized it for the scam that it is. XRP ultimately will not be useful or necessary for international banking or anything else other than pumping Ripples pockets until someone can prove it was illegal. Even then the fine will be nothing compared to what they've stolen from you.

If your coin isn't decentralized, it's poopoo.

This chart is a bit of a meme, but maybe this is the curve that no one else is looking at. A curve perpetually averaging out to zero, which is what XRP is intrinsically worth.

Thanks for coming to my TEDx Talk.

Buy bitcoin you fools.

Why XRP will explode! Ripple is about to bust Wild West Style!Hi all,

I found something very interesting about XRP, which leads me to believe that something big is gonna happen to XRP/BTC pair. Looking at the RSI we clearly see a real divergence happening. The last time this happened, Ripple exploded to the moon.

This time it can happen as well. However I think we have to observe the BTC price, as a huge rise in Bitcoin could mean the red downward line.

So either way, its like the wild west...where Sherrif Bitcoin and Bandit Ripple holding a gun pull competition....whoever pulls first, shoots first!

Friends, I hope you liked my Idea and I would love to get your feedback on this.

Thank you Friends,

N11

LIKE THIS IDEA YOU THINK I HELPED YOU IN ANY WAY!

share your twitter Love: @thatwalletguy

!SHARE KNOWLEDGE, SHARE FUTURE!

This is no financial Advice, but my own personal opinion. Please consider it as such and act based on your own decisions.

Very possible XRP path short termThis chart is self explanatory. Using support and resistance confluence point gives us key level.

Possibly heading towards 0,31 and test 0,34 area which will be a crucial level. breaking through should allow us to see further upside later this summer but this is too far off to predict.

This is no financial advice.

$BTC increasing, $XRP and other cryptos can't keep the paceNewsletter 10/05

Key levels

Short term

Supports—> S1: 0.000046 & S2: 0.0000415

Resistances—> R1: 0.0000545 & R2: 0.0000585

Medium/Long term

Supports—> S3: 0.000037 & S4: 0.000041

Resistances—> R3: 0.000062 & R4: 0.000065

Potential scenario

This XRP/BTC chart shows the negative correlation of BTC with XRP. BTC has been increasing in value since mid December, reaching 2019 highs at $6300. The vast majority of the other coins have been increasing as well but at a slower pace. This means that, in a more bullish market with BTC as base coin, your open positions will become negative. While BTC continues with a bullish direction, XRP/BTC will keep decreasing.

TA comment

As deployed in the chart, Kaufman’s Adaptative Moving Average ( KAMA ) has been following this downward trend perfectly. If selected to Buy and Sell along with shorting settings, it would have shorted your XRP positions until it buys back once the downtrend ends. Therefore maintaining the value of your XRP.

Pattern

This downtrend, mainly caused by the increasing BTC price, is having strong downward movements produced by the continuous BTC pumps. These downward movements are characterized by long red decreasing candles which feature the pattern Long Line Berarish , a bearish continuation pattern represented by one candle with a big body moving down.

--Cryptohopper--

Long XRP / Short BitcoinLooking at BTC/XRP trading pair... bottom right quarter of screen.

XRP is currently gathering bullish momentum, while BTC is gathering bearish momentum.

Zooming out BTC is actually in a huge descending triangle against XRP.

RSI is currently at long term resistance line and appears to be turning down.

Also note, XRP/USD pair is forming a 'golden cross' 50 day/200 day moving average crossover.

If XRP make a push in the next couple of days (and BTC/USD doesn't drop too much), there could be fireworks.

Expecting to see XRP overtake BTC in market cap value in next few weeks.

*Opinion only - not financial advice*

XRP/BTC SHORTERM LONG I can see this breaking to the upside

Setting a tight stop loss for this one

We should see a small leg down and an impulse wave up once we reach end of pennant

Volume plays a BIG part here for this to take off to the upside

Reward: 14%

Risk: 5%

You can minimize your risk by placing bids above the support line

Have an amazing Friday!

XRP could kiss $0.10 - $0.08Hey everyone! I am back! Did you miss me? If you would like more analysis, please, comment and like my article.

My approach for the $0.08 / $ 0.10 target is a top down approach and I mainly use Elliot Waves Theory from Prechter et.al – (2018)

1 - I have identified a 5 impulse waves structure responding to the typical Fibonacci retracement and 5 corrective wave structure that I have called A

1) The impulse waves from September 2018 did not reach higher highs vis-à-vis the impulse waves in April 2018

2) The impulse wave from September is in 3 times which is typical for a correction in ABC (0.786 of A) in turquoise - they are moving inside B

As a consequence, if and only if we assume that A is a 5 wave corrective structure of 12345 impulse wave from April and B is an ABC corrective structure and believing that the retracements are consistent with the Fibonacci rules, C must be a 5 wave corrective structure.

It would be a 12345 impulse wave corrected in ABC 5 - 3 - 5 Zigzag - following the same rules A is generally equals to C but can correct lower... (61.8%, 100% or 1.236 in extension)

It means that XRP should correct to the below price

61.8% = $0.52 <-- failed

100% = $0.25 <-- will be tested

1.236 = $0.08 / $0.10 ?

The question is will $0.25 hold? to assume and inquiry this question I need to find a confluence to other retracement related to my current analysis...

The trendline!!

We can clearly see that XRP is evolving in descending channel. Surprisingly we find a confluence of support at 0.08

Believing that we are currently in a 5 wave corrective structure - I have been able to identify a retracement of 0.786 for wave 2

Being more granular, I have identified the first 3 waves in turquoise inside the biggest 3rd wave in red and they all respond perfectly to my retracement.

It means that we are currently in the Fourth wave - following the EW rules, we should reach at least 0.382 retracement -$0.40

The Third big wave (red) should end at $0.22 / $ 0.25

The Fourth big wave (red) should test the current level at nearly $ 0.35

The Fifth wave could be truncated and end at the same level, which is at nearly $ 0.25 and it would confirm the above hypothesis

However, the Fifth wave corrective truncation happens during bull markets and we are currently finishing a great bear market that has corrected a long 12345 wave structure

Moreover, the volume profile is showing a titanesque support at nearly $0.10

If XRP reaches $0.25, I would be able to draw a symmetrical triangle, which is a continuation pattern.

According to the Wyckoff rules, if the triangle is broken below, the base should follow down which is at nearly $ 0.10 - $ 0.08

Be aware that anything can change at any time (please, do not take my analysis as a trading advice)- this analysis is solely based on what I currently see for XRP today. I would update you if I see anything changing.

Saying this, does it change anything for the future of XRP? Absolutely not! I firmly believe that XRP has a huge potential and it will overtake Bitcoin very soon... I mean very soon– when finishing this correction, XRP will reach higher highs and I believe that the price will skyrocket!

Take care everyone.

Ma maîtrise est sans faille et mon skill sans égal

I am Magic`ArKaiN

Bitcoin vs Top Market Comparison - Daily Record Chart - ( XRP )- This chart is designed to be used as a tool to monitor the Daily market comparisons, ultimately XRP's progress.

- It seems that XRP is attempting to break away from BTC, with obvious gains against the other top market holders.

- XRP has made some excellent recent gains recently, especially with it's BTC pair XRPBTC.

- This chart indicates that XRP is in fact breaking away from BTC, and is intended for users to monitor its progress.

- Feel free to leave any suggestions or thoughts in the comment section down below.

Peace V

The best bet in Crypto right now

BITFINEX:XRPUSD

First time we have seen it break above the Moving averages on the 3 day. Also looks likely that we may have finished or nearly finished wave 2 of a possible set of 5 EW waves.

Also I do like XRP long term, mainly due to the big names it has behind it, if there are any doors needing to be opened then these people will be able to open them thats for sure

So conclusion here is that we have a high probability, high reward low risk trade

Is XRP about to break out again,I think XRP/Ripple is about to break out for a couple of reasons.

The news have been rather positive lately, (no bad news)

The volume is low

MACD is about to cross

The RSI is a little high, but it is bouncing back

So I think there should be a little bit of profit to be taken in the next few days.

Trading might remain flat before it goes up again.

Will revisit on Friday to see if it is time to take profit.

XRP: The great Tribulation1. Introduction

Is XRP starting a new bull-run? This question is legitimate… XRP took up 20% in a couple of hours! It is quite unexpected as we have not seen such momentum for weeks!

Let make things clear and extinguish all useless euphoria; XRP has won a battle but all enemies are not defeated yet.

Please, have a look at my last post if you need more details:

2. Methodology:

In my previous analysis, I have identified a couple of resistances and supports and they were used to describe XRP price movement since 2015.

Today, I would like to keep that set up in the radar but add more details and arguments to nuance my previous view on XRP about:

i. the current supports and resistances and will describe what it entails to the future of XRP price

ii. the Elliott Waves Theory to identify where XRP is currently moving

iii. price extension/retracement through Fibonacci, Pythagoras and other mathematical sequences

iv. Geometrical figures that could confirm XRP price movement

3. Analysis

As XRP just crossed over 2.111 and as I believe it will find it as a support for at least the next days, I would like to focus more on the next indicators.

In that sense, I have added a new enemy that I called The Great Tribulation 2.3 (in red). It is extended from the same method as 2.111 but extended to 2.3 instead.

We can see that this exactly where XRP reached $3.40 in Jan 2018. Moreover, 2.3 is also finding a culminating point with the Resistance of Feb 2018 (Orange) as well as the Golden Support (Yellow 4.772).

I would like to stress out the importance of 4.772 and why I think that 2.3 will play a key role with the Feb 2018 resistance at $0.50

Since the beginning of crypto, every single time XRP finds 4.772 as a support to begin its bull run. It happens 100% of cases. Can I confirm that if XRP crosses above this resistance and find it as a support, there will be another bull run? Most likely! I will explain why afterward.

Mini Bull Run 2015

Continuation bull run April 2017 and Dec 2017

So, today, where are the resistances and supports engaged in the war?

a. Supports:

a. 5.236 (green)

b. Support Feb 2018 (orange)

c. Short term support that was a resistance (purple)

d. Currently EMA34 (red)

e. Currently parabolic 2.111 (white)

b. Resistances

f. Resistance Feb 2018 (orange)

g. 4.772 – Golden Support/Resistance

h. Currently EMA55/89/134 on the daily chart

i. The Great Tribulation 2.3

Be aware that the last 2 times, XRP failed to cross over EMA55, succeed just before while crossing over 89 and 134 but failed in February 2018 to cross over EMA55.

Today, it seems that XRP has difficulties to cross over EMA55 again

If it succeeds it will have to deal with both EMA 89 and 4.772 and EMA134 right after, so I do not think XRP could break straight all these resistances.

On the other hand, I think XRP has the potential to reach $0.41 at EMA89 touching 4.772 then retesting a second time 5.236 at $0.29 to gain some energy and break the long term support (orange) as well as the Golden Support at $0.50

I am also more convinced by this scenario based on the energy that developed the first wave (bare in white) at the culmination point of both support Orange and Purple.

We can see that there is a price level of 0.014 (which is an extension of 3.14 -that is used to draw the entire figure). It is actually crossing in a lozenge 2.3 – The Great Tribulation, 4.772 the Golden Support/Resistance and the Orange resistance

XRP seems to move inside this number 3.14 – so let’s see.

However,

I would like to be clear!

If XRP is not able to break above EMA55 – it will probably break below 5.236 (green). The next stop is at $0.20…

NB: for finding 2.111

a) I have drawn a slope from the bottom to wave “iii” (August 2014 to 17 May 2017)

b) I have drawn a circumference of 2.111 (in white) which is an extension of the square root of the golden ratio 0.236:

a. 55/233 = 0.236

b. 1+0.236 = 1.236

c. √1.236 = 1.111

d. The extension of this number is 2.111 (1.111 + 1)

c) I have drawn a trendline along the previous slope from the bottom to wave “iii” with the constant “pi”, which is “3.141592653589793”. I have used “pi” as an axe and it perfectly matches the price movement of XRP inside the circumference of 2.111, you can see that from this number, I have been able to draw my resistances and supports in orange and purple.

d) I have drawn a trendline in yellow in the circle along 3.14 but this time; I have used 4.772 (time level) which is the extension of “pi” (√3.14) +3. Remember that 4.772 perfectly matches with the slope 3.14 that I have drawn

e) I have drawn a trendline in green through 5.236 (time level) which is an extension of 0.236. Remember that in proportion 5.236 perfectly matches 2.111 white parabolic circle (Point “b” previously described)

j. What about Elliot waves?

I like Elliott Wave Method very much because with the price extension, it helps to provide an overview of the price action but it is sometimes difficult to start counting the first wave…

A) First possibility

Because XRP has already reached it first wave above 0.786 – vis-à-vis the second wave, we could assume that the third wave could potentially reach 2.111 on the resistance (orange) and correct slightly on the Golden Support 4.772

To make this scenario happens, XRP has to break above all the EMAs (34,55, 89 and 134) and it has to cross over 4.772… The fourth wave could correct slightly, so it would make sense… and the fifth wave should be in the intersection of the culmination point previously described.

A good starting point for this scenario should be XRP crossing over $0.34 (EMA55 on the daily chart)

B) Second possibility

XRP actually started its first wave the 12 of September 2018 and is currently finishing its 3rd wave – EMA 55 is too strong and XRP has to find a support on EMA134 on the hourly chart, which correspond to 0.444 retracement .

If this scenario happens, I expect a weak fifth wave, maybe truncated at 1.333 or at 1.886

C) Conclusion

I think XRP has a lot to do, it was a great momentum today with 20% growth but it has to break EMA55 on the daily chart – it is so important!

Every time XRP fails to break EMA55 ($0.341), it goes down and down and this time, it will be a return at $0.20.

If XRP is able to break aboveEMA55, it will have to deal with EMA89 and 134 but the third wave will be on its way so I do not think they will cause so much troubles.

Moreover, XRP will potentially test the golden support 4.772

The RSI and the MACD are crossing over on the daily chart and are showing a bullish momentum. Will it be enough to get over EMA55?

So you understood that everything is played now! Watch out!

I will keep you updated, please share, comment and like my analysis!

Ma maîtrise est sans faille et mon skill sans égal.

Magic`ArKaiN

XRP: The face of the Beast - September 2018Please, have a look at the beginning of my analysis if it is not yet done. Otherwise, it would be difficult to understand this one (link is here: ).

Yesterday, I told you that XRP on the hourly chart will give another try to breach 2.111 but it was unlikely it could succeed. Indeed, XRP only had EMA55 on the hourly chart to be supportive against 2.111 on the daily/weekly chart.

I also mentioned that during the first tentative to break 2.111, 8 billion of XRP were transferred. Even though the transfers were processed from wallets to wallets, they could simply represent Money Management and / or equilibrium of budgets against hundreds of other wallets that are used for other purposes… and never connected to the wallets we have seen. My stomach says that it is highly suspicious and it could be a hidden wall to stop XRP to break this 2.111 parabolic resistance.

Today, I can see that XRP has formed a nice parabolic movement around another 2.111 circle and where the price still moves around.

I have identified a Cosinus in a trigonometrical circle and drawn a diameter, from the right radius there is a 34° angle (Golden Number) that perfectly matches the current support where XRP is moving now:

• Around 2.111 circle (in purple)

• On a support called y=x which is the bisector (in orange)

• Against the long term parabolic resistance 2.111 (in white)

• Against EMA34,55,89 and 134

I think the Bisector y=x will be a strong support for the next hours / days as it has developed a significant energy through its rotation.

I believe another tentative will be tried out to breach 2.111.

Again, the likelihood to break 2.111 is low but let see how the Big Banks are playing this out

Ma maîtrise est sans faille et mon skill sans égal.

Magic`ArKaiN

XRP: the face of the beast...XRP: The face of the beast

I) Introduction

I do not know if you remember but last week I described XRP on the daily chart at the hedge of:

-Long term parabolic resistance

-EMA55 resistance

-Middle and long term support based on trendline in orange (long) and purple (middle)

You will find more details here:

The price is currently contracting among these indicators and XRP will have no choice to brutally cross over (or under) at some point.

Why brutally?

Remember, that price motive acts like an energy; it contacts, reinforces, implodes and explodes.

Why this current analysis is interesting and what does it bring vis-à-vis the last one? I aim at describing price moving like energy and forming perfect figures through price contractions and explosions that are comprised through supports and resistances.

Methodology and analysis

a) I have drawn a slope from the bottom to wave “iii” (August 2014 to 17 May 2017), you can find more details on my counting here:

b) I have drawn a circumference of 2.111 (in white) which is an extension of the square root of the golden ratio 0.236:

a. 55/233 = 0.236

b. 1+0.236 = 1.236

c. √1.236 = 1.111

d. The extension of this number is 2.111 (1.111 + 1)

c) I have drawn a trendline along the previous slope from the bottom to wave “iii” with the constant “pi”, which is “3.141592653589793”. I have used “pi” as an axe and it perfectly matches the price movement of XRP inside the circumference of 2.111, you can see that from this number, I have been able to draw my resistances and supports in orange and purple. Look at how XRP is prisoner inside the resistances and supports

d) Going back to 2.111, it shows that XRP is moving against this parabolic line and has difficulties to get it out and EMA55 is perfectly touching 2.111. EMA55 is the price moving average of XRP during 55 days and 55 days is a golden number.

e) XRP succeeded to break above this EMA55 in April but failed against 2.111

f) Today, EMA55 and 2.111 are in convergence, they are crossing each other, and we can clearly see that XRP is in contraction against all the resistances and supports

a. In orange (long term support)

b. In purple (short term support) that is crossing the orange long term support

c. Against the resistance 2.111 (in white) and EMA55 (in yellow)

II) Something is missing

You will say, thank you Magic’ArKaiN but you just provided more details and identified perfect Geometry Figures, what’s the point here? You already described all these things in you previous analysis…

Let there be light…

A support that is broken becomes a resistance and a resistance that is broken becomes a support…

Let me repeat this again, a support that is broken becomes a resistance and a resistance that is broken becomes a support…

So where are the supports and resistances in this grand scheme of things?

Methodology

g) I have drawn a trendline in yellow in the circle along 3.14 but this time; I have used 4.772 (time level) which is the extension of “pi” (√3.14) +3. Remember that 4.772 perfectly matches with the slope 3.14 that I have drawn (point “c” previously described)

h) I have drawn a trendline in green through 5.236 (time level) which is an extension of 0.236. Remember that in proportion 5.236 perfectly matches 2.111 white parabolic circle (Point “b” previously described)

Analysis

In 2014…

At the very beginning of November 2014, 3.14 was used as a support before XRP broke out in wave “i”

Then, it was broken and 5.236 was a new support and rejected, so resistance 3.14 was put at a test but got rejected and the price contracted between the new support 5.236 and the new resistance at 4.772 but got broken again… You know what happened after and I am not going to detail this…

Excepted if…

Excepted if 5.236 support is broken, yes… It will hurt very badly but if 5.236 is not strong enough, XRP will go very low… I prefer to warn you! I will talk about this in the next paragraph…

In 2017…

In May 2017, both 5.236 and 4.772 were crossed over very quickly but XRP had to face the 3.14 monster resistance (the one that plunged XRP to The Abyss in 2014).

Then, guess where XRP found its support? Bim!! At 4.772 (in yellow), it is exactly there that it broke out in December 2017 and everyone got crazy about the price increase!

In 2018…

I am sure you will not believe me but where are we standing today? Ok I let you find it, you have 3.14 seconds to find it…. Tata!! After the breakout in December 2017, XRP found a rejection again at 3.14…

And where did XRP found a support? I am sure that at this stage, it is not a surprise anymore to tell you at 5.236 (in Green) and where did it find a resistance? At 4.772! it is Magic!

Conclusion

My timeline analysis is driving me to the exact same conclusion: we are at the hedge of a HUGE price move. You can find more details here:

We understand that XRP had a 3.14 (in grey) rejection in Jan 2018 and is now moving between 5.236 support (in green) and 4.772 resistance (in yellow) like in 2014/2015. Please, take also into account my detailed analysis in the introduction of this analysis (with the parabolic line – 2.111 and EMA55).

So, why XRP should not fall down below its old support, like it did in August 2015? Because as you understand now, there is no other way around, we go to the TOP or to the MEAN! It is a huge price uncertainty for the traders. That is why the price is basically moving aside at the moment…

The 3.14 Beast Monster becomes weaker and weaker baby!

The face of Monster in June 2015 –

He looked very confident and strong, he gives even some spaces to XRP to nearly 13.40%

The face of the Monster in May 2017

He looks still strong but the space that he gave to XRP is nearly 0%...

The face of the Monster in December 2017

Damn!!! You look bad, you gave, 125% to XRP! Call a doctor!

What could be the face of the Monster during the next price increase and will it succeed to cross over and find 3.14 not at a resistance but as a support?

Beyond technical analysis, what the fundamental analysis is telling us?

In 2014 / 2015

• Mt.Gox crash (biggest Crypto Exchange, 70% of the market)

• Very much uncertainty in the market and low visibility on business case projects

• Not so much news, very wild and rustic market reserved for the geeks

Today

• More investors and trading platforms

• Good news every single day

• New partners

• Institutions being interested in XRP

What is your opinion? Please, share my analysis and put a comment below if you dare!

Ma maîtrise est sans faille et mon skill sans égal !

Magic`ArKaiN

XRP : Fibonacci for defining time sequencesDear traders,

I would like show you a method to identify a tendency according to time periods. My objective is to determine when XRP will start/stop to correct or break out.

On the daily chart, my method consists of

1) using Fibonacci numbers as follow:

a. 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597

b. drawing time periods from Fibonacci Sequences

2) determining how the price is moving

a. Bull, Consolidation and Bear Market

b. price contraction, extension, consolidation, contraction, explosion

c. putting a time sequence according to price action

d.

3) putting codes

a. red for Bear Market

b. orange for consolidation

c. green for Bull Market

d. purple for one sequence of 233 days

NB: Each bar represents one day

Analysis:

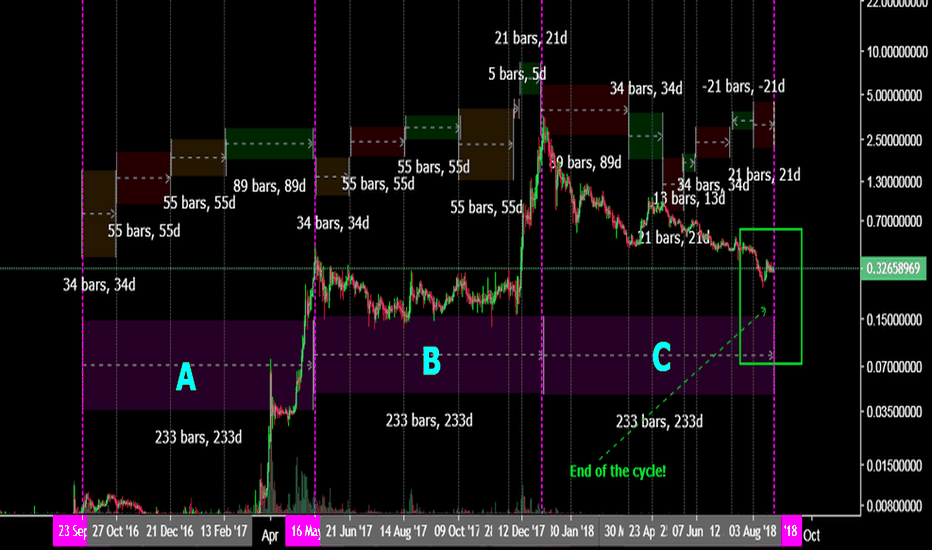

Since 2017, XRP is sequenced in 233 days namely A, B, C – each sequence is calculated from the last high to the next high of the sequence

For the sequence C it is not a high but a low as we are ending the second super cycle wave correction please, have a look at my count wave analysis here:

Let me make things clear, my method is not used to identify a break out – but a sequence or the end of a cycle. In other words, at the end of a bearish cycle, the price can either move aside into a consolidated shape or up – but it cannot continue bearish, otherwise my cycle count is invalid.

Thus, from Elliott Waves, I am able to Identify where the price is moving to and from my Cycle Count, I know when it will happen.

The current cycle will end the 25th of August 2018.

I will provide more details the next days, please like; share and comment.

Ma maîtrise est sans faille et mon skill sans égal.