25.2-25.5K seems interesting for new short positionMorning folks,

BTC goes with our long-term fundamental view and those who read our monthly reports knows about it since December 2021 when we've warned against long-term investments in BTC. This week end we have taken in-depth view on the US stock market that shows bad perspectives and BTC as usual is becoming a storm crower, with 600 Mln+ positions were liquidated just on Friday...

In short-term it seems that 25.2-25.4 resistance area might be interesting to consider another short position. Right now we do not consider any longs by far.

Btp

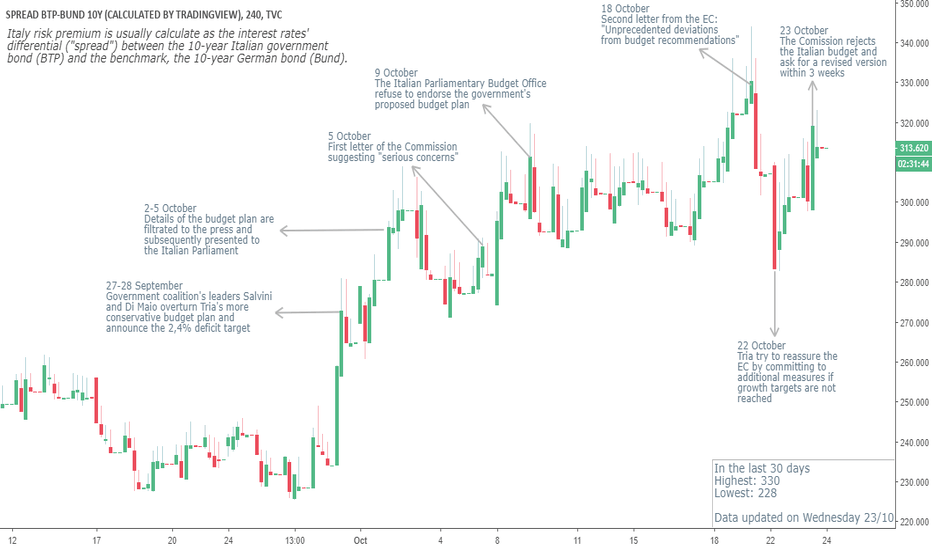

BTP BUND SPREAD - A MACRO INDICATIONThe effects of the spread on the national deficit and public debt are not immediate, but they are seen when the next BTP is issued. If the spread is high when a new BTP is issued, the new bonds will probably adapt to the performance of the secondary market, costing the Government more.

A BTP-Bund spread may also affect businesses and households, not just the government coffers. Indeed, a high spread mostly likely translates into higher interest rates. Banks would suffer the consequences, as they would then be forced to pay more to raise funds and would earn less on the government bonds that they own, driving them to charge more for financing and loans.

BTPs - Lower on the Anticipation of a Clash with BrusslesThe Italian Government sent the aggressive budget proposal to Brussels, with Finance Minister Tria suggesting he can "explain" things to EU counterparties and receive acceptance. Market participants know it's a long shot, and BTPs should come under more pressure.

BTPs - Showing more signs of stressClash between EU and Italy becoming more evident as Italy Rating Outlook Cut by Fitch on Possible Fiscal Loosening but "Italians come before ratings agencies" deputy PM says - “We have to put the financing in the budget so that at least 5 million impoverished Italians can get back to work.”

BTP, calm before the storm, trigger the interest ratehello guys here's a new idea on italy BTP. First of all, we saw recently that the market wants to speculate (again) on BTP, this means that interest rate until September will go down, then will rise due to rating agencies decision and what is called 'DEF', the document of economics and finance by the Government. In this document there'll be the outline of fiscal policy, I expect a higher deficit and maybe a cut in taxes.

This will trigger a sell in the bond market of BTP, driving interest rate up and consequently price down.

Here I post a couple of interest readings on Italy, which can give us some idea of what to expect.

www.zerohedge.com

www.zerohedge.com

au revoir,

docCDS

BTP - Italian bonds still under scrutinyItaly's Deputy PM DiMaio confirms markets' fears: this morning he said

that respecting fiscal rules is not the priority in the next budget.

Until 94.00 is broken to the upside, pressure still remains.

Better picture if we hold here below 93.00 and push towards 90.00 again.

BTP - Bearish Momentum Back in PlayYesterday we expected the Italian 10yr to break back through recent supports, after Conte's initial proposals on immigration, taxes, welfare seem to imply a decisive clash with Brussels. These measures would be good for the population, but EU will not allow them.

Further downside is expected and 90.00 is the first target.