xrp update Here's a polished version of your message that you could use for a post or update:

---

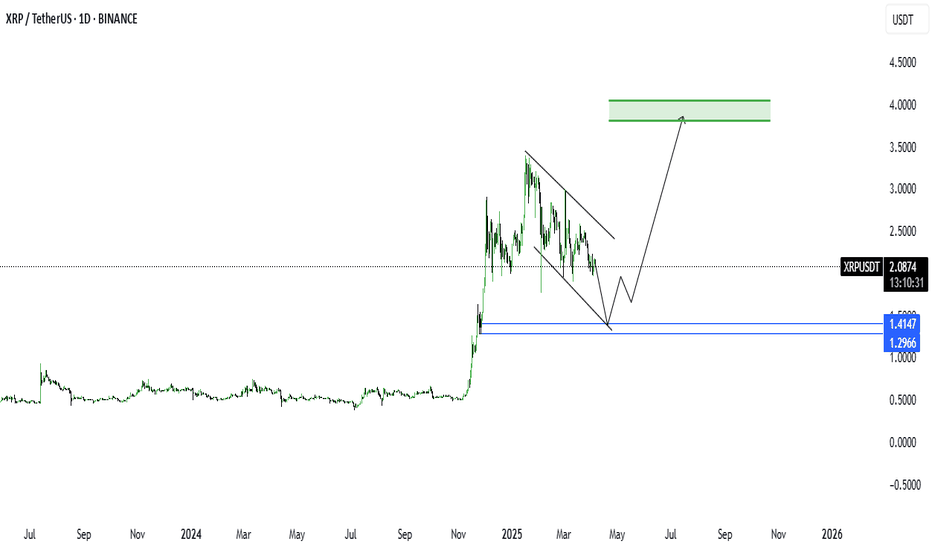

**XRP Update:**

Currently trading around **$2.085**, we're anticipating a **pullback toward the $1.40** levels. That zone could offer a **great opportunity** for long-term investors and spot traders to enter.

🎯 **Targets:**

- First target: **$3**

- Second target: **$5**

**⚠️ Patience is key — wait for the opportunity. Don’t jump in too early.**

Good luck, everyone! 💰🚀

---

Want it styled as a tweet, YouTube caption, or short video script?

BTX

Potential bullish rise?Bitcoin (BTC/USD) is falling towards the pivot which has been identified as a pullback support and could bounce to the overlap resistance.

Pivot: 65,972,81

1st Support: 64,589.11

1st Resistance: 70,123.94

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

HEX is losing steamHEX shows double bearish divergence on 4hr and daily,and on smaller time frames triple bearish divergence (price with higher highs ,RSI & DMI lower highs)

DMI 2h ,bear line is already above bull line with ADX completley reseted for a (bear) run

1hr ,2hr 21 EMA already sloping down : its not the sign of fit & health

RSI on 2,3,4h already under 50 ,bears are in full control

1.As long as price stays above 0.275-0.28c ,no worries ,there`s a decent chance price will go to at least 0.35-0.36c

2.Once price starts to close under 0.265c target is .23c

3.If price goes under 0.18c ,then we should meet our final target : 0.085c (-60%)

Remember ,price action reflects supply & demand ratio in the end of the day (and thank God in hex theres plenty of supply lol) and TA helps take EDUCATED GUESSES,nothing more.

BTC Dominance - Strong Triple Bottom Reversal On the RiseHello my friends,

I hope all is going well in your life and in your trading career.

This publication is to show and give you guys an idea of two possibilities that can occur after this 3D candle close.

There might be an inverse H&S on the works after a fierce triple bottom holding on dominance.

Let's watch and see if this plays out in the end.

Possibilities are written on the chart.

Trade thirsty my friends!

Looking for shopping areas!Looking for shopping areas in different media. When the price touches any of the marked support, the position and management will be evaluated with a candle reading.

It is a simple operation, in the event that no support is valid we will look for areas below in order to maintain.

Correction, Crash, or Burst of a Bubble?A market crash is a rapid and often unanticipated drop in prices. A market crash can be a side effect of a major catastrophic event, economic crisis, or the collapse of a long-term speculative bubble.

A bubble is an economic cycle that is characterized by the rapid escalation of market value, particularly in the price of assets.

This fast inflation is followed by a quick decrease in value, or a contraction, that is sometimes referred to as a "crash" or a "bubble burst."

www.investopedia.com

mid term +2,200%Brooklyn ImmunoTherapeutics, Inc., a clinical stage biopharmaceutical company, engages in developing therapies to treat patients with cancer.

BTCUSD new ideaThe btc hit the resistance trend line as I mentioned in my previous analysis and at the moment the price is testing the next resistance level, if price pullback then price can fall back to support level of 29k.. the support line around 28-30k holding the price above for quite long, Therefore, Take caution as price can pull back or go above the resistance level...

my previous analysis

good luck

Primary Elliot Count for BTC starting 2021Wondering why we haven't had a pull back recently? This is because we are within the third, of a third, of a third wave. This is the most bullish part of any Elliot count. Don't stand in front of a bull or you'll get the horns. Predicting targets for highs is nearly impossible, as we have already exceeded most common Fib extension targets. Always zoom out, the larger time frame always tells the best picture of the direction of the market. (Yes I posted this a few moments ago, but was not satisfied with my charting)

Alt coin market Cap, Retest or Bull FlagIn the previous analysis i showed that alts were in bad shape short term. That uptrend was from past months was about to break but eventually it never broke the first support zone on the daily chart, bouncing up from that zone to rally as it did past week.

So now it looks like it turned the past weeks into a bull flag and this week we had the break out. Also looks as if that trend line still give some resistance. Question now is, are we doing a retest of this weeks breakout, or is it all just a retest of the break of the uptrend.

In case we do drop coming days, there is still a lot of room to remain bullish. A scenario is what i have drawn on the right. If we don't see a huge dump, but stay inside that potential wedge, big chance it will rally again later this week. That would then be the second retest of the bull flag breakout.

For the trend to remain bullish, think it may not get below that big green zone. Because if it would drop below it, big chance the bull flag breakout has failed and could therefore see a counter move to the downside.

So at the moment it all still looks good, just should not drop below that green zone anymore. Those thick blue line on the left show the bullish structure from past months. Each time when breaking a resistance zone it become support later on. Something we have been seeing in almost all the markets lately. So for the long term, think that line should not break anymore.

For Bitcoin it's still less clear, that one is still in the big consolidation. So if that one fails, despite others looking pretty decent, it will of course drag everything down with it.

Previous analysis:

4H Timeframe | Similar To Past Event | Stick To The PlanI'd say that we are still looking good for a breakout to the upside in the next few weeks...

- Ascending Triangle

- Similar to what happened a few weeks back

- Ehlers CG Stochastic Oscillator looking saucy and in the exact same cycle it was in the aforementioned past event

- Bearish scenario is that we bounce back down to the 7900$ range, in my opinion, possible but unlikely

Hope you got some ideas from this :)

It's XBT. Not Hopium Hopium was drawing charts to 20,000 when Bitcoin was $276. We are at less than 1% adoption lol. One use case the silk road and not a decade later every powerhouse in finance is putting Bitcoin ether and or XRP on the road map. Hopium was thinking Bitcoin would be used for anything buying dope when the only exchange was run a guys single computer and named after Dungeons and Dragons crap.

Bitcoin won't break this line for years.

Bitcoin: Listen, do you want to know a secret?Do you promise not to tell? Closer, let me whisper in your ear

I'll tell the words that you long to hear:

Nobody knows now whether Bitcoin will sink or rise, but the crucial question that will determine much more is going to be

whether or not the blue line crosses the red from bottom to top. I can say no more.

Take care & good luck

ReallyMe