This doesn't look like 2000 and 2008 at allThere are too many people expecting a crash nowadays, because there are some indicators showing a similarity to the 2000 and 2008 stock market crashes.

I am convinced however, that if too many people expect something, it will not happen. Quite the contrary will happen.

I am not a stockmarket shill, I don't even own any stocks. I started learning TA when I started with bitcoin 6 years ago. So I might not be an expert on stocks, I fully admit that.

It just is very interesting to make some observations. And it really was noteworthy how this time everyone expected a crash.

The difference is, that in 2000 and 2008, almost nobody was expecting a crash of this magnitued.

Such stuff always takes people by surprise.

I see the situation now more like in the 80s. Nasdaq had some two strong dips back then, where it immediately recovered and made new highs.

I see a similar situation now.

The yearly picture is bullish anyways, see my other chart here:

And the motnhly picture as you can see also looks very healthy.

And this bounce here directly goes on making new all time highs.

Quite different from 2000 and 2008.

We soon shall see, but I just don't see a crash happening when everyone is shorting and expecting it. Market psychology is truly fascinating.

Bubble

When will the SHOP craze end?SHOP has been on a tear since the crash in December last year, currently up 160% in the last six months. It’s easy enough to cry ‘bubble’ at a glance, especially when zooming out reveals a jaw-dropping 1600%+ return in the last 3 ½ years. The stock is experiencing growth that surpasses even AMZN, and in most ways appears to exhibit the same exponential increase in earnings.

Comparing a bit, Shopify has not yet reached the revenue that Amazon was pulling in back in 2005, but at its current pace this will be overcome within a year. Prior to that period in the early 2000s Amazon saw similar increase in its stock price, followed by a long period of volatility and decline until half of those gains had been clawed back. It takes time for the gamblers to move on and for more stable investors to show up and provide a bottom. This is the growing pains of every wildly successful investment. Shopify is no exception to this principle.

Currently where it sits, Shopify is twice as expensive as Amazon was at a similar point, but this makes sense given that we’ve seen the outcome of Amazon already and expectations are increased. My reservations about SHOP are entirely due to the pace of this stock’s increase, not due to the fundamental reasoning being wrong.

I feel that referring to SHOP as a bubble is akin to calling Bitcoin a bubble. It may be experiencing a bubble for the moment, but it’s a natural event when logarithmic growth collides with linear systems. Events like this don’t end with the bubble bursting unless the timeframe of the evaluation is as short a duration as the hype and despair. The expected outcome for this stock is very different based on if we’re speaking of six months or six years from now.

I’ve marked a few spots on this graph that I think are worth watching. The top arrow represents the line of the current trend. Breaking this means we will likely drop to the second arrow for a small correction.

The pullback I’m referring to though is quite a bit larger. The 3rd and 4th arrow down are where I expect us to return to, and the point at which I would be willing to invest in SHOP for the long-term. The 3rd is the 200-day MA which would represent another solid leg up in the price, while the bottom is SHOP’s lowest trend-line which would come of frenzied selling.

Overall from the numbers SHOP seems an incredibly solid choice, but I cannot buy into hype. Every moment of excitement is counterbalanced with despair, and the tab is being run up very quickly here.

Welcome to a Fraudstreet Just seeing this make you barf spyim not a perma bear i really want america to prosper but seeing this what make me barf, im not angry because i missed the rally and losse money trying to be rational, i know, markets could be more irrational that i can stay solven.

There is always risk involved, but now i confirm that stock market is a complete and absolutely fraud.

why? first the political side, all these rally was created and false trade ward with mexico, just when the stock market was suffering the worst may, but they create and trade ward and solve it in a week, just to hide the obvious, the data is not just horrible, look at last job report, they even downgrade previous jobs reports, and even wall street brag about the best week of the year? , now they make a deal with mexico and the new york times said that this was previously arrange months ago, just to hide the fact that things are not only bad at a global level, things are getting worse with china, and now they made the best week of the year, microsft rally more than 10% in 4 days. when is that happen ever before?

looking for indicators Yen/carry trade has been always correlated about 95-98% to sustain rallys, if you look at charts we are at the same level that dic correction, and in may was 98% correlation, so magically they are not even correlated? no is 0.38? wtf is going on now. looking at money flow, the last 3 times we have these moves, corrections happen but these time is actually worst! more oberbougth that nov, dic, and march combine. im buying crazy puts just before the fed " cut rates"into weeks! crazy! idiots are going to make the market crash! hope you guys stay safe! becareful out these this is no man land!

Irrational Exuberance: How do we short this beast?We're way beyond reasonable valuation at this point. What we have here is a bubble that's gotten out of hand. See $TLRY's momentous run up last year, what goes up must come down. But how and when?

$SHOP is a pure momentum stock that people keep buying out of FOMO, it only just over 8 Million shares, which means it will move on you...FAST. THIS IS NOT FOR THE FAINT OF HEART, only use what you're prepared to lose.

Solution #1 : Purchase a Bear Put Spread. Buy 280, sell 250...or whatever width you desire. MAKE SURE this is far dated, July or August at least. What this will do is let you make money IF SHOP CONTINUES TO RISE, you're short put will lose theta and you can collect premium by buying it back cheaper. Once you're short put value has gone to nothing....the inevitable crash should plow right through your now naked long put. Giving you a nice payout. Cannot stress the importance of buying enough time here.

Solution #2 : Wait until its next consolidation and keep your eye on the pivot points (like the ones I highlighted). The reversals that have been happening have ignited massive short squeezes sending this higher every time. Usually the stock will break support intraday and chill there for a bit until it decides it's not having it and reverses. This is the stock telling you "I'm still not ready to collapse yet".

Wait for a CONFIRMED move to the downside. Allow it to close below the pivot and watch for follow-through the next day.

The way premiums are priced on this right now I would say Spreads are the way to go, but this is up to you.

Good luck out there.

BYND IPO BUBBLE?Fundamentals:

Beyond Meat generated $30 million in losses just last year on

revenue of $88 million, and it will need to continue investing

in its operations in the near future. (The IPO raised about

$1.5 billion for the company at the IPO's $25 a share price.

Overvauled and in a bubble??

Now valued at about $5 billion based on investors' faith that

the alternative meat market will boom, this is not a good enough

reason to sustain these levels much longer. Careful if you go short

this stock can stay irrational longer than you can stay solvent.

Exitpump in progress at important resistance, blowoff phaseThe grand exchanges exit pump is upon us. Talked about this in nov-dec '17 on tg and discord that this possibility was very present of how they did this in the past (especially with tethers at almost instantaneous access) and that sentiment can switch on a dime's notice, got the same feeling after the mysterious 100m buyer (i.e. exchanges in cahoot) as years gox and china fud manipulation, then tether/finex investigations went public memories and feelings of mtgox are reliving well now for exit pump in making. Big sells already happened at coinbase with almost no vol +40% up since (same other fiat exchanges, pumping on EMPTY books). No bid liquidity once this monster comes back down. Greedy people means they will be last to exit and we all know how that will look like. Stairs up, elevator down can be related to this human greed emotion. But in the end, not much retail is in anyway, paint tapers do w/e they want, I don't care about illusions and interpretations of fakenews telling you why this and that, always after the fact without any disclosure of personal positions.

Tbh, I would love to have seen finex to 33k while others at 3.3k, but it seems they still are "the market", like gox was "the market" back then.

Yeah, looks legit tether trading at $1.05 while at another place below a $1. Tether should be <= $0.74 by any common sense for the 26% unbacked reserves... All natural, right? The only natural thing coming is the selloff. Manipulation always happens first upwards and is always preferably over going down, because % exceeds the same price delta, that's why most of those exchanges employ the retarded "hodl" meme. If hodl, then please close your exchanges, we don't need you for hodl, I can buy p2p or from some website as well and hodl in my own wallet, thank you very much.

imgur.com

With this idea, I wanna see how this plays out in the months that follow this with all the recent events, the > 99% of bulls (including permabears that flipped to bulls at important resistance), since I'm used to clear all drawings after a while to start from scratch. The previous idea is active and this is a supplement to that and a chart from last year with the wyckoff distribution schematic 2.

Btw, for all bulltards thinking I'm a permabear, you're dead wrong. I bought the entire lower TR back in nov-dec (scalped 4.8k, 4.2k; held 3.2-3.3k), lots of people can confirm on tg and discord as I was one of the only ones insisting to buy and if goes lower buy more, despite everyone calling for lower lows. Nice try though, I'm getting used to this that people flip the script and the worst thing to do is lying to yourself. I will be a bull when the time is there. I don't wanna end up as bullsteak for what's coming.

Can it go higher? Absolutely, can even go to 8k or 13k, sure. Am I prepared for that? Yes, read previous idea how I'm playing this. Can -3k candle come? Absolutely, happened before a lot of times as well. Just use common sense and don't buy when it's pumped 100% with no retrace at a major confluence of resistance, that doesn't make any sense.

Imho, now is the time to #exitallcrypto and enjoy the spring/summer of the money you made. Imagine not taking profits at 100%, talking about greed.

The Next Bubble, where is it? Bitcoin/Crypto analysisAll my thoughts are on the chart.

For reference, definition of treasuries yield curve:

According to Investopedia, the yield curve graphs the relationship between bond yields and bond maturity. More specifically, the yield curve captures the perceived risks of bonds with various maturities to bond investors.

The U.S. Treasury Department issues bonds with maturities ranging from one month to 30 years. As bonds with longer maturities usually carry higher risk, such bonds have higher yields than do bonds with shorter maturities. Due to this, a normal yield curve reflects increasing bond yields as maturity increases.

However, the yield curve can sometimes become flat or inverted. In a flat yield curve, short-term bonds have approximately the same yield as long-term bonds. An inverted yield curve reflects decreasing bond yields as maturity increases. Such yield curves are harbingers of an economic recession .

NIO 1-HOUR TIMEFRAME SHORTThe price for NIO could likely face resistance at the $5.00 price level, or even if it could go higher than this, it would likely face some strong resistance at the $5.90 area. The price has been moving in a downtrend, forming a series of bear flag patterns along the way. One the higher timeframes, the price broke out of a major range to the downside. This should be a key driver for this short trade as the momentum is clearly to the downside.

Would just go long for nowVolume is low in comparison with historic data. Accumulation/Distribution indicates a supportive bull movement. I'd presume volume would remain slight weak, but enough to support the bull. Found rising wedge but who are we kidding.. lol

I'm still bearish btw. There's bubble for sure, I just can't figure out what.

Apple scare the shit out meLooking for history the last time apple recover so quicly was in 2007 it recover for 4 months then start to droping like hell, the question what justify apple trading at these levels, all fang not only absurd overbought, RSI Of stocks are in the 80, like msft, dis, amzn fb, the question you have to ask is why now? we are in a bull market so quickly you see in the times before that apple as fully recover always has double bottom, apple did not do that, also looking at fundamentals, during the last 5 years apple has diluted their shares nearly 19%, so EPS Look Higher, there is a lot of speculation with this stock, i think is the most speculative stock in wallstreet after tsla nflx all and amazn, i get msft has double digit growth but what has apple last quarter iphone sales decline 15% YOY and thatis 65% of his revenue, the claim services is just 10% of his total revenue, even if apple doubles that in 2 years, they have 10 years of the same product,no major changes beside better screen camara and processor, wallstreet always oversale this stock like is the best company in the world, people are buying iphone XR More than 10 thats why they are not even revealing how many units they sell, wallstreet in matter of months take apple again to hit 1 trillion? like a nothing happen, there is a lot of questions regarding the future of apple, i get is a good company, but is not was used to be, they need a new product, now all people buying the stupidity of services like is a big deal, i think apple could cut guidance, market is not expecting so much move because of volatility but look what happen with intel, everyone was so bullish and then earnings fall 10%, with volatilty at 12% dont want to imagine with vix at 20, so, i think apple could fall 188-190 the next week but who knows, these irrational market im all in short here, i just buy 195 puts May 17 GL To all traders!

My view of crypto fraud market, the magician and 666I've wanted to post this idea much earlier, but I didn't feel to write, although I got so many to write about with a constant flow of ideas and information that I could write volumes, I try to keep it short and expand it in updates. I do notice nobody gets my updates, you have to click the "Follow this idea" next to the like button, try if that helps... if not, well my account is shadowbanned indeed.

The pump was artificial, there is no 100m usd mystery buyer, that story is non-sense, because a mystery buyer does not place at hundreds of exchanges same second for supposedly billions of dollars market orders. Imho, it's the crypto cartel, ala exchanges that have done this. I've explained this before in the MM exit pump idea when we went to 8.45k last year.

Today my friends, it's the beginning of the end. I've talked about black swan for over a year that it's coming. Bitfinex and tether are getting sued, but this is just the beginning, because the rest is following.

www.wsj.com

www.theblockcrypto.com

Task Enforcement agencies have already banded worldwide and Binance will be the biggest of entire crypto collapse.

www.asiatimes.com

www.theblockcrypto.com

I shared with friends a vision I had last summer that a major exchange is going to get shutdown in Oct '19, I've put this idea locked/private, here it is for future reference @

This probably will be shunned as fud, but I know asia crackdown is coming coming months already and CZ probably knew he would go to jail when he stayed in Japan, which I've talked about last year, hence fleeing to pirate island, which is now also not safe, they're coming there as well. I've made predictions last year as well what would happen and so far coming true:

1) Fake exchange hack stories, when in reality it's organized theft and exitscams. Many have exitscammed and many more will, including the large exchanges. Quadriga was just one of them;

2) The drop to 3.2-3.3k, before going lower;

3) Manipulation of price using tethers;

4) Manipulation of public sentiment;

5) The toxification of crypto communities (see CT);

6) The rise of fraud and criminal activities.

I've calmed down the guys thinking it was the bottom at 3.12k, which I do not subscribe too. I saw even the permabears became bullish and calling the bear market over. I've always said we going to make a new low to 2-2.2k for bounce area to watch how it reacts before calling anything over. My neutral price is $650-700 and a real collapse could mean $80-$90 per bitcoin. I've shared my fundamental reasons for thinking and feeling so. I've shared the evidence of manipulation back in Bitcoinica days, to MtGox to Bitfinex to Binance to Bitmex and all usual suspects of pump and dump clowns and promoters and useful idiots at the expense of the naive, which there are many.

You've been told lies about Bitcoin and it's become like a religion, which any who believed in it that it would be the future would proof to me they are young souls and probably will find out the hard way if they don't change.

I do believe digital currencies will be the future, probably with blockchain for scalability, uptime and security. I've watched this space since 2011 and only started trading few years laters and I've read the bitcoin white paper and sounded very good. Today, 10 years later, Bitcoin devs have departed from that vision for centralized vision, the anti-thesis of Satoshi Nakamoto. What has become of cryptocommunity freedomlovers has turned into a toxic place of the masses where everything is about the value of bitcoin vs usd, including exchanges who scam people for every cent they got. This was not what Bitcoin was first about, hence I call crypto a giant fiat extraction ponzi scheme. If crypto was about to survive and have meaning, it has to start over, with all rotten players out of the game and start mass adoption in private and public sector at much lower prices so distribution goes to as much people as possible.

Valuations are still in bubble territory and is kept aritficial with tethers. Last month over 1.2 BILLION magic money (yesterday 300m + 40m) was pumped in the system with worldwide fiat trading vol less than 6% and estimation fiat in system less than 10% at much lower prices, so prices are propped up to the last suckers still buying, including some people from MtGox days I know who have not learned anything.

Now here is the kicker. They can still exit scam and pump prices to 8-30k, which has nothing to do with technicals, see my chart, in other words, entire crypto will be Tethers exclusively. This will mean that you CANNOT cash out in fiat, I hope you do understand that, right? Your only place would be p2p with no liquidity and eventually at discount. I've said in my updated post and in the one of SPX + my twitter were first resistance was, which we hit and second to sell coin and also where to exit crypto and cash out. I've recommended not to short and some people didn't listen and got in big losses, then why you telling me this when I said not to short when obviously it would go higher.

With such news, this rally can be over, as it was with Bitconnect. Yeah, how did TA worked out for you with that. Most important asset is your brain.

I will update this post later on, right now is critical time and I don't have time to write more at the moment. This chart was made yesterday and targets were made many months ago. My targets don't change, as you see in my previous ideas, I actually did call the bottom which I said was NOT the FINAL bottom. Many egos said they called it when they didn't call anything without any proof, while mine is over a year old at first.

Most important thing, preserve your capital. Updates will follow.

S&P500 IT BubbleTaking a look at the IT sector of the S&P 500, we can see a some-what bubble formation.

If you look back at the DotCom Bubble you will notice the same has developed ( High, High Low, High High) before tumbling down. Same as the Bitcoin Bubble. Now, going back to this chart it has currently formed that High, High Low and High High pattern exactly the same as the Dotcom and bitcoin bubbles did which leads me to believe, the IT industry crash is imminent.

As tech gets more reliable, there are more and more people who need to buy less of it as their current technological device is reliable enough. Slowing the growth of the market before eventually dropping off.

Any comments or criticism is welcome.

Bitcoin Botom Price GuessFirst lets look at Price

Scenario 1-Mirrors 2014-2015 crash where bitcoin went somewhat mainstream (but still not too well known contrary to 2017 )to some degree.

-Price did 1168$ to 153$, a decrease of 87%

-Using the bit stamp bitcoin price high of 19665, a decrease of 87% will be $2555

Scenario 2-Mirros the worst bubble of all time, 2011, where we did a -93.7% decrease

-Price did 31.83$ to 2.03$, a decrease of nearly -93.5%

-Thus, a -93.5% decrease from 19665 would be 1238$

Scenario 3-Retraces to last bubble high. This has happened in 2013 where ( if we ignore the wick,we made a high of 163$, and this was very close to the bottom of the last crash at 153$. If the wick is included then this analysis is not really useful

The wick went to 276$, much higher then the bottom of 153$

The 2014 crash though had a much smaller wick

-The wick went to about 1168$. The bodies of the candle were at 966$ (using the weekly time frame )

-So thus a bottom at 966-1168$ is possible

Scenario 3- Mega Bear Crash mirroring the performance of some of the dotcom stucks (-95 to -99% )

-We could reach a bigger correction then the previous bubbles mentioned since unlike other times, bitcoin was truly mainstream in 2017.It was the talk of everywhere when it surged past 10K and almost hit 20k. Even celebrities were talking about , and some celebrities participated in advertising shitty icos which are now worthless after hitting the exchanges.

- The thing is, the world decided that blockchain technology/crypto was not worthy of being an asset to hold, so we started to crash. And the 2015-2017 bull run while there were substantial advances in the crypto technology, real life applications are still slim.

- Bitcoins price when it isnt really mainstream and used primarly for shady transactions and as a hedge against the global economy failing is 130-150$ ish. Not likely to go that low but it could happen given the unique circumstances of this bubble

-Market makers also might have a incentive to drive bitcoin below 1K as it would be breaking a pyschological barrier and cause more panic selling. This is because below 1k, the next support area is 500-600$ area, so it would happen rapidly

TL:DR

Potential bottoms are all the way from 150$-2500$. I dont think the bottom has been hit yet btw.

Bitcoin : Don't FOMO ! But ...Hello, I'm as much as you thrilled by the idea of a new bullrun , knowingly that this time, it's going to be even stronger than before. More and more people are joining the crypto sphere and those who got in, back in january 2018 , are still here since then, waiting for the right moment to get their chance . It's going to be massive : some say bitcoin could reach 100k$ easily , that if we compare the Bitcoin bubble to the Internet bubble , we haven't gone anywhere near as high as people went for the internet, if we look at the money involved. We know the tech is good, but the tech isn't linked to the price , sadly, it needs to climb slowly, with cycles , and those take time, that's how it works. After a move up, people will take their profits, and make the price go down, that's a correction .

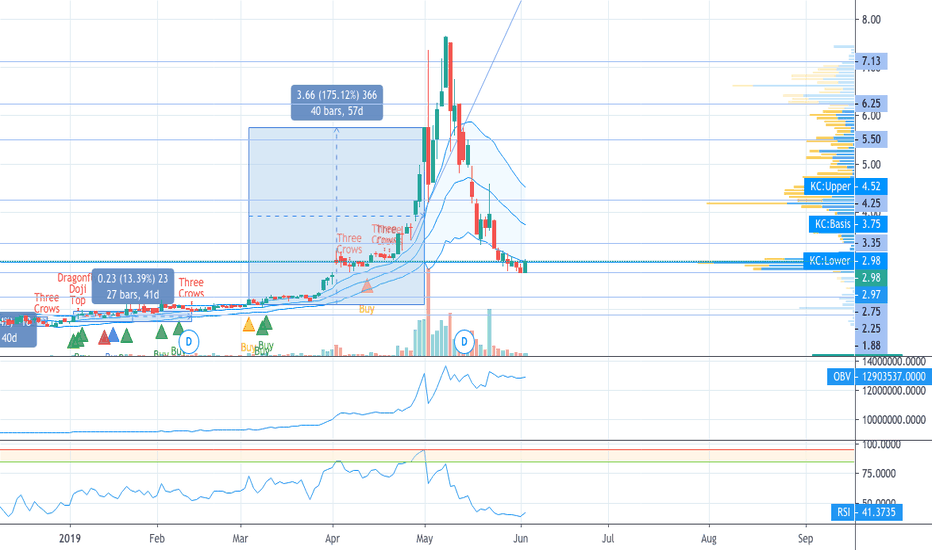

My TA is simple.

The bullish sign is the 200 EMA Cross . We know that when we are above this line 80% of successful trades are longs.

The bearish sign is that the RSI is at its biggest overbought since december 2018 ( when BTC hit 16 500$ )

Right now I'm bearish. But I can't predict the future, that's where TA has a limit.

How to exactly know when to get in ?

You can use My PSAR Bot Trader to set up and alert and receive a notification as soon as the Trend reverses.

TLDR;

Prepare yourself for a move. Get some stable coins and be ready to enter if something were to happen. Do not wait the last minute to make your bank transfer, it can take up to 48h and trust me there is no worse senstation that missing out because of that. But most importantly: Don't FOMO because it could very well go -30% again after this move up.

Good luck ! TAs and ideas are welcome.