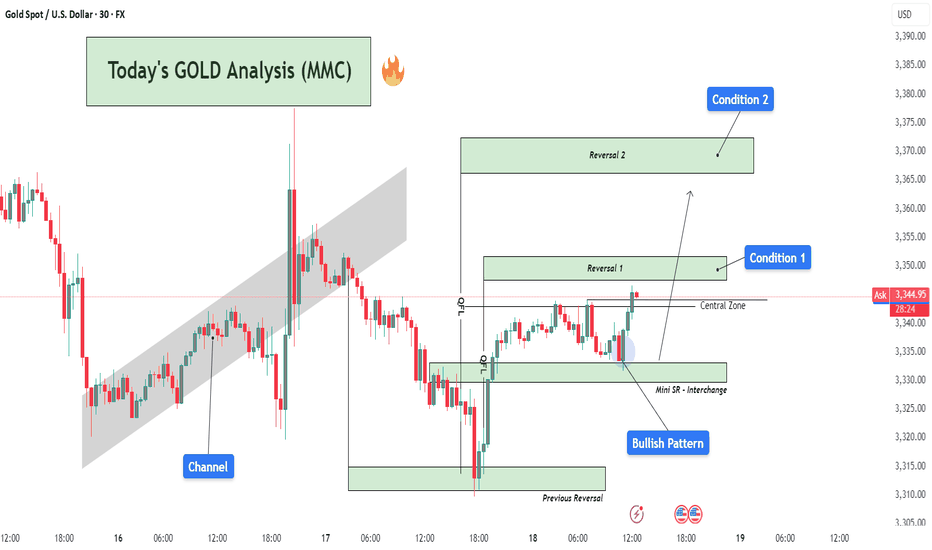

Today's GOLD Analysis (MMC) – Bullish Momentum Building Ahead🔍 Market Overview:

Gold is currently showing signs of a bullish reversal structure after experiencing a downward correction. Price action has reacted strongly from well-defined demand zones, suggesting institutional buying activity at key levels. The current setup highlights a clear accumulation phase transitioning into a potential markup phase, driven by buyers regaining control.

🧱 Chart Structure Breakdown:

1️⃣ Initial Channel Formation (Left Side of Chart)

After a major downtrend, price began consolidating within a rising channel, indicating a retracement or correction phase.

This ascending channel showed a short-term bullish effort, but eventually broke to the downside, resuming the dominant bearish flow temporarily.

2️⃣ Previous Reversal Zone ($3,312 – $3,322)

This is the origin of the recent bullish move, where price strongly reversed after heavy selling.

The reversal formed a long bullish wick and an engulfing candle—clear signs of buying absorption.

This level has historical confluence, acting as both support and prior demand.

3️⃣ Mini SR - Interchange Zone ($3,327 – $3,335)

This zone is a mini structure level where previous resistance has now become support (SR Flip).

The area acted as a platform for the recent bullish reaction.

This zone also aligns with the interchange of order blocks, adding more confluence to the bullish argument.

4️⃣ Bullish Pattern Formation

Price formed a micro double bottom/inverse head and shoulders structure just above the Mini SR.

The pattern suggests strong base-building and provides momentum for the current bullish move.

Confirmation came after the neckline breakout and retest within the Central Zone.

5️⃣ Central Zone ($3,340 – $3,345)

This is an intraday pivot area, acting as a decision-making zone between buyers and sellers.

Price is currently testing this zone with strong bullish candles.

A clean break above this level increases the probability of further upside.

6️⃣ Reversal Zone 1 ($3,345 – $3,353) – ✅ Condition 1

Price is now entering this zone, where previous price rejections occurred.

If buyers can maintain momentum and break above this zone on strong volume, it will validate the bullish continuation thesis.

This zone is also an ideal area to monitor for partial profit-taking or potential short-term rejection.

7️⃣ Reversal Zone 2 ($3,365 – $3,375) – ✅ Condition 2

This is the next significant resistance block.

If price reaches this level, it could face heavy resistance and profit-booking from swing traders.

However, a breakout above this zone could lead to a much larger bullish wave, targeting $3,390+.

🎯 Trade Setup Idea:

Long Bias: Above $3,335 with targets at $3,353 (TP1) and $3,370 (TP2)

Risk Invalidation: Break below Mini SR zone ($3,327) may invalidate bullish thesis

Aggressive Entry: At retest of Mini SR after pattern breakout

Conservative Entry: On breakout and close above Reversal Zone 1 with confirmation

🧠 Trader’s Mindset:

The market is showing a clear shift in momentum, but buyers must sustain control above key levels.

Stay patient at resistance zones; avoid chasing.

Watch for rejection wicks or bearish divergence near Reversal Zone 2 if you're looking for a counter-trade.

📌 Summary:

📈 Bias: Bullish (as long as $3,335 holds)

💡 Opportunity: Breakout from Mini SR with structure support

📉 Risk: Failure to hold central zone could trigger retest of lower support

🚀 Potential: If momentum continues, gold could revisit July highs near $3,390–$3,400

Bullishbias

NZDUSD Daily Outlook: Slight Bullish Bias Amid Today !!NZDUSD Daily Outlook: Slight Bullish Bias Amid Current Market Conditions (31/10/2024)

Introduction

As we delve into today’s trading session, the NZDUSD pair shows signs of a slightly bullish bias due to a combination of fundamental drivers and current market conditions. This article provides a comprehensive analysis of the NZDUSD's outlook on October 31, 2024, shedding light on the key factors impacting the New Zealand Dollar (NZD) and the US Dollar (USD) in today’s trading environment. With the right blend of technical and fundamental insights, we aim to offer valuable insights for traders considering NZDUSD positions.

Key Fundamental Drivers Impacting NZDUSD Today

1. China's Economic Growth and Its Influence on NZD

- The New Zealand Dollar, a commodity-linked currency, closely correlates with China's economic health due to New Zealand's export reliance. Recent reports suggest a moderate recovery in China's industrial and manufacturing data, which bodes well for NZD. Increased demand for New Zealand exports, especially dairy, bolsters the Kiwi's outlook, creating an overall positive sentiment for NZDUSD.

2. Federal Reserve’s Dovish Stance

- A significant driver for NZDUSD is the Federal Reserve’s dovish stance, with expectations for a pause on future rate hikes. This has resulted in a softer USD as investors anticipate fewer rate hikes going forward. A dovish Fed policy tends to weaken the USD, increasing the attractiveness of the NZD and slightly tilting NZDUSD towards bullishness.

3. New Zealand's Stable Economic Indicators

- New Zealand’s recent economic data reveals consistent GDP growth, low unemployment rates, and a robust labor market. This stability has created an optimistic environment for the New Zealand Dollar. Additionally, the Reserve Bank of New Zealand (RBNZ) has maintained a steady rate outlook, supporting the Kiwi by keeping investors interested in NZD assets due to positive yields.

4. US Treasury Yield Fluctuations and Its Impact on USD

- The ongoing fluctuations in US Treasury yields have contributed to the USD's recent mixed performance. A decline in yields typically makes the USD less attractive, as lower yields reduce the appeal for foreign investors. As a result, NZDUSD may benefit from a weaker USD, supporting a bullish bias in today’s trading.

5. Market Sentiment and Risk Appetite

- Recent geopolitical tensions and global market fluctuations have impacted the broader market sentiment. The Kiwi typically gains when there is a higher risk appetite among investors. As volatility stabilizes, we may see increased demand for higher-yielding currencies, which could strengthen NZDUSD’s position, albeit moderately.

Technical Analysis of NZDUSD (31/10/2024)

Looking at today’s technical setup for NZDUSD, the pair trades above its 50-day moving average, a potential bullish indicator. The Relative Strength Index (RSI) currently sits near the 60 mark, indicating a neutral to slightly bullish sentiment. Support levels at 0.5850 and resistance near 0.5920 will be critical zones to monitor.

Key Support: 0.5850

Key Resistance: 0.5920

Conclusion: NZDUSD Outlook for 31/10/2024

With today’s economic data and current sentiment, the NZDUSD pair leans towards a slightly bullish outlook. Strong economic fundamentals from New Zealand, coupled with a softer US Dollar from a dovish Federal Reserve stance, are influencing the pair's potential upward movement. However, traders should stay vigilant to potential changes in Treasury yields and any abrupt shifts in global risk sentiment.

By focusing on today’s fundamental and technical drivers, NZDUSD traders can better gauge the market’s slight bullish bias.

SEO Keywords:

#NZDUSDAnalysis

#NewZealandDollar

#USDForecast

#ForexTrading

#FXMarket

#BullishBias

#CurrencyTrading

#ForexFundamentals

#NZDUSDOutlook

NZDUSD Analysis for 16/10/2024: Slight Bullish Bias ExpectedIntroduction

As of 16th October 2024, the NZDUSD (New Zealand Dollar vs. US Dollar) pair shows a slight bullish bias in today’s trading session. A combination of fundamental factors, economic data releases, and market sentiment are all playing a pivotal role in driving this price action. In this article, we will break down the key drivers for the potential bullish trend in NZDUSD today, with a focus on the latest developments in the global economy, central bank policies, and market conditions.

Key Drivers for NZDUSD Bullish Bias

1. New Zealand Economic Data Strength

One of the primary factors contributing to the slight bullish bias in NZDUSD is the recent release of positive economic data from New Zealand. Key indicators such as GDP growth and retail sales have come in stronger than expected, supporting the NZD. The New Zealand economy continues to exhibit resilience despite global challenges, and this has attracted investors towards the Kiwi dollar.

In the latest report, New Zealand’s consumer sentiment index showed improvement, reflecting increased consumer confidence. This suggests that domestic demand is picking up, which is supportive of the New Zealand Dollar’s strength. As a result, this economic optimism is likely to boost NZDUSD.

2. RBNZ Hawkish Stance

The Reserve Bank of New Zealand (RBNZ) has maintained a relatively hawkish stance, signaling a possible interest rate hike in the near future to combat inflation. Although inflation remains elevated globally, New Zealand’s inflation figures are closely monitored by the RBNZ, and the central bank is prepared to act if needed. A potential rate hike would increase the attractiveness of the NZD in the forex market.

The US Federal Reserve, by contrast, is leaning towards a more neutral stance, with expectations that interest rates may have peaked for the time being. This divergence in monetary policy between the RBNZ and the Federal Reserve is providing support to NZDUSD, as a more hawkish RBNZ outlook favors the New Zealand Dollar.

3. US Dollar Weakness

On the other side of the equation, the US Dollar has experienced some softness amid mixed economic data and shifting market sentiment. The recent US CPI (Consumer Price Index) report showed inflation cooling, reducing the likelihood of aggressive Federal Reserve tightening. As inflation shows signs of easing, investors are beginning to price in the possibility of a Fed pause, which has led to USD weakness.

Additionally, political uncertainty in the US, particularly related to fiscal policy and government shutdown risks, is weighing on the USD. The combination of a potentially dovish Federal Reserve and domestic uncertainty is making the US Dollar less attractive, boosting the NZDUSD pair.

4. Global Risk Sentiment

Risk sentiment in global financial markets is another critical driver of NZDUSD. As a commodity-linked currency, the New Zealand Dollar often performs well when risk appetite improves. Today, we see a more optimistic tone in equity markets as investors respond positively to the easing inflation pressures in the US and signs of stabilization in global growth. This “risk-on” environment typically benefits the NZD, and we are seeing this reflected in the slight bullish bias for NZDUSD.

Moreover, China's economic stabilization efforts, especially in the property sector, have provided additional support for commodity-exporting countries like New Zealand, bolstering the NZD.

5. Technical Outlook

From a technical perspective, NZDUSD has been testing key support levels in recent trading sessions, and a bounce from these levels is likely to fuel further upside. The 50-day moving average (MA) has recently crossed above the 200-day MA, forming a bullish “golden cross,” which is a positive signal for further upside movement in the short term.

In addition, RSI (Relative Strength Index) readings are indicating that the pair is not yet in overbought territory, suggesting more room for the bullish momentum to continue.

Conclusion

In summary, the NZDUSD pair is expected to maintain a slight bullish bias on 16th October 2024, driven by several key fundamental factors. Strong New Zealand economic data, a hawkish RBNZ stance, US Dollar weakness, positive global risk sentiment, and favorable technical signals all contribute to the optimistic outlook for NZDUSD today. However, traders should remain cautious of any unexpected developments that could shift the market sentiment.

Keywords: NZDUSD, New Zealand Dollar, US Dollar, Forex Analysis, 16th October 2024, bullish bias, RBNZ, Federal Reserve, US inflation, interest rates, forex market, technical analysis, risk sentiment, currency trading, New Zealand economy, NZD strength, TradingView analysis, forex forecast, USD weakness.

Bullish Bias Supported by Key Market Factors on 04/10/2024 on UJUSD/JPY Analysis: Bullish Bias Supported by Key Market Factors on 04/10/2024

Today, USD/JPY shows potential for a slightly bullish bias due to a confluence of fundamental factors driving USD strength against the Japanese yen. Key drivers, including strong US economic data, a hawkish Federal Reserve stance, and the Bank of Japan’s accommodative policy, are reinforcing positive sentiment around USD/JPY. This article outlines the factors that could support the USD/JPY bullish outlook in today’s trading session, helping traders anticipate potential market movements and leverage these insights in their strategies.

1. Strong US Economic Data Boosts Dollar Demand

The US economy has shown resilience with recent data releases indicating solid growth. Reports on employment, consumer spending, and manufacturing output have exceeded expectations, showcasing sustained economic strength. These data points are bolstering demand for the USD, with traders positioning themselves for potential further gains in USD/JPY. The strong economic indicators align with the Federal Reserve’s hawkish stance and reinforce USD appeal.

2. Federal Reserve’s Hawkish Policy Outlook

The Federal Reserve has maintained a hawkish outlook, with officials signaling a commitment to higher interest rates to curb inflation. This stance increases the yield differential between the US dollar and the Japanese yen, as Japan’s Bank of Japan maintains its ultra-low interest rate policy. With a higher expected return on USD holdings, USD/JPY sees further upward pressure, attracting buyers and reinforcing a bullish perspective.

3. Dovish Bank of Japan Policy Limits Yen Appeal

The Bank of Japan (BoJ) has retained its dovish policy stance, focusing on stimulus and maintaining low interest rates to encourage economic growth. This stance contrasts starkly with the Federal Reserve's hawkish approach, which benefits the USD/JPY pair. With the BoJ’s commitment to accommodative measures, the yen’s appeal remains limited, creating favorable conditions for a bullish USD/JPY outlook today.

4. Technical Analysis Suggests Upward Momentum

Technical indicators align with the fundamentals, signaling a possible continuation of upward momentum for USD/JPY. The currency pair has recently tested and bounced off significant support levels, with indicators such as the Relative Strength Index (RSI) and moving averages suggesting bullish momentum. With USD/JPY trading above key moving averages, the technical setup points towards further bullish potential in the near term.

Conclusion: Bullish Bias for USD/JPY on 04/10/2024

Given today’s USD/JPY analysis, the factors of a strong US economy, the Fed's hawkish outlook, the Bank of Japan's dovish stance, and supporting technical indicators create a bullish bias for the pair. Traders should monitor these factors closely as they continue to influence USD/JPY dynamics throughout the trading session.

Keywords:

USD/JPY analysis, bullish bias, US dollar strength, Japanese yen, Federal Reserve hawkish policy, Bank of Japan dovish stance, USD/JPY technical analysis, forex market, USD/JPY trading insights, USD/JPY bullish trend, USD/JPY 04/10/2024.

USDJPY Analysis for 01/10/2024: A Slightly Bullish Bias ExpectedThe USDJPY currency pair continues to exhibit a slightly bullish bias as of October 1, 2024, driven by the current fundamental factors and prevailing market conditions. In this article, we will explore the key drivers behind this trend, providing forex traders with actionable insights for today’s trading session.

Key Drivers Behind USDJPY Bullish Bias

1. Hawkish U.S. Federal Reserve Policy

One of the key factors supporting the bullish outlook for USDJPY is the ongoing hawkish stance of the Federal Reserve. The Fed remains committed to controlling inflation, which has led to higher interest rates in the U.S. This rate differential favors the U.S. dollar over the Japanese yen, as investors are drawn to the higher returns offered by U.S. assets. The expectation of steady or potentially higher rates from the Fed further boosts demand for the U.S. dollar, pushing USDJPY higher.

2. Weakness in the Japanese Yen

The Bank of Japan (BoJ) continues its ultra-loose monetary policy, with little indication of shifting towards a more hawkish stance. This dovish approach, coupled with a lack of inflationary pressure in Japan, has led to a sustained weakness in the yen. As long as the BoJ maintains its negative interest rate policy and yields remain low, USDJPY is likely to see upward momentum, supported by the widening gap between U.S. and Japanese interest rates.

3. U.S. Economic Strength

Recent U.S. economic data continues to show resilience, particularly in the labor market and consumer spending. This strength provides further justification for the Fed’s hawkish stance and supports a bullish bias for USDJPY. As long as the U.S. economy outperforms its global peers, particularly Japan, the dollar is likely to retain its strength against the yen.

4. Interest Rate Differentials

The widening interest rate differential between U.S. and Japan is another significant factor driving USDJPY higher. U.S. bond yields remain elevated, attracting foreign investment into U.S. markets, while Japan’s government bonds offer little to no yield. This creates a favorable environment for the U.S. dollar, keeping upward pressure on USDJPY.

5. Geopolitical Stability in the U.S.

While geopolitical risks globally remain a concern, the relative stability in the U.S. compared to regions like Europe or Asia continues to attract investors to the dollar as a safe-haven asset. The yen, traditionally viewed as a safe-haven currency, is seeing reduced demand due to Japan’s domestic challenges and the BoJ’s accommodative policy, further boosting USDJPY.

Technical Outlook

From a technical perspective, USDJPY is currently trading near resistance levels, with the 150.00 mark acting as a key psychological barrier. A break above this level could open the door for further gains toward the 151.00 level. Support is seen around 148.50, which could act as a floor for any short-term pullbacks. Traders should monitor these levels closely as the pair’s momentum remains positive.

Conclusion: USDJPY Bullish Sentiment Expected to Continue

In conclusion, USDJPY is likely to maintain a slightly bullish bias today, driven by the ongoing divergence in monetary policies between the U.S. and Japan, strong U.S. economic fundamentals, and interest rate differentials. Traders should look for potential upside opportunities as the pair tests key resistance levels, with U.S. data releases and BoJ policy statements remaining crucial to shaping the pair’s direction.

Keywords for SEO:

USDJPY analysis, bullish bias, USD to JPY forecast, forex trading USDJPY, USDJPY technical outlook, Federal Reserve impact on USDJPY, Bank of Japan policy, interest rate differentials, U.S. dollar strength, USDJPY key levels, USDJPY trend today.

S&P 500 forecast: Outsized rate cut music to bulls’ ears. S&P 500 forecast: The US stock market has shown impressive resilience following the recent volatility. Investors, thrilled by the Federal Reserve’s outsized rate cut, have pushed index futures higher. However, there are mixed opinions about what lies ahead. For now, it looks the S&P 500 will finish the week at a fresh record high.

Fed’s Rate Cut and Its Impact on Markets

The Federal Reserve’s decision to deliver a 50-basis point rate cut was largely welcomed by investors. The move was seen as a bold but necessary step to ease economic concerns without sending panic signals reminiscent of the 2008 financial crisis. Fed Chair Jerome Powell emphasised that the cuts are not part of a long-term strategy but rather a proactive measure aimed at stabilising growth, now that inflation appears to be on the path of returning to its target.

Markets initially sold off but quickly rebounded, with S&P 500 futures suggesting a potential new record high is on the horizon at the cash open today. The Dot Plot projection also boosted investor confidence, showing a possible 50 basis points of cuts this year and 100 next year, with the terminal rate expected to hit 3.0% by 2026. But what now?

Can the S&P 500 Rally Continue?

With the S&P 500 up nearly 19% year-to-date, investors are wondering if the rally can be sustained. On the surface, it appears that market sentiment is bullish, bolstered by the Fed’s actions and a series of robust earnings reports. Yet, looming risks, such as global economic slowdown in the Eurozone and China, may challenge this optimism. Moreover, seasonal trends indicate that September is typically a tough month for equities, adding a potential headwind to the current rally – although so far this hasn’t held investors back. With the US presidential election approaching, market volatility could spike, leaving investors hesitant to dive into new rallies without a clear trend.

S&P 500 forecast: Technical Analysis and Key Levels to Watch

Despite some volatility after the Fed’s rate cut, the S&P 500’s bullish trend remains intact. Traders should keep an eye on the support range between 5613 and 5670, with the upper end of this range marking the high from July. As long as the index holds above this support area, the short-term path of least resistance will remain upwards, potentially keeping the market on course to head towards 5800 or even the 127.2% Fibonacci extension level of 5827, derived from the drop in July.

However, a dip below 5613 would signal a shift towards bearish sentiment, potentially pushing the index down to its next support and short-term trendline around the 5480-5500 area.

Bearish Risks and Market Sentiment

While the bulls are currently in control, bearish traders are watching for signs of a reversal. A drop below recent lows, as suggested above, could signal the end of the short-term bullish bias, reminiscent of the July sell-off when overbought conditions led to a sharp decline. Then, the signal came in the form of a bearish engulfing candle on 17 July. Bearish traders need to wait for a similar confirmation before making any significant moves, given the overall bullish structure of this market.

Risk Management in a Volatile Market

Regardless of whether you're bullish or bearish, managing risk is critical in today's market. With heightened uncertainty surrounding the economy and upcoming elections, volatility is expected to remain high. Traders should stay nimble and be prepared for sudden shifts in the market’s direction.

In conclusion, while the S&P 500 forecast remains cautiously optimistic, several factors could derail the current rally. Staying informed and agile will be essential for navigating the coming weeks. We will, of course, highlight any major shifts in the trends, if observed. Stay tuned.

-- Written by Fawad Razaqzada, Market Analyst

Decred: Bullish Breakout Imminent?Considering the prevailing bullish sentiment in the market and the pattern observed on other cryptocurrencies throughout the crypto sphere that have broken out of a prolonged accumulation phase, it can be expected that DCR will eventually follow the general trend and repeat the pattern that we have already seen on many other coins.

Decred has been facing resistance at the $18.3 level since May 2023, but recent price action on the 1-hour and 4-hour timeframes indicates a breakout and retest above this level.

The next significant level to watch is $21.4, which has historically been a key support/resistance level for Decred. While there are signs of weakness on the 1-hour timeframe, such as candles with long shadows that could provoke short positions, there is still no confirmation of a breakdown in the upward structure. The 1-week candle seems strong, and the overall asset shows significant buying volume. This indicates that Decred may be able to consolidate above $21.4 and keep moving upwards successfully.

A breakout and consolidation above $21.4 could lead to increased volatility and larger price swings on higher timeframes, with potential profit-taking zones and resistance levels at $50, $67, and $85. Additionally, the February 2023 high of $28.52 may also present a next strong resistance level in the short-term future.

NZDCADOANDA:NZDCAD

Weekly and Daily timeframes are bullish. Price on the daily made a pullback/retest to the Daily Area of Interest/ key support area @ around 0.82446. Entry is based on the bullish engulfing candlestick of the double bottom reversal pattern formed on the 4h @ 0.82446 daily key support

USDJPY: enough Monday Momentum?Potential bullish Judas Swing for another entry position.

1) liq grab of low

2) bullish CHoCH

3) identify established FVg

4) set entry to 50% of FVG/imbalance

5) wait for FVG to be fully tested and rejected (closed inside but wicked outside.

6) go to your lower tf (I pick 1m for entry)

7) wait for CHoCH on lower tf

8) find fvg created

9) wait for retest and rejection

10) enter

USDJPY: enough Monday momentum?Potential bullish Judas Swing for another entry position.

1) liq grab of low

2) bullish CHoCH

3) identify established FVg

4) set entry to 50% of FVG/imbalance

5) wait for FVG to be fully tested and rejected (closed inside but wicked outside.

6) go to your lower tf (I pick 1m for entry)

7) wait for CHoCH on lower tf

8) find fvg created

9) wait for retest and rejection

10) enter

gbpjpy bullish forecastFX:GBPJPY

The Weekly, Daily, and the 4H timeframes are moving in the same bullish direction meaning that we should be looking for buys. As we can see price moved to the upside and made a pullback after hitting the 185.113 weekly resistance area making a pullback. I will be looking to buy at the 184.222 daily support zone and entries will be based on rejections or bullish engulfing candlestick pattern.

short idea on XAUUSD H4 and H1 timeframethe price quite reacted to the strong resistance zone after touching all time high 2147 usd per troy ounce. now we are seeing the price corrective move is on going, while the bearish correction now pushing gold, it creates a bullish flag. me personally expecting a bullish impulse if cpi later this week is against us dollar. we need to put attention at 2007-2010 zone and 1985-1990 zone later to long this trade with a tight sl aiming for another all time high price for gold

Mastercard (NYSE: $MA) Bullish Bias Mastercard (NYSE: NYSE:MA ) is above all of its moving averages, which means it has a bullish bias.

NYSE:MA 's 50-day Moving Average is above the 200-day Moving average giving Bulls partial control of the NYSE:MA stock.

However, NYSE:MA still appears to have an upward momentum.

Key Event

A. Dividend increase

Mastercard increased its quarterly dividend payment to shareholders by 16%. The dividend will be paid on December 29, 2023 to stockholders of record on December 20, 2023.

US30 LONGCURRENCYCOM:US30

US30 broke and closed above 29 500. Shifting bearish bias to bullish bias.

Patiently waiting for a retest at previous resistance turned to support.